Global Wastewater Treatment Services Market Size, Share Analysis Report By Service Type (Operation and Maintenance, Design and Engineering Consultancy, Project Management Consultancy, Process Control, Others), By Application (Industrial Wastewater, Residential Wastewater, Commercial Wastewater) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153380

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

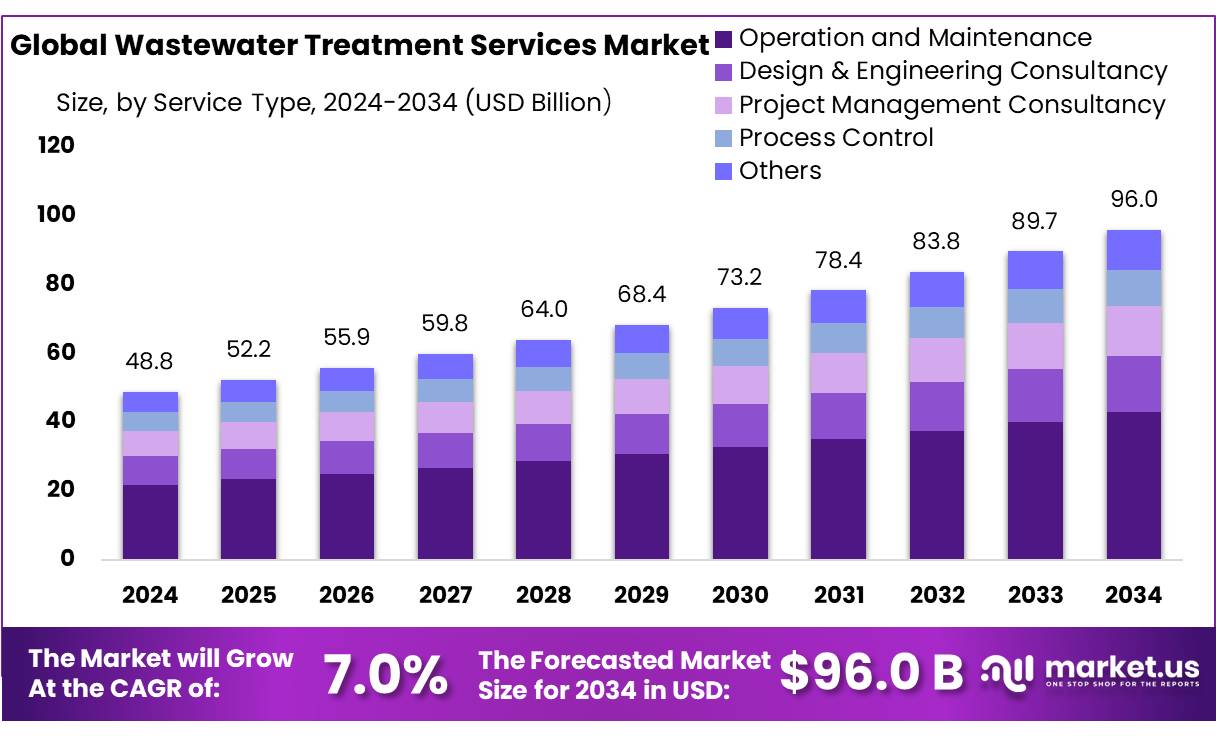

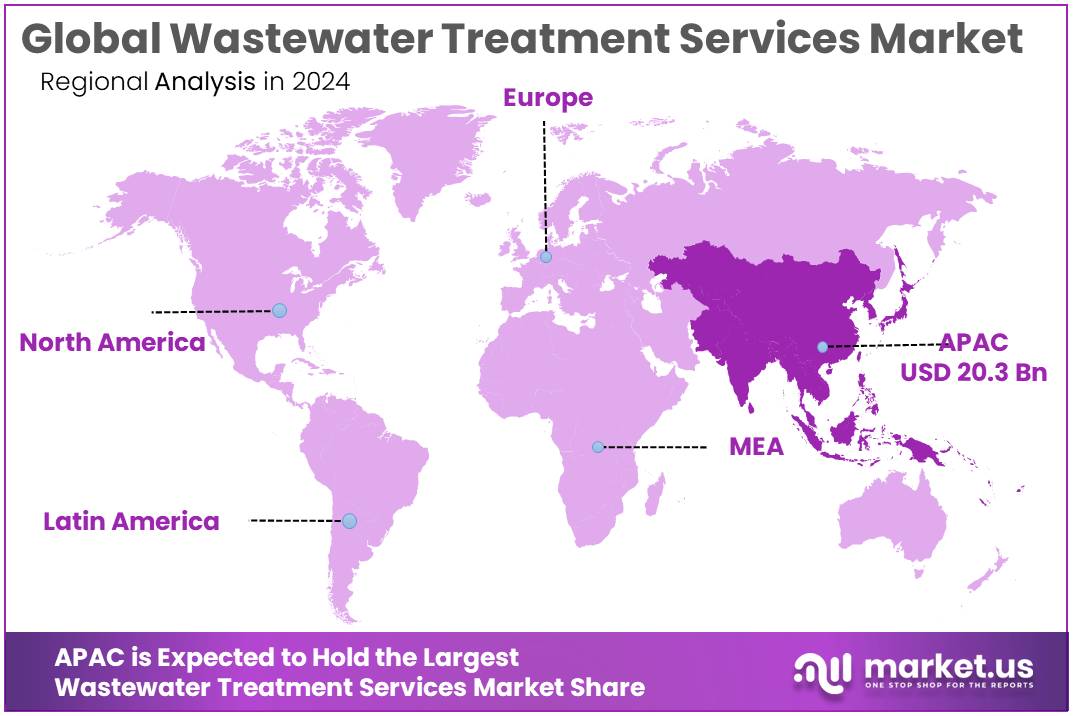

The Global Wastewater Treatment Services Market size is expected to be worth around USD 96.0 Billion by 2034, from USD 48.8 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 41.8% share, holding USD 20.3 Billion revenue.

The global Wastewater Treatment Services industry is characterized by robust demand, significant public-sector engagement, and strong future prospects. Concentrated services—such as design and engineering consulting, process control, maintenance, and operation—comprise a vital segment of water infrastructure, especially in urban and industrial domains. These services underpin critical environmental compliance and public health protection.

Government initiatives play a pivotal role in shaping the wastewater treatment landscape. The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) 2.0 mandates that cities with populations exceeding 100,000 recycle a minimum of 20% of their wastewater. Under the Namami Gange Programme, the