Global Lysine Market Size, Share Analysis Report By Type (L-Lysine Hydrochloride (HCl), L-Lysine Monohydrate, L-Lysine Sulfate and Others), By Form (Powder, Liquid and Granules), By Application (Animal Feed, Food and Dietary Supplements, Pharmaceuticals and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 155142

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

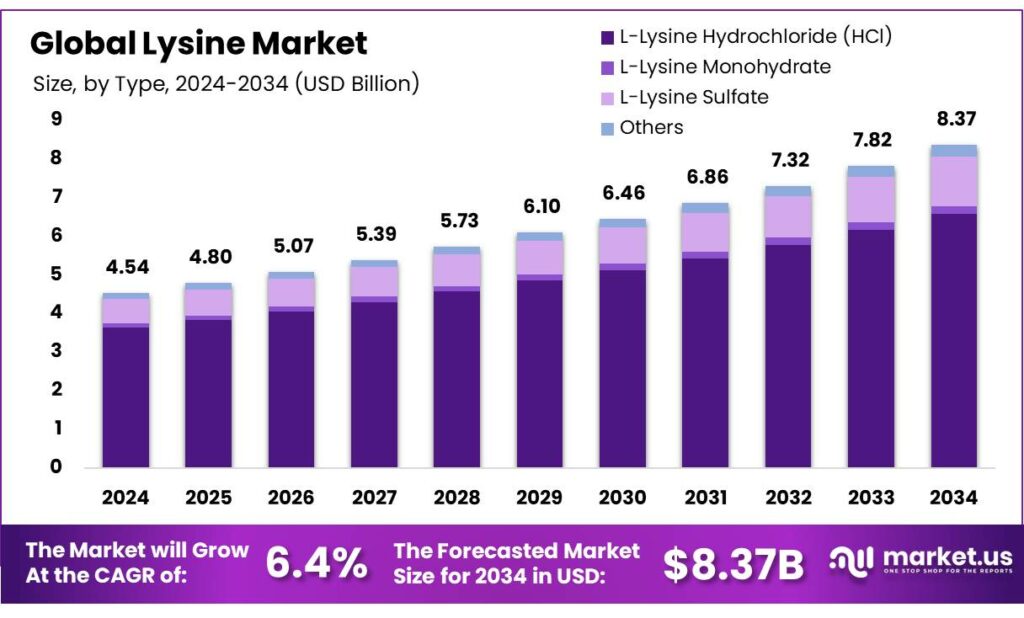

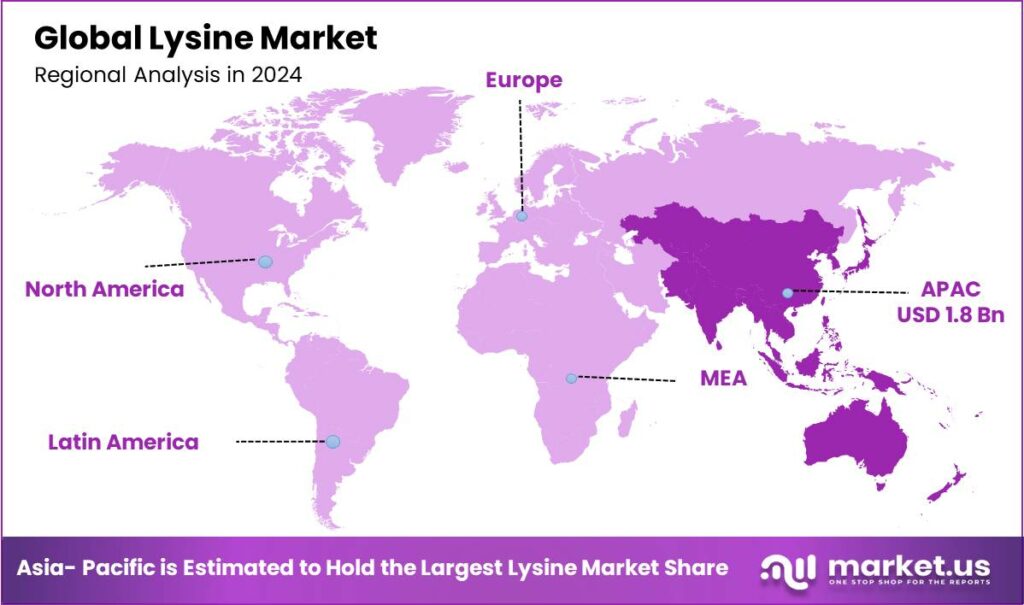

The Global Lysine Market size is expected to be worth around USD 8.37 Billion by 2034, from USD 4.54 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 40.0% share, holding USD 1.8 Billion in revenue.

