Global Smart Composites Market Size, Share Analysis Report By Product Type (Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites), By Application ( Aerospace and Defense, Automotive, Construction, Healthcare, Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160621

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

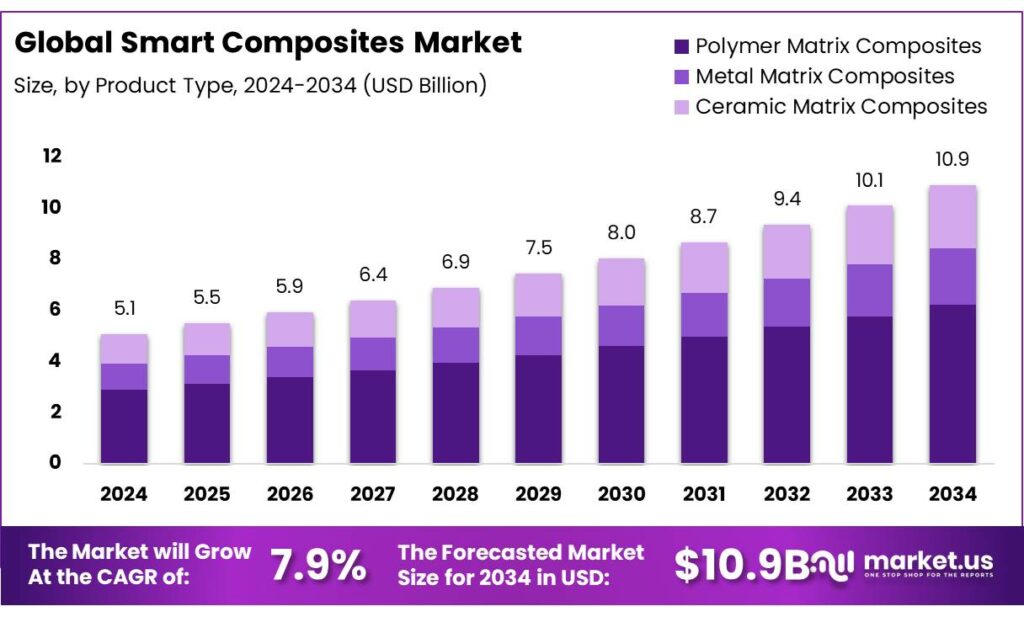

The Global Smart Composites Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

Smart composites represent a transformative class of materials that integrate structural health monitoring (SHM), electromagnetic interference (EMI) shielding, and multifunctional capabilities such as self-sensing, self-healing, responsiveness to external stimuli, and adaptability to environmental conditions. These materials are particularly relevant in aerospace applications, where weight reduction, durability, and real-time health monitoring are crucial factors.

Government initiatives are actively supporting the development and integration of smart composites in the energy sector. The U.S. Department of Energy’s Institute for Advanced Composites Manufacturing Innovation (IACMI) received a federal funding commitment of $6 million for the first year of a five-year investment plan aimed at accelerating technological research and commercialization in the domestic composites manufacturing sector.

For instance, the U.S. Department of Energy’s Advanced Materials & Manufacturing Technologies Office (AMMTO) has allocated $33 million to advance smart manufacturing technologies, including the development of high-performance composite materials for clean energy applications.

The National Mission for Enhanced Energy Efficiency (NMEEE) in India, established in 2010, aims to achieve a total avoided capacity addition of 19,598 MW, fuel savings of around 23 million tonnes per year, and greenhouse gas emissions reductions of 98.55 million tonnes per year. While not directly targeting smart composites, such initiatives create a conducive environment for the adoption of advanced materials that contribute to energy efficiency.

Key Takeaways

- Smart Composites Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 7.9%.

- Polymer Matrix Composites (PMCs) held a dominant market position, capturing more than a 57.3% share.

