Global Independent ISP Chip Market Size, Share, Statistics Analysis Report By Type (Standalone ISP Chips, Integrated ISP Chips), By Application (Consumer Electronics, Automotive, Industrial, Security and Surveillance, Others), By Technology (CMOS, CCD, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141105

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- China Independent ISP Chip Market

- Impact Of AI

- Type Analysis

- Application Analysis

- Technology Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

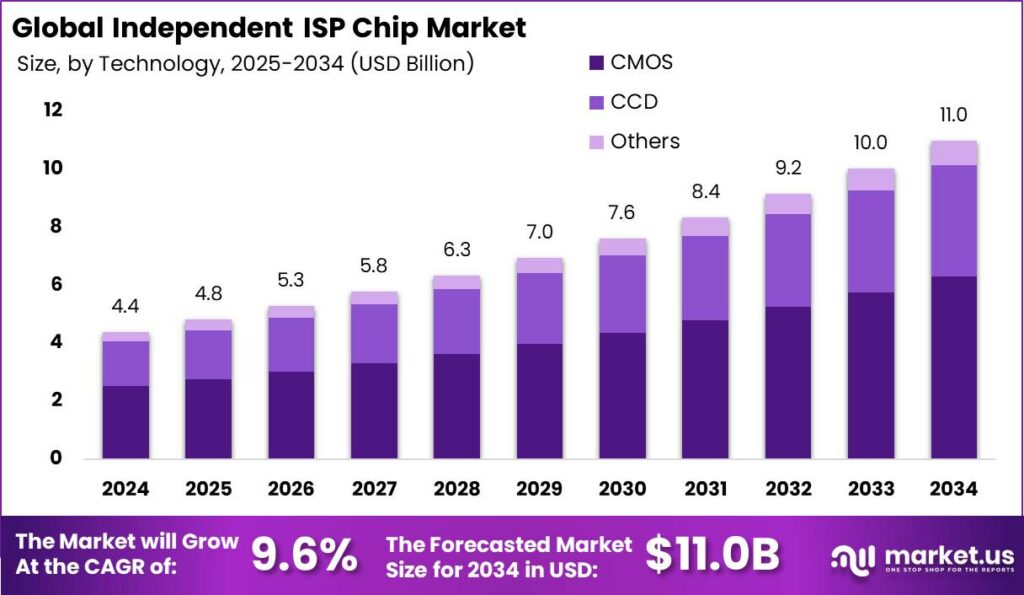

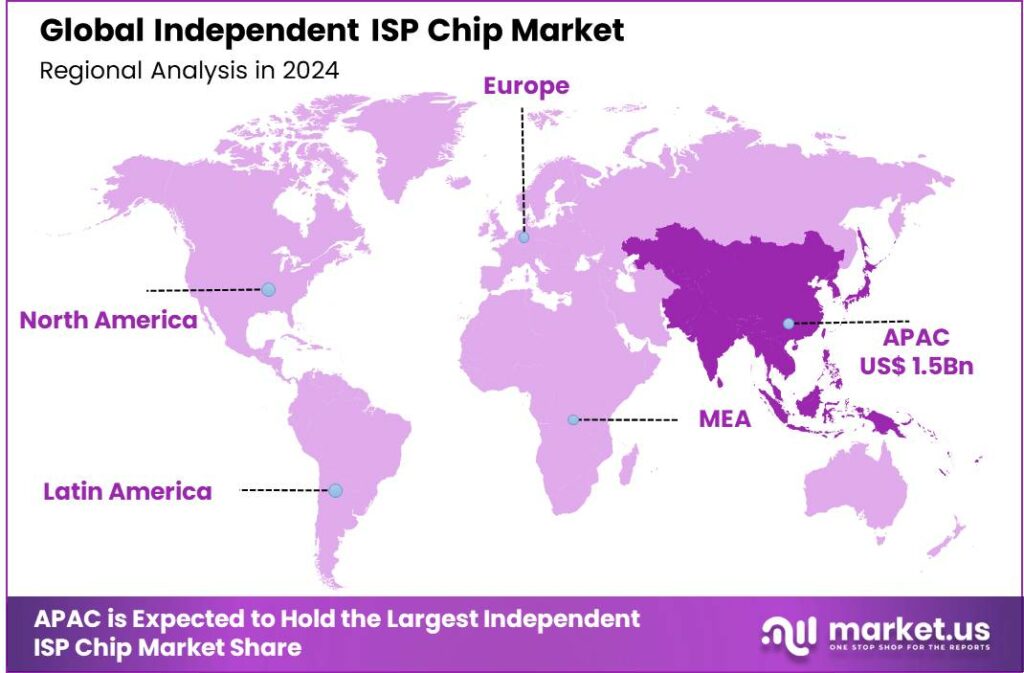

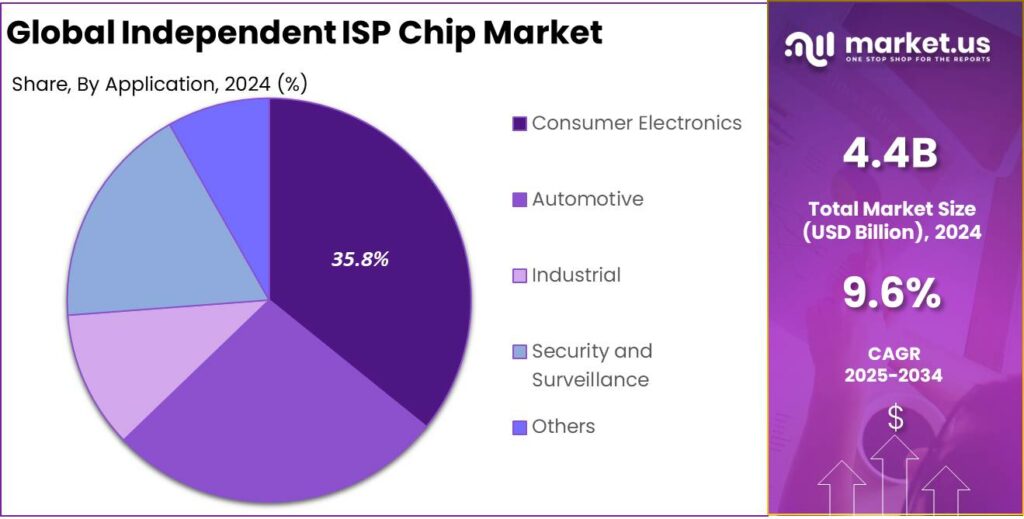

The Global Independent ISP Chip Market size is expected to be worth around USD 11 Billion By 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 9.60% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific dominated the Independent ISP Chip market with over 35.8% market share, equivalent to USD 1.5 billion in revenue.

An Independent ISP Chip (Image Signal Processor) refers to a specialized semiconductor used in image processing within electronic devices such as cameras, smartphones, and automotive systems. These chips handle functions such as image enhancement, noise reduction, and dynamic range adjustment, crucial for improving the quality of images and videos.

The Independent ISP Chip market is growing steadily, driven by the increasing demand for high-quality image processing in consumer electronics, particularly in smartphones, cameras, and security devices. In 2024, the market is projected to reach significant value, driven by factors such as the rising adoption of AI-driven imaging applications and the proliferation of 5G technology, which enhances multimedia capabilities.

As smartphone manufacturers continue to push the boundaries of camera technology, the demand for advanced ISP chips capable of processing higher resolution images and supporting real-time processing is increasing. Additionally, the growth of the automotive and security camera markets – which require high-quality image processing for advanced driver assistance systems (ADAS) and surveillance – further boosts the demand for ISP chips.

Recent technological advancements in Independent ISP chips are largely centered on enhancing AI integration and image processing capabilities. The incorporation of AI and machine learning into ISP chips has enabled real-time processing of images, enhancing capabilities such as object detection, facial recognition, and noise suppression.

