Global O-Nitrochlorobenzene Market By Purity (Less than 95%, More Than 95%), By Application (Dyes and Dyestuff Intermediates, Agrochemical Intermediates, Rubber Chemicals, Others), By Sales Channel (Direct Sale, Indirect Sale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139147

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

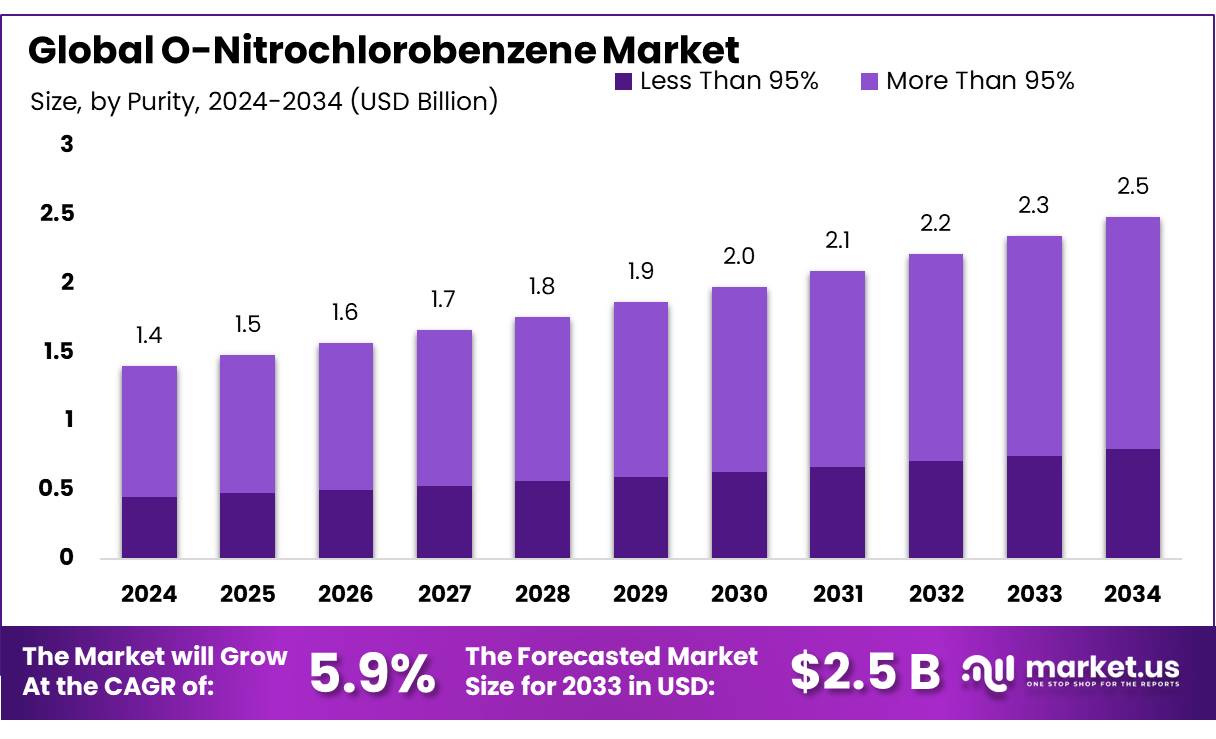

The Global O-Nitrochlorobenzene Market size is expected to be worth around USD 2.5 Bn by 2034, from USD 1.4 Bn in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

O-Nitrochlorobenzene (ONCB) is a key intermediate used in the production of various chemicals such as pesticides, dyes, and pharmaceuticals. It plays a crucial role in the synthesis of azo dyes, which are widely used in textiles, leather, and paper industries, as well as in certain drugs. Additionally, ONCB is important in agrochemical production, particularly in the creation of herbicides and fungicides.

The global market for ONCB is expanding steadily due to rising demand in these sectors, driven by industrial growth and agricultural needs. This demand is especially prominent in emerging economies, where rapid industrialization and population growth are contributing to increased ONCB consumption. The Asia-Pacific region, the largest consumer of ONCB, continues to lead this market expansion.

