Global Goat Milk Derivatives Market By Type (Full Cream Goat Milk Powder, Skimmed Goat Milk Powder, Goat Whey Protein Concentrate, Goat Demineralized Whey Powder, Goat Lactose, and Other Types) By Application (Infant Formula, Cheese, Yogurt, Ice-Cream, and Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 105493

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

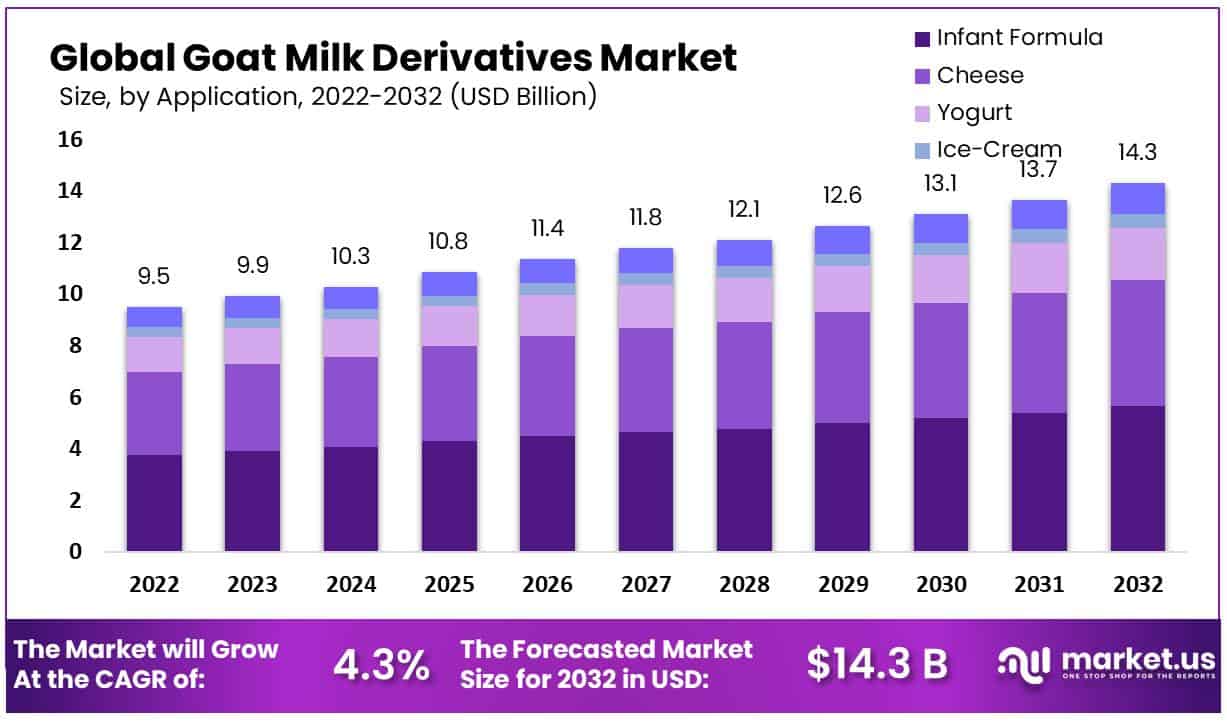

In 2022, the Global Goat Milk Derivatives Market was valued at USD 9.5 Billion, and is expected to reach USD 14.3 Billion in 2032 Between 2023 and 2032, this market is estimated to register a CAGR of 4.3%.

Goat milk derivatives refer to a range of products that are derived from goat’s milk. These products are produced by processing and transforming goat’s milk into various forms that serve different purposes. These derivatives hold unique qualities compared to those sourced from cow milk, making them an appealing choice for consumers.

Goat’s milk is naturally easy to digest because of its smaller fat molecules and lower lactose content, which make it suitable for consumption by individuals who are lactose intolerant. Goat’s milk also contains a higher level of vitamins and minerals such as potassium, vitamin A, and calcium, which are beneficial for bone health. Infant formulas, milk powders, skincare products, yogurts, cheese, and protein concentrate are some examples of goat milk derivatives.

The increasing awareness of dietary preferences and health considerations is a significant driving force behind the global goat milk derivatives market. The demand for goat milk derivatives has increased as more individuals seek alternatives to traditional cow’s milk products due to lactose intolerance, allergies, or perceived health benefits.

