Global Pesticide Residue Testing Market Size, Share, And Business Benefits By Type (Herbicides, Insecticides, Fungicides, Others), By Technology (LC-MS/GC-MS, HPCL, Gas Chromatography, Others), By Class (Organochlorines, Organophosphates, Organonitrogens and Carbamates, Others), By Food Tested (Meat and Poultry, Dairy Products, Processed Foods, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145589

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

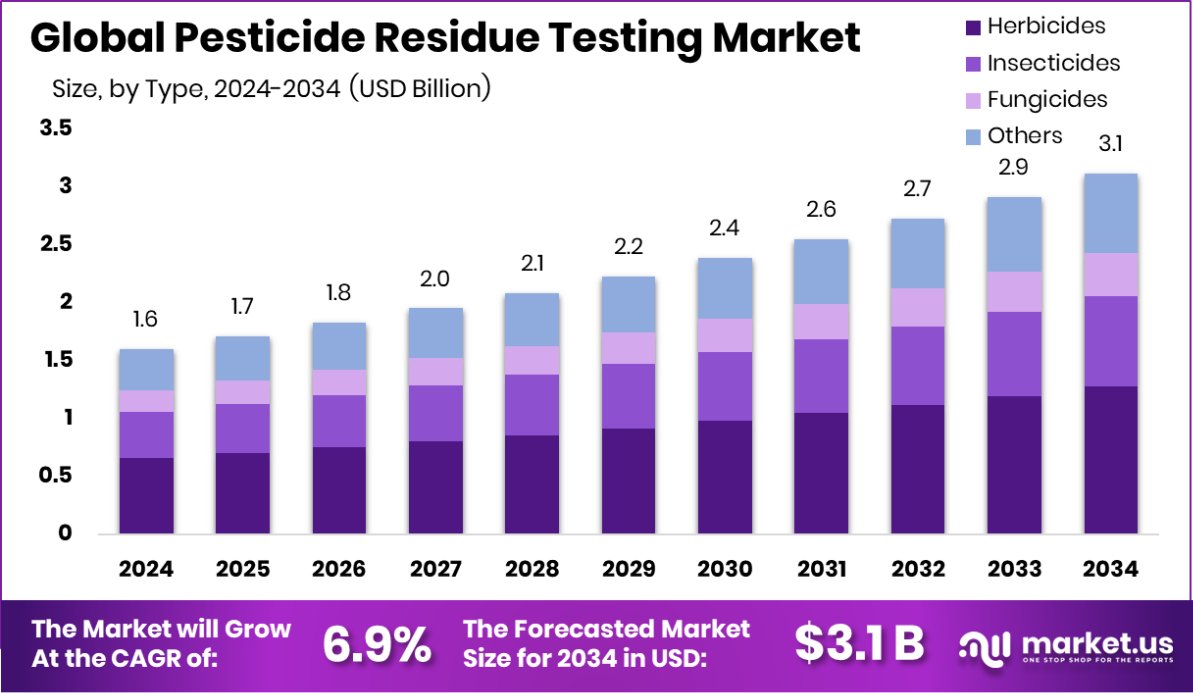

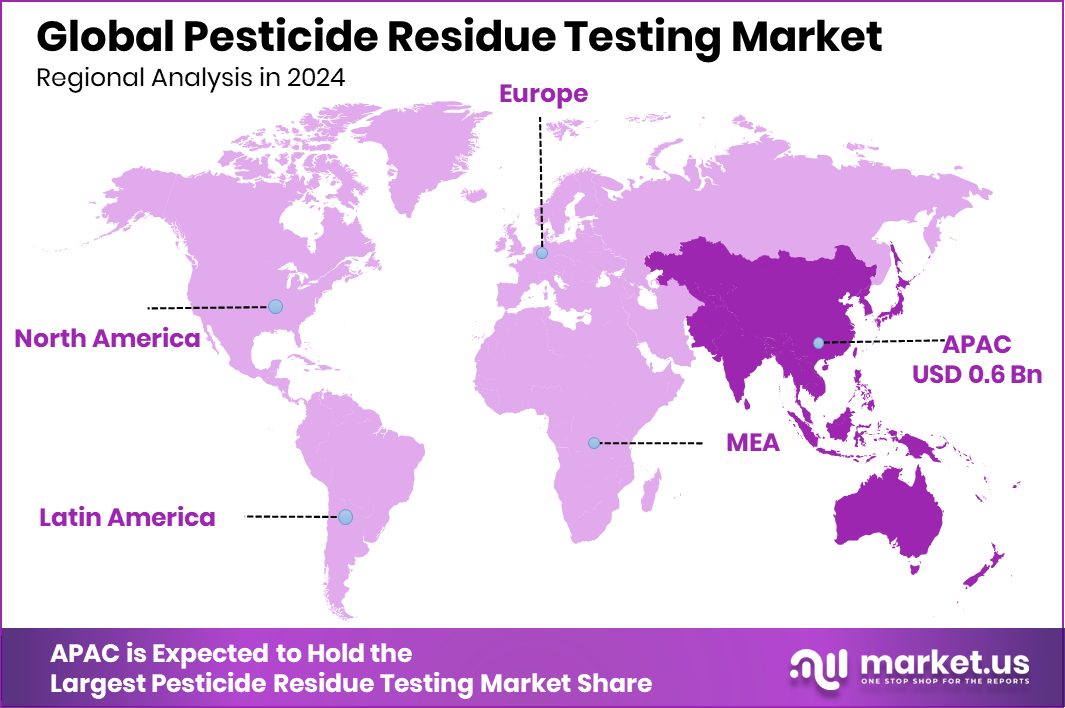

The global Pesticide Residue Testing Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 6.9% from 2025 to 2034. With a 43.50% share, Asia-Pacific leads the USD 0.6 Bn pesticide testing sector.

Pesticide residue testing refers to the process of analyzing food, water, soil, and agricultural products to detect and measure the levels of pesticide chemicals that may remain after their application. This testing is crucial to ensure that the food supply is safe for consumption and complies with legal regulations set by various health and safety authorities. It involves specialized laboratory procedures that can detect trace amounts of pesticides, even in parts per million or billion, ensuring that consumer health is protected from potentially harmful chemicals.

The pesticide residue testing market has been expanding due to increasing consumer awareness about food safety and environmental concerns. As global food trade increases, the need for reliable testing methods to ensure the quality and safety of agricultural products becomes more pressing. Additionally, stricter government regulations on pesticide use are driving demand for residue testing services, particularly in regions with stringent food safety standards.

Growth factors in the pesticide residue testing market include technological advancements in testing methods, such as the development of more sensitive, efficient, and cost-effective analytical techniques. Furthermore, the rise in organic farming and consumer preference for pesticide-free products is fueling demand for testing services to ensure compliance with organic certification standards.

Demand for pesticide residue testing is also being influenced by the growing global focus on food safety and public health. With the rise of health-conscious consumers and increasing concerns over chronic health issues linked to pesticide exposure, food safety is a major concern for both consumers and regulatory bodies.

Key Takeaways

- The Global Pesticide Residue Testing Market is expected to be worth around USD 3.1 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 6.9% from 2025 to 2034.

- The pesticide residue testing market shows significant demand for herbicide detection, contributing 41.20% of testing.

- LC-MS/GC-MS technology dominates pesticide residue testing, accounting for 43.20% of market applications.

- Organophosphates are the most common class found in pesticide residue testing, making up 37.40%.

