Global Potash Fertilizers Market Size, Share, And Business Benefits By Type (Muriate Of Potash, Sulfate Of Potash, Sulfate Of Potash-Magnesia, Potassium Nitrate, Potassium Hydroxide, Others), By Form (Solid, Liquid), By Application (Broadcasting, Foliar, Fertigation, Others), By Crop Type (Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155229

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

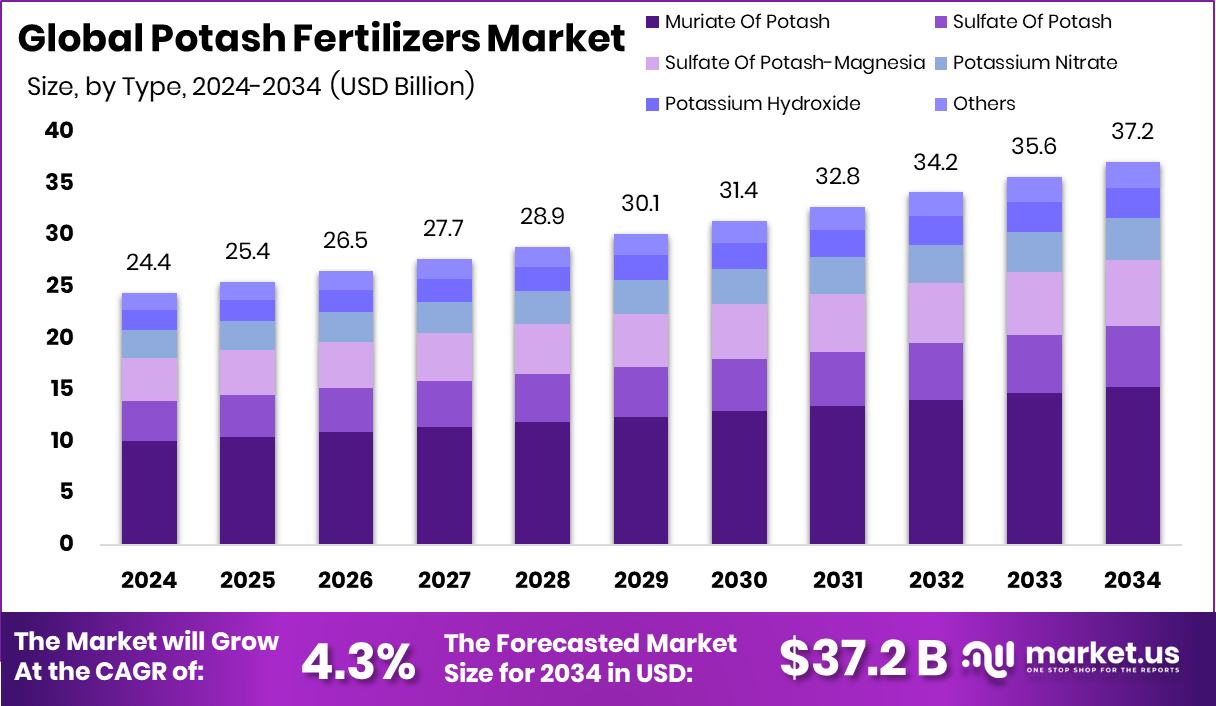

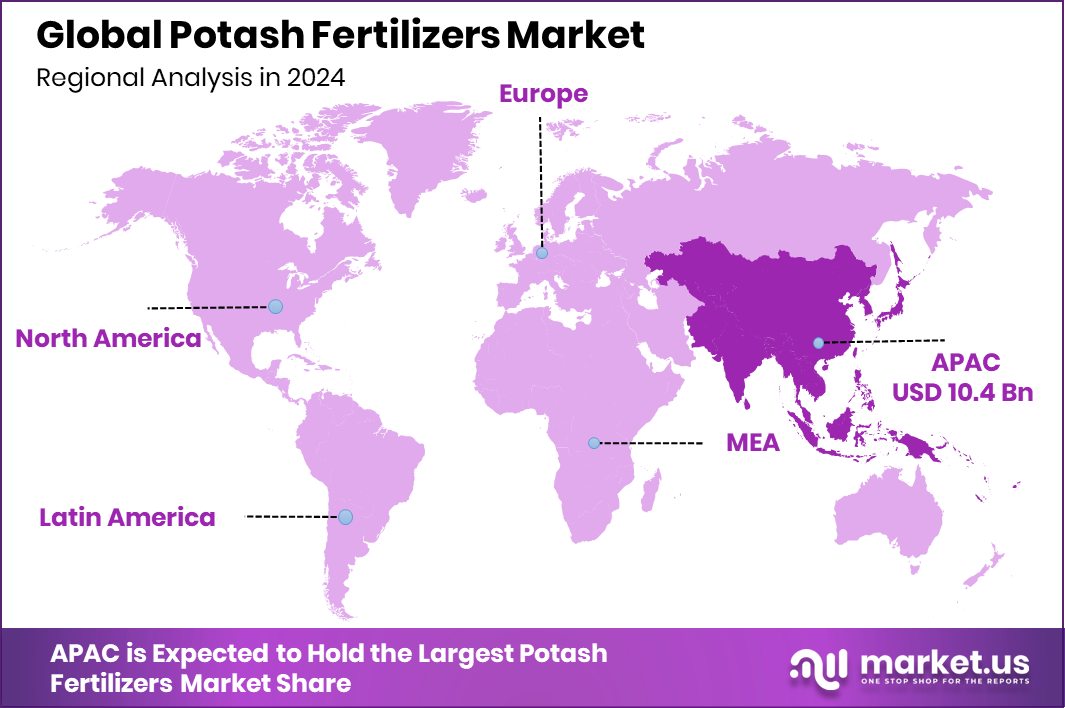

The Global Potash Fertilizers Market is expected to be worth around USD 37.2 billion by 2034, up from USD 24.4 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034. Growing population boosts potash use across the Asia Pacific USD 10.4 Bn region.

Potash fertilizers are mineral-based nutrients primarily composed of potassium, one of the three essential macronutrients required for plant growth alongside nitrogen and phosphorus. They are produced from naturally occurring potash ores, mainly potassium chloride, and help improve water retention, root strength, disease resistance, and overall crop yield. Potash is vital for crop quality, as it enhances fruit size, color, and taste, making it a key input in agricultural productivity.

The potash fertilizers market refers to the global trade, production, and consumption of potassium-based fertilizers across agriculture, horticulture, and commercial farming. The market’s growth is closely tied to global food demand, soil nutrient depletion, and increasing pressure to improve agricultural efficiency. Demand is widespread across cereals, oilseeds, fruits, and vegetables, with usage patterns varying based on regional soil conditions and farming practices. According to an industry report, an $80 million USDA grant has been allocated to the Osceola County potash facility.

Growth in this market is driven by the rising global population and the need to produce more food with limited arable land. Modern farming techniques, precision agriculture, and sustainable soil management are pushing farmers to adopt potassium-rich fertilizers to improve yields and maintain soil health. According to an industry report, the USDA has awarded $80 million grant to support the planned potash facility in Osceola County.

Demand is also fueled by increasing awareness among farmers about balanced nutrient application. With soil potassium deficiency affecting crop resilience, potash application is becoming more essential to safeguard against climate variability. According to an industry report, Millennial Potash receives $3M in U.S. government funding for its Gabon project.

Key Takeaways

- The Global Potash Fertilizers Market is expected to be worth around USD 37.2 billion by 2034, up from USD 24.4 billion in 2024, and is projected to grow at a CAGR of 4.3% from 2025 to 2034.

- In the Potash Fertilizers Market, Muriate of Potash holds 41.2% due to its cost-effectiveness.

- Solid form dominates the Potash Fertilizers Market with an 81.7% share, favored for easy storage and application.