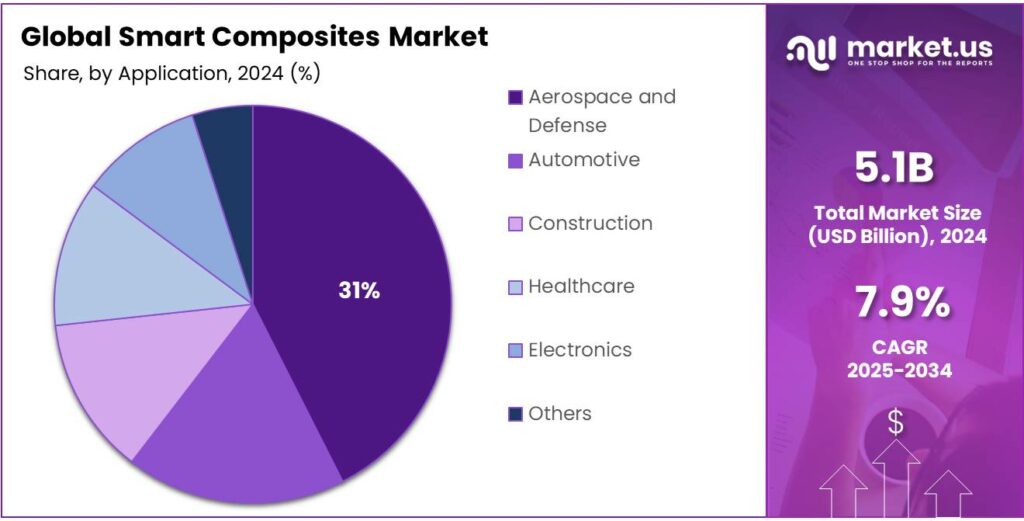

- Aerospace and Defense held a dominant market position, capturing more than a 31.8% share of the smart composites market.

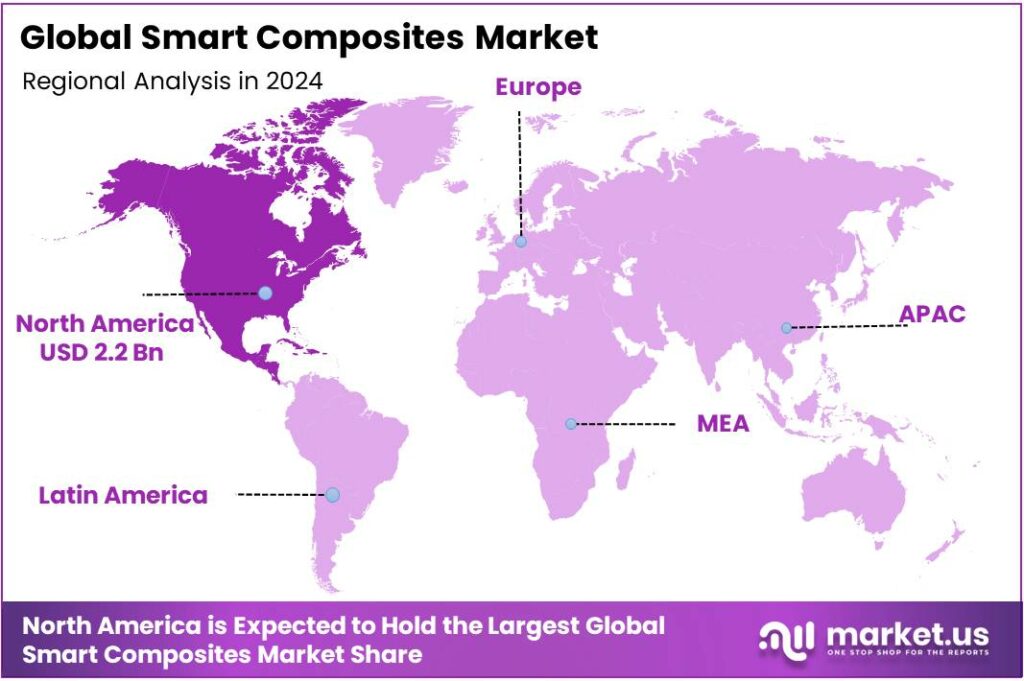

- North America held a commanding position in the smart composites market, capturing more than 45.9% of the global share, equating to an estimated value of USD 2.2 billion.

By Product Type Analysis

Polymer Matrix Composites dominate with 57.3% market share in 2024

In 2024, Polymer Matrix Composites (PMCs) held a dominant market position, capturing more than a 57.3% share of the smart composites market. This leadership can be attributed to their versatile properties, including lightweight nature, high strength-to-weight ratio, and ease of fabrication, which make them suitable for a wide range of applications from aerospace to automotive and renewable energy sectors.

The growing emphasis on energy-efficient and sustainable materials has further reinforced the adoption of PMCs, as they help reduce overall weight and improve fuel efficiency in transportation systems. In the United States, for instance, advanced polymer-based composites developed at the Department of Energy’s Oak Ridge National Laboratory are being increasingly utilized in manufacturing processes due to their cost-effectiveness and enhanced performance

By Application Analysis

Aerospace and Defense leads with 31.8% market share in 2024

In 2024, Aerospace and Defense held a dominant market position, capturing more than a 31.8% share of the smart composites market. This strong position is driven by the sector’s high demand for lightweight, high-strength, and multifunctional materials that improve aircraft performance, reduce fuel consumption, and enhance structural durability.

