Global Spirulina Beverages Market Size, Share, And Business Benefits By Ingredient Source (Conventional, Organic), By End User (Adults, Athletes, Children, Seniors), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157804

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

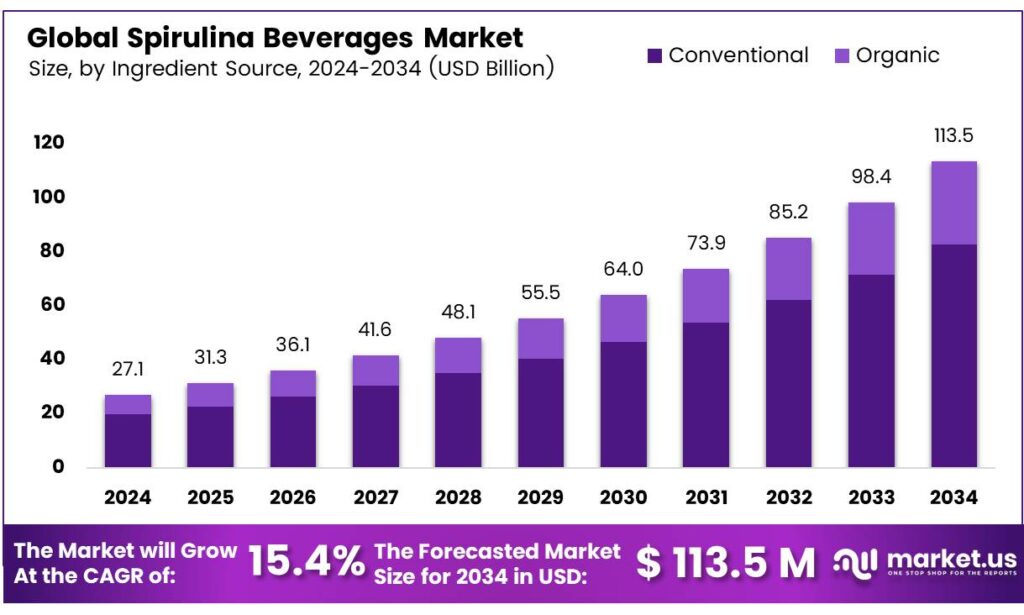

The Global Spirulina Beverages Market size is expected to be worth around USD 113.5 Million by 2034, from USD 27.1 Million in 2024, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034.

The Spirulina Beverages Market has emerged as a dynamic sector within the functional food and beverage industry, driven by rising consumer interest in plant-based nutrition and natural health boosters. Spirulina, a nutrient-rich blue-green microalga, is increasingly being incorporated into drinks such as juices, smoothies, energy beverages, and fermented dairy-based formulations. Its high protein content, vitamins (B1, B2, B12), minerals, antioxidants, and essential amino acids make it a favored ingredient for functional beverages.

Spirulina platensis, a microalga renowned for its rich protein and bioactive compound content, has great potential for functional food applications. Ricotta cheese whey, a byproduct of ricotta cheese manufacturing, often poses challenges for industrial use due to its low pH and less favorable processing properties. This study focused on developing a novel fermented beverage using ricotta cheese whey enriched with Spirulina powder at concentrations of 0.25%, 0.5%, and 0.75% (w/w), combined with 10% lemon and peppermint juice, and fermented with probiotic ABT culture.

The beverage was analyzed over 21 days of cold storage for its physicochemical, rheological, bioactive, microbiological, and sensory attributes. Results showed that the Spirulina-enriched formulations, together with lemon and peppermint juice, enhanced the levels of vitamins, minerals, antioxidants, and total phenolic compounds. Probiotic viability was maintained above 7 log CFU/mL throughout the storage period, confirming the functional probiotic quality. Notably, the 0.5% Spirulina addition yielded the best structural properties and sensory acceptance.

In a parallel experiment, Spirulina was combined with green tea in three brewing formulations: A (0.5 g Spirulina + 1.5 g green tea), B (1 g Spirulina + 1 g green tea), and C (1.5 g Spirulina + 0.5 g green tea). Each blend was brewed in 100 mL of hot water at 80°C for two minutes. The resulting infusions were evaluated using a 2,2-diphenylpicrylhydrazyl (DPPH) free radical scavenging assay for antioxidant activity and the Lowry method for protein quantification.

