Global Subsea Well Access Systems Market Size, Share, And Industry Analysis Report By Type (Rig-Based Well Access System, Vessel-Based Well Access System), By Product (Annular BOP, Ram BOP), By Location (Shallow Water, Deepwater, Ultra-Deepwater), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169539

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

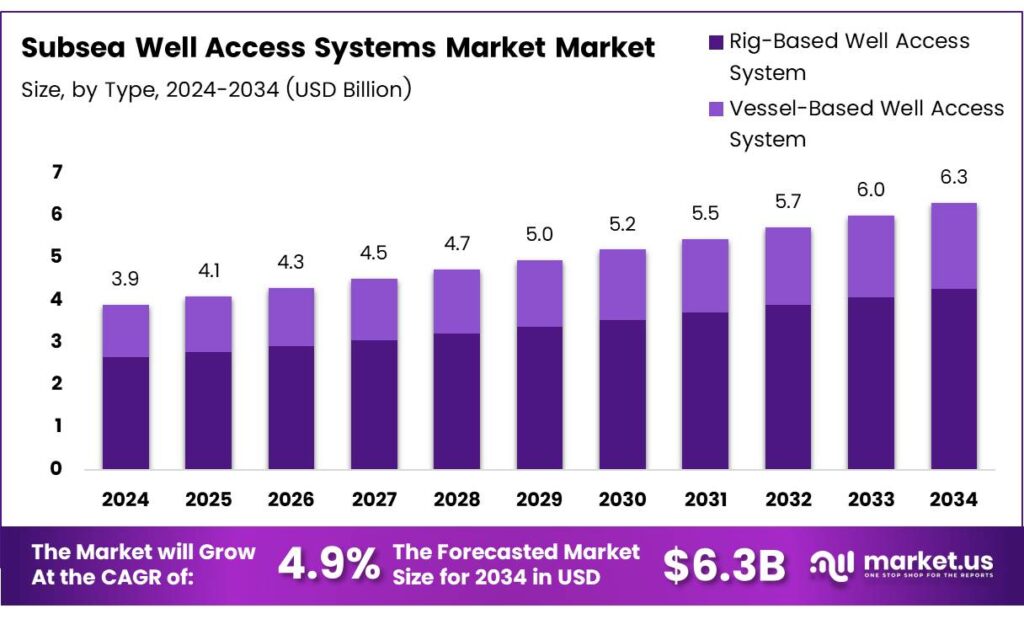

The Global Subsea Well Access Systems Market size is expected to be worth around USD 6.3 billion by 2034, from USD 3.9 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Subsea Well Access Systems Market refers to technologies and services that allow operators to access offshore wells located on the seabed for intervention, monitoring, and maintenance. These systems support offshore oil and gas production without surface structures, enabling safe extraction and transportation in complex deepwater environments using flexible, lower-footprint infrastructure.

Subsea well access systems play a strategic role in offshore asset productivity. As exploration shifts further offshore, operators increasingly rely on subsea architectures to control costs and extend field life. Consequently, demand grows for reliable access systems that reduce intervention risks while improving operational efficiency and safety.

In terms of operating conditions, subsea systems are commonly deployed at depths of 7,000 feet or more. These systems are not designed to drill wells but instead focus on extraction and transport. As water depths increase, the complexity of access rises, strengthening market demand for advanced intervention and access technologies tailored to deepwater operations.

- During well construction and subsea completion phases, access efficiency is financially critical. Daily rig rates typically range from 200,000 to over 750,000 USD per day. Therefore, operators prioritize systems that reduce time spent over the well, shorten intervention windows, and lower exposure to high daily rig expenses through faster, vessel-based solutions.

Economically, subsea completions offer strong advantages compared with bottom-founded development structures. This advantage becomes more pronounced in deeper waters, where fixed installations may be technically or economically unfeasible. The cost of an FPSO-based subsea development is approximately one-half that of a bottom-founded structure, improving project viability in challenging offshore locations.

