Global Infection Surveillance Solutions Market By Type (Private and Public), By Component (Software (On-premise, Web/Cloud/SaaS, and Hybrid), and Services (Implementation/Integration, Training & Education, Support & Maintenance, Consulting, and Managed Services)), By Infection Type (Surgical Site Infections (SSI), Blood-Stream Infections (BSI), Urinary Tract Infections (UTI), Respiratory/Pulmonary Infections, and Others), By End-user (Hospitals, Long Term Care Facilities, Specialty Centers, Clinics/Outpatient Facilities, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2024

- Report ID: 67295

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

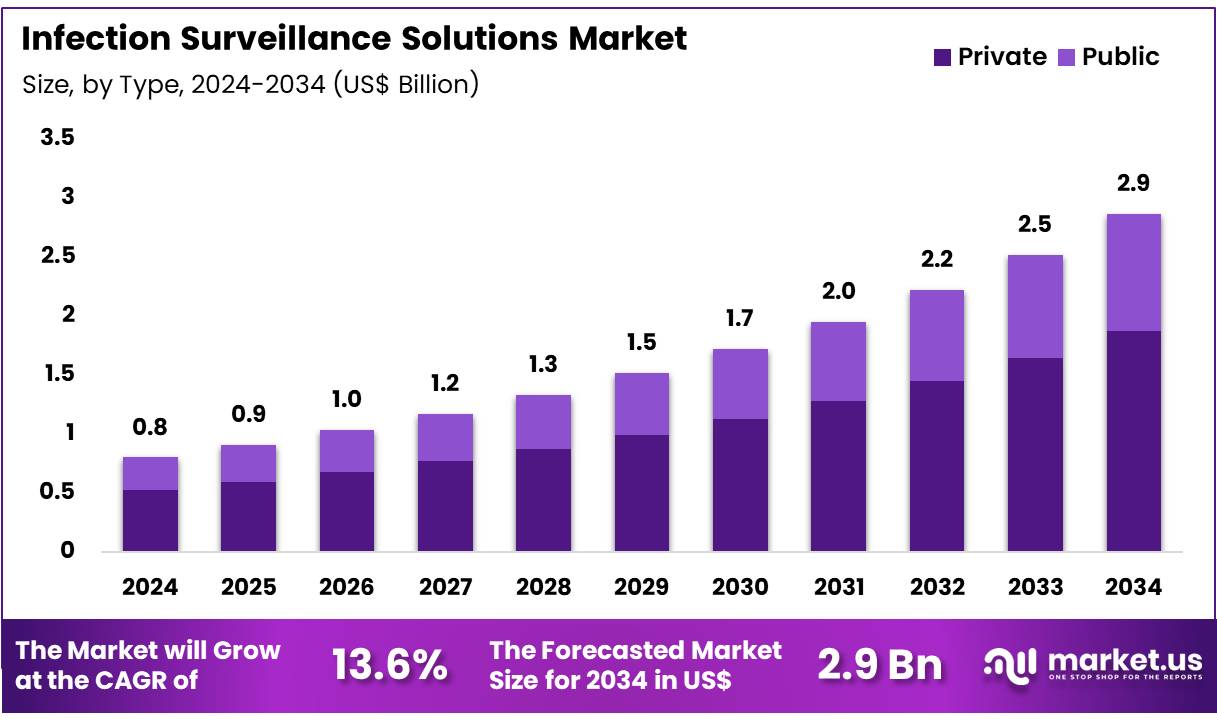

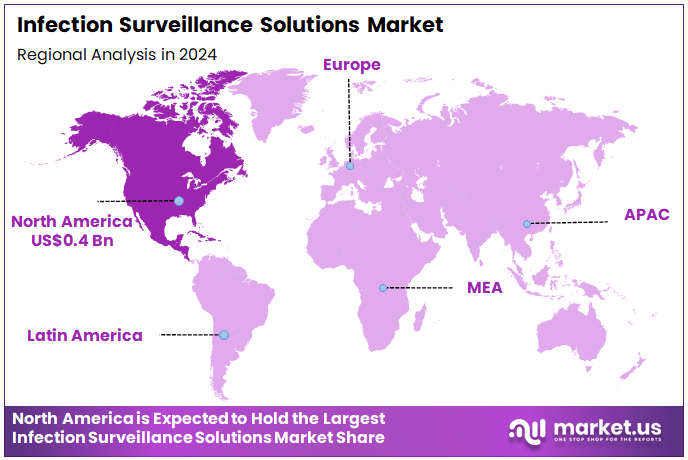

The Global Infection Surveillance Solutions Market size is expected to be worth around US$ 2.9 Billion by 2034 from US$ 0.8 Billion in 2024, growing at a CAGR of 13.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.2% share with a revenue of US$ 0.1 Billion.

Rising incidence of antimicrobial-resistant infections propels the Global Infection Surveillance Solutions market as healthcare systems prioritize robust monitoring to safeguard patient outcomes. Clinicians increasingly leverage these solutions for hospital-acquired infection tracking, analyzing catheter-related bloodstream infection data to enhance sterilization protocols in intensive care units. This driver intensifies with the growing threat of multidrug-resistant pathogens, where platforms integrate genomic sequencing to monitor resistance trends in surgical wards.

Public health agencies deploy these tools for outbreak response, mapping transmission chains for respiratory viruses like influenza. In November 2024, Pfizer India collaborated with the Government of Goa on Project Parivartan to bolster infection prevention in public facilities through systematic surveillance. The WHO estimates 700,000 deaths annually from antimicrobial resistance, underscoring the urgent need for advanced surveillance across healthcare applications.

