Global Horeca Furniture Market Size, Share, Growth Analysis By Product Type (Chairs, Tables, Sofas, Bar Stools, Booths, Lounge Furniture, Outdoor Furniture), By Material (Wood, Metal, Plastic, Upholstery, Glass), By End-User (Restaurants, Hotels, Cafes, Bars, Catering Services), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139501

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

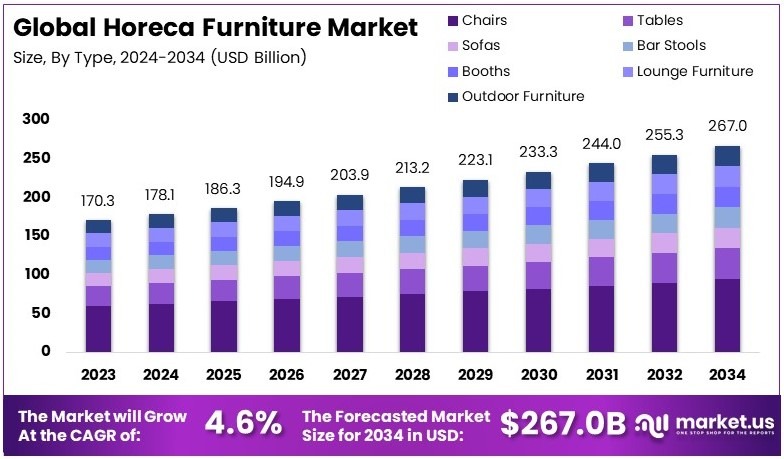

The Global Horeca Furniture Market size is expected to be worth around USD 267.0 Billion by 2034, from USD 170.3 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

Horeca furniture refers to furniture specifically designed for the hospitality industry, which includes hotels, restaurants, cafes, and bars. It is built to withstand heavy usage while offering comfort and style. This furniture includes tables, chairs, booths, and other items tailored for commercial environments.

The Horeca furniture market is the business sector focused on supplying and selling furniture for the hospitality industry. It includes manufacturers, suppliers, and distributors of furniture products for hotels, restaurants, and cafes. The market caters to the needs of the hospitality sector, ensuring quality and durability.

The Horeca Furniture market is growing due to the rising demand in the hospitality industry. Hotels, restaurants, and cafes require stylish and functional furniture to enhance guest experiences. According to the World Travel & Tourism Council (WTTC), the global tourism sector saw a 23.2% growth in 2023, contributing to a 9.1% increase in global GDP, boosting demand for quality Horeca Furniture.

The demand for high-end and luxury furniture is strong, especially in the European Union, which produces nearly two-thirds of global high-end furniture. As the tourism sector grows, the need for upscale Horeca Furniture increases, creating opportunities. However, the market is becoming saturated in some areas, making competition more intense, especially in established regions.

The Horeca Furniture market faces moderate saturation in key European markets. However, the growing culinary tourism in emerging markets presents fresh opportunities. As an example, France and Spain remain major tourism hotspots, fueling continuous demand for furniture in hotels and restaurants. Meanwhile, innovation keeps the competition level high across regions.

Government investment in infrastructure and hospitality development, especially in tourism-heavy regions, is stimulating growth. As international tourist arrivals surged by 33.4% in 2023, more hotels and restaurants were built to meet the demand. This increase translates to higher demand for quality Horeca Furniture in both local and broader markets.

On a local scale, governments are investing in hospitality sectors, making regions more attractive for tourists and businesses. For example, the U.S. accommodation and food services sector employed 14.3 million people as of December 2024, indicating the sector’s significant role in job creation and economic development. This trend impacts both local and international furniture suppliers.

Key Takeaways

- Horeca Furniture Market was valued at USD 170.3 billion in 2024 and is expected to reach USD 267.0 billion by 2034, with a CAGR of 4.6%.

- In 2024, Chairs dominate the product type segment with 35.2%, driven by high demand in various dining and seating environments.

- In 2024, Wood leads the material segment with 41.1%, favored for its durability and aesthetic appeal in furniture designs.

