Global Medium Voltage Power Cable Market Size, Share, And Industry Analysis Report By Installation (Overhead, Underground), By Voltage (1kV to 15kV, 16kV to 35kV, 36kV to 70kV), By Application (Utility, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 167753

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

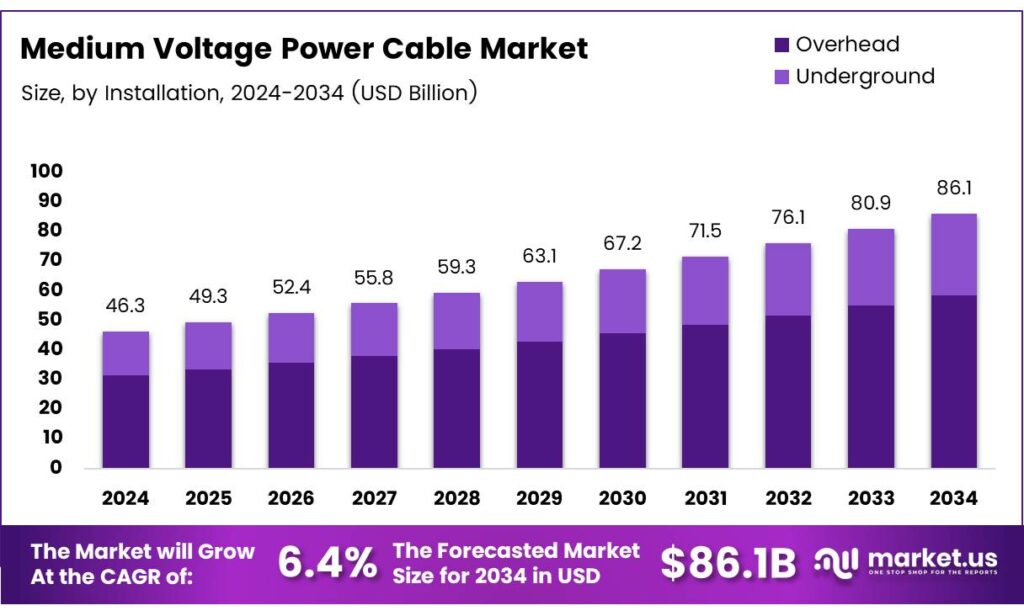

The Global Medium Voltage Power Cable Market size is expected to be worth around USD 86.1 billion by 2034, from USD 46.3 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The Medium Voltage Power Cable Market refers to insulated electrical cables designed to transmit electricity between 1 kV and 35 kV across industrial, commercial, and utility networks. These cables are used in renewable grid expansion, underground installations, smart grid upgrades, and urban infrastructure. The market benefits from rising electrification, industrial automation, and increasing preference for underground cabling to reduce outage risks and improve operational safety.

The maximum allowable continuous temperature during a short circuit is 250°C, significantly higher than PVC or PILC cables. XLPE variants can operate at 130°C during an emergency, but the duration must not exceed 1500 hours. This allows up to 20% higher current during temporary overloads. Further, peroxide-containing polymer compounds are extruded between 110°C and 140°C and vulcanized under 100–200 psi dry nitrogen, enabling stable cross-linking for durability.

- Additionally, current carrying performance influences installation choices. A 300 mm² copper conductor carries 670 Amps when buried, while an aluminum conductor of the same size carries 525 Amps. To match performance, aluminum requires a 500 mm² cross-section. The continuous rating is calculated based on a conductor temperature of 90°C, the standard operating limit for service conditions.

Governments are investing heavily in infrastructure upgrades, and utilities prefer medium-voltage cables for performance, reliability, and reduced transmission losses. In cities, underground MV power cables are preferred because they reduce environmental impact and support urban design goals. As renewable energy accelerates, offshore wind, microgrids, and distributed energy systems continue driving installations.

Key Takeaways

- The Global Medium Voltage Power Cable Market is projected to reach USD 46.3 billion in 2024, expected to reach USD 86.1 billion by 2034, at a CAGR of 6.4% between 2025–2034.

- Underground installation leads the market with a 65.2% share due to safety, low maintenance, and smart city development.

- The 1kV to 15kV voltage segment dominates with 49.8%, supported by increasing use in distribution-level energy systems.