Key Takeaways

- The Global Subsea Well Access Systems Market is projected to grow from USD 3.9 billion in 2024 to USD 6.3 billion by 2034, expanding at a CAGR of 4.9% from 2025–2034.

- Rig-Based Well Access Systems dominated the market by type in 2024, accounting for a leading share of 62.4% due to stability and compatibility with offshore rigs.

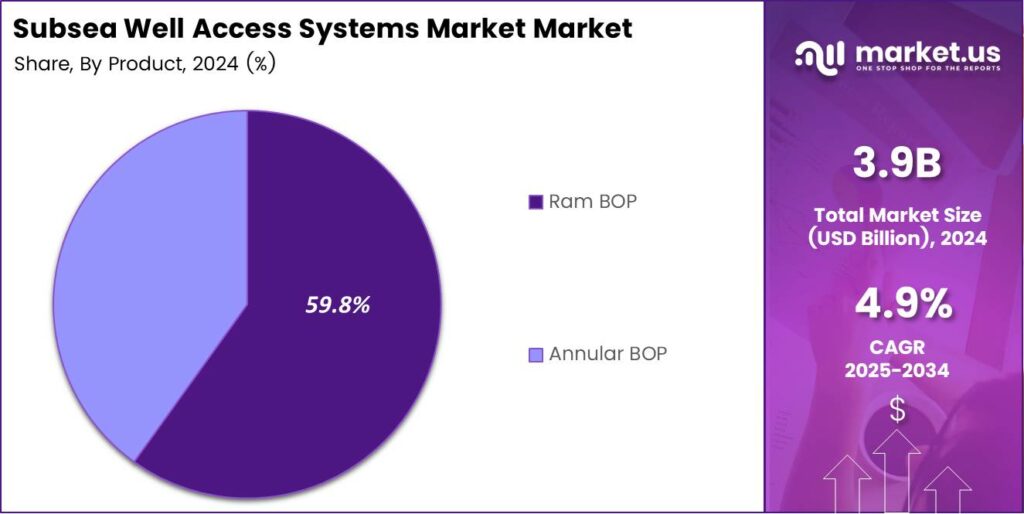

- Ram BOP held a dominant market share of 59.8% in 2024, supported by strong sealing performance in high-pressure subsea environments.

- The Deepwater segment led by location, capturing 43.5% of the market in 2024 as offshore activity moved toward greater water depths.