These advancements also play a crucial role in the development of 4K and 8K camera systems, driving the demand for more sophisticated ISP chips. Moreover, 5G networks are also influencing the market, allowing faster transmission speeds for video and image data, which increases the need for more powerful image processing solutions in devices

Innovations in independent ISP chips focus on improving speed, efficiency, and scalability. The use of Gallium Nitride (GaN) enhances performance and reduces power consumption, while software-defined networking (SDN) offers more flexible network management. These advancements help build smarter, low-latency networks that adapt to changing demands and maintain optimal performance.

Key Takeaways

- The Global Independent ISP Chip Market size is expected to be worth around USD 11 Billion by 2034, growing from USD 4.4 Billion in 2024, with a CAGR of 9.60% during the forecast period from 2025 to 2034.

- In 2024, the Standalone ISP Chips segment dominated the market, capturing more than 56.4% of the Independent ISP chip market share.

- The Consumer Electronics segment also held a dominant position in 2024, capturing more than 35.8% of the total market share for independent ISP chips.

- The CMOS (Complementary Metal-Oxide-Semiconductor) segment led the Independent ISP Chip market in 2024, capturing more than 57.3% of the total market share.

- In 2024, Asia-Pacific dominated the Independent ISP Chip market, capturing more than 35.8% of the total market share, which was equivalent to USD 1.5 billion in revenue.

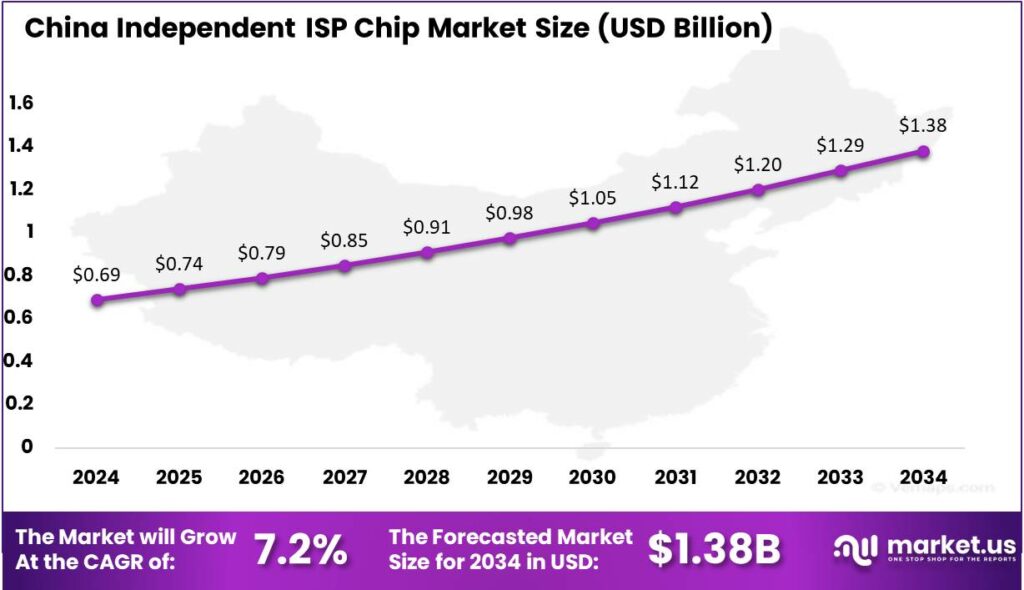

- The China Independent ISP Chip market is projected to be valued at approximately USD 0.69 billion in 2024, and it is expected to witness a CAGR of 7.2%.

Analysts’ Viewpoint

The Independent ISP Chip market presents substantial investment opportunities, especially with the increasing demand from the mobile, automotive, and security sectors. Major semiconductor manufacturers are continuously innovating to improve image quality and reduce processing times.

