Global Wind Energy Equipment Market Size, Share, Growth Analysis Report By Equipment Type (Turbines, Towers, Blades, Control Systems, Gearboxes, Generators, Others), By Size of Wind Farms (Small-Scale Wind Farms, Medium-Scale Wind Farms, Large-Scale Wind Farms), By Technology Type (Horizontal Axis Wind Turbines (HAWTs), Vertical Axis Wind Turbines (VAWTs), Floating Wind Turbines, Hybrid Systems), By Location (Onshore, Offshore), By End Use (Utility Companies, Independent Power Producers (IPPs), Govement Agencies, Commercial and Industrial Entities, Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143407

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

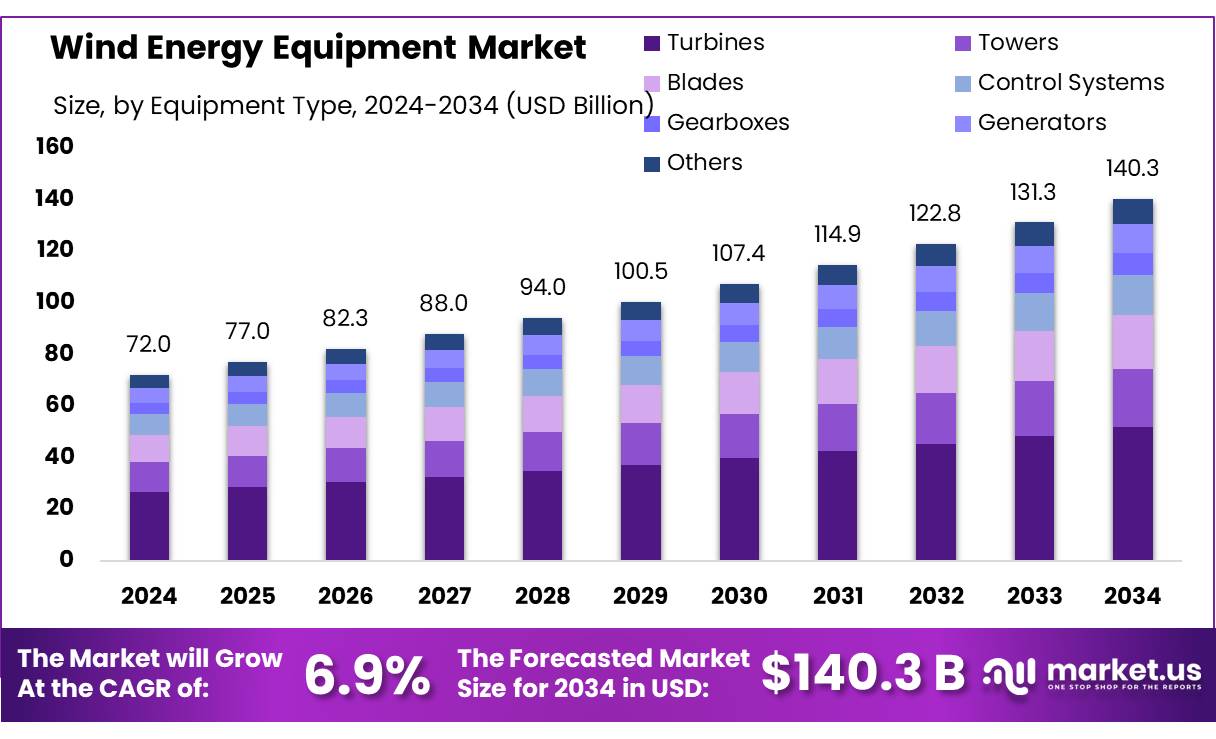

The Global Wind Energy Equipment Market size is expected to be worth around USD 140.3 Bn by 2034, from USD 72.0 Bn in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The wind energy equipment sector plays a pivotal role in the global transition to renewable energy, encompassing the design, manufacturing, installation, and maintenance of wind turbines and associated technologies. This sector includes key components such as turbines, blades, towers, gearboxes, generators, and control systems, all essential for harnessing wind power efficiently.

The wind energy industry has experienced remarkable growth over the past two decades, driven by technological advancements, economies of scale, and supportive government policies. Since 2000, wind power capacity has increased at an average CAGR of more than 21%, with cumulative installed capacity reaching 542 GW by the end of 2018. In 2023, the industry set a new record by installing 117 GW of new capacity, a 50% increase from the previous year. China led this expansion, installing 75 GW, accounting for nearly 65% of global installations.