Furthermore, the rising interest in natural and organic products has spurred the growth of niche markets, where goat milk derivatives are favored for their perceived purity and minimal processing. This growing consumer awareness, coupled with the nutritional advantages goat milk derivatives offer, positions the market for sustained expansion, driving manufacturers to diversify their offerings and invest in research to meet evolving demands.

Actual Numbers Might Vary in the Final Report.

Key Takeaways

- Market Growth: The global Goat Milk Derivatives Market was valued at USD 9.5 billion in 2022 and is projected to reach USD 14.3 billion by 2032, with an estimated Compound Annual Growth Rate (CAGR) of 4.3% during the period from 2023 to 2032.

- Unique Qualities of Goat Milk: Goat’s milk, from which these derivatives are produced, is naturally easy to digest due to its smaller fat molecules and lower lactose content. It contains higher levels of essential nutrients like potassium, vitamin A, and calcium, making it a preferred choice for individuals with lactose intolerance or those seeking additional health benefits.

- Increasing Demand: Growing awareness of dietary preferences and health considerations is a major driver of the global goat milk derivatives market. Consumers are seeking alternatives to traditional cow’s milk products, driven by lactose intolerance, allergies, and perceived health advantages.

- Natural and Organic Products: The rising interest in natural and organic products has contributed to the growth of niche markets where goat milk derivatives are favored for their perceived purity and minimal processing. This shift in consumer awareness positions the market for sustained expansion.

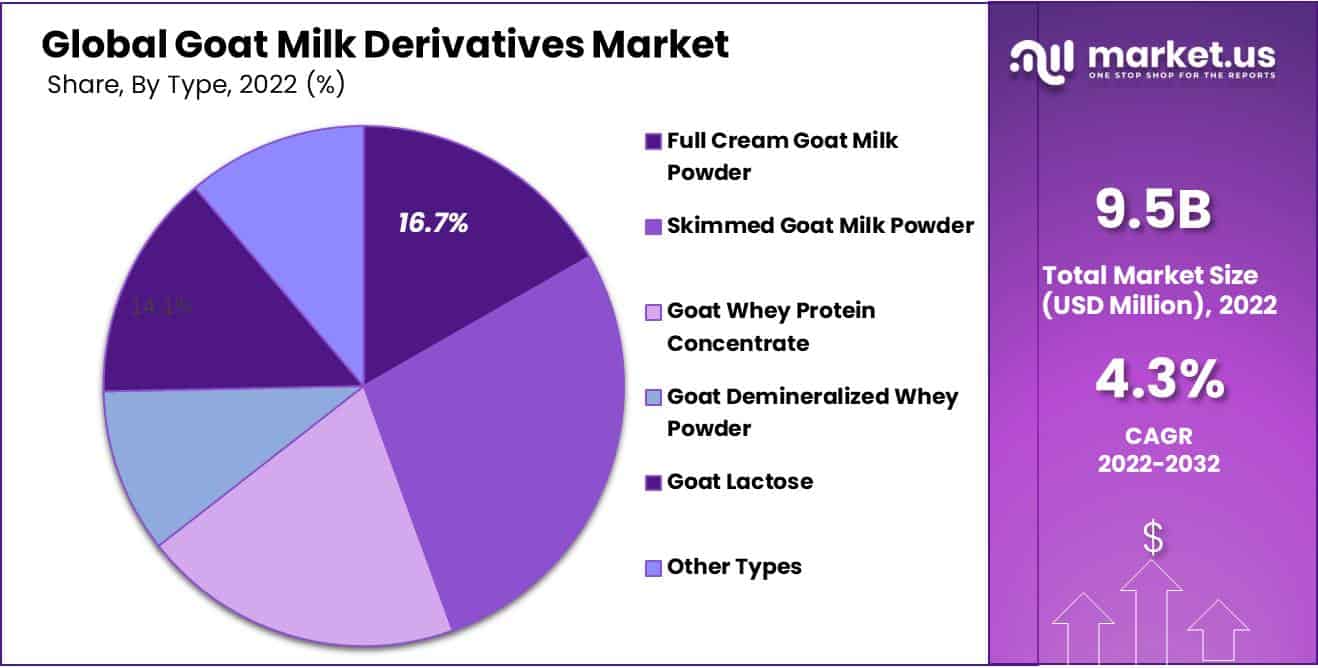

- Skimmed Goat Milk Powder Dominance: Among the types of goat milk derivatives, skimmed goat milk powder held the largest market share in 2022, at 27.7%. This is due to the increasing global focus on health and nutrition, as consumers seek dairy products with reduced fat content.

