Global Natural Vitamin E Market By Type (Tocopherols, Tocotrienols), By Source (Soybean Oil, Rapeseed Oil, Sunflower Oil), By Form (Capsules, Cream/Serum), By Application (Dietary Supplements, Fortified/Functional Food and Beverage, Beauty and Personal Care Products, Pharmaceuticals, Animal Feed, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148246

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

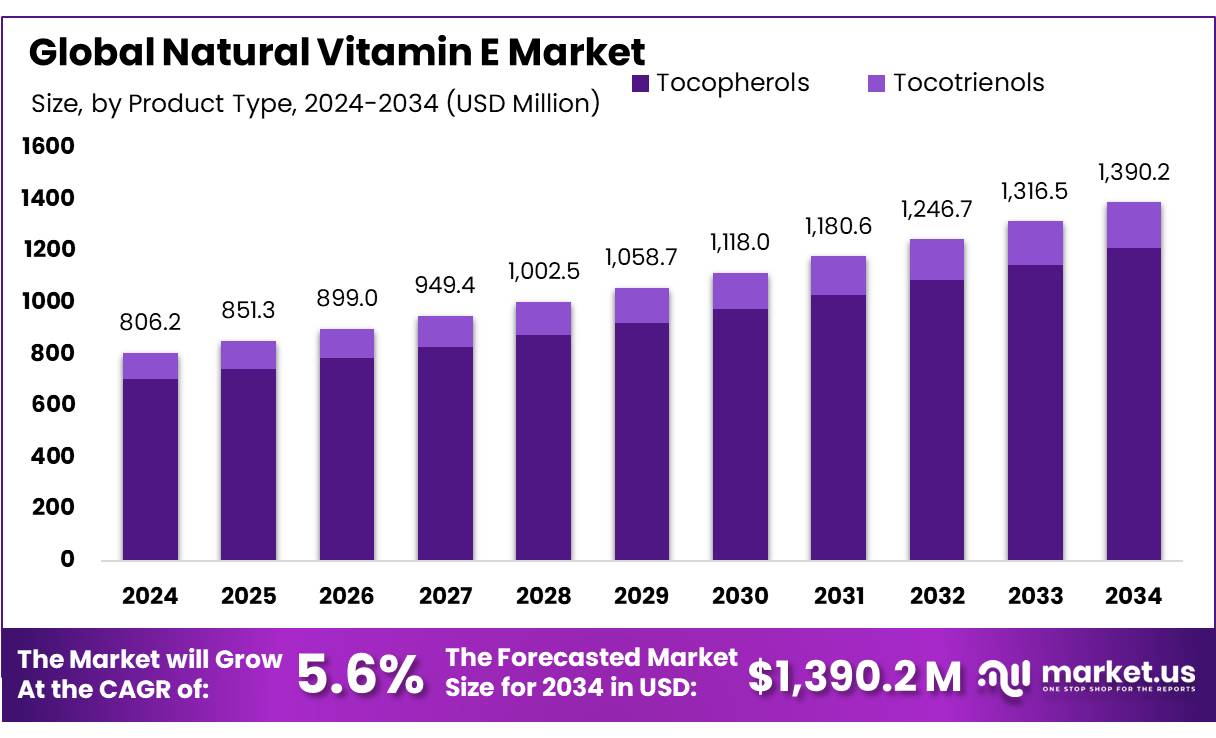

The Global Natural Vitamin E Market size is expected to be worth around USD 1390.2 Million by 2034, from USD 806.2 Million in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Natural vitamin E concentrates, primarily derived from vegetable oils such as soybean, sunflower, and rapeseed, are widely used in dietary supplements, food fortification, cosmetics, and animal nutrition due to their potent antioxidant properties. The global market for natural vitamin E is driven by increasing consumer awareness of health and wellness, coupled with rising demand for clean-label and organic products.