Government Policies and Incentives Supportive policies, including tax credits, subsidies, and renewable energy targets, have been instrumental in promoting wind energy adoption. For example, the U.S. Investment Tax Credit (ITC) and Production Tax Credit (PTC) have significantly reduced financial barriers for wind energy projects.

Government Policies and Incentives Supportive policies, including tax credits, subsidies, and renewable energy targets, have been instrumental in promoting wind energy adoption. For example, the U.S. Investment Tax Credit (ITC) and Production Tax Credit (PTC) have significantly reduced financial barriers for wind energy projects.Cost Competitiveness: The levelized cost of electricity (LCOE) for wind power has declined, making it a viable alternative to conventional energy sources. In 2021, unsubsidized wind-generated electricity costs ranged from $26 to $50 per MWh, competing favorably with new gas power plants.

Key Takeaways

- Wind Energy Equipment Market size is expected to be worth around USD 140.3 Bn by 2034, from USD 72.0 Bn in 2024, growing at a CAGR of 6.9%.

- Turbines held a dominant market position, capturing more than a 37.20% share of the global wind energy equipment market.

- Medium-Scale Wind Farms held a dominant market position, capturing more than a 42.30% share.

- Horizontal Axis Wind Turbines (HAWTs) held a dominant market position, capturing more than a 67.30% share.

- Onshore held a dominant market position, capturing more than a 78.20% share of the wind energy equipment market.

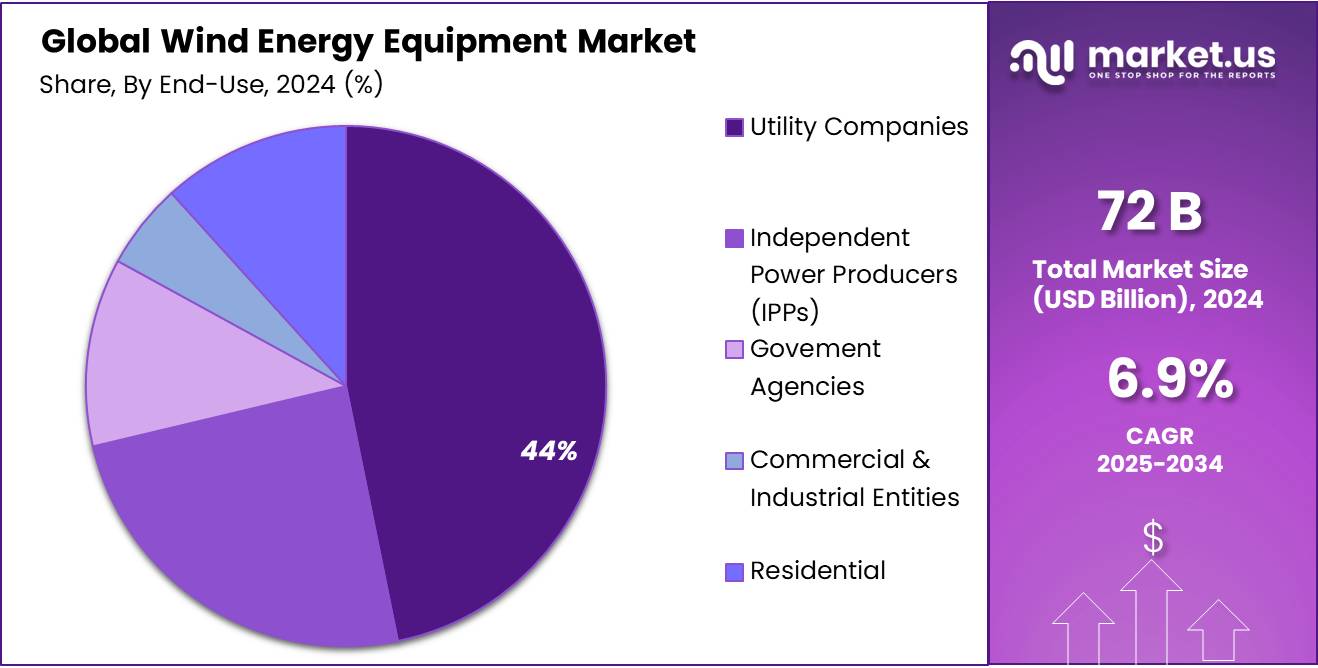

- Utility Companies held a dominant market position, capturing more than a 44.60% share of the wind energy equipment market.

