Global Industrial Brown Sugar Market By Product Type (Light Brown and Dark Brown), By Applications (Bakery Goods, Confectionery Products, Sauces/Marinades, Beverages, Dairy Products, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157175

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

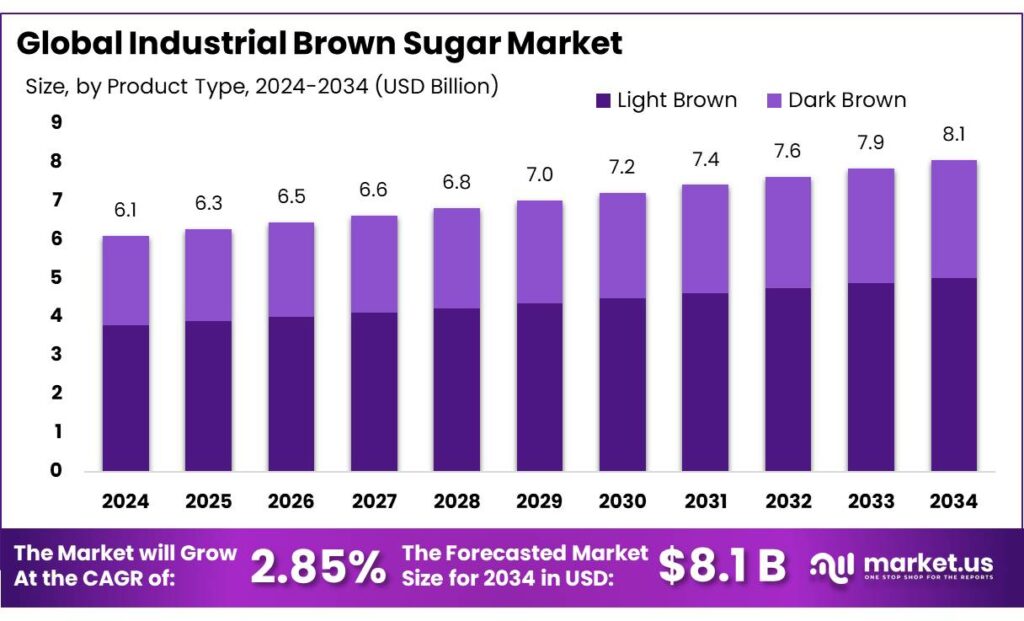

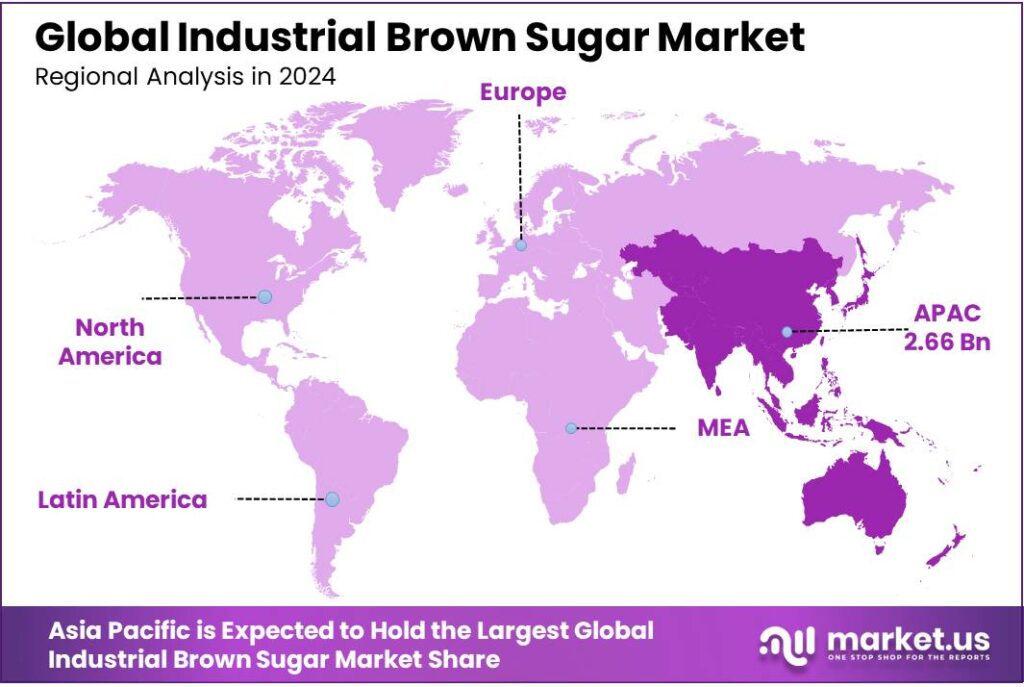

The Global Industrial Brown Sugar Market size is expected to be worth around USD 8.1 Billion by 2034, from USD 6.1 Billion in 2024, growing at a CAGR of 2.8% during the forecast period from 2025 to 2034. In 2024 Asia‑Pacific held a dominant market position, capturing more than a 43.6% share, holding USD 10.4 Billion in revenue.

