Global Sorbitan Oleate Market Size, Share Analysis Report By Function (Emulsifier, Stabilizer, Dispersant, Lubricant), By Sorbitan Type (Sorbitan Monooleate, Sorbitan Trioleate, Sorbitan Sesquioleate), By Application (Personal Care and Cosmetics, Food and Beverages, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152638

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

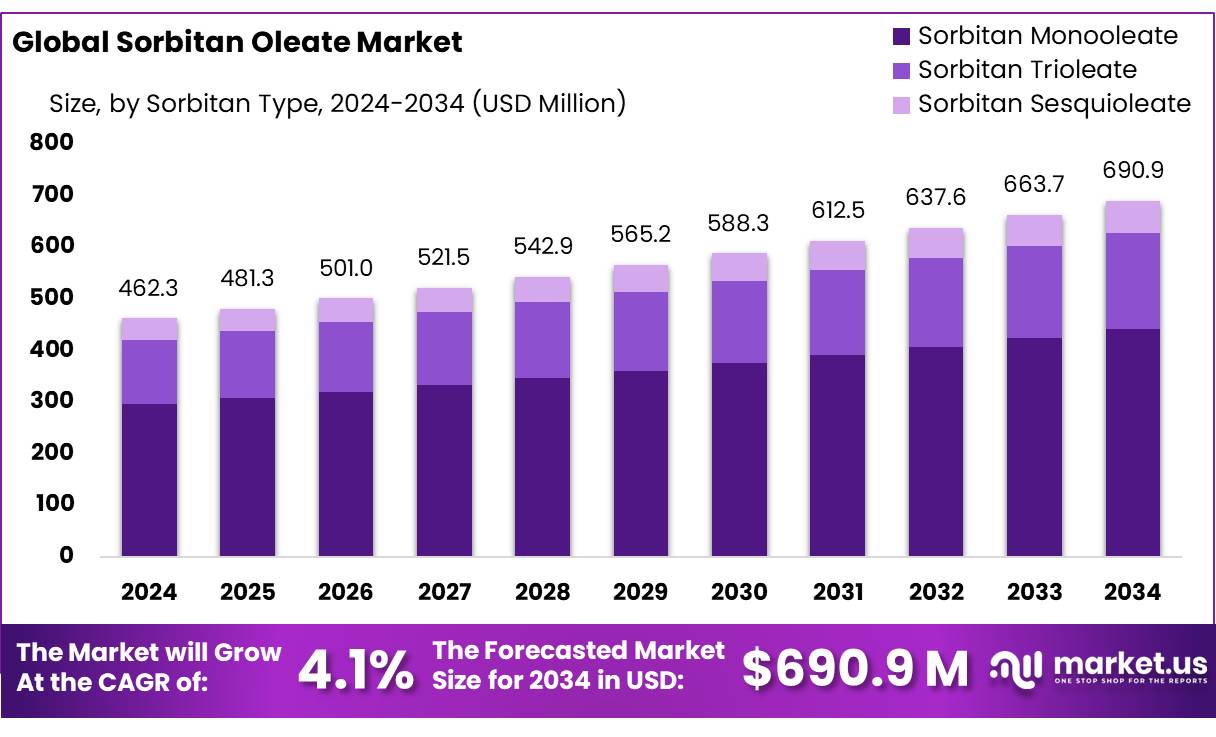

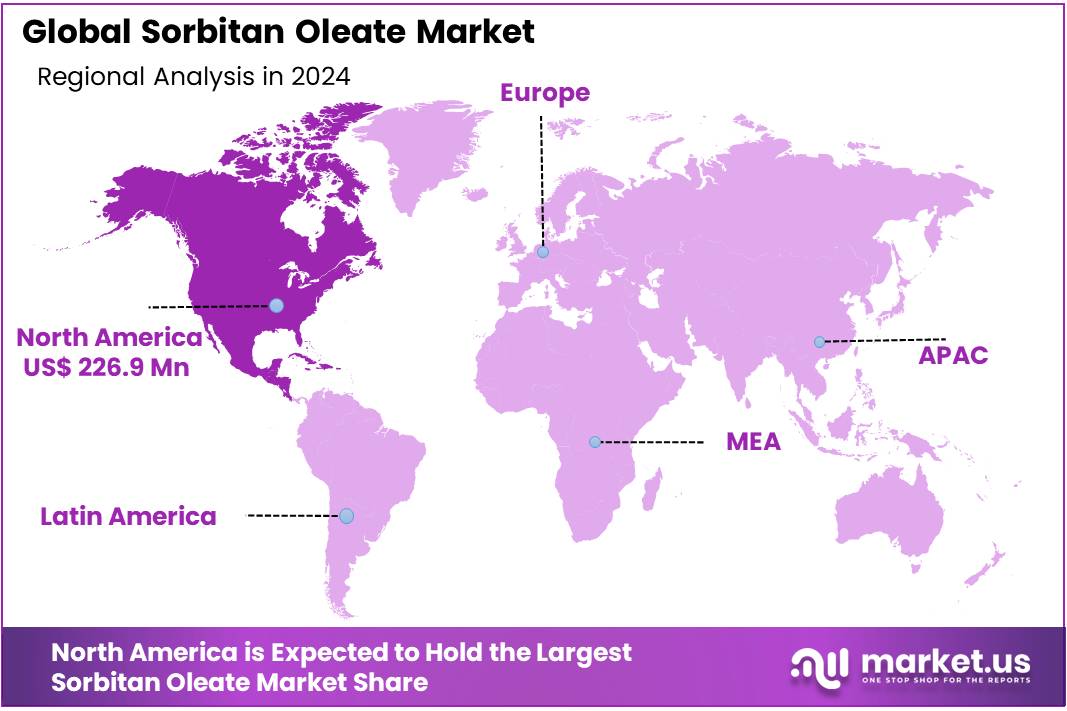

The Global Sorbitan Oleate Market size is expected to be worth around USD 690.9 Million by 2034, from USD 462.3 Million in 2024, growing at a CAGR of 4.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 49.1% share, holding USD 226.9 Million revenue.

Sorbitan Oleate serves as a stabilizer and emulsifier in products like ice cream, salad dressings, and baked goods. It helps improve texture and consistency by reducing interfacial tension between oil and water phases. The compound is also used in pharmaceutical formulations to enhance the solubility and bioavailability of active ingredients. In cosmetics, it is employed in creams and lotions for its emulsifying properties, contributing to product stability and skin compatibility.

In the United States, Sorbitan Oleate is recognized as a Generally Recognized As Safe (GRAS) substance by the Food and Drug Administration (FDA) and is included in the list of substances added to food . This regulatory approval underscores its safety and suitability for use in food products.

Additionally, the U.S. Department of Agriculture (USDA) supports the development of biobased products through programs like the Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program, which provides loan guarantees up to $250 million to assist in the development and construction of new and emerging technologies, including those related to renewable chemicals and biobased products.