Advanced composites are increasingly being used in aircraft fuselages, wings, and defense vehicles due to their ability to withstand extreme conditions while contributing to overall efficiency. For instance, polymer matrix composites and fiber-reinforced composites are widely integrated into military and commercial aircraft to reduce weight without compromising safety and performance.

Key Market Segments

By Product Type

- Polymer Matrix Composites

- Metal Matrix Composites

- Ceramic Matrix Composites

By Application

- Aerospace and Defense

- Automotive

- Construction

- Healthcare

- Electronics

- Others

Emerging Trends

The Rise of Smart Composites in Food Packaging

In 2025, the food industry is witnessing a transformative shift towards sustainable and intelligent packaging solutions. A significant development in this arena is the integration of smart composites—materials that combine traditional polymers with advanced functionalities like biodegradability, antimicrobial properties, and real-time freshness monitoring. These innovations are not only enhancing food safety and shelf life but also aligning with global sustainability goals.

Smart composites are engineered to respond dynamically to environmental changes, such as temperature fluctuations or microbial growth, thereby extending the freshness of food products. For instance, researchers at IIT Madras have developed a biodegradable packaging material using agricultural waste and mycelium—the root-like structures of fungi—as a sustainable alternative to traditional plastic foams. This innovation addresses both plastic pollution and agricultural waste management by converting residues into compostable packaging solutions.

The research demonstrated that mycelium composites grown on substrates like cardboard exhibited superior mechanical strength compared to conventional Expanded Polystyrene (EPS) and Expanded Polyethylene (EPE) foams. While still at the laboratory stage, the material has shown promising properties like strength, water resistance, and biodegradability.

Governments worldwide are recognizing the importance of sustainable packaging solutions and are implementing policies to encourage innovation in this field. In India, the Ministry of Environment, Forest and Climate Change has introduced regulations to reduce single-use plastics and promote the use of biodegradable materials. These policies are creating a conducive environment for the development and adoption of smart composites in food packaging.

Drivers

Demand for Lightweight Materials in Aerospace and Automotive Industries

One of the primary catalysts for the growth of smart composites is the escalating demand for lightweight materials in the aerospace and automotive sectors. This demand is driven by the need to enhance fuel efficiency, reduce emissions, and improve overall performance. Smart composites, known for their high strength-to-weight ratios and durability, offer a viable solution to these industry challenges.

In the aerospace industry, the adoption of composite materials has been instrumental in reducing aircraft weight, leading to significant improvements in fuel efficiency and operational costs. For instance, the integration of composites in the Boeing 787 Dreamliner has resulted in a 20% reduction in weight compared to traditional aluminum structures, translating to approximately 10% better fuel efficiency. Similarly, Airbus has incorporated composites in its A350 XWB, achieving a 25% weight reduction, which contributes to lower fuel consumption and enhanced performance.

The automotive industry is also experiencing a shift towards lightweight materials to meet stringent fuel economy standards and reduce greenhouse gas emissions. According to the U.S. Department of Energy, a 10% reduction in vehicle weight can improve fuel efficiency by 6–8%. This has led to increased use of carbon fiber reinforced plastics (CFRP) and glass fiber reinforced plastics (GFRP) in vehicle components. For example, BMW’s i3 electric vehicle utilizes CFRP for its passenger cell, resulting in a 50% weight reduction compared to conventional steel structures.

Government initiatives are further propelling the adoption of lightweight materials. In the United States, the Department of Energy’s Lightweight Materials Program supports research and development of advanced materials to reduce vehicle weight and improve energy efficiency. The program has funded numerous projects focused on developing lightweight composites for automotive applications.

Restraints

High Manufacturing Costs Hindering Widespread Adoption of Smart Composites

One of the most significant barriers to the widespread adoption of smart composites is their high manufacturing costs. These advanced materials, which integrate functionalities like self-healing, sensing, and actuation, often require specialized raw materials and complex processing techniques, leading to elevated production expenses.

For instance, carbon fiber-reinforced polymers (CFRPs), commonly used in smart composites, are notably expensive. The production of CFRPs involves intricate processes such as resin transfer molding and autoclave curing, which demand precise control and specialized equipment. These methods not only increase the cost of the raw materials but also contribute to higher operational expenses.

Additionally, the integration of smart functionalities into composite materials necessitates the incorporation of sensors, actuators, and other electronic components. This integration adds another layer of complexity and cost to the manufacturing process. The need for specialized knowledge and equipment to embed these components further escalates production costs.

The high costs associated with smart composites pose challenges, particularly for industries that are price-sensitive or operate on thin profit margins. For example, in the automotive sector, manufacturers are under pressure to reduce vehicle weight to improve fuel efficiency and meet environmental regulations. While smart composites offer a potential solution, their high costs can be prohibitive, especially for mass-market vehicles.

