Global HR Analytics Market, By Solution (Employee Engagement & Development, Recruitment, and Other Solutions) By Service (Implementation & Integration, Support & Maintenance, and Training & Consulting) By Deployment, By Region and Companies - Industry Segment Outlook, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov 2024

- Report ID: 103679

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

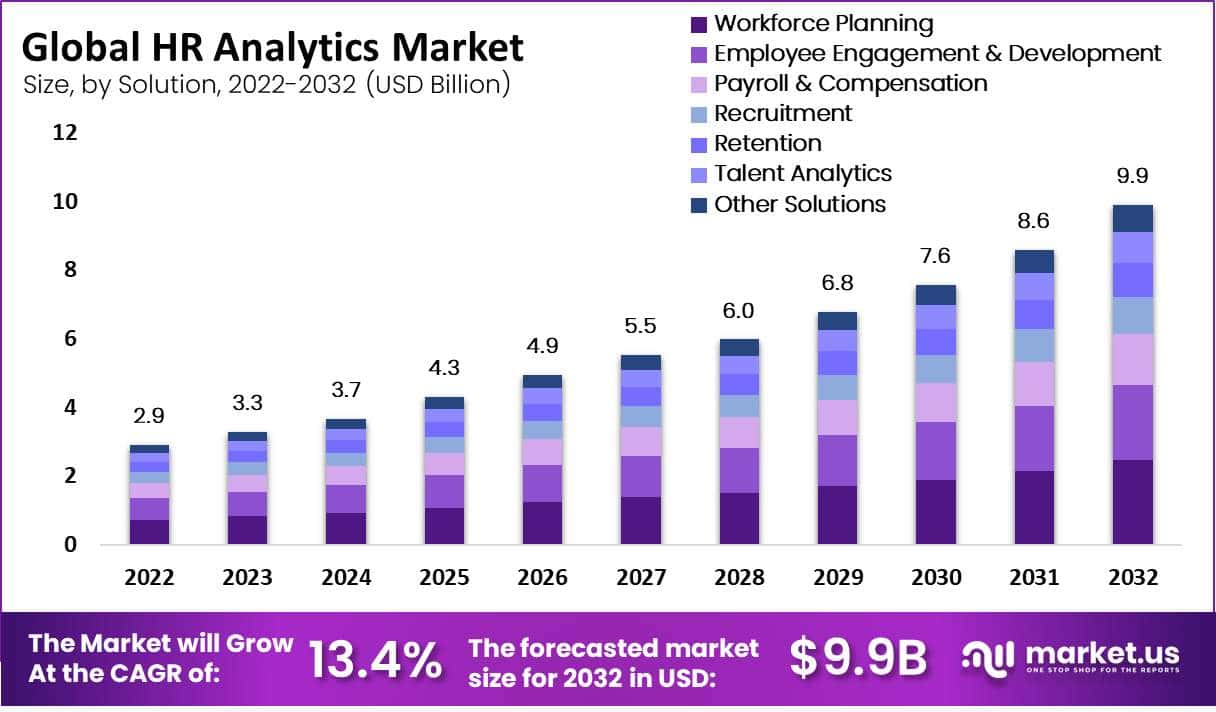

In 2023, the Global HR Analytics Market was valued at USD 3.3 billion. This market is estimated to reach USD 9.9 billion in 2032 at a CAGR of 13.4% between 2023 and 2032. This growth is driven by the need to effectively use human resources, decrease operational costs, and gain insight into employee behavior.

HR Analytics, often referred to as People Analytics, involves the application of analytic processes to the human resource department of an organization. This practice is aimed at improving employee performance and extracting valuable insights from data to make informed workforce decisions.

By leveraging data analysis, HR professionals can optimize hiring practices, enhance employee retention rates, predict workforce trends, and better understand productivity. It’s about using data to create better work environments and increase overall business efficiency.

The HR Analytics Market is burgeoning as companies recognize the importance of data-driven decisions in managing their workforce. This market covers various tools and software designed to analyze employee data and provide insights that aid in strategic planning. These solutions help businesses in forecasting staffing needs, analyzing training programs’ effectiveness, and assessing the impact of employee satisfaction on performance.

The primary driving force behind the HR Analytics market is the growing need for enhanced decision-making processes that can support HR functions like talent acquisition, retention strategies, and performance evaluations.

Businesses are increasingly relying on data analytics to streamline HR processes and reduce operational costs. Moreover, the shift towards remote working has intensified the need for sophisticated HR tools that can handle the complexities of a dispersed workforce.