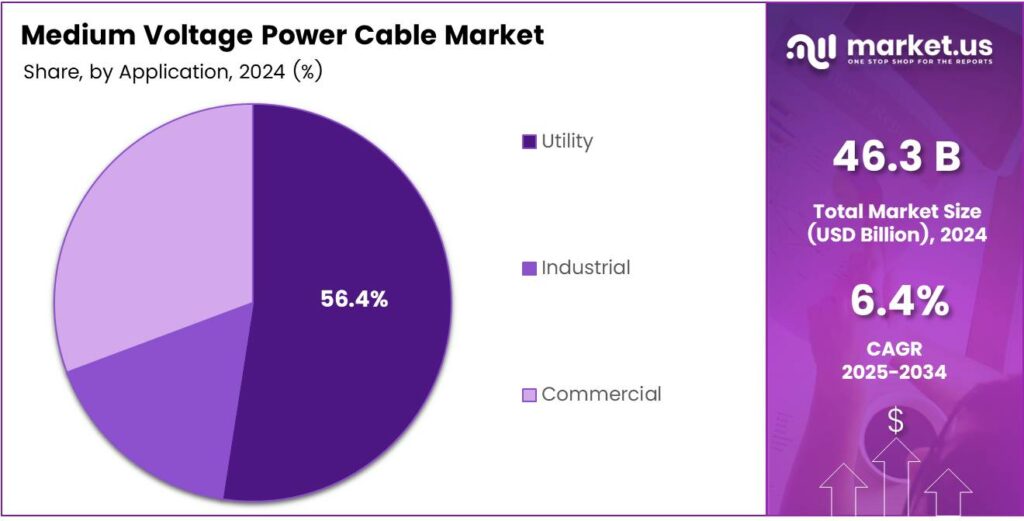

- The Utility sector accounts for the highest application share at 56.4% due to rising national electrification and renewable grid integration.

- Asia Pacific leads regionally with a 49.1% market share, valued at USD 22.7 billion, reflecting strong infrastructure and industrial growth.

By Installation Analysis

Underground dominates with 65.2% due to safety, durability, and suitability for urban expansion.

In 2024, Underground held a dominant market position in the ‘By Installation’ segment of the Medium Voltage Power Cable Market, with a 65.2% share. The demand grew as cities expanded grid networks and focused on resilient, low-maintenance, and visually hidden cable infrastructure for energy security and reliability.

The Overhead installation segment remained relevant due to its cost-efficiency and ease of repair. It serves rural developments and temporary infrastructure where investment costs must be minimized. Despite competition from underground cabling, overhead solutions continue to support transmission, grid modernization, and rapid electrification in emerging economies.

By Voltage Analysis

1kV to 15kV leads with 49.8% driven by rising adoption in distribution networks and infrastructure upgrades.

In 2024, the 1kV to 15kV category held a dominant market position in the ‘By Voltage’ segment of the Medium Voltage Power Cable Market, with a 49.8% share. This range supported growing energy demand in distribution projects, smart grid upgrades, and commercial zone electrification.

The 16kV to 35kV segment advanced as industries and power utilities expanded high-load systems. Its usage aligned with modernization plans and mid-level grid reinforcement, supporting stable power delivery across regional demand clusters in developing regions.

The 36kV to 70kV segment served transmission-level applications where long-distance power transfer and higher performance were critical. It continued gaining traction in renewables integration, substation upgrades, and industrial power corridors.

By Application Analysis

Utility leads with 56.4% due to nationwide electrification projects and smart grid investments.

In 2024, the Utility segment held a dominant market position in the ‘By Application’ category of the Medium Voltage Power Cable Market, with a 56.4% share. Utility providers expanded their networks to support electrification, reduce losses, and integrate renewable capacity. The Industrial segment expanded with manufacturing, mining, and energy-intensive operations requiring reliable power solutions.

It contributed steadily as automation, energy efficiency, and expansion of production hubs gained momentum globally. The Commercial segment remained essential in powering malls, offices, data centers, healthcare, and transportation buildings. Demand increased as infrastructure development accelerated and backup power systems gained importance.

Key Market Segments

By Installation

- Overhead

- Underground

By Voltage

- 1kV to 15kV

- 16kV to 35kV

- 36kV to 70kV

By Application

- Utility

- Industrial

- Commercial

Emerging Trends

Shift Toward Smart Grid and Automation Systems Fuels Market Trends

One key trending factor is the adoption of smart grids and digital power distribution systems. Utilities are gradually using monitoring devices, automated switching, and advanced fault-detection systems that require compatible medium-voltage cable installations.

- The demand for fire-resistant and low-smoke halogen-free cable materials. These cables enhance safety in critical buildings, tunnels, and public infrastructure. Insulated metallic wire and cable consumption reached roughly 1,266 kt (kilotons) in 2023, accounting for about 6% of global consumption, and is projected to grow around 7.8% year-on-year in 2024.

The market is also seeing greater interest in underground installation due to reduced outage risk, improved lifespan, and better climate resilience. As extreme weather events increase, underground cabling is becoming a preferred long-term investment across many regions.