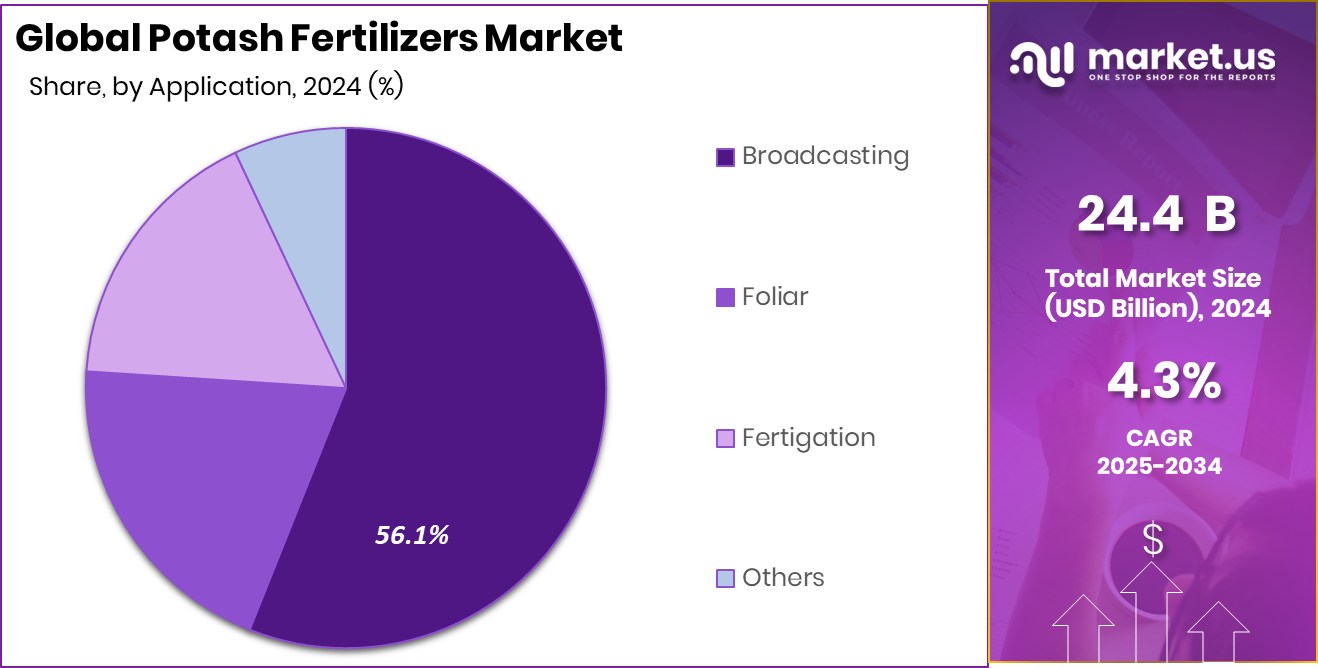

- Broadcasting application leads the Potash Fertilizers Market at 56.1%, offering uniform nutrient distribution across fields.

- Cereals and grains account for 46.9% of the Potash Fertilizers Market demand, driven by high potassium needs.

- Strong agricultural base drives potash fertilizer demand in Asia Pacific by 42.7%.

By Type Analysis

Muriate of Potash holds a 41.2% share in the Potash Fertilizers Market.

In 2024, Muriate of Potash held a dominant market position in the By Type segment of the Potash Fertilizers Market, with a 41.2% share. This dominance is attributed to its high potassium content, cost-effectiveness, and broad application across major crops such as cereals, oilseeds, and fruits.

Known chemically as potassium chloride, Muriate of Potash is preferred by farmers for its ability to rapidly replenish potassium levels in the soil, enhancing plant water retention, root development, and resistance to pests and diseases. Its high solubility ensures quick nutrient availability, making it suitable for both conventional and modern irrigation systems.

The segment’s growth is supported by the increasing need for balanced fertilization to improve agricultural productivity, especially in potassium-deficient soils. Its widespread use in large-scale farming and compatibility with blended fertilizers further strengthen its market appeal. Additionally, its role in improving crop quality—boosting yield, size, and taste—makes it a crucial input for commercial agriculture.

The affordability of Muriate of Potash compared to other potassium sources also drives its adoption in cost-sensitive markets. As global food demand continues to rise, coupled with limited arable land, the segment is expected to sustain its leading position, supported by consistent demand from both developed and emerging agricultural regions.

By Form Analysis

Solid form dominates with an 81.7% share in the potash fertilizer market.

In 2024, Solid held a dominant market position in the By Form segment of the Potash Fertilizers Market, with an 81.7% share. This strong position is driven by the ease of handling, storage, and transportation of solid fertilizers, making them highly preferred for large-scale agricultural operations. Solid potash fertilizers, typically in granule or crystalline form, offer longer shelf life and consistent nutrient release, allowing farmers to apply them through both broadcasting and localized placement methods.

The widespread adoption of solid potash fertilizers is also linked to their compatibility with existing farm equipment, reducing the need for specialized application technology. Farmers value their cost-effectiveness and high nutrient density, which ensures efficient potassium delivery to crops while minimizing input costs. In addition, solid formulations are less prone to nutrient loss through leaching compared to some liquid forms, making them ideal for sustainable nutrient management.

This segment’s dominance is further reinforced by strong demand from staple crop cultivation, where bulk application is common. As global agricultural productivity targets rise, solid potash fertilizers are expected to maintain their leading market share, supported by their practicality, efficiency, and affordability in meeting large-scale farming needs.

By Application Analysis

The broadcasting method accounts for 56.1% of the potash fertilizer market.

In 2024, broadcasting held a dominant market position in the By Application segment of the Potash Fertilizers Market, with a 56.1% share. This method’s leadership is attributed to its simplicity, cost-effectiveness, and ability to cover large agricultural areas efficiently. Broadcasting involves evenly spreading solid potash fertilizers over the soil surface, ensuring widespread nutrient availability for crops. It is particularly favored in the cultivation of cereals, oilseeds, and other field crops where uniform potassium distribution is essential for healthy growth and high yields.