Growing advancements in real-time analytics create substantial opportunities in the Global Infection Surveillance Solutions market. Innovators develop cloud-based platforms that aggregate infection data, supporting epidemiology research for Clostridium difficile trends in long-term care facilities. Hospitals explore these systems for ventilator-associated pneumonia surveillance, enabling early interventions to reduce mortality risks.

Opportunities also emerge in veterinary medicine, where solutions track zoonotic infections like avian influenza to prevent cross-species transmission. In January 2025, the UK Health Security Agency launched a metagenomics program to enhance rapid pathogen detection, expanding high-throughput monitoring capabilities. The CDC reports that 1 in 31 hospital patients develops a healthcare-associated infection daily, highlighting the potential for scalable surveillance to transform infection control strategies.

Recent trends in the Global Infection Surveillance Solutions market emphasize AI-driven insights and cross-sector initiatives to optimize infection prevention. Developers integrate machine learning for predictive modeling, aiding neonatal units in forecasting sepsis risks through microbial pattern analysis. Trends also include interoperable dashboards for community health surveillance, streamlining data sharing for enteric disease outbreaks.

In April 2025, University of Liverpool researchers launched VetCLIN-AMR to monitor antimicrobial resistance in companion animals, enhancing preventive veterinary measures. Industry data notes a 30% increase in adoption of automated surveillance systems in 2024, reflecting a shift toward proactive, data-centric frameworks. These advancements drive a cohesive evolution toward integrated, precision-focused infection surveillance ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 8 Billion, with a CAGR of 13.6%, and is expected to reach US$ 2.9 Billion by the year 2034.

- The type segment is divided into private and public, with private taking the lead in 2023 with a market share of 65.3%.

