Global Methionine Market Size, Share Analysis Report By Source (Plant Based, Animal Based), By Product Type (DL-Methionine, L-Methionine, Hydroxy Analogue of Methionine), By Application (Animal Feed, Food and Dietary Supplements, Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155120

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

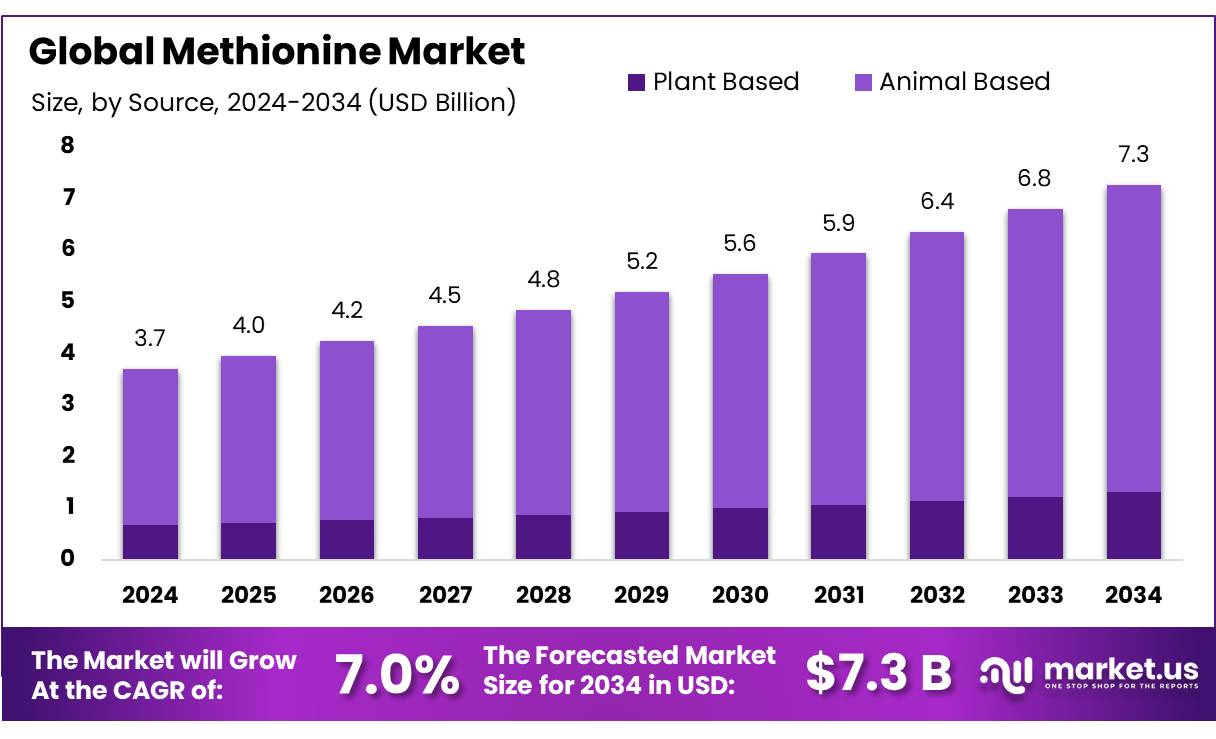

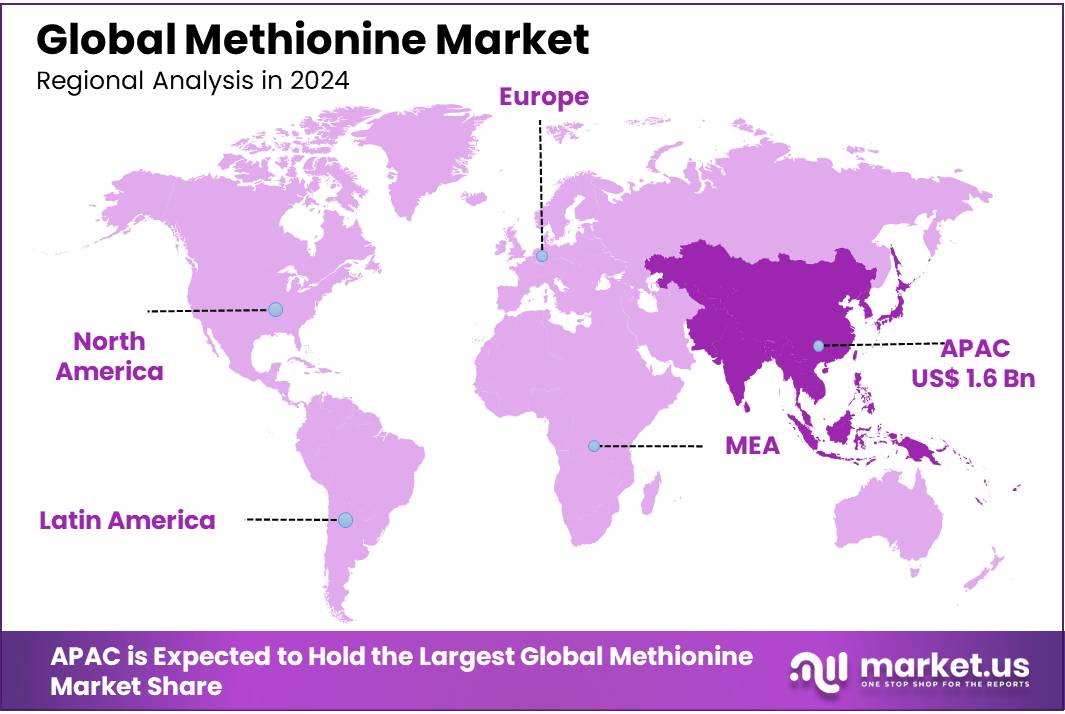

The Global Methionine Market size is expected to be worth around USD 7.3 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 44.70% share, holding USD 1.6 Billion revenue.

Methionine concentrates (DL-methionine and hydroxy-analogue/MHA) are essential amino-acid inputs that let feed formulators lower crude protein while maintaining performance, especially in poultry and swine. Industrially, most DL-methionine is synthesized from petrochemical intermediates—acrolein, methyl mercaptan and hydrocyanic acid—with ammonia and carbon dioxide used in hydantoin routes; this well-established pathway is documented in U.S. Department of Agriculture technical materials and patents.