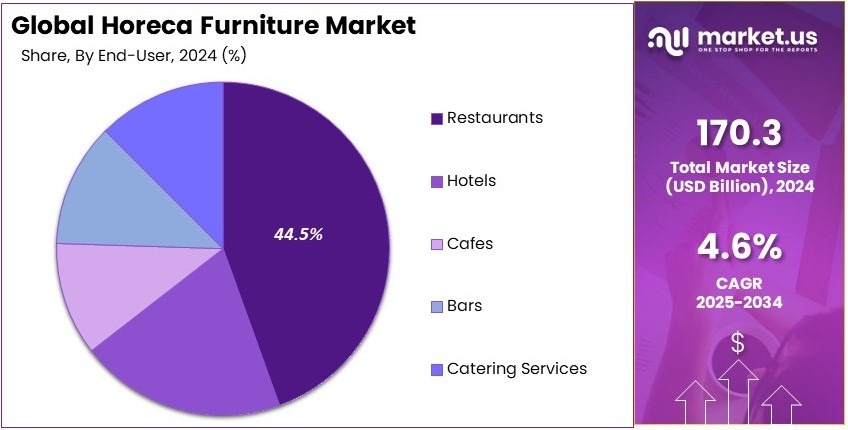

- In 2024, Restaurants dominate the end-user segment with 44.5%, reflecting the high need for quality furniture in the hospitality industry.

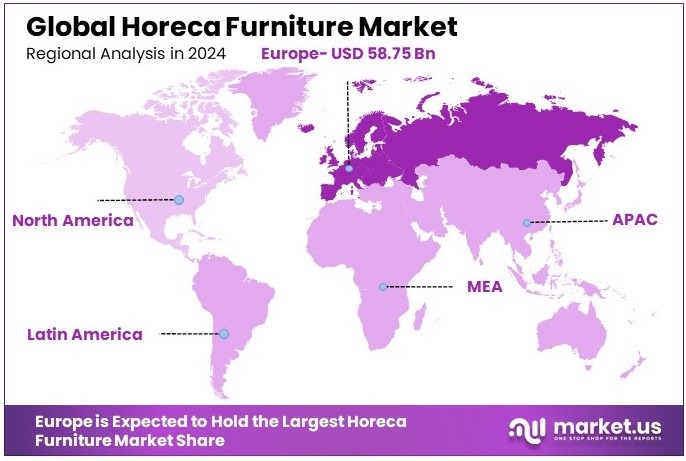

- In 2024, Europe is the dominant region with 34.5% market share, contributing USD 58.75 billion, due to its established Horeca sector.

Product Type Analysis

Chairs dominate with 35.2% due to comfort, versatility, and wide applicability across sectors like restaurants, cafes, and hotels.

In the Horeca furniture market, chairs make up the largest share at 35.2%. This dominance is driven by the high demand for comfortable and functional seating in various establishments like restaurants, cafes, and hotels.

Chairs are essential in almost every type of hospitality setting, whether for customers or staff. The versatility of chairs, as they can be designed in various styles and materials to suit different environments, contributes to their widespread use. For instance, ergonomic chairs in hotels ensure comfort, while stylish café chairs add to the ambiance.

Tables come in second, following closely behind chairs in terms of market share. These are critical in any dining or leisure setting and vary widely in size, shape, and function. Sofas, another key segment, are highly valued in hotels and lounges for their ability to provide comfort in common areas, though they occupy a smaller portion of the market.

Bar stools are frequently used in bars, adding functionality and a trendy aesthetic, but they hold less significance in other sectors like restaurants. Booths are often chosen for their space-efficient nature, particularly in fast-casual restaurants, yet they aren’t as prevalent as chairs or tables.

Lounge furniture, mainly used in hotels or lounges, is popular for creating luxurious settings but has a more niche role. Outdoor furniture, used in hotels with outdoor dining or pool areas, has seen growth but remains a smaller segment due to seasonal demand.

Material Analysis

Wood dominates with 41.1% due to its durability, aesthetic appeal, and suitability for a wide range of designs.

Wood is the leading material in the Horeca furniture market, accounting for 41.1% of the segment share. The natural elegance and durability of wood make it a popular choice for various types of hospitality furniture. It is commonly used in chairs, tables, and booth designs, offering a timeless and versatile look.

Wood furniture is highly customizable, allowing businesses to match the aesthetics of their spaces, whether rustic, modern, or traditional. The material’s ability to be easily shaped and finished in numerous ways also adds to its appeal. For instance, wooden tables and chairs are often chosen for restaurants and cafes for their welcoming, earthy vibe that aligns with the relaxed atmosphere many establishments strive for.

