Biochips Market By Product Type (DNA Chips (Cancer Diagnosis & Treatment, SNP Genotyping, Genomics, Gene Expression, Drug Discovery, Agricultural Biotechnology, and Others), Protein Chips (Proteomics, HTS, Expression Profiling, Drug Discovery, Diagnostics, and Others), Lab-on-chip (Genomics, Proteomics, IVD & POC, Drug discovery, and Others), and Others), By End-use (Hospitals & Diagnostic Centers, Biotechnology & Pharmaceutical Companies, Academic & Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137537

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

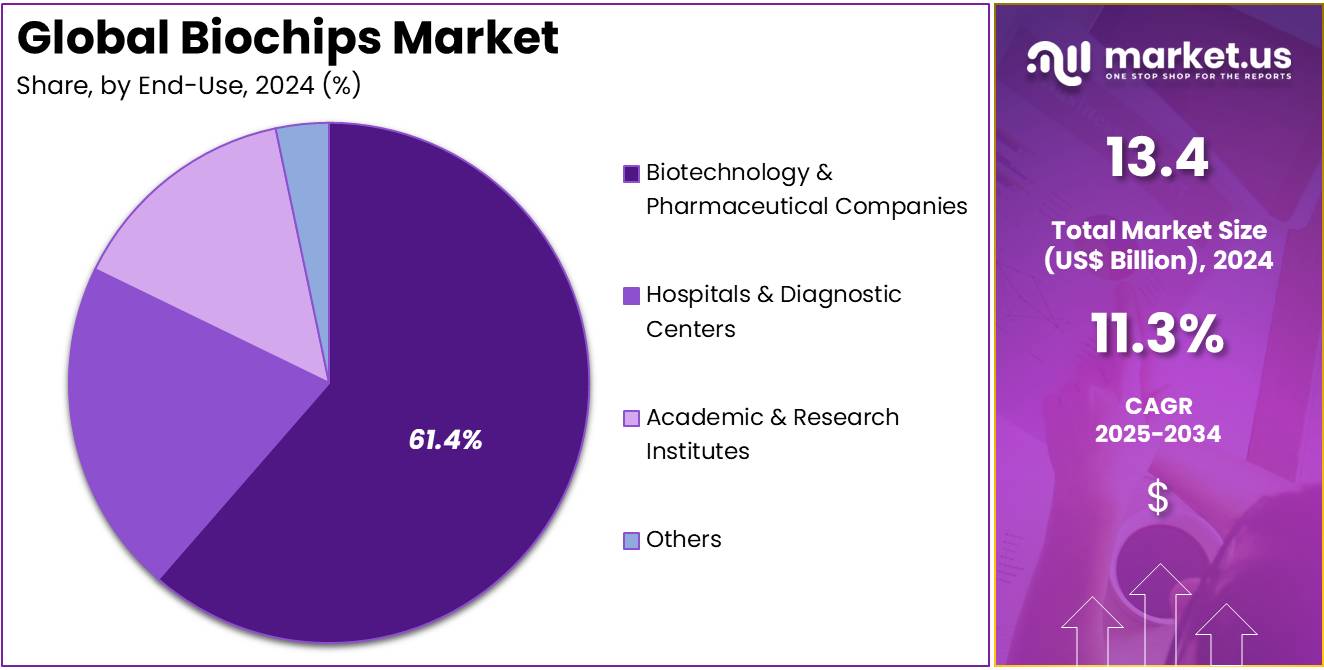

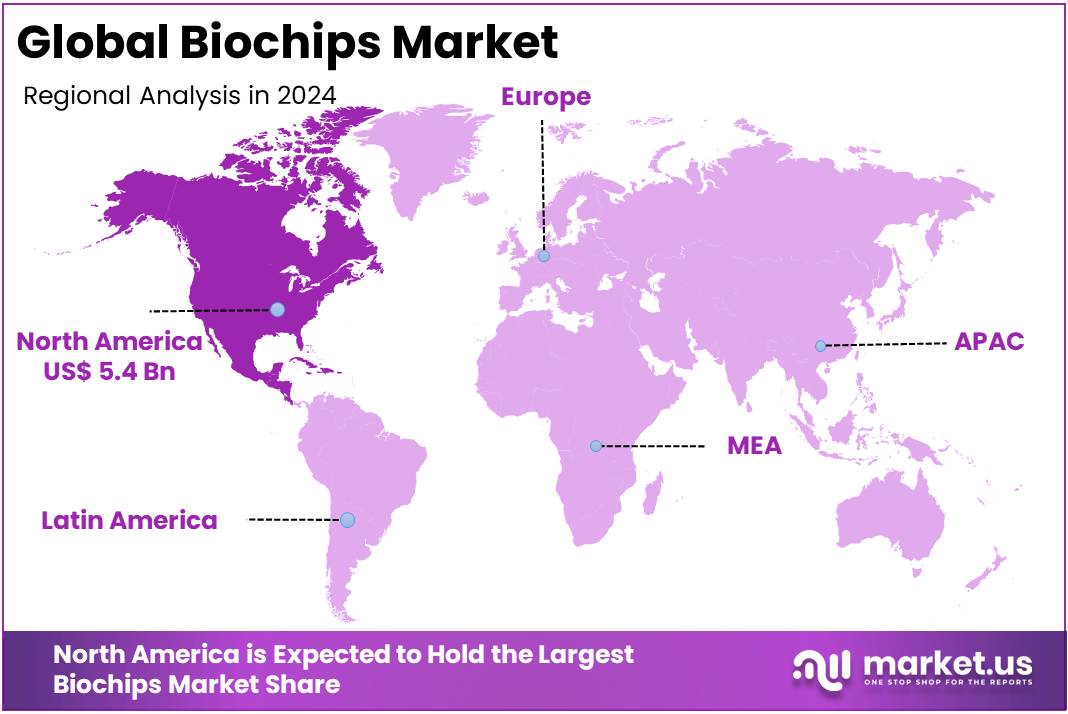

The Global Biochips Market Size is expected to be worth around US$ 39.1 Billion by 2034, from US$ 13.4 Billion in 2024, growing at a CAGR of 11.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 40.2% share and holds US$ 5.4 Billion market value for the year.

Growing demand for high-throughput screening and personalized medicine is driving the expansion of the biochips market. Biochips, which integrate microarray technology with biochemistry and molecular biology, have a wide range of applications in diagnostics, drug discovery, genomics, and environmental monitoring. These devices enable the analysis of large amounts of biological information with precision and speed, making them essential in fields such as cancer research, genetic testing, and pathogen detection.

The increasing focus on precision medicine, where treatments are tailored to individual genetic profiles, creates significant opportunities for biochips to revolutionize diagnostics and therapy. In August 2023, Illumina Inc. inaugurated a new office and a state-of-the-art Solutions Center in Bengaluru, India, aiming to increase genomics accessibility and foster advancements in healthcare, exemplifying the growing role of biochips in healthcare innovation.

Recent trends show rising adoption of biochips for non-invasive diagnostic methods, including liquid biopsy, as well as increased use in personalized nutrition and drug monitoring. Furthermore, the growing use of biochips in point-of-care diagnostics presents an opportunity to provide rapid, cost-effective solutions to healthcare providers. The convergence of biochips with artificial intelligence and data analytics is also enhancing their capabilities, improving accuracy, and facilitating the development of novel applications in clinical and research settings.

Key Takeaways

- In 2024, the market for Biochips generated a revenue of US$ 13.4 billion, with a CAGR of 11.3%, and is expected to reach US$ 39.1 billion by the year 2034.

- The product type segment is divided into DNA chips, protein chips, lab-on-chip, and others, with DNA chips taking the lead in 2024 with a market share of 55.6%.