Key Takeaways

- The Global Spirulina Beverages Market is projected to grow from USD 27.1 million in 2024 to USD 113.5 million by 2034, at a CAGR of 15.4%.

- Conventional spirulina beverages held a 72.9% market share in 2024, driven by cost-effectiveness and consumer trust.

- Supermarkets and Hypermarkets led distribution in 2024, capturing a 32.6% share due to product variety and competitive pricing.

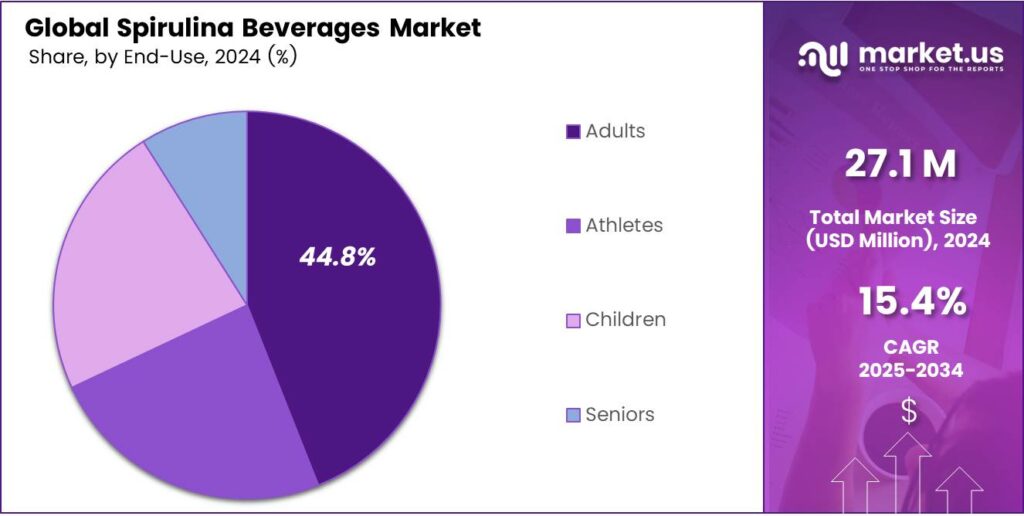

- Adults dominated the market in 2024 with a 44.8% share, fueled by demand for functional drinks rich in protein and antioxidants.