Metal is the second-largest material used in Horeca furniture, known for its sturdiness and modern appeal. It’s often seen in urban restaurants and trendy bars, where sleek and minimalist furniture designs are in demand. Plastic, while durable and cost-effective, occupies a smaller share. It’s primarily used for budget-conscious establishments or outdoor furniture, offering convenience and ease of maintenance.

Upholstery materials, although integral for seating comfort, especially in chairs and sofas, have a smaller share than wood and metal. Glass, used mostly in tables or decorative pieces, represents a small niche. Its sleek, transparent quality suits upscale or contemporary settings but is less practical for high-traffic areas due to fragility.

End-User Analysis

Restaurants dominate with 44.5% due to the constant need for varied, stylish, and comfortable furniture in dining areas.

Restaurants represent the largest segment in the Horeca furniture market, capturing 44.5% of the share. This is largely due to the diverse needs of dining establishments, which require a variety of furniture types to cater to different customer preferences and dining experiences. Chairs and tables are integral, but booths and bar stools also play crucial roles in creating functional and inviting spaces.

The demand for customizability is high, with restaurants seeking furniture that complements their brand identity, from casual to fine dining. The continuous evolution of design trends in restaurants, along with the need for durability and comfort, keeps the market for Horeca furniture strong.

Hotels come next, contributing significantly to the demand for furniture, especially for lobbies, lounges, and guest rooms. Sofas and lounge chairs are highly sought after in these settings. Cafes, though smaller in number, continue to be strong players, with a focus on stylish, durable, and easy-to-maintain furniture that suits their high-foot traffic environments.

Bars, while essential for the Horeca market, have a more niche demand for furniture, focusing on bar stools and high-top tables. Catering services, although important, are less reliant on permanent furniture compared to other sectors. These services often use rented or temporary setups for events, which limits their market share compared to more stationary establishments like restaurants and hotels.

Key Market Segments

By Product Type

- Chairs

- Tables

- Sofas

- Bar Stools

- Booths

- Lounge Furniture

- Outdoor Furniture

By Material

- Wood

- Metal

- Plastic

- Upholstery

- Glass

By End-User

- Restaurants

- Hotels

- Cafes

- Bars

- Catering Services

Driving Factors

Tourism, Luxury Expansion, and Sustainability Drive Market Growth

The rapid expansion of global tourism and hospitality is driving strong demand for premium Horeca furniture. As travel rebounds, hotels, bars, and restaurants are investing in high-end furnishings to enhance guest experiences. Upscale venues prioritize stylish, durable, and comfortable furniture to attract customers and differentiate from competitors.

Rising disposable incomes and shifting consumer expectations are further fueling market growth. Guests now seek immersive and luxurious hospitality experiences, prompting businesses to invest in high-quality, aesthetically appealing furnishings. This demand encourages manufacturers to develop innovative designs that blend comfort, functionality, and modern aesthetics.

Accelerated urbanization is also contributing to the expansion of the Horeca furniture market. The rapid development of luxury hotels, fine dining restaurants, and boutique cafes in metropolitan areas has created a steady need for customized furniture solutions. Cities like Dubai, Singapore, and New York are prime examples of how urban growth fuels market expansion.

Sustainability has emerged as a key driver in Horeca furniture adoption. More hospitality businesses are prioritizing eco-friendly materials and sustainable production methods. Recycled wood, bamboo, and energy-efficient manufacturing processes are increasingly preferred. This shift not only meets regulatory demands but also aligns with consumer preferences for greener hospitality environments.

Restraining Factors

Cost, Regulation, and Skill Gaps Restraints Market Growth

Rising raw material costs and frequent supply chain disruptions challenge Horeca furniture production. Manufacturers face delays and cost overruns when critical inputs become scarce. These challenges force companies to adjust pricing strategies and manage production risks carefully in practice. Supply delays often impact delivery schedules and affect customer satisfaction adversely.

Strict regulatory and environmental compliance measures further constrain production. Companies must follow complex rules that vary by region, slowing down expansion and innovation. Regulatory burdens force manufacturers to invest extra resources in meeting legal standards. This additional cost can reduce profit margins and discourage risk‐taking in design and production significantly.