By Equipment Type

Turbines dominate with 37.20% share in the Wind Energy Equipment Market

In 2024, Turbines held a dominant market position, capturing more than a 37.20% share of the global wind energy equipment market. This segment is expected to maintain its lead in the coming years, as turbines are the core component in wind energy generation, and the growing demand for renewable energy continues to drive the market. The rise in global wind energy installations, along with technological advancements in turbine design, efficiency, and size, is expected to further bolster their dominance.

The trend is expected to continue in 2025, with turbines maintaining a significant portion of the market share. This is driven by increasing investments in renewable energy infrastructure, which are focused on expanding wind energy capacity worldwide. The demand for larger, more efficient turbines also plays a key role in sustaining their market leadership. As nations and companies focus on reducing carbon emissions, wind energy continues to be a preferred source, contributing to the growth of turbine demand and market share.

By Size of Wind Farms

Medium-Scale Wind Farms lead with 42.30% share in the Wind Energy Equipment Market

In 2024, Medium-Scale Wind Farms held a dominant market position, capturing more than a 42.30% share of the global wind energy equipment market. This segment’s strong performance can be attributed to the growing interest in medium-sized projects, which strike a balance between cost efficiency and energy output. As many countries focus on diversifying their energy sources, medium-scale wind farms offer a feasible solution for regions looking to expand renewable energy capacity without the massive investment required for large-scale projects.

Looking ahead to 2025, the medium-scale wind farm sector is expected to maintain its strong market share. This is driven by a rising number of initiatives, particularly in developing countries, where the scale of large wind farms may be too costly or impractical. As the technology continues to improve and become more affordable, medium-scale wind farms are likely to remain a popular choice for both commercial and government-backed renewable energy projects.

By Technology Type

Horizontal Axis Wind Turbines (HAWTs) dominate with 67.30% share in the Wind Energy Equipment Market

In 2024, Horizontal Axis Wind Turbines (HAWTs) held a dominant market position, capturing more than a 67.30% share of the wind energy equipment market. HAWTs are the most widely used type of wind turbine due to their high efficiency and performance in a variety of wind conditions. Their proven technology, which has been in use for decades, continues to be favored by developers for large-scale wind farm projects around the world. The ability of HAWTs to harness wind energy efficiently, especially in offshore and onshore wind farms, is a key factor behind their strong market presence.

Looking forward to 2025, HAWTs are expected to maintain their leading position in the market. This trend is largely driven by continued improvements in turbine design, increased energy output, and enhanced reliability. With the ongoing global focus on expanding renewable energy sources, the dominance of Horizontal Axis Wind Turbines is likely to persist as they remain the preferred choice for the majority of wind energy projects.

By Location

Onshore leads with 78.20% share in the Wind Energy Equipment Market

In 2024, Onshore held a dominant market position, capturing more than a 78.20% share of the wind energy equipment market. Onshore wind farms have been the primary choice for wind energy developers due to their lower installation and maintenance costs compared to offshore projects. The accessibility of land, coupled with improvements in turbine technology, has made onshore wind farms a cost-effective and viable option for large-scale energy production. The growth in onshore wind farms is also supported by favorable government policies and increasing investments in renewable energy infrastructure.

This trend is expected to continue into 2025, with onshore wind farms maintaining their significant market share. The increased focus on renewable energy adoption and the expansion of wind farms in both developed and emerging markets will ensure onshore wind energy remains the dominant choice. As technology evolves and wind turbines become more efficient, onshore wind farms are likely to continue to play a leading role in global efforts to reduce carbon emissions and meet energy demands.

By End Use

Utility Companies dominate with 44.60% share in the Wind Energy Equipment Market

In 2024, Utility Companies held a dominant market position, capturing more than a 44.60% share of the wind energy equipment market. This strong market share reflects the growing role of utility companies in the global push toward renewable energy. Utility companies are increasingly investing in wind energy to diversify their energy portfolios and meet renewable energy targets. Wind farms provide a stable and scalable source of clean energy, making them an attractive investment for utilities that are transitioning away from fossil fuels.