Key drivers of market growth include increased demand for processed and convenience food, where Sorbitan Oleate acts as a stabilizer and emulsifier. The FDA permits usage at 0.32–0.7% in various bakery and icing applications. Safety assessments, including subchronic feeding studies in rodents, show no adverse effects up to dietary concentrations of 5–10%, supporting regulatory confidence in its food-grade use. Additionally, growing personal care and pharmaceutical applications, fueled by consumer preference for plant-derived and minimally processed ingredients, propel market expansion.

Health Canada’s guidelines on maximum permissible levels of emulsifiers (e.g., 5,000ppm) reinforce safe use in food preparations. Meanwhile, EFSA has proactively reevaluated usage conditions for sorbitan monostearate (E 491) in enzyme preparations, and EU authorities are monitoring dietary exposure, particularly among toddlers and children at high percentiles. In addition, the Codex Alimentarius has requested global industry data to support reassessment of INS 475 (sorbitan esters), with reporting expected by end2026.

In the U.S., Sorbitan Oleate is listed in the FDA’s Substances Added to Food inventory and regulated under 21 CFR 172.840 with defined maximum permissible use levels. In Europe, its registration under REACH (Regulation EC 1907/2006) ensures that safety data are available and risk assessments are performed for its manufacture and importation. These regulatory frameworks ensure product safety and enforce compliance along the supply chain, thereby enhancing consumer and industry confidence.

Key Takeaways

- Sorbitan Oleate Market size is expected to be worth around USD 690.9 Million by 2034, from USD 462.3 Million in 2024, growing at a CAGR of 4.1%.

- Sorbitan Monooleate held a dominant market position, capturing more than a 63.9% share in the global Sorbitan Oleate market.

- Emulsifier held a dominant market position, capturing more than a 58.1% share in the global Sorbitan Oleate market.

