Global Vapor Isolation Films Market Type(Vapor Barrier Films, Air-Vapor Control Films), Film Type(Polyethylene, Polyamide, Polypropylene, Other Film Types), Thickness(Less than 100 microns, 100-200 microns, 200-300 microns, More than 300 microns), Application(Construction, Agriculture, Packaging, Manufacturing, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 36460

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

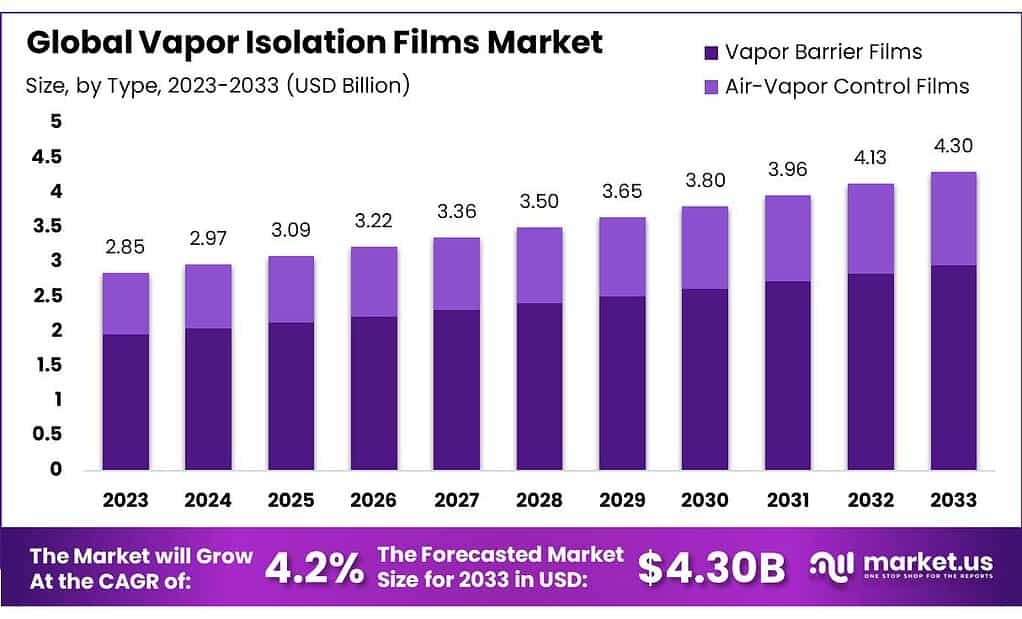

The Vapor Isolation Films Market size is expected to be worth around USD 4.30 Billion by 2033, from USD 2.85 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

The development of the vapor isolation films market is anticipated to be fueled by the rising demand for vapor isolation films, such as vapor barrier films, air-vapor control films, control films medical, and others.

These films are widely used in sectors like construction, packaging, etc. Any damp-proofing substance, frequently a plastic or foil sheet, that stops moisture from diffusing across building the wall, floor, ceiling, or roof assemblies to avoid interstitial condensation and packing is referred to as a vapor barrier film.

Many of these materials are merely vapor retarders due to their varying degrees of permeability. Some vapor retarders include expanded polystyrene, cellulose insulation, elastomeric coating, and others.

Currently, the market for vapor isolation films is anticipated to increase throughout the projected period due to rising government spending in the construction industry and the inclining growth of the e-commerce sector. This market report gives a detailed analysis of the vapor isolation films market size, share, growth, key trends, applications, major players, and other details.

Key Takeaways

- Market Growth Projection: Vapor Isolation Films Market set to grow at 4.2% CAGR, reaching USD 4.30 Billion by 2033 from USD 2.85 Billion in 2023.

- Type Dominance: Vapor Barrier Films claimed 68.7% market share in 2023, showcasing their vital role in moisture control within construction and various industries.

- Film Type Focus: Key film types include polyethylene and polyamide, with building & construction accounting for 48% market share in 2022, projected to grow at 4.5% CAGR.

- Thickness Segmentation: Films categorized by thickness, including less than 100 microns, 100-200 microns, 200-300 microns, and more than 300 microns, catering to diverse applications.