The global lysine market is a critical segment of the amino acids industry, underpinned by its indispensable role in both animal nutrition and human health. Lysine, an essential amino acid, is widely used in animal feed formulations—particularly for poultry, swine, and aquaculture—where it enhances feed efficiency, promotes growth, and reduces nitrogen emissions, thereby aligning with global sustainability goals. Rising animal-protein consumption, especially in emerging economies across Asia-Pacific, Latin America, and Africa, is the primary growth driver, as demand for poultry and pork surges alongside income growth and urbanization.

Beyond feed, lysine’s applications span pharmaceuticals, nutraceuticals, and personal care, supporting functions such as collagen formation, immune regulation, and treatment of conditions such as herpes simplex virus, osteoporosis, and hypertension. Industrial applications also extend into hydrogels, nanoparticles, and biodegradable polymers.

- Highly Pathogenic Avian Influenza (HPAI) outbreaks have caused widespread mortality among wild and domestic birds, such as the 2021–2022 HPAI H5N1 strain which caused over 53 million bird deaths in the U.S. affected over 683 flocks in 47 states. This results in drastically reduced poultry production and feed inputs including lysine.

- During the African Swine Fever outbreak in China, a reduction of 9–34% in global swine production was estimated.

- Outbreak simulations in the U.S. project an ASF event could cause a 40–50% domestic hog price drop and an industry loss of $50 billion.

From a production standpoint, lysine is primarily manufactured via microbial fermentation, with Asia—especially China—dominating global supply. Despite its robust outlook, the market faces restraints such as livestock disease outbreaks, which reduce meat demand and consequently suppress lysine consumption, as seen with avian influenza and African swine fever.

Nevertheless, innovation in fermentation technologies, sustainable feed practices, and rising demand for nutrient-dense diets create strong opportunities. Overall, lysine remains a cornerstone of global food security, health, and industrial innovation, positioning the market for sustained long-term growth.

Key Takeaways

- The global lysine market was valued at USD 4.54 Billion in 2024.

- The global lysine market is projected to grow at a CAGR of 6.4% and is estimated to reach USD 8.37 Billion by 2034.

- Between types, L-Lysine Hydrochloride (HCl) accounted for the largest market share of 80.0%.

- Among forms, powder dominated the market with the largest share of 67.5%.

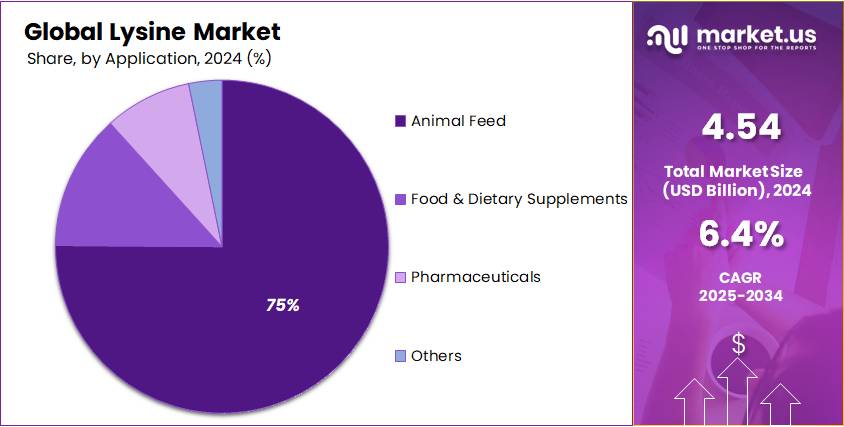

- Among applications, animal feed accounted for the majority of the market share at 75.1%.

- Asia-Pacific is estimated as the largest market for Lysine with a share of 40.0% of the market share.