The demand for ONCB is primarily driven by the need for dyes and pigments in industries like textiles, leather, and paper. The continued growth of the textile industry in countries like India, China, and Bangladesh is expected to sustain ONCB demand in the coming years.

Future growth in the ONCB market will be shaped by advancements in chemical manufacturing and the growing focus on sustainable, eco-friendly solutions. Green chemistry initiatives present opportunities for ONCB manufacturers to improve production processes and reduce environmental impact. The rise of sustainable agriculture and bio-based pesticides could also influence market dynamics, while innovations in waste treatment and process optimization will help address ONCB’s environmental concerns.

Key Takeaways

- O-Nitrochlorobenzene Market size is expected to be worth around USD 2.5 Bn by 2034, from USD 1.4 Bn in 2024, growing at a CAGR of 5.9%.

- More than 95% held a dominant market position, capturing more than a 67.2% share of the O-Nitrochlorobenzene market.

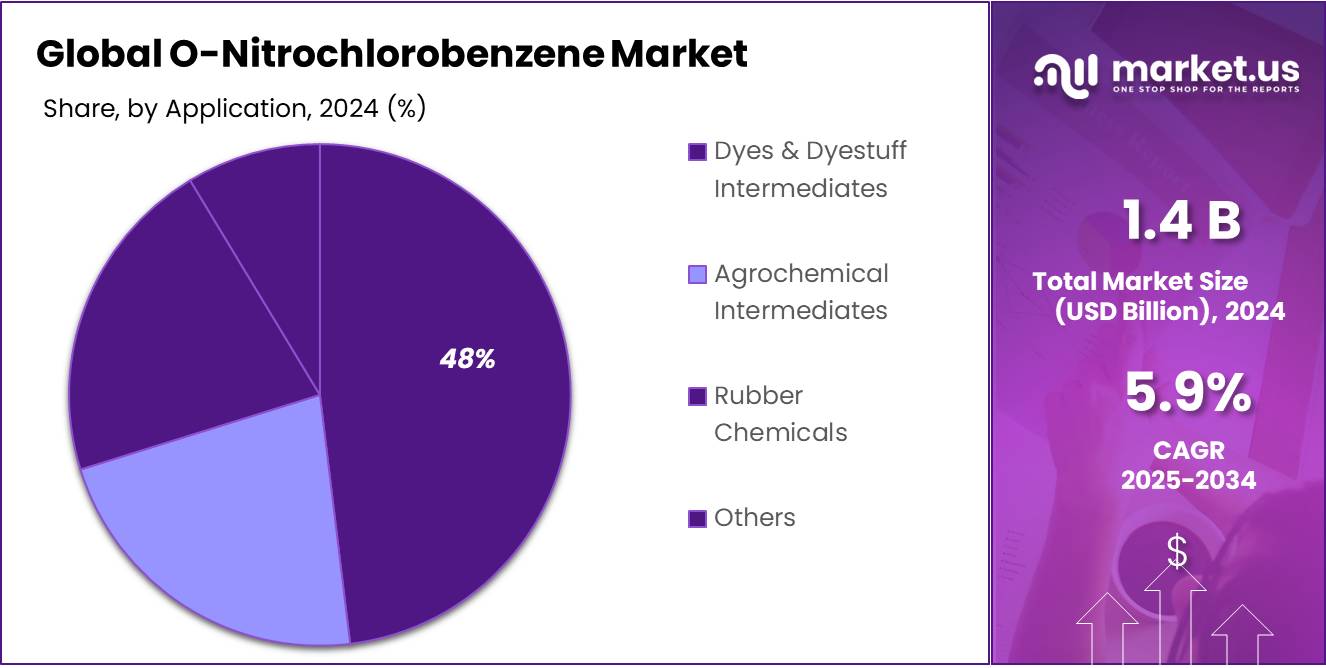

- Dyes & Dyestuff Intermediates held a dominant market position, capturing more than a 48.2% share.

