Global Digital Genome Market By Product (Sequencing Services and Instruments), By Application (Agriculture & Animal Research and Diagnostics), By End-user (Research Centers & Government Institutes and Academic Institutions), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2034

- Published date: Jan 2025

- Report ID: 138269

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

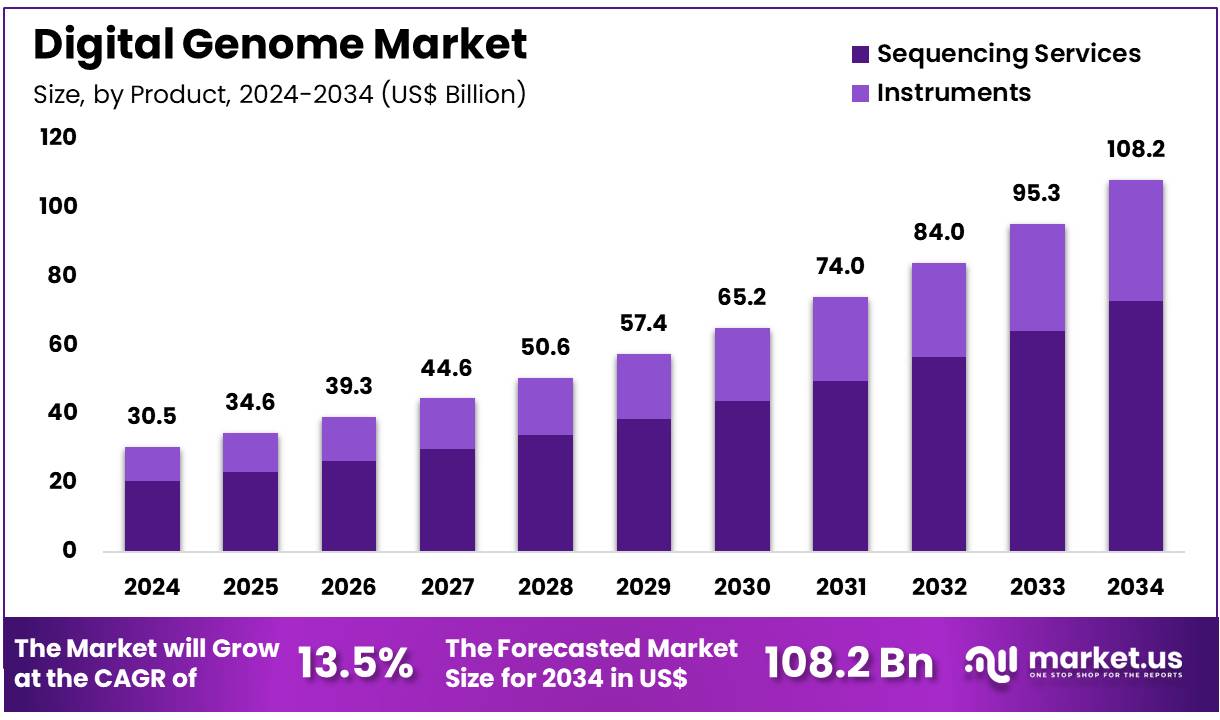

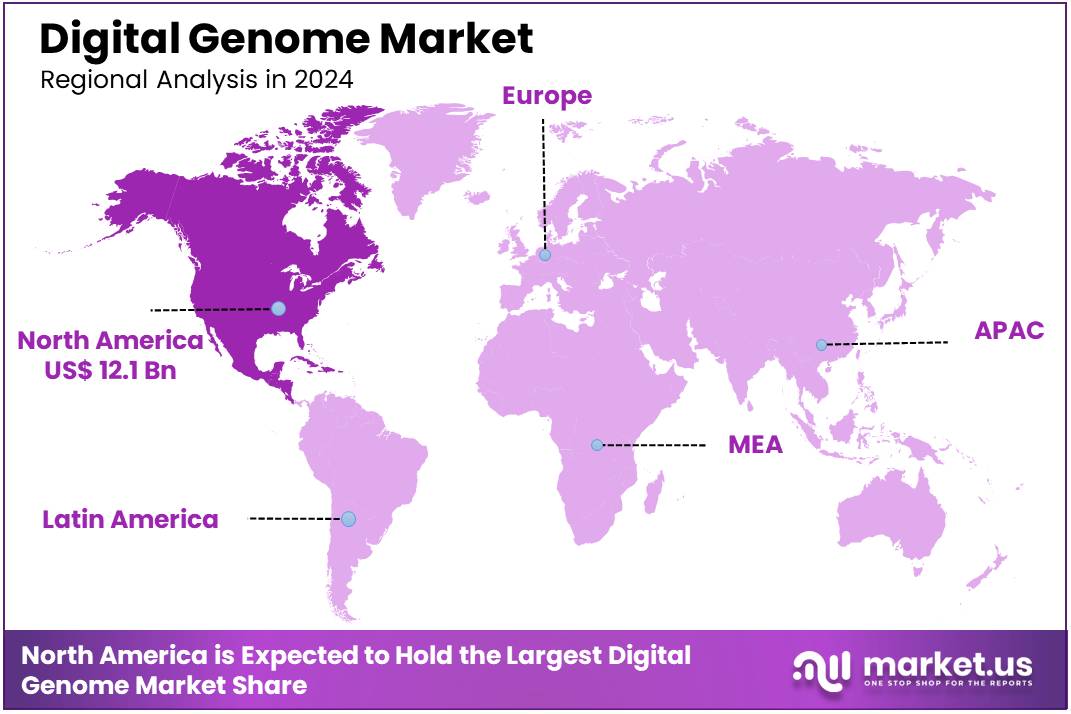

Global Digital Genome Market size is expected to be worth around US$ 108.2 billion by 2034 from US$ 30.5 billion in 2024, growing at a CAGR of 13.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.8% share with a revenue of US$ 12.1 Billion.

Increasing advancements in genomic research and the growing need for personalized medicine are driving the expansion of the digital genome market. Digital genome technologies enable the collection, analysis, and interpretation of vast amounts of genomic data, facilitating applications such as precision medicine, drug discovery, and disease prevention.

The rise of genomic sequencing, coupled with the increasing adoption of electronic health records (EHR), is creating significant opportunities for integrating genetic data into routine healthcare, enabling more accurate diagnoses and targeted treatments.

In April 2021, Genome Medical, a digital health company focused on integrating genetics and genomics into routine healthcare, expanded its technology offerings to support the clinical services delivered by its nationwide team of genetic specialists, underscoring the growing role of digital genomics in healthcare systems.

Recent trends highlight the increasing use of cloud-based platforms to store and analyze genomic data, improving accessibility and collaboration across research and clinical settings. Additionally, advancements in artificial intelligence and machine learning are enhancing the precision of genomic analysis, enabling faster and more reliable results.

The integration of digital genome technologies into diagnostics, particularly in cancer and rare diseases, provides valuable opportunities for early detection and personalized treatment plans. As more healthcare providers embrace these technologies, the digital genome market is expected to experience significant growth, offering innovative solutions to address complex healthcare challenges.

Key Takeaways

- In 2024, the market for digital genome generated a revenue of US$ 30.5 billion, with a CAGR of 13.5%, and is expected to reach US$ 108.2 billion by the year 2034.

- The product segment is divided into sequencing services and instruments, with sequencing services taking the lead in 2024 with a market share of 67.3%.

