Global Hub Motor Market Size, Share, Growth Analysis By Motor Type (Gearless Hub Motor, Geared Hub Motor), By Vehicle Type (Electric Two-Wheelers, Electric Cars, Electric Buses, Electric Scooters, Others), By Installation Type (Front Hub Motor, Rear Hub Motor), By Power Output (Below 3 kW, 3–5 kW, 5–10 kW, Above 10 kW), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137248

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Motor Type Analysis

- Vehicle Type Analysis

- Installation Type Analysis

- Power Output Analysis

- Sales Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

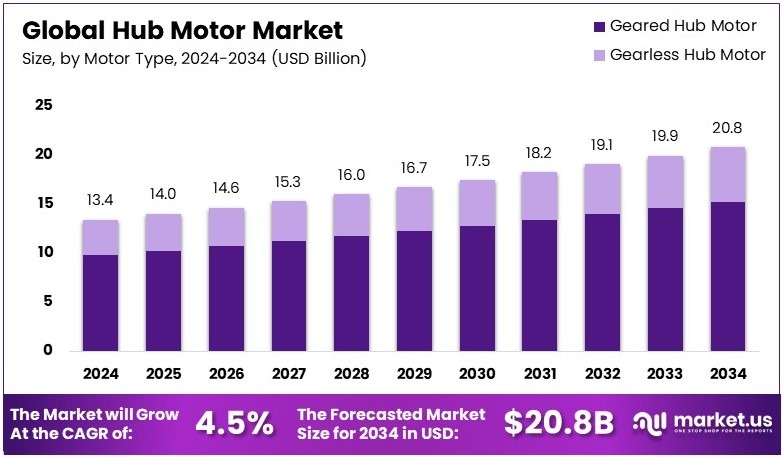

The Global Hub Motor Market size is expected to be worth around USD 20.8 Billion by 2034, from USD 13.4 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

A hub motor is an electric motor integrated directly into the wheel of a vehicle, primarily bicycles and electric scooters. It powers the wheel directly, enhancing efficiency and simplifying the drivetrain by eliminating the need for additional components like gears or belts.

The hub motor market entails the design, manufacture, and distribution of wheel-integrated motors for various types of vehicles. This market targets electric vehicle manufacturers and consumers looking for a direct-drive motor solution that simplifies vehicle design and increases propulsion efficiency.

Hub motors are essential for electric vehicles, offering compact designs and high efficiency. According to the International Energy Agency (IEA), global sales of electric three-wheelers grew by 13% in 2023, reaching almost 1 million units. Demand is rising for lightweight, eco-friendly vehicles, driving hub motor adoption in both two- and three-wheeler segments.

The hub motor market remains moderately competitive, with established players and new entrants targeting emerging markets. Germany, with 11.3 million e-scooter users in 2023, highlights strong adoption in Europe. Market opportunities are expanding in Asia, where government incentives like Thailand’s 50 billion baht investment plan attract manufacturers and encourage innovation in hybrid and electric vehicles.

Growth factors include stricter environmental policies and increased consumer preference for clean energy solutions. The EPA’s proposed emission rules aim for a 56% reduction by 2032, boosting demand for efficient electric motors. In addition, Thailand’s tax reductions from 2028 to 2032 further enhance market growth, especially for hybrid and electric vehicles.

Key Takeaways

- The Hub Motor Market was valued at USD 13.4 billion in 2024 and is expected to reach USD 20.8 billion by 2034, with a CAGR of 4.5%.

- In 2024, Geared Hub Motors led the motor type segment with 73.2%, due to their high efficiency in diverse applications.

- In 2024, Electric Two-Wheelers accounted for 29.7% of the vehicle type segment, reflecting strong demand for compact and eco-friendly transport.

- In 2024, Rear Hub Motors dominated the installation type segment with 71.5%, driven by their superior traction and performance.

- In 2024, the 3–5 kW power output segment led with 51.4%, owing to its suitability for mid-range electric vehicles.