- Goat Whey Protein Concentrate: The goat whey protein concentrate segment was the second dominant segment in the market, with a market share of 20% in 2022. This is driven by the increasing demand for protein-rich alternatives and the unique nutritional profile of goat whey protein.

- Infant Formula Market: Infant formula was the most lucrative application segment in 2022, with a market share of 39.5%. Goat milk-derived infant formula is in high demand due to its digestibility and suitability for infants with sensitive digestive systems.

- Cheese Segment: Cheese emerged as the second dominant application segment in the global goat milk derivatives market, with a market share of 34.1% in 2022. Goat cheese’s distinct flavor profile and nutritional benefits have contributed to its popularity in culinary applications.

- Market Drivers: Two key drivers of the market are the rising awareness of lactose intolerance and the nutritional superiority of goat milk over cow’s milk. Goat milk contains higher levels of essential nutrients, making it an attractive option for health-conscious consumers.

- Supply Chain Challenges: The market faces supply chain vulnerabilities and seasonality due to the influence of environmental factors on goat milk production. This can lead to inconsistent supply and hindered market growth.

- Limited Awareness: The limited awareness and consumer familiarity with goat milk derivatives compared to traditional cow milk derivatives present a significant restraint in the market. Educational campaigns are needed to overcome these barriers.

- Sustainability Trend: The market is witnessing a trend towards sustainability and eco-conscious production, with producers adopting sustainable farming practices, environmentally friendly sourcing, and eco-friendly packaging options.

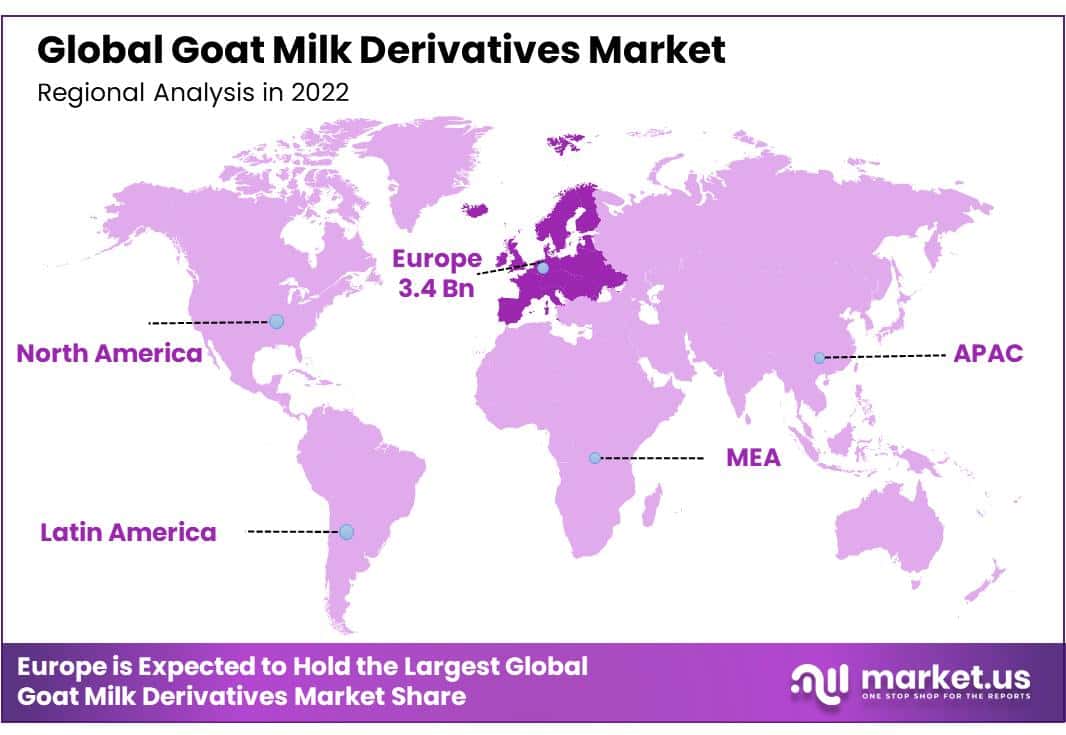

- Regional Dominance: Europe held the leading position in the global market in 2022, with a market share of 34.4%, due to its historical connection to goat farming, advanced dairy processing infrastructure, and consumer preferences for organic and natural foods.

