Global Inorganic Acid Market By Type (Hydrochloric Acid, Sulfuric Acid, Nitric Acid, Phosphoric Acid, Boric Acid, Hydrofluoric Acid, Others), By Basicity (Monobasic, Dibasic, Tribasic), By Strength (Strong Acid, Weak Acid), By Grade (Industrial Grade, Technical Grade, Food Grade, Pharmaceutical Grade, Electronic Grade), By Application (Agrochemicals and Fertilizers, Metal Processing, Lead Battery Manufacturing, Dyes and Pigments, Explosives, Soap and Detergent, Petroleum Refining, Cellulose Fiber, Others), By End-use Industry (Agriculture, Paints and Coatings, Pulp and Paper, Chemical and Petrochemical, Pharmaceutical, Food and Beverages, Electronics, Textile, Wastewater Treatment, Metalworking, Woodworking, Others), By Distribution Channel (Direct Sales, Distributors, Wholesalers, Online Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132714

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

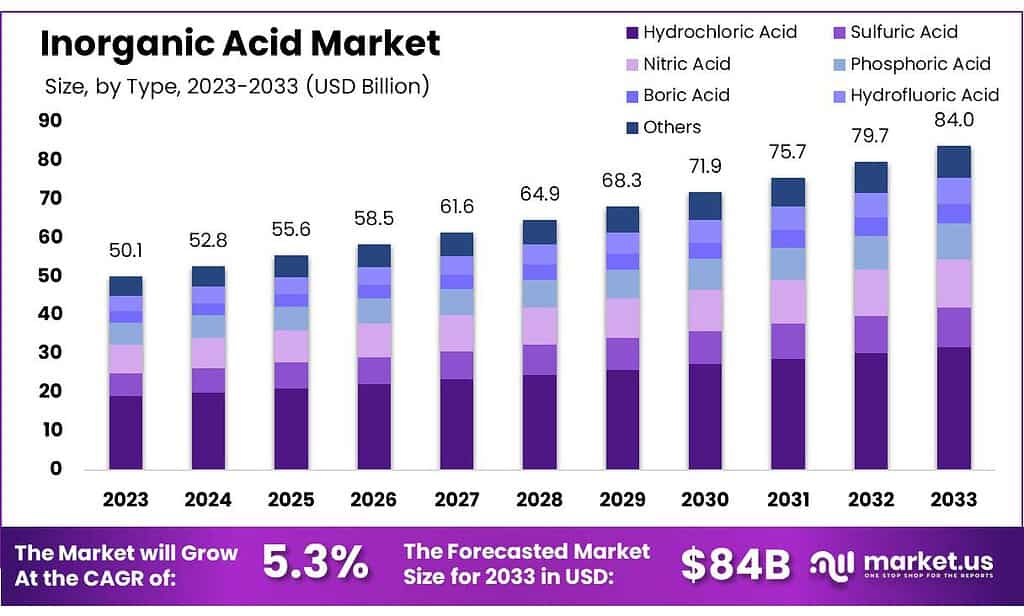

The Global Inorganic Acid Market size is expected to be worth around USD 84.0 Bn by 2033, from USD 50.1 Bn in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Inorganic acids are a category of acids that do not contain carbon, with a few exceptions, such as cyanide and cyanates, which include carbon in their molecular structure. These acids are typically derived from mineral sources and are characterized by their relatively simple chemical structures.

Inorganic acids generally exhibit higher volatility and melting points compared to organic acids, which are carbon-based and often derived from natural or synthetic processes involving living organisms or carbon-based compounds.

Government investments have been significant in promoting sustainable agricultural practices and the development of the chemical sector. In 2020, the Canadian government allocated CAD 560,000 towards the Canadian Agri-Food Sustainability Initiative, aiming to support more sustainable practices within the agriculture and food industries.

Similarly, the U.S. Department of Agriculture initiated the Agriculture and Food Research Initiative (AFRI), which focuses on advancing sustainable practices in the agriculture and food sectors, reinforcing the global push for sustainability in industrial processes.

From a trade perspective, Mexico has become an important player in the inorganic acid market. The country’s trade exchange for inorganic acids in 2023 amounted to US$412 million, with San Luis Potosí accounting for the largest share at US$126 million.

