Global Load Break Switch Market Size, Share, And Business Benefits By Type (Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed), By Current (Upto 400 A, 400 A to 600 A, Above 600 A), By Voltage (Upto 30 kV, 30 kV-50 kV, Above 50 kV), By Installation (Outdoor, Indoor), By End-use (Utilities, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143895

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

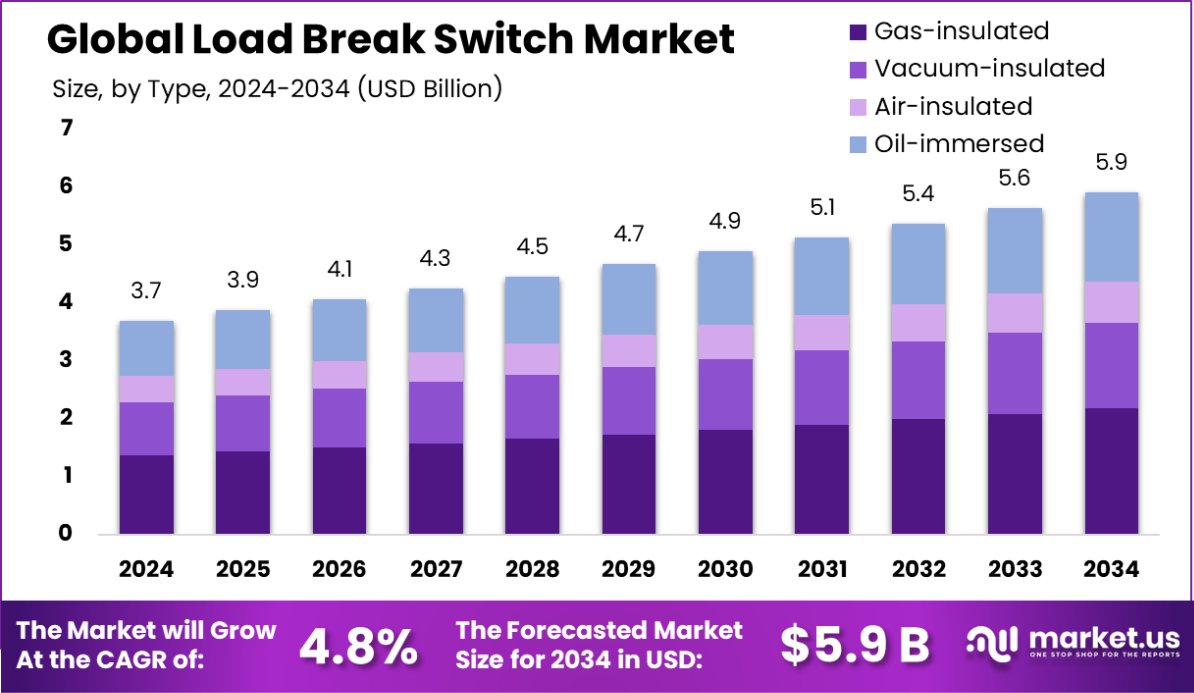

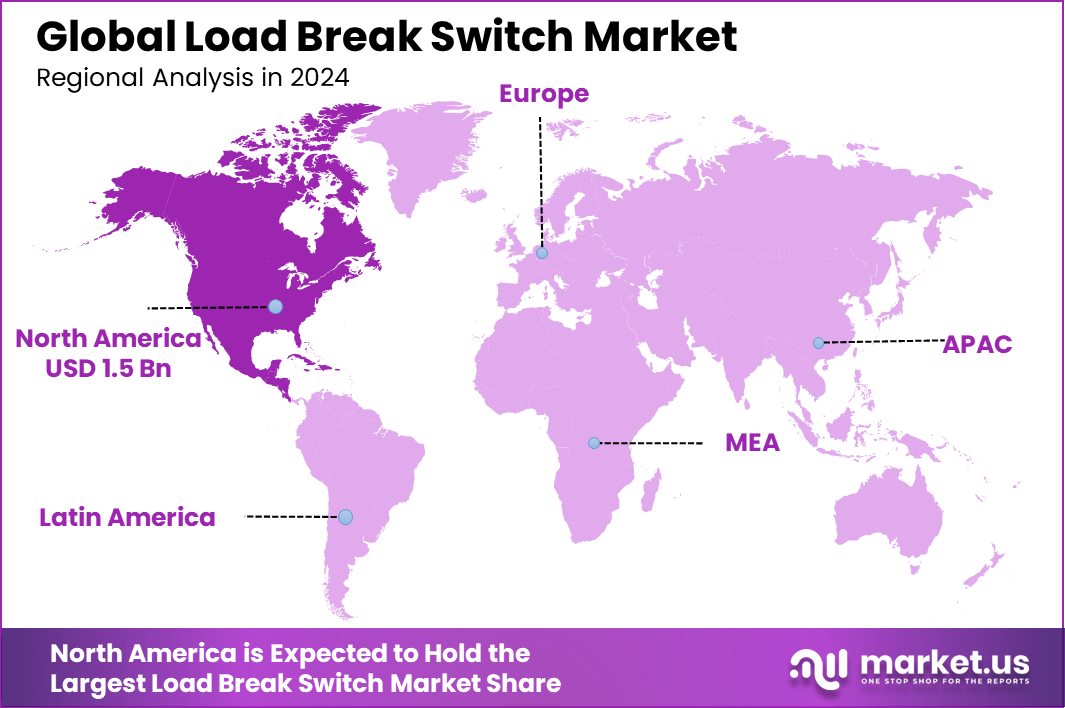

Global Load Break Switch Market is expected to be worth around USD 5.9 billion by 2034, up from USD 3.7 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034. With a 41.20% market share, North America significantly contributes to the global Load Break Switch landscape.

A Load Break Switch (LBS) is an electrical switch designed to disconnect or connect a current load safely. It operates by breaking a circuit, thereby interrupting the flow of electricity, while ensuring that no arcing occurs, making it different from typical circuit breakers. LBSs are crucial in managing electrical systems and ensuring safety during maintenance or operational adjustments, commonly used in both power distribution networks and industrial applications.

The Load Break Switch Market refers to the industry centered around the production, distribution, and sale of load break switches. This market is influenced by various sectors including utilities, commercial, and industrial, where effective power distribution and safety are critical. Growth in this market is primarily driven by the global expansion of electrical networks and the need for modernizing existing infrastructure to accommodate renewable energy sources and increased power demand.

One significant growth factor in the Load Break Switch Market is the increasing global demand for electricity. As populations grow and urbanization increases, especially in emerging economies, there is a surge in the need for reliable power distribution solutions. This trend pushes the demand for advanced switching equipment, like LBSs, to ensure efficient management and distribution of electricity.

Moreover, the push for renewable energy sources also presents numerous opportunities for the Load Break Switch Market. Renewable energy systems often require more complex grid integration and management, which LBSs facilitate by allowing safe disconnections and connections to the power grid. This capability is crucial for incorporating intermittent power sources like solar and wind, thus driving the adoption of LBSs in renewable energy projects.

Key Takeaways

- Global Load Break Switch Market is expected to be worth around USD 5.9 billion by 2034, up from USD 3.7 billion in 2024, and grow at a CAGR of 4.8% from 2025 to 2034.

- Gas-insulated load break switches hold a market share of 36.20%, emphasizing their reliability and safety.

- Load break switches rated between 400 A to 600 A dominate, with a 43.30% market presence.

- Load break switches designed for 30 kV to 50 kV applications account for 49.10% of the market.

- Outdoor installation of load break switches leads to a significant 72.10% segment of the market.