Looking ahead to 2025, the demand from utility companies is expected to remain strong, with their market share likely to stay dominant. As governments around the world continue to set ambitious renewable energy goals, utility companies will continue to be major players in the expansion of wind energy infrastructure. Their large-scale investments and the ongoing development of wind farms will ensure their continued leadership in the sector.

Key Market Segments

By Equipment Type

- Turbines

- Towers

- Blades

- Control Systems

- Gearboxes

- Generators

- Others

By Size of Wind Farms

- Small-Scale Wind Farms

- Micro Wind Turbines

- Mini Wind Turbines

- Household-size Wind Turbines

- Medium-Scale Wind Farms

- Large-Scale Wind Farms

By Technology Type

- Horizontal Axis Wind Turbines (HAWTs)

- Vertical Axis Wind Turbines (VAWTs)

- Floating Wind Turbines

- Hybrid Systems

By Location

- Onshore

- Offshore

By End Use

- Utility Companies

- Independent Power Producers (IPPs)

- Govement Agencies

- Commercial & Industrial Entities

- Residential

Drivers

Government Policies and Incentives

Government initiatives and incentives play a pivotal role in driving the growth of the wind energy equipment market. Policies such as tax credits, grants, and loan programs significantly reduce financial barriers for companies investing in wind energy technologies. For instance, the U.S. federal government offers the Production Tax Credit (PTC) and Investment Tax Credit (ITC), which allow taxpayers to deduct a percentage of the cost of renewable energy systems from their federal taxes.

These incentives have led to substantial investments in the sector. The Inflation Reduction Act of 2022, for example, introduced expanded clean energy incentives, spurring significant project development in renewable energy, including wind power. In 2024, the U.S. installed a record 50 gigawatts of new solar capacity, with wind energy also experiencing notable growth.

Similarly, China has demonstrated a strong commitment to renewable energy, installing a record 357 gigawatts of wind and solar power in 2024, surpassing its renewable energy target for 2030 six years ahead of schedule. This rapid expansion is supported by favorable policies and substantial investments, positioning China as a leader in the global energy transition.

Restraints

High Capital and Operational Costs

One of the primary challenges hindering the widespread adoption of wind energy is the substantial capital and operational expenses associated with wind energy equipment. Establishing wind farms, particularly offshore installations, requires significant initial investments in turbines, infrastructure, and technology. For instance, offshore wind developments face formidable challenges, including the need for structures built to withstand harsh ocean climates, erosion, and corrosion.

The financial burden extends beyond initial setup; ongoing operational costs also pose significant challenges. Rising material costs, especially for steel used in turbine construction, have further strained budgets. In 2022, steel prices surged by 86% in the U.S. and 53% in Europe, directly impacting wind turbine manufacturers.

These economic challenges are not limited to manufacturers; they also affect project developers and investors. The high costs associated with wind energy projects have led to financial uncertainties, causing some projects to be delayed or canceled. For example, the New Jersey offshore wind project, Leading Light Wind, sought a second delay due to difficulties in finding manufacturers for crucial turbine equipment and dealing with ongoing market price volatility.

Addressing these financial challenges is crucial for the sustainable growth of the wind energy sector. Potential solutions include technological innovations to reduce manufacturing costs, economies of scale through larger installations, and supportive government policies that provide financial incentives and subsidies. Such measures are essential to make wind energy a more economically viable and competitive alternative to traditional energy sources.

Opportunity

Government Incentives Propel Growth in Wind Energy Equipment Manufacturing

A significant growth opportunity for the wind energy equipment sector lies in the robust government incentives aimed at promoting renewable energy. These incentives not only reduce the financial burden on manufacturers but also stimulate investment and innovation within the industry.

In the United States, the Inflation Reduction Act of 2022 introduced substantial tax credits for clean energy manufacturing. The Act provides a 30% Investment Tax Credit (ITC) for eligible renewable energy projects, including wind energy systems. This credit is available to businesses that commence construction on wind energy projects by December 31, 2024.

Beyond the U.S., global initiatives are fostering wind energy development. The European Union’s Net-Zero Industry Act aims to bolster clean tech investments and localize production, enhancing competitiveness against subsidies from other regions. This act is part of a broader strategy to attract investment and support ambitious offshore wind projects, including foreign investments in wind turbine manufacturing facilities.

China’s involvement further underscores the sector’s potential. The Chinese government is investing £60 million to establish wind turbine manufacturing facilities in Scotland, aiming to serve North Sea offshore wind farms. This initiative highlights China’s commitment to expanding its footprint in the global wind energy market.

