Global Vodka Market Size, Share Analysis Report By Type (Flavored, Non-Flavored), By Category (Mass, Premium, Super Premium), By End User (Men, Women), By Distribution Channel (Off-Trade, On-Trade) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152946

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

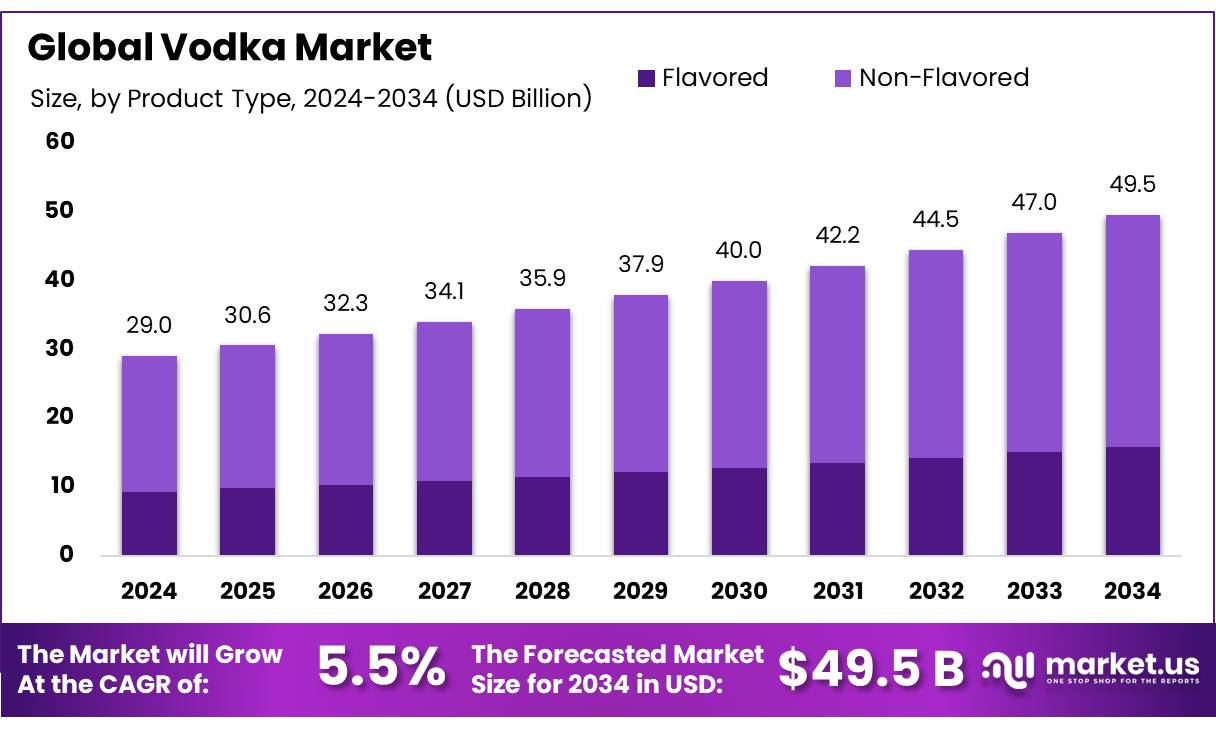

The Global Vodka Market size is expected to be worth around USD 49.5 Billion by 2034, from USD 29.0 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 38.9% share, holding USD 11.2 Billion revenue.

The global vodka concentrates market has been experiencing significant growth in recent years, driven by increasing consumer demand for convenient, ready-to-mix alcoholic beverages. Vodka concentrates are highly concentrated versions of vodka, offering consumers the ability to mix their desired strength of alcohol with flavors and mixers.

This trend has gained traction due to the rising preference for at-home consumption and the growing demand for cocktail products in the retail sector. According to the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB), in 2024, the consumption of vodka in the U.S. alone reached approximately 77 million cases, reflecting a steady rise in demand for various forms of vodka-based products, including concentrates.

Driving factors for this market include changing lifestyle preferences and the increasing popularity of home-based cocktail preparation. A report from the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) indicated that the consumption of spirits in the U.S. has been steadily rising, with vodka continuing to be one of the most consumed spirits, with sales increasing by 4.5% in 2024.

The demand for vodka-based cocktails in home settings is expected to grow further, especially as consumers become more inclined to recreate bar-quality drinks in their own homes. Additionally, the demand for low-calorie and gluten-free alcohol options is expected to grow, with vodka being an attractive option due to its naturally low-calorie profile.