Startups in the semiconductor and AI sectors are attracting significant venture capital, particularly those developing advanced ISP technologies capable of integrating with AI applications. The rising trend of autonomous vehicles and AI-powered surveillance systems is expected to open additional revenue streams, providing lucrative investment opportunities

Governments worldwide are increasingly recognizing the importance of semiconductors, including ISP chips, for the development of technology-driven economies. In regions like Asia-Pacific and North America, governments are providing financial incentives and grants for companies involved in semiconductor research and development.

This substantial government support is not only aimed at fostering domestic manufacturing capabilities but also at securing national interests in strategic sectors such as automotive and telecommunications, where high-quality image processing is crucial. Additionally, governments are driving public-private partnerships to stimulate innovation in imaging technologies, which will continue to support the growth of the Independent ISP chip market.

China Independent ISP Chip Market

The China Independent Internet Service Provider (ISP) chip market is projected to be valued at approximately USD 0.69 billion in 2024. This market is expected to witness a compound annual growth rate (CAGR) of 7.2%, reflecting the continued expansion of China’s broadband infrastructure and the increasing demand for high-performance networking solutions.

The growth of the independent ISP chip market in China is driven by government efforts to improve digital infrastructure, rising demand for faster internet, and the increasing use of data-driven applications in sectors like e-commerce, healthcare, and education. This creates a favorable environment for innovation and investment, with a shift towards energy-efficient and cost-effective solutions as competition intensifies.

In 2024, Asia-Pacific held a dominant market position in the Independent ISP Chip market, capturing more than 35.8% of the total market share, equivalent to USD 1.5 billion in revenue. Asia-Pacific leads the independent ISP chip market due to rapid digital infrastructure expansion, 5G adoption, and IoT development, driving demand for advanced ISP chips to support high-speed internet and data services.

China drives market growth with significant investments in telecommunications infrastructure and semiconductor manufacturing. Government initiatives, along with the rise of cloud computing, e-commerce, and smart home technologies, fuel demand for advanced ISP chips supporting high data throughput and low latency.

The competitive landscape in Asia-Pacific is also characterized by the presence of numerous regional and global players, which fosters innovation and technological advancements in the ISP chip market. The region’s focus on energy-efficient chip solutions, alongside its large-scale production capabilities, ensures that it remains at the forefront of the market.

Additionally, the growing internet penetration across emerging markets in Southeast Asia, India, and other developing nations contributes to the expansion of the regional market share. As these countries modernize their telecommunication infrastructure, the demand for ISP chips will likely continue to surge, supporting the region’s dominant position in the global market.

Impact Of AI

Artificial Intelligence (AI) is revolutionizing the Independent ISP chip market by enabling enhanced image recognition, predictive capabilities, and real-time adjustments to images and videos. AI algorithms embedded in ISP chips are improving the quality of images captured under various lighting conditions, offering significant enhancements to low-light performance and color accuracy.

These AI-driven improvements are essential in applications such as autonomous driving, where accurate image processing is critical for safety. The increasing use of AI in camera systems, such as face identification in smartphones and security cameras, is further accelerating the demand for AI-powered ISP chips, making them indispensable for future imaging technologies

Type Analysis

In 2024, the Standalone ISP Chips segment held a dominant market position, capturing more than a 56.4% share of the Independent ISP chip market. This dominance can be attributed to the growing demand for high-performance image processing capabilities, particularly in consumer electronics and automotive applications.

Standalone ISP chips are designed to function independently, offering specialized processing for image and video data. This independence allows them to handle more complex processing tasks compared to integrated ISP chips, making them the preferred choice for devices requiring high-quality imaging, such as smartphones, security cameras, and autonomous vehicles.

One of the key factors driving the popularity of Standalone ISP chips is their ability to enhance image quality by offering superior noise reduction, color correction, and real-time image processing. These chips are particularly effective in applications where image quality is a critical factor, such as in high-end smartphones and digital cameras.

The integration of AI in imaging applications drives the strong performance of standalone ISP chips. AI enables features like facial recognition, scene detection, and object tracking, with ISP chips well-suited to handle the computational demands, making them ideal for autonomous driving and advanced security systems.