Trends

Integration of Digital Technologies Enhances Wind Energy Equipment Efficiency

A notable trend in the wind energy sector is the integration of digital technologies, such as digital twins and advanced data analytics, to enhance the efficiency and performance of wind energy equipment. Digital twins—a virtual representation of physical assets—enable real-time monitoring and optimization of wind turbines, leading to improved operational efficiency and reduced maintenance costs. The NorthWind project, supported by the Research Council of Norway, exemplifies this advancement by developing digital twins for wind farms to forecast performance and inform decision-making.

Moreover, the U.S. Department of Energy’s Wind Energy Technologies Office has been instrumental in advancing wind energy research, focusing on areas such as wind atmospheric science and turbine system optimization. Their 2024 report highlights significant achievements in these domains, contributing to the overall growth and efficiency of the wind energy sector.

Regional Analysis

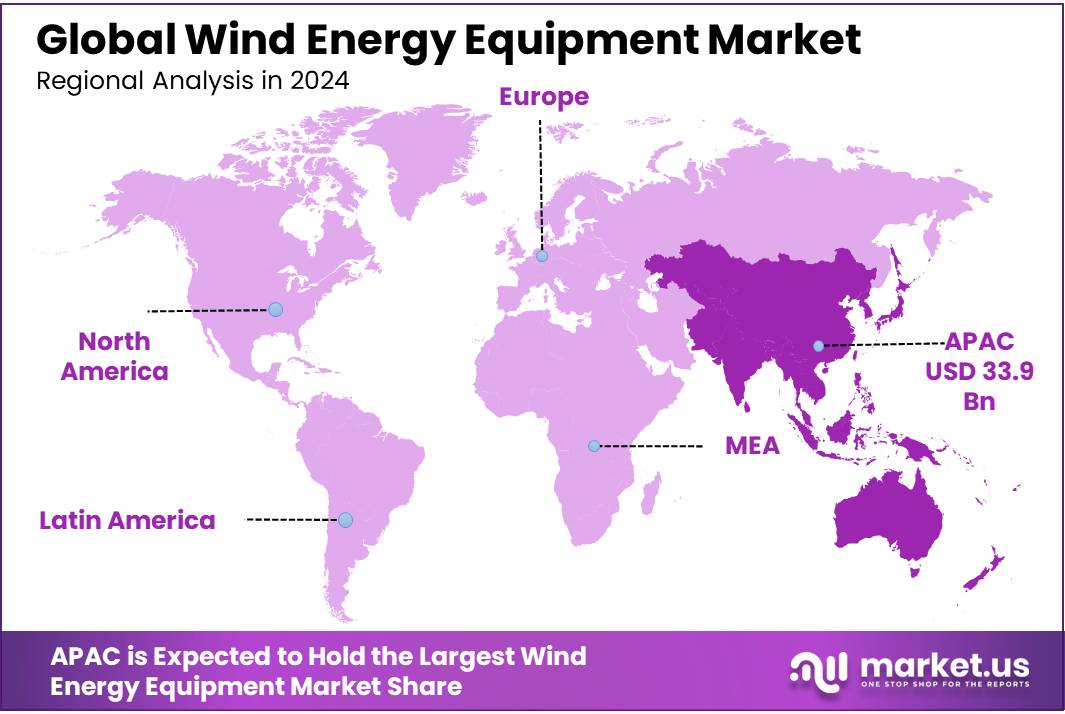

APAC Dominates with 47.20% Share, Valued at $33.9 Billion in the Wind Energy Equipment Market

In 2024, the Asia-Pacific (APAC) region held a dominant position in the wind energy equipment market, capturing more than 47.20% of the market share, valued at approximately $33.9 billion. This growth is primarily driven by significant investments in renewable energy infrastructure, particularly in China and India, which are leading the charge in wind energy development in the region. China remains the global leader in both onshore and offshore wind installations, contributing to a large portion of the region’s wind energy capacity. In 2023, China installed over 30 gigawatts of new wind power capacity, making up around 50% of global installations for that year.

India, another major player in the APAC region, is also witnessing rapid growth in its wind energy sector. In 2024, India’s total wind energy capacity surpassed 42 GW, with ongoing projects expected to significantly increase this number in the coming years.

