Global Modified Starch Market Size, Share, And Enhanced Productivity By Raw Material (Corn, Cassava, Wheat, Potato, Others), By Type (Starch Esters and Ethers, Resistant, Cationic, Pre-gelatinized, Others), By Function (Thickeners, Stabilizers, Binders, Emulsifiers, Others), By Application (Food and Beverages, Animal Feed, Paper, Pharmaceuticals, Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171313

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

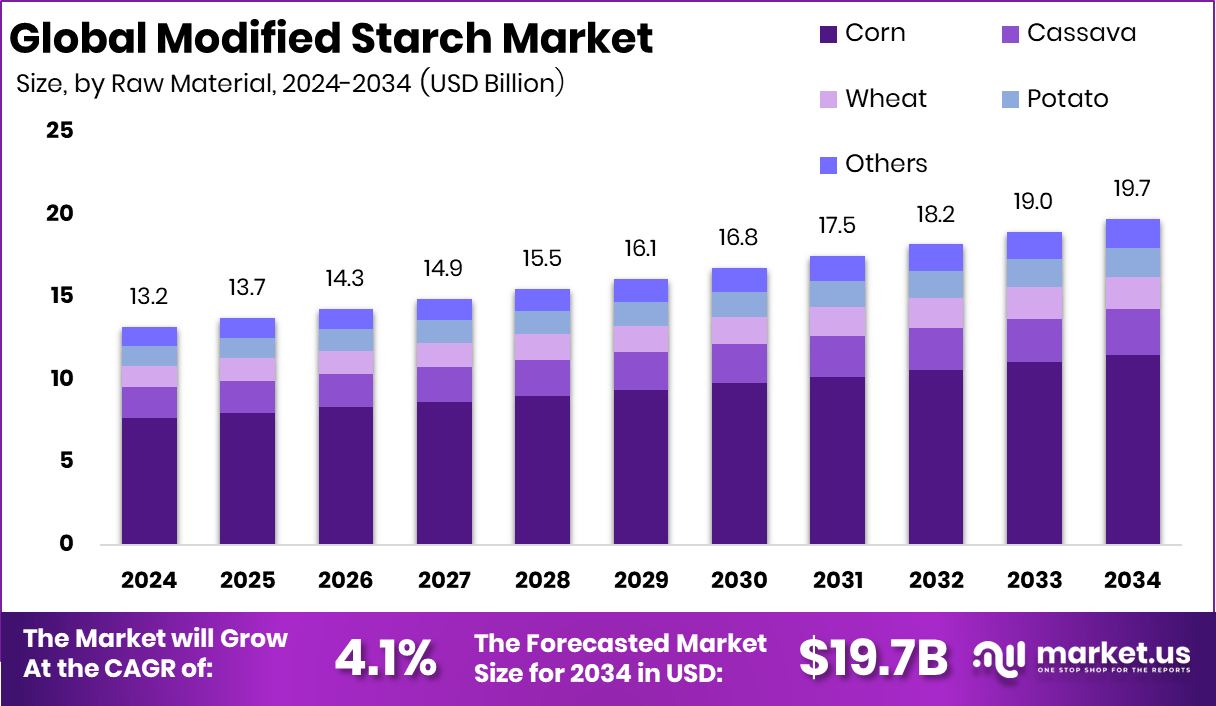

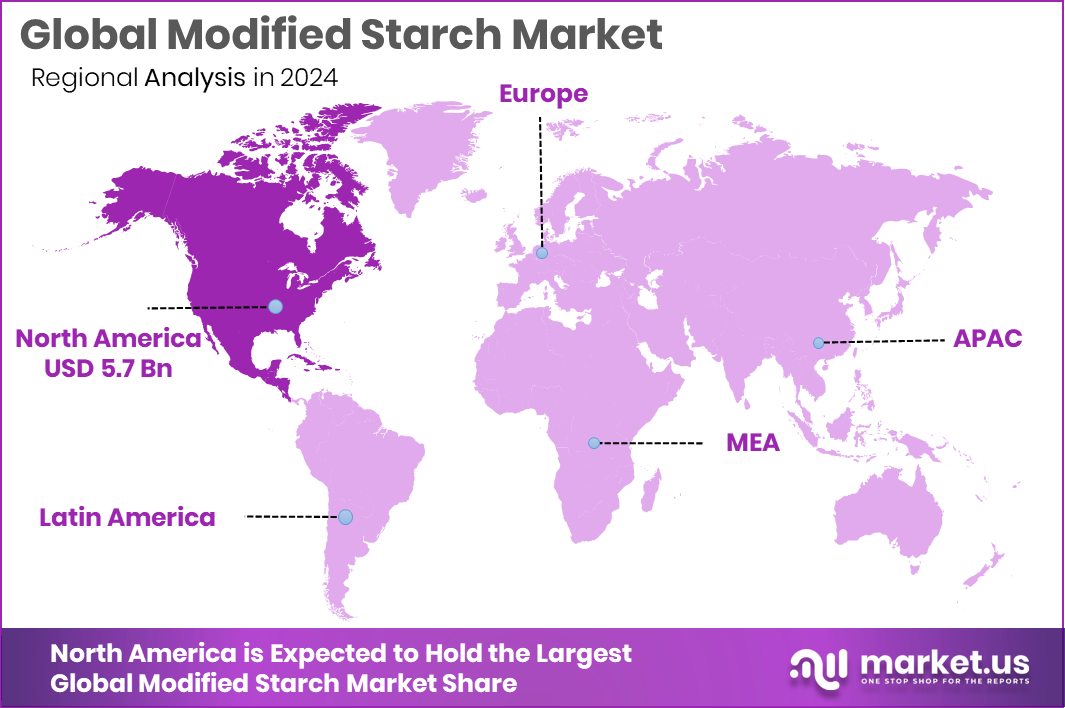

The Global Modified Starch Market is expected to be worth around USD 19.7 billion by 2034, up from USD 13.2 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Modified Starch Market in North America reached 43.70% share, accounting for USD 5.7 Bn.

Modified starch is a natural starch that has been physically, enzymatically, or chemically adjusted to improve how it performs in food and industrial uses. These changes help starch handle heat, acidity, freezing, and processing stress better than native starch. Because of this, modified starch is widely used to thicken soups, stabilize sauces, improve texture in bakery items, extend shelf life, and maintain consistency in packaged and ready-to-eat foods. It is valued because it keeps food looking and tasting the same from production to consumption.

The modified starch market covers the production and use of these enhanced starches across food, beverages, pharmaceuticals, paper, and personal care products. In food, it supports clean textures, moisture control, and reliable performance in mass manufacturing. As packaged foods, convenience meals, and functional products grow, modified starch plays a quiet but essential role in meeting quality and scale requirements without changing familiar recipes.

Growth factors are closely linked to innovation in food ingredients and processing. Startups are investing in multifunctional and fermented ingredients that often rely on starch systems for structure and stability. Summ Ingredients secured €1.7 million to launch a multifunctional fermented protein category, where modified starch supports texture, binding, and shelf stability.

Demand is rising for protein-rich and better-for-you foods that need a balance between nutrition and eating experience. Low-carb, high-protein bakery and snack products still depend on starch solutions to deliver softness and bite. BetterBrand closed a $6 million Series A round to expand its guilt-free bagel business, highlighting how reformulated foods still require functional starch systems to succeed at scale.

Opportunities are expanding in performance nutrition and convenient protein foods. After launching in September 2024 and raising $10 million in seed funding, protein bar maker David raised $75 million in a Series A round to scale manufacturing and product development. This expansion creates room for advanced modified starches that improve texture, binding, and shelf life while supporting higher protein formulations.

Key Takeaways

- The Global Modified Starch Market is expected to be worth around USD 19.7 billion by 2034, up from USD 13.2 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- Corn dominates the modified starch market, holding 58.3% share due to wide availability and cost efficiency.