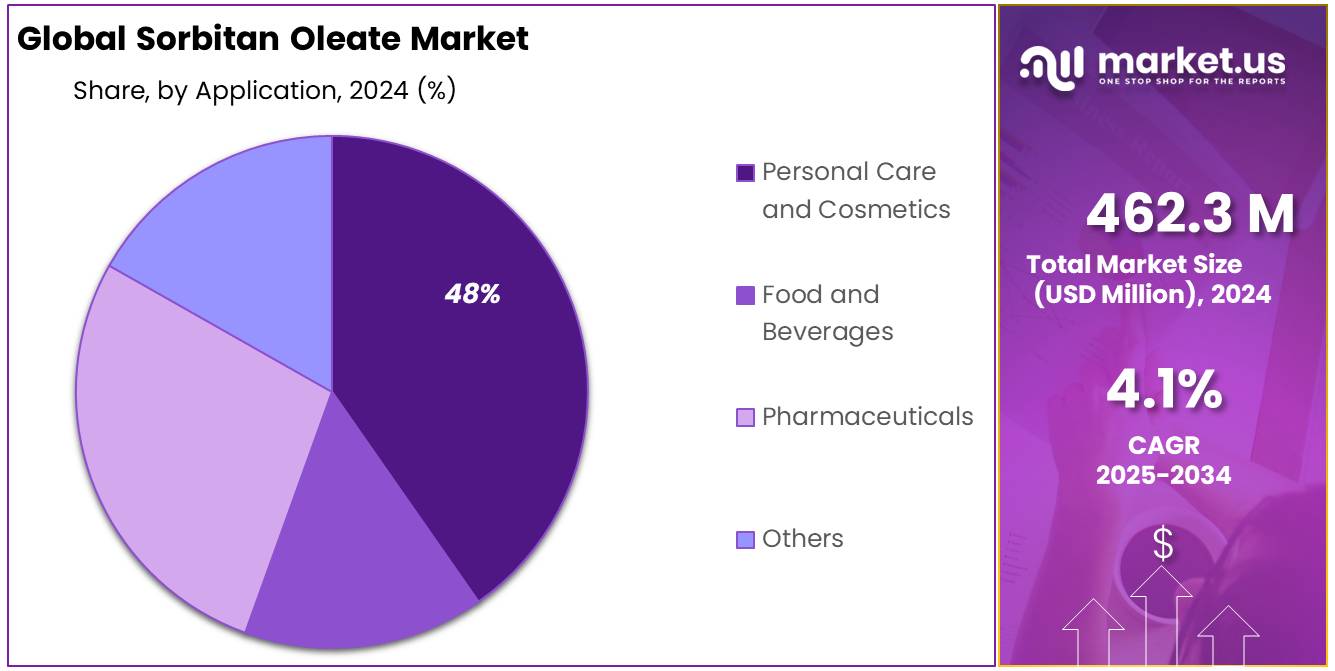

- Personal Care and Cosmetics held a dominant market position, capturing more than a 48.2% share in the global Sorbitan Oleate market.

- North America established itself as the leading region in the Sorbitan Oleate market, securing a commanding 49.1% share, equivalent to approximately USD 226.9 million.

By Function Analysis

Sorbitan Monooleate dominates with 63.9% in 2024 due to its broad usage across food and cosmetic applications.

In 2024, Sorbitan Monooleate held a dominant market position, capturing more than a 63.9% share in the global Sorbitan Oleate market. This leading position is largely attributed to its extensive use as a non-ionic surfactant and emulsifier in multiple industries.

Its ability to maintain product stability and blend oil and water effectively has made it a preferred ingredient in processed food items such as bakery products, dressings, and creams, where consistent texture and shelf-life are essential. In the cosmetic and personal care sector, Sorbitan Monooleate continues to be in high demand for lotions, creams, and cleansers due to its skin-friendly profile and plant-derived origin.

By Sorbitan Type Analysis

Emulsifier leads with 58.1% in 2024 driven by strong demand in food and personal care industries.

In 2024, Emulsifier held a dominant market position, capturing more than a 58.1% share in the global Sorbitan Oleate market. This leadership can be linked to the increasing need for stable emulsification in products across the food, cosmetic, and pharmaceutical sectors.

Sorbitan Oleate, known for its excellent emulsifying properties, is commonly used to help mix oil and water phases, ensuring consistent texture and quality in end products. In the food industry, it plays a vital role in bakery mixes, margarine, and creamy sauces where maintaining a smooth and uniform blend is essential.

By Application Analysis

Personal Care and Cosmetics lead with 48.2% in 2024 due to rising demand for skin-friendly emulsifiers.

In 2024, Personal Care and Cosmetics held a dominant market position, capturing more than a 48.2% share in the global Sorbitan Oleate market. This strong presence is largely due to the growing consumer preference for natural, skin-safe, and non-irritating ingredients in daily-use products like moisturizers, creams, lotions, and cleansers. Sorbitan Oleate, known for its gentle emulsifying properties and compatibility with sensitive skin, has become a key component in both mass-market and premium beauty formulations.

