Global Infant Formula DHA Algae Oil Market Size, Share, Report Analysis By Content (30% - 40%, 40%-50%), By End Use (0-3 years old, 3-6 years old, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156373

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

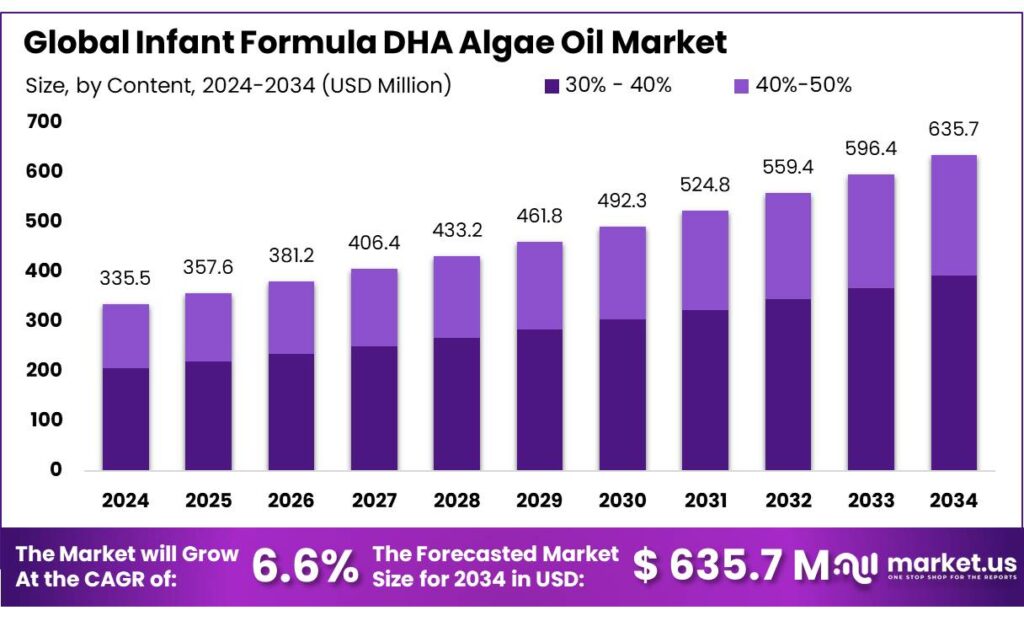

The Global Infant Formula DHA Algae Oil Market size is expected to be worth around USD 635.7 Million by 2034, from USD 335.5 Million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.70% share, holding USD 17.2 Billion revenue.

The infant formula industry is experiencing unprecedented growth opportunities driven by DHA algae oil applications, particularly as parents increasingly demand natural, scientifically-backed nutrition options for their children. This omega-3 rich ingredient has become essential for supporting healthy brain and eye development in infants, creating substantial market expansion possibilities as manufacturers recognize the competitive advantages of incorporating algae-derived DHA into their formulations.

The regulatory framework supporting DHA algae oil demonstrates strong institutional confidence in this natural ingredient. The Food and Drug Administration has determined that DHA-rich oils can be used at a level that provides a total intake of DHA and/or EPA up to 3.0 grams per day, according to federal guidelines. This generous allowance reflects extensive safety testing and provides manufacturers with significant flexibility in product development, enabling them to create formulations that meet diverse nutritional requirements while maintaining regulatory compliance.

The global regulatory acceptance of DHA algae oil creates international market opportunities that extend far beyond domestic markets. Algal oil produced from Schizochytrium sp. has been approved for direct use in foods by the U.S. FDA, Health Canada, European Union, Food Standards Agency of Australia, China’s Ministry of Health, and Brazil’s National Health Surveillance Agency. This widespread international approval reduces regulatory barriers and enables manufacturers to develop global product strategies using standardized formulations across multiple markets.

Key Takeaways

- Infant Formula DHA Algae Oil Market size is expected to be worth around USD 635.7 Million by 2034, from USD 335.5 Million in 2024, growing at a CAGR of 6.6%.