The United States was the leading commercial destination for these exports, receiving US$185 million worth of inorganic acids, followed by Japan, which imported US$3.48 million in goods. This trade activity underscores the importance of inorganic acids in global supply chains, particularly in regions like North America and Asia.

On the mergers and acquisitions (M&A) front, 2023 saw a decline in activity within the chemical sector, with M&A transactions falling by approximately 16%, marking the lowest level in a decade due to broader economic challenges.

However, notable deals included INEOS acquiring Eastman’s Texas City site, which hosts a 600kt acetic acid plant, and LyondellBasell’s acquisition of the ethylene oxide business for US$700 million, highlighting continued strategic investments in key chemical assets despite overall market uncertainty.

Key Takeaways

- Inorganic Acid Market size is expected to be worth around USD 84.0 Bn by 2033, from USD 50.1 Bn in 2023, growing at a CAGR of 5.3%.

- Sulfuric Acid held a dominant market position, capturing more than a 38.4% share.

- Monobasic acids held a dominant market position in the inorganic acid sector, capturing more than a 56.3% share.

- Strong Acids held a dominant market position in the inorganic acid industry, capturing more than a 78.1% share.

- Industrial Grade held a dominant market position, capturing more than a 51.2% share of the inorganic acid market.

- Agrochemicals and Fertilizers held a dominant market position in the inorganic acid industry, capturing more than a 38.4% share.

- Agriculture held a dominant market position in the inorganic acid industry, capturing more than a 28.3% share.

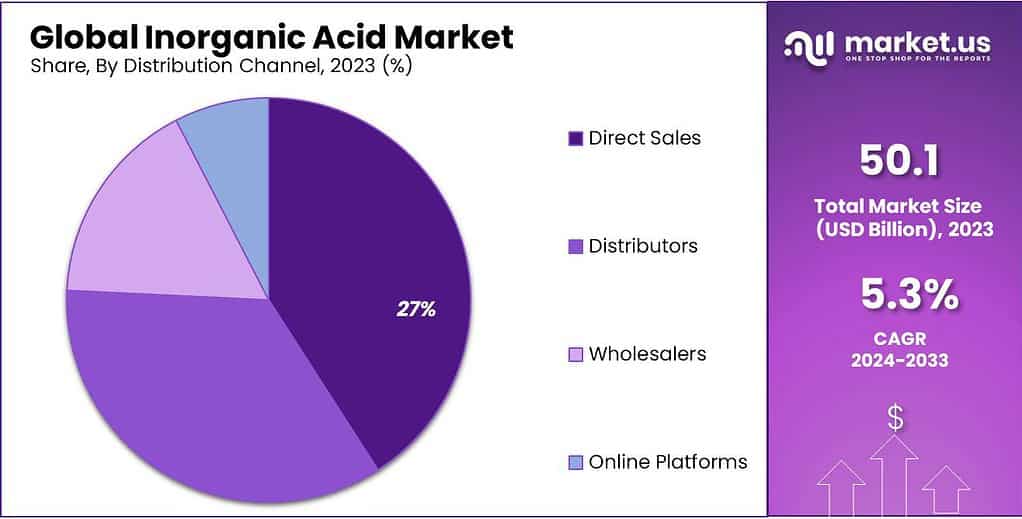

- Direct Sales held a dominant market position in the inorganic acid market, capturing more than a 51.2% share.

