Global Human Capital Management Market Size, Share, Statistics Analysis Report By Component (Software, Service), By Deployment (Cloud-based, On-premises), By Industry Vertical (BFSI, Retail, IT & Telecom, Healthcare, Hospitality, Government, Manufacturing, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136395

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

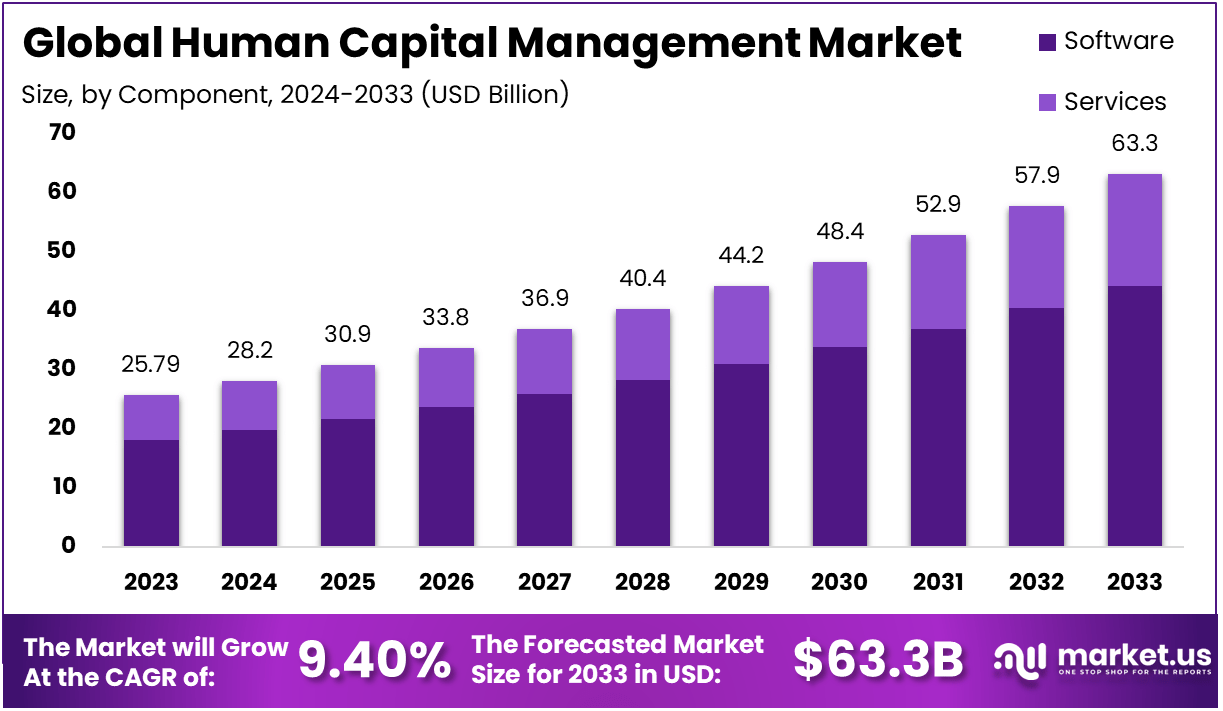

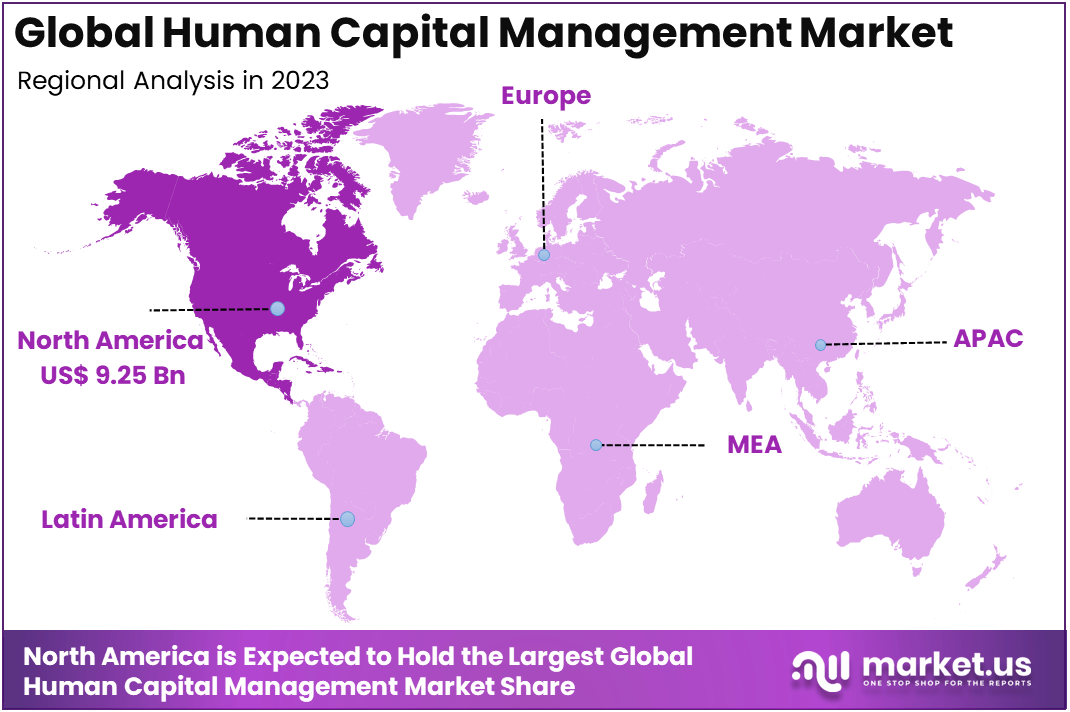

The Global Human Capital Management Market size is expected to be worth around USD 63.3 Billion By 2033, from USD 25.79 Billion in 2023, growing at a CAGR of 9.40% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 35.9% share, holding USD 9.25 Billion in revenue.

Human Capital Management (HCM) refers to the practices, processes, and technologies that organizations use to manage their workforce throughout the employee lifecycle. It encompasses everything from recruiting, training, and development to performance management, compensation, and retirement planning.

HCM is a strategic approach that aligns an organization’s human resources with its goals, optimizing workforce productivity, engagement, and retention. The core aim of HCM is to maximize the value of human capital as a critical asset in driving business success.

This is achieved through a combination of talent management, technology, and data analytics to streamline human resource functions and enhance overall employee performance and satisfaction. The Human Capital Management market has seen tremendous growth over the years, driven by the increasing importance of workforce optimization and employee engagement.

Companies are now realizing the value of efficient HCM solutions to support their talent management, improve employee experience, and ensure regulatory compliance. The market has evolved from traditional HR management practices to more sophisticated, technology-driven solutions, integrating artificial intelligence, machine learning, and cloud-based platforms.