- 30% – 40% content held a dominant market position, capturing more than a 61.8% share in the Infant Formula DHA Algae Oil market.

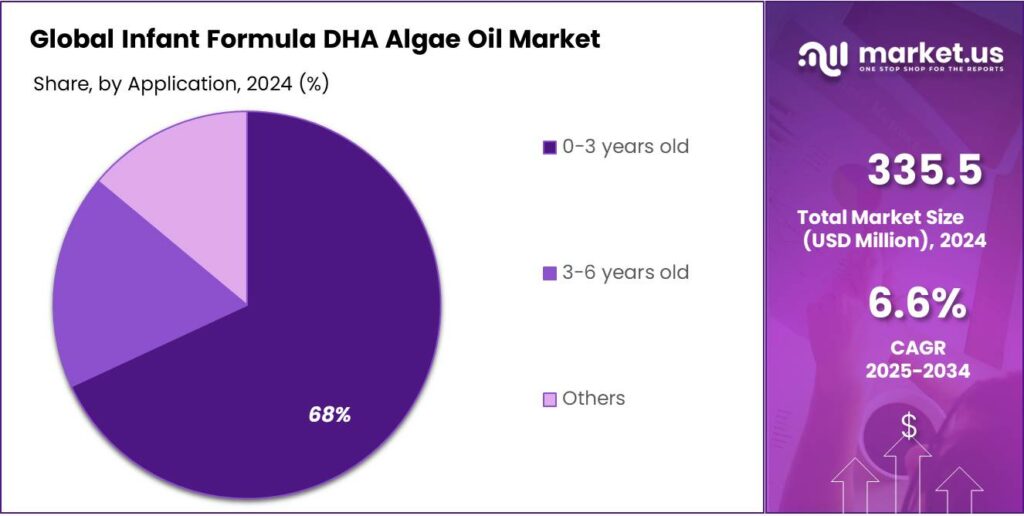

- 0–3 years held a dominant market position, capturing more than a 68.3% share in the Infant Formula DHA Algae Oil market.

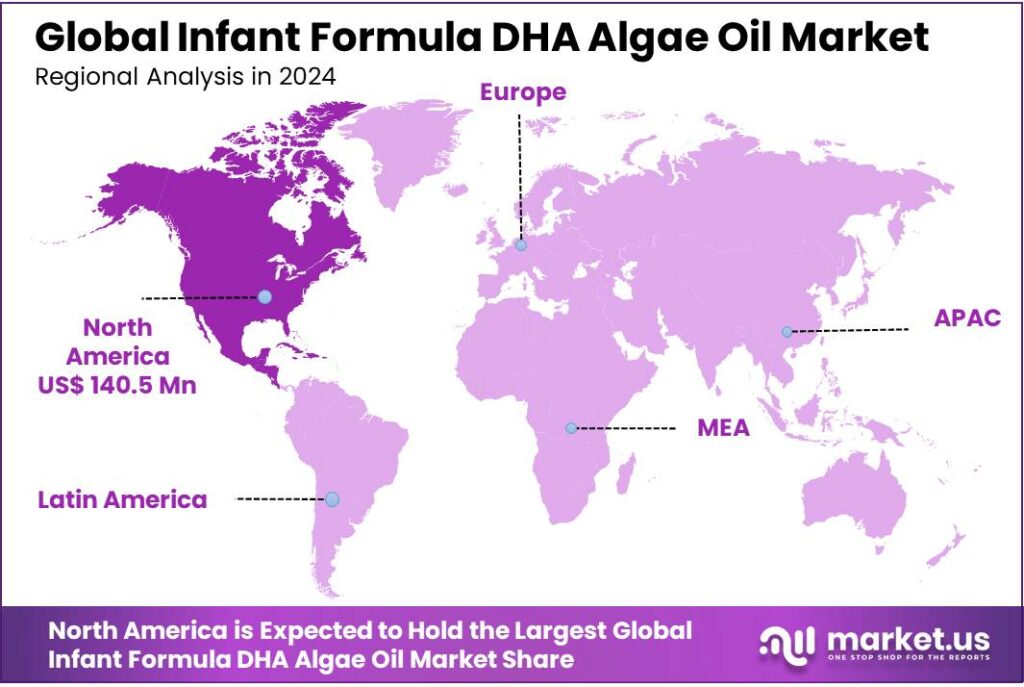

- North America held a commanding lead in the Infant Formula DHA Algae Oil market, capturing 41.90% of the global share, translating to approximately USD 140.5 million.