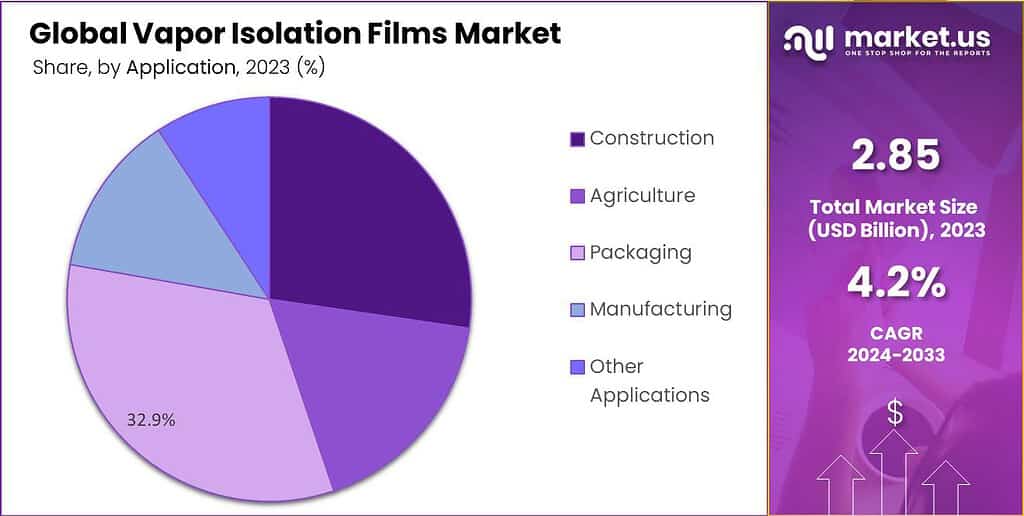

- Dominant Application: Packaging led with over 32.9% market share in 2023, reflecting the industry’s preference for vapor isolation films in preserving product quality.

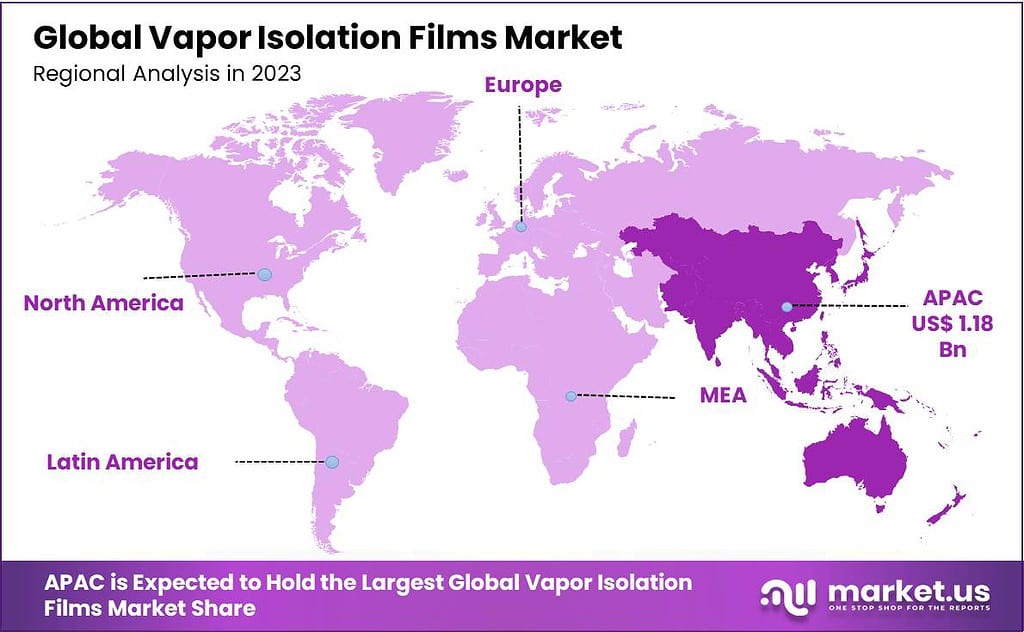

- Regional Leadership: Asia Pacific (APAC) held the largest revenue share at 41.3% in 2023, driven by government support for infrastructure development in key countries.

Type Analysis

In 2023, Vapor Barrier Films emerged as the frontrunner in the Vapor Isolation Films market, seizing a substantial 68.7% share. This dominance highlights the widespread preference for Vapor Barrier Films within the industry. Vapor Barrier Films play a pivotal role in construction and various industries, serving as a crucial component for moisture control.