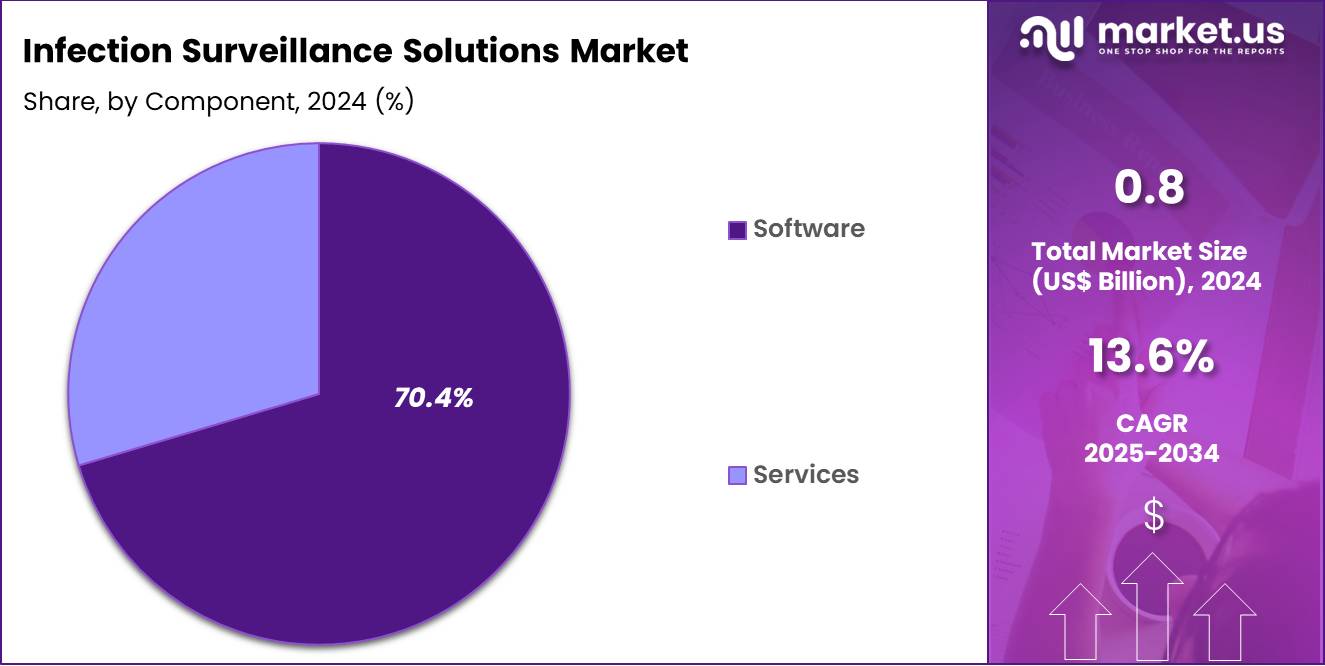

- Considering component, the market is divided into software and services. Among these, software held a significant share of 70.4%.

- Furthermore, concerning the infection type segment, the market is segregated into surgical site infections (SSI), blood-stream infections (BSI), urinary tract infections (UTI), respiratory/pulmonary infections, and others. The surgical site infections (SSI) sector stands out as the dominant player, holding the largest revenue share of 35.9% in the market.

- The end-user segment is segregated into hospitals, long term care facilities, specialty centers, clinics/outpatient facilities, and others, with the hospitals segment leading the market, holding a revenue share of 48.3%.

- North America led the market by securing a market share of 46.2% in 2024.

Type Analysis

Private infection surveillance solutions lead the market with 65.3% of the share and are expected to continue growing due to their ability to provide more tailored, flexible, and efficient services compared to public counterparts. The private sector’s focus on adopting advanced technologies, including cloud-based solutions and AI-driven analytics, is projected to drive market expansion. Private healthcare providers are increasingly prioritizing infection control as part of their commitment to patient safety, regulatory compliance, and operational efficiency.

The growing need for more personalized care and the ability to monitor patient data in real-time is likely to boost demand for infection surveillance solutions in private healthcare settings. The rise of private healthcare facilities, particularly in emerging economies, is also anticipated to contribute to the segment’s growth.

Furthermore, the increasing number of private hospitals and clinics investing in advanced infection prevention tools is expected to enhance the adoption of private infection surveillance solutions. The segment’s growth will also be fueled by the rising demand for data-driven decision-making and the integration of infection surveillance into electronic health record systems.

Component Analysis

Software-based infection surveillance solutions dominate the component segment, holding 70.4% of the market share, and are expected to maintain strong growth due to their ability to integrate seamlessly with existing hospital and healthcare IT infrastructure. Software solutions for infection surveillance allow real-time monitoring, advanced data analytics, and predictive modeling, providing healthcare facilities with the tools to manage and prevent infections more effectively.