- Direct Sale held a dominant market position, capturing more than a 69.1% share of the O-Nitrochlorobenzene market.

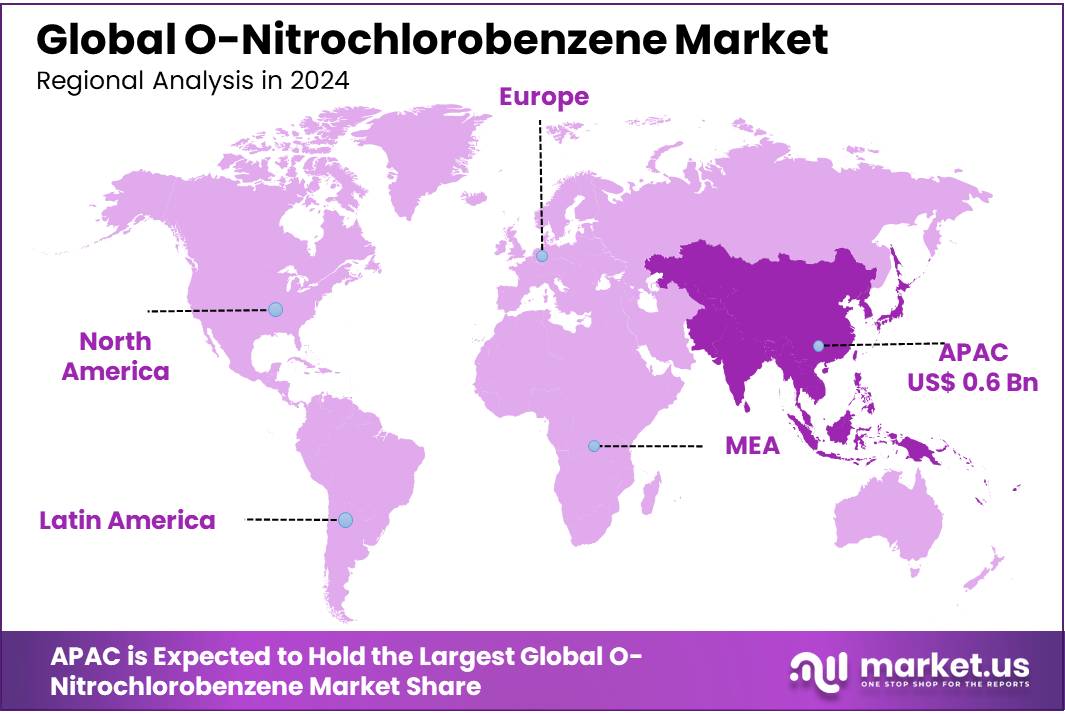

- Asia Pacific (APAC) region held a dominant position in the O-Nitrochlorobenzene market, capturing more than 44.3% of the global market share, valued at approximately USD 0.6 billion.

By Purity

In 2024, More than 95% held a dominant market position, capturing more than a 67.2% share of the O-Nitrochlorobenzene market. This segment’s strong performance can be attributed to its higher purity level, which is critical for various industrial applications such as chemical synthesis, pharmaceutical production, and in the manufacture of specific dyes and pigments. The consistent demand for high-purity O-Nitrochlorobenzene in these industries has contributed to the growth and stability of this segment, especially in developed regions where stringent quality standards are a priority.

The Less than 95% purity segment, while accounting for the remaining share, has experienced steady growth but remains smaller in comparison. This segment serves specific niche applications where the slightly lower purity does not compromise the end-product quality. In 2024, it held a smaller portion of the market but continues to grow as cost-sensitive industries seek more affordable alternatives for non-critical applications. However, the difference in purity levels often limits its use in higher-end markets.