Application Analysis

In 2024, the Consumer Electronics segment held a dominant market position, capturing more than 35.8% of the total market share for independent ISP chips. This dominance can be attributed to the significant demand for high-speed internet connectivity in consumer devices such as smartphones, smart TVs, laptops, and gaming consoles.

The rise in streaming services, online gaming, and remote work has heightened the need for advanced ISP chips that can deliver reliable, high-performance networks to support these applications. The increasing consumer reliance on connected devices, coupled with the constant innovation in the consumer electronics sector, continues to drive the demand for ISP chips in this space.

The demand within the Consumer Electronics segment is also driven by the continuous evolution of technologies like 5G and Wi-Fi 6. These technologies require ISP chips capable of supporting ultra-fast internet speeds, fueling market growth. As more consumer electronics are designed to be internet-enabled, the need for efficient ISP solutions is expanding.

The Consumer Electronics sector is rapidly evolving, with innovations like smart TVs and wearable devices requiring high-performance internet connectivity. This shift to data-intensive applications drives the need for ISP chips that can handle faster data transfer rates and enhanced security features.

Technology Analysis

In 2024, the CMOS (Complementary Metal-Oxide-Semiconductor) segment held a dominant position in the Independent ISP Chip market, capturing more than 57.3% of the total market share.

This leadership can be attributed to the CMOS technology’s widespread adoption due to its high efficiency, low power consumption, and cost-effectiveness, making it the preferred choice for ISP chips used in various applications. CMOS-based ISP chips offer superior performance for high-speed internet services and are well-suited for integration in broadband networks, fueling their significant demand.

One of the primary factors contributing to CMOS’s market dominance is its scalability and ability to meet the growing data demands of modern communication networks. As data traffic increases, particularly with the rise of 5G technology, CMOS chips are able to deliver reliable performance, providing the high throughput and low latency necessary for efficient data transmission.

In addition to their technological advantages, CMOS chips benefit from significant cost efficiencies. The manufacturing process for CMOS technology is well-established, with economies of scale contributing to lower production costs. This has allowed CMOS-based ISP chips to dominate the market, particularly in cost-sensitive regions where affordability plays a crucial role in the selection of technology.

Key Market Segments

By Type

- Standalone ISP Chips

- Integrated ISP Chips

By Application

- Consumer Electronics

- Automotive

- Industrial

- Security and Surveillance

- Others

By Technology

- CMOS

- CCD

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increased Demand for High-Speed Internet

The demand for high-speed internet continues to rise globally, serving as a major driver for independent ISP chip market growth. As more consumers and businesses require faster, more reliable internet connections, the need for high-performance hardware becomes essential. Streaming services, remote working, online gaming, and the growing adoption of Internet of Things (IoT) devices have all contributed to this rising demand.

The demand for 5G networks is also influencing the chip market, as independent ISPs seek to support faster data transmission. The trend toward fiber-optic internet installations, which require advanced ISP chip technology, is further driving the market. Additionally, as consumer expectations grow for faster speeds, ISP providers are under pressure to offer state-of-the-art connectivity solutions, which enhances the market for ISP chips.

Restraint

High Cost of Chip Development

One of the primary challenges for independent ISPs is the high cost associated with developing and manufacturing ISP chips. Chip production requires significant capital investment in research and development (R&D), as well as in the acquisition of cutting-edge manufacturing technologies. Additionally, designing and producing chips that meet the high standards of performance required by independent ISPs can be a lengthy and costly process.

The production of ISP chips involves specialized processes and advanced materials, which make it an expensive endeavor. For smaller independent ISPs, these high costs can be a significant barrier to entry, as they may lack the financial resources to invest in the necessary technology. Moreover, these costs can be exacerbated by the global semiconductor shortage, which has affected chip prices and availability in recent years.