The significant market share signifies that a majority of consumers and businesses favored these films over alternative options. Their dominance is indicative of the trust placed in Vapor Barrier Films for effectively preventing the passage of moisture, protecting structures, and ensuring a controlled environment.

The popularity of Vapor Barrier Films in 2023 underscores their essential role in maintaining optimal conditions and safeguarding against potential damage caused by moisture infiltration. As the market leader, Vapor Barrier Films showcases its significance in meeting the stringent requirements of diverse applications, contributing to the overall growth and stability of the Vapor Isolation Films market.

By Film Type

The vapor isolation films market is predicted to develop due to the rising growth of the construction sector. In 2022, building & construction accounted for 48% of the market share for vapor isolation films. Also, it is anticipated to expand at a CAGR of 4.5% from 2023 to 2032.

For instance, according to the U.S. Census Bureau, the total construction value climbed by 8% between January 2021 and January 2022. Additionally, private construction’s overall construction value scaled by 11%. It is also projected that rising government construction investments will fuel industry expansion.

Thickness

Less than 100 microns: Thin vapor isolation films suitable for applications where minimal thickness is essential. Commonly used for lightweight vapor barrier requirements.

100-200 microns: Medium-thickness films offer a balance between flexibility and strength. Ideal for various vapor isolation applications with moderate performance requirements.

200-300 microns: Thick vapor isolation films provide enhanced durability and protection. Suited for applications requiring a robust vapor barrier with higher performance specifications.

More than 300 microns: Heavy-duty vapor isolation films with substantial thickness, offering maximum strength and protection. Designed for demanding applications with stringent vapor barrier requirements.

By Application

In 2023, Packaging emerged as the dominant application segment in the Vapor Isolation Films market, securing a significant market share of more than 32.9%. This indicates a clear preference for vapor isolation films in the packaging industry, highlighting their crucial role in preserving the quality and integrity of packaged goods.

The substantial market share underscores the industry’s acknowledgment of the effectiveness and versatility of vapor isolation films in addressing moisture-related challenges. The Packaging segment’s prominence reflects the growing demand for advanced packaging solutions that ensure protection against moisture, thereby extending the shelf life of products.

Vapor isolation films serve as a reliable barrier, preventing moisture ingress and safeguarding items from potential damage caused by environmental factors. The market’s recognition of Packaging as a leading application segment underscores the significance of vapor isolation films in enhancing the overall quality and longevity of packaged products.

The choice of Packaging as the dominant segment also suggests that industries value the role of vapor isolation films beyond their traditional applications. The adaptability of these films in meeting the specific needs of the packaging sector highlights their versatility and potential for addressing diverse challenges in different industries. Overall, the market’s focus on Packaging signifies the crucial role of vapor isolation films in advancing packaging practices and ensuring the optimal preservation of goods.

Key Market Segments

Type

- Vapor Barrier Films

- Air-Vapor Control Films

Film Type

- Polyethylene

- Polyamide

- Polypropylene

- Other Film Types

Thickness

- Less than 100 microns

- 100-200 microns

- 200-300 microns

- More than 300 microns

Application

- Construction

- Agriculture

- Packaging

- Manufacturing

- Other Applications

Drivers

When discussing the drivers of the Vapor Isolation Films market, it’s important to consider the various factors that contribute to its growth and development. The Vapor Isolation Films market is witnessing robust growth due to a confluence of key drivers that are shaping the industry landscape. These factors are steering the market towards increased demand and adoption across various sectors.

One of the primary drivers is the growing awareness and emphasis on energy efficiency in construction and industrial processes. As sustainability becomes a paramount concern, the need for effective vapor isolation solutions is escalating, propelling the market forward.

The Vapor Isolation Films market is growing rapidly because more buildings are being constructed, especially in developing countries. Cities are expanding, and new infrastructure projects are happening, creating a high demand for special films that can keep moisture out. These films are crucial in making structures last longer by preventing damage from water.

Rules and guidelines about construction are getting stricter, and they now require the use of vapor isolation materials. This is pushing companies to come up with better films that not only meet these rules but also work better in different situations.

Improvements in how these films are made are also helping the market to grow. New technologies are being used to create films that are better at stopping moisture, more durable, and easier to install. This progress is making these films useful in many different industries. People are now more focused on building in a way that is good for the environment.

