Global Pea Starch Market Size, Share, And Business Benefits By Type (Food, Feed), By Function (Gelling, Thickeners, Texturizing, Film Forming, Others), By End-use (Food and Beverage, Animal Feed, Paper, Pharmaceuticals, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158580

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

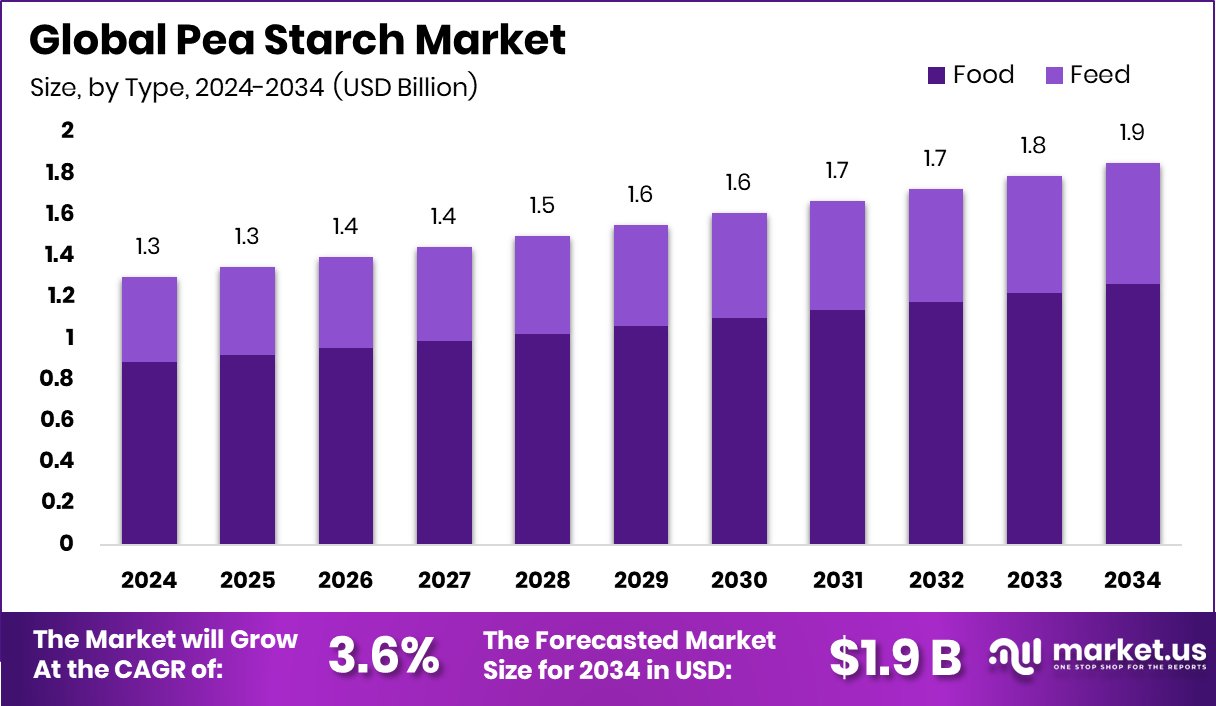

The Global Pea Starch Market is expected to be worth around USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034. Pea starch adoption in bakery and plant-based foods drove North America’s 32.90% share, USD 0.4 Bn.

Pea starch is a natural carbohydrate extracted from yellow peas. It is widely used in the food industry as a thickener, gelling agent, and stabilizer. Its clean-label appeal and allergen-free nature make it a popular alternative to wheat and corn starch, especially in gluten-free and plant-based product formulations. Beyond food, it also finds applications in pharmaceuticals, pet nutrition, and industrial uses due to its versatility and high amylose content.

The pea starch market is gaining strong momentum as consumers increasingly shift toward plant-based diets and clean-label products. The demand is also driven by the broader use of pea protein, where starch is a valuable by-product. With rising interest in natural and sustainable ingredients, the market is expanding across regions, including North America, Europe, and Asia, supported by investments in processing facilities and innovation.

