Global Lucerne Market Size, Share, And Enhanced Productivity By Type (Hay, Silage, Chaff), By End Use (Dairy Industry, Household, Equine, Feed Industry), By Distribution Channel (Supermarkets & Hypermarkets, Store Based Retail, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170826

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

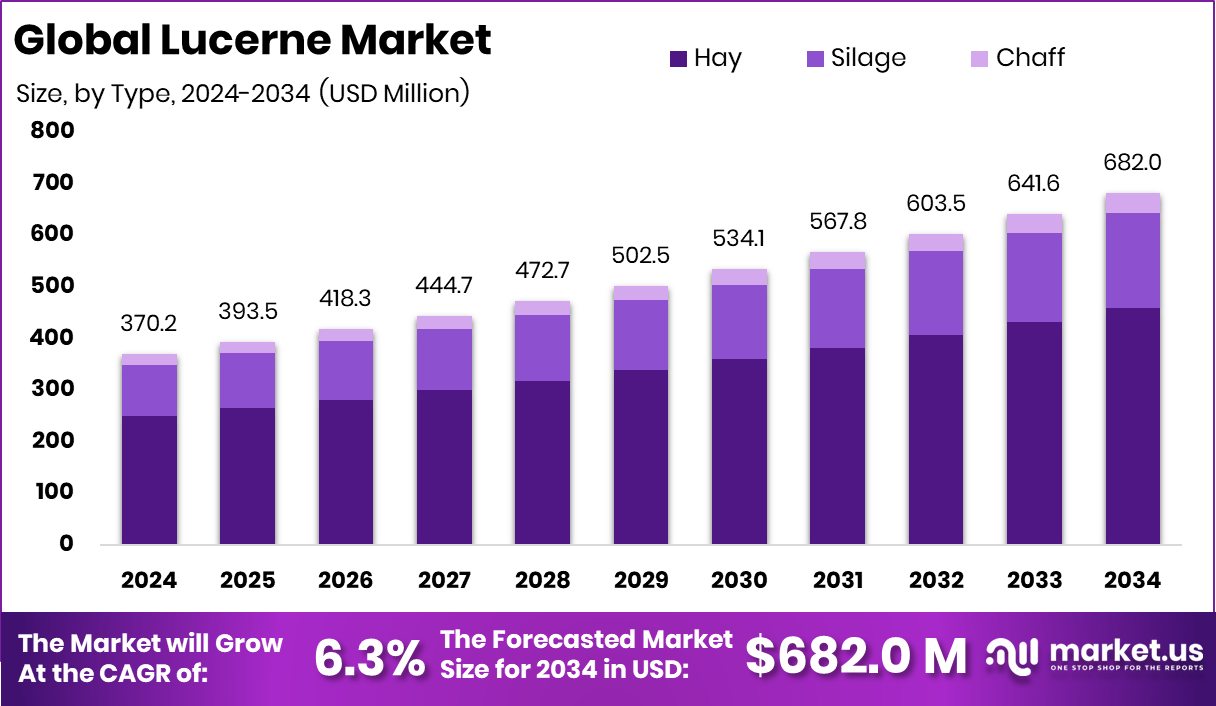

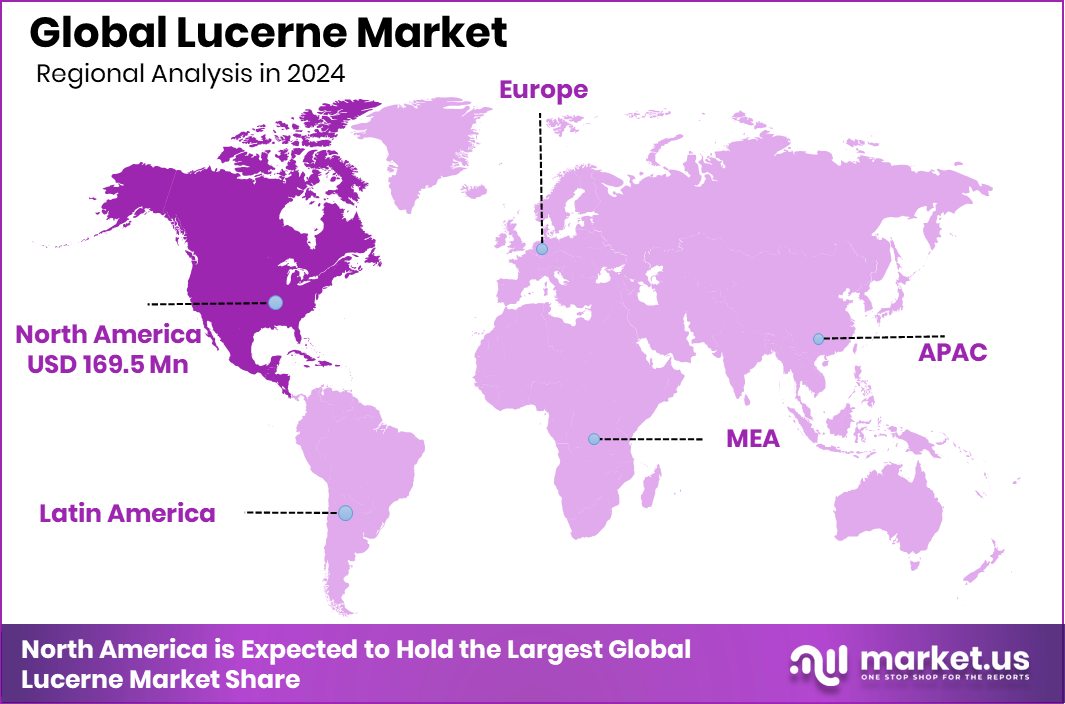

The Global Lucerne Market is expected to be worth around USD million by 2034, up from USD 370.2 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. North America accounted for 45.80% of the Lucerne Market, translating into USD 169.5 Mn revenues.

Lucerne is a high-nutrient forage crop widely used as animal feed, especially for dairy and livestock farming. It is valued for its high protein content, digestibility, and ability to improve animal health and productivity. Lucerne grows in many regions because it supports soil health, fixes nitrogen naturally, and fits well into sustainable farming systems.

The Lucerne Market refers to the production, processing, and distribution of lucerne in forms such as hay, pellets, or feed ingredients. It supports livestock nutrition across dairy, cattle, and mixed farming systems. The market is closely linked to feed demand, farm productivity goals, and long-term agricultural sustainability needs rather than short-term price movements.