- North America’s Growth: North America emerged as the second dominant segment in the global goat milk derivatives market, with a market share of 25.6% in 2022, driven by health-conscious consumers and the popularity of niche dairy products like goat cheese and yogurt.

- Key Players: Major players in the market include Saputo Inc., Emmi AG, Hoogwegt Group B.V, Ausnutria Dairy Corp. Ltd, Prolactal Gmbh, and more. They focus on product innovation, geographic expansion, and sustainability.

Type Analysis

The Skimmed Goat Milk Powder Segment Held the Largest Market Share in 2022 Due to an Increasing Global Focus on Health and Nutrition.

Based on Type, the goat milk derivatives market is segmented into full cream goat milk powder, skimmed goat milk powder, goat whey protein concentrate, goat demineralized whey powder, goat lactose, and other types. Among these types, the skimmed goat milk powder segment was the most lucrative in the global goat milk derivatives market, with a market share of 27.7% in 2022.

The dominance can be attributed to the increasing global focus on health nutrition and consumers seeking dairy products with reduced fat content. Skimmed Goat Milk Powder fits this trend perfectly, offering the goodness of goat milk while minimizing fat intake. Its versatility and potential integration into various dietary lifestyles, including weight management and wellness regimes, further contribute to its market dominance.

The rise of lactose intolerance awareness has also bolstered the demand for skimmed goat milk products. Several individuals who experience lactose sensitivity find skimmed goat milk a palatable alternative, as removing fat often reduces lactose content. This has fueled its adoption among a broader consumer base, driving market growth.

Goat whey protein concentrate has emerged as the second dominant segment in the global goat milk derivatives market, with a market share of 20.0% in 2022. Consumers increasingly prioritize health and fitness, seeking protein-rich alternatives to meet dietary needs.

Being a potent source of essential amino acids and bioactive peptides, goat whey protein concentrate aligns well with these trends. It boasts a high biological value, aiding muscle recovery and overall well-being. Furthermore, the distinctive flavor profile of goat whey protein has a variety of applications, including sports nutrition products, protein shakes, bars, and functional foods, broadening its market appeal.

Application Analysis

The Infant Formula Segment Held the Largest Market Share in 2022 Due to Goat Milk’s Suitability for Sensitive Digestive Systems and Growing Awareness of its Nutritional Benefits

Based on application, the goat milk derivatives market is segmented into infant formula, cheese, yogurt, ice cream, and other applications. Among these applications, infant formula was the most lucrative in the global goat milk derivatives market, with a market share of 39.5% in 2022.

Infant formula, as a category, holds immense importance due to its critical role in providing nutrition for infants who may have sensitivities. Goat milk, known for its digestibility and similarity to human milk, is an alternative that suits the delicate digestive systems of many infants. Furthermore, goat milk-derived infant formula has gained popularity due to its potential to alleviate issues such as colic and eczema, often associated with cow’s milk allergies.

This has led to a heightened preference among parents and caregivers for goat milk-based options. Additionally, the increasing awareness of the nutritional benefits of goat milk, including its richness in essential nutrients and proteins, has bolstered the demand for goat milk-derived infant formulas. The expanding trend of natural and organic products in the baby food segment has also played a role, as goat milk aligns well with these preferences.

Cheese has emerged as the second dominant segment in the global goat milk derivatives market, with a market share of 34.1% in 2022. Goat cheese has gained recognition for its distinct flavor profile, nutritional benefits, and versatility in culinary applications. The culinary world has embraced goat cheese’s adaptability in various dishes, from salads to gourmet recipes.

Its crumbly texture and rich taste make it an ideal ingredient for both savory and sweet preparations. This culinary flexibility has expanded its presence beyond specialty cheese shops to restaurants, cafes, and even home kitchens. Moreover, health-conscious consumers also find goat cheese appealing due to its relatively lower cholesterol and calorie content than some cow’s milk cheeses.