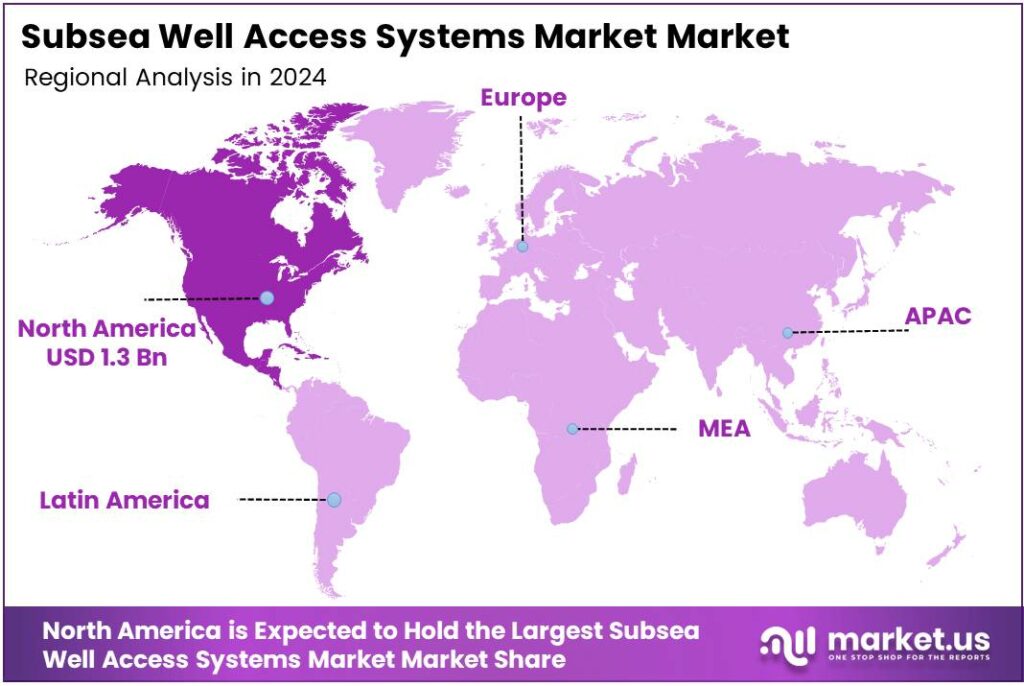

- North America emerged as the leading regional market in 2024, holding a 34.9% share and generating approximately USD 1.3 billion in revenue.

By Type Analysis

Rig-Based Well Access System dominates with 62.4% due to its operational stability and widespread offshore adoption.

In 2024, Rig-Based Well Access System held a dominant market position in the By Type Analysis segment of the Subsea Well Access Systems Market, with a 62.4% share. This dominance is driven by higher load capacity, reliable pressure control, and seamless integration with existing drilling rigs in complex offshore fields.

In contrast, Vessel-Based Well Access Systems serve operators seeking flexibility and rapid mobilization. These systems are often preferred for intervention and maintenance work. However, weather sensitivity and limited stability compared to rig-based systems moderately restrict their wider adoption in harsh offshore environments.

By Product Analysis

Ram BOP dominates with 59.8% owing to its strong sealing performance in high-pressure subsea operations.

In 2024, Ram BOP held a dominant market position in the By Product Analysis segment of the Subsea Well Access Systems Market, with a 59.8% share. This leadership stems from its ability to shut in wells under extreme pressure, improving safety and compliance in deepwater drilling operations.

Annular BOP systems play a critical supporting role by allowing flexible sealing around varying drill pipe sizes. They are commonly used during routine drilling and intervention activities. However, their pressure-handling limitations compared to Ram BOPs limit dominance in high-risk subsea environments.

By Location Analysis

Deepwater dominates with 43.5% driven by rising offshore exploration at greater water depths.

In 2024, Deepwater held a dominant market position in the By Location Analysis segment of the Subsea Well Access Systems Market, with a 43.5% share. Growth is supported by increased investments in deepwater oil and gas projects where advanced subsea access systems ensure operational efficiency and safety.

Shallow Water installations remain relevant due to lower development costs and simpler infrastructure requirements. These locations continue to use established subsea access technologies for mature fields, supporting steady but slower adoption compared to deeper offshore developments.

Ultra-Deepwater projects demand highly specialized subsea well access systems capable of extreme pressure and depth conditions. Although capital-intensive, these systems enable operators to unlock high-value reserves, positioning ultra-deepwater as a strategic long-term focus despite operational complexities.

Other locations include marginal fields and experimental offshore zones where subsea well access adoption remains selective. These areas often serve pilot deployments or limited-scale operations, contributing incremental demand while awaiting technological maturation and favorable economic feasibility.

Key Market Segments

By Type

- Rig-Based Well Access System

- Vessel-Based Well Access System

By Product

- Annular BOP

- Ram BOP

By Location

- Shallow Water

- Deepwater

- Ultra-Deepwater

- Others

Emerging Trends

Automation and Digitalization Shape Market Trends

One of the most important trending factors in the Subsea Well Access Systems Market is the increasing use of automation and digital technologies. Operators are adopting remote operations to improve safety and reduce human exposure in harsh offshore environments.