One major growth factor is the rising consumer demand for plant-based and gluten-free foods. Pea starch provides functional benefits while meeting dietary needs, making it an attractive choice for manufacturers reformulating bakery, snacks, and meat alternatives. Investments such as Cargill’s additional $75 million to propel pea protein production in the US reflect how infrastructure expansions are aligned with increasing starch demand.

The demand is also pushed by sustainability initiatives and government-backed research. For example, USask livestock researchers received nearly $7 million to improve food sustainability and safety, highlighting how pea-based ingredients are tied to broader agricultural goals. This focus on eco-friendly protein and starch production enhances market acceptance among both businesses and consumers.

Opportunities are unfolding as new projects scale up globally. Equinom’s $10 million Series B funding and Phyto Organix’s $10 million grant for a net-zero plant protein facility show how innovation and sustainability are driving the next phase of growth. With such investments, the pea starch market has the chance to diversify into new applications, from nutraceuticals to bioplastics, strengthening its long-term growth potential.

Key Takeaways

- The Global Pea Starch Market is expected to be worth around USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In the pea starch market, food applications dominate with 68.3%, reflecting strong global dietary trends.

- Pea starch achieves 31.2% in gelling applications, offering superior texture and stability across food categories.

- Food and beverage hold a 48.9% share, showcasing pea starch’s widespread role in daily nutrition choices.

- Strong consumer demand for clean-label foods in North America supported a 32.90% market share worth USD 0.4 Bn.

By Type Analysis

By type, food dominates the pea starch market with 68.3%.

In 2024, Food held a dominant market position in the By Type segment of the Pea Starch Market, with a 68.3% share. The growth of this segment is strongly linked to the rising demand for clean-label, gluten-free, and plant-based food products. Pea starch is widely used in bakery items, snacks, soups, sauces, and meat alternatives because of its thickening, gelling, and stabilizing properties.

Consumers are increasingly seeking natural and allergen-free ingredients, which has pushed manufacturers to adopt pea starch in their formulations. The market has further benefited from growing investments in plant-based production facilities and sustainability-focused initiatives, enabling broader adoption of pea starch in mainstream food applications and reinforcing its leading position in 2024.

By Function Analysis

By function, gelling holds a 31.2% share in the pea starch market.

In 2024, Gelling held a dominant market position in the By Function segment of the Pea Starch Market, with a 31.2% share. The strong preference for gelling applications is driven by the high amylose content of pea starch, which delivers firm textures and stability in various food formulations. It is widely used in confectionery, meat alternatives, dairy products, and ready-to-eat meals, where texture and mouthfeel are critical to consumer acceptance.

The demand has further grown with the increasing popularity of plant-based and clean-label products, as pea starch offers a natural and allergen-free solution. These advantages have enabled the gelling function to establish a clear lead in 2024, reinforcing its importance in driving consistent market growth.