By Application

In 2024, Dyes & Dyestuff Intermediates held a dominant market position, capturing more than a 48.2% share of the O-Nitrochlorobenzene market. This segment’s lead can be attributed to the critical role O-Nitrochlorobenzene plays in the production of azo dyes, which are widely used in textiles, leather, and printing. The growth of the textile industry, particularly in emerging markets, has bolstered the demand for high-quality dyestuff intermediates, driving this segment’s strong performance.

Agrochemical Intermediates is the second-largest application segment, capturing a significant share of the market. O-Nitrochlorobenzene is used in the production of herbicides and pesticides, where it serves as an important intermediate. As agriculture continues to modernize and increase in scale, especially in regions like North America and Asia, the demand for effective and affordable agrochemical intermediates is rising.

The Rubber Chemicals segment, while smaller in comparison, has shown steady growth due to the use of O-Nitrochlorobenzene in the production of rubber accelerators, which are essential for improving the quality and performance of rubber products. The growing automotive industry, which is a major consumer of rubber products, continues to support this segment’s development.

By Sales Channel

In 2024, Direct Sale held a dominant market position, capturing more than a 69.1% share of the O-Nitrochlorobenzene market. This strong market share is largely driven by the growing preference for direct relationships between manufacturers and end-users, particularly in industries like chemicals and pharmaceuticals, where consistency and high-quality standards are critical. Direct sales offer benefits such as better control over pricing, faster delivery, and stronger customer support, making it the preferred sales channel for large-scale industrial buyers.

On the other hand, the Indirect Sale segment, while holding a smaller share, has been gradually growing due to its ability to reach a broader audience, especially in regions where establishing direct relationships may be more difficult or cost-prohibitive. Through distributors, wholesalers, and retailers, indirect sales offer an efficient way to penetrate emerging markets and smaller industries that may not have the infrastructure or volume to justify direct purchasing.

Key Market Segments

By Purity

- Less than 95%

- More Than 95%

By Application

- Dyes & Dyestuff Intermediates

- Agrochemical Intermediates

- Rubber Chemicals

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Drivers

Growing Demand from Agrochemical Industry

One of the major driving factors for the O-Nitrochlorobenzene market is the growing demand for agrochemical intermediates, particularly in the production of herbicides and pesticides. As global agricultural production continues to increase to meet the needs of a growing population, the demand for agrochemicals, and consequently for the chemicals used in their production, is rising steadily.

Government Initiatives and Focus on Agricultural Sustainability

Government policies worldwide are also driving the demand for agrochemicals. For example, the U.S. Department of Agriculture (USDA) has emphasized the importance of using advanced technologies and sustainable practices to increase crop yields and ensure food security. The U.S. government’s initiatives, such as the “Sustainable Agriculture Research and Education (SARE)” program, aim to promote agricultural practices that maintain productivity while minimizing the environmental impact. This push for sustainable agriculture leads to increased use of agrochemicals, which in turn fuels the demand for intermediate chemicals like O-Nitrochlorobenzene.

Rise in Agricultural Output and Chemical Use in Emerging Markets

The growing need for agrochemicals is particularly pronounced in emerging markets such as India, China, and Brazil. In these regions, rapid urbanization, changing dietary habits, and the need to feed a growing middle class are all contributing to higher agricultural production. For instance, China, one of the world’s largest consumers of agrochemicals, has seen a steady rise in the use of herbicides and pesticides as part of efforts to boost agricultural productivity. According to a report from the FAO, the total consumption of pesticides in China has increased by over 30% in the past decade, with herbicides and fungicides accounting for the largest share.

Restraints

Environmental Concerns and Regulatory Pressures

One of the major restraining factors for the growth of the O-Nitrochlorobenzene market is the increasing environmental concerns and the growing regulatory pressures surrounding the use of chemicals in industries such as agrochemicals and dyes. As awareness of environmental sustainability continues to rise, governments and organizations worldwide are introducing stricter regulations to minimize the environmental impact of industrial chemicals, including those used in the production of O-Nitrochlorobenzene.

