Global Autoclaved Aerated Concrete Market Size, Share, And Business Benefits By Element (Blocks, Beams and Lintels, Cladding Panels, Roof Panels, Wall Panels, Floor Elements, Others), By Density (Low Density, Medium Density, High Density), By End-Use (Residential, Non-residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2023

- Report ID: 147623

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

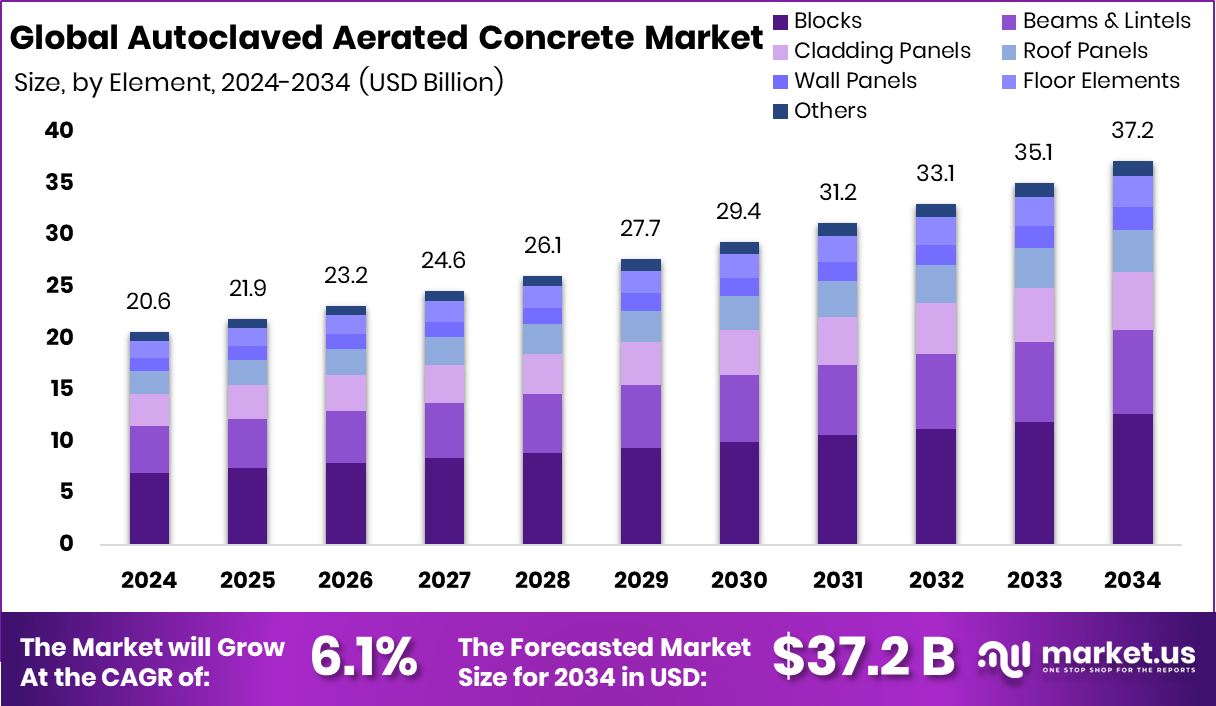

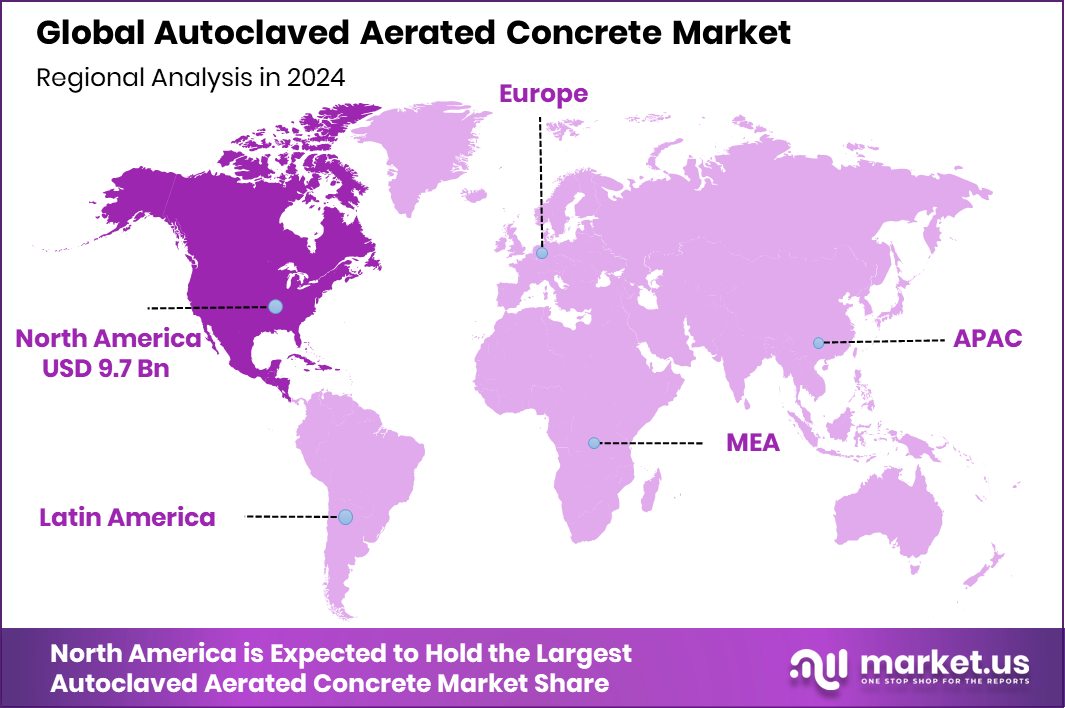

Global Autoclaved Aerated Concrete Market is expected to be worth around USD 37.2 billion by 2034, up from USD 20.6 billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034. North America dominates the AAC market with USD 9.7 Bn, holding 47.3% share.

Autoclaved Aerated Concrete (AAC) is a lightweight, precast foam concrete building material developed for sustainable construction. Made by combining cement, lime, water, sand, and a small amount of aluminum powder, AAC undergoes curing in a high-pressure steam autoclave, resulting in a strong yet porous structure. Its internal air pockets not only make the material lighter but also significantly improve its insulation properties.

The Autoclaved Aerated Concrete market revolves around the production and distribution of AAC blocks, panels, and related components across residential, commercial, and infrastructure sectors. With rising demand for eco-friendly and energy-efficient materials, AAC has seen increased adoption globally. From large-scale buildings to small housing units, the market is expanding due to its thermal insulation, fire resistance, and speed of construction benefits.

One key growth factor for AAC is its superior thermal insulation capability. By foaming the concrete with hydrogen, AAC blocks trap air pockets that help maintain indoor temperatures—cooler in summer and warmer in winter. This feature directly reduces the load on air-conditioning systems, bringing down energy bills by approximately 25%. The construction industry is increasingly favoring such materials to meet modern energy efficiency regulations and reduce long-term operational costs.

Demand is rising due to the enhanced fire safety features of AAC blocks. These blocks are noncombustible and can resist fire for up to six hours, withstanding temperatures as high as 1,200 degrees Celsius. This makes them highly suitable for buildings in fire-prone areas or those requiring strict safety codes, such as hospitals, schools, and residential towers. Developers are prioritizing these benefits while planning new construction projects.

Key Takeaways

- Global Autoclaved Aerated Concrete Market is expected to be worth around USD 37.2 billion by 2034, up from USD 20.6 billion in 2024, and grow at a CAGR of 6.1% from 2025 to 2034.

- Blocks held a dominant 34.7% share, driven by easy handling and reduced construction time benefits.

- Medium-density AAC captured 53.7% market share due to its balance of strength and insulation.