Demand fundamentals are tied to livestock output and feed volumes. The OECD-FAO Outlook projects global meat consumption to rise by about 47.9 million tonnes by 2034, supporting higher compound-feed use and sustained amino-acid inclusion. In broilers, the United States, China and Brazil together account for roughly half of world chicken meat production (2024/25), underscoring the geographic concentration of methionine demand.

Government data also point to accelerating Asian demand China’s feed use is projected at ~286.5 MMT in MY 2024/25, while India’s egg output reached 142.77 billion in 2023-24 (up from 78.48 billion in 2014-15), both reinforcing amino-acid needs in layer and broiler diets.

Regulation and productivity are the key industrial drivers. The EU’s ban on antibiotic growth promoters since 1 January 2006 pushed the industry toward nutritional and management solutions; amino-acid balancing, with methionine as the first-limiting amino acid in poultry, became a mainstream tool.

Evidence from European feed manufacturers and peer-reviewed work shows that cutting dietary crude protein by 1% point—while supplementing essential amino acids—can lower nitrogen excretion up to ~10% in poultry and pigs, and that a 2-point reduction can cut broiler house ammonia emissions by as much as ~24%. These quantifiable environmental gains are central to permit compliance under EU Best Available Techniques (BAT) for intensive poultry and pig rearing.