Regulatory Pressure on Agrochemicals

In the U.S., the Environmental Protection Agency (EPA) has been working to regulate the use of certain chemical compounds, particularly those that are persistent in the environment or harmful to ecosystems. For instance, the EPA’s Pesticide Registration Improvement Act (PRIA) emphasizes the need for manufacturers to demonstrate that their products meet environmental safety standards before they are approved for use. Such regulatory pressure can create challenges for companies involved in the production of O-Nitrochlorobenzene, as they may need to invest significantly in research and development to meet these stringent standards.

Growing Focus on Sustainable Practices

As the global population grows and the demand for agricultural products increases, there is a growing demand for agricultural chemicals. However, this demand is being met with a stronger focus on sustainability. Consumers and environmental organizations are pushing for chemicals that have a lower environmental impact, are less toxic, and decompose more easily in the environment. For example, the United Nations Environment Programme (UNEP) has been working to reduce the use of toxic chemicals globally, especially in agriculture. The UNEP’s Global Chemicals Outlook II stresses the need for a transition towards safer and more sustainable chemicals.

Environmental Impact of O-Nitrochlorobenzene

While O-Nitrochlorobenzene itself is an effective intermediate in various industrial applications, its production and disposal can lead to environmental contamination. If not handled properly, by-products from its production process can contaminate air, soil, and water. This raises concerns among environmental regulators and public health organizations. The World Health Organization (WHO) has highlighted the need for industries to adopt best practices when handling chemicals to prevent environmental damage and ensure public safety.

Opportunity

Expansion in Emerging Agricultural Markets

One of the most significant growth opportunities for the O-Nitrochlorobenzene market lies in the expanding agricultural sectors of emerging economies. As developing countries increase their agricultural output to meet the demands of a growing population, the need for effective agrochemicals—especially herbicides and pesticides—has surged. O-Nitrochlorobenzene plays a crucial role in the synthesis of many herbicides and agrochemical intermediates, and the rising agricultural demand in these regions presents a substantial opportunity for market growth.

Increasing Demand for Agricultural Products in Emerging Economies

The global population is expected to reach 9.7 billion by 2050, according to the Food and Agriculture Organization (FAO), and a large portion of this population will live in emerging markets. In these regions, agricultural productivity must increase dramatically to meet the demands for food, fiber, and biofuels. The FAO predicts that food production will need to rise by 70% by mid-century to meet global food demands. Emerging economies, particularly in Asia, Africa, and Latin America, are expected to be at the center of this growth as they strive to modernize their agricultural practices and increase their yields.

For example, in India, which is one of the largest agricultural producers in the world, the government has set ambitious targets to increase food production to ensure food security for its growing population. India’s agricultural production is expected to increase by 50% by 2030. As a result, the demand for agrochemicals, including herbicides and pesticides made with intermediates like O-Nitrochlorobenzene, is expected to continue rising. India alone accounts for nearly 20% of global pesticide consumption, making it a critical market for O-Nitrochlorobenzene.

Government Initiatives and Investment in Agriculture

Governments in emerging markets are increasingly investing in agricultural development to boost food production and ensure food security. In Brazil, for example, agriculture is a cornerstone of the economy, and the government has introduced several programs to support the sector, including the “Plano Agrícola e Pecuário” (Agricultural and Livestock Plan), which allocates billions of dollars in credit to farmers for the purchase of agrochemicals, machinery, and other agricultural inputs. These initiatives will directly benefit the O-Nitrochlorobenzene market, as herbicides and other chemicals play a major role in Brazil’s agricultural practices, especially in the production of soybeans, corn, and coffee.

Additionally, the World Bank has recognized the need for sustainable agricultural practices in emerging economies and has invested in programs that aim to promote the use of modern agrochemical solutions that improve productivity while maintaining environmental safety. These initiatives are likely to increase the adoption of chemicals like O-Nitrochlorobenzene, which serve as important intermediates in the production of agrochemicals.

