Global Mannitol Market Size, Share Analysis Report By Form (Powder, Crystal), By End-Use (Food, Beverages, Pharmaceuticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155630

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

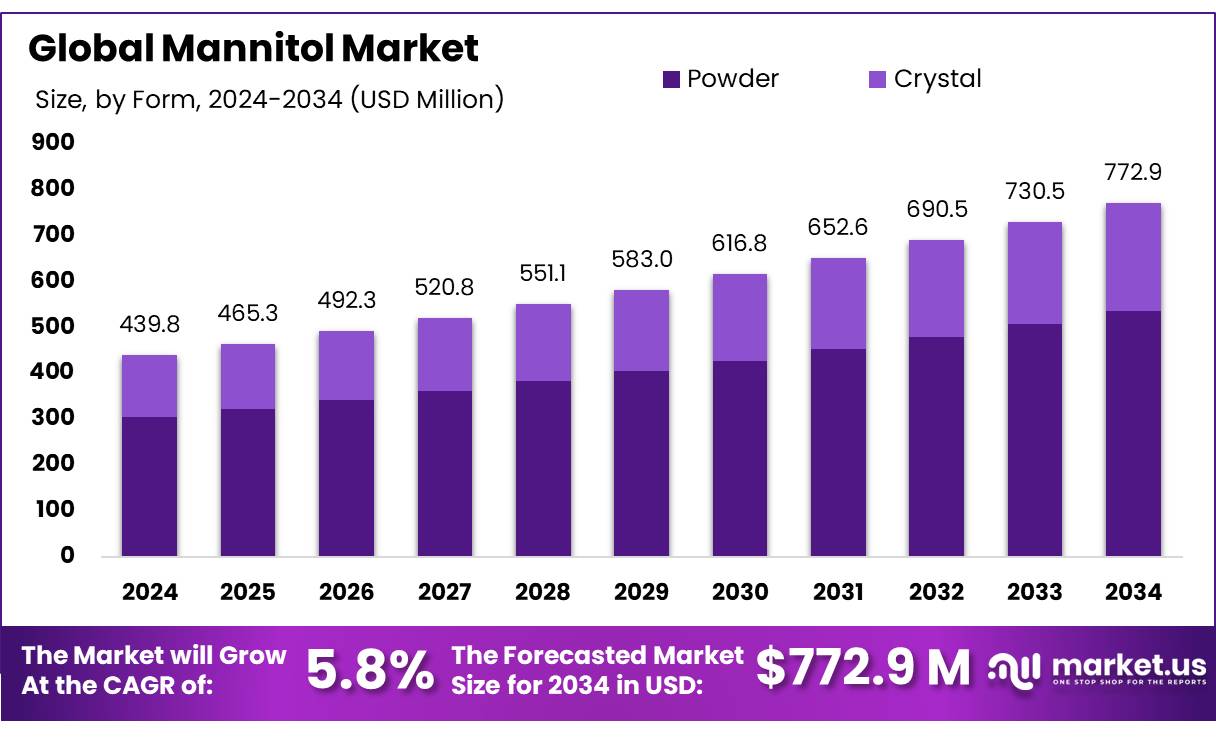

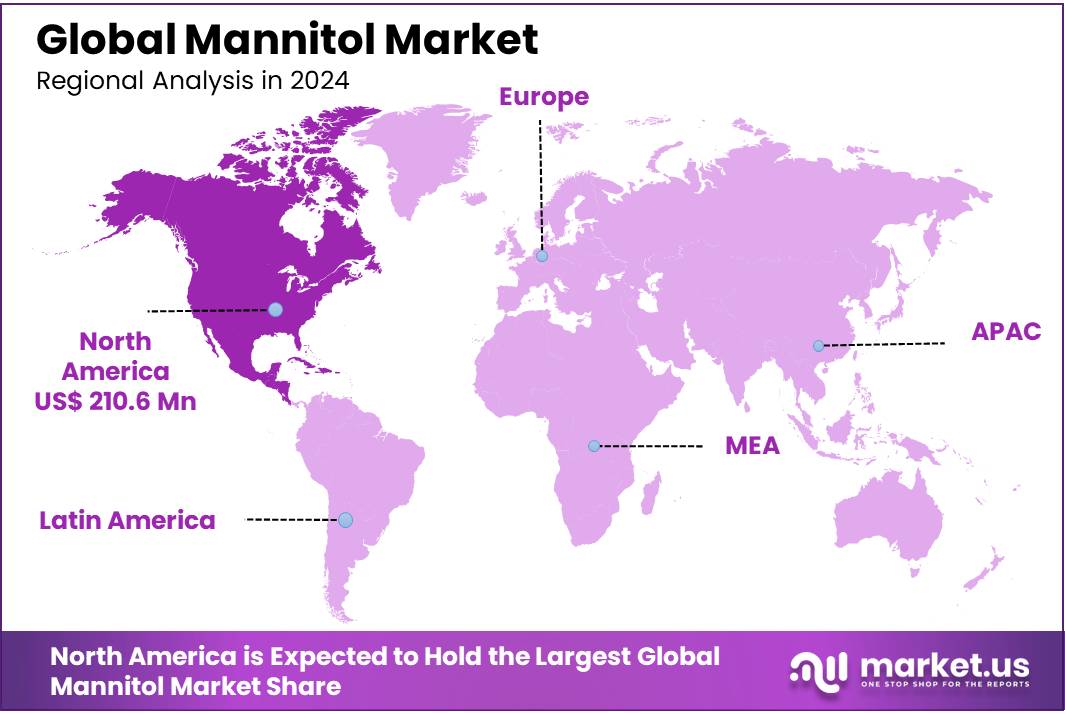

The Global Mannitol Market size is expected to be worth around USD 772.9 Million by 2034, from USD 439.8 Million in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.90% share, holding USD 210.6 Million revenue.

Mannitol, a six‑carbon sugar alcohol widely used both as a bulk sweetener in low‑glycemic and diabetic‑friendly foods and as a pharmaceutical excipient or osmotic diuretic, is traditionally produced via the catalytic hydrogenation of high‑purity fructose derived from starch or sucrose; yield is typically around 50% mannitol versus 50% sorbitol, under alkaline conditions enhancing mannitol selectivity.

In industrial biosynthesis, catalytic hydrogenation achieves production volumes such as ~13.6 million kg/year at approximately $7.30/kg. Although historically smaller in scale, global mannitol demand has been steadily rising: estimates put the global mannitol market value at USD 474.11 million in 2025, with projections to reach USD 615.25 million by 2030—representing a compound annual growth rate (CAGR) of around 5.35%

Technologically, industrial mannitol production primarily relies on chemical hydrogenation of fructose/glucose mixtures—a process that yields about 50,000 tons per year globally, but with a low chemical‑route yield of approximately 17% w/w, producing a mixture of mannitol and sorbitol. Biotechnological and enzymatic routes offer more selective, sustainable alternatives, yet they remain less favored at industrial scale due to issues such as enzyme stability, cofactor requirements, and process integration complexity.

