Global Magnesium Oxide Market Size, Share and Future Trends Analysis Report By Product Type (CCM (80% to 85%), DBM (90% to 94%), Fused MgO (95% to 99%)), By Grade (High Purity, Standard), By Application (Refractories, Agrochemical, Construction, Chemical, Rubber Processing, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149769

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

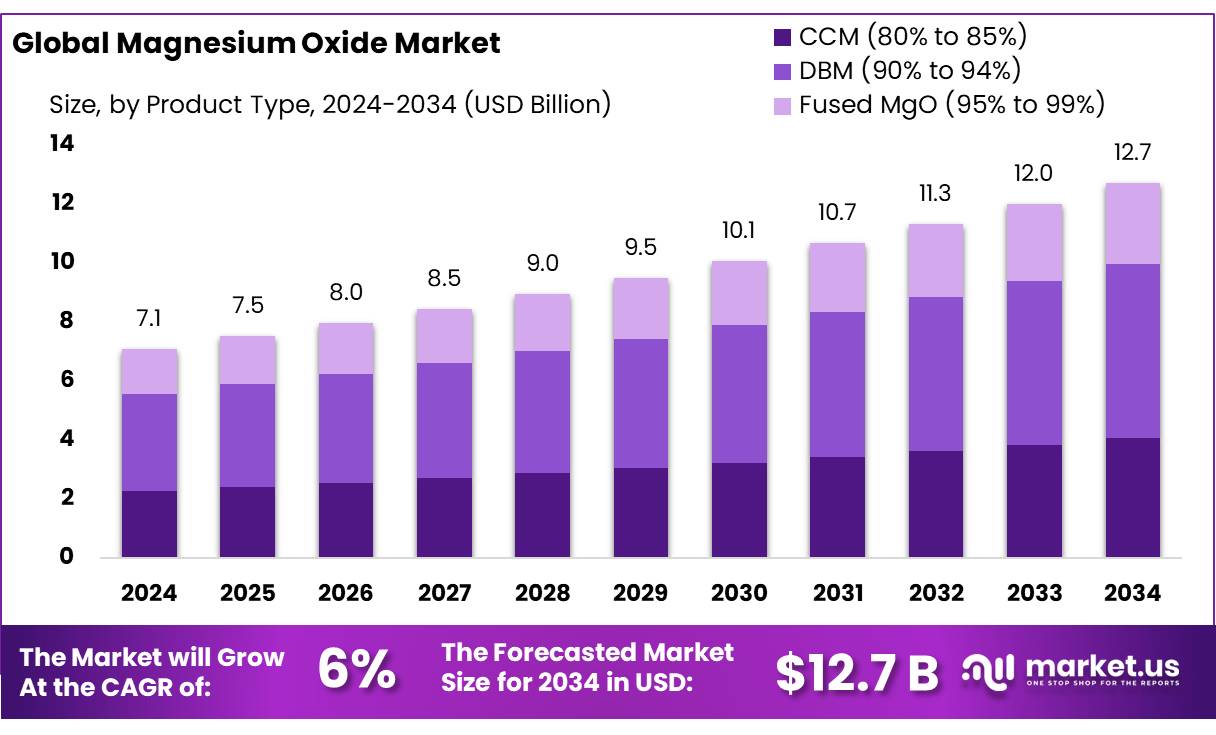

The Global Magnesium Oxide Market size is expected to be worth around USD 12.7 Billion by 2034, from USD 7.1 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Magnesium oxide (MgO) concentrates are integral to various industrial applications, including agriculture, construction, and environmental management. Derived primarily through the calcination of magnesium carbonate minerals like magnesite (MgCO3) and dolomite (CaMg(CO3)2), MgO is produced at temperatures ranging from 600°C to over 2000°C, depending on the desired reactivity. The high melting point of MgO, approximately 2852°C, and its insolubility in water make it suitable for high-temperature and moisture-resistant applications.

In the agricultural sector, magnesium oxide is recognized for its role in enhancing soil quality and providing essential nutrients to crops. The United States Department of Agriculture (USDA) has approved MgO for use in organic crop production, specifically as a synthetic substance allowed for controlling the viscosity of clay suspension agents for humates, as stipulated in 7 CFR 205.601(j). This approval underscores its significance in sustainable farming practices.

Environmental considerations are increasingly influencing the MgO industry. Traditional production methods, especially those involving the calcination of magnesite in regions like China’s Liaoning province, have been associated with significant carbon emissions. Estimates indicate that the carbon footprint from MgO production in this area exceeded 16.6 million metric tons of CO2-equivalent in 2014. In response, there is a growing emphasis on sustainable practices, such as sourcing magnesium from seawater and brines, which accounted for approximately 67% of U.S. magnesium compound production in 2022.

