Global IgE Allergy Blood Tests Market By Product Type (ELISA Testing Kits, Reagents, Fluorescent Enzyme Immunoassays (FEIA) Testing Kits, Consumables, Chemiluminescent Immunoassays (CLIA), Assays & Kits, and Analyzers), By Application (Aero Allergies, Venoms, Outdoor Allergies, Medicine Allergies, Latex/Metal Allergies, Indoor Allergies, and Food Allergies), By End-user (Diagnostic Laboratories, Specialty Clinics, Research & Academic Centers, and Hospitals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164981

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

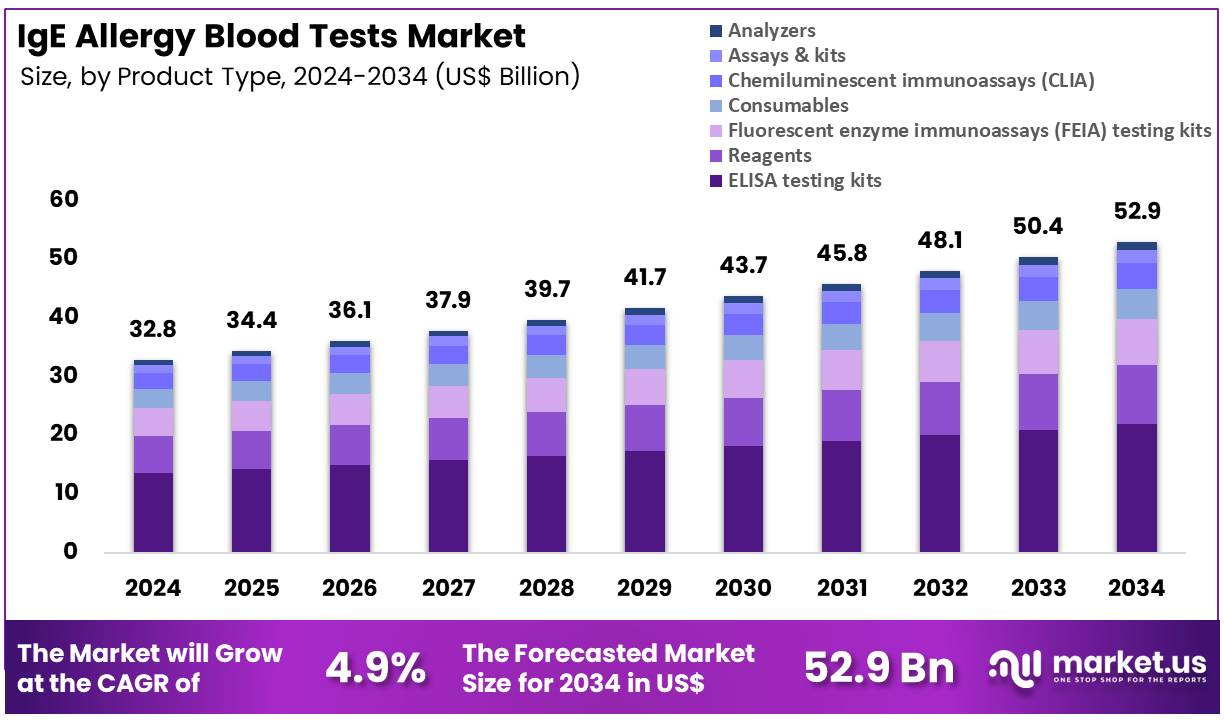

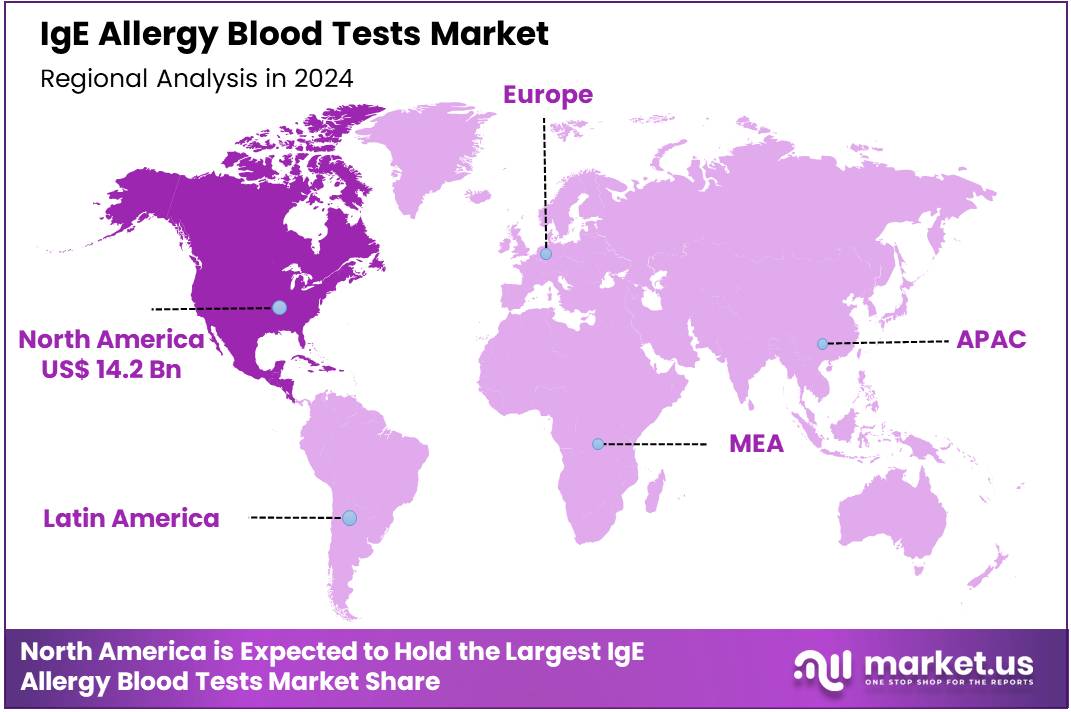

The Global IgE Allergy Blood Tests Market size is expected to be worth around US$ 52.9 Billion by 2034 from US$ 32.8 Billion in 2024, growing at a CAGR of 4.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.3% share with a revenue of US$ 14.2 Billion.

Increasing prevalence of allergic disorders drives the IgE Allergy Blood Tests Market, as clinicians seek quantitative measures for precise patient management. Allergists utilize specific IgE assays to identify triggers in food allergy cases, guiding elimination diets and epinephrine prescription protocols. These tests support asthma care by profiling aeroallergen sensitization, optimizing inhaled corticosteroid and biologic therapy selection.