government has sanctioned 161 sewage management projects at an estimated cost of ₹24,581 crore, aiming to create and rehabilitate 5,501 million liters per day (MLD) of sewage treatment capacity and lay 5,134 km of sewerage networks. Additionally, the Swachh Bharat Mission and the Jal Jeevan Mission are instrumental in enhancing sanitation infrastructure and providing safe drinking water, thereby indirectly supporting wastewater management efforts.

The National Mission for Clean Ganga (NMCG), launched under the Namami Gange Programme, is another cornerstone of India’s wastewater management strategy. With an allocated budget of ₹20,000–22,500 crore (approximately USD 2.5–3 billion) from 2014 to 2026, the initiative focuses on constructing and upgrading sewage treatment plants, intercepting and diverting wastewater, and promoting riverfront development.

These initiatives are complemented by state-level projects. For instance, Maharashtra’s urban development department has approved a ₹332 crore sewage pipeline project for 16 merged villages under the Pune Municipal Corporation, involving the installation of 472 km of new collection lines, 90.5 km of main sewage lines, and the construction of eight sewage treatment plants. Similarly, Delhi has been allocated ₹800 crore under the AMRUT 2.0 scheme to expand its sewage infrastructure, including the installation of approximately 2.5 lakh new sewer connections benefiting around 35 lakh residents.