This means there’s a growing interest in using vapor isolation films that are eco-friendly. Manufacturers are spending time and money on research to make films that not only keep moisture out but also follow environmentally friendly practices.

In summary, the Vapor Isolation Films market is being propelled by a combination of factors such as the demand for energy-efficient solutions, rapid construction activities, regulatory compliance, technological advancements, and a growing emphasis on sustainability. These drivers collectively contribute to the market’s positive trajectory and underscore the critical role of vapor isolation films in modern construction and industrial applications.

Restraints

The Vapor Isolation Films market is not without its share of challenges, with several factors acting as restraints and limiting its growth potential. One significant constraint is the cost associated with high-performance vapor isolation films.

The advanced technologies and materials used in manufacturing these films can contribute to elevated production costs, making them less accessible for certain segments of the market, particularly in regions with budget constraints. Another restraint stems from the complexity of regulations and standards governing the construction industry.

Following the rules can be good for the Vapor Isolation Films market, but sometimes, the rules are very complicated. Manufacturers might find it hard to understand and meet all the different standards in various places. This makes it tricky to produce and sell these films efficiently. Additionally, the Vapor Isolation Films market is sensitive to changes in the economy, especially in construction.

When the economy is not doing well, and there’s less construction happening, people don’t need these films as much. This can lead to a decrease in demand for the films, impacting the market and its growth. So, economic uncertainties and downturns can make things difficult for the Vapor Isolation Films market.

Technical challenges related to the installation and compatibility of vapor isolation films can also hinder their widespread adoption. If these films are difficult to install or do not integrate seamlessly with existing construction materials and methods, it may discourage their use among builders and contractors. Using environmentally friendly films is good for the Vapor Isolation Films market, but it can also create problems.

Making and getting rid of these eco-friendly materials might still have some negative effects on the environment. So, manufacturers need to find a balance between being sustainable and making sure they’re not causing new environmental issues.

To sum up, even though the Vapor Isolation Films market looks like it can grow a lot, there are challenges like expensive production, confusing rules, uncertain economies, tricky installation, and environmental concerns. Manufacturers have to carefully manage these challenges to make sure the market keeps growing and becomes successful everywhere.

Opportunities

The Vapor Isolation Films market is poised for significant opportunities that could drive its growth and market presence. The Vapor Isolation Films market has great opportunities because people worldwide are focusing more on making buildings in a way that’s good for the environment and uses less energy.

People are becoming aware of how regular building materials impact the environment, so there’s a growing demand for vapor isolation films that are eco-friendly. Manufacturers can take advantage of this by creating films that not only work well but also help in reaching sustainability goals.

The progress in technology is also giving a chance for new and better things in the vapor isolation film industry. There’s room for innovation to make films that are even better at stopping moisture, last longer, and are easier to install. Manufacturers who invest in creating these advanced products can get ahead in the competition and reach new customers.

Cities around the world are changing, and buildings are becoming smarter with the use of technology. This creates a need for better building materials, including high-quality vapor isolation films. Manufacturers can benefit by adapting their products to fit the requirements of these modern and smart construction practices. By doing so, they can meet the growing demand in this changing construction landscape.

The surge in infrastructure projects in developing economies offers a substantial growth opportunity for the Vapor Isolation Films market. Rapid urban development and increased construction activities in emerging markets create a robust demand for effective moisture control solutions. Manufacturers can strategically target these regions and collaborate with local stakeholders to establish a strong market presence.

In conclusion, the Vapor Isolation Films market has great chances to grow because more people care about being eco-friendly, there are new and better technologies, and buildings are getting smarter. Also, in developing countries, more construction is happening, creating more opportunities.

Manufacturers can do well by taking action on these opportunities. This not only helps them sell more but also plays a part in making the construction industry more eco-friendly and advanced.

Challenges

Despite its growth potential, the Vapor Isolation Films market encounters various challenges that manufacturers and stakeholders must navigate. One significant hurdle is the cost associated with producing high-quality vapor isolation films.

Advanced materials and technologies used in manufacturing can lead to higher production expenses, limiting accessibility for certain markets and regions, particularly those with financial constraints. Navigating a complex web of regulations and standards poses another challenge for market participants.

Compliance requirements vary across regions and can be intricate, making it challenging for manufacturers to ensure that their products adhere to diverse and sometimes conflicting standards. This complexity can hinder the smooth production and distribution of vapor isolation films, impacting overall market efficiency.