Growth factors for the lucerne market are strongly connected to sustainability and climate-focused investments in agriculture. Funding activity highlights this shift. Tunis- and Paris-based nextProtein raised EUR 18 M (USD 20.7 M) in Series B funding, along with EUR 4 M in debt, to scale alternative feed production. Full Circle Biotechnology also secured funding to build a 7,000-ton low-carbon feed facility, reinforcing demand for sustainable feed inputs.

Demand for lucerne is rising as livestock producers seek reliable, nutrient-dense, and climate-friendly feed solutions. Danone led a USD 7 M funding round for methane-reducing cattle feed additives, while Antler Bio raised USD 4.3 M to scale smart dairy technologies. These developments indirectly support consistent demand for high-quality forage like lucerne.

Opportunities are expanding through public and multilateral support for dairy and feed systems. IFAD and GCF partnered on a USD 358 M climate programme for East Africa’s dairy sector, while New York State announced USD 10 M for dairy processing expansion and USD 21.6 M awarded to over 100 farms.

Key Takeaways

- The Global Lucerne Market is expected to be worth around USD million by 2034, up from USD 370.2 million in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In the Lucerne Market, hay dominates by type, accounting for 67.3% share of livestock demand.

- Within the Lucerne Market, the dairy industry leads end use with a 49.2% share, driven by feeding.