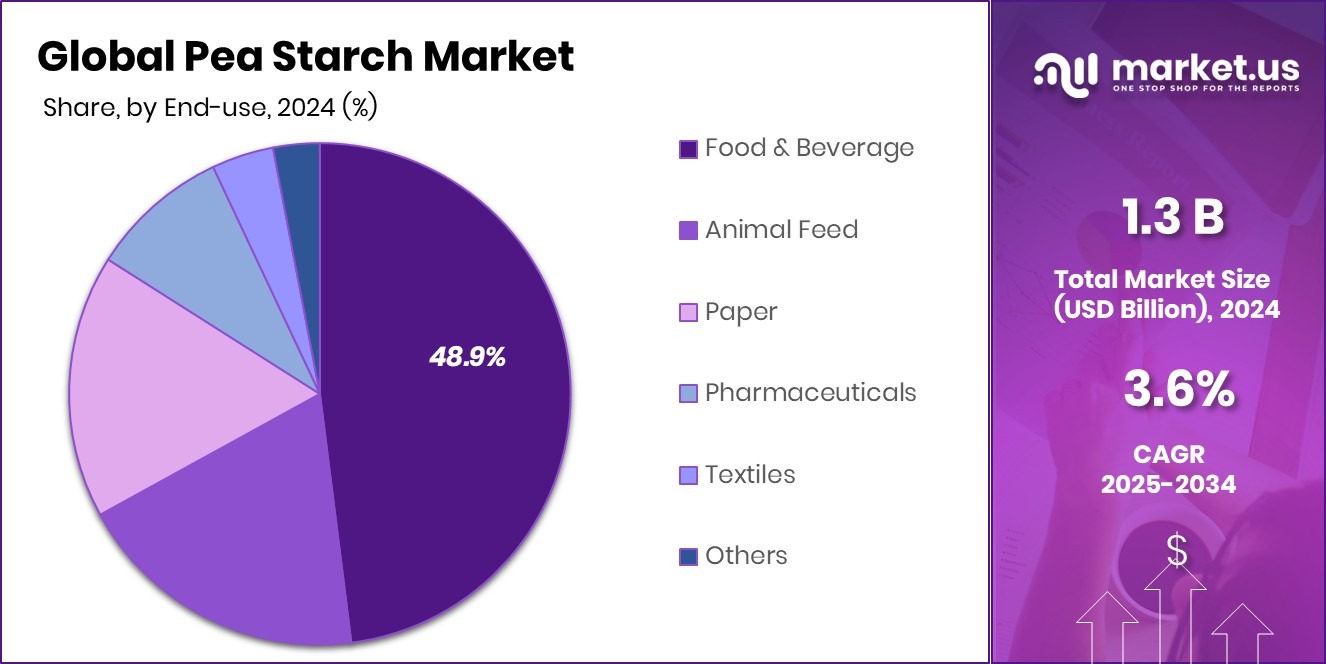

By End-use Analysis

By end-use, food and beverage leads with a 48.9% share.

In 2024, Food and Beverage held a dominant market position in the by-end-use segment of the Pea Starch Market, with a 48.9% share. This dominance is supported by the growing use of pea starch in bakery, snacks, dairy alternatives, soups, sauces, and meat substitute products. Its role as a clean-label, gluten-free, and allergen-free ingredient makes it highly attractive to both manufacturers and health-conscious consumers.

The segment has further benefited from rising demand for plant-based diets and processed convenience foods, where pea starch provides superior texture, stability, and gelling properties. These factors combined have firmly positioned Food and Beverage as the leading end-use area, accounting for nearly half of the overall market in 2024.

Key Market Segments

By Type

- Food

- Feed

By Function

- Gelling

- Thickeners

- Texturizing

- Film Forming

- Others

By End-use

- Food and Beverage

- Animal Feed

- Paper

- Pharmaceuticals

- Textiles

- Others

Driving Factors

Rising Demand for Clean-Label and Plant-Based Foods

One of the biggest driving factors for the pea starch market is the rising demand for clean-label and plant-based foods. Consumers are increasingly choosing products that are natural, minimally processed, and free from allergens like gluten. Pea starch fits perfectly into this shift because it is non-GMO, allergen-free, and suitable for vegan and vegetarian diets.

It also offers excellent functional benefits like gelling, thickening, and stabilizing, making it valuable in baked goods, snacks, sauces, and plant-based meat alternatives. With plant-based food sales steadily growing worldwide, pea starch continues to gain importance in product innovation. This rising health awareness and preference for sustainable, natural ingredients strongly push the growth of the pea starch market.

Restraining Factors

Higher Production Costs Compared to Conventional Starches

A key restraining factor for the pea starch market is its higher production cost compared to conventional starches like corn, potato, or wheat. Extracting starch from peas requires advanced processing, which makes it more expensive to produce. For manufacturers, this cost difference can become a challenge, especially in price-sensitive markets where cheaper alternatives are widely available.

Many food producers hesitate to switch to pea starch because the end product may become more expensive for consumers. While demand for natural and plant-based ingredients is rising, the price gap limits their faster adoption in some regions. Overcoming this cost barrier through technological innovation and scaling up production is crucial for wider market growth.