- Digital monitoring systems help track well conditions in real time. This allows faster decision-making and early detection of issues. By using data analytics, operators can plan maintenance activities more efficiently and avoid unplanned shutdowns. International Energy Agency (IEA), global energy demand grew by 2.2% in 2024, with electricity demand jumping 4.3%.

Vessel-based well access is also gaining attention as a trending approach. Compared to rig-based solutions, vessels offer more flexibility and lower costs. This trend supports cost-efficient offshore operations, especially in mature fields. Environmental focus is another emerging trend. Companies are pressured to lower emissions and minimize offshore impact. Subsea well access systems that support reduced intervention time and lower fuel usage gain strong interest.

Drivers

Rising Deepwater and Ultra-Deepwater Oil Production Drives Market Growth

One of the main drivers of the Subsea Well Access Systems Market is the steady rise in deepwater and ultra-deepwater oil production. As many onshore and shallow-water reserves mature, energy companies are moving offshore to access untapped resources. Subsea well access systems play a critical role in safely intervening, maintaining, and controlling wells at high depths.

- These systems allow operators to perform well-intervention tasks without bringing rigs back to the site. This improves operational efficiency and reduces downtime. Energy demand grew by 2.2% in 2024, and electricity demand rose even more sharply (4.3%) — meaning the world still needs a stable mix of energy sources, including oil and gas.

Oil and gas companies benefit from faster access to subsea wells, which helps maintain stable production levels over the life of the field. Subsea well access solutions reduce the need for expensive drilling rigs by enabling vessel-based operations. This leads to lower operational costs, especially in remote offshore locations.

Restraints

High Installation and Operational Costs Limit Market Expansion

A key restraint affecting the Subsea Well Access Systems Market is the high cost associated with system installation and operations. Designing and deploying equipment for deep and ultra-deepwater environments requires advanced engineering, specialized vessels, and skilled personnel. These requirements increase overall project expenses.

Small and mid-sized operators often struggle to justify such high capital investment. Even though subsea systems reduce long-term intervention costs, the upfront expenditure remains a challenge. Budget pressure becomes stronger during periods of oil price volatility, leading to delayed or canceled offshore projects.

Technical complexity is another limiting factor. Subsea well access operations involve high pressure, low temperatures, and complex seabed conditions. Any failure can cause long repair times and financial losses. This risk discourages some operators from adopting advanced subsea solutions.

Growth Factors

Expansion of Offshore Projects Creates Strong Growth Opportunities

The growing number of offshore exploration and production projects presents strong growth opportunities for the Subsea Well Access Systems Market. Many countries are investing in offshore energy to strengthen supply security and reduce dependence on imports. These developments increase demand for efficient well access technologies.

- Technological innovation also opens new opportunities. Improved subsea robotics, remote monitoring, and digital control systems allow safer and faster well intervention. These advances make subsea operations more reliable and attractive for operators planning long-term offshore projects. Global renewable electricity capacity is set to increase by nearly 4,600 GW between 2025 and 2030 — roughly double the deployment seen in the previous five years.

Emerging offshore markets offer additional growth potential. Regions investing in offshore infrastructure create new demand for modern subsea solutions. As offshore activity becomes more widespread, suppliers of well access systems can benefit from long-term contracts and service agreements.

Regional Analysis

North America Dominates the Subsea Well Access Systems Market with a Market Share of 34.9%, Valued at USD 1.3 Billion

North America leads the Subsea Well Access Systems Market due to sustained offshore production in the Gulf of Mexico and strong investments in deepwater and ultra-deepwater assets. The region benefits from early adoption of advanced subsea intervention technologies and high offshore operational maturity. In 2024, North America accounted for 34.9% of global demand, with market value reaching USD 1.3 billion, supported by the redevelopment of aging subsea fields.

Europe represents a technologically advanced market driven by subsea field life extension projects in the North Sea. Operators increasingly rely on vessel-based and rigless well access solutions to reduce costs and emissions. Strict offshore safety regulations also encourage upgrades of subsea access infrastructure. Demand is steady, supported by brownfield optimization rather than new field developments.