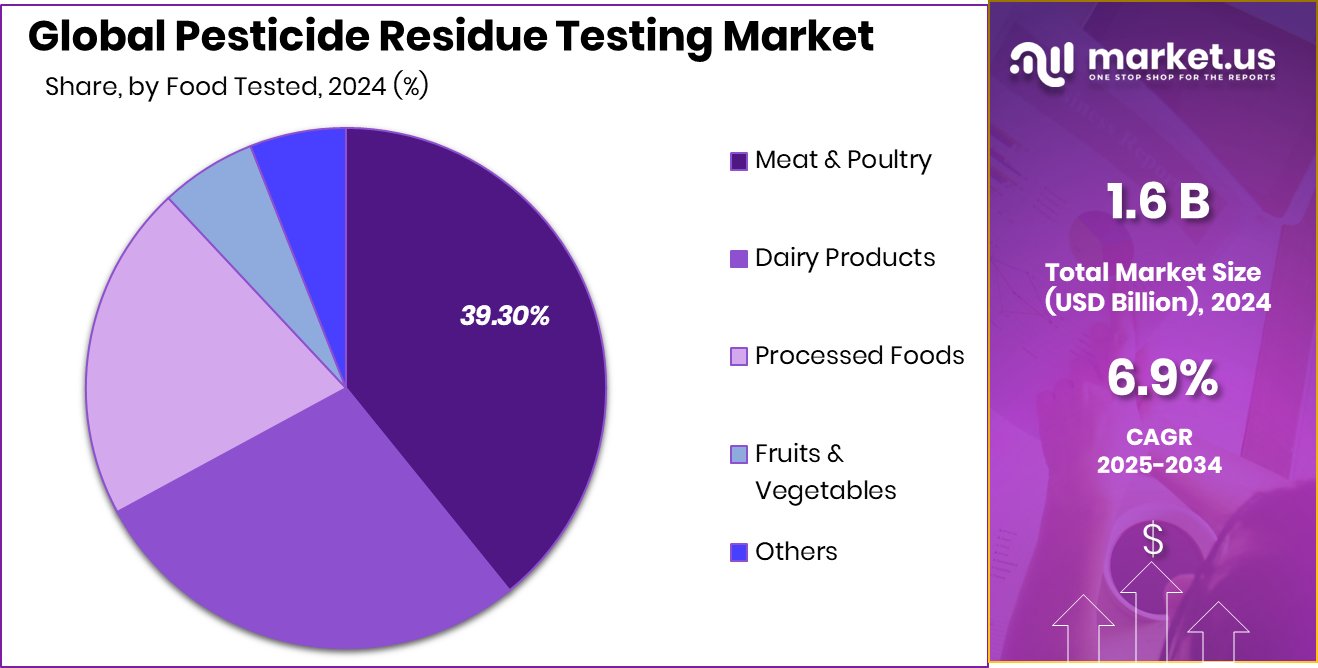

- Meat and poultry testing is critical in the pesticide residue testing market, representing 39.30%.

- The Asia-Pacific pesticide residue testing market is valued at approximately USD 0.6 billion.

By Type Analysis

Herbicides make up 41.20% of the pesticide residue testing market share globally.

In 2024, Herbicides held a dominant market position in the By Type segment of the Pesticide Residue Testing Market, with a 41.20% share. Herbicides are commonly used in agriculture to control unwanted plants, and their widespread application across various crops has resulted in significant demand for testing to ensure that residue levels remain within permissible limits.

The substantial market share of herbicides in pesticide residue testing is largely attributed to their extensive use in both conventional and organic farming. With increasing concerns about the potential health risks of pesticide residues, consumers and regulatory bodies demand stringent testing to monitor and control pesticide exposure in the food supply.

As regulations continue to evolve and governments implement stricter policies on pesticide use, the herbicide segment is expected to remain a key driver in the pesticide residue testing market. The ongoing adoption of advanced testing methods and technologies will further support the growing need for herbicide residue analysis, providing opportunities for growth within the segment.

By Technology Analysis

LC-MS/GC-MS technology dominates pesticide residue testing, accounting for 43.20% of the market.

In 2024, LC-MS/GC-MS held a dominant market position in the By Technology segment of the Pesticide Residue Testing Market, with a 43.20% share. Liquid Chromatography-Mass Spectrometry (LC-MS) and Gas Chromatography-Mass Spectrometry (GC-MS) are widely regarded as the gold standard technologies for pesticide residue analysis due to their high sensitivity and accuracy in detecting trace amounts of pesticides across various sample types, including food, water, and soil.

The dominance of LC-MS/GC-MS is driven by their ability to analyze a broad range of pesticides simultaneously, offering high throughput and precision. These technologies are crucial in meeting the increasing demand for more accurate and reliable testing results as food safety regulations become more stringent globally. Additionally, the growing need for more sophisticated and efficient analytical methods in the pesticide residue testing market has fueled the adoption of LC-MS/GC-MS technologies.

As pesticide residue testing becomes more complex, with the need to detect multiple residues at lower concentrations, LC-MS/GC-MS technologies are expected to maintain their market lead. Their capability to provide comprehensive and detailed analyses with minimal sample preparation contributes significantly to their widespread use. Moving forward, advancements in LC-MS/GC-MS technologies are anticipated to enhance their performance, further solidifying their dominance in the market.

By Class Analysis

Organophosphates represent 37.40% of pesticide residue testing, highlighting their widespread use.

In 2024, Organophosphates held a dominant market position in the By Class segment of the Pesticide Residue Testing Market, with a 37.40% share. This significant share can be attributed to the widespread use of organophosphate pesticides across various agricultural applications, particularly in developing economies.

These compounds are commonly used due to their effectiveness against a broad spectrum of pests, but their potential health risks have raised regulatory and safety concerns globally. As a result, regulatory authorities have tightened inspection protocols and residue limits, which has driven the demand for accurate and efficient organophosphate residue testing.