Fierce competition from low‐cost alternatives also pressures premium manufacturers. Budget options attract price‐sensitive customers, eroding margins for quality producers. This intense competition forces established brands to lower prices or compromise on design, which can dilute brand value. Market fragmentation creates challenges for firms that rely on exclusivity and superior craftsmanship.

A shortage of skilled artisans and craftsmanship further hampers production of custom designs. Many companies struggle to find qualified workers to meet high‐quality standards. This labor gap slows innovation and limits the ability to offer unique, tailored furniture. The challenge calls for enhanced training programs and investment in workforce development.

Growth Opportunities

Global Expansion Provides Opportunities

The rise of digital platforms and e-commerce opens direct channels for Horeca furniture sales. Companies now market products online to reach hospitality venues directly. This shift eliminates intermediaries and reduces costs. Digital presence also enhances brand visibility and allows companies to respond quickly to changing market demands, boosting overall sales.

Strategic collaborations with global hospitality chains create new opportunities for co‐designing custom furniture. These partnerships allow manufacturers to understand client needs better and tailor products accordingly. Joint ventures enable shared expertise and risk. For example, collaborations with international hotel groups often lead to exclusive design contracts and long‐term business relationships.

Adoption of advanced materials and eco‐friendly manufacturing practices offers firms a chance to differentiate. Sustainable products appeal to customers and reduce environmental impact. Companies invest in green technologies to meet consumer expectations. This commitment enhances brand image and clearly opens doors to new market segments focused on responsible consumption.

Expanding into emerging markets in Asia-Pacific and the Middle East provides additional growth potential. These regions show rising demand for quality, Horeca furniture. Local customers seek modern designs and sustainable products. Companies that enter these markets benefit from less competition and high growth prospects in untapped territories, yielding strong returns

Emerging Trends

Digital and Eco Trends Are Latest Trending Factor

A surge in eco‐conscious design trends is transforming the Horeca furniture market. Manufacturers now favor sustainable materials to reduce environmental impact. Eco‐friendly designs appeal to modern consumers who value green practices. This shift encourages companies to adopt renewable resources and innovate with recycled components, aligning products with global sustainability goals.

Modular and multi‐functional furniture concepts are gaining popularity. These designs allow flexible use of space in hospitality venues. Innovative layouts meet diverse needs by combining storage, seating, and display elements. Such versatile furniture helps businesses maximize limited areas and adapt quickly to changing customer preferences. This trend boosts spatial efficiency.

Digital design tools and virtual reality are revolutionizing customization. Clients now view and modify furniture layouts in real time before production begins. This advanced technology reduces errors and speeds up the design process. It also offers a more engaging experience, allowing customers to visualize personalized setups with clarity and confidence.

Integration of contactless and smart safety features has become essential. In response to health protocols, venues now adopt touchless systems and digital menus. These innovations enhance customer safety and streamline operations. Consequently, manufacturers add smart functions to furniture, meeting hygiene standards and modern design expectations while ensuring high reliability consistently.

Regional Analysis

Europe Dominates with 34.5% Market Share

Europe holds a dominant position in the Horeca Furniture Market, with a 34.5% market share, valued at USD 58.75 billion. The region’s dominance can be attributed to a strong hospitality industry, comprising high-end hotels, restaurants, and cafes, alongside increasing tourism. Europe’s rich cultural history, emphasis on luxury, and large hospitality-driven economy have made it a key market for high-quality horeca furniture.

The region’s market is also bolstered by a robust demand for stylish, durable, and sustainable furniture. Countries like Italy and France are known for their premium furniture designs, catering to a growing demand in the horeca sector. Additionally, the increasing number of boutique hotels and unique restaurant experiences further boosts the need for innovative and customized furniture solutions. The high standards of design and quality expected by customers in Europe drive this growth.

As Europe maintains its leadership, the demand for sustainable and eco-friendly materials in horeca furniture will continue to increase, aligning with global environmental trends. The region’s focus on both luxury and sustainability, paired with its thriving hospitality industry, ensures that Europe will remain a dominant player in the Horeca Furniture Market for years to come.

Regional Mentions:

- North America: North America holds a significant share in the Horeca Furniture Market, driven by a booming hospitality sector, especially in urban areas like New York and Los Angeles. High standards of comfort and functionality are in demand for both new and renovation projects in hotels, restaurants, and bars.