Pediatricians apply component-resolved diagnostics to distinguish cross-reactivity in peanut allergy, reducing unnecessary avoidance. In April 2025, Thermo Fisher announced a four-year investment plan to expand U.S. manufacturing for diagnostic reagents, including IgE testing platforms. This expansion ensures reliable supply and accelerates delivery of allergy blood testing solutions to clinical laboratories.

Growing demand for multiplex allergen panels creates opportunities in the IgE Allergy Blood Tests Market, as comprehensive screening streamlines diagnostic workflows. Immunologists employ microarray-based IgE tests to evaluate over 100 allergens simultaneously, facilitating rapid identification in polysensitized patients. These assays aid dermatology by confirming contact sensitizers in chronic eczema, informing patch testing strategies.

Automated immunoassay systems enhance throughput for population-based epidemiological studies on allergy trends. In May 2025, Siemens Healthineers committed USD 150 million to boost U.S. production of diagnostic instruments, improving access to IgE allergy testing systems. This investment drives market growth by strengthening local manufacturing and technology deployment in healthcare facilities.

Rising integration of artificial intelligence propels the IgE Allergy Blood Tests Market, as advanced analytics refine result interpretation and predictive modeling. Laboratory professionals leverage AI algorithms to analyze complex IgE profiles, predicting anaphylaxis risk in venom-allergic individuals. These tools support immunotherapy monitoring by tracking specific IgE reduction over treatment courses, adjusting dosing schedules.

