Global Liquefied Natural Gas Market Size, Share, And Business Benefit By Type (Liquefaction, Regasification), By Application (Transportation Fuel, Power Generation, Others), By End Use (Electric Utilities, Industrial, Residential, Transportation Sector, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166864

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

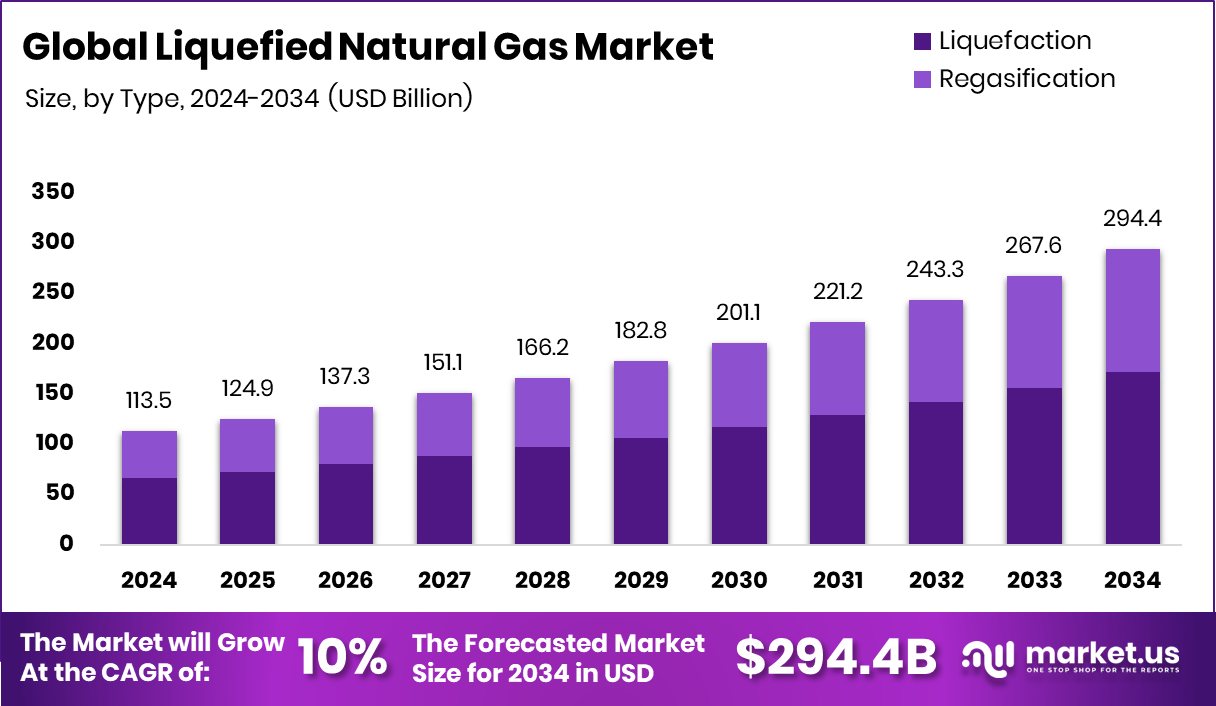

The Global Liquefied Natural Gas Market is expected to be worth around USD 294.4 billion by 2034, up from USD 113.5 billion in 2024, and is projected to grow at a CAGR of 10% from 2025 to 2034. Asia Pacific 46.20% maintains LNG dominance due to rising energy demand across the region.

Liquefied Natural Gas (LNG) is natural gas that has been cooled to around –162°C, turning it into a liquid that is easier to store and transport. This process reduces its volume significantly, allowing it to move across long distances where pipelines are not available. LNG is valued for its cleaner-burning profile compared to many conventional fuels, making it important for power generation, industrial use, and emerging clean-energy transitions.

The Liquefied Natural Gas Market includes the global trade, storage, liquefaction, regasification, and end-use consumption of LNG across power plants, industries, and transportation. It is shaped by energy security needs, shifting fuel policies, and investments that expand liquefaction and import capacity. As countries look for reliable alternatives to coal and oil, LNG plays a strategic role in balancing grids and supporting flexible energy systems.