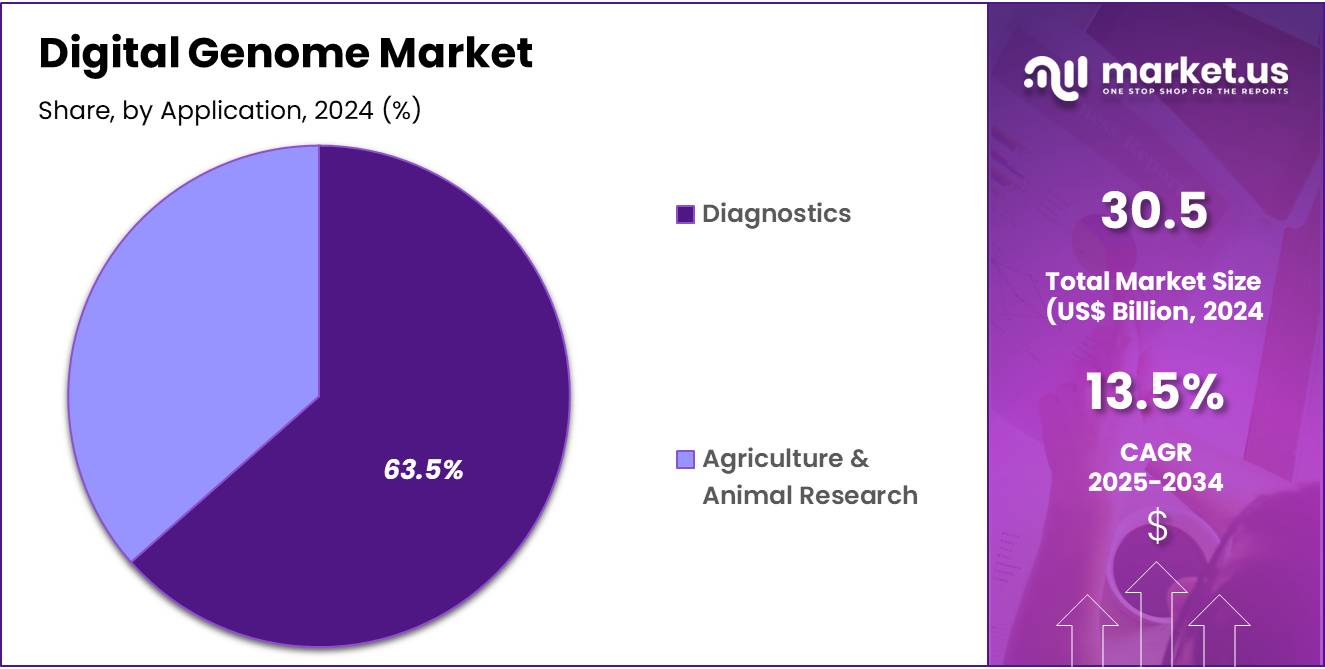

- Considering application, the market is divided into agriculture & animal research and diagnostics. Among these, diagnostics held a significant share of 63.5%.

- Furthermore, concerning the end-user segment, the market is segregated into research centers & government institutes and academic institutions. The research centers & government institutes sector stands out as the dominant player, holding the largest revenue share of 58.1% in the digital genome market.

- North America led the market by securing a market share of 39.8% in 2024.

Product Analysis

The sequencing services segment led in 2024, claiming a market share of 67.3% owing to as advancements in genomic technologies make sequencing more accessible and affordable. The demand for sequencing services is projected to rise due to their increasing use in applications such as personalized medicine, cancer genomics, and genetic disorder diagnostics. The growing need for high-throughput sequencing to analyze large genomic data sets and to perform whole-genome sequencing is likely to drive the expansion of this segment.

Moreover, the rise in genomic research for disease prevention and treatment is anticipated to further fuel demand for sequencing services. As healthcare providers and research institutions increasingly adopt sequencing technologies, the services sector will continue to grow, supported by ongoing improvements in sequencing accuracy and speed.

Application Analysis

The diagnostics held a significant share of 63.5% due to the increasing use of genomic technologies in medical diagnostics. Digital genome tools are likely to play a pivotal role in the early detection, diagnosis, and personalized treatment of genetic disorders, cancers, and infectious diseases. The integration of genomics into routine diagnostic practices is expected to enhance the precision and reliability of diagnoses.

As healthcare systems continue to focus on precision medicine and tailored therapies, the demand for diagnostic tools based on digital genome technologies will rise. Additionally, the growing prevalence of genetic conditions and the shift toward non-invasive diagnostic methods like liquid biopsy are expected to contribute to the expansion of this segment.

End-user Analysis

The research centers & government institutes segment had a tremendous growth rate, with a revenue share of 58.1% owing to as these institutions focus on advancing genomics research for medical and scientific breakthroughs. Government-backed initiatives and funding for genomic research are expected to fuel the development of innovative genomic technologies. Research centers, particularly those dedicated to genomics and personalized medicine, are projected to increasingly adopt digital genome technologies to accelerate discoveries in human genetics, disease mechanisms, and drug development.

As governments invest more in genomic research to address public health challenges and improve healthcare outcomes, the demand for digital genome tools in research centers is likely to grow. The increasing collaboration between academic and government institutions to study genomics at a deeper level will further drive the growth of this segment.

Key Market Segments

By Product

- Sequencing Services

- Instruments

By Application

- Agriculture & Animal Research

- Diagnostics

By End-user

- Research Centers & Government Institutes

- Academic Institutions

Drivers

Rise in technological advancements is driving the digital genome market

Rising technological advancements significantly drive the digital genome market by enhancing the capabilities and efficiency of genomic analysis. In May 2022, NanoString Technologies, Inc. introduced a cloud-based workflow designed to improve the spatial data analysis experience. This streamlined solution integrates the GeoMx Digital Spatial Profiler with Illumina’s NextSeq 2000 and NextSeq 1000 sequencing systems, offering improved usability for customers.

These advancements enable researchers to perform more comprehensive and accurate genomic studies, facilitating breakthroughs in personalized medicine and targeted therapies. The integration of high-throughput sequencing technologies with advanced data analytics tools allows for faster and more precise interpretation of genomic data, accelerating research and development processes.