By Content Analysis

30% – 40% Content Leads with 61.8% Share in 2024

In 2024, 30% – 40% content held a dominant market position, capturing more than a 61.8% share in the Infant Formula DHA Algae Oil market. This segment emerged as the clear leader because it provides the optimal concentration of DHA for infant growth and brain development, aligning with nutrition guidelines and parental demand for balanced, science-backed products. Parents and caregivers increasingly prefer formulas in this concentration range since it closely matches global dietary recommendations for DHA in early childhood.

The dominance of this range also reflects the trust built by leading formula producers who use algae oil as a safe and sustainable DHA source, reducing reliance on fish-based oils. By 2025, the 30% – 40% segment is expected to maintain its lead as health authorities and pediatric associations continue to emphasize the role of DHA in cognitive development and vision health during the first two years of life. With growing awareness, parents are showing stronger loyalty toward products highlighting DHA levels within this range, further boosting demand.

By End Use Analysis

0–3 Years Segment Leads with 68.3% Share in 2024

In 2024, 0–3 years held a dominant market position, capturing more than a 68.3% share in the Infant Formula DHA Algae Oil market. This age group is the most critical stage of early development, where DHA intake directly supports brain growth, visual acuity, and overall cognitive function. Parents and caregivers across the globe are increasingly aware of the importance of DHA during this window, leading to a stronger demand for formulas enriched with algae oil as a sustainable and safe source of nutrition.

The high share is also linked to the growing trust in algae oil as an alternative to fish-derived DHA, particularly in regions where sustainability and allergen-free ingredients are priorities. By 2025, the 0–3 years category is expected to maintain its leadership as pediatric guidelines consistently emphasize the necessity of DHA in infants and toddlers for healthy neurological and physical development. Infant nutrition companies are actively marketing products within this segment, highlighting clinical benefits and natural sourcing, further reinforcing consumer confidence.

Key Market Segments

By Content

- 30% – 40%

- 40%-50%

By End Use

- 0-3 years old

- 3-6 years old

- Others

Emerging Trends

Growing Regulatory Support for Algal DHA in Infant Nutrition

One of the most promising developments in the infant formula DHA algae oil market is the increasing regulatory support for the inclusion of algal-derived DHA in infant nutrition products. This trend reflects a broader recognition of the nutritional benefits of DHA and the safety of algal sources, aligning with global shifts towards plant-based and sustainable ingredients.

In India, the Food Safety and Standards Authority of India (FSSAI) has established regulations that permit the use of algal and fungal oils as sources of Docosahexaenoic Acid (DHA) and Arachidonic Acid (ARA) in infant formulas. Specifically, the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, allow the inclusion of DHA and ARA from sources such as Schizochytrium sp., Mortierella alpina, and Ulkenia sp. These regulations ensure that the DHA content in infant formulas meets safety standards, thereby facilitating the incorporation of algal DHA into products intended for infant nutrition.

Similarly, in the United States, the Food and Drug Administration (FDA) has recognized algae-derived DHA as a safe ingredient for use in infant formulas. The FDA’s Generally Recognized as Safe (GRAS) status for DHA-rich oils from algae, such as those derived from Schizochytrium sp., underscores the agency’s confidence in the safety and nutritional adequacy of these ingredients for infant consumption .

This regulatory endorsement is significant because it not only validates the safety of algal DHA but also encourages manufacturers to explore and adopt these sustainable alternatives in their formulations. As a result, the market for algal DHA in infant formulas is experiencing growth, driven by both consumer demand for plant-based ingredients and the support of regulatory bodies that ensure the safety and efficacy of these products.