While direct government data on mannitol is limited, broader biotechnology and pharma ecosystem initiatives support its industrial growth. In India, the Department of Biotechnology (DBT) administers the Bio‑RIDE scheme (Bioeconomy‑R&D‑Innovation‑Development) aimed at scaling biotechnology and biomanufacturing to grow India’s bio‑economy to USD 300 billion by 2030. The DBT also supports biotech infrastructure via biotechnology parks and the Biomanufacturing and Bio‑foundry initiative, fostering industry research and scale‑up capabilities.

The Cabinet approved the BioE3 policy in August 2024 to foster high‑performance biomanufacturing under the Department of Biotechnology. These initiatives bolster local R&D, production, and innovation in biochemicals, potentially including fermentation‑ or enzyme‑based mannitol production. Meanwhile, India’s pharmaceutical sector, valued at USD 50 billion in FY 2023‑24 and projected to reach USD 130 billion by 2030, establishes a robust domestic demand base for pharmaceutical‑grade excipient.

Biotechnological and fermentation‑based methods offer greener, potentially cost‑effective pathways to mannitol, with microbial processes achieving yields like ~180 g/L of crystallizable mannitol in fermentation broths. Advancements such as these align with sustainability mandates and can lower production costs. There’s further scope in expanding low‑endotoxin mannitol for injectable and biopharma formulations, where higher growth rates (~8.2 %) are already evident.

Key Takeaways

- The Mannitol market is projected to reach USD 772.9 million by 2034, rising from USD 439.8 million in 2024, with a steady CAGR of 5.8%.

- In terms of form, Powder led the market in 2024, securing over 69.4% share globally.