Market demand for HR Analytics is driven by the growing recognition of its role in boosting business outcomes through improved talent management. Companies are eager to adopt HR analytics solutions to gain a competitive edge by enhancing their workforce planning and management capabilities. The demand is particularly strong in industries facing high turnover rates and those undergoing rapid transformations, necessitating agile HR practices.

There are significant opportunities in the HR Analytics market as businesses of all sizes seek to harness the power of data to tackle HR challenges. The increasing adoption of cloud-based platforms offers an opportunity for the development of more accessible and scalable HR analytics solutions. Furthermore, small to mid-sized enterprises (SMEs) are beginning to realize the benefits of HR analytics, presenting a considerable expansion avenue for service providers.

Technological advancements in artificial intelligence (AI) and machine learning (ML) are revolutionizing the HR Analytics field. These technologies are enhancing the predictive capabilities of HR tools, allowing for more accurate forecasting of HR needs and behaviors. Innovations such as natural language processing and sentiment analysis are being integrated into HR analytics platforms to provide deeper insights into employee feedback and engagement levels.

Key Takeaway

- The global HR Analytics market is projected to experience substantial growth, reaching a valuation of USD 9.9 billion by 2032, with a promising CAGR of 13.4% from 2023 to 2032.

- Workforce planning is the most lucrative segment, projected to grow at a CAGR of 25.0%, indicating a rising need for integrated workforce management systems across enterprises.

- Implementation and integration services dominate the market, driven by the increasing adoption of cloud computing and automation, facilitating seamless integration with internal and external systems for better decision-making.

- On-premise deployment holds the majority share (55.0%) due to the benefits of enhanced control, flexibility, and data security, while hosted deployment is growing rapidly at a CAGR of 17.3%, primarily due to the expansion of data connectivity and cost advantages.

- Large enterprises contribute significantly (55.0% share) due to their extensive workforce data, while small and medium enterprises (SMEs) are expected to grow at a CAGR of 16.0%, emphasizing the need for optimizing assets and costs through HR analytics.

- The IT and telecom sectors hold a 20.0% revenue share, driven by their reliance on a distributed workforce and the need for effective HR analytics solutions, such as the utilization of Deel for global compliance and payroll management.

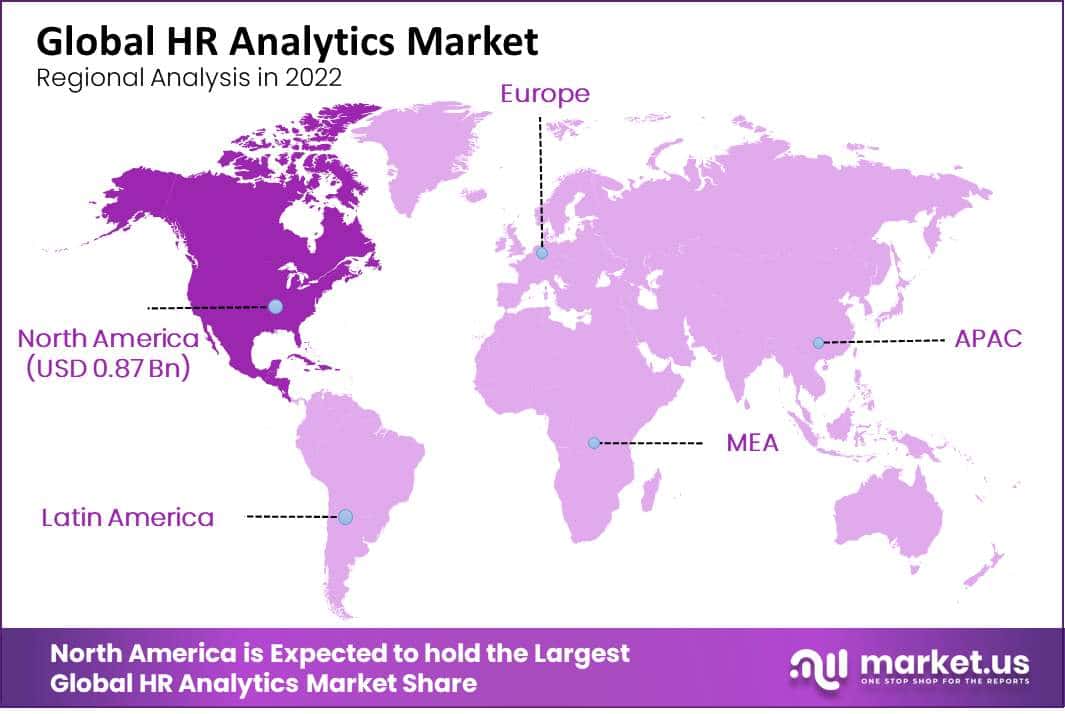

- North America leads the market (30.0% share) due to increased cloud infrastructure usage and advanced HRM tools, while the Asia Pacific region is projected to grow at a CAGR of 16.3%, driven by the adoption of cloud technologies and data-driven talent strategies.