Industrial brown sugar refers to brown sugar packaged and sold in bulk for use in food manufacturing, rather than for direct retail sale to consumers. It is created by coating white sugar crystals with molasses, which gives it its characteristic color and flavor. The molasses content in brown sugar provides a distinctive taste and color, adding depth to the final product. It’s used in a wide range of applications, such as baking, confectionery, beverages, and nutraceutical products.

The major driver of the product is the rising demand for bakery and confectionery products. Similarly, its applications in the food processing industry boost the market. In recent years, flavored brown sugar is anticipated to gain popularity. Despite the unique flavor, the market is facing challenges from its healthier counterparts.

- The World Health Organization (WHO) recommends a daily intake of no more than 25 grams (5.75 tsp) of sugar per person for improved health.

Key Takeaways

- The global industrial brown sugar market was valued at USD 6.1 billion in 2024.

- The global industrial brown sugar market is projected to grow at a CAGR of 2.8% and is estimated to reach USD 8.1 billion by 2034.

- Among the product types, industrial light brown sugar dominated the market, valued at around US$ 14.7 billion in 2024.

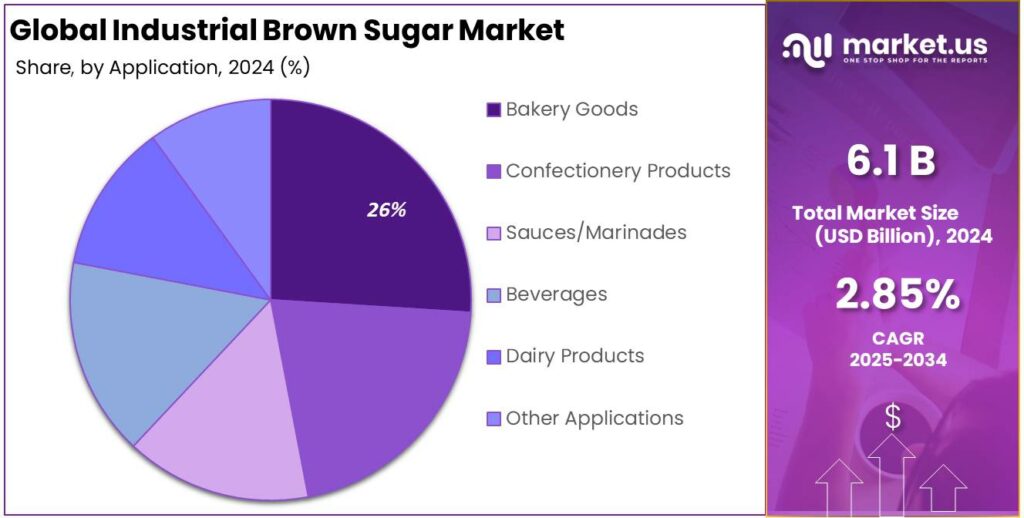

- On the basis of applications, the industrial brown sugar market was dominated by bakery goods with a market share of 24.3% in 2024.

- In 2024, the Asia Pacific was the biggest market for industrial brown sugar, constituting around 43.6% of the total market share, valued at approximately USD 10.4 billion.

Product Type Analysis

Industrial Light Brown Sugar Dominates the Market Due to Its Subtle Flavor.

The industrial brown sugar market is segmented based on product type as light brown and dark brown. In 2024, industrial light brown sugar held a dominant market position, capturing more than a 62% share of the global market. Light brown sugar’s subtler flavor makes it a great substitute for white granulated sugar in many recipes, adding a hint of caramel without drastically altering the taste.

Dark brown sugar’s stronger flavor can sometimes overpower dishes. Light brown sugar contains roughly 3.5% molasses, while dark brown sugar contains around 6.5%. Recipes that say brown sugar without specifying light or dark. In these cases, it is generally assumed that light brown sugar is the intended ingredient.

Application Analysis

Bakery Goods Dominate the Industrial Brown Sugar Market.

On the basis of applications, the market can be divided into bakery goods, confectionery products, sauces/marinades, beverages, dairy products, and other applications. In 2024, bakery goods dominated the global industrial brown sugar market with a market share of 24.3%. The rich flavor of the brown sugar enhances the overall taste of baked goods such as chocolate chip cookies and banana bread. Additionally, the hygroscopic nature of brown sugar creates soft, moist, and chewy textures in baked goods, a desirable characteristic in several cookies, cakes, and quick breads.