Government initiatives are also shaping the future of the MgO market. In India, for instance, the Ministry of Chemicals and Fertilizers has been promoting the use of magnesium-based fertilizers to enhance soil health and crop productivity. Such policies are expected to bolster domestic MgO production and reduce reliance on imports.

Key Takeaways

- Magnesium Oxide Market size is expected to be worth around USD 12.7 Billion by 2034, from USD 7.1 Billion in 2024, growing at a CAGR of 6.0%.

- DBM (90% to 94%) held a dominant market position, capturing more than a 46.3% share in the global magnesium oxide market.

- Standard grade magnesium oxide held a dominant market position, capturing more than a 67.9% share in the global market.

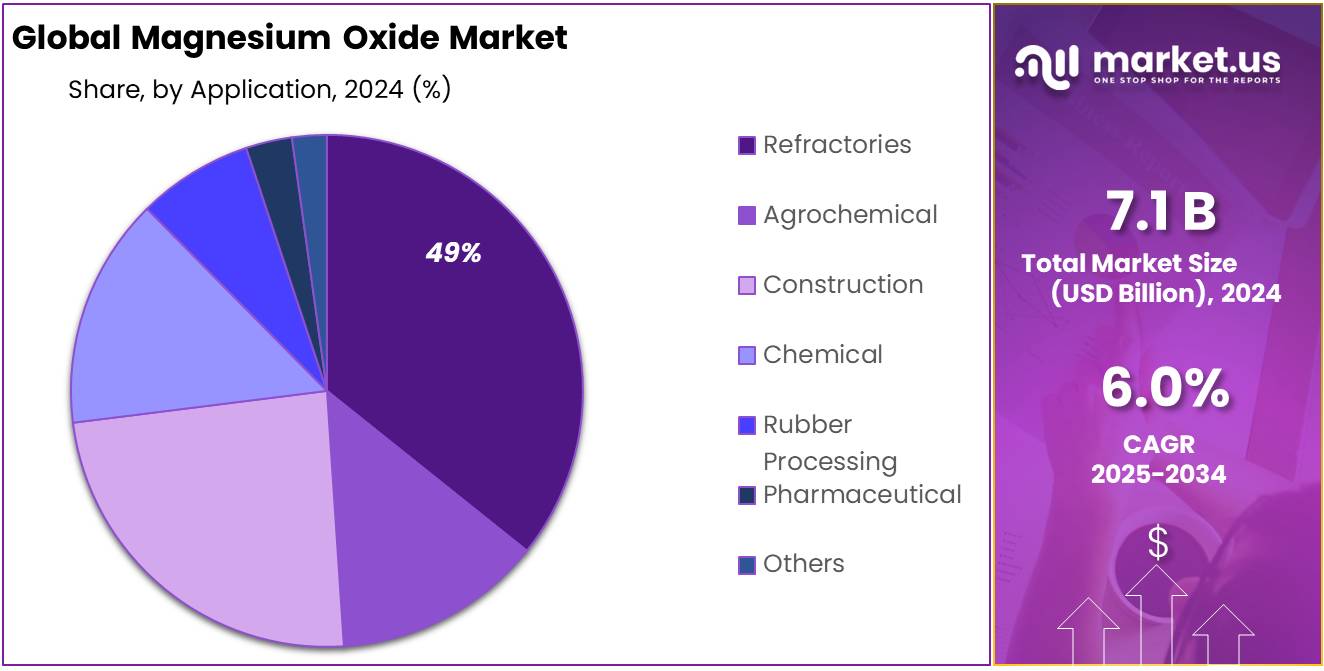

- Refractories held a dominant market position, capturing more than a 49.6% share in the global magnesium oxide market.