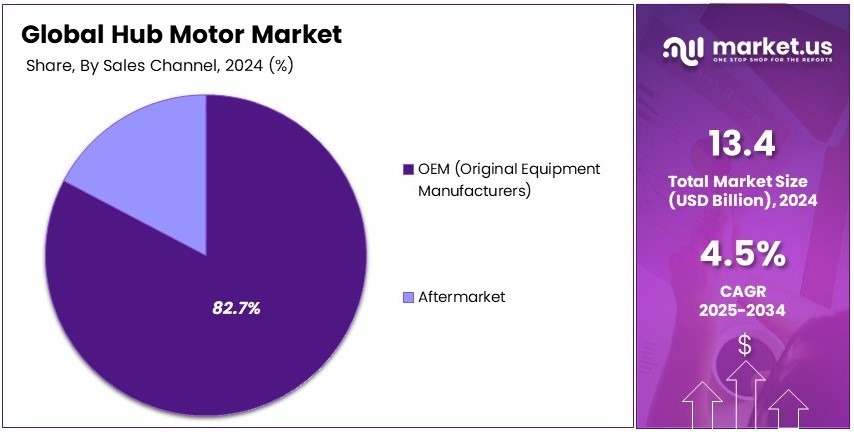

- In 2024, OEMs dominated the sales channel with 82.7%, highlighting their role in integrating hub motors into electric vehicles.

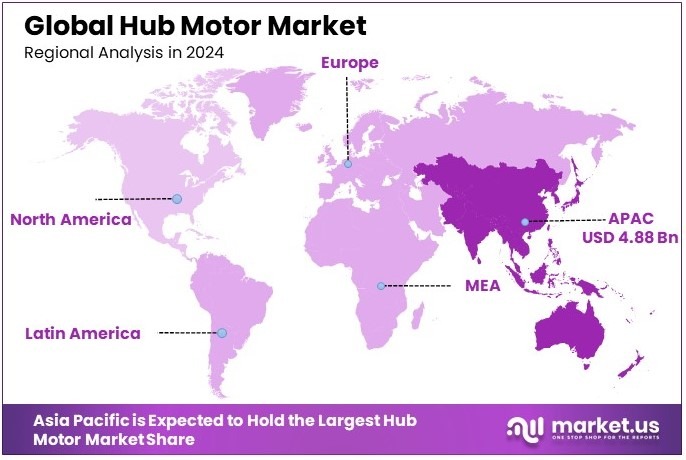

- In 2024, Asia Pacific led the market with 36.4% and generated revenues of USD 4.88 billion, driven by the growing adoption of electric vehicles.

Business Environment Analysis

The hub motor market is moderately saturated in developed regions, with significant growth opportunities in emerging markets. According to the International Energy Agency (IEA), nearly 1 million electric three-wheelers were sold globally in 2023, highlighting the rising demand for compact, efficient motors in electric vehicles.

Target demographics include electric two- and three-wheeler manufacturers targeting urban commuters. Lightweight and cost-effective hub motors are particularly appealing in regions like Asia-Pacific, where affordable and eco-friendly mobility solutions are in high demand. This demand continues to expand as urbanization accelerates globally.

Product differentiation is crucial in this competitive market. Motors offering higher efficiency, better torque, and integration with advanced vehicle control systems stand out. Additionally, innovations in lightweight materials and dual-motor systems further enhance performance and attract consumers seeking reliable and efficient solutions.

Investment opportunities in the hub motor market are increasing due to rising electric vehicle adoption. For instance, the European Investment Bank projects funding for EV infrastructure to exceed €2 billion by 2025, creating a ripple effect in the hub motor segment. Emerging markets also present untapped potential for investors.

Adjacent markets such as battery technologies and smart mobility solutions closely align with hub motors. Innovations in energy storage and integration with IoT-enabled systems enhance the efficiency and functionality of electric vehicles, reinforcing the essential role of hub motors in future mobility ecosystems.

Motor Type Analysis

Geared Hub Motor dominates with 73.2% due to its efficiency and durability.

In the Hub Motor Market, the segmentation by motor type divides the field into Gearless Hub Motor and Geared Hub Motor.

Geared Hub Motors lead substantially, accounting for 73.2% of the market, primarily because they provide higher torque, better vehicle handling, and are generally lighter than their gearless counterparts. This makes geared hub motors ideal for vehicles that require dynamic performance and efficient power usage, such as electric motorcycle and lightweight electric vehicles.

Gearless Hub Motors are valued for their simplicity and lower maintenance needs. They are typically used in applications where simplicity and reliability are more important than high performance, such as in some personal mobility devices and basic electric scooters.

Vehicle Type Analysis

Electric Two-Wheelers lead with 29.7% due to their popularity in urban transport.