Growth is supported by rising demand for cleaner fuels as governments seek lower-emission options for power and industrial sectors. Massive financing flows show long-term confidence, including NextDecade securing $1.8 billion for the Rio Grande LNG project and SK Innovation advancing a 5 trillion-won LNG liquefaction deal. These moves expand global liquefaction capacity, strengthening supply stability.

Demand continues to increase as nations adopt diversified energy portfolios. New liquefaction and hydrogen-linked projects widen the opportunity landscape, such as Canada’s $49 million investment in a hydrogen liquefaction facility and the $140 million hydrogen plant permit approved in North Vancouver. These projects complement LNG infrastructure by creating integrated clean-fuel networks.

Opportunities are widening as LNG becomes a transition fuel supporting flexible grids and industrial decarbonization. Strategic funding like Air Liquide’s €110 million EU grant for an ammonia-to-hydrogen project highlights how LNG infrastructure can coexist with emerging hydrogen pathways, enabling countries to advance toward lower-carbon energy systems.

Key Takeaways

- The Global Liquefied Natural Gas Market is expected to be worth around USD 294.4 billion by 2034, up from USD 113.5 billion in 2024, and is projected to grow at a CAGR of 10% from 2025 to 2034.

- The liquefied natural gas market grows strongly as liquefaction holds 58.2%, driven by rising global export capacity

- Liquefied natural gas market demand rises as power generation leads with a 56.4% share globally.