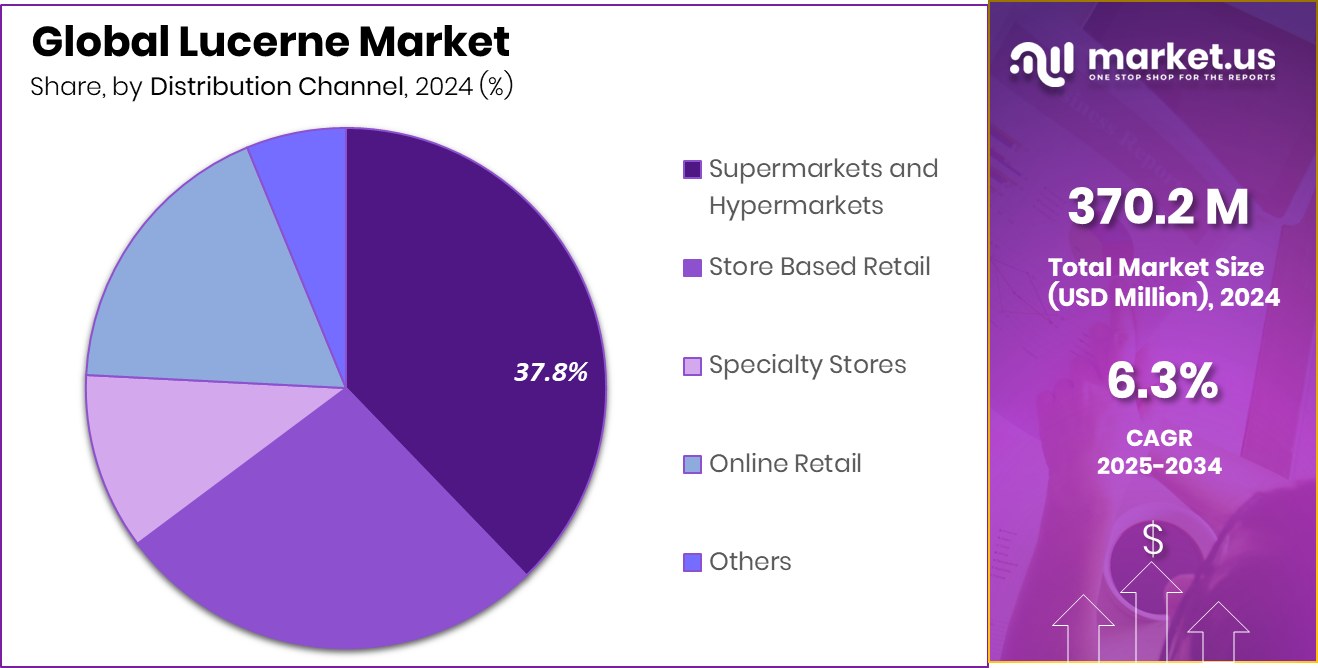

- In the Lucerne Market, supermarkets and hypermarkets dominate distribution channels, holding a 37.8% share globally today.

- Lucerne Market performance in North America reached 45.80%, generating a USD 169.5 Mn value overall.

By Type Analysis

In the Lucerne Market, hay dominates by type, holding a 67.3% share globally.

In 2024, Hay held a dominant market position in By Type segment of the Lucerne Market, with a 67.3% share. This strong share reflects hay’s established role as a primary forage option in lucerne consumption, driven by its ease of storage, transport, and long shelf life. Market participants continue to rely on hay due to its consistent quality profile, which supports predictable feeding outcomes across livestock systems.

The dominance of hay also indicates stable demand from buyers seeking cost-efficient and widely accepted lucerne formats. Its compatibility with existing supply chains and handling infrastructure further reinforces adoption. As a result, hay remains a preferred choice for volume-based procurement, sustaining its 67.3% position within the By Type segment through broad market acceptance and routine usage patterns.

By End Use Analysis

Within the Lucerne Market, the dairy industry leads end use, accounting for 49.2% of demand.

In 2024, the Dairy Industry held a dominant market position in By End Use segment of Lucerne Market, with a 49.2% share. This leadership highlights the critical role of lucerne in dairy feeding programs, where nutritional reliability and feed consistency are essential. The dairy industry’s strong uptake reflects regular demand cycles aligned with milk production requirements and herd management practices.

The 49.2% share also underscores the sector’s dependence on lucerne as a foundational feed input supporting productivity and operational efficiency. Continuous consumption across small and large dairy operations sustains this position, as lucerne aligns well with daily feeding regimes. Consequently, the dairy industry remains the largest end-use contributor, anchoring demand stability within the overall lucerne market structure.