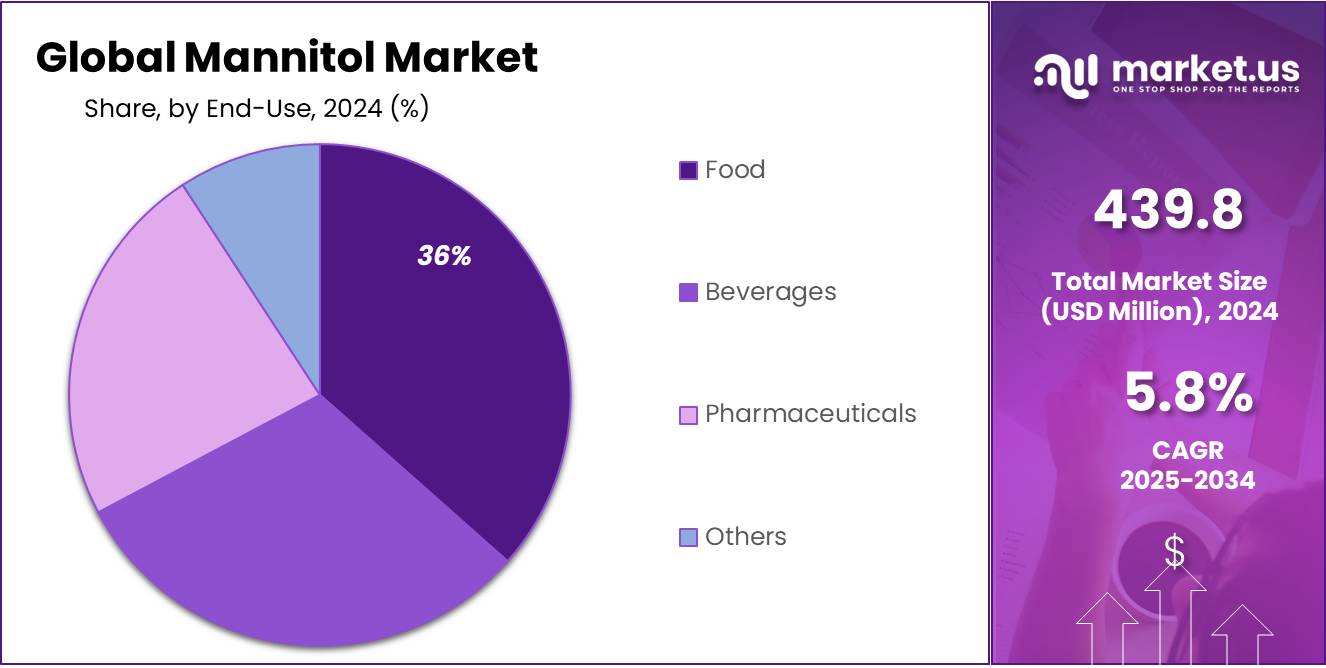

- By end-use, the Food segment dominated in 2024, accounting for more than 35.7% share of the total market.

- Regionally, North America emerged as the leader, contributing 47.90% of global revenue—valued at approximately USD 210.6 million in 2024.

By Form Analysis

Powder Form Leads with 69.4% Market Share in 2024

In 2024, Powder held a dominant market position, capturing more than a 69.4% share of the global mannitol market. The strong presence of powder form comes from its wide usage in pharmaceuticals, food, and nutraceuticals, where it is valued for stability, ease of blending, and cost-effectiveness. Pharmaceutical manufacturers continue to prefer powder mannitol for tablet formulations, chewable tablets, and oral dosage due to its excellent compressibility and non-hygroscopic nature.

In 2024, this segment strengthened its leadership, supported by increasing demand from excipient suppliers and food processors reformulating products with reduced sugar and calorie claims. Looking into 2025, powder form is expected to maintain its lead as expanding applications in low-calorie foods and bulk sweeteners further add to its demand, keeping it ahead of other forms of mannitol.

By End-Use Analysis

Food Segment Dominates with 35.7% Share in 2024

In 2024, Food held a dominant market position, capturing more than a 35.7% share of the global mannitol market. This leadership comes from its growing role as a low-calorie sweetener and texturizing agent in confectionery, bakery, and dairy applications. Food producers increasingly adopt mannitol powder to reduce sugar content while maintaining taste and texture, especially in sugar-free candies and chewing gums where its cooling effect is highly valued.