These innovations have made it easier for organizations to manage their global workforce, automate repetitive tasks, and provide real-time insights for decision-making. The HCM market includes various solutions such as talent acquisition, learning management systems, performance management, and workforce analytics, which have gained significant traction across industries.

The primary driving factors for the HCM market include the increasing need for organizations to manage their workforce more effectively and the growing adoption of digital solutions. As businesses expand globally, managing diverse talent becomes increasingly complex. HCM solutions streamline this process, offering tools that help companies recruit, train, and retain top talent while improving operational efficiency.

Additionally, there is a rising demand for data-driven insights to make informed decisions related to employee performance and compensation, which has led to a surge in demand for advanced analytics and cloud-based HCM platforms. Furthermore, the growing trend of remote work, brought about by the COVID-19 pandemic, has prompted businesses to adopt more flexible and scalable HCM solutions.

The demand for HCM solutions is expected to continue growing as organizations look for ways to optimize their workforce, improve employee engagement, and drive business performance. The market is witnessing increasing adoption of cloud-based platforms, which provide organizations with scalability, flexibility, and real-time insights into workforce data.

There is also a growing need for AI-driven tools that can automate processes, offer personalized training programs, and improve talent acquisition. Companies in sectors such as healthcare, manufacturing, and IT are particularly keen on implementing advanced HCM solutions to manage their workforce more effectively and remain competitive in a rapidly evolving business landscape.