Trends

Shift Toward Biologically-Based Agrochemicals

One of the latest and most significant trends in the O-Nitrochlorobenzene market is the increasing shift towards biologically-based and environmentally sustainable agrochemicals. As the world faces growing environmental concerns and a strong push for sustainable farming practices, there is a rising demand for more eco-friendly alternatives to traditional synthetic chemicals. This trend is shaping the future of agrochemicals, which directly impacts the demand for chemical intermediates like O-Nitrochlorobenzene.

The Rise of Biopesticides and Organic Farming

Biologically-based agrochemicals, especially biopesticides, are gaining traction as an alternative to traditional synthetic pesticides. Biopesticides, derived from natural materials such as plants, bacteria, and fungi, are seen as safer for human health and the environment compared to chemical pesticides. These products are being promoted for their effectiveness in pest control while being less toxic to non-target species, including beneficial insects, birds, and aquatic life.

According to the Food and Agriculture Organization (FAO), the biopesticides market is expected to reach USD 10.2 billion by 2025, growing at a compound annual growth rate (CAGR) of 15.1%. The growing consumer demand for organic food, which is produced without synthetic chemicals, is a major driver of this trend. Organic farming now covers over 72 million hectares worldwide, as reported by the International Federation of Organic Agriculture Movements (IFOAM), and this area is expected to continue growing, especially in countries like the U.S., Germany, and India. Organic farming methods often require biopesticides, providing a strong market for these alternatives.

O-Nitrochlorobenzene’s Role in the Shift to Sustainable Practices

While the rise of biopesticides and organic farming presents a challenge to traditional agrochemicals, it also offers opportunities for companies involved in the production of chemical intermediates like O-Nitrochlorobenzene. One such opportunity lies in the development of more environmentally-friendly and biodegradable chemical formulations that could be used in both synthetic and biologically-based products. By adapting to the growing demand for sustainable solutions, manufacturers of O-Nitrochlorobenzene can stay relevant in a shifting market.

Government Support and Regulatory Changes

Governments around the world are increasingly promoting the transition to more sustainable agricultural practices, which will likely increase the demand for biopesticides and eco-friendly chemical alternatives. In the United States, for example, the Environmental Protection Agency (EPA) has been providing grants and funding to promote the development and use of biopesticides. This includes the Biopesticide and Pollution Prevention Division (BPPD), which supports the research and commercialization of biopesticide products.

Regional Analysis

In 2024, the Asia Pacific (APAC) region held a dominant position in the O-Nitrochlorobenzene market, capturing more than 44.3% of the global market share, valued at approximately USD 0.6 billion. This growth is largely driven by the rapid industrialization and agricultural expansion in countries like China and India, where the demand for agrochemicals, including herbicides and pesticides, is continuously rising.

North America is another significant player in the O-Nitrochlorobenzene market, holding a substantial share due to its well-established chemical and agrochemical industries. The United States, being a major consumer of agrochemicals, contributes significantly to the market, driven by the need for effective weed and pest management solutions in both conventional and organic farming practices. The growing trend towards sustainable agricultural practices also supports the demand for more eco-friendly chemicals in the region.

In Europe, the market is driven by stringent regulatory frameworks and the increasing shift towards environmentally sustainable farming. Countries such as Germany and France are focusing on reducing the use of harmful pesticides, encouraging the adoption of safer alternatives, which could impact the demand for O-Nitrochlorobenzene in the region. The EU’s regulatory environment is one of the most demanding globally, pushing agrochemical companies to develop more efficient and eco-friendly solutions.

Latin America and the Middle East & Africa represent emerging markets, with growth potential driven by increasing agricultural activity and government initiatives promoting sustainable farming practices. However, these regions contribute a smaller share to the global market compared to APAC, North America, and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The O-Nitrochlorobenzene market is characterized by a diverse range of players, with leading companies focusing on expanding their production capabilities and enhancing their product offerings. Aarti Industries Ltd., a major player in the chemical sector, has a strong presence in the manufacturing of various chemical intermediates, including O-Nitrochlorobenzene, and continues to invest in R&D to improve the efficiency of its products. Seya Industries Ltd. and Akshar Chemical India Private Limited are also significant contributors in the market, known for their established production capacity and strong foothold in the Indian market, where demand for agrochemicals and specialty chemicals is high.