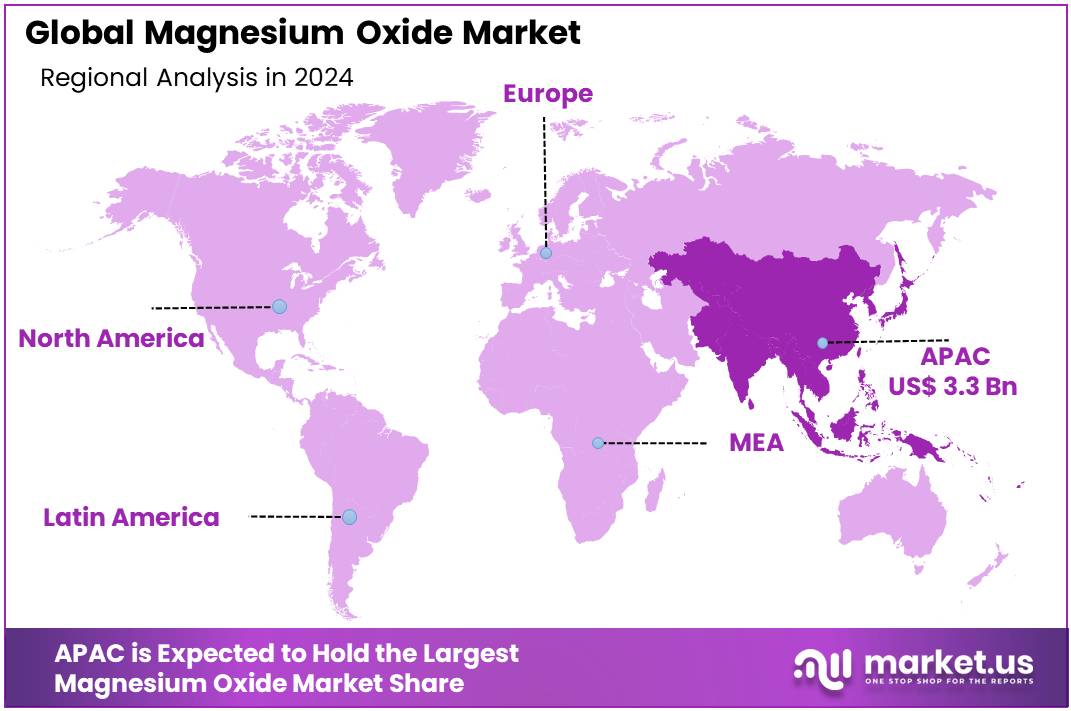

- Asia Pacific (APAC) region emerged as the dominant force in the global magnesium oxide (MgO) market, capturing a substantial 47.4% share, equivalent to a market value of USD 3.3 billion.

Analysts Viewpoint

From an investment standpoint, magnesium oxide (MgO) presents a compelling opportunity, driven by its diverse applications and growing demand across various industries. This growth is fueled by its extensive use in refractory materials, agriculture, environmental applications, and construction.

However, investors should be mindful of certain risks. The production of MgO is energy-intensive and subject to environmental regulations, which can impact operational costs and profitability. Additionally, fluctuations in raw material prices and competition from alternative materials pose challenges to market stability.

Despite these risks, the increasing focus on sustainable practices and the development of eco-friendly production methods offer avenues for innovation and growth. Moreover, the rising demand for MgO in environmental applications, such as water treatment and pollution control, underscores its long-term investment potential.

By Product Type

DBM (90% to 94%) leads with 46.3% share owing to its widespread use in refractory and metallurgical applications

In 2024, DBM (90% to 94%) held a dominant market position, capturing more than a 46.3% share in the global magnesium oxide market. This product type remains highly preferred across the refractory, steel, and cement industries due to its ability to withstand extremely high temperatures and harsh chemical environments. Its dense crystalline structure and high thermal stability make it ideal for lining kilns, furnaces, and other heat-intensive processes, especially in developing economies undergoing rapid industrialization.

By Grade

Standard Grade dominates with 67.9% share thanks to its broad industrial usage and cost efficiency

In 2024, Standard grade magnesium oxide held a dominant market position, capturing more than a 67.9% share in the global market. This segment has remained the most widely used due to its versatility, affordability, and adequate performance across a broad spectrum of industries. From agricultural formulations and animal feed additives to wastewater treatment and environmental applications, standard grade MgO is chosen for its balance between cost and functionality.

By Application

Refractories lead with 49.6% share as high-temperature industries continue to expand

In 2024, Refractories held a dominant market position, capturing more than a 49.6% share in the global magnesium oxide market. This strong lead is due to the essential role magnesium oxide plays in high-heat applications such as steel, glass, cement, and non-ferrous metal production. Its high melting point, thermal stability, and resistance to chemical corrosion make it a preferred raw material for manufacturing refractory bricks, furnace linings, and insulating products.