Solution Analysis

Based on the solution, the market for HR Analytics is segmented into workforce planning, employee engagement & development, payroll & compensation, recruitment, retention, talent analytics, and other solutions. Among these types, the workforce planning segment is the most lucrative in the global HR analytics market, with a projected CAGR of 25.0%.

The segment expansion can be attributable to the increasing need for workforce management systems that are integrated across various locations and are connected and unified across enterprises. By using this approach, businesses can raise worker output, satisfaction, and performance.

Also, by implementing workforce planning services and solutions, remote working can be made simpler while labor optimization is accomplished. These benefits boost enterprises’ interest in putting such solutions into practice to enhance workforce management.

The segment of talent analytics is growing at a rate of 16.4% CAGR over the predicted period. This growth is due to the increased use of data to plan the workforce, the necessity of identifying talent gaps using performance data, as well as the increasing demand for digitalization and automation for manual talent analytics tools.

Organizations can use the talent analytics solution to help them align their goals and talent acquisition activities. This results in improved company performance. The integration of talent analytics solutions allows organizations to make better decisions. This segment is anticipated to grow significantly over the predicted period.

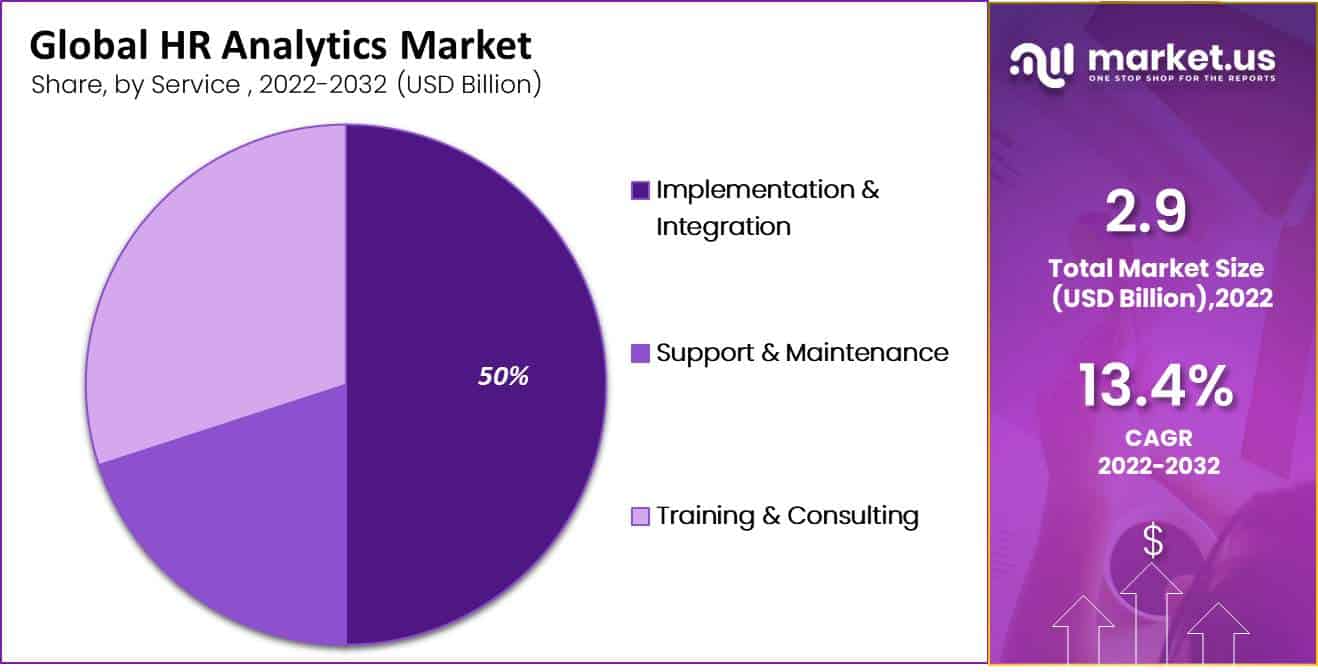

Service Analysis

Based on service, the implementation and integration segment dominate the market. Increased organizational pressure to enhance the performance of their current systems, the uptake of cloud computing, and more automation, are all factors contributing to the segment’s rise.