- North America was estimated second largest growing market with a CAGR of 6.5%

Type Analysis

L-Lysine Hydrochloride (HCl) Domiantes The Global Market

Based on type, the market is further divided into L-Lysine Hydrochloride (HCl), L-Lysine Monohydrate, L-Lysine Sulfate, & Others. As of 2024, the L-Lysine Hydrochloride (HCl) dominated the Lysine market with an 80.0% share due to its superior stability, high bioavailability, and wide applicability in animal nutrition, particularly in poultry and swine feed. Lysine HCl contains a high concentration of lysine (approximately 78–80%), making it the most efficient and cost-effective form for balancing amino acid requirements in feed formulations. Its crystalline structure ensures longer shelf life and ease of transport, which is critical in large-scale global supply chains.

Additionally, its solubility and compatibility with other feed ingredients enhance absorption rates, directly improving animal growth performance and feed conversion ratios. The preference for Lysine HCl is also reinforced by established manufacturing infrastructure, cost efficiencies in large-scale production, and strong demand in rapidly growing livestock sectors across Asia-Pacific, North America, and Europe. These combined functional and economic advantages solidify Lysine HCl’s dominant position within the lysine market landscape.

Global Lysine Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 L-Lysine Hydrochloride (HCl) 2,998.3 3,132.5 3,281.0 3,440.8 3,628.1 L-Lysine Monohydrate 93.0 97.0 101.5 106.3 112.0 L-Lysine Sulfate 524.1 548.3 575.6 605.4 640.6 Others 126.5 132.6 139.2 146.4 155.0 Form Analysis

The market is further categorized as form into powder, liquid & granules. Powder is emerging as the dominant category due to its extensive adoption across multiple industries. In 2024, powder accounted for approximately 67.5% of the overall market share, reflecting its superior handling characteristics, ease of transportation, longer shelf life, and compatibility with blending in animal feed formulations. The powdered form of lysine is widely preferred in livestock nutrition, particularly in poultry, swine, and aquaculture, as it ensures uniform distribution in feed mixes and enhances protein synthesis for improved animal growth and health.

Its cost-effectiveness and stability compared to liquid variants also contribute to its higher penetration rate, especially in developing regions where storage and transportation infrastructure can pose challenges. While liquid and granule forms are gaining traction in niche applications, powder lysine remains the cornerstone of the market, underpinning its leadership position and continued growth trajectory globally.

Global Lysine Market, By Form, 2020-2024 (USD Mn)

Form 2020 2021 2022 2023 2024 Powder 2,531.7 2,645.1 2,770.2 2,904.7 3,061.8 Liquid 917.6 959.3 1,006.5 1,057.6 1,118.4 Granules 292.7 306.0 320.6 336.5 355.5 Application Analysis

Lysine’s Major Role In Improving Livestock Nutrition, Hence Animal Feed Dominates the Market

Based on the application, the market is further divided into animal feed, food & dietary supplements, pharmaceuticals & others. Among them, animal feed accounted for a 75.1% share, which is attributed to lysine’s critical role as an essential amino acid supplement in livestock nutrition, particularly for swine, poultry, and aquaculture. Lysine enhances protein synthesis, promotes faster growth, improves feed efficiency, and supports overall animal health, making it indispensable in large-scale commercial farming operations.

Rising global demand for meat and animal protein products, coupled with an increasing emphasis on cost-effective, nutrient-rich feed formulations, has further consolidated lysine’s position in this segment. The food & dietary supplements segment represents a smaller but steadily growing share, driven by heightened awareness of amino acid supplementation in human health, sports nutrition, and functional food products.

Meanwhile, the pharmaceuticals segment leverages lysine for therapeutic formulations, such as treatments for herpes simplex virus infections, calcium absorption improvement, and bone health support. The other category includes industrial and niche applications where lysine serves as a precursor in biochemical processes.

- Brazil leads Latin America’s lysine demand, contributing most to feed production growth, with a 1.51 MMT b increase in 2023. The country’s beef sector is expected to rebound in 2024 as cattle prices recover, further boosting feed demand.