Opportunity

Government Initiatives Driving Growth in Smart Composites

A significant growth opportunity for smart composites lies in the increasing support from government initiatives aimed at advancing sustainable manufacturing and infrastructure. Governments worldwide are recognizing the potential of smart composites to enhance energy efficiency, reduce emissions, and promote sustainability across various sectors.

In the United States, the Department of Energy’s Advanced Materials and Manufacturing Technologies Office (AMMTO) has released a $33 million funding opportunity to accelerate the advancement of smart manufacturing technologies. This initiative focuses on developing innovative technologies and materials necessary for the nation’s clean energy transition.

The funding aims to support research in areas such as smart manufacturing for a circular economy, sustainable transportation, high-performance materials, and domestic mining. By investing in these areas, the government seeks to foster the development and deployment of smart composites that can contribute to a more sustainable and competitive manufacturing sector.

Similarly, in Europe, the Horizon 2020 program has allocated funds to projects aimed at advancing composite materials for transportation applications. These initiatives focus on developing sustainable and cost-effective composites to reduce environmental impact and enhance performance. By supporting research and development in this field, the European Union aims to promote the adoption of smart composites in various industries, including aerospace, automotive, and construction.

Regional Insights

North America leads with 45.9% share, valued at $2.2 billion in 2024

In 2024, North America held a commanding position in the smart composites market, capturing more than 45.9% of the global share, equating to an estimated value of USD 2.2 billion. This dominance is underpinned by the region’s robust industrial infrastructure, advanced manufacturing capabilities, and significant investments in research and development. The aerospace and defense sectors are particularly influential, with the United States being a global leader in aircraft manufacturing and defense technologies. The integration of smart composites into these industries enhances structural performance and enables real-time monitoring, contributing to improved safety and operational efficiency.

The automotive sector in North America also plays a pivotal role in the adoption of smart composites. The increasing demand for lightweight materials to improve fuel efficiency and reduce emissions has led to the incorporation of advanced composite materials in vehicle manufacturing. Additionally, the construction industry is witnessing a rise in the use of smart composites for applications such as infrastructure monitoring and reinforcement, driven by the need for durable and sustainable building materials.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Established in 1977 and headquartered in Petaluma, California, Hydrofarm Holdings Group, Inc. is a leading manufacturer and distributor of hydroponic equipment and supplies for controlled environment agriculture. The company offers a wide range of products, including high-intensity grow lights, climate control systems, growing media, and nutrients. Hydrofarm serves both professional growers and hobbyists, providing innovative solutions to enhance productivity and sustainability in indoor farming.

Practical Smart Composites (Pty) Ltd is an Australian company specializing in the design, manufacture, testing, and repair of composite materials. With over 20 years of experience, the company develops innovative products and processes that enable clients to achieve transformative changes, quality enhancements, and cost reductions. Their expertise spans various industries, providing tailored composite solutions to meet specific client needs.

Green Life Group is a 100% garment export company based in Dhaka, Bangladesh. The company is committed to producing high-quality garments and fabrics, adhering to sustainable practices in its manufacturing processes. With a focus on innovation and quality, Green Life Group serves the global fashion industry, providing products that meet international standards and customer expectations.

Top Key Players Outlook

- Hexcel Corporation

- Toray Industries, Inc.

- Teijin Limited

- Solvay S.A.

- Owens Corning

- Huntsman Corporation

- Gurit Services AG

- 3M Company

- DuPont

- Cytec Industries Inc.

- AGY Holding Corp.

- Arkema S.A.

Recent Industry Developments

In 2024 Green Life Knit Composite Ltd, reported exports totaling approximately $28.47 million, reflecting its significant presence in the global apparel market. Their product range includes children’s clothing, such as 2-piece sets, hoodies, and rompers, catering to various international markets.

In 2024 Hydrofarm Holdings Group Inc, reported annual net sales of $190.3 million, a 16% decline from $226.6 million in 2023. The fourth quarter of 2024 saw a 20.9% decrease in net sales to $37.3 million, primarily due to a 16.8% drop in product volume and a 3.9% decrease in pricing.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Bn Forecast Revenue (2034) USD 10.9 Bn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites), By Application (Aerospace and Defense, Automotive, Construction, Healthcare, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hexcel Corporation, Toray Industries, Inc., Teijin Limited, Solvay S.A., Owens Corning, Huntsman Corporation, Gurit Services AG, 3M Company, DuPont, Cytec Industries Inc., AGY Holding Corp., Arkema S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

Hexcel Corporation Toray Industries, Inc. Teijin Limited Solvay S.A. Owens Corning Huntsman Corporation Gurit Services AG 3M Company DuPont Cytec Industries Inc. AGY Holding Corp. Arkema S.A.