Global Iced Coffee Market Size, Share Analysis Report By Type (Unflavored Iced Coffee, Flavored Iced Coffee, Vanilla, Caramel, Butterscotch, Chocolate, Honey, Others), By Packaging Type (Cans, Bottles, Tetra Packs, Others), By Distribution Channel ( Supermarkets/Hypermarkets, Online, Retail Pharmacies, Specialty Health Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144318

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

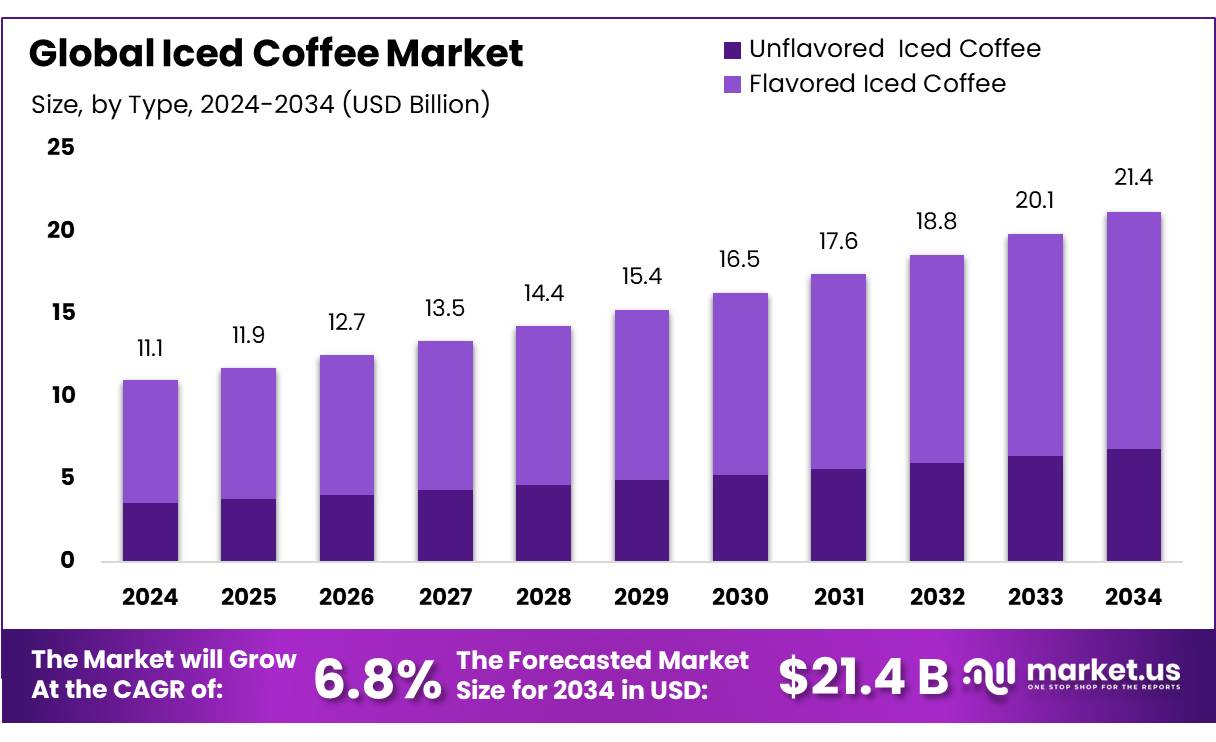

The Global Iced Coffee Market size is expected to be worth around USD 21.4 Bn by 2034, from USD 11.1 Bn in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The global Iced Coffee Market has witnessed a steady transformation from a niche offering to a mainstream beverage category driven by shifting consumer preferences, urban lifestyles, and the rapid growth of on-the-go beverage culture. Iced coffee, typically served chilled and available in ready-to-drink (RTD) formats or freshly brewed variations, caters to a growing demand for cold caffeinated alternatives among younger consumers, especially in developed and emerging economies alike.