Energy-system dynamics increasingly shape cost and technology choices for methionine. The IEA notes the chemicals sector is the largest industrial energy consumer and the third-largest source of direct industrial CO₂; petrochemicals are set to drive over one-third of global oil demand growth to 2030 and nearly half by 2050. As industry decarbonizes, this raises incentives for process efficiency, lower-carbon feedstocks and potential bio-routes for L-methionine, alongside power- and hydrogen-related cost exposures in traditional plants.

Key Takeaways

- Methionine Market size is expected to be worth around USD 7.3 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 7.0%.

- Animal Based held a dominant market position, capturing more than a 81.2% share.

- DL-Methionine held a dominant market position, capturing more than a 56.3% share.

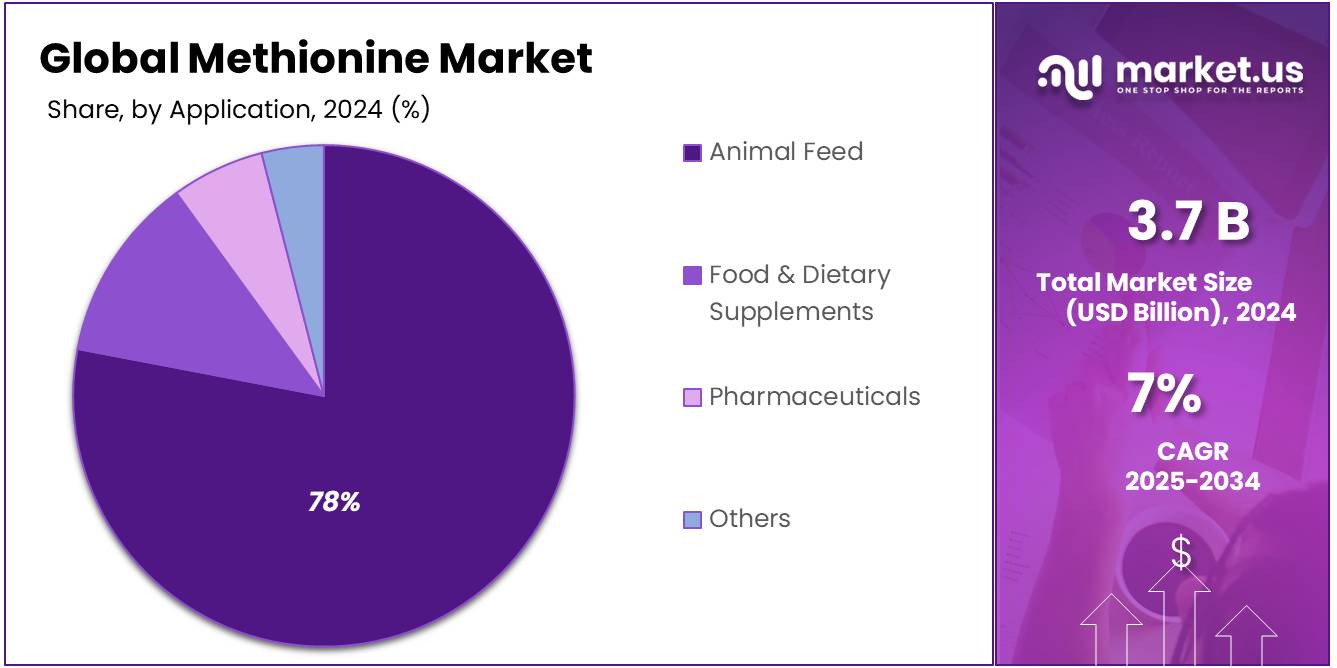

- Animal Feed held a dominant market position, capturing more than a 78.9% share.

- Asia-Pacific emerged as the clear growth engine for the global methionine market, capturing 44.70% of total revenues, valued at USD 1.6 billion.

By Source Analysis

Animal-Based Methionine dominates with 81.2% on proven feed performance.