Technological advancements have significantly shaped the evolution of HCM. Cloud computing has revolutionized the way organizations manage their human resources by offering scalable, cost-effective, and accessible solutions. Artificial intelligence (AI) and machine learning (ML) are also playing a critical role in enhancing HCM platforms, enabling predictive analytics for talent management, automating administrative tasks, and providing deeper insights into employee performance.

Furthermore, mobile technologies have made HCM systems more accessible, enabling employees and managers to engage with HR systems on the go. These advancements, combined with increased data security and compliance tools, are pushing the growth of the HCM market, making it easier for organizations to manage their human capital more effectively while improving employee satisfaction and productivity.

Human Capital Management (HCM) encompasses a range of practices and tools aimed at effectively managing an organization’s workforce to achieve business goals. Key statistics in HCM highlight its impact on employee management and organizational efficiency.

For instance, 57% of organizations view employee retention as a significant challenge, with 22% of new hires leaving their jobs within the first 45 days. The median annual wage for human resources managers, who play a crucial role in HCM, was reported at $136,350 in May 2023, with job growth projected at 6% from 2023 to 2033.

Additionally, employee engagement is a critical metric; recent data indicates that only 30% of employees report being highly engaged, while 17% are actively disengaged. This disengagement can have substantial economic implications, with estimates suggesting that low employee engagement costs the global economy approximately $8.9 trillion, or about 9% of global GDP.

Furthermore, organizations typically experience a turnover rate of around 15%, which can significantly affect productivity and morale. The HR-to-employee ratio averages about 1:50, meaning there is one HR professional for every fifty employees, reflecting the level of HR support available to the workforce.

Key Takeaways

- Market Growth: The global Human Capital Management (HCM) market is projected to grow significantly from USD 25.79 billion in 2023 to USD 63.3 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 9.40%.

- Dominant Component: In 2023, the Software segment dominated the market, capturing more than 70% of the total market share. The growth in this segment is driven by the increasing demand for digital solutions that optimize HR functions, from talent acquisition to performance management.