Global Lysine Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Animal Feed 2,825.4 2,949.3 3,086.5 3,234.0 3,407.0 Food & Dietary Supplements 484.9 508.3 534.9 563.7 597.8 Pharmaceuticals 313.1 328.2 345.0 363.2 384.8 Others 118.6 124.5 131.0 138.0 146.1 Key Market Segments

By Type

- L-Lysine Hydrochloride (HCl)

- L-Lysine Monohydrate

- L-Lysine Sulfate

- Others

By Form

- Powder

- Liquid

- Granules

By Application

- Animal Feed

- Food & Dietary Supplements

- Pharmaceuticals

- Others

Drivers

Increasing Animal-Protein Consumption Is Driving The Market Growth.

Increasing animal-protein consumption is a key driver of growth in the global lysine market, as lysine is an essential amino acid used to optimize animal diets, especially in compound feeds for poultry, swine, and aquaculture. According to FAO, country income and protein availability data, rising incomes in countries such as China, Vietnam, South Korea, and Indonesia over the past two decades have been closely associated with higher proportions of animal protein in diets.

In the United States, food supply statistics show that per capita availability of chicken, pork, and other meats has steadily increased. USDA data indicate that chicken availability per person has more than doubled since 1980. As compound feed production has scaled up globally, driven by larger livestock operations and performance-oriented farming practices, formulators increasingly depend on feed additives such as lysine to meet the nutritional demands of high growth, reproduction, and feed efficiency.

Additionally, the shift from beef and pork to poultry in high-income countries further strengthens this trend, as poultry production systems rely heavily on precision nutrition and amino acid balancing to achieve cost efficiency, environmental sustainability, and higher performance. Beyond poultry, the expected increases in sheep, beef, and pig meat consumption across emerging economies further expand lysine’s role, as these sectors also depend on lysine-enriched feeds to improve growth rates, reproduction, and feed efficiency.

- 45% of global consumption growth will occur in upper-middle-income countries.

- Major countries driving growth (beyond China & India): Brazil, Indonesia, the Philippines, the United States, Viet Nam.

- Africa’s population: rising from 1.5 billion to 1.8 billion over the next decade, driving a 33% increase in meat consumption.

- Annual per capita consumption is expected to increase by 0.9 kg per capita/year (rwe) by 2034.

- In high-income countries (35% of global meat consumption but only 17% of the population), per capita meat consumption will stagnate or decline.

- Global meat consumption is projected to grow by 47.9 million tonnes over the next decade.

- Improved slaughter weights will account for 8% of bovine, 27% of pig meat, and 19% of poultry meat production gains.

Hence, rising animal-protein consumption pushes farmers toward higher-performing, cost-effective feed formulas—and lysine is essential to meeting these nutritional, cost, and environmental demands, making it an essential in animal feed ingredients. Furthermore, increasing demand for protein-rich diets, especially meat consumption, is a key driver of lysine market growth. Lysine is essential for animal feed to support optimal growth and high-quality meat production.

Restraints

Disease Outbreaks Can Reduce Meat Demand, Thereby Lowering Lysine Consumption

Disease outbreaks, particularly those linked to foodborne pathogens or animal-related viruses such as avian influenza, can significantly reduce consumer confidence in meat and dairy products, thereby dampening demand and indirectly restraining the global lysine market. Lysine is primarily used as a feed additive in animal agriculture, especially in poultry, swine, and cattle production, to enhance growth rates, improve feed efficiency, and maintain animal health.

However, when outbreaks such as avian influenza or other zoonotic diseases occur, governments often enforce strict biosecurity measures, including culling of animals, trade restrictions, and heightened surveillance, which immediately reduce livestock populations and consequently lower feed consumption. At the same time, public perception plays a crucial role in shaping demand. For instance, avian influenza outbreaks in Asia have historically led to sharp declines in poultry sales as consumers avoided chicken despite reassurances of safety through cooking.

- The highly pathogenic avian influenza (HPAI or bird flu) outbreaks in the United States in 2021-2022 affected more than 683 commercial and backyard flocks in 47 states, resulting in the death of 53.12 million birds. These outbreaks led to significant declines in poultry sales as consumer demand dropped amid fears, despite safety reassurances.

- African swine fever (ASF) outbreaks in China decreased hog stock by about 30%, equating to roughly 128 million hogs lost, causing major reductions in pork supply and altering market dynamics.