Actual Numbers Might Vary in the Final Report

Key Market Segments

Based on the Type

- Full Cream Goat Milk Powder

- Skimmed Goat Milk Powder

- Goat Whey Protein Concentrate

- Goat Demineralized Whey Powder

- Goat Lactose

- Other Types

Based on Application

- Infant Formula

- Cheese

- Yogurt

- Ice-Cream

- Other Applications

Drivers

Rising Lactose Intolerance Awareness

Growing awareness of lactose intolerance is a significant driver for the global goat milk derivatives market. Many individuals struggle to digest cow’s milk due to lactose intolerance, prompting them to seek alternative dairy sources. Goat milk and its derivatives contain lower levels of lactose, making them an easily digestible option.

Consumers turn to goat milk derivatives such as goat cheese, yogurt, and milk-based products as this awareness spreads. The demand for these alternatives drives market growth, with manufacturers expanding their offerings to cater to health-conscious individuals who are keen on avoiding lactose-related discomfort.

Nutritional Superiority

The nutritional superiority of goat milk over cow’s milk is another key driver behind the growth of the global goat milk derivatives market. Goat milk is naturally rich in vitamins, minerals, and proteins, making it a valuable nutritional source.

It contains higher levels of nutrients like calcium, potassium, and vitamin A compared to cow’s milk. These nutritional qualities have piqued the interest of health-conscious consumers looking for products that balance taste and wellness benefits.

Restraints

Supply Chain Vulnerabilities and Seasonality

The global goat milk derivatives market faces a significant restraint due to supply chain vulnerabilities and seasonality. Unlike cow’s milk, goat milk production is influenced by seasonal factors and geographical limitations. Goats are more sensitive to environmental changes and require specific conditions for optimal milk yield. This makes the supply of goat milk derivatives inconsistent throughout the year and across different regions.

Moreover, the limited number of dairy goats compared to cows contributes to supply challenges. The market’s reliance on small-scale goat farmers further intensifies these issues, as they may lack resources for advanced farming techniques and efficient year-round production. These supply chain vulnerabilities and seasonality constraints can result in fluctuating prices, product shortages, and hindered market growth.

Limited Awareness and Consumer Familiarity

Another significant restraint facing the global goat milk derivatives market is the limited awareness and consumer familiarity with these products compared to traditional cow milk derivatives. While cow milk products have been staples for generations, goat milk derivatives are relatively novel to many consumers. This lack of awareness can lead to skepticism and hesitation among potential buyers, hindering the market’s growth.

Additionally, misconceptions about taste, texture, and nutritional value can further deter consumers from exploring goat milk derivatives as viable alternatives. Overcoming these barriers requires comprehensive educational campaigns to dispel myths and showcase the benefits of goat milk derivatives, enabling consumers to make informed choices.

Opportunity

Expanding Applications in Functional Foods

Research indicates that goat milk contains bioactive compounds such as oligosaccharides, peptides, and fatty acids that may contribute to improved gut health, immune modulation, and inflammation reduction. These properties present a unique opportunity to develop functional foods targeting digesting wellness, immune system support, and other health-related benefits.

As consumer demand for natural and alternative sources of nutrition grows, goat milk derivatives can find their place in various functional food categories, including probiotic-enriched yogurts, protein bars, and dietary supplements. By capitalizing on the distinct advantages of goat milk, manufacturers can tap into a niche market segment, catering to health-conscious individuals seeking specialized functional foods that align with their nutritional preferences and requirements.

Trends

Shift Towards Sustainability

The global goat milk derivatives market has witnessed a distinct trend towards sustainability and eco-conscious production. Driven by increasing consumer demand for transparent and environmentally friendly sourcing, producers are now adopting sustainable farming practices, ensuring the well-being of goats and reducing their carbon footprint.

This is not only limited to farming but also packaging and transportation. Reusable and biodegradable packaging options have become more prevalent. Furthermore, there’s a marked emphasis on local production and distribution to reduce transportation emissions. This shift is not just an eco-conscious move but also positions brands positively in the eyes of environmentally-aware consumers.