According to the U.S. Food and Drug Administration (FDA), vitamin E is recognized as an essential nutrient, with a recommended daily allowance (RDA) of 15 mg for adults, further supporting its inclusion in fortified foods and supplements. The National Institutes of Health (NIH) highlights that natural vitamin E (d-alpha-tocopherol) is biologically more active than its synthetic counterpart, enhancing its demand in premium health products.

Vitamin E is available in various dosage forms, including capsules, tablets, and solutions, each offering different concentrations. Capsules are commonly available in 100, 200, 400, 600, and 1000 international units, while tablet forms are offered in 100 and 200 units. The solution formulations include concentrations of 1150 units per 1.25 mL, 400 units per mL, and 15 units per 0.3 mL, providing flexibility in dosing for specific therapeutic needs. Such diverse formulations cater to a broad range of patient requirements, from basic supplementation to higher-dose therapeutic interventions, depending on clinical conditions and nutritional needs.

Hypervitaminosis E is considered rare, with vitamin E being the least toxic of the fat-soluble vitamins. The upper limits for adults range between 1500 and 2200 international units, varying based on whether the source is natural or synthetic. For children, the recommended limits are age-dependent, beginning at 200 international units for one-year-olds and increasing to 800 units by age 18.

Key driving factors include the rising prevalence of chronic diseases, such as cardiovascular disorders and diabetes, which has heightened demand for antioxidant-rich supplements. Additionally, the cosmetics industry is leveraging natural vitamin E for its anti-aging and skin-protective properties. Government initiatives, such as the European Union’s (EU) approval of health claims for vitamin E (Regulation (EC) No 1924/2006), have further bolstered market growth by validating its benefits in reducing oxidative stress.

Key Takeaways

- Tocopherols held a dominant market position, capturing more than an 87.3% share in the Natural Vitamin E market.

- Soybean Oil held a dominant market position, capturing more than a 52.6% share in the Natural Vitamin E market.

- Capsules held a dominant market position, capturing more than a 72.4% share in the Natural Vitamin E market.