According to the International Coffee Organization (ICO), global coffee consumption reached 177 million 60-kg bags in 2023, growing by 1.7% from the previous year. Notably, the rising popularity of cold coffee variants has contributed to this uptick, with the U.S. Department of Agriculture (USDA) reporting that over 40% of coffee consumed in the U.S. by millennials is served cold. In line with this, the National Coffee Association USA noted that 42% of Americans consumed cold coffee at least once weekly in 2023, a marked rise from 30% in 2020.

Several driving factors contribute to the market’s sustained expansion. The increasing focus on health-conscious beverages has led manufacturers to develop low-sugar, dairy-free, and functional iced coffee options using oat milk, almond milk, and added protein. Furthermore, the expansion of café culture, digital ordering platforms, and consumer affinity for Instagrammable beverages have also boosted demand.

Government and institutional support further underpins this growth. The European Commission, under its Farm to Fork strategy, is supporting sustainable coffee production initiatives that indirectly benefit iced coffee producers focusing on organic and ethically sourced coffee beans. In the United States, the USDA Specialty Crop Block Grant Program allocated over $72 million in 2023 to enhance agricultural competitiveness, including coffee-related projects in Hawaii and Puerto Rico, both significant iced coffee raw material sources.

Key Takeaways

- Iced Coffee Market size is expected to be worth around USD 21.4 Bn by 2034, from USD 11.1 Bn in 2024, growing at a CAGR of 6.8%.

- Flavored iced coffee segment emerged as a clear leader within the iced coffee market, accounting for a significant 67.20% share.

- Bottled packaging for iced coffee secured a dominant market position, holding more than a 48.20% share.

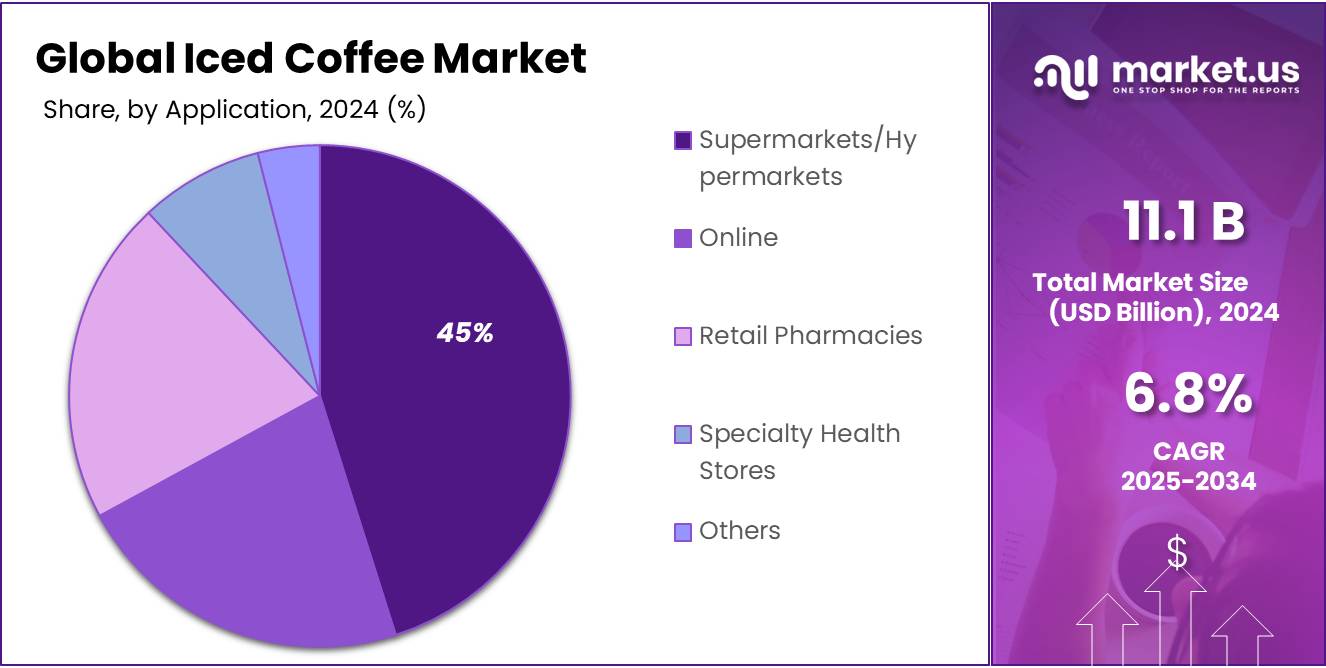

- Supermarkets/hypermarkets continued to dominate the iced coffee market distribution channels, capturing more than a 45.20% share.