Drivers

Rising Grid Modernization and Infrastructure Projects Drive Market Growth

Growing investment in electricity infrastructure is one of the biggest drivers for the Medium Voltage Power Cable Market. Countries are upgrading aging grid systems to support higher loads, electrification, and renewable integration. Medium-voltage cables are critical for underground distribution, smart grids, and industrial power supply systems.

- Another strong driver is the increasing use of renewable energy such as wind and solar. The Ministry of Power reported that peak power shortage in India stood at only 1.4% and energy shortage at 0.3%, compared to 4.0% and 0.5% respectively in the previous year—indicative of improving supply‐side capacity, but also rising expectations for reliability and distribution quality.

Urbanization and industrial development also contribute to market momentum. New residential zones, data centers, transportation electrification, and manufacturing expansions require secure and efficient power transfer. Manufacturers are responding by developing longer-life, low-loss, and heat-resistant cable materials such as XLPE.

Restraints

High Raw Material Cost Limits Market Expansion

A major restraint for the Medium Voltage Power Cable Market is the high cost of raw materials such as copper, aluminum, insulation polymers, and coatings. Price fluctuations make project planning difficult and increase installation expenses. This affects adoption, especially in cost-sensitive developing economies.

Complex installation and permitting processes add further challenges. Underground cabling requires trenching, regulatory approvals, and skilled labor, which can extend project timelines and raise overall project budgets. These hurdles slow market growth when compared to overhead systems.

Another limitation is technical failure risk due to improper installation or environmental exposure. Moisture entry, corrosion, or overheating can disrupt operations and demand costly maintenance. Limited awareness and high upfront cost discourage smaller businesses from shifting to advanced cable systems.

Growth Factors

Growing Renewable Energy Investments Create New Opportunities

The rising shift toward renewable energy installations opens significant opportunities for medium-voltage power cable manufacturers. Wind farms, solar plants, and energy storage systems require reliable cable networks to transfer power efficiently across sites.

- Governments and utilities are deploying advanced automation and monitoring systems to improve grid resilience. Medium-voltage cables designed for smart monitoring and fault detection are gaining attention. The Indian government’s vision to integrate over 500 GW of renewable energy by 2030 also mandates smarter transmission and distribution architectures, including underground MV cable networks.

There is also a rising adoption of underground cable installations for safety, space optimization, and aesthetics, especially in urban and industrial locations. This trend is creating new opportunities for heat-resistant, longer-life, and eco-friendly cable materials. Companies investing in sustainable product innovations are likely to benefit from long-term growth.

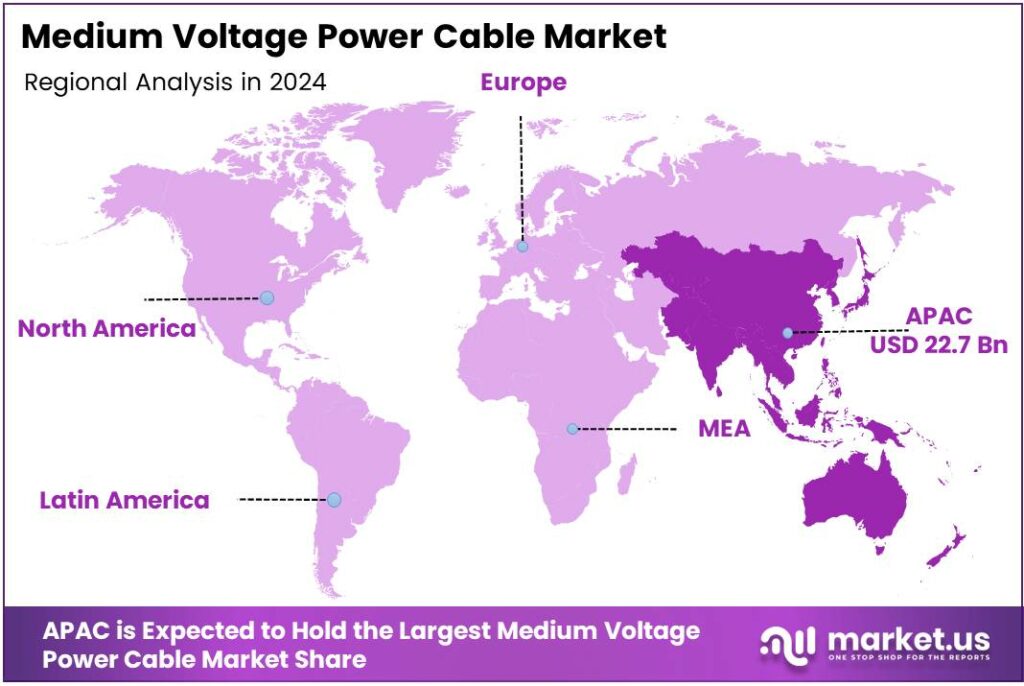

Regional Analysis

Asia Pacific Leads the Medium Voltage Power Cable Market with a Market Share of 49.1%, Valued at USD 22.7 Billion

Asia Pacific remains the largest regional market, driven by rapid urbanization, strong renewable energy adoption, and large-scale grid modernization projects. The region’s share of 49.1% reflects accelerated electrification programs across China, India, Japan, and Southeast Asia. With the market valued at approximately USD 22.7 billion, ongoing investments in industrial expansion, data centers, and HV/MV transmission infrastructure continue to strengthen demand.