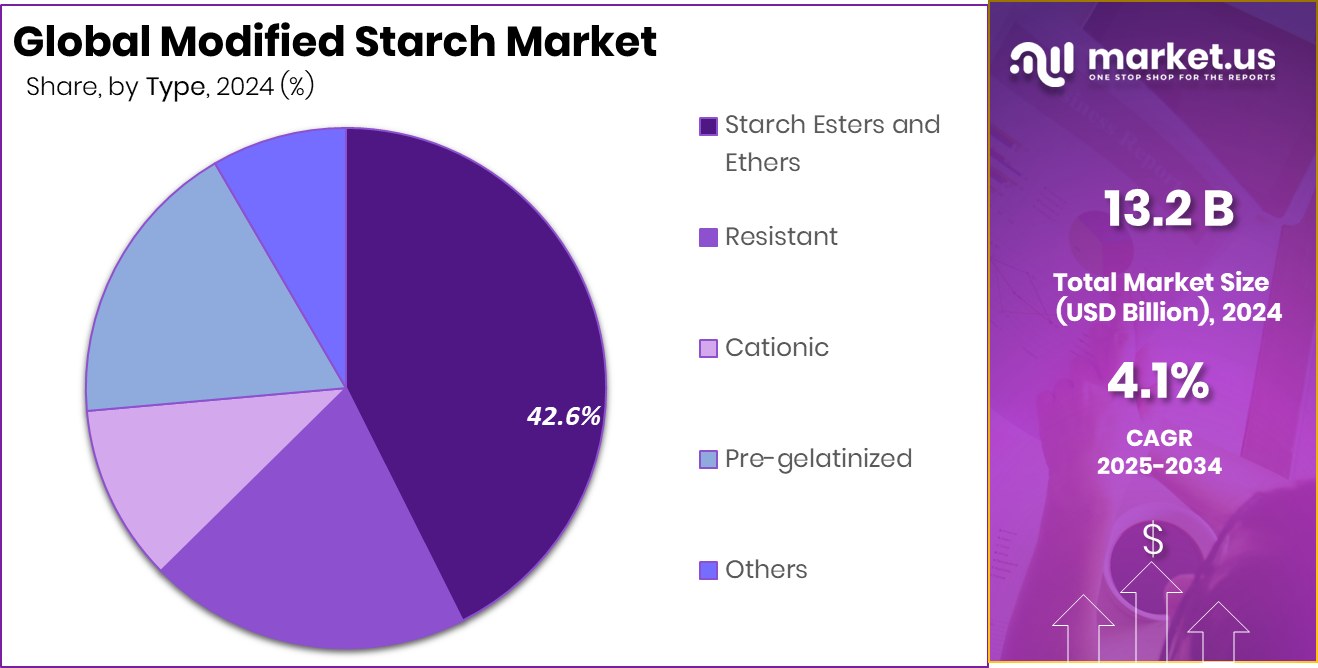

- Starch esters and ethers lead the modified starch market by type, accounting for 42.6% share globally.

- Thickeners represent 32.6% of the modified starch market, driven by texture and consistency needs.

- Food and beverages account for 41.5% of the modified starch market, supported by processed food demand.

- North America leads the Modified Starch Market, holding 43.70% share, generating USD 5.7 Bn.

By Raw Material Analysis

Modified Starch Market sees corn raw materials leading with 58.3% share globally.

In 2024, Corn held a dominant market position in the By Raw Material segment of the Modified Starch Market, with a 58.3% share, reflecting its wide availability, cost efficiency, and consistent functional performance across food and industrial uses. Corn-based modified starch is easy to process and adapts well to multiple modification techniques, making it suitable for large-scale manufacturing. Its neutral taste and stable behavior under heat and shear further strengthen its preference among processors.

This strong position is also supported by well-established agricultural supply chains and predictable output quality. Manufacturers rely on corn-derived starch to achieve uniform texture, viscosity control, and shelf stability in processed products. The 58.3% share highlights corn’s role as a dependable raw material that balances performance with scalability, keeping it central to modified starch production decisions.

By Type Analysis

Modified Starch Market type dominance comes from starch esters ethers holding 42.6%.

In 2024, Starch Esters and Ethers held a dominant market position in By Raw Material segment of the Modified Starch Market, with a 42.6% share, driven by their superior stability under heat, acidity, and mechanical stress. These starch types are widely used where consistent texture and resistance to processing conditions are essential, especially in complex food formulations and industrial applications.

The 42.6% share reflects steady demand for ingredients that deliver reliable thickening, emulsification, and moisture retention without compromising product integrity. Starch esters and ethers offer predictable performance across processing stages, helping manufacturers maintain quality from production through storage. Their dominance indicates a continued preference for modified starch forms that combine functional flexibility with dependable end-use behavior.

By Function Analysis

Modified Starch Market functions highlight thickeners as the primary use, accounting 32.6% share.

In 2024, Thickeners held a dominant market position in By Function segment of the Modified Starch Market, with a 32.6 share, highlighting the essential role of viscosity control in processed products. Modified starch used as a thickener improves mouthfeel, consistency, and visual appeal, making it a foundational functional component in many formulations.

This dominance reflects steady reliance on starch-based thickeners to ensure product uniformity during cooking, cooling, and storage. The 32.6 share indicates that thickening remains a primary functional requirement, supporting smooth textures and stable structures. As formulation demands grow more precise, thickeners continue to anchor the functional value of modified starch across multiple end uses.

By Application Analysis

Modified Starch Market application strength remainsin the food and beverages segment, contributing 41.5% demand.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Modified Starch Market, with a 41.5% share, underlining the sector’s heavy reliance on texture, stability, and shelf-life enhancement. Modified starch plays a key role in sauces, bakery items, dairy alternatives, and ready-to-eat foods where consistent quality is critical.