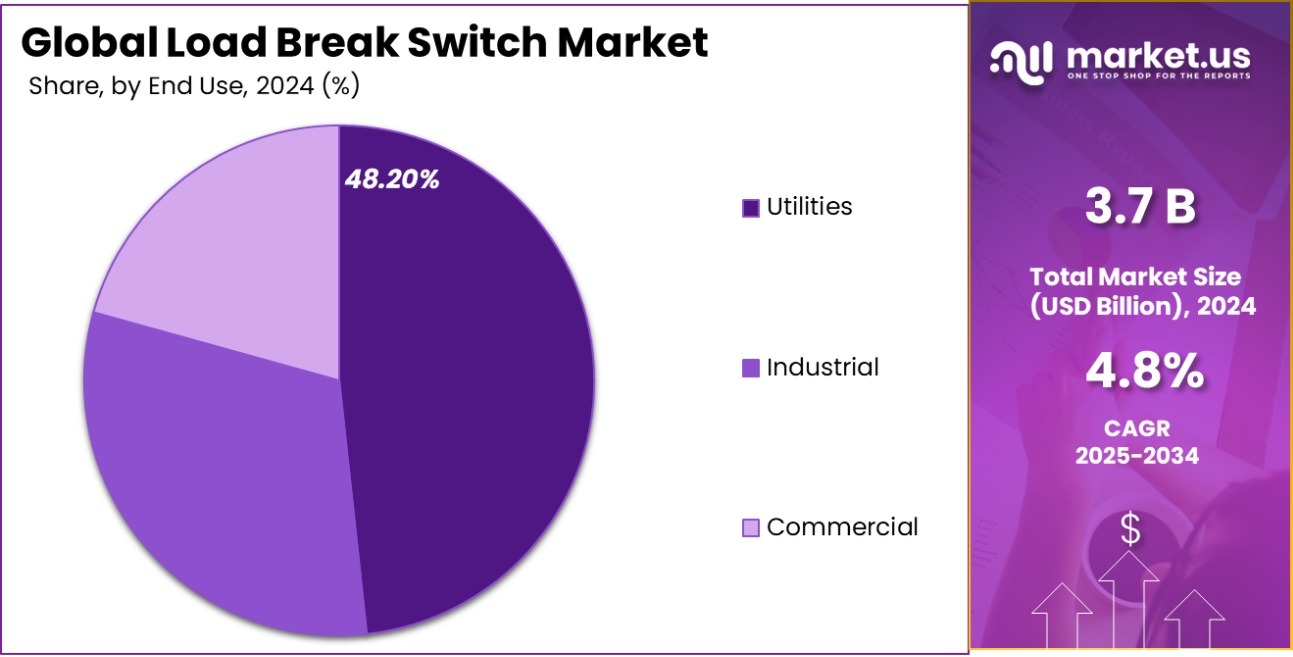

- Utilities are the largest end-users of load break switches, constituting 48.20% of the market demand.

- The market value in North America reached USD 1.5 billion, reflecting robust regional growth.

By Type Analysis

Gas-insulated load break switches dominate, holding 36.20% of the market share.

In 2024, the Gas-insulated type held a dominant position in the Load Break Switch Market, capturing a significant market share of 36.20%. This segment’s leadership is attributed to its superior attributes, such as enhanced safety, reliability, and efficiency in high-voltage electrical systems.

Gas-insulated load break switches are preferred for their compact design and excellent arc-quenching capabilities, making them ideal for urban and industrial applications where space is at a premium and system reliability is crucial.

The market’s preference for gas-insulated switches is also driven by the growing demand for electrical systems that offer robust performance under critical conditions, coupled with increasing investments in upgrading aging power infrastructure. As urbanization accelerates, especially in developing regions, the demand for reliable and efficient energy solutions like gas-insulated load break switches is expected to rise, potentially increasing their market share further.

Looking ahead, the market for gas-insulated load break switches is poised for continued growth, driven by technological advancements and the increasing integration of renewable energy sources into the grid. These factors are expected to further cement the leading position of gas-insulated types in the Load Break Switch Market.