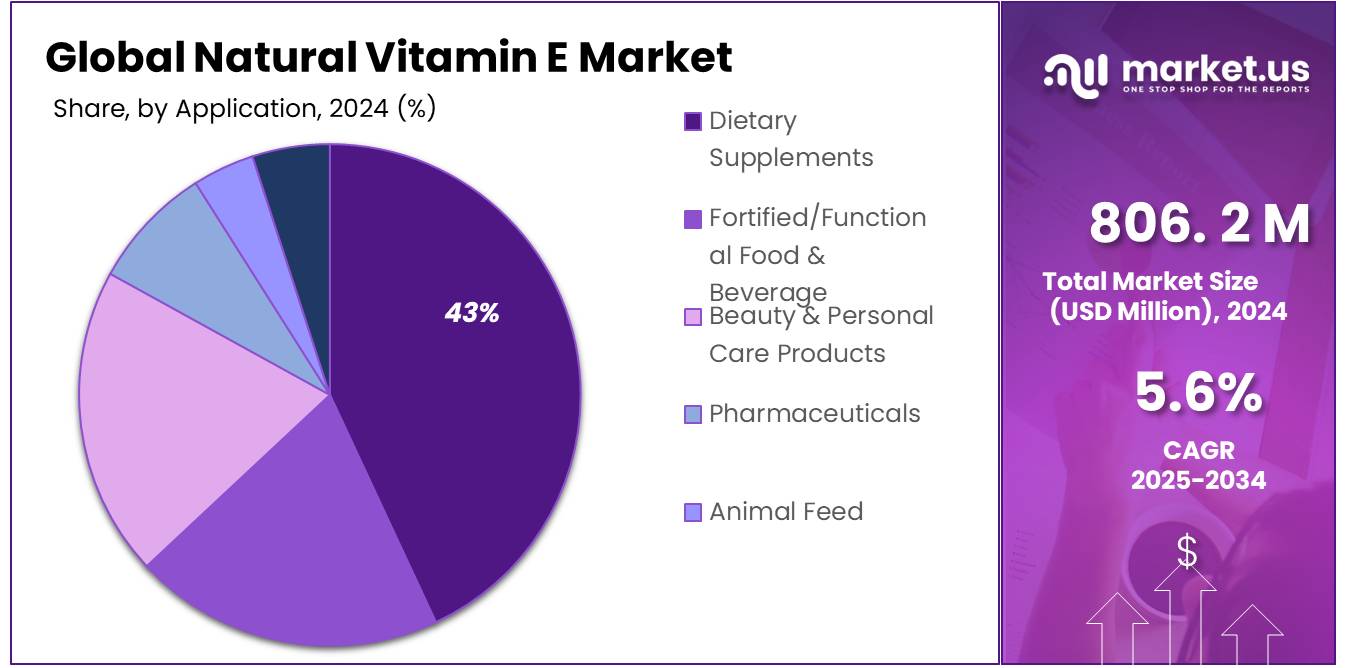

- Dietary Supplements held a dominant market position, capturing more than a 43.1% share in the Natural Vitamin E market.

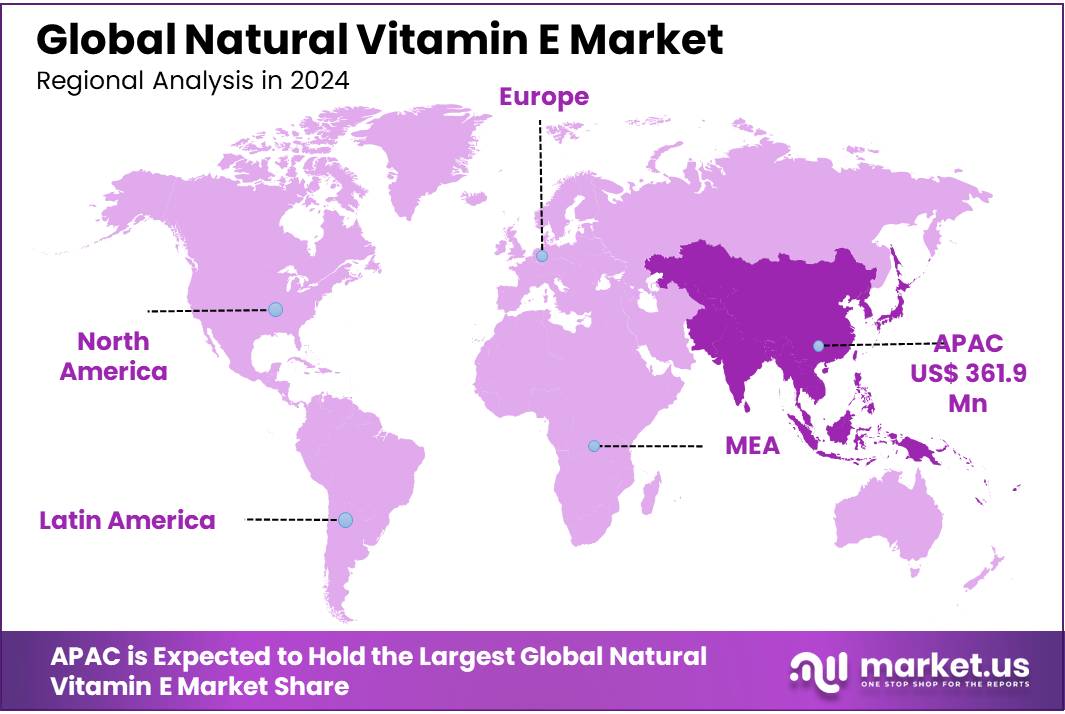

- Asia-Pacific (APAC) region stands as the leading contributor to the global natural vitamin E market, commanding a substantial 44.9% share, equating to approximately USD 361.9 million.

By Type

Tocopherols dominate with 87.3% due to widespread application in health supplements and cosmetics.