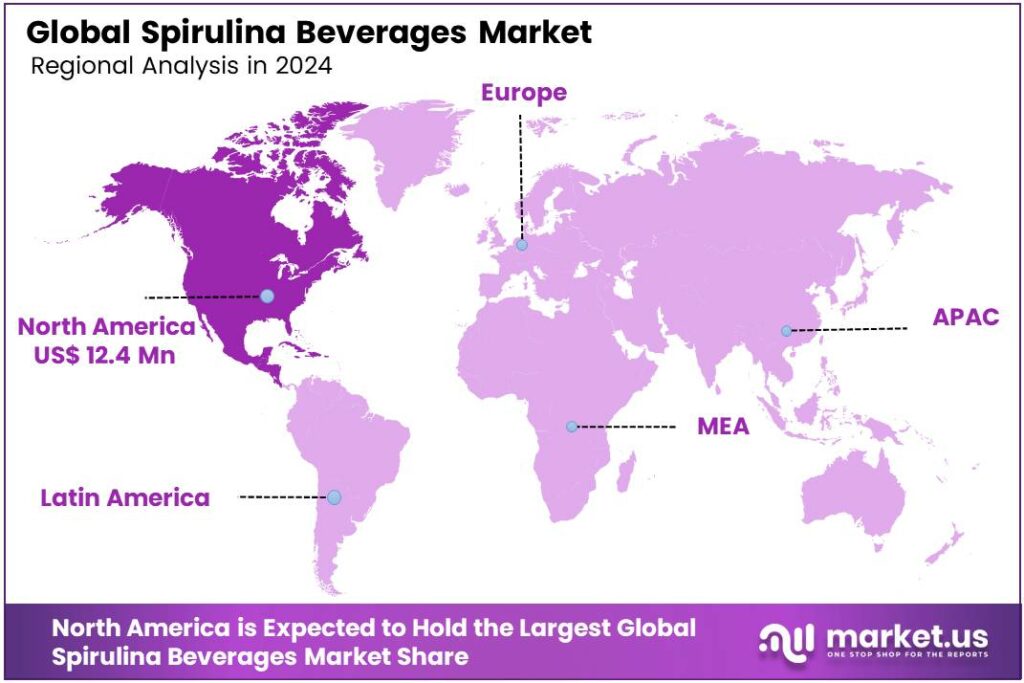

- North America accounted for 45.8% of sales in 2024, valued at USD 12.4 million, due to strong health-and-wellness trends and robust retail channels.

Analyst Viewpoint

The spirulina beverages market is a hotspot for investors eyeing the health and wellness sector. With consumers increasingly ditching sugary drinks for nutrient-dense options, spirulina’s high protein and antioxidant profile make it a standout. Opportunities lie in diversifying product lines—think spirulina-infused energy drinks, smoothies, or even kombucha-style beverages.

The growing vegan and eco-conscious consumer base, particularly in North America and the Asia-Pacific region, creates a fertile ground for startups and established brands to innovate. Partnerships with gyms, cafes, or e-commerce platforms can boost visibility. Plus, technological advancements like closed-loop water systems and solar-powered cultivation are lowering production costs, making it easier to scale operations and attract investment.

Health-conscious consumers, especially millennials and Gen Z, are driving demand for spirulina beverages. They’re drawn to its natural, plant-based appeal and benefits like immune support and detoxification. Urban markets show a strong preference for convenient, ready-to-drink formats, while eco-conscious buyers value sustainable sourcing.

By Ingredient Source

Conventional Ingredient Source Dominates with 72.9% Share

In 2024, Conventional held a dominant market position, capturing more than a 72.9% share of the Spirulina Beverages Market. This segment’s strength lies in its cost-effectiveness, wide-scale availability, and established consumer trust compared to niche or premium alternatives.

Conventional spirulina-based drinks are more affordable for producers and consumers, enabling them to penetrate mass markets, especially in regions where functional beverages are still in their growth phase. The segment is expected to sustain its leading role, supported by consistent demand from mainstream retail and supermarket channels.

The preference for conventional spirulina beverages also reflects the growing awareness of natural nutritional benefits without the higher costs often associated with organic sourcing. This dominance highlights that, despite increasing health-consciousness, price sensitivity and accessibility continue to drive most consumer purchasing decisions in the spirulina beverages industry.

By Distribution Channel

Supermarkets and Hypermarkets Lead with 32.6% Share

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 32.6% share of the Spirulina Beverages Market. These large retail outlets have become the primary choice for consumers as they offer wide product visibility, variety, and competitive pricing under one roof.

The ability to compare brands and access promotional offers makes supermarkets and hypermarkets a preferred shopping destination for spirulina beverages, especially among urban buyers. This channel is expected to strengthen further, driven by expanding retail networks and increasing shelf space for functional and plant-based drinks.

By End User

Adults Segment Leads with 44.8% Share

In 2024, Adults held a dominant market position, capturing more than a 44.8% share of the Spirulina Beverages Market. The strong presence of this segment is driven by the rising adoption of functional drinks among health-conscious adults who seek natural sources of protein, vitamins, and antioxidants to support daily wellness and active lifestyles.

Spirulina-based beverages are particularly attractive to working professionals and fitness-focused consumers, as they provide an easy way to boost energy and immunity. The adult segment is expected to maintain its lead, supported by growing awareness about plant-based nutrition and preventive healthcare. This steady demand from adults highlights the segment’s critical role in shaping the overall growth and acceptance of spirulina beverages in mainstream consumption patterns.