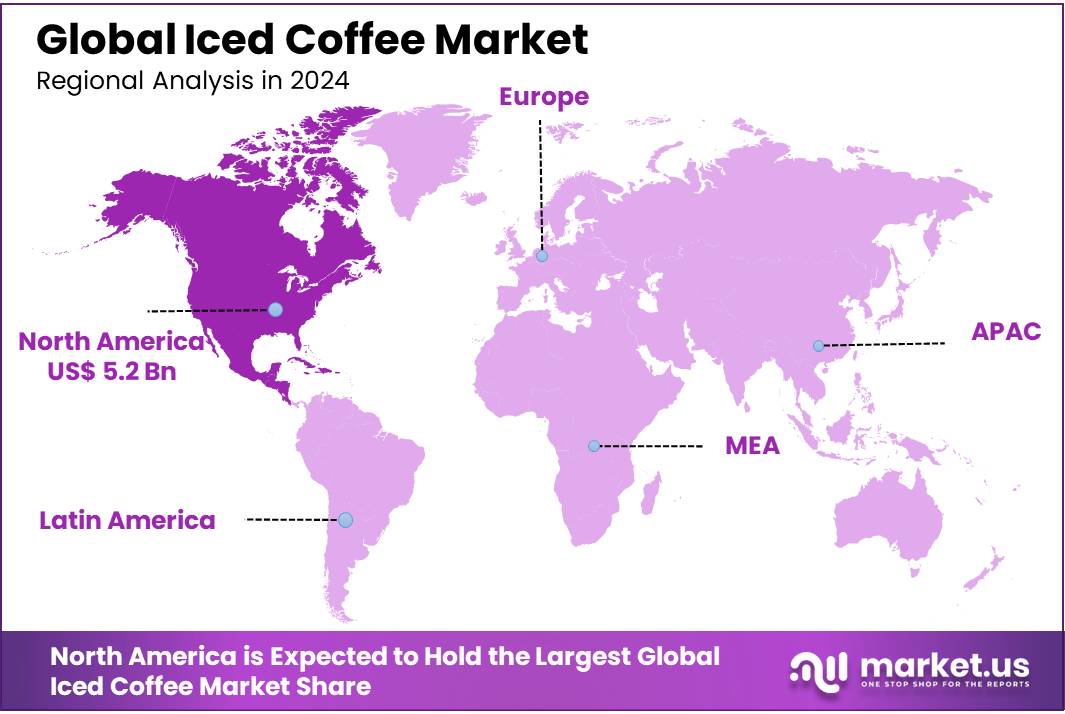

- North America stands out as a dominant region, capturing a substantial 47.10% market share, which equates to approximately USD 5.2 billion.

Analysts’ Viewpoint

From an investment perspective, the iced coffee market has seen significant growth, driven by consumer demand for convenient and refreshing caffeinated beverages. Younger generations, especially Gen Z, are contributing to this surge, showing a preference for cold coffee drinks and digital purchasing channels. This demographic shift suggests a promising avenue for investment in iced coffee products and associated technologies.

However, potential investors should be mindful of certain challenges. The coffee industry is susceptible to price volatility due to factors like climate change impacting coffee production and geopolitical instability in key coffee-producing regions. Additionally, the market is highly competitive, with numerous brands vying for consumer attention, necessitating substantial investment in branding and innovation. Furthermore, regulatory compliance regarding food safety standards and labeling varies across regions, adding complexity to market entry and operations.

Technological advancements have positively influenced the iced coffee market, particularly in processing and packaging, enhancing product shelf life and maintaining flavor integrity. The rise of e-commerce platforms has also expanded distribution channels, allowing brands to reach a broader audience. Consumer insights reveal a growing preference for premium and specialty iced coffee products, with an emphasis on sustainability and ethical sourcing. Brands that align with these values and leverage technological innovations are well-positioned to capitalize on the expanding iced coffee market.