By Current Analysis

In the current rating, 400 A to 600 A types lead with 43.30%.

In 2024, the 400 A to 600 A range held a dominant market position in the By Current segment of the Load Break Switch Market, securing a substantial 43.30% share. This segment’s prominence is largely due to its wide applicability in medium-scale industrial, commercial, and utility applications, where moderate current handling capacity is essential.

The versatility and efficiency of load break switches in this current range make them a preferred choice for safely controlling and interrupting power flow, thereby preventing electrical faults and enhancing system reliability.

The preference for 400 A to 600 A load break switches is supported by their optimal balance between performance and cost, making them particularly attractive in markets sensitive to initial investment costs without compromising on safety and operational capabilities. As industries continue to expand and modernize their electrical infrastructure, the demand for reliable and efficient load break switches within this current range is expected to remain robust.

Looking forward, the 400 A to 600 A segment is anticipated to maintain its market dominance, driven by ongoing industrial growth, infrastructural developments, and the increasing complexities of electrical network designs that require dependable load management solutions.

By Voltage Analysis

For voltage range, 30 kV to 50 kV switches represent 49.10% of sales.

In 2024, the 30 kV-50 kV range held a dominant market position in the By Voltage segment of the Load Break Switch Market, with a commanding 49.10% share. This segment’s leadership underscores its critical role in medium voltage applications, which are pivotal in regional and municipal utility distribution networks.

The 30 kV-50 kV load break switches are especially valued for their ability to manage higher voltage levels efficiently, ensuring safe and reliable power distribution across extensive electrical networks.

The significant market share of this voltage range reflects its suitability for a broad spectrum of applications, including substations, industrial plants, and commercial buildings, where robust and durable power management solutions are required. The adoption of 30 kV-50 kV load break switches is further bolstered by the ongoing efforts to upgrade aging infrastructure and integrate renewable energy sources, which often operate within this voltage range.

As the electrical grid continues to evolve towards more decentralized and dynamic systems, the demand for 30 kV-50 kV load break switches is expected to grow. This trend is likely to be supported by advancements in switchgear technology and increased focus on grid stability and energy efficiency, ensuring that this segment retains its market dominance.

By Installation Analysis

Outdoor installation of load break switches prevails, capturing 72.10% of the market segment.

In 2024, the Outdoor segment held a dominant market position in the By Installation category of the Load Break Switch Market, commanding a significant 72.10% share. This dominance is largely attributed to the extensive deployment of outdoor load break switches in utility, industrial, and commercial sectors, where they are crucial for controlling and protecting outdoor electrical distribution networks. The robust construction and high durability of outdoor switches enable them to withstand harsh environmental conditions, making them ideal for external applications.

The high market share of the Outdoor segment reflects the ongoing expansion of electrical grids and the increasing emphasis on improving reliability and safety in power distribution outdoors. These switches are particularly favored in areas where environmental exposure is inevitable, such as in rural or remote infrastructure, which requires dependable and resilient electrical components.

As infrastructure development continues to grow, especially in emerging markets, and as investments in renewable energy projects increase, the demand for outdoor load break switches is expected to remain strong. The ongoing need for efficient and secure power distribution systems will likely keep the Outdoor segment at the forefront of the Load Break Switch Market.

By End-use Analysis

Utilities are major end-users, constituting 48.20% of the load break switch market.

In 2024, Utilities held a dominant market position in the By End-use segment of the Load Break Switch Market, with a substantial 48.20% share. This segment’s leadership is indicative of the critical role load break switches play in utility networks, where they are essential for ensuring the reliable distribution and management of electricity.

The high percentage reflects the extensive use of these switches in the operational frameworks of public and private utility companies, aimed at enhancing the efficiency and safety of power transmission and distribution systems.