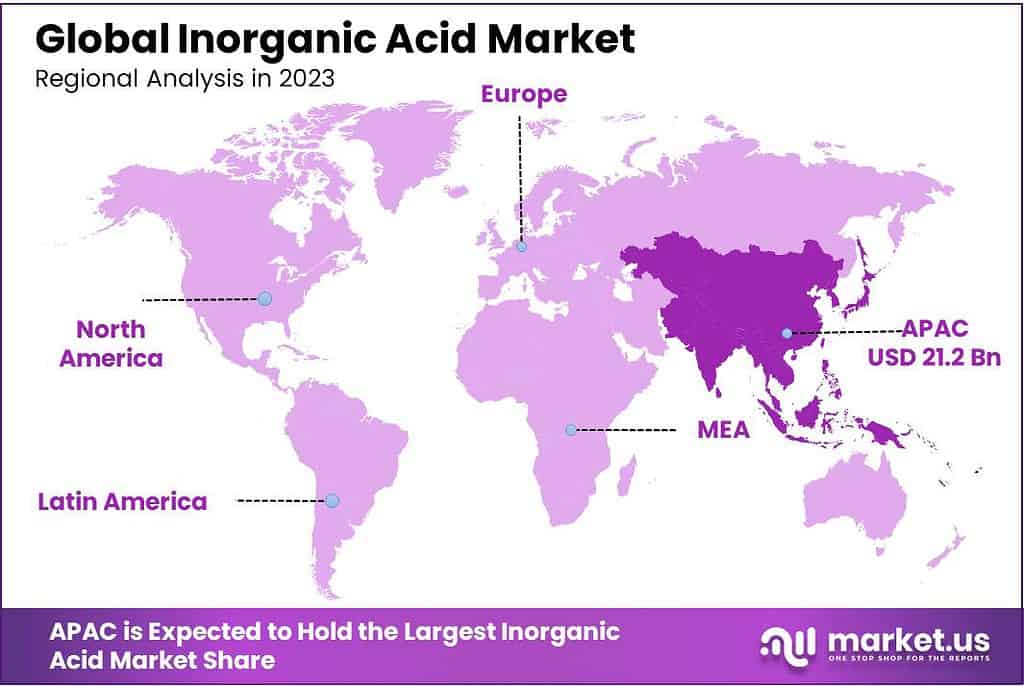

- Asia Pacific (APAC) holds a dominant position in the inorganic acid market, accounting for approximately 42.3% of the market share and generating revenue of USD 21.2 billion.

By Type

In 2023, Sulfuric Acid held a dominant market position, capturing more than a 38.4% share of the inorganic acid market. This prominence is due to its extensive use across various industries, including fertilizer production, chemical manufacturing, and petroleum refining, where it is essential for processes like acidulation of phosphate rock.

Hydrochloric Acid also holds a significant share of the market, utilized heavily in applications such as steel pickling, ore processing, and as a cleaning agent in various industrial processes. Its versatility and effectiveness in removing impurities make it a staple in the chemical industry.

Nitric Acid is another key player, critical in the manufacture of fertilizers and explosives. Its ability to react with most metals makes it valuable in metal processing, particularly in the fabrication of precision metal parts.

Phosphoric Acid follows closely, primarily used in the production of phosphate fertilizers, which are crucial for global agriculture. It is also used in food processing, where it acts as a flavoring agent and acidity regulator.

Boric Acid is noted for its use in glass and ceramics manufacturing and as an antiseptic and insecticide, catering to both industrial and consumer markets.

Hydrofluoric Acid, although less prevalent, is essential in the production of high-purity fluorine compounds and for etching glass, reflecting its niche but vital role in the market.

By Basicity

In 2023, Monobasic acids held a dominant market position in the inorganic acid sector, capturing more than a 56.3% share. These acids, characterized by their ability to donate one proton per molecule, are pivotal in various industrial and chemical processes.

Examples include hydrochloric acid and nitric acid, which are widely used in the manufacturing of fertilizers, in metal processing, and as integral components in the production of numerous chemicals.

Dibasic acids, which can donate two protons per molecule, also play a significant role in the market. Common dibasic acids include sulfuric acid, which is essential in battery acid production, wastewater treatment, and mineral extraction processes. Its ability to dehydrate substances makes it valuable in the chemical synthesis of many compounds.

Tribasic acids, like phosphoric acid, have the capacity to donate three protons per molecule and are heavily utilized in agriculture to produce phosphate fertilizers, a critical component in boosting crop yields. Additionally, phosphoric acid is used in the food and beverage industry as an acidity regulator, particularly in soft drinks.

By Strength

In 2023, Strong Acids held a dominant market position in the inorganic acid industry, capturing more than a 78.1% share. This category includes highly reactive acids like sulfuric acid, hydrochloric acid, and nitric acid, which are essential in numerous industrial processes.

Strong acids are characterized by their complete dissociation in water, releasing a higher concentration of hydrogen ions, which makes them particularly effective in applications such as metal processing, manufacturing of fertilizers, and chemical synthesis, where high reactivity is required for efficient production.