In 2024, Tocopherols held a dominant market position, capturing more than an 87.3% share in the Natural Vitamin E market. This significant share underscores the growing demand for Tocopherols, primarily driven by their extensive use in dietary supplements, skincare products, and fortified foods. The antioxidant properties of Tocopherols have bolstered their consumption, particularly in the nutraceutical and personal care sectors.

Additionally, rising consumer awareness regarding natural ingredients and the increasing inclination toward health and wellness products have further propelled the adoption of Tocopherols. This trend is expected to continue in 2025, as manufacturers focus on sourcing naturally derived Tocopherols to meet consumer demand for clean-label and plant-based products.

By Source

Soybean Oil dominates with 52.6% due to its widespread availability and nutritional benefits.

In 2024, Soybean Oil held a dominant market position, capturing more than a 52.6% share in the Natural Vitamin E market. This significant share can be attributed to the abundant availability of soybean crops and the extensive extraction of Vitamin E from soybean oil. The oil’s rich antioxidant content has driven its adoption in dietary supplements, fortified foods, and skincare products, making it a preferred source in the natural vitamin E segment.

Additionally, the rising consumer awareness of plant-based ingredients and their health benefits has further propelled the use of soybean oil as a key raw material. This trend is expected to persist in 2025 as manufacturers focus on sustainable and plant-based vitamin E sources to meet the growing demand for natural health products.

By Form

Capsules lead with 72.4% due to their convenient dosage and extended shelf life.

In 2024, Capsules held a dominant market position, capturing more than a 72.4% share in the Natural Vitamin E market. This significant market share is largely attributed to the growing consumer preference for easy-to-consume, accurately dosed supplements. Capsules offer extended shelf life and effective nutrient delivery, making them highly favored in the nutraceutical and dietary supplement sectors.

Additionally, the rising awareness of natural antioxidants and their health benefits has fueled demand for natural vitamin E capsules, particularly in regions where preventive healthcare is gaining momentum. As more consumers shift towards plant-based and clean-label products, the capsule segment is anticipated to maintain its dominant position in 2025, driven by product innovations and the inclusion of plant-derived tocopherols.

By Application

Dietary Supplements lead with 43.1% due to rising health-conscious consumer demand.

In 2024, Dietary Supplements held a dominant market position, capturing more than a 43.1% share in the Natural Vitamin E market. This substantial share is driven by the increasing focus on health and wellness, with consumers seeking vitamin-enriched supplements to boost immunity and prevent nutrient deficiencies.

The growing geriatric population and the prevalence of lifestyle-related health issues have further propelled the demand for Vitamin E supplements, particularly those sourced from natural ingredients. Additionally, the rising popularity of clean-label and plant-based supplements has contributed to the segment’s robust growth. As consumers continue prioritizing preventive healthcare, the Dietary Supplements segment is expected to maintain its leading position in 2025.

Key Market Segments

By Type

- Tocopherols

- Tocotrienols

By Source

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

By Form

- Capsules

- Cream/Serum

By Application

- Dietary Supplements

- Fortified/Functional Food & Beverage

- Beauty & Personal Care Products

- Pharmaceuticals

- Animal Feed

- Others

Drivers

Government Initiatives and Health Awareness Driving Natural Vitamin E Demand

The growing awareness of health and wellness among consumers is significantly boosting the demand for natural vitamin E concentrates. Natural vitamin E, known for its antioxidant properties, plays a crucial role in protecting cells from oxidative stress and supporting overall health. This has led to increased incorporation of natural vitamin E into dietary supplements, functional foods, and personal care products.

In India, the government’s initiatives to fortify edible oils with essential nutrients, including vitamin A and D, aim to address micronutrient deficiencies prevalent in the population. Such programs not only enhance public health but also stimulate the demand for vitamin E concentrates as a fortification agent. Similarly, China’s Ministry of Health has been promoting the consumption of fortified foods to combat nutritional deficiencies, further driving the demand for natural vitamin E concentrates.