By ensuring that solutions are simple to adopt and seamlessly integrate with both internal and external systems, these services help organizations make the most of their investments in IT infrastructure. Also, by using these services, firms can access and view data for use in decision-making. Throughout the predicted period, these elements will keep driving the segment.

Note: Actual Numbers Might Vary In The Final Report

Deployment Analysis

Based on deployment, the on-premise segment dominated the market, with 55.0% of the total revenue. Organizations have greater control and flexibility over their IT infrastructure with on-premise deployment.

They are also easily replaceable and allow for customization and enhancement of plug-ins as required. On-premise deployment decreases internet dependence and protects data from possible fraud and losses. It eliminates the requirement that onsite staff must be accessed over a network connection.

This makes it accessible to everyone without the demand to secure a connection. These advantages will drive substantial demand during the predicted period for on-premise deployment. Hosted segment growth is projected to be 17.3%, which is the fastest CAGR over the predicted period.

Segment growth can be attributed to the expansion of data connectivity by multi-cloud environments, advances in information-sharing technologies, as well as the price advantages of cloud analytics solutions.

Enterprise Size Analysis

Based on the enterprise, the large enterprise segment had the highest revenue share more than 55.0%. Large firms usually deal with a lot of worker data due to their vast staff. HR analytics make it possible to examine such a large amount of data at lower operational expenses. Additionally, these technologies allow companies to control sizable employee databases and offer real-time access to employee information from any location in the world.

In addition, many enormous organizations are applying big data analytics to increase profits, strengthen analytical skills, and conveniently access extensive staff data. Large businesses are employing HR analytics solutions as a result, which is fostering market expansion.

Small and medium enterprises (SMEs) are expected to grow at a CAGR (of 16.0%). SMEs have greater resource limitations than those larger businesses, so they need better strategies to optimize their assets and costs. SMEs are now focusing on HR analytics to manage their employees and control their solutions across multiple locations.

Real-time HR analytics can also help managers gain insight into engagement, productivity, employee sentiment, and other metrics. They can also draw on their strengths to improve employee satisfaction and culture long-term. These advantages will require HR analytics tools for SMEs over the predicted period.

By End-User Analysis

By end-user, the IT and telecom sectors dominate the market with a 20.0% revenue share. which utilizes a large workforce and has the technological infrastructure needed to implement analytics solutions. Additionally, since many large firms operate on a global scale, it is challenging to manage a workforce that is distributed throughout the world, so effective HR analytics solutions are in high demand.

For instance, Deel, a worldwide compliance supplier, and payroll that enables anyone, to get work and paid, is used by a number of IT services Industries, including Video Husky, Turing, & Firebase. Using a tech-enabled self-service procedure, businesses may also utilize Deel to handle their payroll services and establish legal connections in more than 150 countries.

Driving Factors

- Increasing demand for data-driven insights: In today’s data-driven world, companies increasingly rely on analytics to make informed decisions about their workforce. HR analytics offers invaluable insights into employee performance, engagement, and retention that can support organizations to optimize their human capital management practices.

- Increasing demand for talent management tools: As competition for top talent increases, businesses are turning to HR analytics to acquire a strategic advantage in personnel management and acquisition. Organizations can identify strong performers, create efficient training programs, and keep top staff by using HR data.

Restraining Factors

- Data Privacy and Security Concerns: As with any data-driven technology, HR analytics raises privacy and security issues. Organizations must ensure they are collecting and handling HR data in a compliant and secure way, which can be challenging given the sensitive nature of HR data.

- Resistance to Change: Some organizations may be resistant to adopting HR analytics solutions due to a lack of familiarity with the technology or an unwillingness to alter existing processes, especially those with more traditional HR practices.

Key Market Segments

Based on Solution

- Employee Engagement & Development

- Payroll & Compensation

- Recruitment

- Retention

- Talent Analytics

- Workforce Planning

- Other Solutions

Based on Service

- Implementation & Integration

- Support & Maintenance

- Training & Consulting

Based on Deployment

- Hosted

- On-premise

Based on Enterprise Size

- Large Enterprise

- Small & Medium Enterprise (SME)

Based on End-User

- Academia

- BFSI

- Government

- Healthcare

- IT & Telecom

- Manufacturing

- Retail

- Other End-Users

Growth Opportunity

Increasing adoption of advanced technologies:

To enhance workforce planning, recruitment, talent management, and employee engagement, businesses are using advanced technologies including AI, machine learning, and predictive analytics in their HR processes. This offers a big potential for HR analytics suppliers to offer products that make use of these tools and aid businesses in streamlining their HR procedures.