Similarly, concerns over raw milk safety discourage dairy consumption when contamination risks are highlighted. Reduced demand for meat and dairy translates to slower growth in livestock farming activities, lower feed production, and subsequently reduced demand for lysine, since producers adjust feed formulations downward to avoid oversupply. This creates a chain reaction across the lysine market, where weakened end-consumer demand translates into stagnation in feed additive purchases.

Opportunity

Global Demand For Nutrient-Rich Animal Feed Is Creating New Opportunities Within the Market

Rising global demand for nutrient-rich animal feed is emerging as one of the most significant factors driving the growth of the global lysine market. Lysine, an essential amino acid that cannot be synthesized naturally by monogastric animals such as poultry, pigs, and fish, plays a crucial role in protein synthesis, growth, and overall animal health. The rapid expansion of the livestock, poultry, and aquaculture sectors, coupled with the need to produce high-quality, safe, and efficient animal protein, has created an urgent demand for feed formulations that maximize nutritional output while minimizing waste.

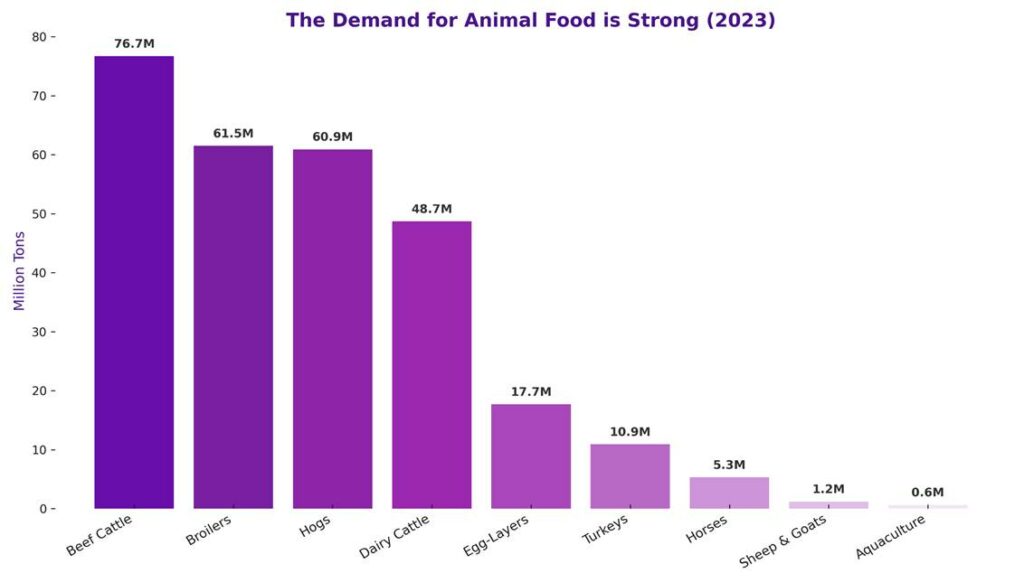

According to the Institute for Feed Education and Research (IFEEDER), U.S. domestic livestock, poultry, and aquaculture consumed approximately 284 million tons of feed in 2023, underscoring the immense scale of modern feed requirements. Major feed consumers included beef cattle at 76.7 million tons, broiler chickens at 61.5 million tons, and hogs at 60.9 million tons. With corn and soy-based products accounting for 84% of feed composition, lysine supplementation becomes essential to balance amino acid profiles, particularly as corn protein is deficient in lysine.

The growing reliance on circular feed ingredients, such as byproducts from food processing and ethanol industries, also amplifies the need for lysine fortification, as these co-products often lack sufficient amino acid density. Globally, rising meat consumption—projected to increase by 47.9 million tons by 2034, with poultry alone accounting for 62% of additional demand—further reinforces lysine’s critical role in optimizing feed efficiency to support the scaling of animal protein production.

Source: American Feed Industry Association

Trends

The Fermentation Innovation Shaping the Future of the Global Lysine Market

Fermentation innovation is emerging as one of the most transformative trends shaping the future of the global lysine market, redefining how this essential amino acid is produced and positioned across industries. Traditionally, lysine production relied heavily on microbial fermentation using strains such as Corynebacterium glutamicum, which have been optimized over decades to generate high yields. However, recent advances in synthetic biology, metabolic engineering, and bioprocess optimization are pushing fermentation efficiency to unprecedented levels, reducing production costs while improving sustainability.