In 2024, Animal Based held a dominant market position, capturing more than a 81.2% share. The segment’s lead was anchored by day-to-day realities in feed mills: consistent performance in broiler, layer, and swine diets, predictable inclusion rates, and easy fit with low-protein formulations that help control nitrogen output. Buyers leaned on reliable supply partnerships and tried-and-tested dosing practices, which kept switching costs high and reinforced preference for animal-based options across large integrated operations. Procurement teams also favored the familiarity of these inputs when balancing price, amino-acid profiles, and pellet quality across different feed lines.

By Product Type Analysis

DL-Methionine dominates with 56.3% for flexible, reliable nutrition.

In 2024, DL-Methionine held a dominant market position, capturing more than a 56.3% share. Its lead was built on everyday feed-mill realities: consistent amino acid delivery across broiler, layer, swine, and aqua diets; easy dosing in premixes; and predictable results when nutritionists lower crude protein while protecting feed conversion. Buyers valued DL-Methionine for its broad compatibility with common raw materials and pellet conditions, which reduced reformulation risk and kept throughput steady. Through 2024, integrators leaned on established supply contracts and technical support to manage volatility in protein meals, keeping DL-Methionine as the default choice in baseline and performance diets.

By Application Analysis

Animal Feed dominates with 78.9% as methionine’s core use.

In 2024, Animal Feed held a dominant market position, capturing more than a 78.9% share. This lead reflects day-to-day realities in poultry, swine, and aquaculture where methionine is essential for balanced amino-acid nutrition, steady growth, and better feed conversion. Formulators prefer methionine because it lets them lower crude protein while keeping performance intact, which helps manage input costs and reduce nitrogen output at farms. In feed mills, it fits cleanly into premixes and compound feed, with predictable inclusion rates and minimal reformulation risk across different raw-material blends. Large integrators sustained demand through annual contracts and technical support programs that standardize dosing and pellet quality across sites.

Key Market Segments

By Source

- Plant Based

- Animal Based

By Product Type

- DL-Methionine

- L-Methionine

- Hydroxy Analogue of Methionine

By Application

- Animal Feed

- Food & Dietary Supplements

- Pharmaceuticals

- Others

Emerging Trends

Optimizing Methionine Supplementation for Sustainable Livestock Production

A significant trend in the methionine sector is the growing emphasis on precision nutrition to enhance livestock productivity and sustainability. This approach involves tailoring methionine supplementation to meet the specific amino acid requirements of animals, thereby improving feed efficiency and reducing environmental impact.

- For instance, research on broilers demonstrated that adding methionine to a 15% protein diet improved growth performance and welfare, indicating that precise supplementation can optimize animal health and productivity.

Furthermore, integrating methionine with other supplements like guanidinoacetic acid (GAA) has shown promising results. A study on beef cattle found that combining GAA with methionine enhanced growth performance by improving nutrient digestibility and boosting antioxidant levels, suggesting that such combinations can lead to more efficient and healthier livestock.

Government initiatives are also supporting this trend. The U.S. Department of Agriculture (USDA) has been actively involved in researching the effects of methionine supplementation on livestock, aiming to improve feed efficiency and animal health. Such research not only enhances productivity but also contributes to sustainable agricultural practices by optimizing resource use.

Drivers

Increased Demand for Animal Feed and Livestock Production

One of the major driving factors behind the growing demand for methionine is the rising global need for animal feed, especially for livestock production. Methionine, an essential amino acid, plays a crucial role in animal nutrition, supporting growth, muscle development, and overall health in animals. This demand is particularly heightened by the expanding global population, which increases the need for protein-rich foods such as poultry, beef, and pork.

- According to the Food and Agriculture Organization (FAO), global meat consumption is projected to increase by 73% by 2050, which is significantly influencing the need for more efficient and nutritious animal feed formulations.

Additionally, the shift toward more sustainable and economically viable farming practices is accelerating the use of methionine in animal feed. Methionine supplementation ensures optimal growth and productivity in livestock, improving feed efficiency and minimizing waste. This is particularly important in the context of rising feed costs and increasing pressure on farmers to produce more with less. In 2023, the FAO noted that global feed production reached approximately 1 billion tons, and the share of amino acids like methionine in this production continues to rise as a result of their vital role in enhancing animal health and reducing costs.