The 41.5% share reflects ongoing demand for ingredients that support large-scale production without altering taste or appearance. Food and beverage manufacturers depend on modified starch to manage processing stress and maintain product performance over time. This strong application share confirms the sector’s continued influence on modified starch usage patterns.

Key Market Segments

By Raw Material

- Corn

- Cassava

- Wheat

- Potato

- Others

By Type

- Starch Esters and Ethers

- Resistant

- Cationic

- Pre-gelatinized

- Others

By Function

- Thickeners

- Stabilizers

- Binders

- Emulsifiers

- Others

By Application

- Food and Beverages

- Animal Feed

- Paper

- Pharmaceuticals

- Textiles

- Others

Driving Factors

Rising Food Security Focus Drives Modified Starch Demand

Food security and safer food systems are becoming a strong driving force for the modified starch market. Governments and institutions are investing heavily to improve crop quality, food safety, and nutrition, which directly supports starch-based ingredients. In the United States, the USDA-NIFA awarded USD 9.6 million under the Food Safety Outreach Program to strengthen safe food handling and processing practices. These efforts increase demand for stable, safe, and functional ingredients like modified starch in processed foods.

Crop improvement is another major driver. A nutrition-focused project that began as a humanitarian effort received more than USD 1 million to adapt a naturally selected, more nutritious corn variety for use in the United States. This supports better raw materials for starch production, improving consistency and functionality. Additionally, Penn State plant scientists received nearly USD 1.25 million from the U.S. Department of Agriculture to study corn–soil fungi interactions, aiming to boost crop resilience and yield. Stronger corn production directly benefits modified starch availability and long-term supply stability.

Restraining Factors

Rising Raw Material Price Volatility Limits Market Stability

Price instability in agricultural inputs remains a major restraining factor for the modified starch market. Global food price fluctuations, often driven by geopolitical events and speculative trading, directly affect corn and other starch feedstocks. During the early phase of the Ukraine war, ten momentum-driven hedge funds earned an estimated USD 1.9 billion by trading on food price spikes, a situation that pushed input costs higher and reduced price predictability for food processors. Such volatility makes long-term sourcing and pricing of modified starch more difficult for manufacturers.

Shifting agricultural priorities also influence starch availability. Governments are directing funds toward alternative solutions that compete for raw materials and policy attention. Innovafeed secured a USD 11.8 million USDA grant to advance insect-based fertilizer production, redirecting investment toward non-traditional agricultural inputs. In addition, the agriculture sector received a P197.84 billion budget for 2024 to strengthen food and water security, which may prioritize staple food production over industrial starch uses. These factors collectively constrain stable supply planning and cost control.

Growth Opportunity

Advanced Crop And Feed Innovation Creates Opportunity

Investment in crop science and feed innovation is opening strong growth opportunities for the modified starch market. Better seed research improves starch quality, yield, and processing performance. Inari has secured a total of USD 145 million over four years and expanded its team to advance corn, wheat, and soybean research at its Purdue-based Seed Foundry. Stronger and more resilient crop varieties support a consistent starch supply and improved functional properties, benefiting food and industrial starch applications.

Growth in sustainable animal feed systems also supports starch demand through feed binders and digestibility enhancers. Elmentoz raised USD 4.5 million to launch India’s largest insect protein facility and eliminate antibiotics in animal feed, increasing demand for stable feed formulations where modified starch plays a functional role. Clean-tech startup Wastelink raised USD 3 million, led by Avaana Capital, to strengthen the animal feed supply chain, improving raw material flow and efficiency. These investments improve upstream stability and create long-term opportunities for modified starch usage.

Latest Trends

Resilient Food Infrastructure Shapes Modified Starch Usage

A key latest trend in the modified starch market is the growing focus on resilient and efficient food systems. Governments and private investors are strengthening food infrastructure to reduce waste, improve processing reliability, and support a stable ingredient supply. Modified starch benefits directly from this shift, as it helps improve shelf life, texture stability, and processing efficiency across food applications. Better infrastructure allows starch-based ingredients to perform consistently from production to distribution.

Supply-chain modernization is another important trend. Startups working on waste reduction and logistics efficiency are improving raw material flow, which supports steady starch processing. In India, Wastelink raised ₹27 crore in Series A funding to build a stronger, more reliable food and feed supply chain. At the same time, public programs are upgrading food facilities and storage systems, indirectly increasing demand for functional ingredients like modified starch that suit large-scale, stable food production.

- Infrastructure support: MDARD awarded over USD 3.1 million under the Resilient Food System Infrastructure Program

Regional Analysis

North America dominated the Modified Starch Market with 43.70% share, USD 5.7 Bn.