By Type

Flavored Iced Coffee Leads Market with a 67.20% Share in 2024

In 2024, the flavored iced coffee segment emerged as a clear leader within the iced coffee market, accounting for a significant 67.20% share. This dominance is largely attributed to evolving consumer preferences towards diverse and exotic flavors, which have significantly driven the demand. Throughout the year, as more consumers leaned towards personalization and premium taste experiences, companies responded by expanding their flavor offerings, thus further cementing the segment’s substantial market share.

By Packaging Type

Bottled Iced Coffee Captures 48.20% of Market in 2024

In 2024, bottled packaging for iced coffee secured a dominant market position, holding more than a 48.20% share. This segment’s prominence is driven by consumer appreciation for convenience and portability, which bottles offer exceptionally well.

As lifestyles continue to accelerate, the demand for grab-and-go beverages like bottled iced coffee has surged, making it a preferred choice for many coffee lovers. The robust performance of this segment highlights the ongoing shift towards more practical and user-friendly packaging options in the beverage industry.

By Distribution Channel

Supermarkets/Hypermarkets Lead with 45.20% in Iced Coffee Sales in 2024

In 2024, supermarkets/hypermarkets continued to dominate the iced coffee market distribution channels, capturing more than a 45.20% share. This significant market share is primarily due to their widespread availability and the convenience they offer to consumers seeking a variety of iced coffee options under one roof.

As central shopping locations, these venues not only provide accessibility but also play a crucial role in influencing consumer choices through strategic product placements and promotions, further solidifying their position in the market.

Key Market Segments

By Type

- Unflavored Iced Coffee

- Flavored Iced Coffee

- Vanilla

- Caramel

- Butterscotch

- Chocolate

- Honey

- Others

By Packaging Type

- Cans

- Bottles

- Tetra Packs

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online

- Retail Pharmacies

- Specialty Health Stores

- Others

Drivers

Rising Health Consciousness Boosts Demand for Iced Coffee

One major driving factor for the growth of the iced coffee market is the increasing health consciousness among consumers worldwide. As people become more aware of their dietary choices, there’s a noticeable shift towards beverages that offer both health benefits and convenience. Iced coffee, particularly those varieties that are lower in calories and sugar, are becoming popular choices for health-conscious consumers.

For instance, according to data from the World Health Organization (WHO), there has been a consistent increase in health awareness activities globally, leading to a rise in the consumption of beverages that are perceived as healthier. The WHO’s guidelines and initiatives around reducing sugar intake have influenced many consumers to opt for healthier coffee variants, including iced coffee. This trend is supported by a significant number of beverage manufacturers who are now offering iced coffee products with added health benefits such as fortified with vitamins, minerals, and even protein.

Furthermore, the Food and Agriculture Organization (FAO) has highlighted the growth in consumer demand for natural and organic products. This shift is seen in the coffee industry with an increasing number of organic iced coffee products hitting the market, aligning with consumers’ preferences for natural ingredients and transparency in sourcing and production processes.

Moreover, government initiatives promoting healthier lifestyles have also contributed to the surge in iced coffee consumption. For example, national health campaigns in several countries advocating for reduced sugar intake have seen a positive response in the beverage sector, with many opting for iced coffee as a healthier alternative to sugary soft drinks.

Restraints

Fluctuating Coffee Bean Prices Challenge Iced Coffee Market Growth

A significant restraining factor in the iced coffee market is the volatility in coffee bean prices. These fluctuations can profoundly impact the cost of production for iced coffee manufacturers, leading to challenges in maintaining stable prices for consumers. Coffee beans are a primary commodity traded on global markets, and their prices are susceptible to changes due to a variety of factors such as weather conditions, political instability in coffee-producing countries, and changes in global demand.

For example, the International Coffee Organization (ICO) reports that coffee prices have shown considerable volatility over the past years due to unexpected weather patterns affecting major coffee-producing regions. Events like droughts or excessive rainfall directly impact the yield of coffee crops, thereby causing price surges that ripple through to the retail level, affecting the pricing of coffee-based products including iced coffee.