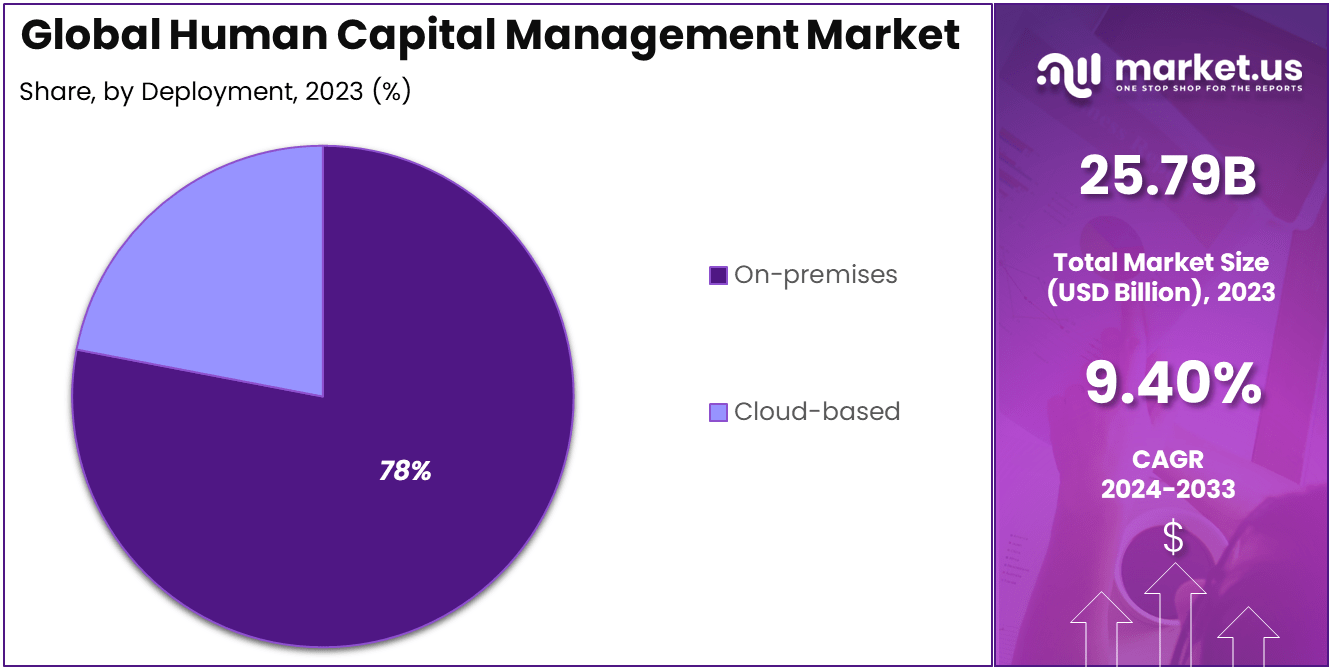

- Deployment Mode: The On-premises deployment segment held a major share, accounting for 78% of the market in 2023. On-premises solutions remain popular due to the control and customization they offer, particularly in large enterprises with strict security and compliance requirements.

- Industry Vertical: IT & Telecom accounted for the largest share of the HCM market in 2023, representing 22.7%. The sector is investing heavily in HCM solutions to manage its dynamic workforce, streamline operations, and enhance productivity.

- Regional Dominance: North America held the largest market share in 2023, with a 35.9% share, translating to USD 9.24 billion in revenue. The strong presence of key players, coupled with a high adoption rate of advanced HR technologies, positions North America as a leader in the HCM market.

By Component

In 2023, the Software segment held a dominant market position, capturing more than a 70% share of the global Human Capital Management (HCM) market. This dominance can be attributed to the increasing demand for comprehensive, automated solutions to manage a wide array of human resources tasks.

As businesses continue to adopt digital transformation strategies, the need for software solutions that streamline functions such as recruitment, performance management, payroll processing, and employee development is critical. HCM software offers scalability, flexibility, and advanced functionalities that allow organizations to optimize workforce operations efficiently.

One of the primary drivers for the growth of the software segment is the growing adoption of cloud-based HCM solutions. These cloud-based platforms provide organizations with greater flexibility, remote accessibility, and cost-effectiveness compared to traditional on-premises systems.

With the increase in remote work and global workforces, organizations are increasingly turning to cloud HCM software to enable real-time collaboration, ensure seamless communication, and maintain secure access to employee data across locations.

Another factor contributing to the dominance of the software segment is the increasing emphasis on data-driven HR decision-making. HCM software enables businesses to gather, analyze, and leverage employee data for strategic decision-making, helping organizations enhance employee engagement, optimize talent acquisition, and improve overall productivity. These data insights are invaluable for businesses looking to foster a more agile and informed workforce.

By Deployment

In 2023, the On-premises segment held a dominant market position, capturing more than 78% of the global Human Capital Management (HCM) market. This dominance can be attributed to the preference of many large organizations for on-premises solutions, especially when it comes to managing sensitive employee data.

On-premises deployment provides organizations with greater control over data security and compliance, which is particularly critical in industries with strict regulatory requirements, such as healthcare, finance, and government.

Additionally, on-premises solutions allow businesses to tailor their HCM systems to their specific needs and workflows. This customization offers greater flexibility in aligning the software with internal processes, particularly in larger organizations with complex structures.

The ability to modify the system without limitations imposed by external cloud providers makes on-premises deployment a more attractive option for enterprises seeking a high level of personalization in their HCM software.

However, despite the advantages of on-premises deployment, the market is also witnessing a shift toward cloud-based solutions, driven by the growing demand for scalable, cost-effective, and accessible solutions. Cloud-based deployment offers numerous benefits, including reduced upfront costs, easy scalability, and the ability to access the system from anywhere, making it a strong contender in the future growth of the market.

The shift toward cloud-based HCM solutions, however, is expected to complement on-premises systems rather than replace them entirely, as organizations continue to seek the right mix of flexibility, security, and cost-efficiency for their unique needs.

By Industry Vertical

In 2023, the IT & Telecom segment held a dominant market position, capturing more than 22.7% of the global Human Capital Management (HCM) market. This dominance can be attributed to the rapidly evolving and competitive nature of the IT and telecom industries, which heavily rely on effective management of their human resources.