The market’s strong focus on food safety and consumer health further supports the segment’s growth. Increasing testing frequency by government agencies and food manufacturers, especially in fruits, vegetables, and cereals, has intensified the need for robust detection systems targeting organophosphates.

Laboratories and food quality inspection centers are consistently investing in advanced chromatographic and spectrometric technologies to ensure compliance with international residue standards. Moreover, growing awareness among consumers regarding pesticide exposure and its potential health implications continues to fuel the demand for rigorous residue screening.

By Food Tested Analysis

Meat and poultry testing accounts for 39.30% of the pesticide residue testing market.

In 2024, Meat and Poultry held a dominant market position in the By Food Tested segment of the Pesticide Residue Testing Market, with a 39.30% share. This dominance is primarily due to increasing global concerns regarding the presence of pesticide residues in animal-derived food products. Livestock and poultry are often exposed to pesticide-contaminated feed and water, which leads to residue accumulation in meat.

The rising consumption of meat and poultry products worldwide, particularly in North America, Europe, and parts of Asia-Pacific, has led to a corresponding increase in testing volumes. Export-focused meat producers have also scaled up residue screening processes to comply with strict international standards and gain access to premium markets. Furthermore, consumer demand for transparency and safe food products has driven meat processing facilities and food quality labs to invest in reliable and fast-testing technologies.

Meat and poultry testing continues to gain attention from government health agencies and private food safety organizations, further reinforcing its share. With growing global trade in processed and frozen meat products, the segment is expected to retain its strong position in the pesticide residue testing market in the short to medium term.

Key Market Segments

By Type

- Herbicides

- Insecticides

- Fungicides

- Others

By Technology

- LC-MS/GC-MS

- HPCL

- Gas Chromatography

- Others

By Class

- Organochlorines

- Organophosphates

- Organonitrogens and Carbamates

- Others

By Food Tested

- Meat and Poultry

- Dairy Products

- Processed Foods

- Fruits and Vegetables

- Others

Driving Factors

Rising Food Safety Concerns Drive Market Growth

One of the biggest reasons for the growth of the pesticide residue testing market is the increasing concern about food safety. People today are more aware of what goes into their food, and they want to make sure it is safe to eat. Governments across the world have also become stricter with food safety laws, especially when it comes to pesticide levels.

Because of this, farmers, food producers, and exporters are testing their food more often before selling it. This growing demand for safe food is pushing the need for better and faster pesticide testing methods.

Restraining Factors

High Testing Costs Limit Market Expansion Potential

One of the main challenges in the pesticide residue testing market is the high cost of testing. Advanced equipment, trained staff, and modern laboratories are needed to carry out accurate tests, which can be very expensive.

Small farmers and food companies often cannot afford these costs, especially in developing countries. This makes it hard for them to meet strict food safety standards. As a result, they may avoid or delay testing, which slows down market growth.

In some regions, the lack of proper infrastructure also adds to the problem. Unless testing becomes more affordable and accessible, it will remain a barrier for many businesses, limiting the overall expansion of the pesticide residue testing market.

Growth Opportunity

Organic Food Boom Creates Testing Market Opportunities

The fast-growing demand for organic food is creating a big opportunity for the pesticide residue testing market. Consumers now prefer organic fruits, vegetables, and packaged foods because they believe these are safer and healthier.

To be labeled organic, products must be proven free of harmful pesticide residues. This is where testing plays a key role. More companies and farms are seeking certifications that require strict pesticide checks.

This trend is especially strong in North America and Europe, but it’s also growing in Asia. As organic farming expands, the need for reliable and accurate residue testing will rise. This opens up huge business potential for testing labs, technology providers, and certification agencies in the coming years.

Latest Trends

AI-Powered Tools Transform Pesticide Residue Testing Methods

One of the newest trends in the pesticide residue testing market is the growing use of artificial intelligence (AI) and machine learning (ML) tools. These technologies are helping labs analyze pesticide residue faster and more accurately than before.

AI can quickly study large volumes of test data and spot patterns that may be missed by traditional testing methods. This is especially helpful for detecting low-level residues in food and crops.

As food safety rules become stricter, more companies are adopting smart systems to stay compliant. AI tools also reduce testing costs and human error, making the whole process more efficient.

Regional Analysis

Asia-Pacific holds a dominant 43.50% share in the pesticide residue testing market.