Additionally, government policies and trade tariffs can also play a crucial role in coffee pricing. Changes in trade regulations can alter the dynamics of coffee import and export, further contributing to price instability. For instance, any increase in export tariffs in coffee-producing countries can elevate the cost for manufacturers who then might need to pass these costs onto consumers, potentially lowering demand for higher-priced iced coffee products.

This price volatility not only affects the pricing strategies of iced coffee producers but also poses a challenge in maintaining consumer loyalty, as price-sensitive consumers might seek more stable and affordable alternatives. Thus, the instability of coffee bean prices remains a persistent challenge for the growth of the iced coffee market, requiring companies to strategize effectively to mitigate impacts on production costs and retail prices.

Opportunity

Expansion into Emerging Markets Offers Growth Opportunities for Iced Coffee

A major growth opportunity for the iced coffee market lies in its expansion into emerging markets. As global coffee culture continues to evolve, regions previously dominated by traditional tea consumption are experiencing a surge in coffee popularity, including iced varieties. This shift presents a significant opportunity for iced coffee manufacturers to tap into new consumer bases.

According to a report from the Food and Agriculture Organization (FAO), the demand for coffee is expanding rapidly in Asia, Africa, and Latin America, driven by increasing urbanization and the influence of Western culture. For instance, countries like China and India, traditionally tea-drinking nations, have shown remarkable increases in coffee consumption. Young consumers in these regions, particularly in urban areas, are embracing Western dining trends, which include a preference for iced coffee beverages.

Moreover, government initiatives aimed at boosting local coffee production in these emerging markets also support the growth of the coffee sector. For example, several African governments have implemented programs to enhance agricultural practices and increase the quality and quantity of coffee production, aiming to capitalize on the global coffee market.

Entering these emerging markets requires strategic planning, including local partnerships and adaptations to local tastes and preferences. However, the potential for growth is substantial due to the size of these untapped markets and their growing middle classes with disposable income to spend on premium beverages like iced coffee.

Trends

Sustainability and Ethical Sourcing: A Rising Trend in the Iced Coffee Market

One of the latest trends in the iced coffee market is the growing emphasis on sustainability and ethical sourcing of coffee beans. This trend is driven by increasing consumer awareness and concern for environmental and social issues associated with coffee production. Consumers are becoming more informed about the impact of their purchasing decisions and are seeking products that align with their values of environmental protection and fair labor practices.

A significant number of coffee consumers are now demanding transparency in the coffee supply chain. According to a survey by the Global Coffee Platform, a substantial percentage of coffee drinkers prefer brands that demonstrate a commitment to sustainable practices. This includes using coffee beans that are certified by organizations like Fairtrade and Rainforest Alliance, which ensure that coffee is grown in a way that is better for the environment and coffee farmers.

This trend is also reflected in the policies of several large coffee retailers and manufacturers who are committing to sustainability goals. For example, major coffee chains have announced plans to increase their purchase of sustainably sourced coffee in the coming years, responding to consumer demand and potential regulatory pressures regarding environmental sustainability.

The focus on ethical sourcing and sustainability not only helps protect the environment and improve the lives of farmers but also serves as a strong marketing point for iced coffee brands. By promoting their sustainability credentials, companies can enhance their brand image and build deeper trust and loyalty among consumers, particularly among the younger demographic who are highly conscious of ecological and social issues.

Regional Analysis

In the iced coffee market, North America stands out as a dominant region, capturing a substantial 47.10% market share, which equates to approximately USD 5.2 billion in sales. This significant percentage underscores the region’s robust consumer demand and deep-rooted coffee culture, particularly in the United States and Canada, where iced coffee has become a year-round staple rather than just a seasonal beverage.

The popularity of iced coffee in North America is fueled by a combination of factors including high disposable incomes, the prevalence of coffee shop chains offering a wide variety of iced coffee beverages, and the growing trend of at-home coffee consumption. Innovations in coffee brewing techniques and flavor infusions continue to attract a broad spectrum of consumers, from millennials seeking artisanal and customizable options to older generations appreciating the convenience of ready-to-drink formats.