By Distribution Channel Analysis

Supermarkets and hypermarkets lead distribution in the Lucerne Market with a 37.8% share globally.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Lucerne Market, with a 37.8% share. This dominance reflects the channel’s ability to offer broad product visibility and reliable access for buyers, supported by organised retail networks. Supermarkets and hypermarkets benefit from established logistics systems that ensure steady product availability and standardised quality presentation.

The 37.8% share also indicates buyer preference for centralised purchasing environments that simplify sourcing and comparison. Strong footfall and consistent replenishment cycles further reinforce this channel’s role in Lucerne distribution. As a result, supermarkets and hypermarkets continue to lead the distribution landscape, maintaining their dominant position through scale efficiency and structured retail operations.

Key Market Segments

By Type

- Hay

- Silage

- Chaff

By End Use

- Dairy Industry

- Household

- Equine

- Feed Industry

By Distribution Channel

- Supermarkets and Hypermarkets

- Store-Based Retail

- Specialty Stores

- Online Retail

- Others

Driving Factors

Rising Dairy Innovation Strengthens Lucerne Feed Demand

The growing focus on modern dairy farming is a key driving factor for the lucerne market. Dairy producers increasingly depend on nutritious and reliable forage to support animal health, milk yield, and feed efficiency. As dairy operations become more structured and technology-driven, the need for consistent, high-quality feed inputs like lucerne becomes essential. This shift is visible through rising investments in dairy startups and digital farming models that aim to improve productivity, transparency, and supply reliability. Funding activity reflects confidence in scalable dairy systems that indirectly depend on stable forage availability.

- Doodhvale Farms secured USD 3 million in funding led by Atomic Capital to strengthen organised dairy supply chains.

- Digital Dairy Chain announced a GBP 2 million competition fund to support innovation across dairy operations.

At the same time, alternative dairy innovation also influences feed dynamics. Imagindairy raised USD 15 million to scale alternative milk production, highlighting broader investment interest in dairy-related nutrition ecosystems. These developments collectively reinforce long-term demand for lucerne as a foundational feed supporting evolving dairy systems.

Restraining Factors

Shift Toward Alternative Dairy Limits Feed Growth

The growing investment in alternative and direct-to-consumer dairy models acts as a restraining factor for the lucerne market. As new dairy formats gain attention, traditional livestock-based milk production faces gradual pressure, which can slow demand growth for conventional feed crops like lucerne. Funding trends highlight this shift. Sid’s Farm raised USD 10 million in Series A funding to expand its D2C dairy model, focusing on branded milk distribution rather than farm-level expansion. At the same time, animal-free dairy startups in India secured USD 4 million to develop bioengineered dairy products that reduce dependence on livestock feed systems.

- Daisy Lab received NZD 250,000 to advance animal-free dairy solutions in New Zealand.

These investments support alternatives that may lower long-term livestock numbers or change feeding patterns. As resources and innovation move toward non-traditional dairy production, the pace of lucerne demand expansion could face structural constraints despite steady baseline consumption.

Growth Opportunity

Rising Climate-Focused Capital Supports Sustainable Feed Expansion

The launch of new climate-focused investment funds creates a strong growth opportunity for the Lucerne market. As investors increasingly support sustainable agriculture and food systems, capital availability improves for climate-resilient crops and low-impact feed solutions. Lucerne fits well into this shift because it supports soil health, requires fewer synthetic inputs, and aligns with long-term sustainability goals in livestock farming. Funding momentum shows that capital is actively moving toward innovations that improve agricultural efficiency and environmental outcomes. Volt Capital debuted its second fund, valued at USD 50 million, backed by multiple contributors, with a focus on climate and sustainability-driven technologies.

- USD 50 million second fund launched by Volt Capital to support climate-aligned innovations

Such funding environments encourage farm-level improvements, better feed systems, and scalable agricultural practices. As more capital flows into sustainable farming models, lucerne stands to benefit as a trusted, eco-aligned forage option supporting future livestock and dairy systems.

Latest Trends

Integrated Fodder Platforms Transform Lucerne Supply Chains

A key latest trend in the lucerne market is the rise of integrated fodder platforms that connect growers, processors, and livestock farmers through organised systems. These platforms improve planning, reduce supply gaps, and help farmers access consistent-quality feed. Lucerne benefits directly from this trend because it is a core fodder crop used regularly across dairy and livestock operations.