These sectors are characterized by high workforce mobility, innovation, and rapid technological advancements, making the need for efficient HCM solutions even more critical. The IT & telecom industries also deal with a large and diverse talent pool, including software developers, engineers, technicians, and customer service representatives.

Managing this large and varied workforce requires robust HCM solutions to streamline recruitment, performance management, training, and retention processes. With the increasing adoption of cloud technology and automation, the IT & telecom sectors are also well-positioned to leverage advanced HCM solutions to stay ahead in the market. These solutions help organizations reduce administrative overheads, improve employee engagement, and enhance productivity.

Furthermore, the fast-paced nature of the IT and telecom industries necessitates that employees are constantly upskilling and adapting to new technologies. HCM systems help organizations provide continuous learning and development opportunities, enabling companies to remain competitive and employees to stay relevant in the job market. This focus on employee development and skill management further drives the adoption of HCM systems within the IT and telecom sectors.

Key Market Segments

By Component

- Software

- Service

By Deployment

- Cloud-based

- On-premises

By Industry Vertical

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Hospitality

- Government

- Manufacturing

- Others

Driving Factors

Increasing Adoption of AI and Automation in Human Capital Management

The increasing adoption of artificial intelligence (AI) and automation in Human Capital Management (HCM) is a key driver of growth in the market. AI technologies, particularly machine learning and predictive analytics, are transforming how companies manage their workforce.

These tools allow businesses to automate repetitive tasks, streamline processes, and make data-driven decisions that were previously time-consuming and error-prone. AI is particularly beneficial in recruitment, where it helps identify the best candidates by analyzing vast amounts of data and patterns that human recruiters might miss.

Automated resume screening, chatbots for candidate interactions, and AI-driven performance assessments are becoming standard features in many HCM systems. This automation reduces the time-to-hire, increases recruitment efficiency, and helps organizations attract top talent quickly. Additionally, AI-powered tools are increasingly used in employee retention strategies by predicting which employees might leave, enabling proactive retention measures.

Another major benefit of AI and automation in HCM is in performance management. Traditional performance reviews are often time-consuming and subjective, but AI tools can analyze real-time data, track employee progress, and provide actionable insights that are more objective.

Automation in payroll processing, benefits administration, and compliance management is also improving efficiency and reducing human error. The growing need for efficiency, scalability, and enhanced decision-making in HCM is propelling the growth of AI-powered solutions in this space, making it a critical driver for the market.

Restraining Factors

Data Privacy and Security Concerns in Human Capital Management Systems

Data privacy and security concerns are significant restraints for the Human Capital Management (HCM) market. As organizations collect and store vast amounts of sensitive employee data—such as personal details, compensation, performance reviews, and health records—there is an increased risk of data breaches, cyberattacks, and unauthorized access. These risks can lead to substantial financial losses, reputational damage, and legal consequences for businesses.

The implementation of advanced technologies such as cloud-based HCM solutions and AI-powered tools further complicates these concerns. While these technologies offer significant benefits, they also create new security vulnerabilities.

The sensitive nature of employee data makes HCM systems an attractive target for cybercriminals. Even with strong encryption, secure networks, and compliance with data protection regulations like GDPR, there is always a risk that data could be compromised.

Many businesses are also struggling to comply with the varying data protection regulations across different regions. Different countries have their standards for handling and storing employee data, and maintaining compliance across multiple jurisdictions can be complex.

The need for stronger security measures and ongoing vigilance presents a major challenge for HCM software providers and businesses alike. To address these concerns, HCM solutions must offer robust data protection features, including multi-factor authentication, advanced encryption, and continuous monitoring to mitigate these risks.

Growth Opportunities

Rise of Cloud-based HCM Solutions

The rise of cloud-based Human Capital Management (HCM) solutions presents a significant opportunity for growth in the HCM market. As more businesses, particularly small and medium-sized enterprises (SMEs), adopt cloud technologies for cost efficiency and scalability, the demand for cloud-based HCM systems is growing rapidly. These solutions allow organizations to manage their workforce without the need for on-premises infrastructure, reducing capital expenditure and operational overheads.