Growth Opportunity

Expanding Use in Bioplastics and Sustainable Packaging

A major growth opportunity for the pea starch market lies in its expanding use in bioplastics and sustainable packaging. With rising global concerns about plastic pollution, industries are actively searching for eco-friendly alternatives to petroleum-based plastics. Pea starch, being biodegradable and renewable, can be converted into films and packaging materials that reduce environmental impact. This aligns perfectly with government regulations and consumer demand for greener products.

Companies investing in sustainable packaging are increasingly considering starch-based solutions, and pea starch stands out due to its clean-label and natural origin. As awareness about climate change grows, the application of pea starch in bioplastics is expected to open up a profitable and long-term growth path.

Latest Trends

Rising Popularity in Gluten-Free Food Innovations

One of the latest trends in the pea starch market is its growing use in gluten-free food innovations. With more consumers being diagnosed with gluten intolerance or choosing gluten-free diets for lifestyle reasons, the demand for alternative ingredients has risen sharply. Pea starch is naturally gluten-free, making it a perfect fit for bakery items, snacks, noodles, and sauces that require thickening and stability without wheat-based starches.

Beyond just replacing gluten, it also enhances texture and improves shelf life, which appeals to both manufacturers and consumers. This trend is gaining momentum globally as health-conscious buyers look for nutritious, allergen-free products, firmly positioning pea starch as a trending choice in the food industry.

Regional Analysis

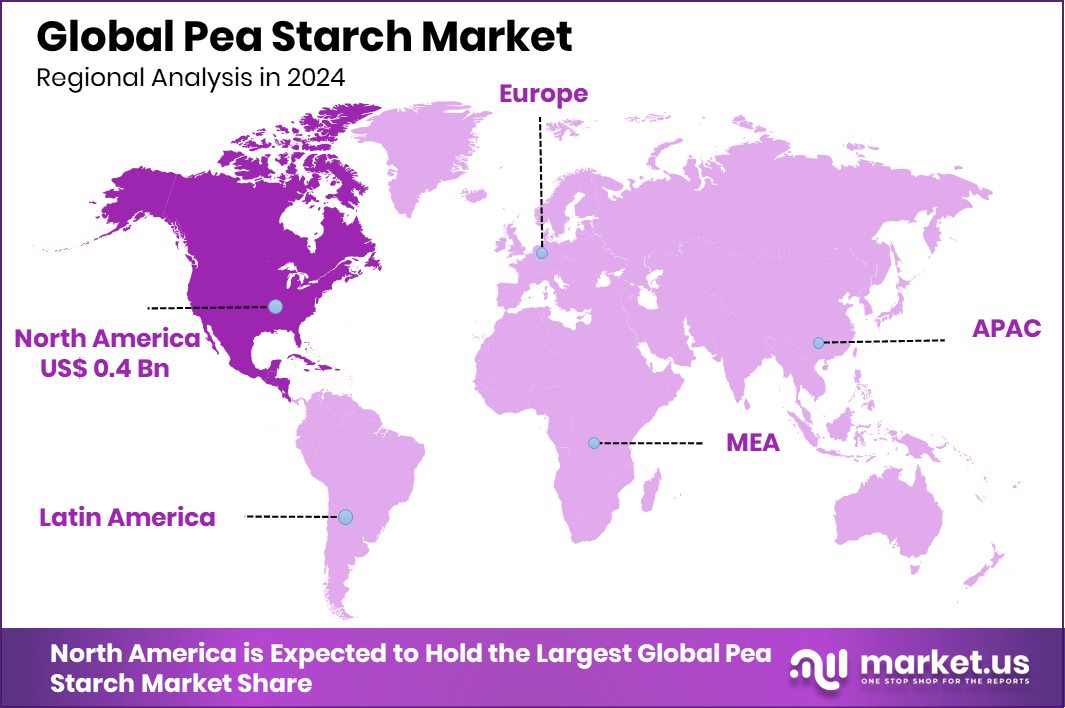

In 2024, North America held a 32.90% share of the Pea Starch Market, reaching USD 0.4 Bn.