Additionally, the development of user-friendly interfaces and automated workflows reduces the technical barriers, making digital genome technologies accessible to a broader range of laboratories and institutions. Innovations in cloud computing and data storage solutions support the handling of vast amounts of genomic data, ensuring scalability and reliability. Furthermore, advancements in bioinformatics and machine learning algorithms enhance the ability to identify genetic variations and their implications in various diseases.

As a result, the digital genome market experiences increased adoption across academic research, clinical diagnostics, and pharmaceutical development. Continuous investment in technology development and integration is anticipated to sustain the growth of the digital genome market, positioning it as a cornerstone of modern biotechnology and healthcare advancements.

Restraints

Growing concerns over data privacy are restraining the digital genome market

A significant restraint in the digital genome market is the growing concerns over data privacy, which limit consumer trust and market expansion. As digital genome technologies involve the collection, storage, and analysis of vast amounts of sensitive genetic information, ensuring the security and confidentiality of this data becomes paramount.

High-profile data breaches and unauthorized access incidents have heightened awareness about the potential risks associated with genomic data sharing, leading to increased skepticism among consumers and healthcare providers. Regulatory frameworks such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States impose stringent requirements on data handling practices, increasing compliance costs for companies in the market.

Additionally, ethical concerns regarding genetic discrimination and the misuse of genetic information for purposes such as insurance and employment further exacerbate these issues. The complexity of implementing robust data security measures and maintaining compliance with diverse regional regulations poses significant challenges for companies, particularly smaller firms with limited resources.

Furthermore, the fear of privacy invasions can deter individuals from opting for digital genome services, reducing market penetration and adoption rates. As a result, these growing data privacy concerns create substantial barriers to the widespread acceptance and growth of the digital genome market, hindering its ability to fully capitalize on technological advancements and increasing demand.

Opportunities

Integration of AI is creating opportunities for the digital genome market

Growing integration of artificial intelligence (AI) creates substantial opportunities for the digital genome market by revolutionizing data analysis and interpretation processes. According to a February 2022 article titled “Covid-19 and Artificial Intelligence: Genome Sequencing, Drug Development, and Vaccine Discovery,” AI played an instrumental role in identifying the genome sequence of SARS-CoV-2 and in the rapid detection of variants of concern (VOC), including Delta and Omicron strains.

This showcases AI’s transformative impact on genomic research and its ability to accelerate the identification of genetic mutations and their implications. AI-powered algorithms enhance the accuracy and speed of genomic sequencing, enabling researchers to process and analyze large datasets more efficiently.

Additionally, machine learning models facilitate the discovery of novel genetic markers and the prediction of disease susceptibility, advancing personalized medicine initiatives. The integration of AI with digital genome technologies allows for the automation of complex analytical tasks, reducing human error and increasing reproducibility in genomic studies.

Furthermore, AI-driven bioinformatics tools provide deeper insights into gene function and regulation, supporting the development of targeted therapies and precision diagnostics. The ability of AI to uncover hidden patterns and correlations within genomic data fosters innovation and drives the creation of more effective and tailored healthcare solutions.

As AI technology continues to evolve, its application in digital genome analysis is expected to expand, further enhancing the capabilities and scope of the digital genome market. This synergy between AI and genomic technologies not only improves research outcomes but also enables the commercialization of advanced genomic services, positioning the digital genome market for sustained growth and enhanced competitiveness.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the digital genome market. On the positive side, the growing global demand for precision medicine, personalized healthcare, and advancements in genomics research boosts the adoption of digital genome technologies. The increasing investment in healthcare infrastructure, particularly in emerging markets, further accelerates market expansion.

However, economic downturns or recessions can lead to reduced funding for research and healthcare projects, potentially slowing market growth. Geopolitical tensions and regulatory changes, such as data privacy laws and cross-border data-sharing restrictions, can create barriers to market access and disrupt global collaborations.

Additionally, fluctuating currency exchange rates and political instability in certain regions may affect the cost and availability of essential genomic tools and data. Despite these challenges, the rising global focus on genomics research and innovation continues to provide strong momentum for market growth, ensuring long-term opportunities.

Latest Trends

Surge in Partnerships and Collaborations Driving the Digital Genome Market:

Rising partnerships and collaborations are a key trend driving the digital genome market. High levels of cooperation between healthcare providers, technology companies, and research institutions are expected to enhance the development and application of genomics-based solutions. These collaborations enable organizations to pool resources, share data, and accelerate the creation of innovative tools and therapies.