The growing prevalence of hospital-acquired infections (HAIs) and the rising demand for data-driven insights to improve patient outcomes are key drivers of this segment’s growth. Software solutions allow for automated tracking and reporting of infection data, reducing manual errors and improving the overall efficiency of infection control programs. As hospitals and clinics continue to digitize their operations, software solutions are expected to remain the backbone of infection surveillance programs. Additionally, software can be updated regularly, adding new features or adapting to emerging infection threats, further increasing its value in the market.

Integration with electronic health records (EHRs) and other hospital management systems is anticipated to accelerate the adoption of infection surveillance software, positioning it as a critical component in modern healthcare facilities.

Infection Type Analysis

Surgical site infections (SSI) represent the largest infection type in the market, holding 35.9% of the share and are expected to continue growing as healthcare providers increase efforts to improve patient safety and minimize the risk of infection during and after surgical procedures. SSIs are one of the most common types of hospital-acquired infections, making them a critical focus for infection surveillance systems. Hospitals and clinics are prioritizing the prevention of SSIs through more stringent infection control protocols, enhanced sterilization practices, and better post-operative care, all of which are expected to drive demand for infection surveillance solutions.

Increasing awareness of the costs associated with SSIs, both in terms of patient outcomes and hospital finances, is anticipated to accelerate the adoption of SSI monitoring tools. Additionally, the rising complexity of surgeries and an aging population requiring more surgeries are projected to contribute to the growth of this segment. Advancements in infection detection technologies, such as AI-driven monitoring systems and real-time alerts, will likely improve the prevention and management of SSIs, further strengthening the demand for specialized surveillance solutions in this area.

End-User Analysis

Hospitals account for 48.3% of the end-user segment and are projected to remain the largest consumers of infection surveillance solutions due to their high patient volumes and increased focus on preventing healthcare-associated infections. As the leading healthcare providers in most regions, hospitals are likely to continue investing in infection surveillance systems to improve patient safety, enhance operational efficiency, and comply with regulatory standards. Hospitals are facing increasing pressure to reduce hospital-acquired infections (HAIs) and improve patient outcomes, making infection surveillance systems an essential tool for infection control departments.

The growing complexity of treatments and surgeries, along with the rising rates of chronic diseases, increases the risk of infections, further driving the demand for infection surveillance systems. Additionally, hospitals are adopting more advanced technologies such as predictive analytics, AI, and cloud-based solutions to better manage infection risks and reduce outbreaks.

The rising focus on patient safety initiatives and government regulations requiring hospitals to report infection rates is expected to continue fueling growth in this segment. Moreover, as hospitals strive to provide high-quality, patient-centered care, the demand for advanced infection surveillance solutions to ensure compliance and improve outcomes is expected to remain strong.

Key Market Segments

By Type

- Private

- Public

By Component

- Software

- On-premise

- Web/Cloud/SaaS

- Hybrid

- Services

- Implementation/Integration

- Training & Education

- Support & Maintenance

- Consulting

- Managed Services

By Infection Type

- Surgical Site Infections (SSI)

- Blood-Stream Infections (BSI)

- Urinary Tract Infections (UTI)

- Respiratory/Pulmonary Infections

- Others

By End-user

- Hospitals

- Long Term Care Facilities

- Specialty Centers

- Clinics/Outpatient Facilities

- Others

Drivers

Rising incidence of healthcare-associated infections (HAIs) is driving the market

The persistently high and, in some key areas, increasing burden of healthcare-associated infections globally is the primary factor accelerating the demand for sophisticated infection surveillance solutions. These infections, often preventable, represent a major public health challenge, leading to extended hospital stays, significant patient harm, and higher mortality rates. The need for continuous, accurate monitoring is critical to prevent outbreaks and ensure patient safety.

Regulatory bodies and public health organizations are intensifying their focus on HAI prevention, compelling hospitals to invest in automated surveillance systems to meet reporting mandates and quality metrics. The financial penalties tied to poor infection control outcomes further incentivize healthcare facilities to adopt advanced tools that can automatically identify and track infections more efficiently than manual methods.