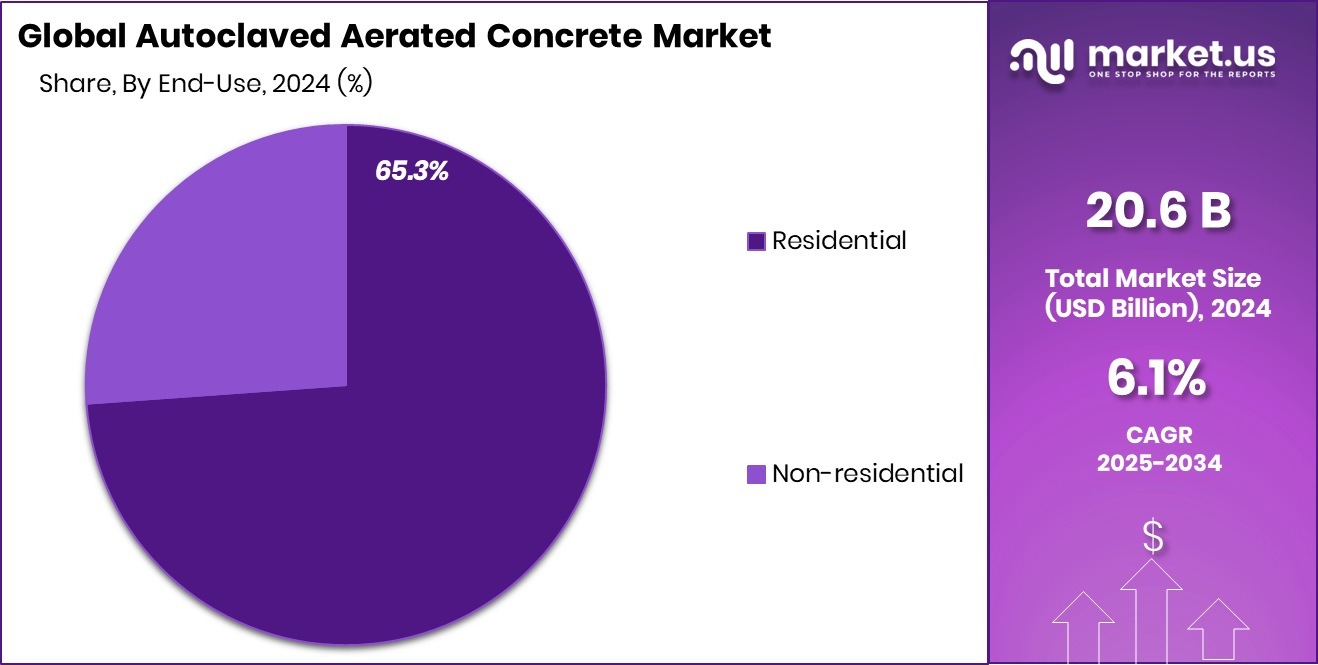

- The residential segment accounted for a 65.3% share due to demand for energy-efficient and lightweight materials.

- In 2024, North America’s AAC market touched USD 9.7 Bn at 47.3%.

By Element Analysis

Blocks dominate the Autoclaved Aerated Concrete market with 34.7% market share.

In 2024, Blocks held a dominant market position in the By Element segment of the Autoclaved Aerated Concrete Market, with a 34.7% share. This dominance highlights the growing preference for AAC blocks in modern construction, particularly in residential and mid-rise buildings. Their lightweight nature, combined with excellent thermal insulation and fire resistance properties, makes them a favorable choice among architects and contractors.

As construction practices continue shifting toward sustainable and energy-efficient materials, AAC blocks stand out due to their reduced environmental impact and improved structural performance. The 34.7% market share also reflects their compatibility with standard construction methods and ease of handling on-site, which contributes to faster project completion times and lower labor costs.

Additionally, AAC blocks significantly enhance the indoor climate by maintaining better temperature control, thus reducing dependency on heating and cooling systems. Their ability to resist fire for up to six hours further elevates their appeal in regions with strict building safety regulations. The consistent demand for Blocks in the AAC segment reinforces their leading role in shaping the evolving landscape of energy-efficient construction materials.

By Density Analysis

Medium density AAC holds a 53.7% share due to the strength-to-weight balance.

In 2024, Medium Density held a dominant market position in the By Density segment of the Autoclaved Aerated Concrete Market, with a 53.7% share. This leadership can be attributed to its balanced structural strength and thermal insulation properties, making it an optimal choice for both residential and commercial applications.

Medium-density AAC blocks offer a reliable compromise between low-density blocks, which provide better insulation but lesser load-bearing capacity, and high-density blocks, which offer strength but reduced energy efficiency.

Due to their superior performance in seismic and high-load zones, medium-density AAC is widely adopted in modern construction. Their weight-to-strength ratio and ease of handling on-site reduce labor costs and construction timelines. Additionally, medium-density AAC blocks are well-suited for internal and external walls, enabling versatility in design and structure. Their fire resistance, acoustic insulation, and eco-friendly profile further contribute to their extensive use.

As demand for sustainable and thermally efficient materials increases across the construction industry, medium-density AAC continues to attract attention for energy-conscious urban development. Its contribution to reducing heating and cooling energy requirements aligns with green building standards and regulations.