Government initiatives play a crucial role in supporting the growth of the vodka concentrates industry. In India, for instance, the “Make in India” campaign has attracted foreign investments and encouraged local production of premium spirits. Notably, Pernod Ricard invested €200 million to establish India’s largest malt distillery, reflecting the positive impact of such initiatives . Similarly, in the United States, the government has implemented policies to promote competition and reduce corporate consolidation in the alcohol industry, aiming to benefit consumers and foster a more competitive market.

Key Takeaways

- The global vodka market is projected to reach approximately USD 49.5 billion by 2034, rising from USD 29.0 billion in 2024, with a compound annual growth rate (CAGR) of 5.5%.

- Non-flavored vodka dominated the product segment, accounting for over 68% of the total market share.

- In terms of pricing tier, mass segment led the market, holding more than 57.2% of the global share.

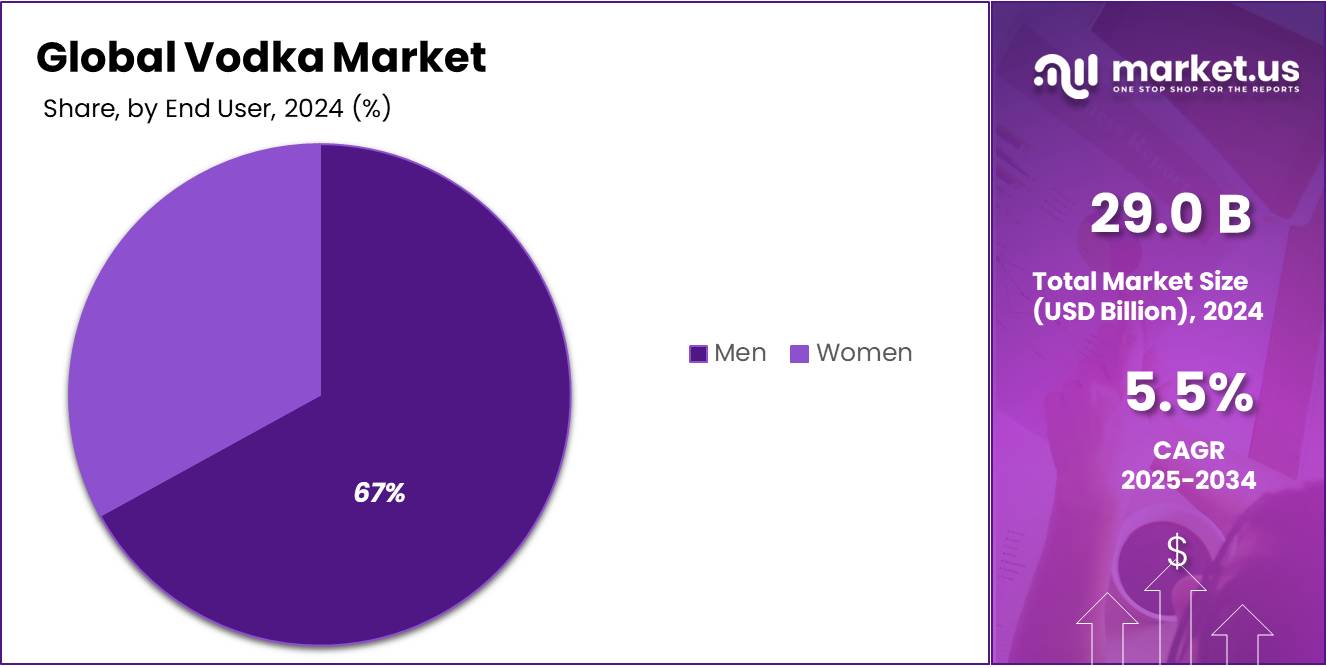

- By gender demographics, men represented the dominant consumer group, contributing to over 67.9% of the total market.

- Off-trade distribution channels (such as retail stores and supermarkets) led with a commanding 78.3% share of the overall market.

- North America emerged as the leading regional market, capturing approximately 38.9% of the global share and reaching a valuation of USD 11.2 billion.

By Type Analysis

Non-Flavored Vodka dominates with 68% share in 2024, driven by its purity and global appeal.

In 2024, Non-Flavored held a dominant market position, capturing more than a 68% share of the global vodka market. This strong lead can be credited to its clean taste, versatility in cocktails, and consistent consumer demand across both developed and emerging markets. Non-flavored vodka remains a preferred choice among consumers who appreciate traditional spirits or seek a neutral base for mixing with juices, sodas, or other ingredients.