Drivers

Consumer Demand for Plant-Based DHA Sources

One of the most significant driving factors behind the growth of the infant formula DHA algae oil market is the increasing consumer preference for plant-based and sustainable nutrition options. Parents are becoming more conscious of the ingredients in their children’s food, seeking alternatives that align with ethical, environmental, and health considerations. Algae-derived DHA offers a plant-based source of docosahexaenoic acid, an essential omega-3 fatty acid crucial for infant brain and eye development. This shift towards plant-based DHA sources is not only driven by ethical concerns but also by a growing awareness of the environmental impact of traditional fish-derived DHA production.

In India, the Food Safety and Standards Authority of India (FSSAI) has recognized the importance of DHA in infant nutrition. Under the Food for Infant Nutrition Regulations, 2020, FSSAI permits the inclusion of algal and fungal oils as sources of DHA and arachidonic acid (ARA) in infant formulas. These regulations ensure that the DHA content is not less than 0.2% of total fatty acids when a DHA claim is made, and that the ratio of ARA to DHA is maintained at a minimum of 1:1. Such regulatory support underscores the commitment to providing infants with safe and nutritionally adequate food options.

Globally, the acceptance of algae-derived DHA in infant formulas is further bolstered by regulatory bodies. In the United States, the Food and Drug Administration (FDA) has recognized algae oil as a safe source of DHA for use in infant formula. The FDA’s approval process ensures that DHA-rich oils from algae meet stringent safety and quality standards before they are incorporated into infant nutrition products. This regulatory endorsement provides confidence to manufacturers and consumers alike regarding the safety and efficacy of algae-derived DHA.

Restraints

Regulatory Hurdles and Approval Delays

One significant challenge facing the infant formula DHA algae oil market is the complex and time-consuming regulatory approval process. In both India and the United States, obtaining approval for new DHA-rich algal oils involves rigorous safety evaluations and documentation, which can delay market entry and increase costs for manufacturers.

In India, the Food Safety and Standards Authority of India (FSSAI) governs the inclusion of DHA in infant formulas. According to the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, infant formulas may contain algal and fungal oils as sources of DHA and Arachidonic Acid (ARA) from specific strains such as Schizochytrium sp. and Mortierella alpina. However, the inclusion of such ingredients requires prior approval from FSSAI, which involves a detailed evaluation process to ensure safety and compliance with nutritional standards.

Similarly, in the United States, the Food and Drug Administration (FDA) oversees the approval of new ingredients in infant formulas. Manufacturers must submit a Generally Recognized as Safe (GRAS) notice for any new ingredient, including DHA-rich algal oils. For instance, a GRAS notice for DHA-rich oil from Schizochytrium sp. was submitted to the FDA, detailing the safety and intended use of the ingredient in infant formulas. The FDA evaluates such notices to ensure that the ingredient is safe for consumption by infants and complies with all regulatory requirements.

Opportunity

Government Support and Regulatory Backing Fuel DHA Algae Oil Adoption in Infant Formulas

The global market for DHA algae oil in infant formulas is experiencing significant growth, driven by increasing awareness of its health benefits and strong regulatory support. DHA (docosahexaenoic acid) is a crucial omega-3 fatty acid that plays a vital role in the development of an infant’s brain and eyes. As parents and healthcare professionals recognize the importance of DHA, the demand for DHA-enriched infant formulas has surged.

In the United States, the market for DHA algae oil in infant formulas was valued at USD 22.3 million in 2024. The expansion of the market is stimulated by more inclusive regulatory standards, such as those set by the U.S. Food and Drug Administration (FDA), which has established minimum levels of DHA to be incorporated into infant formulas.