Key Takeaways

- Wastewater Treatment Services Market size is expected to be worth around USD 96.0 Billion by 2034, from USD 48.8 Billion in 2024, growing at a CAGR of 7.0%.

- Operation and Maintenance held a dominant market position, capturing more than a 44.8% share of the global wastewater treatment services market.

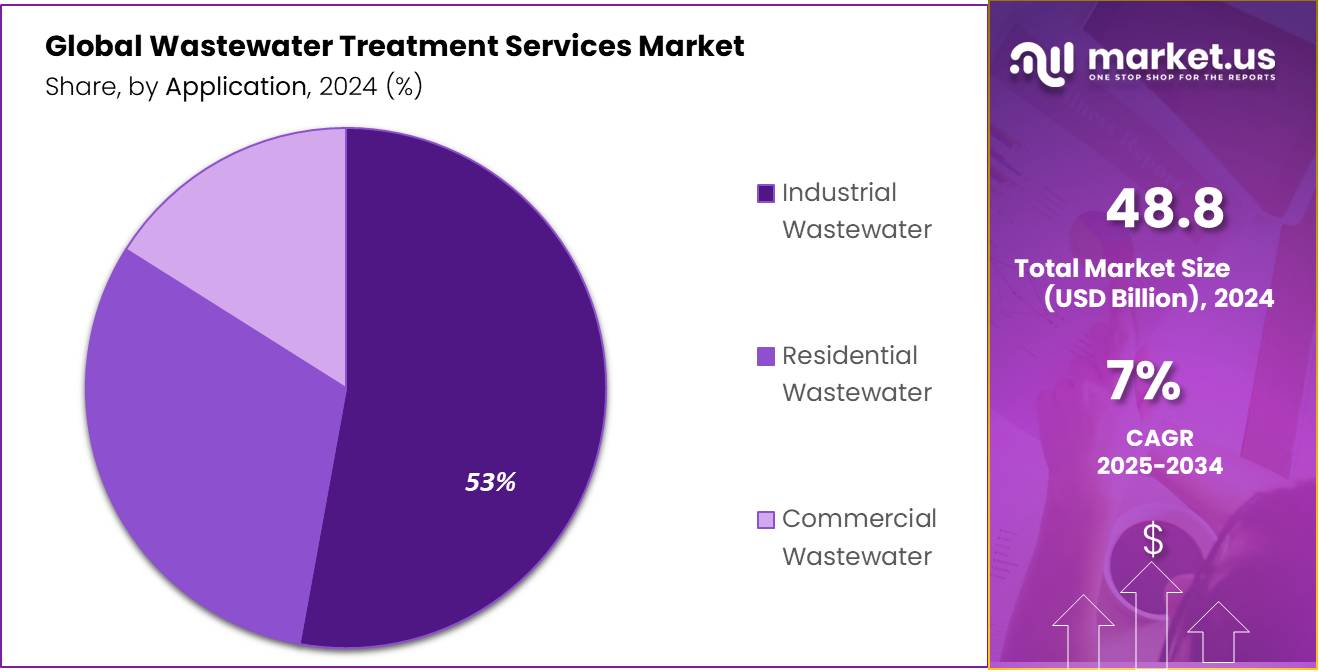

- Industrial Wastewater held a dominant market position, capturing more than a 52.7% share of the global wastewater treatment services market.

- Asia-Pacific (APAC) region dominated the global wastewater treatment services market, accounting for a substantial 41.8% share, with a market value reaching approximately USD 20.3 billion.

By Service Type Analysis

Operation and Maintenance leads with 44.8% due to ongoing facility needs and regulatory compliance.