On the other hand, Weak Acids, such as boric acid, do not dissociate completely in solution and thus have a less pronounced release of hydrogen ions. While they hold a smaller segment of the market, weak acids are crucial in specific applications where a milder acid reaction is necessary. They are widely used in industries like pharmaceuticals, where they help in the manufacture of drugs, and in the food industry, serving as preservatives and pH stabilizers.

By Grade

In 2023, Industrial Grade held a dominant market position, capturing more than a 51.2% share of the inorganic acid market. This grade is primarily used in large-scale industrial applications, including metal processing, manufacturing, and chemical production. The demand for industrial-grade acids is driven by the need for effective cleaning, etching, and acidification processes in various industries.

Technical Grade acids followed closely behind, accounting for a significant share of the market. These acids are widely used in applications where high purity is required, but not to the extent of food or pharmaceutical grades. Industries such as textiles, rubber, and wastewater treatment rely heavily on technical-grade acids due to their balanced performance and cost efficiency.

Food Grade acids are gaining traction, particularly in the food and beverage industry. These acids meet strict safety and purity standards, ensuring they are suitable for use in food processing, preservation, and flavor enhancement. The increasing consumer demand for processed and preserved food products is contributing to the growth of this segment.

Pharmaceutical Grade acids, while a smaller segment, are critical for the production of active pharmaceutical ingredients (APIs), excipients, and formulations. These acids must meet stringent regulatory standards and are used in high-precision applications in the healthcare sector. With the growth of the global pharmaceutical industry, the demand for pharmaceutical-grade acids is expected to rise steadily.

Electronic Grade acids, although niche, are essential in the electronics manufacturing industry, particularly in the production of semiconductors and circuit boards. The growth of the electronics sector, fueled by the rise of consumer electronics and technology, is driving demand for high-purity electronic-grade acids.

By Application

In 2023, Agrochemicals and Fertilizers held a dominant market position in the inorganic acid industry, capturing more than a 38.4% share. This sector relies heavily on inorganic acids like phosphoric and nitric acids, which are integral to the synthesis of nitrogen and phosphate-based fertilizers. These fertilizers are crucial for enhancing soil fertility and crop yield, reflecting the growing global demand for agricultural productivity due to increasing food requirements.

The Metal Processing segment also plays a significant role, utilizing strong acids such as sulfuric and hydrochloric acids in processes like electroplating, anodizing, and pickling. These acids help in cleaning, etching, and coating metals, which is essential for preventing corrosion and preparing metals for further processing.

Lead Battery Manufacturing uses sulfuric acid as a key component. The acid acts as an electrolyte in lead-acid batteries, which are widely used in automotive and industrial applications. This segment continues to grow with the expanding automotive sector and the need for renewable energy storage solutions.

Dyes and Pigments industries utilize acids such as nitric and sulfuric acids to process and manufacture colorants used in textiles, paints, and inks. This application is critical for achieving the desired chemical properties and stability in dyes and pigments.

Explosives manufacturing is another significant application where strong acids like nitric acid are used to produce nitroglycerine and other nitrate-based explosives. These materials are crucial for mining and construction industries.

The Soap and Detergent industry, Petroleum Refining, and Cellulose Fiber production also contribute to the inorganic acid market, each utilizing specific acids to enhance product quality and efficiency in manufacturing processes.

By End-use Industry

In 2023, Agriculture held a dominant market position in the inorganic acid industry, capturing more than a 28.3% share. This sector primarily uses inorganic acids such as nitric, phosphoric, and sulfuric acids for fertilizer production, which is crucial for enhancing soil nutrition and increasing crop yields. The demand is driven by the global need to boost agricultural output to meet food requirements for a growing population.

The Paints and Coatings industry also heavily relies on inorganic acids, utilizing them as catalysts and cleaning agents during manufacturing processes. These acids are essential for ensuring the quality and durability of paints and coatings, which are applied across various sectors, including automotive and construction.

In the Pulp & Paper industry, inorganic acids are used to process wood fibers and in the bleaching process, helping to break down lignin and enhance paper whiteness and strength. This application remains vital for producing high-quality paper products.

The Chemical and Petrochemical sector utilizes inorganic acids for a wide range of processes, including catalysis, polymerization, and refining operations. These industries depend on the high reactivity of inorganic acids to facilitate chemical reactions and produce a variety of chemical products.