By End-Use Analysis

Residential sector leads AAC market with 65.3% share in global applications.

In 2024, Residential held a dominant market position in the By End-Use segment of the Autoclaved Aerated Concrete Market, with a 49.2% share. This dominance is largely driven by the rising adoption of AAC blocks in low-rise and mid-rise housing due to their excellent insulation, fire resistance, and lightweight properties. Homebuilders increasingly prefer AAC for constructing energy-efficient and durable homes that reduce long-term heating and cooling costs.

The lightweight nature of AAC makes it easier to transport and handle on residential construction sites, minimizing labor effort and material wastage. Moreover, its inherent soundproofing and thermal insulation characteristics enhance residential living comfort, contributing to the material’s growing preference. Fire resistance of up to six hours also adds safety advantages for homeowners, making AAC blocks more favorable than traditional clay bricks or concrete blocks in housing projects.

As urban population growth continues and demand for sustainable and affordable housing rises, AAC has become a strategic material of choice in residential construction. The 49.2% share in 2024 reflects this shift in market preference, particularly in regions focusing on eco-friendly and cost-efficient residential development.

Key Market Segments

By Element

- Blocks

- Beams and Lintels

- Cladding Panels

- Roof Panels

- Wall Panels

- Floor Elements

- Others

By Density

- Low Density

- Medium Density

- High Density

By End-Use

- Residential

- Non-residential

Driving Factors

Rising Demand for Green Buildings Using AAC Blocks

One of the main driving factors for the Autoclaved Aerated Concrete (AAC) market is the increasing focus on eco-friendly and sustainable building materials. As more countries adopt green building codes, builders are turning to AAC blocks because they are lightweight, use less energy in production, and provide excellent thermal insulation.

These blocks help reduce heating and cooling costs, which makes them attractive for both residential and commercial projects. Also, since they are made from non-toxic raw materials and generate less construction waste, AAC fits perfectly into the goals of sustainable construction.

Restraining Factors

High Initial Production Costs Limit AAC Adoption

One major factor holding back the growth of the Autoclaved Aerated Concrete (AAC) market is the high initial cost of production. Compared to traditional clay bricks or concrete blocks, AAC requires specialized machinery, steam curing, and skilled labor. Setting up AAC manufacturing units involves a significant investment in autoclaving equipment and high-pressure steam systems.

This makes it difficult for small manufacturers or builders with limited budgets to shift from conventional materials to AAC. Additionally, in regions where the construction industry is still developing, the upfront cost acts as a barrier. Although AAC offers long-term savings through energy efficiency and reduced structural load, the high initial setup cost continues to slow down its wider adoption in cost-sensitive markets.

Growth Opportunity

Urbanization Fuels Demand for AAC in Housing

Rapid urbanization is a key growth driver for the Autoclaved Aerated Concrete (AAC) market. As more people move to cities, there’s a growing need for affordable and sustainable housing. AAC blocks are lightweight, strong, and provide excellent insulation, making them ideal for building homes quickly and efficiently. They help keep houses cooler in hot climates and warmer in cold ones, reducing energy bills.

Additionally, AAC is fire-resistant and soundproof, enhancing safety and comfort. Governments and builders are increasingly adopting AAC to meet housing demands while promoting eco-friendly construction. This trend is especially notable in countries like India and China, where urban populations are expanding rapidly. As cities continue to grow, the demand for AAC in residential construction is expected to rise significantly.

Latest Trends

Smart Construction Techniques Boost AAC Panel Demand

A notable trend in the Autoclaved Aerated Concrete (AAC) market is the growing use of AAC panels in modern construction. These panels are large, lightweight, and easy to install, making them ideal for building walls, roofs, and floors quickly. Their excellent insulation properties help keep buildings energy-efficient, reducing heating and cooling costs. As more builders look for ways to speed up construction and meet green building standards, AAC panels are becoming a preferred choice.

In addition, advancements in AAC technology are enhancing the quality and performance of these panels. For instance, companies are developing AAC products with improved strength and durability, making them suitable for a wider range of applications. This trend is expected to continue as the construction industry seeks innovative solutions to build faster, safer, and more sustainable structures.

Regional Analysis

North America led with a 47.3% share, Autoclaved Aerated Concrete market worth USD 9.7 Bn.