This compelling combination of clinical urgency, public health oversight, and financial pressure creates a strong market driver for surveillance technologies. For instance, an increase in certain infection types between 2022 and 2023 highlights the ongoing challenge: in the US, surgical site infections (SSIs) following abdominal hysterectomy increased by 8% in acute care hospitals when comparing 2023 to 2022 standardized infection ratios, according to data from the Centers for Disease Control and Prevention (CDC).

Restraints

High cost for smaller healthcare facilities is restraining the market

The initial financial commitment and ongoing operational expenses associated with implementing and maintaining modern infection surveillance solutions pose a significant barrier, particularly for smaller hospitals, long-term care facilities, and facilities in developing and rural markets. These advanced systems often require substantial upfront investment in software licensing, hardware infrastructure, and extensive integration with existing Electronic Health Records (EHR) systems, which can be prohibitively expensive for organizations with limited budgets.

Beyond the capital outlay, there are recurring costs for technical support, system upgrades, and dedicated staff training to operate the complex software effectively and ensure data accuracy. The high cost makes it difficult for these smaller facilities to justify the investment compared to other urgent operational needs, leading to reliance on less efficient manual or semi-automated processes, which limits the overall market penetration.

Opportunities

Partnerships with national/regional disease surveillance networks is creating growth opportunities

Strategic collaborations between technology developers and national or regional public health agencies are creating substantial opportunities for market expansion and innovation in infection surveillance. These partnerships focus on integrating local healthcare facility data directly into broader governmental disease monitoring systems.

By aligning private-sector technology with public health infrastructure, these collaborations ensure data standardization, improve the accuracy of regional and national reports, and accelerate the adoption of advanced surveillance tools through public endorsements or subsidies. Such joint efforts can lead to the creation of standardized, scalable solutions that are more accessible to a wider range of healthcare providers, moving beyond individual facility needs to a community-wide and national public health benefit.

For instance, the World Health Organization (WHO) Pandemic Hub has actively promoted its work on Collaborative Surveillance Implementation, noting that in October 2023, a technical workshop was held to support tool development with the WHO Regional Office for South-East Asia, which drives the global implementation of these collaborative surveillance frameworks at the national and regional levels. This focus by major international health bodies signals a clear pathway for commercial technologies to gain traction by linking their platforms to government-led public health intelligence efforts.

Impact of Macroeconomic / Geopolitical Factors

Rising energy costs and fiscal tightening are putting pressure on innovators in the pathogen tracking software market, leading them to prioritize essential alert functionalities over advanced genomic mapping features to manage cash flow challenges. Increasing geopolitical tensions, such as NATO-Russia frictions, and delays in the Panama Canal are causing disruptions in the delivery of ruggedized field sensors, slowing system calibrations and raising deployment costs for health coalitions across the hemisphere.

To counter these issues, strategic companies are partnering with Colorado-based telemetry experts, reinforcing data silos and reducing latency in outbreak forecasting models. At the same time, growing concerns over antimicrobial resistance are driving philanthropic investments into AI-powered surveillance systems, accelerating their adoption in sentinel laboratories.

Meanwhile, the U.S. Department of Commerce’s investigation into medical consumables and diagnostic equipment, launched on September 26, 2025, could lead to tariffs of up to 25% on Asian-sourced interfaces and probes. These potential duties would increase integration costs and disrupt procurement processes in cash-strapped public systems, causing delays and freezing budgets. This scrutiny is also resulting in timeline slippages, occasionally causing fragmentation in data feeds from international validation cohorts.

In response, forward-thinking companies are accessing HHS modernization funds to build processing clusters in Oregon, enabling the development of geospatial contagion simulators and refining anomaly detection capabilities. Despite Johnson & Johnson projecting US$400 million in tariff-related costs for 2025, these challenges are fostering a shift towards a resilient, domestically driven approach aimed at achieving long-term success in pathogen tracking and surveillance innovations.