Cutting-edge techniques such as CRISPR-Cas9 gene editing are now being used to fine-tune microbial strains for enhanced lysine output, better resistance to stress conditions, and more efficient use of feedstocks. Moreover, the shift toward using renewable and alternative raw materials—such as agricultural residues, food industry byproducts, or lignocellulosic biomass—offers a sustainable alternative to traditional carbohydrate-heavy feedstocks like corn or wheat, which are increasingly subject to price volatility and competition from food and biofuel industries.

Geopolitical Impact Analysis

China Export Effect on the EU Market & US Tariff Impact On The Lysine Market.

U.S. Tariffs on Lysine: In the United States, rising concerns over unfair competition from Chinese lysine exports have led to a stronger trade protection stance. American authorities, responding to industry petitions, have imposed tariffs and initiated investigations into subsidized Chinese lysine imports. The University of Wisconsin estimates that if domestic amino acid production were to collapse due to Chinese undercutting, the U.S. could lose nearly 30,000 jobs and $15 billion in GDP annually.

As a countermeasure, the U.S. has levied additional tariffs on lysine and other amino acids imported from China in early 2025, a move designed to protect domestic producers and safeguard strategic agricultural supply chains. While these measures aim to revive domestic manufacturing, they also raise costs for livestock farmers, feed manufacturers, and ultimately consumers, as lysine is an irreplaceable input in animal feed formulations. U.S. tariffs thus highlight the tension between protecting local industries and ensuring affordable feed costs in a highly competitive global agricultural sector.

China Export Effect on the EU Market: China, as the leading global supplier of lysine, has faced escalating accusations of dumping—selling lysine at artificially low prices, supported by government subsidies, to capture global market share. These practices have triggered a wave of anti-dumping duties across key export markets. In July 2025, the European Commission formalized duties ranging from 43.7% to 58.2% on Chinese lysine imports, citing significant harm to European producers. Brazil has taken similar action, further limiting Chinese access to major international buyers.

The impact has been twofold: first, Chinese lysine exporters have been forced to absorb losses domestically, with oversupply driving average local prices down by 23%–27%; second, importing regions have faced higher costs, reflecting a trade-off between protecting domestic industries and raising input prices for downstream livestock sectors. The anti-dumping rulings reveal the degree to which Chinese lysine pricing dictates global market trends, with Chinese FOB prices leading European price movements by as much as one quarter.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Lysine Market

In 2024, the Asia Pacific led the Global Lysine Market with a 40.0% share primarily due to its expanding livestock sector, rising protein demand, and dominant production capacity. The region’s rapid dietary transition, especially in China, India, and Southeast Asia, has fueled demand for poultry, pork, and aquaculture products, where lysine serves as a key feed additive to enhance growth performance and feed efficiency. China, as the world’s largest feed producer, significantly contributes to lysine consumption while also driving global supply through its large-scale fermentation and biotechnology industries.

Additionally, growing urbanization and rising health awareness in the Asia-Pacific have expanded lysine’s applications beyond animal feed into pharmaceuticals, nutraceuticals, and functional foods, further strengthening demand. Local investments in manufacturing have reduced import dependency and allowed the region to shape global pricing trends. Together, these factors underscore Asia-Pacific’s central role in balancing protein supply, nutritional quality, and sustainable food production.

Global Lysine Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 686.4 718.3 753.7 791.8 836.4 Europe 1,151.8 1,192.8 1,238.7 1,287.9 1,346.6 Asia Pacific 1,454.4 1,530.8 1,615.5 1,707.1 1,813.8 Middle East & Africa 198.7 206.8 215.9 225.6 237.1 Latin America 250.7 261.6 273.6 286.5 301.8 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Innovation, Sustainability, and Expansion Are The Key Strategies Of Major Players Of the Lysine Market.

Major players in the global lysine market are pursuing a mix of capacity expansion, technological innovation, and strategic partnerships to strengthen and expand their market share. Leading producers are investing heavily in advanced fermentation technologies and biotechnology platforms to improve yield efficiency, reduce production costs, and minimize environmental impact, thereby ensuring competitiveness in a resource-intensive industry.