The Vehicle Type segment includes Electric Two-Wheelers, Electric Cars, Electric Buses, Electric Scooters, and Others. Electric Two-Wheelers dominate this segment with a 29.7% market share.

This popularity stems from the growing trend towards urban mobility solutions where compact and energy-efficient vehicles are favored. Electric two-wheelers, such as e-bikes and electric motorcycles, offer an accessible and eco-friendly alternative to traditional transportation methods, particularly in congested city environments.

Electric Cars and Electric Buses are critical for the transition towards sustainable urban ecosystems, offering significant reductions in carbon emissions. Electric Scooters are becoming increasingly popular for short urban trips, providing a quick and convenient mode of transport. Other vehicle types, including innovative personal and cargo transport solutions, continue to explore the benefits of hub motor applications.

Installation Type Analysis

Rear Hub Motor dominates with 71.5% due to its balance of power and control.

Installation Type segmentation focuses on Front Hub Motor and Rear Hub Motor. Rear Hub Motors are the predominant choice, making up 71.5% of the market.

They are preferred for their ability to provide better traction and balance, as they support the vehicle’s weight and handle the primary driving forces. This placement is particularly beneficial in wet or slippery conditions, where extra grip is necessary for safe vehicle operation.

Front Hub Motors are used in specific configurations where weight distribution or vehicle design necessitates their placement. They are important in dual-motor setups, providing additional power and improved handling, especially in all-wheel-drive electric vehicles.

Power Output Analysis

3-5 kW leads with 51.4% due to its optimal balance of performance and energy consumption.

Power Output in the Hub Motor Market is categorized into Below 3 kW, 3-5 kW, 5-10 kW, and Above 10 kW. The 3-5 kW segment dominates with a 51.4% share, favored for its versatility across a wide range of vehicle applications.

This power range is particularly effective in providing sufficient thrust for daily commuting without excessive energy consumption, making it ideal for medium-range electric vehicles and two-wheelers.

Below 3 kW motors are commonly used in lightweight and compact vehicles, where minimal power is sufficient. The 5-10 kW and Above 10 kW segments cater to more performance-oriented vehicles, including high-power motorcycles and heavy-duty electric vehicles that require greater torque and longer range capabilities.

Sales Channel Analysis

OEM leads with 82.7% due to the direct integration of motors in new vehicles.

The Sales Channel segmentation includes OEM (Original Equipment Manufacturers) and Aftermarket. OEMs dominate the market with an 82.7% share, largely due to the benefits of integrating hub motors during the manufacturing process.

This integration ensures that the motor is perfectly matched to the vehicle’s specifications and performance requirements, providing consumers with reliability and optimized performance right from the start.

The Aftermarket segment, though smaller, is significant for older vehicles that are being converted or upgraded to electric power. This channel provides opportunities for vehicle owners to customize or enhance the capabilities of their existing vehicles with hub motor technology.

Key Market Segments

By Motor Type

- Gearless Hub Motor

- Geared Hub Motor

By Vehicle Type

- Electric Two-Wheelers

- Electric Cars

- Electric Buses

- Electric Scooters

- Others

By Installation Type

- Front Hub Motor

- Rear Hub Motor

By Power Output

- Below 3 kW

- 3 – 5 kW

- 5 – 10 kW

- Above 10 kW

By Sales Channel

- OEM (Original Equipment Manufacturers)

- Aftermarket

Driving Factors

Electric Mobility Demand Drives Market Growth

The Hub Motor Market is experiencing significant growth due to several key factors. Rising demand for electric vehicles, especially in urban areas, increases the need for efficient hub motors. The focus on energy efficiency in automotive design supports this trend.

Advancements in battery technologies have also improved electric vehicle performance, making hub motors more attractive. For example, companies like Niu Technologies are using advanced hub motors in their electric scooters to enhance range and efficiency.

Growing adoption of two-wheelers and three-wheelers in cities like Delhi and Shanghai further fuels market expansion. These drivers create a robust market environment. The shift to electric mobility leads to increased production of hub motors. Energy-efficient designs reduce overall vehicle consumption and operating costs. Improved battery life and power delivery directly impact the reliability of hub motors.

As consumer awareness grows, more manufacturers invest in hub motor innovations. This synergy of demand, efficiency, and technological advancement propels the market forward. Auto manufacturers and startups alike focus on enhancing hub motor performance, which in turn drives consumer adoption.