Cloud-based systems offer greater flexibility and accessibility, enabling HR teams and managers to access HCM tools from anywhere and on any device. This is particularly beneficial for remote and global teams, allowing for seamless communication, collaboration, and data sharing. Additionally, the cloud allows for faster updates, ensuring that businesses are always using the latest version of their HCM software with minimal downtime.

Another major opportunity for cloud-based HCM solutions is their ability to integrate with other enterprise systems such as payroll, accounting, and performance management. This integration helps eliminate data silos and improves the accuracy and consistency of employee information across different departments.

As businesses increasingly embrace remote work, the demand for flexible, cloud-based solutions that support collaboration and improve workforce management will continue to drive the growth of the HCM market.

Challenging Factors

Integration of HCM Systems with Existing IT Infrastructure

One of the key challenges in the Human Capital Management (HCM) market is the integration of HCM systems with existing IT infrastructure. Many businesses already have legacy systems in place, and integrating new HCM solutions with these systems can be complex, costly, and time-consuming. These integration challenges often require significant investment in technology and skilled personnel to ensure smooth interoperability.

The lack of standardized systems and data formats across various software platforms further complicates the integration process. Businesses may face difficulties aligning data between HR software, payroll systems, and other enterprise tools, which can lead to discrepancies and delays in critical HR processes.

This challenge is particularly pronounced in large organizations with multiple departments and diverse needs. Furthermore, the complexity of integration can lead to system downtime, which can negatively affect HR operations and disrupt employee productivity. To overcome this challenge, HCM providers need to develop more adaptable and customizable solutions that can easily integrate with existing infrastructure.

Many HCM vendors are addressing this challenge by offering APIs and integration tools that allow their systems to connect with a wide range of third-party platforms. Additionally, businesses should invest in skilled IT teams and comprehensive training for HR staff to ensure that they can effectively use new HCM systems alongside their existing infrastructure.

Growth Factors

The Human Capital Management (HCM) market is experiencing substantial growth due to several key factors. The increasing complexity of managing a global workforce is one of the main drivers. As organizations expand and diversify, they require more sophisticated tools to manage employee data, performance, and payroll.

Additionally, the adoption of cloud-based solutions has facilitated the growth of HCM software, making it accessible for businesses of all sizes. Cloud solutions offer scalability, flexibility, and real-time updates, which are crucial for businesses operating in fast-paced environments. Another key growth factor is the rising importance of employee engagement and experience. Organizations are focusing on improving employee satisfaction, which directly impacts retention and productivity.

HCM solutions are evolving to include tools that foster better communication, learning, and development opportunities, all aimed at improving the employee experience. This trend is supported by the increasing demand for performance management systems that are more data-driven and personalized.

Emerging Trends

A significant emerging trend in the HCM market is the increasing integration of artificial intelligence (AI) and machine learning (ML) in HR processes. AI is being used to automate repetitive tasks such as resume screening and interview scheduling, which allows HR professionals to focus on more strategic tasks. Additionally, AI-driven analytics are helping HR departments make more informed decisions regarding talent acquisition, employee engagement, and retention.

Another trend is the rise of people analytics. HR teams are leveraging data to gain insights into employee performance, career progression, and overall organizational health. By using data-driven insights, businesses can optimize their workforce management strategies, helping them make more accurate decisions and improving employee outcomes.

Business Benefits

Human Capital Management solutions provide businesses with a wide array of benefits. These tools streamline HR processes, from recruitment to retirement, reducing administrative costs and time spent on manual tasks. HCM software improves accuracy and compliance by automating processes like payroll and benefits management, ensuring that organizations adhere to regulatory standards.

Furthermore, HCM solutions help companies enhance employee engagement and retention. By providing managers with real-time access to performance data, they can identify top performers, offer feedback, and create personalized development plans. This leads to better employee satisfaction, which ultimately results in higher productivity and lower turnover rates. As a result, businesses can achieve better financial performance and long-term growth.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 35.9% share, holding USD 9.25 Billion in revenue. North America’s leadership in the Human Capital Management (HCM) market can be attributed to the region’s robust technological infrastructure and the widespread adoption of advanced software solutions by enterprises.