As the demand for natural vitamin E concentrates continues to rise, it presents significant opportunities for manufacturers to innovate and expand their product offerings. By aligning with government initiatives and consumer preferences for natural products, companies can capitalize on the growing market for natural vitamin E concentrates.

Restraints

High Production Costs and Limited Raw Material Availability

One of the significant challenges in the natural vitamin E market is the high production costs associated with its extraction and manufacturing processes. Natural vitamin E is typically sourced from vegetable oils, such as sunflower, soybean, and palm oil. However, the extraction process for obtaining pure and high-quality natural vitamin E from these sources is complex, labor-intensive, and costly. This, in turn, drives up the price of the final product, making it less competitive compared to synthetic alternatives. Additionally, fluctuations in the availability and price of raw materials, such as vegetable oils, due to factors like seasonal variations, agricultural challenges, and geopolitical issues, further contribute to production cost volatility.

For instance, in June 2022, Kensing, LLC, a manufacturer of natural vitamin E, acquired Vitae Naturals, a producer of plant sterol esters and non-GMO natural vitamin E derivatives. This acquisition highlights the industry’s focus on securing sustainable and high-quality raw materials to meet the growing demand for natural vitamin E. However, such strategic moves also underscore the challenges associated with sourcing and maintaining a steady supply of raw materials.

Moreover, the production of natural vitamin E is susceptible to supply chain disruptions, which can lead to price fluctuations. For example, a fire at a major vitamin producer’s plant in Germany in July 2024 severely disrupted the production of vitamins A, E, and carotenoids. This incident led to limited contract fulfillment and significant price surges for vitamins A and E, with severe shortages expected through early 2025.

These high production costs and the volatility in raw material availability pose significant challenges for the natural vitamin E market. They can impact the pricing and accessibility of natural vitamin E products, potentially limiting their adoption in various applications. Addressing these challenges requires innovative approaches to sourcing raw materials, improving extraction processes, and enhancing supply chain resilience.

Opportunity

Expanding Applications in Functional Foods and Supplements

One of the most promising growth opportunities for natural vitamin E lies in its integration into functional foods and dietary supplements. As consumers become more health-conscious, there’s a noticeable shift towards products that offer additional health benefits beyond basic nutrition. Natural vitamin E, renowned for its antioxidant properties, is increasingly being incorporated into various products to meet this demand.

Government initiatives also play a significant role in promoting the use of natural vitamin E. For instance, China’s Ministry of Health has been actively promoting the consumption of fortified foods to combat nutritional deficiencies. Such policies not only enhance public health but also stimulate the demand for vitamin E concentrates as a fortification agent.

The Asia-Pacific region, particularly countries like India and China, presents substantial growth opportunities for natural vitamin E in functional foods and supplements. With increasing disposable incomes and a growing middle-class population, there’s a rising demand for health-enhancing products. This trend is further supported by government policies aimed at improving public health through nutrition.

Trends

Rising Demand for Clean-Label and Plant-Based Products

A significant trend shaping the natural vitamin E market is the increasing consumer preference for clean-label and plant-based products. Consumers are becoming more health-conscious and are actively seeking products with transparent ingredient lists, minimal processing, and natural sourcing. This shift is particularly evident in the food and beverage, dietary supplement, and cosmetics industries, where natural vitamin E is being favored over synthetic alternatives.

In India, the government’s initiatives to fortify edible oils with essential nutrients, including vitamin A and D, aim to address micronutrient deficiencies prevalent in the population. Such programs not only enhance public health but also stimulate the demand for vitamin E concentrates as a fortification agent. Similarly, China’s Ministry of Health has been actively promoting the consumption of fortified foods to combat nutritional deficiencies, further driving the demand for natural vitamin E concentrates.

The Asia-Pacific region, particularly countries like India and China, presents substantial growth opportunities for natural vitamin E in functional foods and supplements. With increasing disposable incomes and a growing middle-class population, there’s a rising demand for health-enhancing products. This trend is further supported by government policies aimed at improving public health through nutrition.

