Global Real And Compound Chocolate Market Size, Share, And Enhanced Productivity By Category (Real Chocolate, Compound Chocolate), By Type (Milk Chocolate, Dark Chocolate, White Chocolate), By Form (Chips, Slabs, Coatings, Others), By Application (Confectionery, Bakery, Dairy and Frozen Desserts, Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169949

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

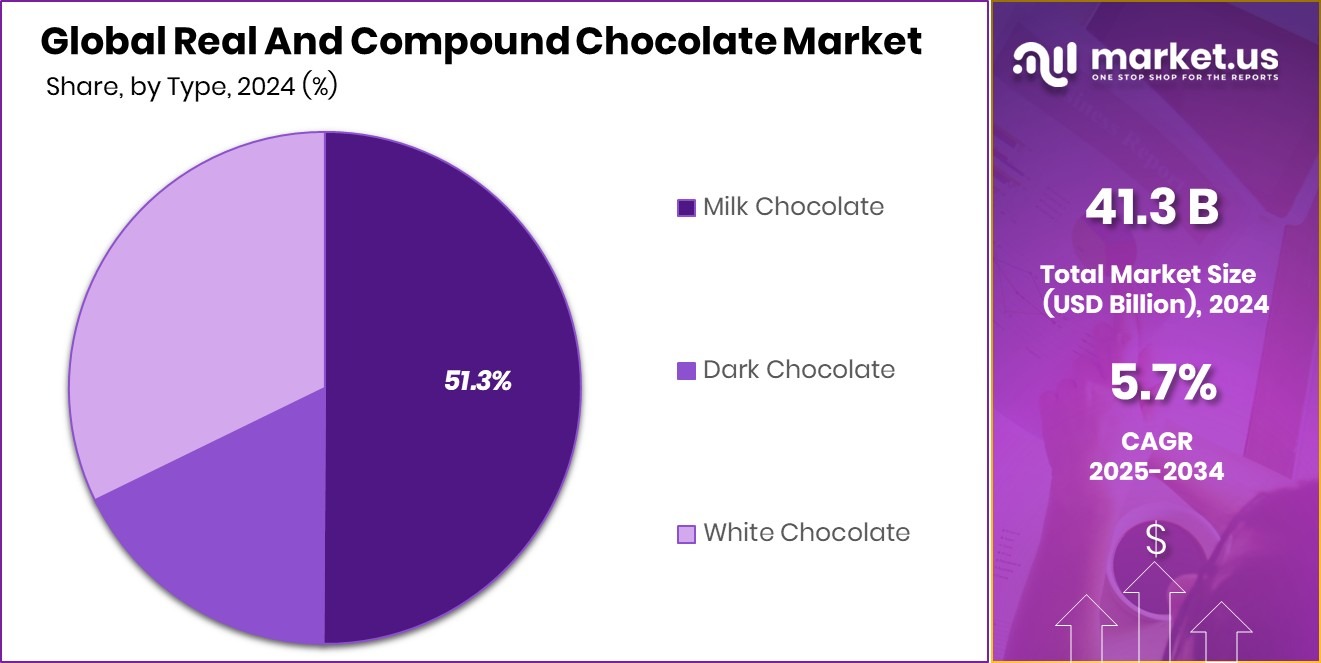

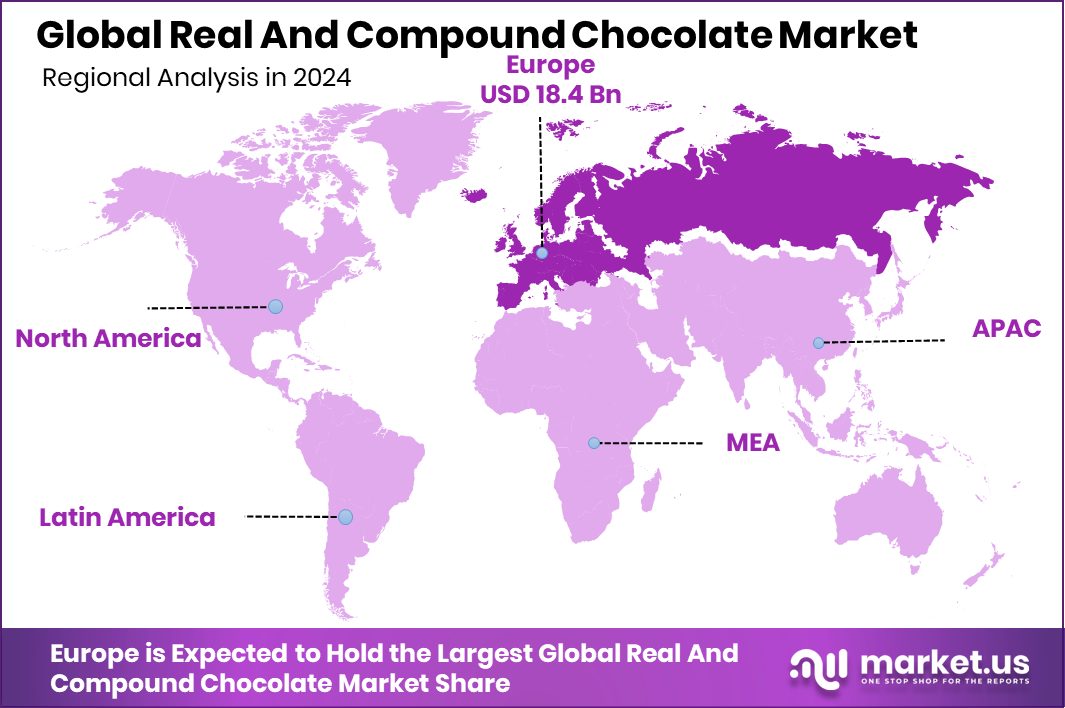

The Global Real And Compound Chocolate Market is expected to be worth around USD 71.9 billion by 2034, up from USD 41.3 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034. In Europe Real And Compound Chocolate Market reaches 44.70% share, totaling USD 18.4 Bn value.

Real chocolate is made using cocoa butter along with cocoa solids and sugar, giving it a rich taste and smooth melt. Compound chocolate replaces cocoa butter with vegetable fats, which improves heat stability, lowers cost, and simplifies large-scale production. Both types serve different consumer needs across indulgent, functional, and mass-market formats.

The market spans premium confectionery, bakery coatings, seasonal products, functional snacks, and value-based offerings. Real chocolate leads in gifting and premium consumption, while compound chocolate supports volume-driven categories where pricing, shelf life, and ease of handling are important. Together, they create a balanced market serving both quality-focused and cost-sensitive buyers.

Market growth is influenced by sustainability-led innovation and alternative ingredient development. Companies are investing in fermentation, cocoa-free formulations, and plant-based processing to address cocoa price volatility, climate risks, and ethical sourcing concerns, while maintaining familiar taste and texture profiles for consumers.

- Green Spot Technologies (€5M / $5.8M): Funding supports scale-up of waste-derived fermented ingredients, including cocoa alternatives under the Milatea brand, helping reduce food waste while creating stable, low-impact chocolate inputs.

- Voyage Foods ($22M): Investment strengthens production of cocoa-free chocolate alternatives designed to lower environmental impact and improve long-term supply reliability.

Consumer demand is expanding toward reduced sugar, functional energy formats, and affordable indulgence. A 30% lower-sugar chocolate bar priced at Rs 50 shows health-driven pricing acceptance, while discount-led promotions and limited editions increase volume sales and trial across mass retail channels.

Opportunities lie in functional chocolates, ethical formulations, and alternative cocoa sources. Funding activity such as Win-Win’s £3M, Awake Chocolate’s C$8M, Prefer Brews’ $4.2M, and MOSH’s $3M highlights growing confidence in sustainable, functional, and next-generation chocolate products.