Digital and ecosystem-based models are helping standardise production and improve traceability, making lucerne sourcing more reliable. This shift is supported by targeted investment in fodder-focused startups. Cornext raised USD 2.2 million in funding from Omnivore to build a structured fodder ecosystem that supports farmers with better access to quality feed and advisory services.

- USD 2.2 million raised by Cornext to strengthen fodder ecosystem development

As such platforms expand, Lucerne distribution becomes more organised and efficient. This trend supports long-term market stability by aligning production with actual on-farm demand patterns.

Regional Analysis

North America led the Lucerne Market with a 45.80% share, valued at USD 169.5 Mn.

North America dominated the Lucerne Market with a 45.80% share, valued at USD 169.5 Mn, reflecting its well-established forage consumption base and mature agricultural supply chains. The region benefits from large-scale livestock operations and consistent demand for quality feed inputs, which supports steady market performance and reinforce its leading position. Strong integration between producers, distributors, and end users further strengthens North America’s role as the primary regional contributor to overall lucerne demand.

Europe represents a stable regional market, supported by structured farming practices and an emphasis on feed quality and traceability. Demand is shaped by organised livestock systems and balanced feed formulations, keeping lucerne relevant across multiple applications. Asia Pacific shows growing market presence, driven by expanding livestock populations and gradual modernisation of feeding practices, which encourages wider adoption of lucerne-based products.

The Middle East & Africa region reflects selective demand, influenced by climatic conditions and reliance on imported or managed forage solutions to support animal nutrition. Latin America contributes through its strong agricultural base, where lucerne supports traditional livestock activities and regional feed requirements. Collectively, these regions complement North America’s dominance, shaping a diversified and regionally balanced lucerne market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Anderson Hay & Grain continued to play a critical role in the global lucerne market through its strong focus on large-scale hay processing and export-oriented operations. The company’s ability to manage consistent quality, grading, and logistics supports long-term supply relationships and positions it as a dependable player in international lucerne trade.

M&C Hay maintained relevance by emphasising flexibility in sourcing and regional distribution. Its operational model allows it to respond quickly to changing feed requirements, making it a reliable supplier for customers seeking stable lucerne availability and consistent product standards across seasons.

Gruppo Carli demonstrated a differentiated presence by aligning Lucerne offerings with integrated agricultural practices. The company’s structured approach to cultivation and processing enhances supply continuity, supporting buyers who prioritise predictable forage quality and dependable delivery schedules in competitive markets.

Bailey Farms strengthened its position through farm-level expertise and direct control over production activities. This approach enables closer oversight of harvesting and handling practices, contributing to product consistency. In 2024, Bailey Farms remained well-positioned to serve customers seeking traceable and quality-focused lucerne supply, reinforcing its role within the global market.

Top Key Players in the Market

- Anderson Hay & Grain

- M&C Hay

- Gruppo Carli

- Bailey Farms

- Others

Recent Developments

- In November 2025, Anderson Hay & Grain, a U.S. exporter of hay and forage, including alfalfa (lucerne) products, submitted a Chapter 11 bankruptcy petition in the U.S. Bankruptcy Court for the Eastern District of Washington as part of efforts to reorganise operations and address financial challenges. This filing is intended to help the company stabilise and manage its debts while continuing its hay export business.

- In November 2025, Gruppo Carli exhibited at the Cremona International Livestock Fair 2025 in Italy, showcasing its forage and lucerne-based products and engaging with livestock professionals and farmers on sustainable feeding solutions.

Report Scope

Report Features Description Market Value (2024) USD 370.2 Million Forecast Revenue (2034) USD Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hay, Silage, Chaff), By End Use (Dairy Industry, Household, Equine, Feed Industry), By Distribution Channel (Supermarkets & Hypermarkets, Store-Based Retail, Speciality Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Anderson Hay & Grain, M&C Hay, Gruppo Carli, Bailey Farms, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anderson Hay & Grain

- M&C Hay

- Gruppo Carli

- Bailey Farms

- Others