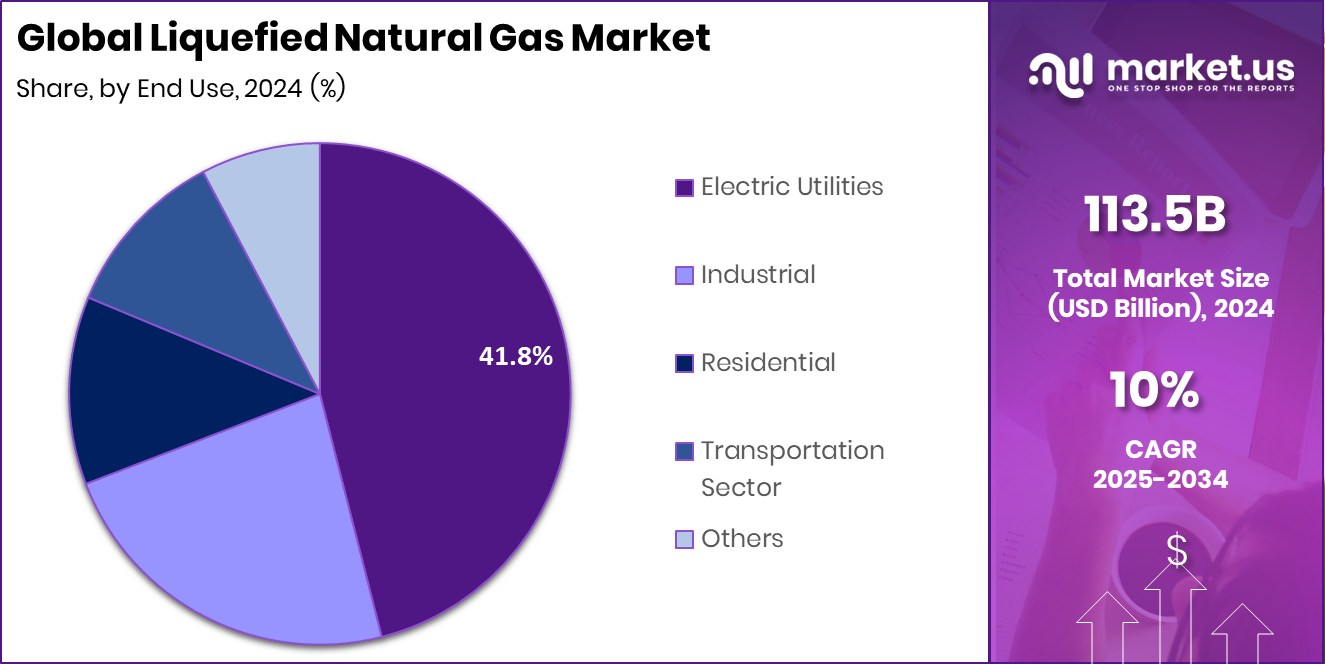

- The liquefied natural gas market benefits from electric utilities holding 41.8% due to stable fuel needs.

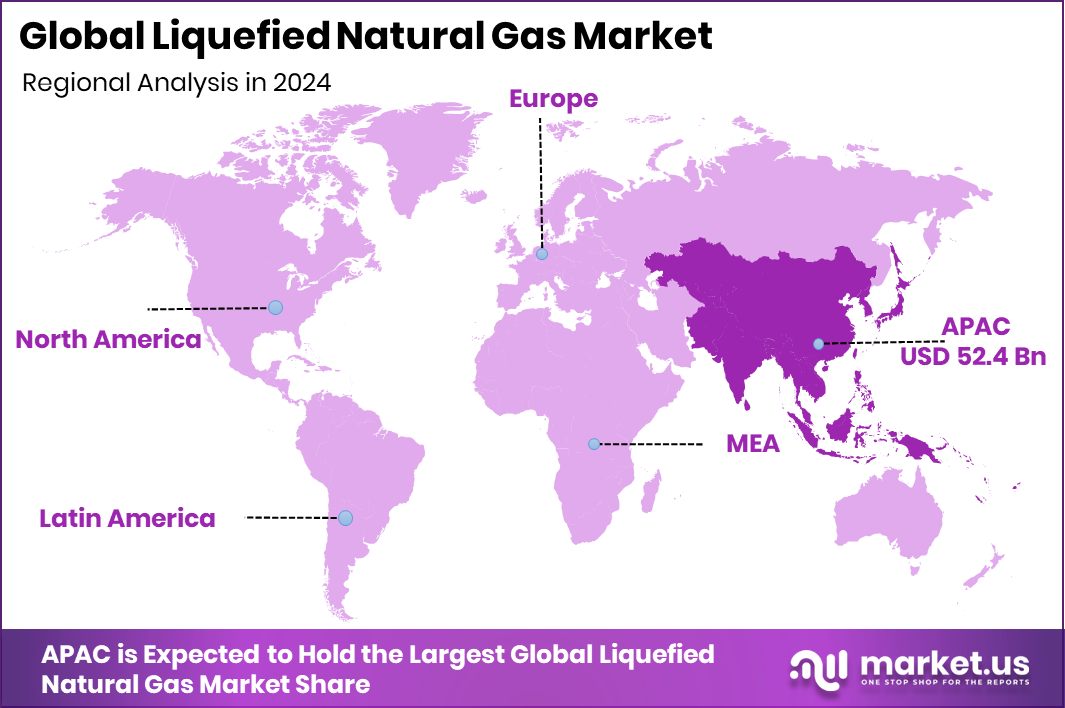

- The Asia Pacific records a strong market value of USD 52.4 Bn overall.

By Type Analysis

Liquefaction at 58.2% reflects rising investments in global gas processing infrastructure.

In 2024, Liquefaction held a dominant market position in the By Type segment of the Liquefied Natural Gas Market, with a 58.2% share. This strong lead reflects the growing global focus on expanding liquefaction capacity to meet rising cross-border LNG demand. Liquefaction facilities play a central role in converting natural gas into a transportable form, enabling long-distance shipment to importing regions that lack pipeline infrastructure.

The 58.2% share also highlights how producers are prioritising large-scale liquefaction investments to secure long-term supply commitments. As more countries seek flexible and cleaner fuel options, liquefaction remains the critical upstream step supporting LNG trade flows, energy security goals, and the development of modern gas-based power and industrial systems.