Key Market Segments

By Product Type

- CCM (80% to 85%)

- DBM (90% to 94%)

- Fused MgO (95% to 99%)

By Grade

- High Purity

- Standard

By Application

- Refractories

- Agrochemical

- Construction

- Chemical

- Rubber Processing

- Pharmaceutical

- Others

Drivers

Rising Demand for Magnesium Oxide in Nutritional Supplements and Functional Foods

In 2024, a significant driving factor for the magnesium oxide market is its increasing application in the food and health sectors, particularly in nutritional supplements and functional foods. Magnesium oxide is valued for its high bioavailability and health benefits, such as aiding digestion, supporting bone health, and maintaining muscle function.

This growth is driven by the rising health-conscious population and the increasing demand for clean and safe ingredients in the global market. Magnesium oxide’s role in food fortification, dietary supplements, and as an antacid and laxative contributes to its growing demand.

Government initiatives and regulatory frameworks also play a role in this growth. For instance, the U.S. Food and Drug Administration (FDA) recognizes magnesium oxide as a safe and effective ingredient for use in over-the-counter antacid products. Additionally, the European Food Safety Authority (EFSA) has approved the use of magnesium oxide in food supplements, acknowledging its benefits in maintaining normal muscle function and bone health.

Restraints

Environmental and Regulatory Challenges Hamper Magnesium Oxide Market Growth

A significant restraining factor for the magnesium oxide (MgO) market is the environmental impact associated with its production, particularly through the Pidgeon process. This method, widely used in countries like China, is energy-intensive and contributes substantially to greenhouse gas emissions. For instance, producing 1 kg of magnesium via the Pidgeon process emits approximately 37 kg of CO2, compared to less than 2 kg for producing 1 kg of steel. Such high emission levels have led to increased scrutiny from environmental agencies and have prompted stricter regulations on MgO production.

These environmental concerns are compounded by the volatility in raw material prices, particularly magnesite, the primary source for MgO. Fluctuations in magnesite availability and cost can disrupt the supply chain, leading to increased production costs and reduced profit margins for manufacturers . Additionally, the food-grade MgO market faces regulatory challenges due to its use in food and supplements. Meeting stringent quality and safety standards can be a barrier for manufacturers, especially in regions with rigorous regulations .

Furthermore, the availability of alternative materials such as graphite and silicon carbide poses a threat to the MgO market. These substitutes offer similar properties at potentially lower costs, making them attractive options for industries seeking cost-effective solutions . As a result, the MgO market must navigate environmental concerns, regulatory hurdles, and competition from alternative materials, which collectively restrain its growth potential.

Opportunity

Expanding Role of Magnesium Oxide in Nutritional Supplements and Functional Foods

In 2024, a significant growth opportunity for the magnesium oxide (MgO) market lies in its increasing application within the food and health sectors, particularly in nutritional supplements and functional foods. Magnesium oxide is valued for its high bioavailability and health benefits, such as aiding digestion, supporting bone health, and maintaining muscle function.

The growing awareness of magnesium’s health benefits has led to its widespread use as a nutritional supplement, anticaking agent, and stabilizer in various food products. High concentrations are observed in processed foods, dietary supplements, and fortified foods, accounting for approximately 70% of the market value . This trend is further supported by the increasing prevalence of magnesium deficiency, which has become a common concern, especially in developed countries.

Government initiatives and regulatory frameworks also play a role in this growth. For instance, the U.S. Food and Drug Administration (FDA) recognizes magnesium oxide as a safe and effective ingredient for use in over-the-counter antacid products. Additionally, the European Food Safety Authority (EFSA) has approved the use of magnesium oxide in food supplements, acknowledging its benefits in maintaining normal muscle function and bone health.

Trends

Advancements in High-Purity Magnesium Oxide for Specialized Applications

In 2024, the magnesium oxide (MgO) market is witnessing a notable shift towards high-purity variants, driven by their expanding applications in specialized sectors such as pharmaceuticals, electronics, and food industries.

Furthermore, the food industry is also contributing to this trend, with high-purity MgO being employed as a food additive and dietary supplement due to its recognized safety and health benefits. The U.S. Food and Drug Administration (FDA) acknowledges magnesium oxide as a safe ingredient for use in over-the-counter antacid products, and the European Food Safety Authority (EFSA) has approved its use in food supplements, highlighting its importance in maintaining normal muscle function and bone health.

This trend towards high-purity magnesium oxide underscores the market’s response to the evolving demands of industries that prioritize quality and performance. As technological advancements continue and regulatory standards become more stringent, the preference for high-purity MgO is expected to strengthen, offering significant growth opportunities for manufacturers and stakeholders in the magnesium oxide market.