For confectionery, such as hard candies or delicate caramel, white sugar’s purity and faster caramelization are often favored to achieve specific textures and prevent potential burning from the molasses in brown sugar. Similarly, for beverages, white sugar or superfine sugar is generally preferred due to its faster dissolution and less pronounced flavor, allowing other ingredients to shine through.

Key Market Segments

By Product Type

- Light Brown

- Dark Brown

By Application

- Bakery Goods

- Confectionery Products

- Sauces/Marinades

- Beverages

- Dairy Products

- Other Applications

Drivers

Rising Demand for Bakery and Confectionery Products Drives the Industrial Brown Sugar Market.

The rising demand for bakery and confectionery products is a major driver of the industrial brown sugar market, as this form of sugar is prized for its rich flavor, moisture-retaining qualities, and caramel-like color that enhances product appeal. Brown sugar is widely used in cookies, cakes, pastries, chocolates, and syrups, where its molasses content adds depth and softness. For instance, in the U.S., the popularity of soft-baked chocolate chip cookies and cinnamon rolls has surged, both of which commonly use brown sugar as a key ingredient.

Similarly, in European countries like Germany and France, traditional baked goods such as gingerbread and spiced biscuits heavily rely on brown sugar for their distinctive taste and texture. In Asia, brown sugar is a staple in sweet buns and fillings, such as in Japanese anko-filled pastries or Taiwanese brown sugar bubble tea pearls. The rapid urbanization and growing middle-class population in emerging economies have also fueled the expansion of quick-service restaurants and artisanal bakeries, increasing industrial demand for high-quality sweeteners.

Restraints

Several Healthier Alternatives to Industrial Brown Sugar Might Pose a Challenge to the Market.

The growing popularity of healthier sugar alternatives poses a notable challenge to the industrial brown sugar market, as consumers increasingly seek natural, low-calorie, or low-glycemic sweeteners. Alternatives such as coconut sugar, stevia, monk fruit extract, and agave syrup are gaining traction in both home kitchens and industrial applications.

For instance, coconut sugar, having a glycemic index between 35 and 54 compared to brown sugar’s 64, is used widely in vegan and health-focused baked goods. Stevia and monk fruit, both zero-calorie plant-based sweeteners, are becoming common in sugar-free candies, protein bars, and beverages. Major food manufacturers are responding to health-conscious trends by reformulating recipes to include these substitutes, especially in products targeting diabetic or fitness-oriented consumers.

In countries such as the U.S. and Japan, labeling laws requiring the disclosure of added sugars have pushed companies to seek perceived cleaner alternatives to traditional brown sugar. Moreover, consumer awareness around metabolic health, obesity, and sugar addiction continues to rise, influencing purchasing decisions.

Opportunity

Brown Sugar Added to Packaged Foods is Anticipated to Create More Opportunities in the Market.

The increased use of brown sugar in packaged foods is anticipated to create significant opportunities in the industrial brown sugar market due to shifting consumer preferences toward richer flavors and more natural ingredients. Brown sugar, with its molasses content, imparts a deeper taste and enhanced moisture retention, making it ideal for a wide range of packaged goods such as granola bars, breakfast cereals, ready-to-eat desserts, sauces, and marinades.

For instance, brands have begun launching oatmeal and cereal products that highlight brown sugar as a key flavoring, appealing to consumers who associate it with a less processed, more wholesome image than white sugar.

Similarly, brown sugar is increasingly used in bottled beverages and traditional snack packs such as brown sugar mochi or jelly drinks, aligning with regional flavor preferences. Packaged food producers targeting premium or artisanal markets often use brown sugar to add perceived quality and authenticity to their products. This trend diversifies the applications of industrial brown sugar and opens avenues for innovation in product development across global markets.

Trends

Demand for Flavored Industrial Brown Sugar.

The growing demand for flavored industrial brown sugar is an emerging trend reshaping the industrial brown sugar market, driven by consumer desire for unique taste experiences and product differentiation. Flavored brown sugar varieties, such as vanilla, cinnamon, maple, and chili-infused, are being increasingly adopted by food and beverage manufacturers to enhance the sensory profile of their offerings.

For instance, cinnamon-flavored brown sugar is now commonly used in breakfast items like instant oatmeal and granola bars, providing warmth and spice without requiring additional flavoring agents. In the confectionery sector, vanilla or caramel-flavored brown sugar is used to deepen the taste of chocolates, syrups, and cookies, especially in premium or limited-edition product lines.

These flavored varieties offer manufacturers a way to enhance product appeal naturally, often without needing artificial additives, aligning with clean-label trends. As flavor innovation continues to be a key differentiator in food processing, flavored brown sugar is becoming an attractive option for product development across global markets.

Geopolitical Impact Analysis

Geopolitical Tensions Disrupt the Global Supply Chain, Affecting the Industrial Brown Sugar Market.