The utilities sector’s reliance on load break switches is driven by the need to minimize power outages and optimize network performance, particularly in the face of increasing energy demands and the integration of renewable energy sources. The robustness and adaptability of load break switches make them suitable for a variety of settings, ranging from rural distribution networks to urban energy grids.

As the global energy landscape evolves, with a greater focus on sustainability and reliability, the utility segment’s demand for advanced load break switch solutions is expected to continue growing. This will likely ensure the sustained dominance of Utilities in the Load Break Switch Market, supporting grid modernization initiatives and expanding electrification projects.

Key Market Segments

By Type

- Gas-insulated

- Vacuum-insulated

- Air-insulated

- Oil-immersed

By Current

- Upto 400 A

- 400 A to 600 A

- Above 600 A

By Voltage

- Upto 30 kV

- 30 kV-50 kV

- Above 50 kV

By Installation

- Outdoor

- Indoor

By End-use

- Utilities

- Industrial

- Commercial

Driving Factors

Increasing Electrification in Developing Regions

One of the primary driving factors of the Load Break Switch Market is the increasing electrification in developing regions. As countries strive to enhance their infrastructure, there’s a growing need for reliable and efficient electrical distribution systems. Load break switches play a crucial role in these systems by providing the necessary control and safety mechanisms to handle electricity distribution effectively.

The surge in infrastructure projects, including residential, commercial, and industrial developments, requires robust electrical systems to support growth and ensure safety. As these regions continue to industrialize, the demand for electrical components like load break switches is expected to rise, driving the market forward.

Restraining Factors

High Installation Costs Limit Market Expansion

A significant restraining factor for the Load Break Switch Market is the high installation costs associated with these systems. Load break switches, particularly those designed for high voltage and outdoor use, require substantial investment in terms of both the equipment and the specialized labor needed for installation and maintenance. This high cost can be prohibitive for small and medium-sized enterprises or regions with limited financial resources.

Additionally, the need for compliance with various safety and operational standards further escalates the initial setup expenses. As a result, while the demand for reliable and efficient electrical distribution systems is increasing, the high initial costs associated with load break switches can slow down their adoption, particularly in cost-sensitive markets.

Growth Opportunity

Renewable Energy Integration Offers Market Growth Opportunities

The integration of renewable energy sources presents a significant growth opportunity for the Load Break Switch Market. As the world shifts towards sustainable energy solutions, the need for advanced electrical infrastructure to manage and distribute energy from renewable sources like solar and wind power increases.

Load break switches are pivotal in these setups, ensuring safe operations and effective load management across renewable energy systems. Their ability to provide reliable isolation and protection in power grids, especially those incorporating intermittent energy sources, makes them indispensable.

As governments and private entities continue to invest in green energy, the demand for load break switches that can handle the complexities of renewable energy networks is expected to surge, driving market growth.

Latest Trends

Smart Grid Technology Adoption Drives Market Trends

A leading trend in the Load Break Switch Market is the adoption of smart grid technology. Smart grids utilize digital communication technology to enhance the reliability, efficiency, and sustainability of electrical distribution systems. As part of this technological advancement, load break switches are increasingly being integrated with automation features that allow for remote control and real-time monitoring.

This integration not only improves operational efficiency but also enhances the ability to respond quickly to system faults or changes in load conditions. The shift towards smart grids is particularly pronounced in developed countries that are upgrading their aging infrastructure. As more regions adopt smart grid technologies, the demand for advanced load break switches equipped with automation capabilities is expected to grow, reflecting a significant trend in the market.

Regional Analysis

In North America, the Load Break Switch Market holds 41.20% of the global share.

The Load Break Switch Market exhibits varied performance across different regions, reflecting the unique dynamics and development stages of electrical infrastructure globally. North America dominates the market with a 41.20% share, valued at USD 1.5 billion, underscoring its advanced utility networks and heightened focus on upgrading aging electrical systems. This region leads due to its rapid adoption of smart grid technologies and significant investments in renewable energy integrations.