Anhui Bayi Chemical Industry, Chemieorganic Chemicals (I) Pvt, and CHEMINTEL are key players involved in the production of chemical intermediates for a wide array of applications, including the agrochemical industry, which drives substantial demand for O-Nitrochlorobenzene. Companies like Chirag Organics and Jiangsu Yangnong Chemical Group Co. Ltd. have also positioned themselves as reliable suppliers of O-Nitrochlorobenzene, with a focus on meeting the growing demand for herbicides and pesticides, particularly in regions like Asia Pacific, where agriculture plays a crucial role in economic growth.

Jiaxing Zhonghua Chemical Co. Ltd., Kutch Chemical Industries Ltd., and Liaoning Shixing Pharmaceutical & Chemical Co., Ltd. further strengthen the global supply chain, offering a range of chemical products and intermediates. These companies are focusing on enhancing their manufacturing processes and expanding their reach in emerging markets. Similarly, Panoli Intermediates, Sarna Chemical PVT. LTD. (SCPL), and Seya Industries continue to increase their production capacities to meet the growing demand for chemical intermediates used in agrochemical formulations, positioning themselves as key players in the O-Nitrochlorobenzene market.

Top Key Players

- Aarti Industries Ltd. Seya Industries Ltd

- Akshar Chemical India Private Limited

- Anhui Bayi Chemical Industry

- Chemieorganic Chemicals (I) Pvt

- CHEMINTEL

- Chirag Organics

- Jiangsu Yangnong Chemical Group co. Ltd

- Jiaxing Zhonghua Chemical Co.Ltd,

- Kutch Chemical Industries Ltd

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd.

- Panoli Intermediates

- Sarna Chemical PVT. LTD. (SCPL)

- Seya Industries

Recent Developments

Aarti Industries, a leading manufacturer of specialty chemicals, generated USD 1.5 billion in revenue in 2023 and continues to expand its operations to meet the growing demand for agrochemicals and industrial chemicals. In 2024, the company plans to increase its production capacity by 15%, driven by strong demand in both domestic and international markets.

In 2023 Akshar Chemical India Private Limited, the company invested heavily in expanding its manufacturing capacity by 20%, with plans for further capacity increases in 2024. This expansion is aligned with the growing demand for O-Nitrochlorobenzene in the production of herbicides, pesticides, and other agrochemical products.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.5 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity(Less than 95%, More Than 95%), By Application (Dyes and Dyestuff Intermediates, Agrochemical Intermediates, Rubber Chemicals, Others), By Sales Channel (Direct Sale, Indirect Sale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aarti Industries Ltd. Seya Industries Ltd, Akshar Chemical India Private Limited, Anhui Bayi Chemical Industry, Chemieorganic Chemicals (I) Pvt, CHEMINTEL, Chirag Organics, Jiangsu Yangnong Chemical Group co. Ltd, Jiaxing Zhonghua Chemical Co.Ltd,, Kutch Chemical Industries Ltd, Liaoning Shixing Pharmaceutical & Chemical Co., Ltd., Panoli Intermediates, Sarna Chemical PVT. LTD. (SCPL), Seya Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  O-Nitrochlorobenzene MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

O-Nitrochlorobenzene MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aarti Industries Ltd. Seya Industries Ltd

- Akshar Chemical India Private Limited

- Anhui Bayi Chemical Industry

- Chemieorganic Chemicals (I) Pvt

- CHEMINTEL

- Chirag Organics

- Jiangsu Yangnong Chemical Group co. Ltd

- Jiaxing Zhonghua Chemical Co.Ltd,

- Kutch Chemical Industries Ltd

- Liaoning Shixing Pharmaceutical & Chemical Co., Ltd.

- Panoli Intermediates

- Sarna Chemical PVT. LTD. (SCPL)

- Seya Industries