Geopolitical tensions have a significant impact on the industrial brown sugar market, particularly through disruptions in trade routes, export-import restrictions, and fluctuations in energy costs. For instance, conflicts such as the Russia-Ukraine war have affected global fertilizer supplies, as both countries are key exporters of potash and other agricultural inputs. This has increased production costs for sugarcane farmers in major producing countries such as India and Brazil, indirectly influencing the price and availability of brown sugar.

Similarly, trade disputes between the U.S. and China have led to tariffs and restrictions on agricultural commodities, complicating the supply chain for manufacturers relying on cross-border sourcing of raw or refined sugar. In Southeast Asia, tensions in the South China Sea have affected shipping routes vital for exporting brown sugar from countries such as Thailand and the Philippines, causing delays and increased freight charges.

Furthermore, sanctions on countries such as Iran or Venezuela can limit access to fuel for transport and processing, again raising operational costs. These geopolitical dynamics often lead to supply shortages, price volatility, and reduced reliability for industries that depend on consistent, high-volume brown sugar inputs.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Industrial Brown Sugar Market.

In 2024, the Asia Pacific dominated the global industrial brown sugar market, holding about 43.6%, valued at approximately US$ 2.66 billion. Asia Pacific holds the largest share of the global industrial brown sugar market due to its vast population, deeply rooted sugar consumption traditions, and extensive food and beverage industry. Countries such as India, China, Thailand, and Indonesia are major producers and consumers of brown sugar, using it extensively in traditional sweets, beverages, sauces, and bakery products. For instance, in India, jaggery-based brown sugar is commonly used in desserts such as chikki, while in China, brown sugar is a staple in sweet soups, buns, and health tonics.

Additionally, Thailand is both a significant exporter and consumer, known for its palm sugar-based brown varieties. The region’s tropical climate and well-established agricultural infrastructure support large-scale sugarcane cultivation, giving it a natural advantage in sugar production. Moreover, the presence of a massive food processing sector, particularly in countries such as Japan and South Korea, increases the demand for brown sugar as a sweetening and flavor-enhancing agent.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ASR Group, Cargill, Incorporated, Amalgamated Sugar Company, Taikoo Sugar Limited, Südzucker AG, Louis Dreyfus Company, Agrana Beteiligungs-AG, Tereos (Whitworths), and Associated British Foods plc are the global major players in the industrial brown sugar market. As the industrial brown sugar market is very competitive, many players try to gain a competitive edge by engaging in strategic activities, such as product development, mergers, partnerships, and investments.

ASR Group is the world’s largest refiner and marketer of cane sugar, producing a wide range of sweeteners, including brown sugars, under various brands like Domino, C&H, and Redpath. ASR Group is committed to innovation, sustainability, and supporting the communities in which they operate. Südzucker AG is Europe’s leading sugar producer and a major international food company.

The company operates more than 90 production sites, primarily in Europe, and is known for its Europe first initiatives. Taikoo Sugar Limited is a long-established Hong Kong-based company, founded by Swire, that produces and markets premium sugar products, including unrefined brown sugars, and observes consumer trust due to its long history.

The Major Players In The Industry

- ASR Group

- Cargill, Incorporated

- Amalgamated Sugar Company

- Taikoo Sugar Limited

- Südzucker AG

- Louis Dreyfus Company

- Agrana Beteiligungs-AG

- Tereos (Whitworths)

- Associated British Foods plc

- Other Key Players

Key Development

- In August 2025, the McCormick brand brought back brown sugar with an expanded collection of eight limited-edition finishing sugars, namely, apple cider, maple brown sugar, pumpkin spice, salted caramel, chocolate hazelnut, spiced orange, candy cane, and english toffee.

- In February 2024, Sucro Limited, an integrated sugar company, announced plans to construct a cane sugar refinery in the Greater Chicago Area to address the growing and underserved U.S. sugar market. The refinery has specialty sugar capabilities, including large grain crystals used in specialty foods and confectionery, an integrated brown sugar line, specialty liquid production and organic sugar refining capabilities.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Bn Forecast Revenue (2034) USD 8.1 Bn CAGR (2025-2034) 2.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Light Brown and Dark Brown), By Applications (Bakery Goods, Confectionery Products, Sauces/Marinades, Beverages, Dairy Products, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape ASR Group, Cargill, Incorporated, Amalgamated Sugar Company, Taikoo Sugar Limited, Südzucker AG, Louis Dreyfus Company, Agrana Beteiligungs-AG, Tereos (Whitworths), Associated British Foods plc, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Industrial Brown Sugar MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Brown Sugar MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ASR Group

- Cargill, Incorporated

- Amalgamated Sugar Company

- Taikoo Sugar Limited

- Südzucker AG

- Louis Dreyfus Company

- Agrana Beteiligungs-AG

- Tereos (Whitworths)

- Associated British Foods plc

- Other Key Players