During 2024, the food industry saw rising demand for healthier formulations, which directly supported higher utilization of mannitol. Moving into 2025, the segment is expected to sustain its strong position, as consumer preference for sugar-reduced foods and government-backed nutrition programs continue to encourage the use of functional sweeteners like mannitol in mainstream packaged food categories.

Key Market Segments

By Form

- Powder

- Crystal

By End-Use

- Food

- Bakery Goods

- Sweet Spreads

- Confectionery

- Dairy Products

- Canned Food

- Others

- Beverages

- Carbonated Drinks

- Fruit Drinks & Juice

- Powdered Drinks and Mixes

- Pharmaceuticals

- Solid Dosage Forms

- Lyophilized Preparations

- Medicated Confectionery

- Others

Emerging Trends

Rising Demand for Plant-Based and Clean-Label Sweeteners Boosts Mannitol Use

A clear trend shaping the mannitol market today is the shift toward plant-based, clean-label ingredients in the global food industry. Consumers are paying more attention to what goes into their meals, snacks, and beverages. They are not only looking for low-calorie alternatives but also for products that are natural, transparent, and safe. Mannitol, produced from natural sources such as seaweed and starch through fermentation, fits neatly into this demand. Its recognition as a safe additive by regulatory authorities allows manufacturers to present it as a healthier and more natural choice compared to artificial sweeteners.

Health concerns are also pushing this trend further. The World Health Organization (WHO) recommends limiting free sugar intake to less than 10% of total daily calories, ideally under 5% for additional health benefits. Such guidelines encourage both consumers and governments to push industries toward natural sugar substitutes. Mannitol, with only 1.6 calories per gram compared to sugar’s 4 calories, is increasingly highlighted in reformulated “clean-label” products where calorie reduction and natural sourcing are key selling points.

- According to the International Diabetes Federation (IDF), around 463 million adults were living with diabetes globally in 2019, and this is expected to rise to 700 million by 2045. For this growing consumer base, clean-label foods using natural sugar substitutes like mannitol are more than lifestyle choices—they are health necessities. Companies are reformulating snacks, baked goods, and beverages with polyols such as mannitol to target these health-conscious and medically sensitive populations.

Government-backed nutrition strategies also support this shift. In the European Union, additives like E421 are subject to strict safety evaluation by the European Food Safety Authority (EFSA), ensuring consumers trust products labeled with it. In the United States, the FDA lists mannitol under its Generally Recognized as Safe (GRAS) status, giving manufacturers confidence to highlight it in clean-label foods. Such transparent approvals help strengthen consumer confidence in mannitol-based products.

Drivers

Growing Use of Mannitol as a Sugar Substitute in the Food Industry

One of the strongest driving factors for mannitol demand today is its increasing use as a low-calorie sugar substitute in the global food and beverage industry. With consumers paying more attention to health and lifestyle, mannitol is becoming a preferred option because it offers sweetness with fewer calories compared to traditional sugar. It contains only about 1.6 calories per gram, which is nearly half of the 4 calories per gram in regular sugar. This makes it attractive for food companies developing products for diabetics and calorie-conscious consumers.

The World Health Organization (WHO) has repeatedly highlighted the global rise in diabetes, estimating that around 422 million people worldwide live with diabetes and the number continues to grow each year. At the same time, the International Diabetes Federation (IDF) projects that by 2045, over 783 million people will be living with diabetes. For this group, sugar reduction in daily diets is not just a preference but a medical necessity. Mannitol provides a solution since it does not cause sharp spikes in blood sugar, making it suitable for diabetic-friendly foods like sugar-free chocolates, chewing gums, and baked goods.

Governments are also playing a role in pushing the market forward. For example, the U.S. Food and Drug Administration (FDA) recognizes mannitol as a safe sugar substitute, and it is also approved as a food additive in the European Union (E421). Public health bodies such as the U.S. Centers for Disease Control and Prevention (CDC) encourage reduced sugar intake to help combat rising obesity and diabetes cases. This policy direction aligns with food manufacturers’ increasing use of sugar alternatives like mannitol in processed foods and beverages.

- According to the Food and Agriculture Organization (FAO), global sugar consumption reached about 175 million metric tons in 2023. However, demand for reduced-sugar and sugar-free categories is expanding faster than overall sweetener markets, as consumers actively seek healthier options. This consumer shift means that sugar alcohols such as mannitol are not just niche products but central to reformulation strategies for major brands.