Trends toward digital reporting platforms enable seamless data sharing between specialists and primary care providers. In October 2025, Thermo Fisher Scientific partnered with OpenAI to incorporate AI into diagnostic workflows for multiplex IgE results. This collaboration positions the market for sustained advancement through faster, more accurate precision allergy diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 32.8 Billion, with a CAGR of 4.9%, and is expected to reach US$ 52.9 Billion by the year 2034.

- The product type segment is divided into ELISA testing kits, reagents, fluorescent enzyme immunoassays (FEIA) testing kits, consumables, chemiluminescent immunoassays (CLIA), assays & kits, and analyzers, with ELISA testing kits taking the lead in 2023 with a market share of 41.6%.

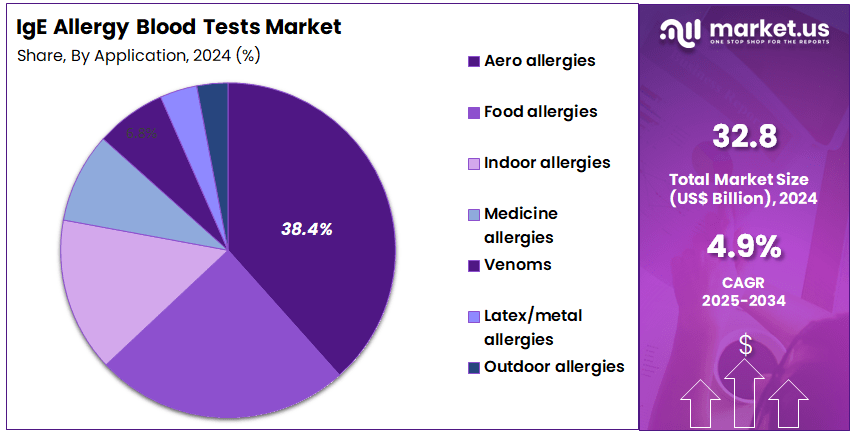

- Considering application, the market is divided into aero allergies, venoms, outdoor allergies, medicine allergies, latex/metal allergies, indoor allergies, and food allergies. Among these, aero allergies held a significant share of 38.4%.

- Furthermore, concerning the end-user segment, the market is segregated into diagnostic laboratories, specialty clinics, research & academic centers, and hospitals. The diagnostic laboratories sector stands out as the dominant player, holding the largest revenue share of 54.2% in the market.

- North America led the market by securing a market share of 43.3% in 2023.

Product Type Analysis

ELISA testing kits hold 41.6% of the IgE Allergy Blood Tests market and are expected to remain dominant due to their reliability, cost-effectiveness, and widespread clinical use in allergy diagnostics. ELISA tests allow quantitative measurement of allergen-specific IgE antibodies with high sensitivity, making them the gold standard for allergy screening.

The increasing global prevalence of allergic diseases such as asthma, rhinitis, and dermatitis is fueling demand for accurate diagnostic methods. Laboratories favor ELISA kits because of their scalability, allowing simultaneous testing for multiple allergens. Continuous improvements in automation and microplate reader technology enhance throughput and precision.

The growing number of FDA and CE-approved ELISA-based assays for allergen panels boosts adoption across diagnostic facilities. The development of simplified, ready-to-use kits with shorter turnaround times supports efficiency in high-volume testing centers.

The expansion of allergy research in emerging economies strengthens the need for ELISA technology in both clinical and research settings. As healthcare providers emphasize early and accurate allergy detection, ELISA testing kits are projected to retain a dominant role in IgE-based diagnostics globally.

Application Analysis

Aero allergies account for 38.4% of the IgE Allergy Blood Tests market and are projected to dominate due to the rising prevalence of airborne allergens such as pollen, dust mites, mold spores, and pet dander. Rapid urbanization, pollution, and changing climatic patterns are contributing to the growing incidence of respiratory allergies worldwide. IgE testing for aeroallergens enables clinicians to diagnose allergic rhinitis, asthma, and conjunctivitis with high accuracy.