Asia-Pacific dominates the pesticide residue testing market, accounting for 43.50% of the global share, valued at approximately USD 0.6 billion. This leadership is driven by stringent food safety regulations in key economies such as China, Japan, and India.

Rapid urbanization and increasing exports of agricultural produce have further fueled the demand for efficient testing protocols across the region. In North America, robust government frameworks and consumer awareness are pushing testing services forward, with the United States being a key contributor due to its expansive food supply chain. Europe remains a strong market, supported by established regulatory bodies and high compliance standards among food producers.

Countries like Germany and France maintain consistent growth owing to their advanced laboratory infrastructure. The Middle East & Africa region, although smaller in market size, is gradually adopting pesticide residue monitoring due to growing international trade and food safety concerns.

Latin America, led by Brazil and Mexico, shows emerging potential with increasing agricultural exports to North America and Europe, demanding higher compliance with global safety norms. Overall, while Asia-Pacific leads in both value and volume, other regions are steadily investing in residue testing frameworks, driven by globalized food trade and rising health-conscious consumer behavior.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Waters Agricultural Laboratories continues to demonstrate robust service capabilities through its advanced analytical infrastructure. The company’s strong footprint across the U.S. agricultural belt provides direct access to core farming regions, enabling fast turnaround times and localized support. Its emphasis on precision testing, supported by modern instrumentation, aligns well with the rising demand for accurate multi-residue screening in exports and domestic compliance.

Scicorp Laboratories PTY Ltd., based in South Africa, brings strategic regional strength to the global pesticide residue testing market. With a key focus on high-throughput pesticide analysis using advanced chromatography and mass spectrometry, Scicorp has positioned itself as a reliable partner for the agri-export sector. Its specialization in testing a wide spectrum of agrochemical residues reflects growing regional compliance with international standards, especially EU MRLs.

Microbac Laboratories Inc., headquartered in the United States, offers extensive testing solutions through a network of certified laboratories. The company’s broad analytical expertise spans food, water, and environmental testing, with pesticide residue detection forming a significant part of its food safety portfolio. Its ability to adapt to regulatory changes and support large-scale food producers gives it a competitive advantage.

Top Key Players in the Market

- SGS S.A.

- ALS Limited

- Eurofins Scientific

- AB SCIEX

- Fera Science Limited

- AGQ Labs

- Waters Agricultural Laboratories

- Scicorp Laboratories PTY Ltd.

- Microbac Laboratories Inc.

- Symbio Laboratories

- Bureau Veritas S.A.

- Intertek Group plc.

- Arbro Pharmaceuticals Private Limited

- Romer Labs

- Charm Sciences

- Neogen Corporation

Recent Developments

- In January 2025, SGS signed an agreement to acquire RTI Laboratories, a leading provider of environmental and materials testing services based in Detroit, Michigan. This acquisition enhances SGS’s material testing capabilities, including metallurgical testing and failure analysis, which can support pesticide residue analysis.

- In March 2024, ALS strategically expanded its presence in Europe by acquiring Wessling, a company with revenues of approximately A$160 million in 2023. Wessling provides environmental, food, and pharmaceutical testing across 22 locations in Europe, including Germany, France, and Switzerland.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.1 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Herbicides, Insecticides, Fungicides, Others), By Technology (LC-MS/GC-MS, HPCL, Gas Chromatography, Others), By Class (Organochlorines, Organophosphates, Organonitrogens and Carbamates, Others), By Food Tested (Meat and Poultry, Dairy Products, Processed Foods, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SGS S.A., ALS Limited, Eurofins Scientific, AB SCIEX, Fera Science Limited, AGQ Labs, Waters Agricultural Laboratories, Scicorp Laboratories PTY Ltd., Microbac Laboratories Inc., Symbio Laboratories, Bureau Veritas S.A., Intertek Group plc., Arbro Pharmaceuticals Private Limited, Romer Labs, Charm Sciences, Neogen Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pesticide Residue Testing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Pesticide Residue Testing MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SGS S.A.

- ALS Limited

- Eurofins Scientific

- AB SCIEX

- Fera Science Limited

- AGQ Labs

- Waters Agricultural Laboratories

- Scicorp Laboratories PTY Ltd.

- Microbac Laboratories Inc.

- Symbio Laboratories

- Bureau Veritas S.A.

- Intertek Group plc.

- Arbro Pharmaceuticals Private Limited

- Romer Labs

- Charm Sciences

- Neogen Corporation