- Considering end-use, the market is divided into hospitals & diagnostic centers, biotechnology & pharmaceutical companies, academic & research institutes, and others. Among these, biotechnology & pharmaceutical companies held a significant share of 61.4%.

- North America led the market by securing a market share of 40.2% in 2024.

Product Type Analysis

The DNA chips segment led in 2024, claiming a market share of 55.6% owing to the increasing demand for high-throughput genomic analysis tools. DNA chips are expected to become increasingly popular in applications such as gene expression profiling, genetic variation analysis, and disease diagnostics. The growing need for personalized medicine and the ability to analyze large sets of genomic data efficiently is likely to fuel the demand for DNA chips.

Additionally, advancements in microarray technologies and the rising prevalence of genetic disorders are anticipated to drive this segment’s expansion. DNA chips provide a cost-effective and efficient method for analyzing multiple genes simultaneously, making them essential for both clinical and research applications. As the global focus on genomics and molecular biology continues to intensify, DNA chips are expected to play a critical role in accelerating scientific discovery and improving patient care.

End-use Analysis

The biotechnology & pharmaceutical companies held a significant share of 61.4% as these companies increasingly adopt biochips in their research and drug development processes. Biochips are likely to become essential tools in drug discovery, biomarker identification, and personalized medicine, allowing for faster and more accurate testing of potential therapies.

Pharmaceutical companies are anticipated to use biochips for high-throughput screening, helping to identify compounds that may be effective in treating specific diseases. The growing emphasis on biologics and targeted therapies is projected to further drive the demand for biochips, as these companies look for more efficient ways to test and develop new treatments.

Additionally, the integration of biochips into diagnostic workflows and clinical research will likely contribute to the continued growth of this segment, as biotechnology and pharmaceutical companies leverage these technologies to advance scientific understanding and improve patient outcomes.

Key Market Segments

By Product Type

- DNA Chips

- Cancer Diagnosis & Treatment

- SNP Genotyping

- Genomics

- Gene Expression

- Drug Discovery

- Agricultural Biotechnology

- Others

- Protein Chips

- Proteomics

- HTS

- Expression Profiling

- Drug Discovery

- Diagnostics

- Others

- Lab-on-chip

- Genomics

- Proteomics

- IVD & POC

- Drug discovery

- Others

- Others

By End-use

- Hospitals & Diagnostic Centers

- Biotechnology & Pharmaceutical Companies

- Academic & Research Institutes

- Others

Drivers

Advancements in Engineering Technologies for Cells Driving the Biochips Market

Increasing breakthroughs in engineering technologies for cells are projected to propel the biochips market. These innovations enable precise cellular manipulation, fostering applications in drug discovery, diagnostics, and personalized medicine. The March 2023 collaboration between Mekonos and bit.bio exemplifies this trend, aiming to enhance cell engineering capabilities. Their joint efforts focus on advancing bit.bio’s platform to convert stem cells into specific cell types, expediting therapeutic developments and research.

The growing demand for sophisticated tools in genetic studies further reinforces the adoption of biochip technologies. Engineering advancements improve data accuracy and processing speed, vital for high-throughput applications. Biochip integration with cellular engineering accelerates functional studies and biomarker identification, reducing timeframes for drug efficacy tests. Expanding uses in oncology, immunology, and regenerative medicine are expected to drive demand.

Research institutes and biotech firms continue to prioritize investments in biochip-based cellular solutions. The convergence of cell engineering with microfluidics and nanotechnology is anticipated to unlock novel applications. Robust support from partnerships and technological innovations underscores the biochips market’s growth trajectory. This momentum positions the sector to significantly impact precision medicine and life sciences.

Restraints

High Costs Are Restraining the Biochips Market

High costs associated with the development and manufacturing of biochips are restraining the market. Designing biochips requires advanced materials, precision engineering, and sophisticated technologies, making them expensive to produce. These high costs limit accessibility for smaller research labs and institutions with constrained budgets.