Key Market Segments

By Function

- Emulsifier

- Stabilizer

- Dispersant

- Lubricant

By Sorbitan Type

- Sorbitan Monooleate

- Sorbitan Trioleate

- Sorbitan Sesquioleate

By Application

- Personal Care and Cosmetics

- Food and Beverages

- Pharmaceuticals

- Others

Emerging Trends

Emphasis on Clean Label and Plant-Based Ingredients

A significant trend shaping the sorbitan oleate market is the growing consumer demand for clean label and plant-based ingredients. As consumers become more health-conscious and environmentally aware, there’s a noticeable shift towards products that are perceived as natural, transparent, and free from synthetic additives. This movement is particularly evident in the food and cosmetics industries, where ingredients like sorbitan oleate are favored for their natural origins and multifunctional properties.

This growth is driven by the increasing preference for clean label products and the rising demand for plant-based ingredients. Sorbitan oleate, derived from natural sources like sorbitol and oleic acid, aligns with these consumer preferences, making it a preferred choice for manufacturers aiming to meet the clean label trend.

Governments and regulatory bodies are also supporting this shift towards clean label and plant-based ingredients. Regulations in regions like the European Union and the United States encourage the use of natural and safe ingredients in food and cosmetic products, providing a conducive environment for the growth of ingredients like sorbitan oleate.

The trend towards clean label and plant-based ingredients is significantly influencing the sorbitan oleate market. As consumer preferences continue to evolve towards natural and sustainable products, sorbitan oleate’s role as a natural emulsifier positions it well to meet these demands, driving growth in both the food and cosmetics industries.

Drivers

Growing Demand for Processed and Convenience Foods

One of the primary drivers propelling the sorbitan oleate market is the increasing global demand for processed and convenience foods. As lifestyles become busier, consumers are seeking ready-to-eat and easy-to-prepare food options, which often require emulsifiers like sorbitan oleate to maintain texture, stability, and shelf life. This trend is particularly evident in regions with rapidly urbanizing populations and changing dietary habits.+

This growth is driven by the increasing consumption of processed foods, which rely on emulsifiers to ensure consistent quality and appearance. For instance, sorbitan oleate is commonly used in products such as ice cream, margarine, and salad dressings to improve texture and prevent separation.

In the United States, the Food and Drug Administration (FDA) has approved sorbitan oleate for use as a food additive under 21 CFR 173.75, which pertains to indirect food additives used in food packaging and processing . This regulatory approval underscores the recognized safety and utility of sorbitan oleate in the food industry.

Similarly, in Canada, Health Canada’s Food Directorate has authorized the use of polysorbate 80 (polyoxyethylene (20) sorbitan monooleate), a related compound, as an emulsifier in various food products, including seasonings and rice-based ready-to-eat cereals . This approval highlights the broader acceptance of sorbitan esters in food applications.

Restraints

Raw Material Price Volatility

A significant challenge impacting the sorbitan oleate market is the volatility in raw material prices, particularly oleic acid and sorbitol. These fluctuations are influenced by various factors, including agricultural yields, geopolitical tensions, and shifts in global demand. For instance, disruptions in palm oil production—a primary source of fatty acids—can lead to price hikes, directly impacting the cost structure for sorbitan oleate manufacturers. Such instability not only affects profit margins but also complicates long-term planning and pricing strategies for producers.

The Food and Agriculture Organization (FAO) reported that the Vegetable Oil Price Index fluctuated by 43% between January 2022 and December 2023, eroding profit margins for fixed-price contracts. Manufacturers without long-term pricing agreements faced margin compression of 8–12%, limiting their ability to reinvest in supply chain resilience. Smaller players, particularly in Asia-Pacific markets, were disproportionately affected, with 14% exiting the sector in 2023 due to unsustainable input costs.

This raw material volatility poses a restraint on the sorbitan oleate market, as manufacturers must navigate these uncertainties to maintain cost-effectiveness and competitiveness. The need for strategic sourcing and inventory management becomes paramount to mitigate the impact of these price fluctuations.

Opportunity

Expansion of the Cosmetics and Personal Care Sector

A significant growth opportunity for the sorbitan oleate market lies in the expanding cosmetics and personal care industry. Sorbitan oleate is widely used as an emulsifier and stabilizer in various cosmetic formulations, including creams, lotions, and makeup products. Its ability to improve texture, enhance spreadability, and extend shelf life makes it a valuable ingredient in the development of high-quality cosmetic products.