Increased awareness of environmental allergens and their health impact drives the demand for advanced diagnostic solutions. Laboratories are increasingly offering multiplex IgE tests that detect sensitivities to several airborne allergens in a single assay. Public health initiatives promoting early allergy diagnosis in school-age and working populations further boost market growth.

The availability of standardized aeroallergen panels for regional allergens enhances test specificity and clinical relevance. Integration of molecular allergology into aeroallergen testing allows identification of component-specific IgE responses, leading to better patient management. As global exposure to airborne irritants intensifies, aero allergy testing is expected to remain the most frequently performed IgE diagnostic category.

End-User Analysis

Diagnostic laboratories represent 54.2% of the IgE Allergy Blood Tests market and are anticipated to maintain their leading position due to the concentration of advanced testing infrastructure and skilled personnel. These laboratories serve as the primary centers for performing large-scale IgE testing, processing millions of allergy samples annually. The shift from skin-prick testing to blood-based IgE analysis is accelerating due to its safety, accuracy, and suitability for patients with skin conditions or ongoing medication use.

High-throughput automated analyzers and robotics in diagnostic labs increase testing efficiency and reduce human error. Strategic partnerships between laboratories and test kit manufacturers facilitate access to high-quality reagents and standardized protocols. Growing demand for personalized allergy profiles and comprehensive IgE panels supports continued laboratory-based testing.

The rise of centralized laboratory networks in both developed and emerging economies strengthens distribution and turnaround efficiency. Additionally, integration of laboratory information systems (LIS) with hospital databases enhances data accuracy and reporting speed. As healthcare systems continue to modernize and focus on preventive diagnostics, diagnostic laboratories are projected to remain the backbone of the IgE allergy testing ecosystem.

Key Market Segments

By Product Type

- ELISA Testing Kits

- Reagents

- Fluorescent enzyme immunoassays (FEIA) Testing Kits

- Consumables

- Chemiluminescent Immunoassays (CLIA)

- Assays & kits

- Analyzers

By Application

- Aero allergies

- Venoms

- Outdoor allergies

- Medicine allergies

- Latex /metal allergies

- Indoor allergies

- Food allergies

By End-user

- Diagnostic laboratories

- Specialty clinics

- Research & academic centers

- Hospitals

Drivers

Increasing Prevalence of Allergic Disorders is Driving the Market

The upward trajectory in allergic disorder incidence has substantially propelled the IgE allergy blood tests market, as these serological assays are essential for pinpointing specific allergen sensitivities through immunoglobulin E quantification.

IgE blood tests, utilizing methods like enzyme-linked immunosorbent assays, detect antibodies against inhalants, foods, and venoms, enabling precise allergy confirmation and personalized management plans. This driver is pronounced in urbanizing regions, where environmental pollutants and dietary shifts exacerbate sensitization rates, prompting routine screening in symptomatic individuals.

Clinical protocols increasingly favor these over skin prick tests for patients with dermatological contraindications, integrating them into allergy workups for conditions like rhinitis and urticaria. The chronic nature of allergies necessitates serial testing to monitor immunotherapy responses, further embedding assays in long-term care. Public health efforts to combat allergy epidemics underscore their diagnostic value, subsidizing test accessibility in primary settings.

The Centers for Disease Control and Prevention reported that 25.7% of U.S. adults and 18.9% of children suffered from seasonal allergies in 2021 data, with trends sustaining elevated levels through 2024 amid environmental factors. This prevalence underscores the testing imperative, as assays mitigate complications via targeted avoidance strategies. Refinements in multiplex configurations broaden allergen coverage, suiting poly-sensitized profiles.

Economically, their deployment optimizes specialist referrals, reducing healthcare expenditures on misdiagnosed cases. International bodies harmonize reference ranges, ensuring consistent interpretations globally. This disorder surge not only amplifies assay demands but also reinforces blood testing’s integration in allergology protocols. Collectively, it fosters progress in component-resolved diagnostics, aligning evaluations with therapeutic precision.