Latest Trends

Shift from reactive to proactive/predictive surveillance is a recent trend

A significant and current evolution in the infection surveillance market is the pronounced move away from solely reactive reporting of past infections to a more proactive and predictive approach utilizing advanced analytics, machine learning, and artificial intelligence (AI). This trend involves deploying tools that continuously analyze patient data streams in real-time, such as lab results, physician orders, and vital signs, to identify patients at high risk of developing an infection before it becomes clinically apparent.

The goal is to enable infection preventionists to intervene early, thereby preventing the infection entirely or mitigating its severity, which offers a massive improvement over traditional surveillance that primarily focuses on counting confirmed cases after the fact. This strategic shift is being strongly encouraged by public health experts who advocate for a modern, forward-looking approach to epidemic preparedness.

For example, the CDC’s efforts in forecasting respiratory disease illustrate this movement: in August 2024, the CDC released its respiratory disease season outlook to provide decision-makers with information and potential scenarios to assist in public health preparedness during the 2024–2025 respiratory virus season, signaling a governmental commitment to predictive planning over reactive measures.

Regional Analysis

North America is leading the Global Infection Surveillance Solutions Market

In 2024, North America accounted for 46.2% of the global infection surveillance solutions market, invigorated by stringent federal mandates for antimicrobial stewardship and the imperative to integrate genomic sequencing into routine hospital protocols following heightened awareness of multidrug-resistant organisms. Clinical leaders adopted networked platforms to consolidate syndromic data from emergency departments, enabling predictive alerts that curtailed ventilator-associated pneumonia incidences in critical care units.

The Department of Health and Human Services’ interoperability rules expedited vendor-neutral deployments, fostering collaborative analytics across regional health information exchanges for influenza-like illness forecasting. Institutional consortia emphasized machine learning enhancements for anomaly detection, addressing gaps in underreported community-acquired methicillin-resistant Staphylococcus aureus cases.

Escalating focus on equity in surveillance extended tools to tribal health services, aligning with national objectives to diminish disparities in sepsis outcomes. These refinements illustrated the area’s dedication to resilient, evidence-based epidemiological frameworks. The Centers for Disease Control and Prevention indicated a 13% reduction in hospital-onset Clostridioides difficile infections from 2022 to 2023, linked to refined surveillance methodologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Health authorities across Asia Pacific project the infection surveillance solutions sector to burgeon during the forecast period, as sovereign outlays reinforce syndromic monitoring to counter resurgent arboviral epidemics in tropical corridors. Regulators in Thailand and Indonesia channel funds into geospatial dashboards, arming municipal teams with cluster mapping to intercept chikungunya transmissions in peri-urban settlements. Surveillance innovators partner with continental bodies to calibrate genomic pipelines, anticipating expedited lineage tracing for norovirus variants in tourism hotspots.

Administrative councils in Fiji and Papua New Guinea pioneer solar-powered sensors, positioning isolated clinics to upload leptospirosis signals via low-orbit satellites. Governments estimate fusing wearable telemetry with core databases, mitigating diagnostic lags in nomadic groups through automated fever thresholding. Regional technicians cultivate adaptive algorithms for polymicrobial alerts, coordinating with maritime patrols to preempt cholera incursions on trade routes. These synergies nurture a fortified bastion against zoonotic incursions. Singapore’s National Environment Agency reported 13,655 dengue cases in July 2024, representing a 37.4% rise from 9,949 cases in 2023.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent organizations in the infection monitoring market are accelerating growth by deploying AI-driven platforms that use natural language processing to detect sepsis in real time, similar to Wolters Kluwer’s Sentri7 initiative. These companies are building collaborative partnerships with pharmaceutical giants to enhance antimicrobial stewardship programs, as demonstrated by BD’s alliance with Pfizer. In addition, enterprises are introducing specialized analytics for extended care settings, akin to Premier’s PINC AI deployment, which enables facility-wide oversight of infection control.