The dominance of broadcasting is further supported by its compatibility with both manual and mechanized farming practices, enabling use across smallholder farms and large-scale commercial operations. This application method allows for faster nutrient delivery, especially when followed by soil incorporation through tillage, minimizing nutrient loss and enhancing uptake. Its ease of execution reduces labor intensity and operational complexity, making it a preferred choice in regions with limited access to advanced application technologies.

Additionally, broadcasting supports balanced soil fertility by enabling farmers to apply potash fertilizers in bulk quantities, addressing potassium deficiencies in a cost-efficient manner. With growing emphasis on productivity and operational efficiency in agriculture, broadcasting is expected to retain its leading share in the potash fertilizers market.

By Crop Type Analysis

Cereals and grains capture a 46.9% share of the potash fertilizers market.

In 2024, Cereals and Grains held a dominant market position in the By Crop Type segment of the Potash Fertilizers Market, with a 46.9% share. This leadership is driven by the high global demand for staple crops such as wheat, rice, maize, and barley, which form the primary source of food for a large portion of the world’s population. Potash fertilizers play a crucial role in cereal and grain production by improving root strength, enhancing water retention, and increasing resistance to pests, diseases, and environmental stress.

The segment’s dominance is further supported by the extensive cultivation area dedicated to cereals and grains, particularly in Asia-Pacific, North America, and parts of Europe. These crops require significant potassium inputs to achieve optimal yields and quality, making potash fertilizers an indispensable part of farming practices. In addition, potassium application improves grain size, weight, and storage quality, aligning with the market’s focus on both productivity and post-harvest value.

Growing population pressures, coupled with limited arable land, have pushed farmers to adopt nutrient management strategies that prioritize yield optimization. As global cereal and grain consumption continues to rise, the demand for potash fertilizers in this segment is expected to remain strong, sustaining its leading market share.

Key Market Segments

By Type

- Muriate Of Potash

- Sulfate Of Potash

- Sulfate Of Potash-Magnesia

- Potassium Nitrate

- Potassium Hydroxide

- Others

By Form

- Solid

- Liquid

By Application

- Broadcasting

- Foliar

- Fertigation

- Others

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

Driving Factors

Rising Global Food Demand Boosting Potash Use

The biggest driving factor for the Potash Fertilizers Market in 2024 is the growing global food demand. With the world population steadily increasing, farmers need to produce more crops on the same or even smaller areas of farmland. Potash fertilizers help improve crop yield, quality, and resistance to pests and harsh weather, making them essential for meeting food production targets.

They are especially important for staple crops like wheat, rice, and maize, which are consumed worldwide in large quantities. As soil nutrients get depleted over time, farmers are turning to potash to maintain soil health and sustain high yields. This rising need to secure food supply is pushing the demand for potash fertilizers across both developed and developing agricultural markets.

Restraining Factors

High Production and Transportation Costs Limiting Growth

A major restraining factor for the Potash Fertilizers Market is the high cost of production and transportation. Potash is mainly mined from deep underground deposits, requiring expensive extraction, processing, and refining processes. Additionally, large potash reserves are concentrated in specific regions, meaning many countries rely on imports. The cost of shipping bulky solid fertilizers over long distances adds to the final price for farmers.

In developing regions, where farming budgets are tight, these higher prices can discourage the regular use of potash fertilizers, leading to under-application and reduced demand. Price fluctuations due to global market changes or geopolitical issues can also make potash less affordable, slowing its adoption despite its proven benefits in boosting crop yields.

Growth Opportunity

Expanding Use in Emerging Agricultural Economies Worldwide

A key growth opportunity for the Potash Fertilizers Market lies in the expanding agricultural activities of emerging economies. Countries in Asia, Africa, and Latin America are increasing their focus on improving crop yields to ensure food security and support growing populations. Many of these regions have potassium-deficient soils, creating a strong need for potash fertilizers to boost productivity.

Governments are also introducing subsidy programs and training initiatives to promote balanced fertilization practices among farmers. As modern farming techniques and irrigation systems spread in these markets, the demand for efficient and cost-effective fertilizers like potash is expected to grow significantly. This untapped potential in emerging agricultural regions offers a strong pathway for market expansion over the coming years.