The dominance of this segment is further reinforced by its widespread availability in retail, horeca, and duty-free channels. As consumers become more mindful of artificial additives and flavorings, the appeal of classic, unaltered vodka continues to grow. In 2025, this trend is expected to hold steady as major producers prioritize the production of premium non-flavored variants and expand distribution networks to tap into rising demand from Eastern Europe, the United States, and parts of Asia.

By Category Analysis

Mass Category leads with 57.2% share in 2024, supported by affordability and broad consumer access.

In 2024, Mass held a dominant market position, capturing more than a 57.2% share of the global vodka market. This segment’s lead is mainly due to its affordability, wide availability, and strong demand across both urban and rural regions. Mass-market vodkas are typically positioned as value-for-money options, appealing to a broad range of consumers who prioritize price over premium branding. These products are heavily distributed through local liquor shops, supermarkets, and wholesale channels, which helps in maintaining their strong sales volumes.

The popularity of mass vodka also stems from its role in large-scale events, festivals, and everyday consumption where price-sensitive buyers drive volumes. In 2025, the segment is expected to remain stable, especially in regions like Eastern Europe, South America, and parts of Asia, where economic considerations play a key role in purchasing decisions and large local brands continue to dominate shelf space.

By End User Analysis

Men dominate vodka consumption with 67.9% share in 2024, led by cultural and social preferences.

In 2024, Men held a dominant market position, capturing more than a 67.9% share in the global vodka market. This trend reflects long-standing consumption habits, where vodka is often preferred by male consumers in both casual and formal settings. In many cultures, particularly in Eastern Europe, Russia, and parts of Asia, vodka is traditionally associated with male social gatherings, celebrations, and ceremonial toasts. Marketing campaigns and brand imagery have also historically targeted male audiences, reinforcing the association between vodka and masculinity.

Consumption patterns among men remain consistent across urban and rural settings, with vodka being favored for its strength, affordability, and blendability. In 2025, this dominance is likely to continue, although slight shifts may emerge as more brands introduce inclusive and gender-neutral campaigns. Nonetheless, male consumers are expected to remain the core driver of volume sales across both mass and premium vodka categories.

By Distribution Channel Analysis

Off-Trade channels lead vodka sales with 78.3% share in 2024, driven by convenience and affordability.

In 2024, Off-Trade held a dominant market position, capturing more than a 78.3% share in the global vodka market. This channel includes supermarkets, liquor stores, hypermarkets, and online platforms, all of which offer consumers the ease of purchasing vodka for home consumption. The popularity of off-trade retailing is supported by competitive pricing, frequent promotional discounts, and a wide variety of brands and product sizes.

The COVID-19 pandemic further accelerated consumer preference for off-trade options, a trend that has remained steady due to ongoing demand for in-home drinking experiences. In addition, the rise of e-commerce and doorstep delivery services has made vodka more accessible to a broader audience, particularly in urban areas. In 2025, the off-trade segment is expected to retain its lead as consumers continue to prioritize convenience, affordability, and flexibility in how and where they purchase alcoholic beverages.

Key Market Segments

By Type

- Flavored

- Non-Flavored

By Category

- Mass

- Premium

- Super Premium

By End User

- Men

- Women

By Distribution Channel

- Off-Trade

- On-Trade

Emerging Trends

Eco-Friendly Packaging Gains Traction in Vodka Industry

Governments and institutions are supporting this eco-drive through targeted policy frameworks. Notably, the UK has introduced incentives for brands that adopt recyclable glass and renewable packaging materials, encouraging refill models and lightweight solutions for spirits companies.

Meanwhile, schemes like ecoSPIRITS’ “ecoTOTE” in Europe allow distributors to refill bulk vodka in reusable glass containers—mirroring closed-loop systems seen in beer kegs. Producers like Pernod Ricard’s Absolut and Diageo’s Gordon’s have already joined this initiative, reducing single-use bottle production and logistics impact

Beyond packaging, vodka brands are improving sustainability across operations. Many are sourcing organic or locally harvested grains and using renewable energy during distillation. Water recycling systems and waste-to-energy byproducts are becoming integral to production processes. These practices not only align with environmental regulations but resonate with eco-conscious consumers.

These green strategies are translating into real value. Spirits aligned with eco-packaging and sustainability saw strong growth in 2024, as consumers demonstrated a willingness to pay more for environmentally friendly options. The “green premium” is emerging: brands adopting refillable or recyclable formats are gaining competitive advantage in both retail and hospitality channels.