Regional Analysis

The Asia-Pacific (APAC) region stands as the leading contributor to the global natural vitamin E market, commanding a substantial 44.9% share, equating to approximately USD 361.9 million in 2025. This dominance is propelled by rapid economic growth, increasing health awareness, and a burgeoning middle class across key markets such as China, India, Japan, and South Korea.

China, in particular, plays a pivotal role as both a major producer and consumer of natural vitamin E. The country’s extensive agricultural sector, coupled with significant investments in biotechnology, has positioned it as a global leader in vitamin E production. Additionally, China’s large population and rising disposable incomes have fueled domestic demand for health supplements and fortified foods, further bolstering the market.

India, with its vast and youthful population, presents a rapidly expanding market for natural vitamin E. The increasing prevalence of lifestyle-related health issues, coupled with a growing preference for preventive healthcare, has spurred demand for dietary supplements and functional foods enriched with natural vitamin E. Government initiatives promoting nutrition and wellness have also played a crucial role in driving market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Archer Daniels Midland Company (ADM) is a leading global player in the natural vitamin E market, offering a wide range of vitamin E solutions. The company focuses on producing natural vitamin E from vegetable oils, and its products are used in nutritional supplements, functional foods, and personal care applications. ADM’s global reach, sustainable sourcing, and strong focus on innovation make it a key player in the natural vitamin E market.

BASF SE is one of the world’s largest chemical companies, offering high-quality natural vitamin E derived from plant-based sources. BASF’s vitamin E products are widely used in the food, animal feed, and personal care industries. The company emphasizes innovation and sustainability, with a strong commitment to meeting growing consumer demand for natural, clean-label products. BASF’s global presence and significant investment in R&D make it a leading competitor in the vitamin E market.

Brenntag AG is a global distributor of essential ingredients, including natural vitamin E. The company works with major producers to supply vitamin E to various industries, including food, cosmetics, and pharmaceuticals. Brenntag’s extensive distribution network and commitment to product quality and safety ensure that it can meet the growing demand for natural vitamin E. Its strong supply chain and focus on sustainable sourcing make it an influential player in the market.

Top Key Players in the Market

- Archer Daniels Midland Company

- BASF SE

- Brenntag AG

- Dsm N.V

- Excel Vite Inc.

- Kensing, LLC

- Kuala Lumpur Kepong Berhad (Davos Life Science)

- Orah Nutrichem Pvt. Ltd

- Parachem Fine & Specialty Chemicals

Recent Developments

BASF SE, a global leader in the chemical industry, plays a significant role in the natural vitamin E market. In 2024, the company produced approximately 20,000 tons of vitamin E annually, accounting for about 13.8% of the global market share.

In 2024, Brenntag reported operating gross profits of EUR 4.03 billion, with the Essentials division accounting for EUR 2.85 billion.

Report Scope

Report Features Description Market Value (2024) USD 806.2 Mn Forecast Revenue (2034) USD 1390.2 Mn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Tocopherols, Tocotrienols), By Source (Soybean Oil, Rapeseed Oil, Sunflower Oil), By Form (Capsules, Cream/Serum), By Application (Dietary Supplements, Fortified/Functional Food and Beverage, Beauty and Personal Care Products, Pharmaceuticals, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, BASF SE, Brenntag AG, Dsm N.V, Excel Vite Inc., Kensing, LLC, Kuala Lumpur Kepong Berhad (Davos Life Science), Orah Nutrichem Pvt. Ltd, Parachem Fine & Specialty Chemicals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company

- BASF SE

- Brenntag AG

- Dsm N.V

- Excel Vite Inc.

- Kensing, LLC

- Kuala Lumpur Kepong Berhad (Davos Life Science)

- Orah Nutrichem Pvt. Ltd

- Parachem Fine & Specialty Chemicals