Key Takeaways

- The Global Real And Compound Chocolate Market is expected to be worth around USD 71.9 billion by 2034, up from USD 41.3 billion in 2024, and is projected to grow at a CAGR of 5.7% from 2025 to 2034.

- In 2024, Real Chocolate dominated the Real And Compound Chocolate Market with a 59.8% share worldwide.

- Milk Chocolate led the Real And Compound Chocolate Market by type, accounting for 51.3% globally.

- Chips form held a position in the Real And Compound Chocolate Market, capturing 38.4% share.

- Confectionery application drove demand in the Real And Compound Chocolate Market, representing 44.8% share overall.

- Europe accounts for the Real And Compound Chocolate Market dominance at 44.70% worth USD 18.4 Bn.

By Category Analysis

Real chocolate dominated the Real and Compound Chocolate Market with a 59.8% share.

In 2024, Real Chocolate held a dominant market position in By Category segment of Real And Compound Chocolate Market, with a 59.8% share. This strong position reflects steady consumer preference for chocolates made with cocoa butter and higher cocoa content. Buyers increasingly associate real chocolate with better taste, authentic mouthfeel, and premium quality, which has helped this category maintain leadership across both household consumption and professional use in bakeries, patisseries, and confectionery products.

The dominance of Real Chocolate is also linked to rising awareness around ingredient transparency and quality. Consumers are paying closer attention to labels and are willing to choose products perceived as more natural and traditional. This shift continues to support consistent demand, reinforcing Real Chocolate’s leading role in shaping category-level value and consumption patterns within the overall market.

By Type Analysis

Milk chocolate led the Real and Compound Chocolate Market by type with 51.3%.

In 2024, Milk Chocolate held a dominant market position in the By Type segment of Real And Compound Chocolate Market, with a 51.3% share. This leadership is largely driven by its broad consumer appeal, balanced sweetness, and smooth texture, making it a preferred choice across age groups. Milk chocolate continues to perform well in everyday consumption due to its familiar taste profile and versatility in multiple chocolate-based products.

The strong market share also reflects consistent demand from both retail and food service channels, where milk chocolate is widely used in molded chocolates, bars, and confectionery items. Its ability to meet mass-market preferences while maintaining stable consumption patterns has allowed milk chocolate to sustain its dominant position within the type-based segmentation of the market.

By Form Analysis

Chips formed a notable share within the Real and Compound Chocolate Market, 38.4%.

In 2024, Chips held a dominant market position in the By Form segment of the Real And Compound Chocolate Market, with a 49.2% share. This dominance is closely linked to the wide use of chocolate chips in baking and confectionery applications, where consistency in size, easy handling, and controlled melting behavior are highly valued. Chips are commonly preferred for their ability to deliver uniform taste and appearance in finished products.

The strong share also reflects steady demand from commercial kitchens and home baking segments, where chips simplify preparation and reduce processing time. Their functional convenience and compatibility with multiple recipes have helped maintain stable consumption, supporting Chips as the leading form within this segment and reinforcing its role in the overall market structure.

By Application Analysis

Confectionery application dominated the Real and Compound Chocolate Market demand, capturing 44.8% share.

In 2024, Confectionery held a dominant market position in By Application segment of Real And Compound Chocolate Market, with a 44.8% share. This leadership is supported by the steady production of chocolate-based sweets, bars, and coated products, where chocolate remains a core ingredient. Confectionery applications rely heavily on consistent flavor delivery and visual appeal, reinforcing the segment’s importance within overall chocolate usage.

The strong share also reflects regular consumer purchasing patterns, as confectionery products are widely consumed across everyday and seasonal occasions. Stable demand from retail outlets and impulse-buy categories has helped sustain volume movement, allowing the confectionery application to maintain its leading role and continue shaping demand trends within the broader market framework.