Drivers

Rising Consumer Preference for Premium Vodka

In recent years, the global vodka market has witnessed a significant shift driven by the increasing demand for premium and craft vodka. This trend is largely fueled by the growing preference among consumers for high-quality alcoholic beverages, with an emphasis on smoothness, flavor, and craftsmanship. According to the Distilled Spirits Council of the United States (DISCUS), in 2024, sales of premium vodka brands rose by 7.3% in the U.S. alone, indicating a clear preference for higher-quality products. This shift in consumer preferences is also seen in other key markets such as Europe, where premium vodka consumption is increasing due to the rising middle-class population with higher disposable incomes.

Additionally, governments in various countries are promoting local spirits production, including vodka, as part of efforts to boost domestic agriculture and spirits industries. For instance, in Russia, where vodka production is a major industry, government initiatives support the development of high-quality domestic vodka brands, which has contributed to their growth. The Russian Ministry of Agriculture reported a 5% increase in the production of craft vodka varieties in 2023, as demand from both local and international markets has surged.

The rise of consumer interest in sustainability and natural ingredients also plays a role in this shift. Brands that focus on using organic, locally sourced ingredients, and sustainable production methods are gaining traction. A study by the European Commission found that 58% of European consumers are willing to pay more for products that use sustainable practices, including in the spirits sector.

Restraints

Government Regulations and Taxation Policies

One of the major restraining factors for the vodka industry is the growing impact of stringent government regulations and high taxation on alcohol products. Many countries have introduced higher excise duties and stricter regulations on alcohol sales in recent years, which have significantly affected the profitability and affordability of vodka. In the European Union, for example, the European Commission has raised excise duties on spirits, including vodka, by an average of 2.3% annually since 2022. This increase in taxes has led to higher prices for consumers, making it more difficult for budget-conscious buyers to afford premium vodka brands.

In Russia, the government has imposed heavy taxes on alcohol in recent years to curb excessive drinking, leading to a slowdown in vodka consumption. According to the Russian Federal Service for Alcohol Market Regulation, vodka consumption in the country decreased by 4% in 2023 due to the increase in taxes and tightening of regulations. This has put pressure on both producers and consumers, as the rise in costs is limiting access to affordable vodka options.

Moreover, regulatory frameworks surrounding labeling, advertising, and production standards are becoming more complex, further burdening producers. The World Health Organization (WHO) has also set guidelines to reduce alcohol consumption globally, urging governments to implement policies that control the availability and marketing of alcohol, which could hinder growth in the vodka sector. In the U.S., the Alcohol and Tobacco Tax and Trade Bureau (TTB) enforces strict labeling requirements, which complicates the production process and adds to the cost of compliance for vodka manufacturers.

Opportunity

Expansion of Premium Vodka Segment

The premium vodka segment is experiencing rapid growth, presenting a significant opportunity for brands to capitalize on evolving consumer preferences. As disposable incomes rise, particularly in emerging markets, the demand for high-quality, premium alcoholic beverages, including vodka, has surged. In 2024, the premium vodka market accounted for nearly 25% of the global vodka market, with the trend expected to continue as consumers shift toward more sophisticated options.

In the United States, the premium vodka segment has grown by 8.5% annually, as reported by the Distilled Spirits Council. This growth is driven by the increasing inclination towards craft spirits, with consumers looking for unique flavor profiles and artisanal production processes. Moreover, the younger demographic, particularly millennials and Gen Z, has shown a growing preference for premium spirits, which they associate with higher quality and authenticity. This is evident from the fact that 35% of millennial consumers prefer to purchase premium alcohol over standard options, according to a 2023 report by the National Restaurant Association.

Government initiatives supporting the growth of the craft alcohol industry, such as reduced excise taxes for small-scale producers in certain regions, are also fueling the expansion of premium vodka brands. In the European Union, for example, a reduction in taxes for locally produced spirits has opened new avenues for growth for small distilleries producing premium vodka. Additionally, emerging markets in Asia, including China and India, are increasingly consuming vodka, providing a new avenue for brands to expand their presence.

Regional Insights

North America dominates vodka market with 38.9% share, valued at USD 11.2 billion in 2024

In 2024, North America held a leading position in the global vodka market, capturing approximately 38.9% of the total market share and reaching a valuation of USD 11.2 billion. The United States continues to drive the region’s dominance, with its well-established alcoholic beverage industry, broad consumer base, and evolving consumption preferences.

Vodka remains one of the most consumed spirits in the U.S., largely due to its versatility, neutral taste, and compatibility with a wide range of mixers. According to the U.S. Distilled Spirits Council, vodka accounted for over one-third of total spirits volume sales in 2023, further underlining its significance in the region’s alcohol landscape.