Moreover, the growing trend of reducing the environmental footprint of agriculture has also impacted methionine demand. With growing concerns over animal waste and its environmental impact, methionine’s role in improving feed efficiency helps minimize feed wastage, which is beneficial for both sustainability and farm profitability. The U.S. Department of Agriculture (USDA) reports that reducing feed waste by optimizing feed formulation with ingredients like methionine can significantly lower the carbon footprint of animal farming, thereby aligning with global sustainability goals.

The expansion of government initiatives and global partnerships focusing on agricultural innovation further bolsters methionine’s importance. For instance, the U.S. government has been investing in animal nutrition research, including amino acid supplementation, to enhance food security and agricultural productivity. This continued investment ensures that methionine remains a critical component in meeting the rising demand for animal products globally.

Restraints

High Production Costs of Methionine

One of the significant restraining factors for the methionine market is the high production costs associated with its manufacturing. Methionine, an essential amino acid used in animal feed, is produced using complex and energy-intensive processes, primarily through fermentation or chemical synthesis. These production methods require substantial investments in raw materials, equipment, and energy, all of which contribute to the overall cost of methionine. The high cost of production makes methionine more expensive for feed manufacturers, particularly in regions where feed prices are already under pressure due to global inflation or fluctuating raw material costs.

For instance, the International Feed Industry Federation (IFIF) reported in 2023 that global feed costs have been steadily rising, with the average price of raw feed ingredients like maize and soybean increasing by over 25% in the past few years. This situation has further impacted the overall cost of animal feed, with some estimates indicating that feed costs account for over 60% of the total production cost for livestock farmers. As a result, incorporating additional supplements such as methionine can make feed more expensive, which in turn affects the profitability of farmers, particularly in developing regions where cost sensitivity is higher.

Additionally, the production of methionine is heavily dependent on petroleum-based raw materials, which further increases its cost volatility. The fluctuation in the prices of crude oil directly affects the price of methionine production, as petroleum-based inputs are a significant component in its synthesis. This dependency on petroleum is a concern for manufacturers who must navigate the challenges posed by rising fuel prices and supply chain disruptions.

Governments around the world, recognizing the importance of methionine in livestock production, have been taking steps to ease the burden on producers. For example, the U.S. Department of Agriculture (USDA) has provided subsidies and research funding aimed at improving feed efficiency and reducing the costs associated with livestock production. However, despite these initiatives, the overall high cost of methionine continues to be a limiting factor for widespread adoption, especially in smaller farms and emerging markets.

Opportunity

Enhanced Livestock Productivity through Methionine Supplementation

One of the most promising growth opportunities for methionine lies in its ability to enhance livestock productivity, particularly in beef and poultry sectors. Research from the U.S. Department of Agriculture’s Agricultural Research Service (USDA ARS) indicates that supplementing beef cattle diets with methionine during early pregnancy can lead to significant improvements in fetal development. Specifically, a study found that maternal methionine supplementation resulted in increased brain and muscle development in fetuses, highlighting its potential to improve overall herd productivity.

Similarly, in poultry, methionine supplementation has been shown to enhance meat quality. A USDA ARS study demonstrated that varying levels of dietary methionine supplementation affected breast meat quality in broilers, suggesting that optimizing methionine levels can improve meat characteristics, thereby increasing market value.

These findings are particularly relevant as global demand for animal-source foods continues to rise. The Food and Agriculture Organization (FAO) projects that per capita demand for poultry meat in India will increase by 577% between 2000 and 2030, underscoring the need for efficient feeding strategies to meet this demand.

Government initiatives are also supporting this growth opportunity. The USDA ARS has been actively researching the effects of methionine supplementation on livestock, aiming to improve feed efficiency and animal health. Such research not only enhances productivity but also contributes to sustainable agricultural practices by optimizing resource use.