Regional Analysis

Asia Pacific Leads Magnesium Oxide Market with 47.4% Share, Valued at $3.3 Billion in 2024

In 2024, the Asia Pacific (APAC) region emerged as the dominant force in the global magnesium oxide (MgO) market, capturing a substantial 47.4% share, equivalent to a market value of USD 3.3 billion. This leadership is primarily attributed to the region’s robust industrial base, particularly in countries like China, India, and Japan, which are major producers and consumers of MgO.

China, being the world’s largest producer of magnesite—the primary raw material for MgO—plays a pivotal role in the market. The country’s extensive steel and cement industries are significant consumers of dead-burned magnesia, a high-purity form of MgO used in refractory applications. India and Japan also contribute to the region’s dominance through their growing demand in agriculture, construction, and environmental sectors.

The APAC region’s growth is further fueled by increasing investments in infrastructure and urban development projects, leading to heightened demand for MgO in construction materials and environmental applications. Additionally, the region’s focus on sustainable practices has led to the adoption of MgO in water treatment and flue gas desulfurization processes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Grecian Magnesite S.A. is a key producer of caustic calcined and dead burned magnesia, with production facilities in Greece and sales extending across Europe, the Americas, and Asia. In 2024, the company expanded its annual production capacity to over 150,000 metric tons, supporting industries such as refractories, fertilizers, and construction. The company’s strategic investments in sustainable mining and advanced calcination technologies have enabled it to maintain a strong export presence, particularly in Germany, Italy, and India.

Israel Chemicals Ltd. is a prominent player in the magnesium oxide market through its specialty minerals division. The company operates production units in Israel and Spain and reported magnesium oxide output exceeding 100,000 tons in 2024. ICL leverages its Dead Sea mineral resources for premium-grade MgO products used in agriculture, flame retardants, and water treatment. The firm continues to innovate through R&D partnerships and green processing methods to improve product quality and reduce environmental impact.

Headquartered in Japan, Konoshima Chemical specializes in high-purity magnesium oxide tailored for electronics, semiconductors, and ceramics. In 2024, its MgO production exceeded 50,000 metric tons, with a focus on ultra-fine grades and functional materials. The company emphasizes clean manufacturing and precision calcination, ensuring consistent quality for high-tech industries. It has also expanded export operations into Southeast Asia and Europe, backed by strong R&D capabilities and patents in advanced material formulations.

Top Key Players in the Market

- Grecian Magnesite S.A

- Israel Chemicals Ltd.

- Konoshima

- Konoshima Chemical Co., Ltd.

- Kumas-Kuthaya Magnesite Works Co. Ltd.

- Kyowa Chemical Industry Co., Ltd.

- Magnezit Group

- Martin Marietta Materials Inc.

- Nanoshel

- Nedmag

- Premier Magnesia LLC

- RHI Magnesita

- Tateho Chemical Industries Co., Ltd.

- Ube Industries Ltd.

- Xinyang Minerals Group

Recent Developments

In 2024, Grecian Magnesite S.A. reinforced its leadership in the global magnesium oxide (MgO) market, achieving an annual revenue of approximately $486.1 million.

In 2024, Konoshima Chemical Co., Ltd., a Japan-based company, solidified its presence in the global magnesium oxide (MgO) market. The company reported a revenue of approximately ¥27.5 billion (around $190 million USD), reflecting a 9% growth compared to the previous year.

Report Scope

Report Features Description Market Value (2024) USD 7.1 Bn Forecast Revenue (2034) USD 12.7 Bn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (CCM (80% to 85%), DBM (90% to 94%), Fused MgO (95% to 99%)), By Grade (High Purity, Standard), By Application (Refractories, Agrochemical, Construction, Chemical, Rubber Processing, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Grecian Magnesite S.A, Israel Chemicals Ltd., Konoshima, Konoshima Chemical Co., Ltd., Kumas-Kuthaya Magnesite Works Co. Ltd., Kyowa Chemical Industry Co., Ltd., Magnezit Group, Martin Marietta Materials Inc., Nanoshel, Nedmag, Premier Magnesia LLC, RHI Magnesita, Tateho Chemical Industries Co., Ltd., Ube Industries Ltd., Xinyang Minerals Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grecian Magnesite S.A

- Israel Chemicals Ltd.

- Konoshima

- Konoshima Chemical Co., Ltd.

- Kumas-Kuthaya Magnesite Works Co. Ltd.

- Kyowa Chemical Industry Co., Ltd.

- Magnezit Group

- Martin Marietta Materials Inc.

- Nanoshel

- Nedmag

- Premier Magnesia LLC

- RHI Magnesita

- Tateho Chemical Industries Co., Ltd.

- Ube Industries Ltd.

- Xinyang Minerals Group