Consumer trends across North America show a clear tilt toward premiumization, with growing demand for craft and flavored vodka brands. Urban millennials and Gen Z consumers are increasingly choosing premium and boutique vodka labels that emphasize quality ingredients, sustainable sourcing, and transparent production practices. Additionally, the rise of ready-to-drink (RTD) cocktails—where vodka is a key base ingredient—has further fueled consumption, particularly through off-trade channels such as retail and e-commerce.

The region also benefits from favorable regulations, mature distribution infrastructure, and extensive marketing efforts from global and local vodka producers. Canada, while smaller in scale than the U.S., contributes significantly through a strong domestic spirits industry and rising consumer interest in both traditional and flavored vodka offerings. Looking ahead to 2025, North America is expected to maintain its leadership, supported by consistent product innovation, expanding retail presence, and a loyal consumer base.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Diageo plc holds a leading position in the vodka market through its flagship brands—Smirnoff, Ketel One, and Cîroc—accounting for approximately 9% of the company’s global revenue. Smirnoff remains the top-selling vodka brand worldwide, shifting 26.5 million barrels in 2022–2023, more than double. The company’s global reach is bolstered by extensive distribution networks across 132 sites and strategic acquisitions that reinforce its position in mass and premium vodka segments.

Pernod Ricard SA is a major vodka player through its Absolut and Wyborowa brands. Absolut, introduced globally in 1979, sells over 100 million liters annually. The acquisition of Absolut for €5.63 billion in 2008 strengthened Pernod Ricard’s presence in the premium vodka category. With revenue exceeding €12 billion in 2023, the company leverages global distribution and strong brand recognition across 126 countries.

Bacardi Ltd. competes strongly in the vodka segment via its ownership of Grey Goose and Eristoff brands . Grey Goose was acquired in 2004 for $2 billion and has since maintained its status as a high-end vodka. As a privately held firm with global operations in over 170 countries and a portfolio spanning premium spirits, Bacardi reported a 3% decline in net revenue in 2024, yet continues to emphasise premiumisation and RTD innovation

LVMH (Moët Hennessy Louis Vuitton) influences the vodka market primarily through its joint venture with Diageo, Moët Hennessy, which markets Cîroc and premium vodka variants . Cîroc is recognized for its flavored vodkas bottled at 35% ABV in the U.S.. LVMH’s premium spirits strategy focuses on brand elevation, limited releases, and celebrity partnerships that strengthen its position in the luxury vodka sphere.

Top Key Players Outlook

- Diageo plc

- Pernod Ricard SA

- Bacardi Ltd.

- LVMH (Moet Hennessy Louis Vuitton)

- Campari Group

- William Grant and Sons

- Canadian Iceberg Vodka Corp

- Beluga Group

- Stock Spirits Group

- E.and J. Gallo

- Heaven Hill Brands

- Stoli Group

- Proximo Spirits

- Suntory Holdings Limited

- Milestone Brands

- Kirker Greer Holdings

- B Radico Khaitan Ltd.

- Becle SAB de CV

Recent Industry Developments

In 2024, Diageo plc reported total revenue of USD 20.269 billion, driven in part by its leading vodka brands Smirnoff, Ketel One, and Cîroc, which together contribute significantly to its spirits portfolio.

In 2024, Pernod-Ricard SA reported net sales of €11.598 billion, with its vodka brand Absolut contributing around 8% of this total—equating to approximately €928 million in annual sales.

Report Scope

Report Features Description Market Value (2024) USD 29.0 Billion Forecast Revenue (2034) USD 49.5 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavored, Non-Flavored), By Category (Mass, Premium, Super Premium), By End User (Men, Women), By Distribution Channel (Off-Trade, On-Trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Diageo plc, Pernod Ricard SA, Bacardi Ltd., LVMH (Moet Hennessy Louis Vuitton), Campari Group, William Grant and Sons, Canadian Iceberg Vodka Corp, Beluga Group, Stock Spirits Group, E.and J. Gallo, Heaven Hill Brands, Stoli Group, Proximo Spirits, Suntory Holdings Limited, Milestone Brands, Kirker Greer Holdings, B Radico Khaitan Ltd., Becle SAB de CV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Diageo plc

- Pernod Ricard SA

- Bacardi Ltd.

- LVMH (Moet Hennessy Louis Vuitton)

- Campari Group

- William Grant and Sons

- Canadian Iceberg Vodka Corp

- Beluga Group

- Stock Spirits Group

- E.and J. Gallo

- Heaven Hill Brands

- Stoli Group

- Proximo Spirits

- Suntory Holdings Limited

- Milestone Brands

- Kirker Greer Holdings

- B Radico Khaitan Ltd.

- Becle SAB de CV