North America emerged as the dominating region in the Modified Starch Market, holding a 43.70% share valued at USD 5.7 Bn, supported by its strong processed food industry and mature starch processing infrastructure. High consumption of packaged foods, sauces, bakery products, and convenience meals continues to sustain stable demand for modified starch across the region.

Europe represents a well-established market driven by consistent usage of functional ingredients in food manufacturing, clean-label reformulation efforts, and steady demand from industrial applications such as paper and pharmaceuticals. Asia Pacific shows growing market relevance due to expanding food processing capacity, rising urban consumption of ready-to-eat products, and increasing adoption of texture-enhancing ingredients in mass food production.

The Middle East & Africa market remains demand-led by gradual growth in packaged food consumption, import-based starch usage, and expanding food service sectors across key economies. Latin America contributes through agricultural strength and increasing utilization of starch derivatives in regional food manufacturing, where cost-effective formulation and shelf stability remain important.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGRANA Beteiligungs-AG holds a strategic position in the modified starch space through its deep integration with agricultural raw materials and food ingredient processing. In 2024, the company’s strength lies in aligning starch modification with downstream food applications, particularly where texture stability and process reliability matter. AGRANA’s structured approach to sourcing and processing supports consistent quality, helping food manufacturers manage formulation performance across large production volumes. Its focus on value-added starch solutions reflects a shift from commodity supply toward functional ingredients tailored for specific processing needs.

Archer-Daniels-Midland Company brings scale, technical depth, and supply chain reach to the modified starch market. In 2024, ADM’s role is shaped by its ability to connect starch modification with broader food, beverage, and nutrition systems. The company’s diversified processing capabilities allow it to serve multiple end uses while maintaining operational efficiency. ADM’s emphasis on formulation support and ingredient functionality strengthens its relevance as customers seek reliable starch performance under varying processing conditions.

Cargill Incorporated continues to influence the modified starch market through its broad ingredient portfolio and application-driven development approach. In 2024, Cargill’s strength is its close collaboration with food manufacturers to solve texture, stability, and shelf-life challenges. By linking starch functionality with evolving product formats, Cargill reinforces its position as a solution-oriented supplier rather than a basic starch producer.

Top Key Players in the Market

- AGRANA Beteiligungs-AG

- Archer-Daniels-Midland Company

- Cargill Incorporated

- Emsland-Stärke GmbH

- Kent Corporation

- Ingredion Incorporated

- Roquette Frères

- SMS Corporation

- Tate & Lyle PLC

- Tereos

- The cooperative Royal Avebe U.A.

Recent Developments

- In June 2025, Ingredion Germany GmbH received regulatory clearance for a joint venture with AGRANA Stärke GmbH in Romania, where Ingredion will take 49% ownership in a starch production entity. This collaboration aims to increase starch manufacturing capacity and strengthen the company’s competitive position in starch supply and production in Europe

- In May 2025, Kent Corporation officially changed its name to KENT WORLDWIDE to reflect its growth from a regional agribusiness into a global company. This new name unifies its food, beverage, ingredient, agriculture, and pet product businesses under one brand, highlighting expanded manufacturing and marketing reach in both food and industrial starch and related specialty ingredients.

- In August 2024, Roquette expanded its food ingredient offerings by launching four new hydroxypropylated botanical tapioca starches designed to boost texture, viscosity, and consistency in sauces, dairy desserts, yogurts, and bakery fillings. These products strengthen Roquette’s portfolio of plant-based texturizing and modified starch solutions

Report Scope

Report Features Description Market Value (2024) USD 13.2 Billion Forecast Revenue (2034) USD 19.7 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Corn, Cassava, Wheat, Potato, Others), By Type (Starch Esters and Ethers, Resistant, Cationic, Pre-gelatinized, Others), By Function (Thickeners, Stabilizers, Binders, Emulsifiers, Others), By Application (Food and Beverages, Animal Feed, Paper, Pharmaceuticals, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AGRANA Beteiligungs-AG, Archer-Daniels-Midland Company, Cargill Incorporated, Emsland-Stärke GmbH, Kent Corporation, Ingredion Incorporated, Roquette Frères, SMS Corporation, Tate & Lyle PLC, Tereos, The cooperative Royal Avebe U.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Modified Starch MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Modified Starch MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AGRANA Beteiligungs-AG

- Archer-Daniels-Midland Company

- Cargill Incorporated

- Emsland-Stärke GmbH

- Kent Corporation

- Ingredion Incorporated

- Roquette Frères

- SMS Corporation

- Tate & Lyle PLC

- Tereos

- The cooperative Royal Avebe U.A.