Regional Insights

Asia Pacific leads methionine demand with 44.70% share (USD 1.6 Bn).

In 2024, Asia-Pacific emerged as the clear growth engine for the global methionine market, capturing 44.70% of total revenues, valued at USD 1.6 billion. Demand is anchored in feed-grade applications, which account for well over 90% of regional consumption, with poultry nutrition representing roughly three-quarters of feed-grade usage. Rapid expansion of integrated poultry and aquaculture systems in China, India, Indonesia, Vietnam, and Thailand continues to lift inclusion rates of essential amino acids to improve feed conversion ratios and support higher stocking densities.

Producers are also optimizing product mix toward high-concentration liquid and coated grades to improve handling and bioavailability for premix and compound-feed manufacturers. Policy support for protein self-sufficiency, continual upgrades in commercial farming practices, and the growth of quick-service restaurants and modern retail further stabilize baseline demand. Price sensitivity remains important, but procurement strategies in Asia-Pacific increasingly emphasize security of supply through multi-year contracts and diversified sourcing across domestic and international suppliers.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Adisseo is a global leader in animal nutrition, specializing in the production of methionine and other feed additives. In 2024, the company reported a turnover exceeding €2 billion and served over 4,200 customers worldwide. Headquartered in France, Adisseo is recognized for its innovative solutions in animal health and nutrition, including the development of protected methionine products for ruminants. The company is investing in a new methionine plant set to commence production in 2027, aiming to enhance its global production capacities.

Ajinomoto Co., Inc., based in Tokyo, Japan, is a multinational corporation known for its expertise in amino acids and biotechnology. The company produces L-methionine as part of its AminoScience division, catering to various industries, including animal nutrition. With a global presence, Ajinomoto emphasizes the importance of amino acids in enhancing animal health and productivity. In 2024, Ajinomoto reported annual revenues of approximately ¥1.53 trillion (about $10.61 billion USD).

CJ CheilJedang Corp., a South Korean company, is a significant player in the global amino acid market. The company produces L-methionine through a bio-fermentation process, utilizing raw materials like sugar and grape sugar. CJ CheilJedang operates a plant in Malaysia with an annual production capacity of 80,000 tonnes of L-methionine. The company is committed to environmental sustainability and innovation in amino acid production.

Top Key Players Outlook

- Adisseo

- Ajinomoto Co., Inc.

- AMINO GmbH

- AnaSpec

- CJ CHEILJEDANG CORP.

- DSM

- Evonik Industries AG

- IRIS BIOTECH GMBH

- Kemin Industries, Inc.

- KYOWA HAKKO BIO CO., LTD.

Recent Industry Developments

March 31, 2024, Ajinomoto reported consolidated sales of ¥1,439.2 billion, marking a 5.9% increase from the previous year. The company’s business profit rose by 9.1% year-on-year to ¥147.6 billion, primarily driven by increased revenue in its Seasonings and Foods segment.

In 2024, AnaSpec offered both unlabeled and labeled forms of methionine, such as Fmoc-Met-OH and Fmoc-Met(O)-OH, catering to the needs of researchers in peptide synthesis and proteomics.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Bn Forecast Revenue (2034) USD 7.3 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant Based, Animal Based), By Product Type (DL-Methionine, L-Methionine, Hydroxy Analogue of Methionine), By Application (Animal Feed, Food and Dietary Supplements, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Adisseo, Ajinomoto Co., Inc., AMINO GmbH, AnaSpec, CJ CHEILJEDANG CORP., DSM, Evonik Industries AG, IRIS BIOTECH GMBH, Kemin Industries, Inc., KYOWA HAKKO BIO CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adisseo

- Ajinomoto Co., Inc.

- AMINO GmbH

- AnaSpec

- CJ CHEILJEDANG CORP.

- DSM

- Evonik Industries AG

- IRIS BIOTECH GMBH

- Kemin Industries, Inc.

- KYOWA HAKKO BIO CO., LTD.