In 2024, North America held a dominant position in the Autoclaved Aerated Concrete (AAC) market, accounting for 47.3% of the global share, valued at USD 9.7 billion. This leadership is driven by the region’s emphasis on sustainable construction practices and energy-efficient building materials. The adoption of AAC in residential and commercial projects is bolstered by its superior insulation properties and compliance with green building standards.

Europe follows closely, with a significant market share attributed to stringent environmental regulations and the promotion of sustainable construction materials. The region’s focus on reducing carbon footprints in the construction sector has led to increased utilization of AAC, known for its lightweight and thermal insulation characteristics.

The Asia Pacific region is experiencing rapid growth in the AAC market, fueled by urbanization and industrialization in countries like China, India, and Japan. The demand for affordable housing and infrastructure development in these nations has led to a surge in AAC adoption, given its cost-effectiveness and construction efficiency.

In the Middle East & Africa, the AAC market is expanding due to infrastructural developments and the need for energy-efficient building solutions in extreme climates. Latin America is also witnessing growth, albeit at a slower pace, with increasing awareness of sustainable construction practices and the benefits of AAC in terms of durability and energy savings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, CSR Ltd. continued to play a strategic role in the global Autoclaved Aerated Concrete (AAC) market through its strong presence in Australia and selective international markets. The company focused on expanding its AAC product lines, particularly in residential and low-rise commercial construction, leveraging demand for energy-efficient and sustainable building materials. CSR’s consistent investment in upgrading its manufacturing capabilities has supported high-quality AAC production, contributing to growing market share in environmentally conscious regions.

JK Lakshmi Cement emerged as a key player in India’s AAC landscape by integrating innovative construction solutions with cost-effective production. The company strengthened its position through localized manufacturing units and expanded AAC product reach in urban and semi-urban housing markets. As the Indian government continues its push for affordable housing and green construction, JK Lakshmi’s early investments in AAC plants positioned it as a reliable domestic supplier with consistent market traction.

SOLBET, one of the leading AAC producers in Poland, maintained its stronghold in the European AAC market in 2024. Known for its premium quality products and diversified AAC offerings, SOLBET focused on supplying to energy-efficient building projects and sustainable infrastructure.

The company’s strategic alignment with European Union environmental goals helped it retain customer trust in regions enforcing strict emission and material efficiency standards. SOLBET’s regional dominance reflects its deep understanding of customer needs, timely product delivery, and commitment to quality and innovation.

Top Key Players in the Market

- ACICO

- Aercon Florida LIC

- Aircrete

- Bauroc International AS

- Biltech Building Elements Limited

- Broco

- Buildmate Projects Private Limited.

- Cematix

- CSR Ltd.

- JK Lakshmi Cement

- SOLBET

- UAL Industries Ltd

- UltraTech Cement Ltd.

- Wehrhahn GmbH

- Xella International

Recent Developments

- In December 2024, Brimax upgraded its AAC plant with Aircrete Europe, enabling production of reinforced panels alongside blocks. It became South America’s first AAC factory to offer a full panel range with smooth surfaces using advanced automation and reinforcement systems.

- In February 2024, CSR Limited entered into a definitive agreement with Compagnie de Saint-Gobain SA, a global leader in light and sustainable construction, for the acquisition of all issued shares in CSR at an offer price of AUD 9.00 per share.

Report Scope

Report Features Description Market Value (2024) USD 20.6 Billion Forecast Revenue (2034) USD 37.2 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Element (Blocks, Beams and Lintels, Cladding Panels, Roof Panels, Wall Panels, Floor Elements, Others), By Density (Low Density, Medium Density, High Density), By End-Use (Residential, Non-residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ACICO, Aercon Florida LIC, Aircrete, Bauroc International AS, Biltech Building Elements Limited, Broco, Buildmate Projects Private Limited, Cematix, CSR Ltd., JK Lakshmi Cement, SOLBET, UAL Industries Ltd, UltraTech Cement Ltd., Wehrhahn GmbH, Xella International Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autoclaved Aerated Concrete MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample

Autoclaved Aerated Concrete MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ACICO

- Aercon Florida LIC

- Aircrete

- Bauroc International AS

- Biltech Building Elements Limited

- Broco

- Buildmate Projects Private Limited.

- Cematix

- CSR Ltd.

- JK Lakshmi Cement

- SOLBET

- UAL Industries Ltd

- UltraTech Cement Ltd.

- Wehrhahn GmbH

- Xella International