The Pea Starch Market demonstrates varied growth across regions, with North America emerging as the leading contributor. In 2024, North America accounted for 32.90% of the global market, valued at USD 0.4 billion, making it the dominating region. The strong adoption of clean-label and plant-based foods, coupled with rising gluten-free product demand, has positioned the region at the forefront of pea starch consumption.

Europe follows closely, driven by its emphasis on sustainable food ingredients and regulatory push for natural additives. The Asia Pacific region is experiencing rapid growth due to expanding processed food industries and increasing health-conscious consumer bases. Meanwhile, Latin America is gradually integrating pea starch into bakery and convenience food categories, while the Middle East & Africa show steady uptake supported by growing urbanization and dietary diversification.

With North America maintaining dominance through high consumer awareness and strong investments in food innovation, Europe and the Asia Pacific remain the key growth engines for future expansion. Overall, the regional dynamics highlight the importance of developed markets in driving early adoption, while emerging economies present significant opportunities for long-term growth in the pea starch market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global pea starch market is shaped by innovation and expansion strategies adopted by key players such as Ingredion, Roquette Frères, and Yantai Shuangta Food Co., Ltd. These companies are focusing on meeting the rising demand for plant-based, clean-label, and gluten-free ingredients while strengthening their presence across developed and emerging markets.

Ingredion has established itself as a strong player by integrating pea starch into its broader portfolio of specialty ingredients. The company emphasizes functional applications in bakery, dairy alternatives, and convenience foods, positioning itself well to capture consumer preference for natural and allergen-free formulations. Its ability to scale production and align with sustainability trends further strengthens its market standing.

Roquette Frères continues to be a pioneer in plant-based solutions, with a particular focus on leveraging pea starch alongside pea protein. Its investment in R&D and product innovation allows it to provide texture-enhancing and gelling solutions that cater to evolving food industry demands. The company’s global footprint and focus on eco-friendly production resonate with manufacturers seeking reliable and sustainable suppliers.

Yantai Shuangta Food Co., Ltd, a significant player from Asia, has gained traction through its strong production capabilities and competitive pricing. By tapping into the fast-growing demand for pea-based ingredients in the Asia Pacific, it is positioning itself as a critical supplier to regional and international markets.

Top Key Players in the Market

- Ingredion

- Roquette Frères

- Yantai Shuangta Food Co., Ltd

- Ebro Foods, S.A.

- Puris

- Dsm-Firmenich

- AGT Food and Ingredients

- Emsland-Stärke

- Cosucra

- Agrocorp International Pte Ltd

Recent Developments

- In November 2024, QA documentation update (pea starch composition): Ingredion issued an ingredient statement for PURITY® P 1304 / P 1306, confirming both are 100% pea starch derived from yellow peas. This supports clean-label claims and spec transparency for food formulators.

- In April 2024, Roquette Beauté introduced Beauté by Roquette® ST 730, a hydroxypropyl pea starch-based film-former. This ingredient is biodegradable, water-resistant, and has a clinically proven lifting effect. It targets cosmetics and makeup/formulation uses where consumers want plant-based, sustainable alternatives with visible performance.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD1.9 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Food, Feed), By Function (Gelling, Thickeners, Texturizing, Film Forming, Others), By End-use (Food and Beverage, Animal Feed, Paper, Pharmaceuticals, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ingredion, Roquette Frères, Yantai Shuangta Food Co., Ltd, Ebro Foods, S.A., Puris, Dsm-Firmenich, AGT Food and Ingredients, Emsland-Stärke, Cosucra, Agrocorp International Pte Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ingredion

- Roquette Frères

- Yantai Shuangta Food Co., Ltd

- Ebro Foods, S.A.

- Puris

- Dsm-Firmenich

- AGT Food and Ingredients

- Emsland-Stärke

- Cosucra

- Agrocorp International Pte Ltd