Restraints

Reimbursement Variability for Allergy Diagnostics is Restraining the Market

Inconsistent reimbursement policies for IgE blood tests across payers and regions continue to hinder market penetration, as fragmented coverage discourages routine ordering by clinicians. These assays, despite their precision, often encounter prior authorization hurdles, with Medicare’s local determinations imposing stringent criteria for medical necessity. This barrier disproportionately burdens outpatient practices, where out-of-pocket demands deter patients from confirmatory evaluations, perpetuating self-management reliance.

Jurisdictional discrepancies in coding, such as differing rates for specific IgE versus total IgE panels, inflate administrative burdens and delay claims processing. Manufacturers face subsidized validation pressures, constraining investments in sensitivity upgrades. The consequence upholds diagnostic delays, escalating indirect costs through unmanaged allergic exacerbations.

The Centers for Medicare & Medicaid Services noted that Medicare Part B spending on clinical diagnostic laboratory tests reached $8.4 billion in 2022, yet allergy-specific assays contended with restrictive adjustments amid volume increases. These fiscal mechanisms reveal structural impediments, as rate stabilizations curbed broader implementations. Provider preferences veer toward reimbursable alternatives, marginalizing multiplex options.

Initiatives for standardized billing evolve cautiously, limited by outcome validation shortages. These reimbursement voids not only impede scalability but also sustain gaps in diagnostic accessibility. Thus, they necessitate policy advocacy to fuse financial viability with clinical imperatives.

Opportunities

Advancements in Multiplex IgE Testing Platforms is Creating Growth Opportunities

The maturation of multiplex platforms for IgE detection has generated substantial expansion avenues, permitting simultaneous profiling of multiple allergens to streamline allergy characterization. These arrays, employing microarray technologies, interrogate over 100 components in a single draw, surpassing single-analyte limitations in poly-sensitized patients. Opportunities proliferate in tele-allergy integrations, where platforms support remote validations for underserved areas.

Biopharma collaborations fund component-resolved diagnostics, addressing cross-reactivity gaps in food and inhalant sensitivities. This multiplexing resolves diagnostic fragmentation, establishing platforms as enablers of tailored desensitization. Appropriations for lab modernizations hasten procurements, branching into pediatric-specific arrays.

Thermo Fisher Scientific launched ImmunoCAP ISAC 112i in 2023, a multiplex platform enabling analysis of 112 allergen components for enhanced allergy profiling. This launch exemplifies adaptable frameworks, with adoptions projecting amplified reagent needs in specialist workflows.

Formulations with digital readouts boost interoperability, alleviating interpretation burdens. As AI analytics mature, multiplex data unlock pattern-based revenues. These platform evolutions not only widen application scopes but also interweave the market into precision allergology constructs.

Impact of Macroeconomic / Geopolitical Factors

Improving consumer health literacy and expanding access to wellness programs motivate allergy patients to opt for IgE blood tests that pinpoint triggers like pollen or nuts, equipping doctors to devise customized treatment plans that prevent severe episodes. Elevated interest rates from central bank policies, however, compress funding for diagnostic labs, leading firms to postpone rollouts of automated analyzers and prioritize core operations over R&D enhancements.

Geopolitical rifts, including renewed US-EU trade frictions over agricultural exports, complicate procurement of enzyme conjugates from continental suppliers, resulting in elevated freight premiums and intermittent stockouts that hinder seasonal demand fulfillment. Current US tariffs, which apply a 10% baseline rate on imported diagnostic reagents and equipment from over 180 countries as of April 2025, hike expenses for chemiluminescent kits sourced abroad, pressuring regional distributors to pass costs to end-users and risking slower uptake among budget-conscious providers.

Even so, these policy shifts encourage strategic alliances with American biotech startups, fostering development of integrated digital platforms for at-home IgE sampling that bypass traditional lab dependencies. Enhanced regulatory incentives for non-invasive testing further streamline approvals, broadening service reach to teleconsultations and corporate health screens.