Restraining Factors

High Costs and Standardization Issues Restrain Market Growth

The Hub Motor Market faces several restraints that slow down its expansion. High initial cost of hub motor systems is a major obstacle for both manufacturers and consumers. For instance, premium electric scooter brands often face pricing challenges that limit their market reach.

Limited consumer awareness about hub motor technologies adds to the hesitation. Concerns about the durability and longevity of hub motors affect buyer confidence, similar to early concerns with lithium-ion batteries.

Lack of standardization in hub motor components across manufacturers leads to compatibility and maintenance issues. For example, a mechanic in a city like Mumbai might struggle to find replacement parts for less common models, affecting service reliability. These factors create hesitation among potential buyers and investors. Without widespread knowledge of benefits, consumers may stick to traditional engine technologies.

The high costs deter small startups from entering the market without significant capital. Uncertainty over long-term performance prevents some fleets from switching to electric solutions. As a result, market growth is restrained until these issues are addressed through innovation, consumer education, and standardization efforts by industry stakeholders.

Growth Opportunities

Micro-Mobility Integration Provides Opportunities

The Hub Motor Market presents various opportunities for growth and innovation. There is an increasing demand for electric bikes, scooters, and personal transport devices that leverage hub motors for better efficiency.

The rise of micro-mobility solutions, such as shared e-scooters in cities like Los Angeles and Paris, offers a clear pathway for expanding hub motor usage. Rising investment in electric vehicle fleet solutions encourages manufacturers to develop lightweight, high-power hub motors that enhance vehicle efficiency.

Integration of hub motors in autonomous and electric delivery vehicles also opens up new business models. For instance, companies like Gogoro are focusing on fully integrated hub motor and battery systems to simplify maintenance and improve performance. These innovations reduce costs and increase appeal for end-users.

They can offer products with longer life, better performance, and lower total cost of ownership. By capitalizing on these opportunities, stakeholders can tap into growing markets and drive further advancements, meeting the evolving needs of consumers and urban planners seeking greener transport options.

Emerging Trends

Smart Technology Adoption Is Latest Trending Factor

The Hub Motor Market is trending towards smart integration and advanced technology. The rise of micro-mobility solutions like e-scooters and e-bikes using hub motors shows a clear shift in urban transportation.

Increased interest in fully integrated hub motor and battery systems is gaining traction as it simplifies design and improves reliability. Advancements in brushless hub motor technology for better efficiency are notable; brands like Yamaha are adopting brushless designs to reduce maintenance and increase performance.

The growing adoption of smart mobility solutions using hub motors highlights how technology enhances user experience. For example, companies are embedding IoT sensors in hub motors to monitor performance in real-time and predict maintenance needs.

Real-world applications, such as smart city pilot programs in Copenhagen using connected e-bikes, showcase the benefits of these trending factors. The focus on efficiency, reliability, and user-friendly features ensures that smart hub motor solutions remain at the forefront of the mobility revolution.

Regional Analysis

Asia Pacific Dominates with 36.4% Market Share

Asia Pacific leads the Hub Motor Market with a 36.4% share, totaling USD 4.88 billion. This dominance is fueled by the region’s rapid urbanization, extensive manufacturing capabilities, and large-scale adoption of electric bicycles and scooters.

The region’s vast consumer base and strong governmental support for electric vehicles enhance its market dynamics. Major cities across Asia Pacific are focusing on reducing pollution and traffic congestion, which drives the demand for lightweight electric vehicles equipped with hub motors.

Looking forward, the Asia Pacific region’s influence in the Hub Motor Market is expected to grow even more. As urban populations continue to rise and environmental concerns become more pressing, the demand for efficient and compact electric vehicles will likely increase. This trend, coupled with ongoing technological advancements in motor efficiency and battery technology, will ensure that Asia Pacific remains a key player in this market.

Regional Mentions:

- North America: North America is a significant player in the Hub Motor Market, supported by advancements in electric vehicle technologies and an increasing shift towards sustainable transportation solutions. The region’s focus on innovation and high consumer spending power contribute to its robust market growth.

- Europe: Europe maintains a strong market presence in the Hub Motor Market, driven by stringent environmental regulations and high adoption rates of electric vehicles. The region’s commitment to reducing carbon emissions and promoting green mobility solutions supports steady market expansion.

- Middle East & Africa: The Middle East and Africa are gradually entering the Hub Motor Market, with initiatives aimed at modernizing transportation systems and increasing the adoption of electric vehicles, particularly in urban areas.