Opportunity

Growing Market for 5G and IoT Integration

The continuous expansion of 5G networks and the proliferation of IoT devices present a significant opportunity for independent ISPs in the chip market. The demand for 5G connectivity is rapidly growing as industries and consumers alike seek faster, more reliable internet connections. This provides independent ISPs with an opportunity to integrate advanced ISP chips into their networks, allowing them to offer enhanced speed and performance.

Independent ISPs that focus on the development and deployment of 5G and IoT networks are poised to capture a larger share of the market. The integration of ISP chips into 5G infrastructure will allow these companies to offer innovative services that cater to the growing needs of consumers and businesses. As 5G adoption increases, ISP chips will become an essential part of the ecosystem, driving new revenue streams and expanding market reach.

Challenge

Intense Competition from Large Telecom Providers

A significant challenge faced by independent ISPs in the chip market is the intense competition posed by larger telecom providers. Major telecommunications companies have vast resources, allowing them to invest heavily in advanced infrastructure, including the latest ISP chips. These large firms often have the financial and technological advantages needed to stay ahead of smaller competitors, putting independent ISPs at a disadvantage.

Larger telecom providers are capable of offering bundled services, including internet, television, and phone services, which can make it difficult for independent ISPs to differentiate themselves and attract customers. As the market for high-speed internet becomes increasingly saturated, larger telecom providers can leverage their established customer bases and brand recognition to dominate the sector, further marginalizing smaller players.

Emerging Trends

One of the key emerging trends is the rise of fiber-optic broadband. Fiber-optic networks offer higher speeds, lower latency, and increased reliability compared to traditional copper-based infrastructure. As consumers demand faster and more stable internet connections, independent ISPs are increasingly investing in fiber-optic technology to meet this need.

Another trend is the growing focus on customer service and user experience. Independent ISPs are moving away from the generic, impersonal service often associated with large providers. By focusing on more personalized service, such as local customer support and tailored plans, these ISPs are building stronger customer loyalty.

The emergence of fixed wireless internet is also gaining attention. This technology is particularly valuable in rural and underserved areas, where traditional wired infrastructure may be cost-prohibitive. Fixed wireless allows independent ISPs to expand their reach without the significant costs associated with laying cables.

Business Benefits

One major advantage is flexibility. Unlike large corporate ISPs, independent providers can quickly adapt to changing market conditions, offering more competitive pricing and specialized services to niche markets. This flexibility allows them to cater to customer needs that may be overlooked by bigger players, creating opportunities for growth.

Additionally, independent ISPs often have a closer connection to their customers. They can offer more tailored solutions, whether it’s faster support, custom packages, or specific pricing models. This results in stronger customer loyalty, which can translate into lower churn rates and more long-term subscribers. The ability to cultivate these relationships is a significant competitive edge.

The rise of fiber-optic technology also presents business benefits for independent ISPs. By investing in next-generation broadband infrastructure, these providers can deliver superior services and establish themselves as leaders in the market. As demand for faster internet speeds grows, independent ISPs offering cutting-edge solutions will be well-positioned to capitalize on this trend.

Key Player Analysis

The Independent ISP Chip industry has become increasingly competitive, with several major players driving the market forward.

- Intel Corporation is one of the leading players in the ISP chip market. Known for its innovative technologies and advanced processing power, Intel continues to dominate with its cutting-edge chip designs. The company specializes in creating high-performance microprocessors and semiconductors, which are essential for boosting internet speeds and improving device functionality.

- Qualcomm Technologies, Inc. is another significant contributor to the ISP chip market. Renowned for its mobile communication solutions, Qualcomm is known for producing highly efficient and powerful ISP chips, particularly in the realm of mobile devices. The company’s innovations in 5G technology have made them a leading player in the mobile internet space.

- Broadcom Inc. is a major force in the ISP chip market, specializing in the development of a wide range of semiconductors. Known for its work in networking and broadband technologies, Broadcom produces chips that play a vital role in enhancing broadband speeds and data transmission.