Latest Trends

FDA Clearance of AliveDx’s MosaiQ Allergy Test is a Recent Trend

The endorsement of microarray-based IgE profiling has indicated a pivotal refinement in allergy blood testing during 2024, emphasizing simultaneous detection of multiple allergen components for comprehensive sensitization mapping. AliveDx’s MosaiQ, utilizing multiplex immunoassay, assesses specific IgE against protein allergens in serum, supporting component-resolved diagnostics. This clearance embodies a progression toward integrated systems, accommodating aeroallergens and food triggers in unified workflows.

Authority validations affirm its specificity, accelerating guideline incorporations amid polyallergy complexities. This multiplexing harmonizes with ambulatory needs, associating outputs to electronic records for streamlined consultations. The platform confronts single-test inefficiencies, favoring configurations resilient to matrix interferences.

AliveDx received the IVDR CE mark for its microarray immunoassay in July 2024, marking entry into allergy diagnostics with the MosaiQ platform for specific IgE antibody detection. These approvals underscore scalability, as validations correspond with reference assays.

Forecasters anticipate protocol embeddings, magnifying its eminence in initial screenings. Progressive appraisals reveal discordance declines, refining resource efficiencies. The prospect envisions AI-augmented scoring, envisioning predictive sensitization reviews. This microarray evolution not only heightens profiling acuity but also coordinates with diagnostic health imperatives.

Regional Analysis

North America is leading the IgE Allergy Blood Tests Market

In 2024, North America secured a 43.3% share of the global IgE allergy blood tests market, fueled by the American Academy of Allergy, Asthma & Immunology’s endorsement of component-resolved diagnostics that leverage specific IgE assays to identify molecular allergens like Ara h 2 for peanut sensitivity, enabling precise immunotherapy protocols for children with polysensitization, where traditional skin tests pose risks.

Laboratories ramped up deployment of ImmunoCAP systems for quantitative IgE measurement, attaining specificities over 95% for aeroallergens such as birch pollen, which supported tailored avoidance strategies in patients with seasonal rhinitis, amid a documented uptick in urban pollen exposures. The National Institutes of Health’s research on allergic sensitization trends facilitated grant-funded validations of multiplex bead arrays, correlating with federal efforts to bridge diagnostic gaps in underserved Latino and Asian American communities, where food allergy prevalence reaches 8%.

Regulatory clearances under the FDA’s IVD framework in 2022 for wheat and sesame IgE components continued to drive sustained adoption into 2024, enhancing accuracy for celiac-linked hypersensitivities. Demographic patterns, including a 40-50% polysensitization rate in school-aged children, intensified need for blood-based panels in pediatric clinics. These advancements highlighted the region’s commitment to molecular-level allergy serodiagnostics. The Centers for Disease Control and Prevention reported that approximately 2.8 million Americans have egg allergy and 2.5 million have wheat allergy, based on 2022 Food Allergy Research and Education statistics.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as governmental health drives prioritize specific IgE assays to tackle aeroallergen surges in industrializing cities. Officials in Japan and China invest in ImmunoCAP panels, outfitting urban clinics to detect house dust mite sensitization in asthmatic youth from high-pollution areas. Diagnostic companies collaborate with local universities to calibrate multiplex ELISA kits, estimating superior profiling of shellfish allergies common in coastal Southeast Asian groups.

Regulatory agencies in South Korea and India subsidize bead-based platforms, enabling rural facilities to quantify birch and weed IgE without skin prick limitations. National efforts anticipate fusing serological data with digital apps, accelerating venom immunotherapy for agricultural workers.

Area immunologists innovate fluorescence immunoassays, coordinating with WHO centers to trace latex reactions in medical staff. These measures build a dynamic network for allergen-specific immunity evaluation. The World Health Organization noted wheat and buckwheat as common food allergens in Japanese and Korean children in 2022, following egg and milk, with shellfish allergies prevalent in Southeast Asian countries like Singapore, Vietnam, and the Philippines.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the allergy serology diagnostics sector drive expansion by engineering multiplex panels that quantify specific IgE antibodies to over 500 allergens, enabling precise identification of triggers in food and environmental sensitivities. They pursue acquisitions of regional diagnostic specialists to consolidate supply chains and accelerate market entry in underserved areas, bolstering global distribution networks.