In 2024, Operation and Maintenance held a dominant market position, capturing more than a 44.8% share of the global wastewater treatment services market. This strong lead is primarily due to the rising demand for continuous plant operations, efficiency improvements, and adherence to evolving environmental regulations. Public utilities and industrial players increasingly rely on long-term service contracts to ensure that treatment facilities run smoothly, reduce downtimes, and meet discharge standards.

Operation and maintenance services include everything from equipment upkeep, monitoring systems, chemical dosing, and troubleshooting to staff training. The growing burden of water pollution in both developed and developing regions has further increased the focus on efficient plant performance. As a result, the service providers offering end-to-end O&M solutions are witnessing steady contract renewals and long-term partnerships heading into 2025, supporting the segment’s continued dominance in the global market.

By Application Analysis

Industrial Wastewater dominates with 52.7% as factories demand efficient discharge and reuse solutions.

In 2024, Industrial Wastewater held a dominant market position, capturing more than a 52.7% share of the global wastewater treatment services market. This leadership is mainly driven by the rising need for effective treatment of effluents across sectors like chemicals, textiles, pharmaceuticals, food processing, and manufacturing. With stricter environmental regulations and rising water scarcity concerns, industries are prioritizing wastewater recycling and safe disposal to reduce environmental impact and operational risks.

Many factories are also investing in advanced biological and chemical treatment services to meet discharge norms while lowering water consumption through reuse. From 2024 into 2025, the demand for specialized industrial wastewater treatment services is expected to stay strong, as industries continue to expand and modernize operations, especially in emerging markets.

Key Market Segments

By Service Type

- Operation and Maintenance

- Design & Engineering Consultancy

- Project Management Consultancy

- Process Control

- Others

By Application

- Industrial Wastewater

- Food & Beverages

- Automotive

- Pharmaceutical

- Metal & Mining

- Power Generation

- Oil & Gas

- Chemical & Fertilizers

- Paper & Pulp

- Others

- Residential Wastewater

- Commercial Wastewater

Emerging Trends

Embracing AI for Smarter Wastewater Treatment in the Food Industry

A significant trend reshaping wastewater treatment in the food industry is the integration of Artificial Intelligence (AI) to enhance efficiency and sustainability. AI technologies, including machine learning algorithms, are being employed to optimize operations, predict system behaviors, and improve water quality monitoring. This shift is driven by the need to meet stringent environmental regulations and the industry’s commitment to sustainable practices.

In 2023, the U.S. Environmental Protection Agency (EPA) reported that over 30% of food processing plants had adopted AI-driven systems to monitor and control wastewater treatment processes. These systems utilize sensors and data analytics to detect anomalies, predict maintenance needs, and ensure compliance with discharge standards. For instance, machine learning models can forecast membrane fouling in Membrane Bioreactor (MBR) systems, allowing for timely interventions that reduce downtime and maintenance costs.

The implementation of AI in wastewater treatment not only improves operational efficiency but also contributes to cost savings. Advanced process automation has been shown to reduce energy costs by up to 20% and chemical costs by up to 15%, leading to more sustainable and economically viable operations.

Governments are recognizing the potential of AI in enhancing wastewater treatment and are providing support through grants and incentives. In 2023, the EPA allocated over $10 million in funding to food and beverage manufacturing plants for the adoption of AI-based water treatment technologies.

Drivers

Government Regulations and Increasing Environmental Concerns Driving Wastewater Treatment Services

A key driving factor for the growth of wastewater treatment services is the rising government regulations and growing environmental concerns. As the global population continues to increase, the demand for sustainable solutions to manage wastewater has also grown significantly. Governments across various regions are enacting stricter regulations to ensure that industries properly manage their wastewater discharges, minimizing the impact on the environment. This trend is particularly significant in the food and beverage industry, where wastewater from food processing can contain high levels of organic matter, chemicals, and other pollutants.