Key Market Segments

By Ingredient Source

- Conventional

- Organic

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

By End User

- Adults

- Athletes

- Children

- Seniors

Drivers

Combating Micronutrient Deficiency Drives Spirulina Beverage Demand

One major driving force behind the rising popularity of spirulina beverages is micronutrient malnutrition, often referred to as hidden hunger. Even though millions of people consume enough calories, their diets frequently lack essential vitamins and minerals. Spirulina is rich in iron, B vitamins, protein, and antioxidants, making it a potent natural source for filling those nutritional gaps.

For context, the World Health Organization estimates that 40% of children aged 6–59 months, 37% of pregnant women, and 30% of women aged 15–49 suffer from anemia globally. Anemia is often caused by iron, vitamin B12, and folate deficiencies, nutrients that spirulina contains in appreciable amounts.

At the same time, chronic micronutrient deficiencies affect vast numbers: a recent Micronutrient Forum report (supported by GAIN, USAID, Advancing Nutrition) states that one in two preschool-aged children and two in three women of reproductive age around the world suffer from deficiencies in key vitamins and minerals.

Restraints

The Challenge of Taste and Consumer Acceptance

For all its profound nutritional power, the single greatest hurdle preventing spirulina beverages from flooding every supermarket and kitchen is a deeply human one: their taste. The experience of drinking a spirulina-based beverage can be a challenging one for the uninitiated. The dominant flavour profile is often described as intensely earthy, fishy, or reminiscent of pond water, with a sometimes-gritty texture that can feel unpleasant on the palate.

The very algae that packs in the protein, vitamins, and antioxidants also contains compounds like geosmin, which is responsible for that distinct earthy odour and taste that many find off-putting. The Food and Agriculture Organization (FAO) of the United Nations champions spirulina as a key tool for fighting malnutrition due to its incredible efficiency and nutrient density.

This isn’t just an anecdotal observation; it’s a recognized restraint at the highest levels of global food security discussion. The success of any food product, no matter how healthy, hinges on its ability to be incorporated seamlessly into a person’s life, and a disagreeable taste makes that nearly impossible. For many, the first sip is also the last, turning a potential superfood into a forgotten novelty item at the back of the fridge.

Opportunity

Rising Demand for Sustainable, Plant-Based Protein Fuels Spirulina Beverage Growth

One powerful growth driver for spirulina-based beverages is the global urgency around sustainable protein sources. As the world’s population continues to grow, so does the need for protein that is both environmentally responsible and nutritionally rich. Spirulina, a blue-green microalgae, offers exceptionally high protein yield with minimal land and water use, making it a frontrunner for eco-friendly nutrition.

According to the Food and Agriculture Organization (FAO), spirulina contains an impressive 60–70% protein by dry weight, and it achieves this with significantly lower resource demands than traditional livestock. Imagine achieving such high protein output using just ponds or controlled fermenters, rather than vast grazing lands.

On the nutritional side, spirulina is not just high in protein; it also packs vital micronutrients like iron, vitamin B12, and beta-carotene, making it a dense, sustainable superfood. With growing awareness of climate change and its connections to food systems, consumers are increasingly looking for protein alternatives that align with environmental values.

Trends

The Rise of Climate-Conscious Nutrition

A powerful new reason people are reaching for spirulina beverages isn’t just about personal health, but planetary health. There’s a growing, heartfelt understanding that our food choices directly impact the environment, and spirulina is emerging as a stunningly efficient answer to this anxiety.

For a generation of consumers who feel the weight of climate change, choosing a product that actively reduces their environmental footprint is as important as the vitamins it contains. This shift in mindset is transforming spirulina from a niche health supplement into a meaningful symbol of sustainable consumption.

The data backing this environmental promise comes from respected global organizations trying to solve the world’s food security problems. The World Health Organization (WHO) has highlighted spirulina’s potential, noting its incredible nutritional yield. But the true breakthrough is in its resource use. NASA, in its studies for long-term space missions, famously championed spirulina because it generates twenty times more protein per unit area than soybeans.

Regional Analysis

North America leads with a 45.8% share and a USD 12.4 Million market value.