To improve compliance reporting and data accuracy, organizations are investing in modular integrations that unify legacy systems with predictive alerting, streamlining workflows. Expanding their regional reach in Europe and Asia, leaders are customizing dashboards to meet local pathogen profiles and regulatory requirements. Furthermore, they are structuring tiered licensing models that include embedded consulting services, locking in institutional commitments and diversifying revenue streams.

Becton, Dickinson and Company (BD), founded in 1897 and headquartered in Franklin Lakes, New Jersey, manufactures diagnostic instruments and infection control devices that protect patient environments across both acute and ambulatory settings. The company has advanced its BD Alaris platform with surveillance modules that monitor infusion-related risks, providing nurses with actionable dashboards to enhance patient safety. BD is investing heavily in antimicrobial resistance countermeasures, driving innovations in rapid testing and improving data interoperability.

CEO Tom Polen leads a multinational team spanning 50 countries, with a focus on strengthening resilient supply chains amidst global health disruptions. BD collaborates with surveillance networks to refine outbreak modeling, increasing institutional preparedness and response efficiency. By combining device engineering with cutting-edge software intelligence, BD reinforces its leadership position in mitigating transmission risks across healthcare settings.

Top Key Players

- Wolters Kluwer N.V.

- Vigilanz Corporation

- Vecna Technologies

- Truven Health Analytics

- Roper Technologies

- RL Datix Ltd

- Premier, Inc.

- Oracle

- OASIS Medical

- Merative

- IBM Corporation

- Harris Healthcare

- GOJO Industries

- Ecolab Inc.

- Clinisys

- CenTrak, Inc.

- Becton Dickinson and Company

- Baxter International Inc.

Recent Developments

- In May 2025, Fiji inaugurated its Pathogen Genomics Laboratory at the Fiji Centre for Disease Control. This advanced facility strengthens the country’s ability to detect and analyze infectious agents, including antimicrobial-resistant bacteria and viral pathogens, thereby bolstering the infection surveillance solutions market through enhanced genomic monitoring and rapid outbreak response.

- In May 2024, Premier Inc. partnered with AstraZeneca to leverage real-world data and AI-driven analytics for improving patient outcomes and delivering cost-efficient healthcare solutions. This collaboration supports the infection surveillance solutions market by promoting the integration of data-driven tools to monitor infection trends and optimize preventive strategies.

- In February 2024, PINC AI announced a partnership between Applied Sciences (a Premier, Inc. subsidiary) and Datavant to harness global health data for research. This initiative drives the infection surveillance solutions market by enabling large-scale data aggregation, which helps track infectious disease patterns and informs timely interventions.

Report Scope

Report Features Description Market Value (2024) US$ 0.8 Billion Forecast Revenue (2034) US$ 2.9 Billion CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Private and Public), By Component (Software (On-premise, Web/Cloud/SaaS, and Hybrid), and Services (Implementation/Integration, Training & Education, Support & Maintenance, Consulting, and Managed Services)), By Infection Type (Surgical Site Infections (SSI), Blood-Stream Infections (BSI), Urinary Tract Infections (UTI), Respiratory/Pulmonary Infections, and Others), By End-user (Hospitals, Long Term Care Facilities, Specialty Centers, Clinics/Outpatient Facilities, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wolters Kluwer N.V., Vigilanz Corporation, Vecna Technologies, Truven Health Analytics, Roper Technologies, RL Datix Ltd, Premier, Inc., Oracle, OASIS Medical, Merative, IBM Corporation, Harris Healthcare, GOJO Industries, Ecolab Inc., Clinisys, CenTrak, Inc., Becton Dickinson and Company, Baxter International Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infection Surveillance Solutions MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Infection Surveillance Solutions MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Wolters Kluwer N.V.

- Vigilanz Corporation

- Vecna Technologies

- Truven Health Analytics

- Roper Technologies

- RL Datix Ltd

- Premier, Inc.

- Oracle

- OASIS Medical

- Merative

- IBM Corporation

- Harris Healthcare

- GOJO Industries

- Ecolab Inc.

- Clinisys

- CenTrak, Inc.

- Becton Dickinson and Company

- Baxter International Inc.