Pharmaceuticals, Food & Beverages, and Electronics industries also significantly utilize inorganic acids. In Pharmaceuticals, they are used in drug synthesis and as excipients. In Food & Beverages, acids like phosphoric acid serve as acidity regulators and preservatives. In the Electronics industry, acids are crucial for etching and cleaning electronic components.

By Distribution Channel

In 2023, Direct Sales held a dominant market position in the inorganic acid market, capturing more than a 51.2% share. This distribution channel is preferred by many manufacturers due to its ability to maintain close relationships with end-users and offer customized solutions. Direct sales allow for better control over pricing and brand management, which is particularly important in the chemical industry where product specifications and quality standards are critical.

Distributors and wholesalers also play a crucial role, particularly in extending market reach and providing access to various regional and local markets. This channel is essential for manufacturers looking to expand their footprint without directly investing in infrastructure in diverse geographical areas.

Online platforms are rapidly growing as a distribution channel for inorganic acids, driven by the increasing digitization of the sales process and the global shift towards e-commerce. These platforms offer manufacturers the advantage of reaching a broader customer base and provide customers with the convenience of comparing different products and suppliers quickly.

Key Market Segments

By Type

- Hydrochloric Acid

- Sulfuric Acid

- Nitric Acid

- Phosphoric Acid

- Boric Acid

- Hydrofluoric Acid

- Others

By Basicity

- Monobasic

- Dibasic

- Tribasic

By Strength

- Strong Acid

- Weak Acid

By Grade

- Industrial Grade

- Technical Grade

- Food Grade

- Pharmaceutical Grade

- Electronic Grade

By Application

- Agrochemicals and Fertilizers

- Metal Processing

- Lead Battery Manufacturing

- Dyes and Pigments

- Explosives

- Soap and Detergent

- Petroleum Refining

- Cellulose Fiber

- Others

By End-use Industry

- Agriculture

- Paints and Coatings

- Pulp & Paper

- Chemical and Petrochemical

- Pharmaceutical

- Food & Beverages

- Electronics

- Textile

- Wastewater Treatment

- Metalworking

- Woodworking

- Others

By Distribution Channel

- Direct Sales

- Distributors

- Wholesalers

- Online Platforms

Driving Factors

Government Initiatives and Investments

One of the significant drivers of the inorganic acid market is the array of government initiatives aimed at enhancing agricultural productivity and sustainability. Various programs like the Agriculture and Food Research Initiative (AFRI) in the United States and the Canadian Agri-Food Sustainability Initiative are notable examples. These programs, backed by substantial investments, such as the $560,000 funding for the Canadian Federation of Agriculture, focus on improving food safety, security, and sustainable farming practices.

Industrial Demand Across Sectors

The robust demand for inorganic acids across multiple industrial sectors underpins the market’s growth. Industries such as chemical manufacturing, metal processing, and oil and gas exploration rely heavily on inorganic acids. For instance, the industrial grade segment of the market, which includes these applications, held the largest market share in 2023 and is projected to continue its dominance due to increasing demand.

Technological Advancements and R&D

Technological advancements aimed at enhancing the production efficiency of inorganic acids also drive the market. Investments in research and development by key market players, such as BASF and Dow Chemical, are directed towards creating more efficient and environmentally friendly production processes.

Market Expansion in Emerging Economies

The rapid industrialization and urbanization in emerging economies create a substantial demand for inorganic acids. This is particularly evident in the Asia Pacific region, which dominated the market share due to its high phosphate rock reserves and significant production capabilities, especially in countries like China.

Restraining Factors

Environmental and Health Concerns

One of the principal factors restraining the growth of the inorganic acid market is the environmental and health concerns associated with the use and production of these acids. Inorganic acids, such as sulfuric, nitric, and hydrochloric acids, are known for their corrosive nature and potential to cause severe environmental damage and health issues.

This has led to stringent regulatory frameworks aimed at controlling emissions and exposures, which in turn, curtail the market’s expansion.

Shift Towards Organic Acids

The market is also being impacted by the increasing demand for organic acids, which are perceived as less harmful to the environment and human health. This shift is driven by changing regulatory policies and the growing advocacy for sustainable and eco-friendly manufacturing practices.