Asia Pacific shows strong growth potential due to rising offshore exploration in Southeast Asia and Australia. National oil companies increasingly invest in cost-efficient subsea well intervention to support marginal fields. The region benefits from rising energy demand and shallow-to-deepwater project diversification. Localization of offshore services is further strengthening regional adoption.

The U.S. market benefits from advanced offshore infrastructure and a strong focus on subsea well maintenance. Aging wells in mature offshore basins drive consistent demand for intervention and access systems. Operators prioritize efficiency, safety, and reduced downtime. Continued investment in subsea technologies supports stable market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Subsea Well Access Systems Market in 2024 is shaped by rising deepwater and ultra-deepwater investments, stricter operational reliability requirements, and the need to extend the productive life of mature offshore assets. Operators are increasingly prioritizing subsea well access solutions that reduce intervention time, lower offshore manpower dependency, and improve safety in harsh marine environments.

Aker Solutions continues to be viewed as a strong engineering-driven player, benefiting from its integrated subsea production and well access system expertise. In 2024, its focus on modular subsea architectures and standardized designs supports faster deployment and cost control for offshore operators.

Baker Hughes Incorporated maintains solid market positioning through its broad portfolio covering subsea trees, wellheads, and intervention services. Its emphasis on reliability, digital monitoring, and condition-based maintenance aligns well with operator demand for reduced downtime and safer interventions.

Diamond Offshore Drilling, Inc. plays a strategic role by providing rig-based well access capabilities for complex offshore wells. In 2024, its advanced offshore drilling assets support high-pressure and deepwater well interventions, reinforcing its importance in rig-dependent access operations.

Halliburton Company remains a key influencer due to its end-to-end well lifecycle services and strong intervention technologies. Its subsea well access solutions focus on efficiency, integrated planning, and risk reduction, making it a preferred partner for complex offshore developments.

Top Key Players in the Market

- Aker Solutions

- Baker Hughes Incorporated

- Diamond Offshore Drilling, Inc.

- Halliburton Company

- Island Offshore

- KIT Oil and Gas Equipment Industry, LLC

- National Oilwell Varco, Inc.

- Optime Subsea Services

- Proserv

- Schlumberger Limited

Recent Developments

- In 2025, Aker Solutions was awarded a sizeable engineering, procurement, construction, installation, and commissioning (EPCIC) contract by Equinor for the Fram Sør subsea tie-in project in the North Sea. The scope includes upgrading the Troll C platform topsides to process hydrocarbons from the subsea tie-back, along with new subsea templates.

- In 2025, Baker Hughes signed a contract with Petrobras to supply up to 50 subsea trees and associated services for mature fields in Brazil, including Albacora, Jubarte, and Barracuda-Caratinga. Procurement and manufacturing began, aiming to enhance recovery via modern subsea well access systems.

Report Scope

Report Features Description Market Value (2024) USD 3.9 billion Forecast Revenue (2034) USD 6.3 billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rig-Based Well Access System, Vessel-Based Well Access System), By Product (Annular BOP, Ram BOP), By Location (Shallow Water, Deepwater, Ultra-Deepwater, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aker Solutions, Baker Hughes Incorporated, Diamond Offshore Drilling, Inc., Halliburton Company, Island Offshore, KIT Oil and Gas Equipment Industry, LLC, National Oilwell Varco, Inc., Optime Subsea Services, Proserv, Schlumberger Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Subsea Well Access Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Subsea Well Access Systems MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aker Solutions

- Baker Hughes Incorporated

- Diamond Offshore Drilling, Inc.

- Halliburton Company

- Island Offshore

- KIT Oil and Gas Equipment Industry, LLC

- National Oilwell Varco, Inc.

- Optime Subsea Services

- Proserv

- Schlumberger Limited