Beyond diabetes, obesity prevention is another area where mannitol plays a role. The World Obesity Federation predicts that 1 billion people globally will be living with obesity by 2030. Since obesity is tied to high sugar intake, mannitol offers food producers an alternative that helps reduce calorie load while maintaining taste. This growing alignment between public health priorities and consumer preferences makes mannitol an increasingly valuable ingredient in the global food system.

Restraints

Gastrointestinal Side Effects and Limited Daily Intake Restrict Mannitol Growth

One major restraining factor for mannitol’s use in food and pharmaceuticals is its gastrointestinal side effects when consumed in excess. Mannitol belongs to the sugar alcohol family, and while it provides fewer calories and is useful for diabetics, the human body does not absorb it completely in the small intestine. As a result, unabsorbed mannitol passes into the large intestine, where it ferments and may cause symptoms such as bloating, gas, abdominal discomfort, and diarrhea. These side effects limit the amount that food and beverage makers can safely include in products, restricting its wider adoption.

- The U.S. Food and Drug Administration (FDA) has set a daily tolerance guideline of around 20 grams per day for mannitol in adults, noting that consumption above this level is more likely to cause a laxative effect. Similarly, the European Food Safety Authority (EFSA) also recognizes the same limitation, with products containing mannitol above 10% concentration requiring a label warning about potential laxative effects. This regulatory requirement makes manufacturers cautious, as labeling a product with a laxative warning can discourage consumers from buying it.

The World Health Organization (WHO) emphasizes that sugar substitutes should be consumed responsibly, highlighting that excessive intake of sugar alcohols often leads to digestive intolerance in sensitive groups. This presents a challenge in markets where sugar-free and low-calorie foods are increasingly popular, as the very consumers seeking healthier options may experience discomfort if mannitol is present in high amounts.

This limitation is particularly important in the confectionery sector, where products like sugar-free chewing gums, chocolates, and candies often rely on polyols such as mannitol. For example, the FAO (Food and Agriculture Organization) notes that global sugar-free confectionery sales are steadily growing, but producers often blend multiple sweeteners instead of relying solely on mannitol, precisely because of its side effect risks. By mixing mannitol with other polyols like sorbitol or xylitol, companies reduce the concentration per serving, lowering the chance of digestive discomfort but also limiting mannitol’s market share.

Government guidelines also indirectly restrain growth. For instance, the U.S. Centers for Disease Control and Prevention (CDC) recommends reducing added sugars but does not strongly promote sugar alcohols like mannitol, citing digestive risks as a concern for public health if consumed in large quantities. Instead, nutrition advice often emphasizes natural sources like fruits or moderate use of low-calorie sweeteners, leaving mannitol in a somewhat restricted space compared to other substitutes such as stevia.

Opportunity

Sugar-Tax–Driven Reformulation Creates a Large Opportunity for Mannitol

Food and drink makers everywhere are cutting sugar. Not because it’s trendy, but because policy and public health are pushing them to do it. That shift opens a very practical lane for mannitol: it sweetens with fewer calories, adds bulk and a clean bite to chocolate and gum, and helps brands keep taste while meeting stricter sugar targets. The scale is huge—global sugar use in 2024/25 is forecast at 177.8 million tonnes. Even small reformulation shares translate to meaningful mannitol demand.

Demand is also pulled by health needs. The International Diabetes Federation estimates 589 million adults lived with diabetes in 2024, rising to 853 million by 2050. Retailers and manufacturers are expanding low-glycaemic, sugar-reduced ranges; mannitol’s slow absorption and low impact on blood glucose make it a natural fit for diabetic-friendly snacks, bakery mixes, and confectionery where texture matters as much as sweetness.

Government action is speeding up reformulation. The WHO’s global report on sugar-sweetened beverage (SSB) taxes (2023) documents the rapid spread of such taxes across countries, designed to cut sugar intake and push industry to reformulate. When taxes or front-of-pack labels tighten, brands look for polyols that protect mouthfeel—precisely where mannitol is strong.

The UK is a clear case study. The Soft Drinks Industry Levy has driven deep recipe changes: a 46% average reduction in sugar for levy-in-scope soft drinks between 2015 and 2020. That kind of policy-led drop forces consistent reformulation work across portfolios—and those capabilities spill over into dairy desserts, bakery, and confectionery where mannitol can replace part of sucrose without collapsing structure.