North America shows steady expansion supported by aging grid replacement, renewable power integration, and regional electrification targets. The U.S. and Canada are investing in modernizing transmission and distribution lines, especially to support solar, wind, and microgrid developments. Increasing underground installations for resilience against climate events also contributes to consistent market growth.

Europe’s progress is strongly aligned with sustainability goals, offshore wind infrastructure, and smart grid deployments. Countries such as Germany, the U.K., and France are accelerating energy transition programs that require robust medium voltage cabling networks. The shift toward underground cables in urban areas and cross-border interconnection projects remains a major demand driver.

The Middle East and Africa market is growing due to industrial expansion, urban construction, and energy diversification strategies. Investments in utility-scale solar and infrastructure megaprojects, especially in GCC countries and South Africa, strengthen market demand. Expansion of transmission capacity to support population growth and industrial hubs boosts adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Prysmian Group remains the reference point in the global Medium Voltage Power Cable Market, combining strong technology depth with a very broad geographic footprint. The company continues to benefit from grid modernization, offshore wind, and large transmission projects, positioning its MV portfolio as a bridge between distribution utilities and industrial users. Its focus on higher-performance insulation and low-loss designs supports premium pricing and long-term framework contracts.

Nexans is steadily reinforcing its position by pivoting from a pure cable manufacturer to a “cabling systems and services” player. In medium voltage, this translates into turnkey project capabilities, from design to installation and monitoring. The company’s exposure to European decarbonization programs and urban grid reinforcement gives it recurring MV demand, while its growing presence in North America and the Middle East diversifies revenue and mitigates regional risk.

NKT A/S leverages its strong roots in the European power sector to address complex MV applications, especially in utility networks and renewable integration. The company’s strength lies in engineering-intensive projects that require customized cable designs and accessories. By emphasizing sustainability, recyclability, and reduced lifecycle emissions, NKT positions its MV solutions as aligned with utility ESG goals and upcoming regulatory benchmarks.

ABB approaches the Medium Voltage Power Cable Market from a systems and equipment angle, integrating cables with switchgear, transformers, and digital protection. While ABB is not always the primary cable supplier, its role as an EPC and solutions provider makes it highly influential in specifying MV cable technologies. The company’s digital substation and smart grid offerings increasingly pull through demand for advanced MV cables with better monitoring and diagnostic capabilities.

Top Key Players in the Market

- Prysmian Group

- Nexans

- NKT A/S

- ABB

- Brugg Cables

- Riyadh Cables Group Company

- ZTT

- General Cable Technologies Corporation

- FURUKAWA ELECTRIC CO., LTD.

- Jiangnan Group Limited.

Recent Developments

- In 2025, Nexans released the AMCL 12/24 kV cable, featuring thermoplastic insulation (TPI), recycled materials, and local manufacturing to lower emissions. Developed in collaboration with energy sector customers, it meets technical standards while reducing the carbon footprint throughout the value chain

- In 2025, Prysmian will specifically target increased output for MV power cables and overhead transmission lines. This initiative addresses aging infrastructure challenges and rising demand from clean energy sources, with a focus on boosting medium-voltage distribution capabilities.

Report Scope

Report Features Description Market Value (2024) USD 46.3 billion Forecast Revenue (2034) USD 86.1 billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Installation (Overhead, Underground), By Voltage (1kV to 15kV, 16kV to 35kV, 36kV to 70kV), By Application (Utility, Industrial, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Prysmian Group, Nexans, NKT A/S, ABB, Brugg Cables, Riyadh Cables Group Company, ZTT, General Cable Technologies Corporation, FURUKAWA ELECTRIC CO., LTD., Jiangnan Group Limited. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Medium Voltage Power Cable MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Medium Voltage Power Cable MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Prysmian Group

- Nexans

- NKT A/S

- ABB

- Brugg Cables

- Riyadh Cables Group Company

- ZTT

- General Cable Technologies Corporation

- FURUKAWA ELECTRIC CO., LTD.

- Jiangnan Group Limited.