In response to this demand, manufacturers are increasingly focusing on developing natural and sustainable cosmetic products. Sorbitan oleate, derived from natural sources, aligns with this trend and is gaining popularity as a preferred emulsifier in clean-label and eco-friendly formulations. Its biodegradable nature and compatibility with various skin types further enhance its appeal in the cosmetics industry.

Government initiatives supporting the growth of the cosmetics sector also contribute to the market expansion. For instance, the European Union’s Cosmetics Regulation (EC) No 1223/2009 provides a comprehensive legal framework for the safety and efficacy of cosmetic products, fostering consumer confidence and industry growth.

As the cosmetics and personal care industry continues to thrive, the demand for sorbitan oleate is expected to rise, presenting significant growth opportunities for manufacturers and suppliers in the market.

Regional Insights

North America dominates with 49.1% share, reaching USD 226.9 million in 2024, thanks to robust industrial demand.

In 2024, North America established itself as the leading region in the Sorbitan Oleate market, securing a commanding 49.1% share, equivalent to approximately USD 226.9 million. This dominant position is driven by steady demand from key industries such as personal care, cosmetics, pharmaceuticals, and food processing. Manufacturers in the United States and Canada have increasingly adopted Sorbitan Oleate, citing its effective emulsifying and stabilizing characteristics that align with regulatory safety standards.

The strong presence of major producers and established distribution infrastructure has reinforced North America’s advantage, allowing rapid development and market penetration of Sorbitan Oleate-based formulations. In particular, manufacturers within the personal care and food-grade segments have benefited from streamlined approval processes under EPA and FDA frameworks, which reduces commercialization timelines significantly. As of 2025, demand remains robust, driven by steady consumer interest in clean-label and plant-derived emulsifiers for everyday items.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kao Chemicals is a leading player in the global sorbitan oleate market, offering a wide range of specialty chemicals. The company focuses on sustainable solutions and advanced emulsifiers for the food, cosmetics, and pharmaceutical sectors. Kao Chemicals’ commitment to innovation and product quality has established it as a trusted brand in the industry, with a strong market presence in Asia and North America.

BASF is a global leader in chemicals, including sorbitan oleate, which is used extensively in food, cosmetics, and pharmaceuticals. The company emphasizes sustainability, offering eco-friendly and efficient solutions for emulsification. With a robust research and development pipeline, BASF provides high-performance products that meet the growing demand for clean-label and plant-based ingredients. Their extensive global network ensures a strong market presence.

Protameen Chemicals specializes in the production of high-quality emulsifiers, including sorbitan oleate, for the food, pharmaceutical, and cosmetic industries. With a strong focus on customization, Protameen offers tailor-made solutions that meet specific industry needs. Their commitment to sustainability and innovative product development has made them a key player in the emulsifier market, ensuring their continued growth and presence in North America and beyond.

Top Key Players Outlook

- Kao Chemicals

- BASF

- Zschimmer and Schwarz

- The Herbarie

- Protameen Chemicals

- Taiwan Surfactant

- ErcaWilmar

- Vantage Specialty Ingredients

- Italmatch Chemicals

- anyo Chemical Industries

- Lakeland Chemicals

- Evonik

Recent Industry Developments

October 2024, BASF introduced the Emulgade® Verde line of natural-based emulsifiers for personal care, which includes Emulgade® Verde 10 OL.

In 2024 Zschimmer & Schwarz, the company reported a peak revenue of $21.2 million, with a workforce of 53 employees, translating to a revenue per employee ratio of approximately $400,566.

Report Scope

Report Features Description Market Value (2024) USD 462.3 Mn Forecast Revenue (2034) USD 690.9 Mn CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Emulsifier, Stabilizer, Dispersant, Lubricant), By Sorbitan Type (Sorbitan Monooleate, Sorbitan Trioleate, Sorbitan Sesquioleate), By Application (Personal Care and Cosmetics, Food and Beverages, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kao Chemicals, BASF, Zschimmer and Schwarz, The Herbarie, Protameen Chemicals, Taiwan Surfactant, ErcaWilmar, Vantage Specialty Ingredients, Italmatch Chemicals, anyo Chemical Industries, Lakeland Chemicals, Evonik Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kao Chemicals

- BASF

- Zschimmer and Schwarz

- The Herbarie

- Protameen Chemicals

- Taiwan Surfactant

- ErcaWilmar

- Vantage Specialty Ingredients

- Italmatch Chemicals

- anyo Chemical Industries

- Lakeland Chemicals

- Evonik