The growing emphasis on renewable energy to reduce carbon emissions and enhance energy security has prompted substantial government policies and financial incentives, further boosting the demand for wind energy equipment in the region. APAC’s favorable climate conditions, cost-effective manufacturing capabilities, and rapidly advancing wind turbine technology contribute to its strong position in the global market. As governments continue to support green energy transitions, the APAC region is poised to maintain its dominant market share in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB is a key player in the wind energy equipment market, providing innovative electrical solutions, including grid connection technologies, and automation systems. The company’s expertise in power generation and transmission helps enhance the efficiency of wind energy systems. ABB focuses on delivering products that improve the integration of renewable energy into grids, supporting the expansion of wind energy infrastructure globally.

China Ming Yang Wind Power Group Limited is a leading Chinese wind turbine manufacturer, known for producing highly efficient wind turbines for both onshore and offshore projects. The company has developed large-scale wind turbine systems and is expanding its operations internationally. It plays a critical role in China’s renewable energy initiatives and has contributed significantly to the country’s wind power capacity.

ENERCON GmbH, based in Germany, is renowned for its technologically advanced wind turbines. The company specializes in the design, manufacture, and installation of wind energy systems, particularly focusing on high-efficiency turbine technology. ENERCON is recognized for its innovative approaches in wind turbine design and has a strong presence in the European and international markets.

General Electric (GE) is a major player in the global wind energy equipment market, with a diverse portfolio of wind turbines for both onshore and offshore projects. GE’s renewable energy solutions are known for their high performance, efficiency, and cutting-edge technology. The company’s turbines are widely used worldwide, making it one of the most influential companies in advancing wind energy technology.

Top Key Players

- ABB

- China Ming Yang Wind Power Group Limited

- Eaton

- ENERCON GmbH

- GENERAL ELECTRIC

- Goldwind

- Ingeteam

- NORDEX SE

- Phoenix Contact

- S&C Electric

- Shanghai Electric

- Siemens Gamesa Renewable Energy, S.A

- Sinovel Wind Group Co., Ltd

- Sulzer

- Sungrow Power Supply

- Ventus

- VEO

- Vestas

Recent Developments

ABB reported full-year 2024 revenues of $32.9 billion, a 2% increase from the previous year, with operating EBITA reaching $5.97 billion, reflecting a 10% year-on-year growth. These developments underscore ABB’s commitment to advancing wind energy technologies and solidifying its leadership in the renewable energy sector.

In 2024, Eaton reported record sales of $24.9 billion, a 7% increase from 2023, with organic sales rising by 8%. Notably, the company’s data center segment experienced remarkable growth of 35% in 2024, now accounting for 14% of its revenues.

In the first half of 2024 Ming Yang Smart Energy Group Limited, reported revenues of approximately CNY 11.8 billion, marking an increase from CNY 10.6 billion during the same period in 2023.

Report Scope

Report Features Description Market Value (2024) USD 72.0 Bn Forecast Revenue (2034) USD 140.3 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Turbines, Towers, Blades, Control Systems, Gearboxes, Generators, Others), By Size of Wind Farms (Small-Scale Wind Farms, Medium-Scale Wind Farms, Large-Scale Wind Farms), By Technology Type (Horizontal Axis Wind Turbines (HAWTs), Vertical Axis Wind Turbines (VAWTs), Floating Wind Turbines, Hybrid Systems), By Location (Onshore, Offshore), By End Use (Utility Companies, Independent Power Producers (IPPs), Govement Agencies, Commercial and Industrial Entities, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, China Ming Yang Wind Power Group Limited, Eaton, ENERCON GmbH, GENERAL ELECTRIC, Goldwind, Ingeteam, NORDEX SE, Phoenix Contact, S&C Electric, Shanghai Electric, Siemens Gamesa Renewable Energy, S.A, Sinovel Wind Group Co., Ltd, Sulzer, Sungrow Power Supply, Ventus, VEO, Vestas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wind Energy Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Wind Energy Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- China Ming Yang Wind Power Group Limited

- Eaton

- ENERCON GmbH

- GENERAL ELECTRIC

- Goldwind

- Ingeteam

- NORDEX SE

- Phoenix Contact

- S&C Electric

- Shanghai Electric

- Siemens Gamesa Renewable Energy, S.A

- Sinovel Wind Group Co., Ltd

- Sulzer

- Sungrow Power Supply

- Ventus

- VEO

- Vestas