In recent years, organizations such as the U.S. Environmental Protection Agency (EPA) have implemented stringent guidelines to reduce water pollution. According to the U.S. Food and Drug Administration (FDA), in 2023, nearly 65% of food production facilities were required to implement advanced wastewater treatment systems to comply with environmental regulations. These regulations ensure that treated water meets high standards before being released into natural water bodies, reducing the risk of water contamination.

Additionally, food manufacturing companies are increasingly adopting sustainable practices, not only to comply with regulations but also to meet consumer expectations. The Food Industry Environmental Network (FIEN) reported that in 2023, more than 40% of food processors had invested in wastewater treatment technologies as part of their sustainability initiatives. These technologies not only help in treating wastewater but also contribute to water reuse in industrial processes, thereby reducing the overall environmental footprint.

Restraints

High Capital Costs and Financial Constraints Hindering Wastewater Treatment Adoption

One of the major restraining factors for the growth of wastewater treatment services is the high capital costs associated with implementing advanced treatment systems. Many industries, particularly in the food and beverage sector, face financial challenges when it comes to investing in costly wastewater treatment technologies. These systems require substantial initial investments for installation, maintenance, and operation, making them a significant financial burden for smaller or medium-sized businesses.

According to the U.S. Environmental Protection Agency (EPA), in 2023, food processing plants in the U.S. reported an average initial investment of approximately US$ 5 million for upgrading their wastewater treatment facilities to meet regulatory standards. For many food manufacturers, especially those operating on tight margins, such large capital expenditures can be difficult to justify, especially in the face of fluctuating consumer demand and increased operational costs.

In addition to the initial capital outlay, ongoing maintenance costs for wastewater treatment plants can also be a deterrent. These costs include energy consumption, replacement parts, and skilled labor, which can add up quickly over time. A report from the Food Industry Environmental Network (FIEN) indicated that nearly 55% of small-to-medium food processors in 2023 cited ongoing operational costs as a significant barrier to upgrading or maintaining their wastewater treatment systems.

Opportunity

Adoption of Water Recycling and Reuse in the Food Industry

A major growth opportunity for wastewater treatment services lies in the adoption of water recycling and reuse practices, particularly within the food and beverage industry. As water scarcity continues to be a global concern, many industries are looking for sustainable ways to reduce water consumption. Wastewater treatment systems that focus on water reuse are becoming increasingly popular as they allow companies to treat and recycle water for use in non-potable applications like cleaning, cooling, and irrigation, thereby reducing overall water demand.

The U.S. Food and Drug Administration (FDA) reported that in 2023, approximately 30% of food processing plants in the United States had already implemented water recycling systems as part of their efforts to conserve water and comply with environmental regulations. These plants are able to treat and reuse water, which not only reduces their environmental impact but also leads to significant cost savings over time.

The U.S. Environmental Protection Agency (EPA) has recognized the importance of water reuse, offering financial incentives and grants to industries that invest in water-efficient technologies. In 2023, the EPA provided over US$ 10 million in grants to food and beverage manufacturing plants for water recycling projects. The government’s support is helping businesses make the transition to more sustainable practices, which is expected to continue growing in the coming years.

Regional Insights

In 2024, the Asia-Pacific (APAC) region dominated the global wastewater treatment services market, accounting for a substantial 41.8% share, with a market value reaching approximately USD 20.3 billion. This dominant position is primarily driven by the region’s escalating urbanization, expanding industrial base, and rising environmental concerns related to water pollution and resource scarcity. Rapid economic development across major countries such as China, India, Japan, and Southeast Asian nations has led to an increase in municipal wastewater generation and industrial effluent discharge, thereby driving demand for advanced and large-scale wastewater treatment services.

China remains the largest contributor within the APAC region, supported by national strategies such as the 14th Five-Year Plan, which allocates significant funding for the upgrading of water infrastructure and the construction of modern wastewater treatment plants. The country has also mandated zero-liquid discharge and reuse targets in key sectors like textiles, electronics, and petrochemicals. Meanwhile, India is witnessing strong growth in wastewater treatment service demand, fueled by programs such as the Namami Gange Mission and AMRUT (Atal Mission for Rejuvenation and Urban Transformation), which focus on river rejuvenation, urban sanitation, and the development of sewage infrastructure.