Governments and organizations worldwide are actively promoting the use of organic acids, leading to a gradual decrease in the reliance on their inorganic counterparts. This trend is evident in sectors such as agriculture, where the toxicity of inorganic acids to the soil and water bodies is a major concern.

Cost and Supply Chain Volatility

The inorganic acid industry is further challenged by the volatility in the cost of raw materials and the complexities of managing a safe supply chain. The corrosive nature of inorganic acids necessitates specialized handling, storage, and transportation methods, which can significantly elevate operational costs. Additionally, fluctuations in the availability and price of raw materials used to produce these acids can impact production rates and profitability

Growth Opportunity

Expansion into Emerging Markets

A significant growth opportunity for the inorganic acid market lies in its expansion into emerging markets, particularly in the Asia-Pacific region. This region is witnessing rapid industrialization and urbanization, which drives the demand for inorganic acids across various sectors, including agriculture, construction, and manufacturing.

Technological Advancements in Production Processes

Innovations aimed at improving the production processes of inorganic acids present another growth avenue. Companies are investing in developing more efficient and environmentally friendly manufacturing techniques. This not only helps in reducing production costs but also aligns with global regulatory pressures and sustainability goals.

Increasing Application in Agriculture and Fertilizer Production

The agricultural sector offers considerable expansion prospects due to the essential role of inorganic acids in fertilizer production. With the global population on the rise, there is a pressing need to enhance agricultural outputs, which in turn boosts the demand for fertilizers made using inorganic acids. Government initiatives across various countries to support agricultural growth further supplement this demand.

Strategic Partnerships and Market Consolidation

Engaging in strategic partnerships and mergers can provide inorganic acid manufacturers with opportunities to consolidate their market presence and expand their reach. These collaborations could involve sharing technological know-how, expanding into new geographical areas, and joint ventures with local firms to tap into regional markets more effectively.

Latest Trends

Increased Demand in Agriculture and Industry

One prominent trend in the inorganic acid market is the surging demand from agricultural and industrial sectors, especially in regions like Asia-Pacific. This demand is driven primarily by the extensive use of inorganic acids such as nitric acid in fertilizer production, crucial for agriculture in heavily populated countries like China and India. The industrial sector also continues to consume significant amounts of inorganic acids for various applications including metal processing and chemical synthesis.

Technological Advancements in Production

Technological advancements in the manufacturing processes of inorganic acids are shaping the market significantly. Innovations aimed at improving efficiency and reducing environmental impact are becoming prevalent. These advancements are crucial as they help manufacturers meet the stringent regulatory standards imposed to mitigate environmental and health hazards associated with acid handling and disposal.

Shift Towards Eco-friendly Alternatives

There’s a growing trend towards the development and use of biodegradable and less hazardous substitutes for traditional inorganic acids. This shift is in response to increasing environmental concerns and regulatory pressures about the safety and ecological impact of chemical products. The market is gradually adapting to these changes by investing in research and development to discover sustainable alternatives that meet industrial needs without compromising environmental safety.

Expansion of E-commerce and Direct Sales

The distribution channels for inorganic acids are evolving, with a notable increase in direct sales and e-commerce platforms. This change allows for better control over distribution, enhanced customer relationships, and more tailored marketing strategies, thus helping manufacturers navigate the complexities of the global market more effectively.

Regional Analysis

Asia Pacific (APAC) holds a dominant position in the inorganic acid market, accounting for approximately 42.3% of the market share and generating revenue of USD 21.2 billion. This significant share is driven by rapid industrialization and urbanization, particularly in major economies such as China and India. The high demand in APAC is primarily fueled by the agricultural sector, where inorganic acids are extensively used for fertilizer production.

North America follows, characterized by advanced manufacturing sectors and stringent environmental regulations which influence the production and use of inorganic acids. The region benefits from a robust technological infrastructure, which supports innovations in chemical manufacturing and environmental management, thereby sustaining market growth.

Europe exhibits steady growth in the inorganic acid market due to its mature automotive and construction industries, which utilize inorganic acids for various applications such as metal treatment and cement manufacturing. European market dynamics are also shaped by environmental policies that drive the demand for more sustainable and less hazardous chemical formulations.