By Application Analysis

Power generation holds 56.4%, showing LNG’s importance in a stable electricity supply.

In 2024, Power Generation held a dominant market position in the By Application segment of the Liquefied Natural Gas Market, with a 56.4% share. This leadership reflects the growing shift toward cleaner-burning fuels as countries work to lower emissions from their electricity systems. LNG is widely adopted in modern power plants because it offers reliable baseload capacity while producing fewer pollutants than conventional fossil fuels.

The 56.4% share also shows how utilities increasingly rely on LNG to balance renewable energy sources and ensure grid stability during demand peaks. As energy policies continue emphasising flexibility and cleaner generation, power producers maintain strong LNG consumption, reinforcing its central role in supporting national electricity supply strategies.

By End Use Analysis

Utilities represent 41.8%, highlighting LNG’s role in meeting peak electricity needs.

In 2024, Electric Utilities held a dominant market position in the by end-use segment of the Liquefied Natural Gas Market, with a 41.8% share. This reflects the growing dependence of power utilities on LNG to ensure a stable and cleaner electricity supply. As many regions transition away from high-emission fuels, electric utilities increasingly integrate LNG to support reliable baseload power and balance fluctuating renewable generation.

The 41.8% share highlights how utilities view LNG as a practical, flexible energy source that helps maintain grid stability while meeting tightening environmental requirements. With steady demand from electricity providers, LNG continues to play a central role in strengthening national energy systems and supporting long-term power planning strategies.

Key Market Segments

By Type

- Liquefaction

- Regasification

By Application

- Transportation Fuel

- Power Generation

- Others

By End Use

- Electric Utilities

- Industrial

- Residential

- Transportation Sector

- Others

Driving Factors

Growing Investment Boosts LNG Infrastructure Expansion

Strong investment momentum is becoming one of the biggest driving forces for the liquefied natural gas market. Countries and private developers are pouring money into new energy projects that strengthen gas supply, grid stability, and future power reliability.

Recent funding moves clearly show this shift. Texas announced $5 billion in loans to build natural gas power plants, creating long-term demand for LNG as a dependable fuel for new generation facilities. At the same time, innovation in complementary energy solutions is also rising.

For example, Cell-En raised ¥150 million in seed funding to advance microbial power generation technology, showing how different energy systems will coexist around LNG infrastructure. Together, these investments reflect a strong global push to secure cleaner, steadier, and flexible energy options.

Restraining Factors

High Project Costs Slow LNG Expansion

One of the strongest restraints for the Liquefied Natural Gas Market is the very high cost of building new LNG facilities and related infrastructure. Liquefaction plants, storage terminals, and regasification units require huge upfront investments, long construction timelines, and strict safety standards. These financial pressures often slow down new project approvals, especially in regions facing budget limitations or uncertain energy policies.

Even though global capital continues to flow into the broader energy sector—such as Nuveen raising $1.3 billion for a new power generation and sustainable infrastructure credit fund—LNG projects still struggle with rising material costs and complex regulatory requirements. These challenges can delay expansions, increase project risks, and limit the pace at which new LNG capacity comes online.

Growth Opportunity

Microgrid Development Creates New LNG Opportunities

A major growth opportunity for the Liquefied Natural Gas Market comes from the rising development of microgrids that combine multiple energy sources. Many regions are now investing in small, flexible power systems to improve energy security and reduce outage risks. LNG fits naturally into these projects because it provides steady, quick-start power that supports solar and battery systems. This shift is gaining momentum as states and utilities look for cleaner but dependable fuels.

A strong example is Texas finalising $1.8 billion to build solar, battery, and gas-powered microgrids, showing how LNG can play a critical role in mixed-energy setups. As microgrids expand worldwide, LNG demand is likely to rise as a stable backbone fuel supporting flexible and resilient power networks.

Latest Trends

Governments Increasing Support for Gas Projects

A key trend in the Liquefied Natural Gas Market is the growing government support for new gas-based power projects. Many regions see LNG as a stable partner fuel that can balance renewables and strengthen grid reliability.