- Latin America: Latin America is making strides in the Hub Motor Market as it begins to embrace more sustainable transportation methods. Increased environmental awareness and government incentives are key factors driving the market in this region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Hub Motor Market, four standout companies lead the industry in innovation and market presence: Protean Electric, Elaphe Propulsion Technologies Ltd., Ziehl-Abegg SE, and Schaeffler Technologies AG & Co. KG.

Protean Electric is a pioneer in the development of in-wheel electric motors, which are key components of hub motor systems. Protean’s motors are known for their compact design and high torque output, making them ideal for electric vehicles looking to maximize interior space without sacrificing performance.

Elaphe Propulsion Technologies Ltd. specializes in advanced in-wheel motor technology. Elaphe’s products stand out for their ability to deliver high power and torque directly to the vehicle’s wheels, which enhances handling and efficiency. The company’s focus on scalability makes its technology suitable for a wide range of automotive applications.

Ziehl-Abegg SE is renowned for its engineering excellence in electric motor production, including hub motors used in public transport and industrial vehicles. Ziehl-Abegg’s hub motors are highly regarded for their durability and efficiency, key factors that contribute to the company’s strong position in commercial vehicle markets.

Schaeffler Technologies AG & Co. KG integrates its extensive expertise in precision engineering to the hub motor sector, offering solutions that are both innovative and reliable. Schaeffler’s hub motors are designed to meet the rigorous demands of both automotive and industrial applications, ensuring performance and reliability.

These companies are at the forefront of the Hub Motor Market, driving forward with technological advancements that define the future of electric mobility. Their commitment to innovation and quality makes them key players in an industry that demands high performance and sustainable solutions.

Major Companies in the Market

- Protean Electric

- Elaphe Propulsion Technologies Ltd.

- Ziehl-Abegg SE

- Schaeffler Technologies AG & Co. KG

- NSK Ltd.

- NTN Corporation

- Heinzmann GmbH & Co. KG

- Michelin Group

- YASA Limited

- GEM Motors d.o.o.

- QS Motor

- MAC Motor

- GO SwissDrive AG

Recent Developments

- Segway’s New High-Performance E-Bikes and Scooter: On January 2025, Segway unveiled the Xyber and Xafari e-bikes, alongside the GT3 Pro scooter at CES 2025. The Xyber features a motorcycle-inspired design, while the GT3 Pro achieves speeds up to 49.7 mph, powered by a high-efficiency hub drive system.

- Ola Electric’s Financial Performance Amid Rising Sales: On November 2024, Ola Electric reported a 39.1% revenue surge to ₹12.14 billion, driven by the delivery of 98,619 two-wheelers, a 73.6% year-over-year increase. Rising sales reduced second-quarter losses, despite a 21.8% rise in expenses.

- Harley-Davidson’s Electric Maxi-Scooters Collaboration with KYMCO: In December 2024, Harley-Davidson’s LiveWire division partnered with KYMCO to develop high-performance maxi-scooters by 2026. These scooters will feature the S2 Arrow powertrain with an integrated hub motor, delivering 84 hp peak power and a top speed of 101 mph.

Report Scope

Report Features Description Market Value (2024) USD 13.4 Billion Forecast Revenue (2034) USD 20.8 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Motor Type (Gearless Hub Motor, Geared Hub Motor), By Vehicle Type (Electric Two-Wheelers, Electric Cars, Electric Buses, Electric Scooters, Others), By Installation Type (Front Hub Motor, Rear Hub Motor), By Power Output (Below 3 kW, 3–5 kW, 5–10 kW, Above 10 kW), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Protean Electric, Elaphe Propulsion Technologies Ltd., Ziehl-Abegg SE, Schaeffler Technologies AG & Co. KG, NSK Ltd., NTN Corporation, Heinzmann GmbH & Co. KG, Michelin Group, YASA Limited, GEM Motors d.o.o., QS Motor, MAC Motor, GO SwissDrive AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Protean Electric

- Elaphe Propulsion Technologies Ltd.

- Ziehl-Abegg SE

- Schaeffler Technologies AG & Co. KG

- NSK Ltd.

- NTN Corporation

- Heinzmann GmbH & Co. KG

- Michelin Group

- YASA Limited

- GEM Motors d.o.o.

- QS Motor

- MAC Motor

- GO SwissDrive AG