Regulators also give mannitol a clear pathway. In the United States, 21 CFR §180.25 lists mannitol as a permitted additive, laying out manufacturing routes and recognized uses. In the European Union, sweeteners (including E421 mannitol) are permitted additives and must be declared by name or E-number on labels—transparent rules that help big food companies scale supply chains with confidence.

Regional Insights

In 2024, North America held a dominant position in the Mannitol Market, capturing 47.90% of global revenue—about USD 210.6 million—driven by a large healthcare base and strong demand for low-calorie, tooth-friendly sweeteners and reliable pharmaceutical excipients.

Regulatory clarity lowers barriers for formulators: mannitol is expressly permitted in U.S. food uses under 21 CFR 180.25, supporting roles such as non-nutritive sweetener, anti-caking agent, and formulation aid—an important foundation for rapid scale-up across snacks, bakery, confectionery, and specialty nutrition.

The FDA authorizes a dental-caries health claim for sugar alcohols (21 CFR 101.80), enabling “does not promote tooth decay” positioning that benefits sugar-free gum, mints, and oral-care-adjacent formats where mannitol is widely used.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Roquette Frères is a leading French-based supplier of plant-based ingredients and pharmaceutical excipients, with mannitol marketed under its PEARLITOL® brand. In 2024, the company operated more than 30 industrial sites globally, generating revenues of around €4.5 billion. Roquette serves food, nutraceutical, and pharmaceutical markets, offering mannitol in both powder and granular forms for use in sugar-free confectionery, chewable tablets, and infusions. Its strong R&D investment in sustainable carbohydrate solutions positions it as a top innovator in the mannitol segment.

Cargill, headquartered in the U.S., is a global agribusiness giant with a strong presence in starches, sweeteners, and polyols, including mannitol. The company operates in over 70 countries with annual revenues surpassing USD 170 billion in 2024. Cargill supplies mannitol as a specialty sweetener for reduced-calorie foods, pharmaceuticals, and personal care. Its large distribution networks and long-standing expertise in food ingredients provide competitive advantages, while sustainability initiatives and clean-label solutions strengthen its standing in the global mannitol market.

Ingredion, based in Illinois, U.S., specializes in starches, texturizers, and sweeteners, including sugar alcohols like mannitol. The company reported net sales of USD 8.0 billion in 2024, reflecting its strong global reach across 120 countries. Ingredion positions mannitol as a key functional sweetener for sugar-free and reduced-calorie formulations, particularly in beverages, confectionery, and nutrition products. With an emphasis on clean-label ingredients, innovation in specialty polyols, and strong customer collaborations, Ingredion is building competitive strength in the mannitol and specialty carbohydrate market.

Top Key Players Outlook

- Roquette Frères

- Cargill, Incorporated

- Ingredion

- SPI Pharma

- Singsino Group Ltd.

- Shijiazhuang Huaxu Pharmaceutical Co.,Ltd

- Merck KGaA

- Rongde Seaweed Co., Ltd.

- Qingdao Mingyue Seaweed Group Co.

- Moga International Ltd.

Recent Industry Developments

In 2024, Roquette Frères offered an impressive mix of plant‑based ingredients, and mannitol was a standout among its pharmaceutical excipients. The company is present in over 100 countries, running more than 30 production sites and employing nearly 10,000 people globally.

In 2024, Ingredion reported net sales of approximately USD 7.4 billion, driven by its rich mix of plant-based ingredients across food, beverage, and pharmaceutical markets.

Report Scope

Report Features Description Market Value (2024) USD 439.8 Mn Forecast Revenue (2034) USD 772.9 Mn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Crystal), By End-Use (Food, Beverages, Pharmaceuticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Roquette Frères, Cargill, Incorporated, Ingredion, SPI Pharma, Singsino Group Ltd., Shijiazhuang Huaxu Pharmaceutical Co.,Ltd, Merck KGaA, Rongde Seaweed Co., Ltd., Qingdao Mingyue Seaweed Group Co., Moga International Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Roquette Frères

- Cargill, Incorporated

- Ingredion

- SPI Pharma

- Singsino Group Ltd.

- Shijiazhuang Huaxu Pharmaceutical Co.,Ltd

- Merck KGaA

- Rongde Seaweed Co., Ltd.

- Qingdao Mingyue Seaweed Group Co.

- Moga International Ltd.