Government initiatives play a pivotal role in promoting the adoption of DHA-enriched infant formulas. In the United States, the Department of Health and Human Services (HHS) and the FDA have undertaken comprehensive reviews of nutrient requirements for infant formulas. These reviews aim to ensure the safety, reliability, and nutritional adequacy of infant formulas for American families. The FDA has issued a Request for Information (RFI) to begin the nutrient review process required by law for infant formula.

Additionally, the FDA has established comprehensive guidelines for DHA and arachidonic acid (ARA) content in infant formulas, specifying minimum concentrations of 0.2% DHA and 0.35% ARA of total fatty acids. These regulations ensure that infant formulas meet nutritional standards that support optimal infant development.

Regional Insights

North America Leads with 41.90% Share Worth USD 140.5 Million in 2024

In 2024, North America held a commanding lead in the Infant Formula DHA Algae Oil market, capturing 41.90% of the global share, translating to approximately USD 140.5 million in revenue—a clear indication of the region’s dominant role.

This strong foothold is driven by several key factors. A combination of high parental awareness around DHA’s critical role in infant brain and eye development, stringent standards set by health authorities that encourage DHA fortification, and widespread availability of premium infant formulas creates fertile ground for growth. In particular, the United States—home to many leading infant nutrition brands—is a powerhouse in this segment, contributing substantially to North America’s share.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Henry Lamotte OILS, a Germany-based specialist in natural oils and fatty acids, provides high-quality DHA algae oil for infant formula manufacturers. The company’s strengths lie in long-standing expertise, sustainable sourcing, and adherence to international quality certifications. It focuses on delivering reliable, traceable, and clean-label DHA ingredients that meet infant nutrition standards. Leveraging its global distribution network, Henry Lamotte OILS plays a vital role in ensuring steady supply for formula producers while supporting the transition toward plant-based nutrition.

Goerlich Pharma, headquartered in Germany, is a leading supplier of dietary supplements and functional ingredients, including algae-based DHA oils for infant formula. The company emphasizes premium-quality formulations, strict quality assurance, and compliance with European regulatory standards. Through contract manufacturing and product development expertise, Goerlich Pharma caters to infant nutrition brands seeking customized DHA solutions. Its European base and strong partnerships across the nutrition sector help it maintain a competitive role in the growing infant formula market.

Cellana, based in Hawaii, develops and commercializes algae-based products, including DHA-rich oils for infant nutrition. The company’s expertise lies in large-scale cultivation of algae through its patented ReNew™ technology, ensuring sustainable production. By focusing on bio-based solutions, Cellana supports the infant formula industry with reliable and eco-friendly DHA ingredients. Its innovative approach balances high-quality nutritional output with environmental responsibility, helping meet rising consumer demand for natural infant nutrition. Expansion into global partnerships enhances its competitive market position.

Top Key Players Outlook

- Algarithm

- Cellana

- Goerlich Pharma

- Henry Lamotte OILS

- Nordic Naturals

- Polaris

Recent Industry Developments

In 2024, Algarithm—a Canadian innovator—strengthened its presence in the Infant Formula DHA Algae Oil sector by supplying its “alphamega³ 400 MT”, a vegan algal DHA oil that boasts 40% DHA (i.e., 400 mg per gram), produced through a clean, chemical-free process that preserves taste neutrality and high quality.

In 2024, Goerlich Pharma, a Germany‑based contract manufacturer founded in 1984, deepened its role in the Infant Formula DHA Algae Oil space with its vegan algae oil offering that delivers at least 40% DHA content—an attractive, plant‑based omega‑3 solution for formula makers

Report Scope

Report Features Description Market Value (2024) USD 335.5 Mn Forecast Revenue (2034) USD 635.7 Mn CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Content (30% – 40%, 40%-50%), By End Use (0-3 years old, 3-6 years old, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Algarithm, Cellana, Goerlich Pharma, Henry Lamotte OILS, Nordic Naturals, Polaris Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Infant Formula DHA Algae Oil MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Infant Formula DHA Algae Oil MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Algarithm

- Cellana

- Goerlich Pharma

- Henry Lamotte OILS

- Nordic Naturals

- Polaris