With companies increasingly emphasizing employee engagement and retention, HR analytics solutions offer companies a valuable opportunity to analyze employee data and identify factors that contribute to employee engagement and retention. As such, HR analytics vendors should take advantage of this growing need by developing solutions that enhance employee satisfaction and retention rates.

Latest Trends

Adoption of Artificial Intelligence (AI) and Machine Learning (ML):

The application of Artificial Intelligence and Machine Learning in HR analytics is growing rapidly. These technologies allow organizations to analyze large amounts of data, and derive insights that can be applied to enhance HR processes such as recruitment, performance management, and employee engagement.

Furthermore, AI/ML technologies enable the automation of certain HR tasks like resume screening or candidate selection with improved efficiency and accuracy.

The HR analytics market is developing rapidly due to technological improvements, increasing workforce characteristics, and changing workplace goals. Businesses that use HR analytics solutions and adopt these trends should probably be better able to improve their HR procedures and accomplish their business objectives.

Regional Analysis

North America dominated the market, with more than 30.0% of the total revenue. The growth of the regional market can be assigned to major organizations’ increased use of cloud infrastructure as well as to the improvement of labor productivity and Using Human Resource Management (HRM) tools to increase efficiency for payroll management, talent management, time and attendance tracking The Canada and United states are two of the most developed countries.

They have invested heavily in digital technologies and business solutions to improve their operations. a Canadian-based HR platform company, Visier Inc. announced a collaboration with Symplr in June 2022. This will allow Visier’s people analytics capacity to be embedded within Symplr’s Recruiting to create talent analytics. These innovations will increase the need for HR solutions in the region over the predicted period.

Asia Pacific is projected to grow at a 16.3% CAGR over the predicted period. The region’s market will be driven by the growing start-up and the desire to improve employee productivity and company performance. Additionally, government initiatives to adopt cloud technologies will likely drive growth. HR analytics is utilized by organizations in the region to develop data-driven talent strategies.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

In order to boost the growth and development of their internal corporate operations, market participants have been seen to invest resources in R&D projects. Businesses can be observed participating in partnerships and mergers and acquisitions to increase the quality of their products and gain an advantage over competitors in the marketplace. Those are efficiently innovating new products and enhancing their current offerings to bring in more consumers and increase their market share.

Recent Developments

- June 2022, GainInsights is a global data and analysis firm that announced an agreement with Data Switch to accelerate its analytics modernization initiatives via data innovation and accelerators of migration.

- May 2022, Deloitte and Visier have reached a strategic partnership. Combining advanced technology and world-class consulting, Deloitte and Visier are able to provide guidance and professional support for business clients with HR analytics.

Market Key Players

Listed below are some of the most prominent HR analytics industry players.

- IBM Corporation

- Microstrategy Incorporated

- Oracle Corporation

- SAP SE

- UKG Inc.

- Cegid

- Tableau Software, LLC

- Sage Software Solutions Pvt. Ltd.

- Zoho Corporation Pvt. Ltd.

- Workday, Inc.

- Other Market Players

Report Scope

Report Features Description Market Value (2022) USD 2.9 Bn Forecast Revenue (2032) USD 9.9 Bn CAGR (2023-2032) 13.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution (Employee Engagement & Development, Payroll & Compensation, Recruitment, Retention, Talent Analytics, Workforce Planning, and Other Solutions) By Service (Implementation & Integration, Support & Maintenance, Training & Consulting) By Deployment (Hosted and On-premise) By Enterprise Size (Large Enterprise and Small & Medium Enterprise (SME)) By End-User (Academia, BFSI, Government, Healthcare, IT & Telecom, Manufacturing, Retail, and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM Corporation, Microstrategy Incorporated, Oracle Corporation, SAP SE, UKG Inc., Cegid, Tableau Software, LLC, Sage Software Solutions Pvt. Ltd., Zoho Corporation Pvt. Ltd., Workday, Inc. Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM Corporation

- Microstrategy Incorporated

- Oracle Corporation

- SAP SE

- UKG Inc.

- Cegid

- Tableau Software, LLC

- Sage Software Solutions Pvt. Ltd.

- Zoho Corporation Pvt. Ltd.

- Workday, Inc.

- Other Market Players