- Asia Pacific: Asia Pacific is seeing rapid growth in horeca furniture, particularly in countries like China and India. The region’s expanding middle class and increased investments in luxury hotels and restaurants are driving demand for innovative and stylish furniture solutions, fueling market expansion.

- Middle East & Africa: The Middle East & Africa is making strides in the Horeca Furniture Market, driven by luxury hotel projects in cities like Dubai and Riyadh. With an increasing focus on high-end dining and leisure, the demand for durable and stylish furniture continues to rise in the region’s hospitality sector.

- Latin America: Latin America is experiencing steady growth in the Horeca Furniture Market, driven by an expanding restaurant and hospitality industry. The increasing urbanization and modernization of cafes and hotels, particularly in cities like São Paulo and Mexico City, create a strong demand for quality and cost-effective horeca furniture solutions.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Horeca (Hotel, Restaurant, and Café) Furniture Market is characterized by a few dominant players that influence trends, quality standards, and product innovations. Among the top players in the industry, Kian Contract, Zuo Modern, Emeco, and Thonet stand out for their market leadership and innovation.

Kian Contract is a key player known for its high-quality contract furniture solutions tailored for the hospitality industry. Their products focus on durability, aesthetics, and functionality, making them a go-to choice for hotels and restaurants. Kian’s commitment to sustainable materials and customization sets them apart in meeting specific needs within the Horeca sector.

Zuo Modern is another major company providing contemporary furniture solutions. Specializing in modern designs, Zuo’s stylish yet practical furniture has gained popularity among upscale restaurants and trendy cafes. Their wide range of products, which include everything from lounge chairs to tables, offers versatility for different hospitality environments. Zuo is known for blending style with comfort, and their products are often featured in high-end restaurants and hospitality venues.

Emeco has a long history in the furniture industry and is known for its focus on producing durable, high-quality seating for commercial spaces. Their famous Aluminum Navy Chair is a classic that remains a staple in both contemporary and traditional Horeca settings. Emeco emphasizes craftsmanship and sustainability, making them a popular choice for eco-conscious hospitality establishments looking for long-lasting, resilient furniture.

Thonet is a historical leader in furniture design, famous for its iconic bentwood chairs. Their reputation for producing elegant and durable pieces has earned them a strong presence in the Horeca Furniture Market. Thonet’s timeless designs appeal to high-end hotels, restaurants, and cafes, where aesthetics and comfort are equally important.

These companies lead the Horeca Furniture Market by providing products that combine design, functionality, and durability, catering to the growing demand for quality, sustainable furniture in the hospitality sector.

Major Companies in the Market

- Kian Contract

- Zuo Modern

- Emeco

- Thonet

- Wiesner-Hager

- Restaurant Furniture Plus

- Grand Rapids Chair Company

- Flash Furniture

- JMH Furniture Solutions

- Gasser Chair Company

Recent Developments

- Angel: On February 2025, at FHA-HoReCa 2024, ANGEL, a global leader in water purification technology, showcased three advanced solutions for F&B water purification, including the C3 Microfiltration, C8 Microfiltration, and U10 Ultrafiltration systems. These innovations were well-received by industry professionals, enhancing ANGEL’s presence in the Asian market and setting the stage for future international growth.

- FHA-HoReCa 2024: On October 2024, FHA-HoReCa 2024, Asia’s leading foodservice and hospitality event, focused on sustainable practices and featured over 800 exhibitors from more than 30 countries, attracting over 45,000 attendees from 70 regions.

Report Scope

Report Features Description Market Value (2024) USD 170.3 Billion Forecast Revenue (2034) USD 267.0 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Chairs, Tables, Sofas, Bar Stools, Booths, Lounge Furniture, Outdoor Furniture), By Material (Wood, Metal, Plastic, Upholstery, Glass), By End-User (Restaurants, Hotels, Cafes, Bars, Catering Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kian Contract, Zuo Modern, Emeco, Thonet, Wiesner-Hager, Restaurant Furniture Plus, Grand Rapids Chair Company, Flash Furniture, JMH Furniture Solutions, Gasser Chair Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kian Contract

- Zuo Modern

- Emeco

- Thonet

- Wiesner-Hager

- Restaurant Furniture Plus

- Grand Rapids Chair Company

- Flash Furniture

- JMH Furniture Solutions

- Gasser Chair Company