Europe follows, with substantial investments in renewable energy projects driving the demand for reliable load management solutions such as load break switches. The market in Europe is bolstered by stringent regulations regarding energy efficiency and grid reliability, pushing for more advanced and durable electrical components.

Asia Pacific presents a high-growth potential, driven by urbanization and industrialization in emerging economies like China and India. Investments in infrastructure development and an increasing focus on sustainable energy sources are key factors propelling the market in this region.

Conversely, the Middle East & Africa and Latin America are emerging markets with growing demands. These regions are experiencing gradual adoption due to increasing infrastructure projects and governmental efforts to modernize electrical grids, although they start from a smaller base compared to more developed markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Load Break Switch Market was significantly shaped by the contributions of key players such as ABB, Eaton, Ensto, Fuji Electric, and KATKO Oy, each bringing distinct innovations and strategic expansions to the sector.

ABB, a frontrunner in the electrical equipment industry, continued to lead with its technologically advanced solutions, particularly in the integration of digital and automated systems into load break switches. These innovations have enabled ABB to meet the growing demand for smarter grid solutions and enhanced energy management practices, particularly in developed markets with a high focus on grid modernization.

Eaton, known for its reliable and efficient power management solutions, focused on expanding its product offerings to include environmentally friendly and energy-efficient switches. Their products are particularly favored in regions with stringent energy regulations, helping Eaton to solidify its presence in both European and North American markets.

Ensto, while smaller in scale compared to ABB and Eaton, has carved out a niche by specializing in customizable load break switch solutions. Their focus on specific customer needs and applications has enabled them to remain competitive and relevant, particularly in the European market where customized solutions are in high demand.

Fuji Electric has leveraged its extensive expertise in electrical and thermal energy technology to enhance the operational efficiency and safety features of its load break switches. Their commitment to high-quality standards appeals to industrial sectors across Asia Pacific, driving their growth in this rapidly developing region.

Lastly, KATKO Oy has focused on expanding its reach in the renewable energy sector, recognizing the increasing integration of renewables into power grids. Their switches are designed to handle the variable loads typical of renewable installations, making them an essential player in supporting green energy transitions globally.

Top Key Players in the Market

- ABB

- Eaton

- Ensto

- Fuji Electric

- KATKO Oy

- Lucy Group Ltd.

- Powell Industries

- Rockwell Automation

- Safvolt

- Schneider Electric

- Siemens

- Socomec

- Legrand SA

- G&W Electric

- Hughes Power System

- Sécheron

Recent Developments

- In May 2022, Schneider Electric unveiled the SureSeT MV switchgear in the North American market. This switchgear is equipped with EvoPacT circuit protection devices and is designed to be more compact, robust, and intelligent than the Masterclad solution, enhancing the efficiency of daily digital operations.

- In December 2020, ABB introduced a new environmentally friendly switchgear solution. This solution includes a state-of-the-art load break switch that uses puffer interrupter technology and eco-friendly gases as alternatives to SF6, aimed at minimizing environmental impacts.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 5.9 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed), By Current (Upto 400 A, 400 A to 600 A, Above 600 A), By Voltage (Upto 30 kV, 30 kV-50 kV, Above 50 kV), By Installation (Outdoor, Indoor), By End-use (Utilities, Industrial, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Eaton, Ensto, Fuji Electric, KATKO Oy, Lucy Group Ltd., Powell Industries, Rockwell Automation, Safvolt, Schneider Electric, Siemens, Socomec, Legrand SA, G&W Electric, Hughes Power System, Sécheron Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Load Break Switch MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Load Break Switch MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Eaton

- Ensto

- Fuji Electric

- KATKO Oy

- Lucy Group Ltd.

- Powell Industries

- Rockwell Automation

- Safvolt

- Schneider Electric

- Siemens

- Socomec

- Legrand SA

- G&W Electric

- Hughes Power System

- Sécheron