The demand for HCM solutions is particularly strong in the United States, which hosts a large number of multinational companies that require scalable and sophisticated systems to manage their workforce. The region’s early adoption of cloud-based HCM platforms has significantly contributed to market growth.

Additionally, North America’s leadership is driven by the region’s large IT and telecommunications sector, which is one of the highest consumers of HCM solutions. Companies in the region are increasingly seeking solutions that enable them to effectively manage talent, streamline HR processes, and enhance employee engagement, all of which are central components of HCM software.

Moreover, with the growing emphasis on data-driven decision-making, the region has embraced analytics and AI technologies in HR functions, further accelerating the adoption of HCM tools. The region’s growth is also supported by strong government initiatives and favorable policies that encourage the digital transformation of businesses.

Furthermore, North America is home to several leading HCM solution providers, including Workday, ADP, and SAP SuccessFactors, which continue to innovate and offer advanced products, strengthening their market position. These companies not only drive regional growth but also contribute to global market expansion by offering products that cater to the diverse needs of businesses across industries.

In conclusion, North America’s dominance in the Human Capital Management market is driven by a combination of technological advancement, a large base of multinational corporations, and strong market players. With continued investment in digital HR solutions and a focus on improving employee productivity and experience, North America is expected to maintain its leading position in the market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

ADP Inc. strengthened its position in the Human Capital Management (HCM) market by acquiring a workforce analytics company, WorkMetrics, for an undisclosed amount. This acquisition expanded ADP’s capabilities in advanced workforce planning and employee performance tracking.

Additionally, ADP launched its new AI-powered platform called ADP Workforce Insights, designed to deliver predictive analytics and actionable insights to help organizations optimize workforce productivity.

Workday Inc. made significant advancements in the HCM market by introducing its AI-driven Talent Optimization Suite in 2024. This suite enables companies to enhance employee engagement and retention through predictive analytics and customized learning solutions.

Furthermore, Workday formed a strategic partnership with Google Cloud to integrate advanced cloud capabilities into its HCM platform, ensuring better scalability and security for its clients.

SAP SE announced the launch of its next-generation SAP SuccessFactors HXM Suite, which integrates AI and machine learning to improve recruitment, onboarding, and employee engagement processes.

The new suite includes a highly personalized employee experience module, enhancing its appeal to enterprises looking for end-to-end HCM solutions. SAP also expanded its market presence by merging its cloud-based HR solutions division with Qualtrics, further emphasizing employee experience and feedback analytics.

Top Key Players in the Market

- ADP Inc.

- Workday Inc.

- SAP SE

- Oracle Corporation

- JazzHR

- UKG Inc.

- CompTIA Inc.

- Accenture

- Cegid

- Dayforce, Inc.

- Cezanne HR

- Mercer LLC

- Other Key Players

Recent Developments

- In 2024: Workday Inc. announced the launch of its advanced AI-driven talent management solution, which aims to enhance workforce planning and skills mapping for enterprises. The solution integrates machine learning to predict employee retention trends and recommends personalized training programs, helping organizations optimize their talent strategies and boost productivity.

- In 2024: Oracle Corporation introduced its next-generation HCM Cloud platform with enhanced data analytics and employee engagement features. The new platform includes advanced tools for workforce monitoring, predictive analytics for recruitment, and improved user interfaces for seamless employee interaction.

Report Scope

Report Features Description Market Value (2023) USD 25.79 Bn Forecast Revenue (2033) USD 63.3 Bn CAGR (2024-2033) 9.40% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Service), By Deployment (Cloud-based, On-premises), By Industry Vertical (BFSI, Retail, IT & Telecom, Healthcare, Hospitality, Government, Manufacturing, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape ADP Inc., Workday Inc., SAP SE, Oracle Corporation, JazzHR, UKG Inc., CompTIA Inc., Accenture, Cegid, Dayforce, Inc., Cezanne HR, Mercer LLC, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Human Capital Management MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Human Capital Management MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADP Inc.

- Workday Inc.

- SAP SE

- Oracle Corporation

- JazzHR

- UKG Inc.

- CompTIA Inc.

- Accenture

- Cegid

- Dayforce, Inc.

- Cezanne HR

- Mercer LLC

- Other Key Players