Furthermore, the market is supported by extensive distribution channels ranging from supermarkets and convenience stores to extensive networks of cafes and quick-service restaurants, ensuring easy accessibility for consumers across urban and suburban areas. This accessibility is crucial in maintaining the high volume of consumer traffic and repeated sales necessary for sustaining the market’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Starbucks Corporation continues to be a powerhouse in the iced coffee market, leveraging its extensive global network of coffee shops to innovate and popularize new iced coffee offerings. Their strategic emphasis on seasonal flavors and customizable drink options appeals to a diverse customer base. With a commitment to sustainability, Starbucks also focuses on ethically sourced coffee beans and eco-friendly practices, enhancing their brand loyalty among environmentally conscious consumers.

Nestlé has effectively capitalized on the ready-to-drink (RTD) iced coffee segment, offering a variety of flavors through its popular Nescafé brand. The company’s strong distribution channels enable widespread availability of its products in supermarkets and convenience stores globally. Nestlé’s continuous innovation in product development and marketing strategies strengthens its position in the iced coffee market, appealing to consumers seeking convenience and quality.

UCC Ueshima Coffee Co., Ltd., a pioneer in the Japanese coffee industry, offers a broad range of iced coffee products that emphasize quality and taste. Known for their innovation in coffee brewing and packaging technologies, UCC continues to influence the broader Asian market and beyond. Their commitment to quality and a deep understanding of consumer preferences in iced coffee have helped maintain their competitive edge in a crowded market.

The Coca-Cola Company has expanded its footprint in the iced coffee market through strategic partnerships and acquisitions, notably with its Costa Coffee brand. The integration of iced coffee products into its existing beverage lines allows Coca-Cola to leverage its vast distribution network, reaching a wide array of retail and on-the-go consumption points. Their focus on diverse flavor profiles caters to a global palate, reinforcing their market presence.

Top Key Players

- Starbucks Corporation

- Nestlé

- The Coca-Cola Company

- UCC Ueshima Coffee Co. Ltd.

- Stumptown Coffee Roasters

- L’OR Coffee

- Coffeebean

- Jimmy’s Iced Coffee

- Arctic Iced Coffee

- Javvy Coffee Company

- Javo Beverage

Recent Developments

Starbucks’ resilience in the iced coffee market is also supported by its extensive loyalty program, which boasted 33.8 million active members in the U.S., indicating a steady consumer base.

Nestlé’s broader strategy to enhance market presence and adapt to consumer demands in the competitive iced coffee landscape. Despite facing global sales challenges, with a slight decrease in group revenues to CHF 91.3 billion, Nestlé’s focus on its coffee business has helped maintain its position as a leader in the sector.

In 2024, The Coca-Cola Company continued to adapt and innovate in the iced coffee sector, part of its broader beverage portfolio. The company experienced a 1% growth in unit case volumes, signaling a steady but modest increase in consumer demand.

Report Scope

Report Features Description Market Value (2024) USD 11.1 Bn Forecast Revenue (2034) USD 21.4 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Unflavored Iced Coffee, Flavored Iced Coffee, Vanilla, Caramel, Butterscotch, Chocolate, Honey, Others), By Packaging Type (Cans, Bottles, Tetra Packs, Others), By Distribution Channel ( Supermarkets/Hypermarkets, Online, Retail Pharmacies, Specialty Health Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Starbucks Corporation, Nestlé, The Coca-Cola Company, UCC Ueshima Coffee Co. Ltd., Stumptown Coffee Roasters, L’OR Coffee, Coffeebean, Jimmy’s Iced Coffee, Arctic Iced Coffee, Javvy Coffee Company, Javo Beverage Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Starbucks Corporation

- Nestlé

- The Coca-Cola Company

- UCC Ueshima Coffee Co. Ltd.

- Stumptown Coffee Roasters

- L'OR Coffee

- Coffeebean

- Jimmy's Iced Coffee

- Arctic Iced Coffee

- Javvy Coffee Company

- Javo Beverage