Regional Analysis

Europe is the Dominant Region in the Global Goat Milk Derivatives Market in 2022.

In 2022, Europe held the leading position in the global market, with a significant market share of 34.4%. Europe’s dominance in the global goat milk derivatives market can be attributed to historical, cultural, and economic factors. Historically, goat farming has deep roots in several European countries, with established practices for producing high-quality goat milk and its derivatives.

This has been complemented by the region’s rich culinary traditions, where goat cheese and other products have been integral for centuries. Additionally, Europe boasts advanced dairy processing infrastructure and stringent quality control measures, ensuring premium-grade products reach consumers.

Furthermore, European consumers’ rising demand for organic and natural foods has led to an increased preference for goat milk derivatives, known for their nutritional benefits. Lastly, European producers’ well-established trade routes and marketing strategies have ensured a consistent global presence. Thus, Europe’s historical connection, infrastructural advantages, and consumer preferences have cemented its goat milk derivatives market.

North America has emerged as the second dominant segment in the global goat milk derivatives market, with a market share of 25.6% in 2022. North America has witnessed an uptick in health-conscious consumers who are perpetually seeking healthier dairy alternatives, and goat milk derivatives, with their touted nutritional benefits, align perfectly with this demand.

Furthermore, the proliferation of gourmet and artisanal products in the U.S. and Canada has amplified the appeal of niche dairy products like goat cheese and yogurt. The region also benefits from a robust distribution infrastructure, making the accessibility and availability of these products easier for consumers. Additionally, marketing efforts and the overall positive perception surrounding the health benefits of goat milk, compared to cow milk, have played a significant role in shaping consumer preferences.

Actual Numbers Might Vary in the Final Report.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the market include Saputo Inc, Emmi AG, Hoogwegt Group B.V, Ausnutria Dairy Corp. Ltd, Prolactal Gmbh, and more. They focus on product innovation, developing new and varied products such as flavored goat milk beverages and goat milk-based skincare items. Expanding geographic reach through partnerships and acquisitions has been another tactic, helping to tap into emerging markets.

Emphasis on organic and sustainably sourced goat milk products caters to the eco-conscious consumer. Efforts towards strengthening supply chain efficiency and marketing campaigns, particularly emphasizing the health benefits of goat milk over cow milk, are also evident.

Market Key Players

- Saputo Inc.

- Emmi AG

- Hoogwegt Group B.V

- Ausnutria Dairy Corp. Ltd.

- Prolactal Gmbh

- Capriole, Inc.

- Meyenberg

- Happy Days Dairies Ltd.

- Goat Partners International

- CapriLac

- Jovie USA

- Boss Nation Brands Inc.

- Other Key Players

Recent Developments

March 2023 – ObvioHealth, IQVIA Consumer Health, and Jovie USA Launch Innovative At-Home Trial to Bring First Goat Milk-Based Infant Formula to the United States.

July 2023 – Boss Nation Brands Inc. launched new flavors of its Farm Fresh Raw Goat Milk product for pets.

July 2023 – The Montchevre brand from Saputo Cheese USA Inc. launched its new sweet and savory goat cheese flavors.

Report Scope

Report Features Description Market Value (2022) USD 9.5 Bn Forecast Revenue (2032) USD 14.3 Bn CAGR (2023-2032) 4.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Full Cream Goat Milk Powder, Skimmed Goat Milk Powder, Goat Whey Protein Concentrate, Goat Demineralized Whey Powder, Goat Lactose, and Other Types), By Application (Infant Formula, Cheese, Yogurt, Ice-Cream, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Saputo Inc., Emmi AG, Hoogwegt Group B.V, Ausnutria Dairy Corp. Ltd., Prolactal Gmbh, Capriole, Inc., Meyenberg, Happy Days Dairies Ltd., Goat Partners International, CapriLac, Jovie USA, Boss Nation Brands Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Goat Milk Derivatives MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Goat Milk Derivatives MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Saputo Inc.

- Emmi AG

- Hoogwegt Group B.V

- Ausnutria Dairy Corp. Ltd.

- Prolactal Gmbh

- Capriole, Inc.

- Meyenberg

- Happy Days Dairies Ltd.

- Goat Partners International

- CapriLac

- Jovie USA

- Boss Nation Brands Inc.

- Other Key Players