The Vapor Isolation Films market faces some tough challenges. When the economy is not doing well, and there’s less construction happening, people don’t need these films as much. This can lead to less demand and affect the market.

Installing and using these films can be tricky. If they are hard to put in place or don’t work well with other construction materials, builders might not want to use them. This makes it difficult for these films to become widely accepted in the market.

While making films that are good for the environment is an opportunity, it also comes with challenges. Creating and getting rid of eco-friendly materials can still harm the environment in some ways. So, manufacturers need to find a balance between being sustainable and not causing new environmental problems.

In conclusion, the Vapor Isolation Films market faces challenges like expensive production, confusing rules, uncertain economies, tricky installation, and environmental concerns. Overcoming these challenges is crucial for the market to keep growing and for these films to become a common part of modern construction.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 41.3% in 2023. With more government programs aimed at boosting the infrastructure and construction industries in developing nations like China, Japan, and India, the market in the region is expanding.

According to the India Brand Equity Foundation, the Ministry of Housing and Urban Affairs received funding from the government of US$ 7,640 million. Moreover, India’s National Investment and Infrastructure Fund (NIIF) received an equity investment of US$ 54 million from the US International Development Finance Corporation (DFC) in December 2020.

This has supported the nation’s development of essential infrastructure projects. With increasing government support for developing the construction and infrastructure sector in emerging economies, the market is experiencing expansions.

Additionally, businesses in the APAC region are given lucrative opportunities to increase their production capacity and, as a result, spur market expansion. Thus, it is anticipated that demand for vapor isolation films will increase in the APAC region throughout the projection period, along with the development of new construction activities.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market for vapor isolation films is highly fragmented and competitive, with many major international and numerous local vendors involved. Technology launches, product launches, acquisitions, and R&D activities are key strategies players adopt in the vapor isolation films market. Key companies included in this market report are 3M, INDEVCO Group, Insulation Solutions, Inc., and other major players.

Market Key Players

- 3M

- INDEVCO Group

- Insulation Solutions, Inc.

- Kalliomuovi Oy

- Conservation Technology

- POLY FILM

- Brite Coatings Private Limited

- Innovia Films

- Cosmo Films

- Flex Films

- Other Key Players

Recent Developments

In 2023, Amcor acquired Moda Systems, a leading manufacturer of state-of-the-art, automated protein packaging machines.

In 2023, Sealed Air and Koenig & Bauer AG signed a non-binding letter of intent to expand their strategic partnership for digital printing machines.

In 2022, Mitsubishi Chemical announced the commercialization of its new high-performance water vapor barrier film, MWV6000.

Report Scope

Report Features Description Market Value (2022) USD 2.85 Bn Forecast Revenue (2032) USD 4.30 Bn CAGR (2023-2032) 4.2% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type(Vapor Barrier Films, Air-Vapor Control Films), Film Type(Polyethylene, Polyamide, Polypropylene, Other Film Types), Thickness(Less than 100 microns, 100-200 microns, 200-300 microns, More than 300 microns), Application(Construction, Agriculture, Packaging, Manufacturing, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3M, INDEVCO Group, Insulation Solutions, Inc., Kalliomuovi Oy, Conservation Technology, POLY FILM, Brite Coatings Private Limited, Innovia Films, Cosmo Films, Flex Films, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Vapor Isolation Films Market?Vapor Isolation Films Market size is expected to be worth around USD 4.30 Billion by 2033, from USD 2.85 Billion in 2023

What is the CAGR for the Vapor Isolation Films Market?The Vapor Isolation Films Market is registered to grow at a CAGR of 4.2% during 2023-2032.Who are the major players operating in the Vapor Isolation Films Market?3M, INDEVCO Group, Insulation Solutions, Inc., Kalliomuovi Oy, Conservation Technology, POLY FILM, Brite Coatings Private Limited, Innovia Films, Cosmo Films, Flex Films, Other Key Players

Vapor Isolation Films MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Vapor Isolation Films MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- INDEVCO Group

- Insulation Solutions, Inc.

- Kalliomuovi Oy

- Conservation Technology

- POLY FILM

- Brite Coatings Private Limited

- Innovia Films

- Cosmo Films

- Flex Films

- Other Key Players