Japan and South Korea continue to set benchmarks in advanced wastewater treatment and recycling technologies, with widespread implementation of membrane filtration, biological treatment, and sludge recovery systems. Additionally, the growing emphasis on public-private partnerships and stricter compliance regulations across the region are accelerating investments in both centralized and decentralized wastewater treatment services. Overall, the APAC region’s leadership is firmly rooted in its regulatory momentum, infrastructure expansion, and rising awareness of sustainable water management practices.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Acciona is a leading global provider of sustainable water services, including wastewater treatment solutions. The company designs, builds, and operates wastewater treatment plants for municipalities and industries, integrating energy-efficient and circular economy approaches. It has a significant footprint in Europe, Latin America, and the Middle East, with technologies focusing on biological and membrane-based processes. Acciona’s commitment to carbon-neutral water infrastructure reinforces its role in driving innovation and resilience in wastewater treatment service delivery.

American Water is one of the largest publicly traded water and wastewater utility companies in the U.S., providing reliable wastewater treatment services to over 14 million people. The company operates and maintains extensive treatment infrastructure, ensuring compliance with U.S. EPA regulations. Through strategic investments, including smart water technologies and infrastructure upgrades, American Water focuses on improving service reliability, reducing discharge pollutants, and enhancing environmental sustainability across its regional utilities and contract operations.

Aquatech International LLC specializes in advanced wastewater treatment services, particularly for industrial sectors such as energy, chemicals, and food processing. Its offerings include zero liquid discharge (ZLD), reverse osmosis, and biological treatment systems tailored to complex effluent streams. Aquatech’s global operations span North America, the Middle East, and Asia, where it supports both greenfield and retrofit projects. The company emphasizes water reuse, recovery, and sustainability, addressing growing challenges in industrial water management.

Top Key Players Outlook

- 3M

- Acciona

- American Water

- Aquatech International LLC

- ASIO

- BioMicrobics Inc.

- DuPont

- Ecolab Inc.

- Evoqua Water Technologies LLC

- Hydro International

- Italmatch Chemicals S.p.A

- Kemira

- Kurita Water Industries Ltd.

- Pentair PLC

- SUEZ Worldwide

Recent Industry Developments

In 2024, 3M accelerated its commitment to wastewater treatment by investing approximately USD 500 million in capital projects and workforce, part of a broader USD 1 billion environmental commitment over 2021–2041 to reduce water use by 20% by 2025 and 25% by 2030, equating to a projected 2.5 billion gallons saved annually.

In 2024, Acciona recorded €1.19 billion in water division revenues—down 2% from 2023—and achieved an EBITDA of €93 million, a 1.7% decrease year-over-year.

Report Scope

Report Features Description Market Value (2024) USD 48.8 Bn Forecast Revenue (2034) USD 96.0 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Operation and Maintenance, Design and Engineering Consultancy, Project Management Consultancy, Process Control, Others), By Application (Industrial Wastewater, Residential Wastewater, Commercial Wastewater) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Acciona, American Water, Aquatech International LLC, ASIO, BioMicrobics Inc., DuPont, Ecolab Inc., Evoqua Water Technologies LLC, Hydro International, Italmatch Chemicals S.p.A, Kemira, Kurita Water Industries Ltd., Pentair PLC, SUEZ Worldwide Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wastewater Treatment Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Wastewater Treatment Services MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Acciona

- American Water

- Aquatech International LLC

- ASIO

- BioMicrobics Inc.

- DuPont

- Ecolab Inc.

- Evoqua Water Technologies LLC

- Hydro International

- Italmatch Chemicals S.p.A

- Kemira

- Kurita Water Industries Ltd.

- Pentair PLC

- SUEZ Worldwide