Furthermore, integrating biochip platforms into existing workflows often demands additional infrastructure and expertise, further increasing operational expenses. Regulatory complexities surrounding biochips, particularly in healthcare applications, add to the time and cost required for approvals. Delays in regulatory clearance hinder product commercialization, impacting market growth.

Developing biochips tailored for specific applications, such as rare disease diagnostics, increases per-unit production costs, restricting widespread adoption. In regions with limited funding for advanced healthcare and research, cost concerns become a critical barrier. Addressing these challenges requires innovations focused on cost reduction and streamlined manufacturing processes.

Opportunities

Increase in R&D Activities as an Opportunity for the Biochips Market

Growing research and development activities are anticipated to provide a strong growth opportunity for the biochips market. Investments in R&D foster innovation and drive the development of advanced solutions for diagnostics and drug discovery. In March 2024, Randox Laboratories Ltd launched a revolutionary biochip to detect genetic risk factors for type 1 diabetes.

Developed in collaboration with JDRF-funded researchers at the University of Exeter, this test highlights the critical role of R&D in expanding biochip applications. Researchers increasingly utilize biochips for high-throughput screenings and genetic analysis, fueling demand across biotechnology and pharmaceutical sectors.

The ability of biochips to deliver rapid and accurate results aligns with the growing need for precision in medical research. Expansion of R&D initiatives also encourages collaborations between academia, industry, and government bodies, strengthening innovation pipelines. Ongoing advancements in material sciences and microfluidics are projected to enhance biochip performance and affordability. These trends position biochips as integral tools for breakthroughs in genomics, proteomics, and molecular diagnostics. The market is likely to witness sustained growth as R&D initiatives continue to explore novel applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the biochips market. On the positive side, the growing demand for faster and more efficient diagnostics, coupled with increased investments in healthcare and biotechnology, drives the adoption of biochips. The rising focus on personalized medicine, genomics, and precision diagnostics further boosts market growth.

However, economic recessions or budget constraints can reduce healthcare funding, potentially slowing the expansion of biochip technologies. Geopolitical factors, such as trade restrictions or regulatory changes, may disrupt the supply chain for raw materials or hinder access to international markets. Additionally, concerns over data privacy and stringent regulations on healthcare technologies may pose challenges. Despite these hurdles, the continuous advancements in biochip technology, alongside the growing need for rapid and accurate diagnostics, create a positive outlook for the market’s growth.

Trends

Surge in Collaborations and Partnerships Driving the Biochips Market

Rising collaborations and partnerships are driving significant growth in the biochips market. High levels of cooperation between academic institutions, research organizations, and healthcare companies are expected to accelerate innovation and expand the use of biochips in diagnostics and treatment. These partnerships enable better access to resources, cutting-edge technologies, and expertise, fostering the development of next-generation biochips.

In October 2024, researchers from the London School of Hygiene & Tropical Medicine (LSHTM), in collaboration with their partners, secured £3.7 million (approximately USD 4.03 million) in funding to enhance genomic surveillance and support vaccine development for Klebsiella pneumoniae. This collaborative effort exemplifies the increasing trend of partnerships in research and healthcare, which is likely to drive the biochip market forward by enhancing the capabilities and applications of these technologies.

Regional Analysis

North America is leading the Biochips Market

North America dominated the market with the highest revenue share of 40.2% owing to advances in biotechnology, increased adoption of personalized medicine, and rising demand for high-throughput screening technologies. Biochips are essential tools in genomics, diagnostics, and drug discovery, enabling rapid analysis of genetic material, proteins, and other biomarkers. The market’s growth was further fueled by the increasing prevalence of chronic diseases and the growing emphasis on precision medicine, which requires efficient and scalable testing methods.