In 2024, North America emerged as the dominating region, accounting for 45.8% of spirulina beverage sales, valued at USD 12.4 million. The region’s lead reflects strong health-and-wellness spending, rapid acceptance of functional drinks, and a mature retail mix spanning supermarkets, natural food chains, and fast-growing e-commerce.

Consumers in the U.S. and Canada increasingly seek plant-based protein, low-sugar formats, and clean label ingredients; spirulina fits this demand with its dense nutrition profile and versatile use in ready-to-drink blends, shots, and smoothie bases. Brands continue to diversify flavors and pair spirulina with citrus, tropical fruits, and adaptogen cues to improve taste and broaden appeal beyond niche users.

Distribution partnerships with specialty grocers and gym/fitness channels further enhance visibility. On the supply side, reliable quality standards and clear labeling help build trust, while product education around protein, iron, and antioxidant benefits supports repeat purchases. Marketing that emphasizes sustainable water-efficient cultivation and minimal land footprint resonates with eco-conscious shoppers.

Innovation will likely cluster around convenience, kid-friendly variants, and sugar-smart recipes that meet retailer guidelines. Cross-merchandising with smoothies and probiotic beverages can expand basket size, and online subscriptions can lift retention. North America is positioned to maintain its leadership, using flavor innovation, transparent sourcing, and strategic retail placements to keep spirulina beverages on more weekly shopping lists across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Prolgae leverages its domestic cultivation to provide high-quality, cost-effective spirulina. Its strength lies in B2B ingredient supply, providing the foundational biomass for numerous beverage brands, especially in the Asia-Pacific region. This positions it as a crucial enabler rather than a direct consumer brand, allowing it to scale by supplying multiple manufacturers and focusing on B2B relationships and bulk production efficiency.

Cyanotech Corporation grows its spirulina in open ponds using pristine ocean water. Its flagship ingredient, Hawaiian Spirulina Pacifica, is renowned for its high nutrient density and is marketed as a superior, sustainably sourced product. This established reputation for quality makes it a preferred supplier for high-end nutritional beverage and nutraceutical companies seeking a premium, traceable ingredient.

FUL Foods, Inc. is a disruptive consumer-facing brand, not just a supplier. It differentiates itself by creating ready-to-drink functional beverages, most notably its signature blue spirulina lemonade. The company focuses on marketing the unique aesthetic and wellness benefits of spirulina directly to health-conscious consumers, making the ingredient more accessible and appealing to a mainstream market through innovative product formulation.

Top Key Players in the Market

- Prolgae Spirulina Supplies Pvt. Ltd.

- Cyanotech Corporation

- FUL Foods, Inc

- Sol-ti, Inc.

- RAW JUICERY INC

- PHYCOMANIA

- Buried Treasure Liquid Nutrients

- Bitez of Love

- The Juice Smith

- AKAL FOOD

Recent Developments

- In 2024, Prolgae has been scaling its production of spirulina-based products, including exploring spirulina-infused beverages for the Indian market. They’ve introduced spirulina powder suitable for mixing into drinks like smoothies and juices, targeting health-conscious consumers.

- In 2024, FUL Foods launched a new range of spirulina-based sparkling beverages in the European market, focusing on low-sugar, high-nutrient drinks. These were marketed as carbon-negative, aligning with EU sustainability goals.

Report Scope

Report Features Description Market Value (2024) USD 27.1 Million Forecast Revenue (2034) USD 113.5 Million CAGR (2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Source (Conventional, Organic), By End User (Adults, Athletes, Children, Seniors), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Prolgae Spirulina Supplies Pvt. Ltd., Cyanotech Corporation, FUL Foods, Inc., Sol-ti, Inc., RAW JUICERY INC, PHYCOMANIA, Buried Treasure Liquid Nutrients, Bitez of Love, The Juice Smith, AKAL FOOD Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Spirulina Beverages MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Spirulina Beverages MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Prolgae Spirulina Supplies Pvt. Ltd.

- Cyanotech Corporation

- FUL Foods, Inc

- Sol-ti, Inc.

- RAW JUICERY INC

- PHYCOMANIA

- Buried Treasure Liquid Nutrients

- Bitez of Love

- The Juice Smith

- AKAL FOOD