Organizations allocate substantial resources to AI-integrated analyzers that automate result interpretation, enhancing lab throughput and clinician decision-making for personalized management plans. Executives cultivate collaborations with telemedicine providers to incorporate remote testing kits into virtual consultations, expanding access for patients with mobility constraints.

They target high-incidence regions across Asia-Pacific and South America, aligning offerings with national health campaigns to secure reimbursement approvals and volume growth. Moreover, they deploy subscription-based data platforms for longitudinal tracking, reinforcing provider loyalty and establishing diversified income channels.

Thermo Fisher Scientific Inc., a Waltham, Massachusetts-based multinational founded in 2006 through a merger of Thermo Electron and Fisher Scientific, leads in life sciences and diagnostics, delivering innovative tools for healthcare and research worldwide. The company, through its Phadia subsidiary acquired in 2011 and headquartered in Uppsala, Sweden, pioneers ImmunoCAP systems for quantitative IgE assays that support accurate allergy diagnosis and monitoring in over 100 countries.

Thermo Fisher commits extensive R&D to advancing EliA autoimmune tests alongside allergy solutions, emphasizing automation and digital connectivity for efficient workflows. CEO Marc N. Casper directs a diversified enterprise spanning 50 countries, prioritizing sustainability and regulatory excellence. The firm partners with clinical networks to refine guidelines, fostering equitable access to advanced serology. Thermo Fisher solidifies its dominance by integrating analytical precision with scalable ecosystems to address rising allergic burdens.

Top Key Players

- Thermo Fisher Scientific

- Siemens Healthineers

- Danaher Corporation

- Roche Diagnostics

- Abbott Laboratories

- bioMérieux

- Omega Diagnostics

- HYCOR Biomedical

- Euroimmun Medizinische Labordiagnostika

- Minaris Medical

Recent Developments

- In October 2025, bioMérieux acquired a stake in Allergen Alert, a startup specializing in rapid food allergen detection. This acquisition extends bioMérieux’s reach from clinical allergy diagnostics into consumer-facing testing solutions, creating cross-market growth opportunities. By linking real-time allergen monitoring with laboratory-based IgE testing, bioMérieux enhances the continuum of allergy management and testing.

- In January 2025, Thermo Fisher Scientific launched its 2025 Phadia Product Catalogue, showcasing expanded ImmunoCAP and EliA allergen portfolios with over 500 whole allergens and mixes. The introduction of high-throughput, fully automated Phadia Laboratory Systems underscores the company’s role in driving laboratory efficiency and diagnostic standardization. These advancements consolidate IgE blood testing as a key tool in precision allergy diagnostics worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 32.8 Billion Forecast Revenue (2034) US$ 52.9 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (ELISA Testing Kits, Reagents, Fluorescent Enzyme Immunoassays (FEIA) Testing Kits, Consumables, Chemiluminescent Immunoassays (CLIA), Assays & Kits, and Analyzers), By Application (Aero Allergies, Venoms, Outdoor Allergies, Medicine Allergies, Latex/Metal Allergies, Indoor Allergies, and Food Allergies), By End-user (Diagnostic Laboratories, Specialty Clinics, Research & Academic Centers, and Hospitals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Siemens Healthineers, Danaher Corporation, Roche Diagnostics, Abbott Laboratories, bioMérieux, Omega Diagnostics, HYCOR Biomedical, Euroimmun Medizinische Labordiagnostika, Minaris Medical. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IgE Allergy Blood Tests MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

IgE Allergy Blood Tests MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Siemens Healthineers

- Danaher Corporation

- Roche Diagnostics

- Abbott Laboratories

- bioMérieux

- Omega Diagnostics

- HYCOR Biomedical

- Euroimmun Medizinische Labordiagnostika

- Minaris Medical