Middle East & Africa (MEA), although smaller in market size compared to APAC, North America, and Europe, is experiencing moderate growth. This region’s growth is primarily attributed to the development of oil and gas sectors where inorganic acids are used for processes like acid gas treatment.

Latin America shows potential for growth in the inorganic acid market, spurred by the mining and metal processing industries. Investments in agricultural technologies also boost the demand for inorganic acids used in fertilizers, supporting the regional market’s expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The inorganic acid market features a competitive landscape with several key players that drive innovation and market expansion. PPG Industries and Evonik Industries AG are notable for their broad product portfolios and emphasis on sustainable chemical solutions. Nouryon and Tosoh Corporation contribute significantly through their specialized chemical products and have a strong focus on expanding their global market presence. Showa Denko K.K. is another important player, known for its technological innovations in chemical manufacturing.

BASF and Huntsman Corporation are leaders in the chemical industry, investing heavily in research and development to introduce efficient and environmentally friendly inorganic acid products. Kemira Oyj and LCY Chemical Corp. play crucial roles in water treatment and other industrial applications, driving demand for inorganic acids. Solvay SA is recognized for its diversified chemical offerings and strategic market approaches, focusing on optimizing production processes and enhancing global reach.

Olin Corporation and OCI Company Ltd. are instrumental in the development and distribution of industrial chemicals, including inorganic acids, with a strong emphasis on adhering to regulatory standards and enhancing customer satisfaction. The Dow Chemical Company leverages its global network and significant R&D capabilities to maintain a competitive edge, particularly in the development of sustainable chemical solutions. Albemarle Corporation and AkzoNobel N.V. focus on innovative chemical products and have strong commitments to sustainability, which align with global environmental trends and customer demands in the chemical industry.

Top Key Players in the Market

- PPG Industries

- Evonik Industries AG

- Nouryon

- Tosoh Corporation

- Showa Denko K.K.

- BASF

- Huntsman Corporation

- Kemira Oyj

- LCY Chemical Corp.

- Solvay SA

- Olin Corporation

- OCI Company Ltd.

- The Dow Chemical Company

- Albemarle Corporation

- AkzoNobel N.V.

Recent Developments

In the second quarter of 2024, PPG Industries reported net sales of $4.8 billion, with a notable earnings per diluted share (EPS) increase to $2.24, compared to $2.06 in the same quarter of the previous year.

In 2023, Evonik Industries AG achieved notable financial outcomes in the inorganic acid sector, despite facing a challenging economic environment. The company reported revenues of €15.3 billion and an adjusted EBITDA of €1.66 billion for the year.

Report Scope

Report Features Description Market Value (2023) USD 50.1 Bn Forecast Revenue (2033) USD 84.0 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydrochloric Acid, Sulfuric Acid, Nitric Acid, Phosphoric Acid, Boric Acid, Hydrofluoric Acid, Others), By Basicity (Monobasic, Dibasic, Tribasic), By Strength (Strong Acid, Weak Acid), By Grade (Industrial Grade, Technical Grade, Food Grade, Pharmaceutical Grade, Electronic Grade), By Application (Agrochemicals and Fertilizers, Metal Processing, Lead Battery Manufacturing, Dyes and Pigments, Explosives, Soap and Detergent, Petroleum Refining, Cellulose Fiber, Others), By End-use Industry (Agriculture, Paints and Coatings, Pulp and Paper, Chemical and Petrochemical, Pharmaceutical, Food and Beverages, Electronics, Textile, Wastewater Treatment, Metalworking, Woodworking, Others), By Distribution Channel (Direct Sales, Distributors, Wholesalers, Online Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PPG Industries, Evonik Industries AG, Nouryon, Tosoh Corporation, Showa Denko K.K., BASF, Huntsman Corporation, Kemira Oyj, LCY Chemical Corp., Solvay SA, Olin Corporation, OCI Company Ltd., The Dow Chemical Company, Albemarle Corporation, AkzoNobel N.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PPG Industries

- Evonik Industries AG

- Nouryon

- Tosoh Corporation

- Showa Denko K.K.

- BASF

- Huntsman Corporation

- Kemira Oyj

- LCY Chemical Corp.

- Solvay SA

- Olin Corporation

- OCI Company Ltd.

- The Dow Chemical Company

- Albemarle Corporation

- AkzoNobel N.V.