Key Market Segments

By Category

- Real Chocolate

- Compound Chocolate

By Type

- Milk Chocolate

- Dark Chocolate

- White Chocolate

By Form

- Chips

- Slabs

- Coatings

- Others

By Application

- Confectionery

- Bakery

- Dairy and Frozen Desserts

- Beverages

- Others

Driving Factors

Affordability, Investment, and Cultural Support Drive Chocolate Demand

One major driving factor for the real and compound chocolate market is rising accessibility supported by pricing strategies, financial innovation, and public funding. Large supermarket promotions, such as popular Easter chocolates offered at three for £1, encourage impulse buying and bulk purchases, especially during festive seasons.

At the same time, financial interest around chocolate-linked products is growing in Asia, with Chocolate Finance attracting strong attention as its managed assets approach S$1 billion, showing confidence in food and lifestyle–backed value themes. Cultural and creative support is also shaping demand by linking chocolate with tourism, design, and local entrepreneurship rather than just food consumption. Together, affordability, investor interest, and institutional backing are helping chocolate reach new consumers while keeping demand stable across premium and mass-market segments.

- Chocolate City Fund ($1 million): Launched by the culture minister to support creative startups, this funding encourages innovation around chocolate-related businesses, blending food, culture, and urban development while creating new commercial demand pathways.

Restraining Factors

Rising Input Costs And Supply Pressure Limit Growth

A key restraining factor for the real and compound chocolate market is growing pressure on raw materials and ethical sourcing, which raises costs across the value chain. Farmer support, regenerative practices, and clean-label sourcing are positive but expensive shifts. GoodSAM Foods’ $9M raise to scale regenerative farming shows how sustainability requires heavy upfront investment.

Similarly, Beyond Snack’s $3.5 million funding highlights rising competition for quality agricultural inputs, while Wilde’s $20 million round reflects higher spending on premium ingredients, packaging, and distribution. These investments improve long-term resilience but tighten short-term margins for chocolate producers relying on cocoa, sugar, and fats.

Limited capital access also slows innovation for smaller brands, as scaling responsibly demands funding depth. The Naked Market’s $27.5 million Series A underlines how only well-funded players can manage inflation, sourcing standards, and consumer pricing at the same time.

Growth Opportunity

Regenerative Food Expansion Creates New Chocolate Opportunities</h3>

A major growth opportunity for the real and compound chocolate market lies in the wider shift toward regenerative farming, regional food security, and dairy-led innovation. Funding flows show growing support for cleaner ingredients and stable supply chains that also benefit chocolate manufacturing. RIND’s $6.1 million Series A reflects demand for upcycled food inputs, while Orange County’s $1 million in additional food assistance strengthens access to processed foods, including affordable chocolate. In India, Dodla Dairy’s $31.4 million acquisition supports scale and integration of dairy sourcing, helping stabilize input availability for chocolate producers.

- Alec’s Ice Cream ($11M Series A): This funding accelerates regenerative dairy farming, improving long-term milk quality and supply — a key input for real chocolate production.

Latest Trends

Protein And Precision Ingredients Shape Chocolate Innovation

One clear latest trend in the real and compound chocolate market is the move toward high-protein products and advanced ingredient technology. Consumers now see chocolate as more than a treat, pushing brands to add nutrition and performance benefits. This is visible in David’s $75M funding, which supports the growth of its flagship chocolate bar containing 28 g of protein, launched in September 2024. At the same time, bakery and confectionery brands are scaling, with Gaja Capital leading a Rs 60 crore funding round in Bakers Circle, strengthening premium baked and chocolate-linked offerings. Ingredient innovation is also accelerating.

- Melt&Marble (€7.3m): Investment enables precision-fermented fats that help create stable, high-quality chocolate with improved sustainability.

Regional Analysis

Europe leads the Real And Compound Chocolate Market with a 44.70% share valued at USD 18.4 Bn overall.