As a result, public funding and loan programs focused on natural gas projects are becoming more common. This shift reflects a practical approach where cleaner fuels like LNG help maintain energy security while renewable capacity grows.

A clear example is Texas’s $7.2 billion loan program, which has already approved two gas power plant projects in just two years. Such programs signal long-term confidence in LNG and encourage continuous investment in modern, flexible, and dependable energy infrastructure.

Regional Analysis

Asia Pacific leads the Liquefied Natural Gas Market with 46.20% share.

Asia Pacific dominates the Liquefied Natural Gas Market with 46.20% and USD 52.4 Bn, reflecting its strong reliance on LNG for power, industrial demand, and energy security needs. The region continues to expand import terminals and regasification capacity, supporting steady consumption across growing economies. This dominance also highlights the region’s rising electricity requirements and its shift toward cleaner-burning fuels to support long-term energy planning.

North America shows steady LNG development driven by abundant natural gas supply and the continuous expansion of liquefaction facilities. The region benefits from stable production and strong export capabilities, reinforcing its role as a key supplier to global markets. Europe maintains a resilient LNG demand profile as countries diversify energy sources to strengthen security and reduce dependence on traditional fuel routes.

Middle East & Africa remain important in upstream LNG activities, with ongoing efforts to add liquefaction capacity and enhance export competitiveness. Latin America continues to adopt LNG for power generation stability, especially in countries balancing renewable integration with reliable gas-fired systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

British Petroleum (BP) p.l.c. continues to strengthen its position in the LNG landscape by focusing on flexible supply portfolios and integrated gas strategies. The company’s approach emphasises long-term contracting, efficient trading, and optimised LNG shipping networks. BP’s diversified gas assets allow it to respond quickly to global demand shifts, making it a reliable player in regions prioritising cleaner and dependable energy sources.

Chevron Corporation remains a key contributor through its large-scale LNG operations and steady project performance. The company benefits from a strong upstream foundation, which supports stable LNG output and long-term supply commitments. Chevron’s focus on operational reliability and efficiency reinforces its reputation in delivering consistent LNG volumes to global markets, particularly in regions seeking secure natural gas alternatives.

China Petroleum & Chemical Corporation plays an important role through its expanding involvement in natural gas infrastructure and its strong domestic demand profile. Its LNG activities support national energy policies that prioritise cleaner fuels for the industrial and power sectors. By enhancing LNG import, storage, and distribution capabilities, the company helps strengthen regional energy security while supporting China’s broader shift toward lower-emission energy systems.

Top Key Players in the Market

- British Petroleum (BP) p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Eni SpA

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom Energy

- PetroChina Company Limited

- Royal Dutch Shell PLC

- Total S.A.

Recent Developments

- In September 2025, Chevron outlined its gas development strategy in Angola, including non-associated gas feedstock development to support the Angola LNG Plant-linked liquefaction activities.

- In February 2024, BP announced that it expects its LNG supply portfolio to grow to more than 25 million tonnes per annum (mtpa) by 2025, up from previous targets.

Report Scope

Report Features Description Market Value (2024) USD 113.5 Billion Forecast Revenue (2034) USD 294.4 Billion CAGR (2025-2034) 10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquefaction, Regasification), By Application (Transportation Fuel, Power Generation, Others), By End Use (Electric Utilities, Industrial, Residential, Transportation Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape British Petroleum (BP) p.l.c., Chevron Corporation, China Petroleum & Chemical Corporation, Eni SpA, Equinor ASA, Exxon Mobil Corporation, Gazprom Energy, PetroChina Company Limited, Royal Dutch Shell PLC, Total S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liquefied Natural Gas MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Liquefied Natural Gas MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- British Petroleum (BP) p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Eni SpA

- Equinor ASA

- Exxon Mobil Corporation

- Gazprom Energy

- PetroChina Company Limited

- Royal Dutch Shell PLC

- Total S.A.