Top Key Players in the Market

- Intel Corporation

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- NVIDIA Corporation

- Advanced Micro Devices, Inc. (AMD)

- Texas Instruments Incorporated

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- HiSilicon Technologies Co., Ltd.

- Apple Inc.

- Marvell Technology Group Ltd.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- Xilinx, Inc.

- Micron Technology, Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- Sony Semiconductor Solutions Corporation

- Others

Top Opportunities Awaiting for Players

- 5G Network Expansion: The global 5G rollout offers a major opportunity for Independent ISP chip manufacturers, as demand grows for advanced chips capable of supporting higher speeds, lower latency, and increased network capacity.Independent players who can deliver chips optimized for 5G deployment are likely to see a substantial increase in demand.

- Wi-Fi 6 and 6E Adoption: With the rise in remote work and increased reliance on high-bandwidth applications, there is a growing need for better and more efficient wireless connectivity solutions. Wi-Fi 6 and Wi-Fi 6E offer substantial improvements in speed and efficiency over previous generations. Chip manufacturers that can deliver high-performance, cost-effective solutions for Wi-Fi 6 and Wi-Fi 6E are well-positioned to cater to both consumer and enterprise markets.

- Edge Computing Integration: The increasing shift towards edge computing represents another critical opportunity. As more data is processed at the edge of networks rather than centralized data centers, chips that support edge devices and optimize processing speeds will be in demand. Independent ISP chip manufacturers that integrate edge computing into their products are well-positioned to capitalize on the growing demand for IoT applications and low-latency processing.

- Smart City and IoT Networks: Smart cities and IoT ecosystems rely on high-performance chips to support the vast number of connected devices, sensors, and real-time data processing. The growing demand for infrastructure that enables smart cities (including transportation, utilities, and healthcare) creates a fertile market for ISP chip players focused on efficient, scalable solutions that can support these networks.

- Sustainability and Energy-Efficient Chips: As sustainability becomes a central concern for both consumers and businesses, there is an increasing demand for energy-efficient technologies. Independent ISP chip manufacturers that can produce low-power, high-performance chips that meet environmental standards will be well-positioned to capitalize on this trend. Governments and companies are placing a premium on solutions that reduce energy consumption and minimize environmental impact.

Recent Developments

- In July 2024, Indie Semiconductor, Inc. has introduced the iND880xx Video Processor SoC Family, designed to elevate image signal processing (ISP) performance for ADAS and viewing applications. This new SoC family sets a benchmark in ISP execution and functionality, enhancing both sensing and visual capabilities.

- In December 2024, Texas Instruments is set to receive up to $1.6 billion in CHIPS Act funding to build three new 300mm semiconductor wafer fabs in Texas and Utah, boosting production of analog and embedded processing semiconductors.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 11 Bn CAGR (2025-2034) 9.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Standalone ISP Chips, Integrated ISP Chips), By Application (Consumer Electronics, Automotive, Industrial, Security and Surveillance, Others), By Technology (CMOS, CCD, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intel Corporation, Qualcomm Technologies, Inc., Broadcom Inc., NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Texas Instruments Incorporated, MediaTek Inc., Samsung Electronics Co., Ltd., HiSilicon Technologies Co., Ltd., Apple Inc., Marvell Technology Group Ltd., STMicroelectronics N.V., NXP Semiconductors N.V., Renesas Electronics Corporation, ON Semiconductor Corporation, Xilinx, Inc., Micron Technology, Inc., Analog Devices, Inc., Infineon Technologies AG, Sony Semiconductor Solutions Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Independent ISP Chip MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Independent ISP Chip MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Intel Corporation

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- NVIDIA Corporation

- Advanced Micro Devices, Inc. (AMD)

- Texas Instruments Incorporated

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- HiSilicon Technologies Co., Ltd.

- Apple Inc.

- Marvell Technology Group Ltd.

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- ON Semiconductor Corporation

- Xilinx, Inc.

- Micron Technology, Inc.

- Analog Devices, Inc.

- Infineon Technologies AG

- Sony Semiconductor Solutions Corporation

- Others