Geographic expansion is another key strategy, with companies establishing or scaling up production facilities in high-demand regions such as Asia-Pacific to secure proximity to livestock hubs and reduce logistics costs.

The major players in the industry

- Ajinomoto Co., Inc

- Evonik Industries AG

- CJ CheilJedang Corporation

- Meihua Holdings Group Co., Ltd.

- Global Bio-Chem Technology Group

- Archer Daniels Midland Co

- Juneng Golden Corn Co., Ltd.

- Alpspure Lifesciences Pvt Ltd

- Ningxia Eppen Biotech Co., Ltd. (Eppen)

- Daesang Corporation

- Fengchen Group Co.,Ltd

- PANGOO BIOTECH HEBEI CO., LTD.

- Fufeng Group Limited

- Xi’an Healthful Biotechnology Co.,Ltd

- Zhucheng Dongxiao Biotechnology Co.,Ltd

- Other Key Players

Key Development

In September 2024: Ajinomoto and Danone have formed a strategic partnership aimed at reducing greenhouse gas (GHG) emissions in the dairy supply chain. The collaboration utilizes Ajinomoto’s innovative AjiPro-L lysine formulation, which improves feed efficiency and reduces environmental impact. AjiPro-L helps cut CO₂ emissions from soybean meal by 20% and nitrous oxide emissions from manure by 25%. This initiative aligns with Danone’s “Partner for Growth” program, which seeks to enhance sustainability and farmer profitability in milk production. The solution is currently being implemented in several countries, including Spain, Brazil, and the U.S.

In July 2023: Evonik announced a price increase of 8-10% per kilogram for Biolys (L-lysine 62.4%, feed grade), effective immediately. Despite the price hike, all existing contracts and supply agreements will be honored. This price adjustment reflects the company’s ongoing efforts to maintain the quality and efficiency of its products in a dynamic market. Biolys remains a crucial product for the animal feed industry, providing essential amino acids to livestock such as swine and poultry.

In July 2025: Kyowa Hakko Bio Co., Ltd. completed the transfer of its Amino Acids and Human Milk Oligosaccharides business to a special purpose company under Meihua Holdings Group Co., Ltd., a leading Chinese bio-industry firm. This move, initially announced on November 22, 2024, marks a strategic shift in Kyowa Hakko Bio’s operational focus. The transaction is expected to influence the company’s performance and aligns with broader restructuring efforts under Kirin Holdings.

Report Scope

Report Features Description Market Value (2024) USD 4.54 Bn Forecast Revenue (2034) USD 8.37 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (L-Lysine Hydrochloride (HCl), L-Lysine Monohydrate, L-Lysine Sulfate & Others), By Form (Powder, Liquid & Granules), By Application (Animal Feed, Food & Dietary Supplements, Pharmaceuticals & Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Ajinomoto Co., Inc., Evonik Industries AG, CJ CheilJedang Corporation, Meihua Holdings Group Co., Ltd., Global Bio-Chem Technology Group, Archer Daniels Midland Co. Juneng Golden Corn Co., Ltd., Alpspure Lifesciences Pvt Ltd., Ningxia Eppen Biotech Co., Ltd. (Eppen), Daesang Corporation, Fengchen Group Co.,Ltd., PANGOO BIOTECH HEBEI CO., LTD., Fufeng Group Limited, Xi’an Healthful Biotechnology Co. Ltd., Zhucheng Dongxiao Biotechnology Co.,Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Ajinomoto Co., Inc

- Evonik Industries AG

- CJ CheilJedang Corporation

- Meihua Holdings Group Co., Ltd.

- Global Bio-Chem Technology Group

- Archer Daniels Midland Co

- Juneng Golden Corn Co., Ltd.

- Alpspure Lifesciences Pvt Ltd

- Ningxia Eppen Biotech Co., Ltd. (Eppen)

- Daesang Corporation

- Fengchen Group Co.,Ltd

- PANGOO BIOTECH HEBEI CO., LTD.

- Fufeng Group Limited

- Xi'an Healthful Biotechnology Co.,Ltd

- Zhucheng Dongxiao Biotechnology Co.,Ltd

- Other Key Players