A key development that underscored this growth was Nomic Bio’s completion of a Series B funding round in September 2024, raising US$ 42 million. This investment, which exceeded the company’s initial goal, is expected to enhance Nomic Bio’s protein profiling platform, expanding its commercial operations and helping meet rising market demand. As the need for advanced diagnostic tools and personalized therapies continues to increase, the biochips market in North America is expected to continue to grow, supported by continuous innovation and greater access to healthcare technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is projected to experience the fastest growth in the biochips market, driven by substantial investments in biotechnology research and increasing healthcare demands. Nations such as China, Japan, and India are poised to lead, enhancing their healthcare infrastructure and research capacities. This expansion aligns with the regional focus on precision medicine, which is essential for advancing healthcare services.

In September 2024, Japan made significant strides in healthcare innovation when Takeda obtained approval from the Ministry of Health, Labour and Welfare to produce and sell FRUZAQLA Capsules. This cancer treatment, based on fruquintinib, represents a notable advancement in the region’s commitment to modern healthcare solutions. Such approvals underscore the growing emphasis on developing sophisticated treatment options.

The prevalence of chronic diseases in the Asia Pacific is rising, increasing the demand for early disease detection technologies. Governments’ continued investment in healthcare innovations is likely to boost the biochips market. The region’s focus on genomics, diagnostics, and personalized therapies is expected to further propel the demand for biochips, accelerating market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the biochips market focus on advancing microarray and lab-on-a-chip technologies to meet the demands of genomics, proteomics, and diagnostics. Companies invest heavily in R&D to develop multifunctional platforms that streamline testing and analysis processes. Strategic collaborations with pharmaceutical firms and research institutions help expand applications in drug discovery and personalized medicine.

Geographic expansion into regions with growing research funding and healthcare infrastructure supports market penetration. Many players also prioritize offering cost-effective solutions to increase adoption in both clinical and academic settings. Agilent Technologies, Inc. is a leading company in this market, providing innovative biochip solutions for genomics, proteomics, and diagnostics applications.

The company combines advanced microarray technology with user-friendly platforms to deliver reliable results for research and clinical use. Agilent’s strong global presence and continuous commitment to innovation have positioned it as a trusted name in the biochips industry.

Recent Developments

- In April 2024, Boston Micro Fabrication established BMF Biotechnology Inc., a new entity focused on enhancing 3D BioChip technologies for pharmaceutical and cosmetic research. The division aims to develop organ-on-a-chip platforms for large-scale tissue growth in vitro, enabling faster progress in drug discovery and cosmetic innovation.

- In June 2023, Randox Laboratories acquired Cellix Limited, a company in Ireland that develops microfluidic tools and impedance flow cytometers used for analyzing cells in advanced applications.

Top Key Players in the Biochips Market

- Bio-Rad Laboratories, Inc

- Boston Micro Fabrication

- GE HealthCare

- Illumina, Inc

- PerkinElmer Inc

- QIAGEN

- Randox Laboratories Ltd

- Standard BioTools

Report Scope

Report Features Description Market Value (2024) US$ 13.4 Billion Forecast Revenue (2034) US$ 39.1 Billion CAGR (2025-2034) 11.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (DNA Chips (Cancer Diagnosis & Treatment, SNP Genotyping, Genomics, Gene Expression, Drug Discovery, Agricultural Biotechnology, and Others), Protein Chips (Proteomics, HTS, Expression Profiling, Drug Discovery, Diagnostics, and Others), Lab-on-chip (Genomics, Proteomics, IVD & POC, Drug discovery, and Others), and Others), By End-use (Hospitals & Diagnostic Centers, Biotechnology & Pharmaceutical Companies, Academic & Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bio-Rad Laboratories, Inc, Boston Micro Fabrication, GE HealthCare, Illumina, Inc, PerkinElmer Inc, QIAGEN, Randox Laboratories Ltd, and Standard BioTools. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bio-Rad Laboratories, Inc

- Boston Micro Fabrication

- GE HealthCare

- Illumina, Inc

- PerkinElmer Inc

- QIAGEN

- Randox Laboratories Ltd

- Standard BioTools