In July 2021, GE Healthcare and SOPHiA GENETICS, a global leader in healthcare data-sharing, partnered to enhance cancer care by incorporating genomics-based AI into oncology workflows. This collaboration marks a major advancement in integrated cancer medicine and facilitates clinical research by enabling the identification of patients most likely to benefit from new therapies. The increasing trend of strategic partnerships is anticipated to continue, further driving innovation and expanding the market for digital genome technologies.

Regional Analysis

North America is leading the Digital genome Market

North America dominated the market with the highest revenue share of 39.8% owing to significant advancements in genome engineering technologies, increased funding, and rising demand for precision medicine. The region’s emphasis on biotechnology and healthcare innovation has led to the accelerated adoption of digital genome platforms that enable genome-scale analysis and engineering.

In April 2021, Inscripta, a leader in digital genome engineering, shipped its Onyx platform, which marked the first commercial release of a fully automated benchtop instrument for genome-scale engineering. This breakthrough technology has played a key role in driving the market by enhancing the efficiency and accessibility of genomic research.

Additionally, Inscripta’s successful Series E funding round, raising USD 150 million, has fueled its expansion and innovation efforts, enabling the company to further develop and refine its digital genome tools. As the demand for personalized medicine and genomics-based diagnostics grows, the digital genome market in North America is expected to continue to expand, supported by ongoing investments in biotech research, healthcare applications, and genomic innovations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to advancements in biotechnology, rising healthcare needs, and an increasing focus on precision medicine. The region’s growing investment in genomics research and technological infrastructure is likely to propel the adoption of digital genome technologies. In March 2024, the Genome India Project, coordinated by the Department of Biotechnology, completed the sequencing of 10,000 Indian genomes.

This significant milestone is expected to provide crucial insights into genetic diversity, which will support advancements in personalized healthcare and genomics-based treatments. As governments in countries like China, India, and Japan continue to invest in genomics initiatives, the demand for digital genome platforms to analyze and interpret large-scale genomic data will rise.

The growing prevalence of genetic diseases, the need for more effective treatments, and the increasing availability of high-throughput sequencing technologies are expected to drive market growth. As the region focuses on improving healthcare outcomes through genomics, the digital genome market in Asia Pacific is likely to see rapid development and widespread adoption in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the digital genome market focus on developing advanced sequencing technologies and bioinformatics tools to streamline genetic analysis and interpretation. Companies enhance their service portfolios by offering end-to-end solutions for research, diagnostics, and personalized medicine.

Strategic collaborations with research institutions and healthcare providers help expand applications and accelerate innovation. Geographic expansion into regions with increasing investments in genomics drives customer acquisition. Many players also emphasize integrating artificial intelligence and cloud-based platforms to improve data accuracy and accessibility.

Illumina, Inc. is a key company in this market, providing state-of-the-art sequencing systems and analytics platforms. The company focuses on empowering researchers and clinicians with tools that enable groundbreaking discoveries in genomics. Illumina’s strong global presence and continuous innovation solidify its position as a leader in genetic analysis and digital genome solutions.

Top Key Players

- QIAGEN

- LetsGetChecked

- Illumina, Inc

- GenomeMe Inc

- GenMark Diagnostics, Inc

- Gencove

- bioMerieux SA

- BD

Recent Developments

- In March 2022, LetsGetChecked acquired Veritas Genetics Inc. and Veritas Intercontinental, leaders in genomics offering a platform for interpreting genetic data, from single-gene analysis to whole-genome sequencing. This acquisition represents a key step in advancing LetsGetChecked’s efforts to enable proactive health management for individuals and healthcare providers.

- In May 2022, Gencove, a prominent provider of low-pass whole genome sequencing and analysis software, joined forces with NEOGEN Corporation to introduce InfiniSEEK. This groundbreaking, cost-efficient solution integrates whole genome sequencing with targeted SNP analysis, combining the expertise of two leading genomics companies.

Report Scope

Report Features Description Market Value (2024) US$ 30.5 billion Forecast Revenue (2034) US$ 108.2 billion CAGR (2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sequencing Services and Instruments), By Application (Agriculture & Animal Research and Diagnostics), By End-user (Research Centers & Government Institutes and Academic Institutions) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape QIAGEN, LetsGetChecked , Illumina, Inc, GenomeMe Inc, GenMark Diagnostics, Inc, Gencove, bioMerieux SA, and BD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- QIAGEN

- LetsGetChecked

- Illumina, Inc

- GenomeMe Inc

- GenMark Diagnostics, Inc

- Gencove

- bioMerieux SA

- BD