Latest Trends

Shift Toward Sustainable and Precision Farming Practices

One of the latest trends in the Potash Fertilizers Market is the growing shift toward sustainable and precision farming practices. Farmers are increasingly using data-driven techniques, GPS-guided equipment, and soil testing to apply fertilizers more efficiently, reducing waste and environmental impact. Potash fertilizers are being integrated into these modern methods to ensure crops get the exact amount of potassium they need for healthy growth.

There is also a rising interest in eco-friendly and slow-release potash formulations that minimize nutrient loss and improve long-term soil health. This trend is being driven by the global push for sustainable agriculture, stricter environmental regulations, and the need to balance high productivity with responsible resource management in farming operations.

Regional Analysis

Asia Pacific holds a 42.7% share, worth USD 10.4 Bn.

In 2024, Asia Pacific emerged as the dominant region in the Potash Fertilizers Market, accounting for 42.7% of the global share, valued at USD 10.4 billion. The region’s leadership is driven by its vast agricultural base, high population density, and growing food demand, particularly in countries like China, India, and Indonesia. Potash fertilizers are widely used in the cultivation of cereals, grains, fruits, and vegetables to enhance yield, quality, and resistance to environmental stress.

Rapid urbanization and shrinking arable land in the Asia Pacific have further intensified the need for high-efficiency fertilizers to maximize productivity per hectare. Additionally, government initiatives promoting balanced nutrient management, along with subsidies for fertilizer use, have boosted adoption across both smallholder and commercial farms. Precision agriculture and modern irrigation techniques are increasingly being integrated with potash application, improving nutrient utilization efficiency.

While North America and Europe maintain strong market presence due to advanced farming systems, and Latin America sees growth from export-oriented agriculture, Asia Pacific’s scale of production and consumption continues to set it apart. The combination of agricultural expansion, technological adoption, and policy support positions the region to retain its dominant role in the global potash fertilizers market over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agrium Inc. remains a significant supplier of potash fertilizers, leveraging its strong distribution network to serve both large-scale and smallholder farmers, while focusing on delivering consistent quality to meet rising crop nutrient needs.

Yara International ASA maintains its reputation for sustainable fertilizer solutions, with potash products integrated into balanced nutrition programs aimed at improving soil health and boosting crop yields, particularly in potassium-deficient regions.

The Mosaic Company stands out as one of the world’s leading potash producers, benefiting from vertically integrated operations that ensure efficient production, logistics, and market supply stability, especially during peak agricultural seasons.

JSC Belaruskali, a major state-owned producer, plays a vital role in global supply, exporting significant volumes to key agricultural markets and contributing to competitive pricing in the sector. These companies collectively influence pricing trends, availability, and innovation in potash fertilizers, with a shared focus on addressing the challenges of global food demand, soil nutrient depletion, and sustainable farming.

Top Key Players in the Market

- Agrium Inc.

- Yara International ASA

- The Mosaic Company

- JSC Belaruskali

- Eurochem Group AG

- Borealis AG

- HELM AG

- Sinofert Holdings Limited

- Israel Chemicals Ltd.

- Nutrien

- K+S Aktiengesellschaft

- SQM S.A

Recent Developments

- In May 2025, EuroChem unveiled Croplex, a new multi-nutrient fertilizer product now being produced in Brazil. Croplex combines nitrogen, soluble phosphorus, and sulfur in each granule and is aimed at crops like soybean, sugarcane, and corn. It’s produced near their Salitre Complex, highlighting the company’s investment in local solutions and logistics efficiency.

- In May 2025, Borealis highlighted key breakthroughs supporting a circular economy. In 2024, the company significantly increased both its processing capacity and feedstock recycling to produce fertilizers in a more sustainable, resource-efficient way.

Report Scope

Report Features Description Market Value (2024) USD 24.4 Billion Forecast Revenue (2034) USD 37.2 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Muriate Of Potash, Sulfate Of Potash, Sulfate Of Potash-Magnesia, Potassium Nitrate, Potassium Hydroxide, Others), By Form (Solid, Liquid), By Application (Broadcasting, Foliar, Fertigation, Others), By Crop Type (Cereals and Grains, Pulses and Oilseeds, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agrium Inc., Yara International ASA, The Mosaic Company, JSC Belaruskali, Eurochem Group AG, Borealis AG, HELM AG, Sinofert Holdings Limited, Israel Chemicals Ltd., Nutrien, K+S Aktiengesellschaft, SQM S.A Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Potash Fertilizers MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Potash Fertilizers MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agrium Inc.

- Yara International ASA

- The Mosaic Company

- JSC Belaruskali

- Eurochem Group AG

- Borealis AG

- HELM AG

- Sinofert Holdings Limited

- Israel Chemicals Ltd.

- Nutrien

- K+S Aktiengesellschaft

- SQM S.A