Europe emerged as the dominating region in the Real And Compound Chocolate Market, accounting for 44.70% of the total market and reaching a value of USD 18.4 Bn. This dominance reflects Europe’s deep-rooted chocolate culture, strong manufacturing base, and consistent consumption across retail and artisanal segments. The region benefits from long-established production expertise and steady demand across both real and compound chocolate categories, supporting its leading market position.

North America represents a mature and structured regional market, driven by widespread consumption of chocolate products across households and foodservice channels. Consumer familiarity with chocolate-based confectionery and desserts supports stable demand, keeping the region commercially significant within the global landscape.

Asia Pacific continues to gain importance due to urban consumption patterns and expanding bakery and confectionery usage. The Middle East & Africa show growing relevance with rising awareness of packaged chocolate products across urban centers. Latin America maintains a steady presence, supported by chocolate usage in local confectionery traditions. Together, these regions contribute to balanced market participation, while Europe remains the clear leader by value and share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Barry Callebaut AG stands out as a structurally important player in the Real and compound chocolate market due to its strong focus on industrial-scale chocolate solutions. The company’s positioning reflects deep integration across cocoa sourcing, processing, and customized chocolate production. Its ability to serve large confectionery, bakery, and foodservice customers with consistent quality reinforces its role as a backbone supplier in the global value chain, particularly for professional and bulk applications.

Puratos Group is viewed as a quality-driven participant with a strong emphasis on chocolate ingredients for bakery, patisserie, and confectionery use. The company’s strength lies in combining technical know-how with application-focused chocolate solutions. Its approach supports artisanal and industrial customers seeking reliable performance, taste balance, and application consistency, positioning Puratos as a preferred partner where formulation precision matters more than mass-volume output.

Mondelez International brings a brand-led perspective to the market, anchored in its global chocolate portfolio and consumer reach. The company benefits from strong retail presence and brand familiarity, which supports stable demand across multiple consumption occasions. Its scale, distribution strength, and ability to align products with evolving consumer preferences underpin its continued relevance in shaping global chocolate consumption patterns.

Top Key Players in the Market

- Barry Callebaut AG

- Puratos Group

Mondelez International - Cargill Incorporated

- Nestlé S.A.

- Fuji Oil Company Limited

- The Hershey Company

- Mars Incorporated

- Olam International

- Cémoi Group

Recent Developments

- In November 2025, despite global volatility and falling volumes (sales volume dropped 6.8% to 2,125,420 tonnes), Barry Callebaut saw a substantial revenue increase. The surge was driven by rising cocoa prices, leading to revenues reaching CHF 14.79 billion.

- In June 2024, Nestlé launched a new “Sustainably Sourced” chocolate line for travel retail that uses cocoa certified by the Rainforest Alliance and sourced under the Nestlé Cocoa Plan. The bars are sold at airports worldwide, offering travellers ethically-sourced chocolate.

- In June 2024, Fuji Oil launched a new line of commercial-use compound chocolates called the “CP Series”, designed to give a smooth texture and good melt profile using plant-based fats rather than cocoa butter. This helped bakeries and confectioneries manage rising cocoa costs while keeping product quality.

Report Scope

Report Features Description Market Value (2024) USD 41.3 Billion Forecast Revenue (2034) USD 71.9 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (Real Chocolate, Compound Chocolate), By Type (Milk Chocolate, Dark Chocolate, White Chocolate), By Form (Chips, Slabs, Coatings, Others), By Application (Confectionery, Bakery, Dairy and Frozen Desserts, Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barry Callebaut AG, Puratos Group, Mondelez International, Cargill Incorporated, Nestlé S.A., Fuji Oil Company Limited, The Hershey Company, Mars Incorporated, Olam International, Cémoi Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real And Compound Chocolate MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Real And Compound Chocolate MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Barry Callebaut AG

- Puratos Group Mondelez International

- Cargill Incorporated

- Nestlé S.A.

- Fuji Oil Company Limited

- The Hershey Company

- Mars Incorporated

- Olam International

- Cémoi Group