Global Ketchup Market Size, Share, And Business Benefits By Source (Organic, Conventional), By Product Type (Tomato Ketchup, Fruit Ketchup, Mushroom Ketchup), By Category (Regular, Flavored), By Packaging Type (Bottles, Pouches, Containers, Cans), By Distribution Channel (Direct Sales and B2B, Indirect Sales and B2C, Supermarkets and Hypermarkets, Online Retail), By End-user (Household, HoReCa, Food Manufacturers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145471

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

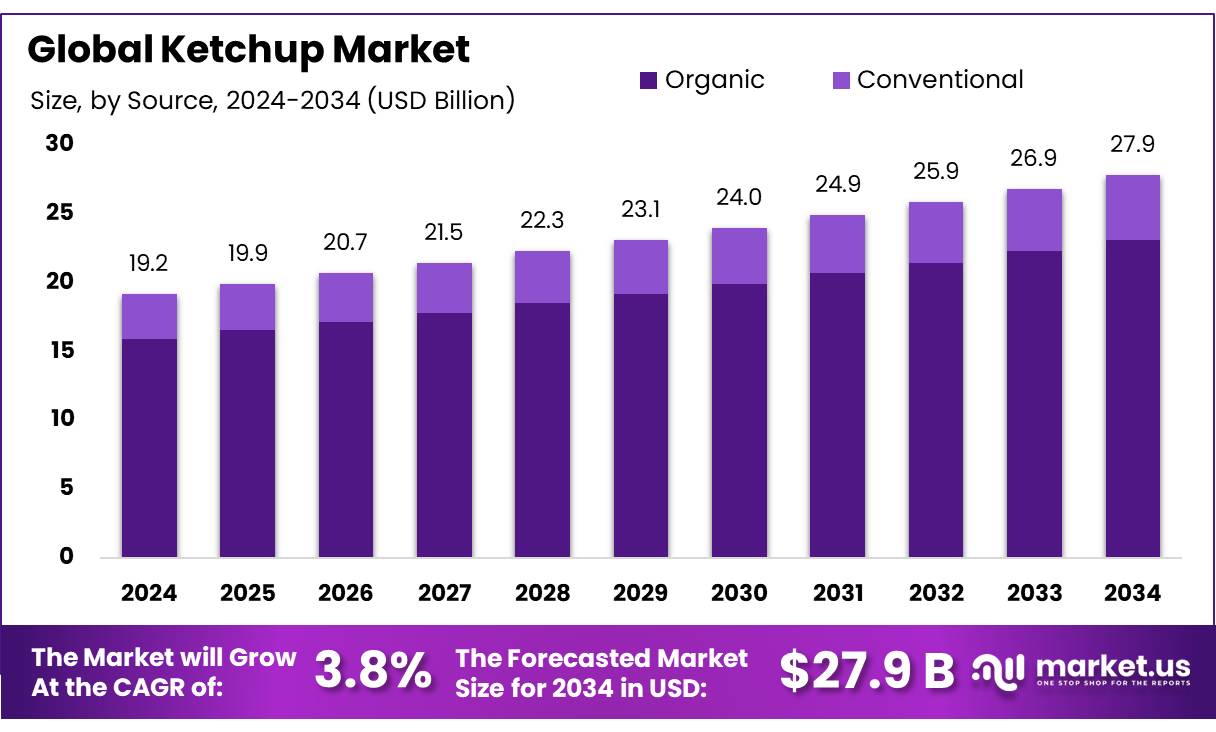

The Global Ketchup Market size is expected to be worth around USD 27.9 billion by 2034, from USD 19.2 billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The Ketchup Market represents a dynamic segment within the condiments industry, characterized by its widespread consumer appeal and adaptability across diverse culinary applications. Ketchup, predominantly tomato-based, serves as a staple condiment in households and food service establishments worldwide, enhancing the flavor of fast foods, snacks, and ready-to-eat meals.

The market thrives on its ability to cater to evolving consumer preferences, with an estimated global volume of 3.6 million tonnes in 2023, reflecting a steady increase from 3.5 million tonnes. This growth trajectory underscores ketchup’s entrenched position in the food industry, supported by its versatility and long shelf life.

This market is shaped by a mix of large-scale manufacturers and regional players, with production concentrated in North America, Europe, and Asia-Pacific, collectively accounting for over 80% of global sales volumes. The industry benefits from robust supply chains, with tomato production a key raw material reaching approximately USD 600.4 million in value for the U.S. fresh market.

Technological advancements in processing and packaging, such as squeezable bottles and single-serve pouches, enhance operational efficiency and meet the demand for convenience, particularly in the food service sector, which drives bulk consumption. Driving factors include rising urbanization, increasing disposable incomes, and the growing popularity of fast food, with 541,642 fast-food restaurants globally reported.

Health consciousness also plays a pivotal role, boosting demand for organic and low-sodium variants, as evidenced by a USD 57.5 billion organic food sales figure in the U.S. Future growth opportunities lie in flavor innovation, such as spicy or regional blends, and expansion into emerging markets.

Key Takeaways

- The global Ketchup Market is projected to reach USD 27.9 billion by 2034, expanding at 3.8% CAGR from 2025-2034.

- Organic ketchup dominates with over 82.60% share, driven by consumer preference for healthy, pesticide-free options.

- Tomato ketchup leads product types, holding over 63.30% share due to widespread usage in homes and restaurants.

- Regular ketchup maintains top category position with more than 73.30% share, favored for its classic tangy-sweet flavor.

- Bottle packaging captures more than 54.7% market share, favored for convenience in storage and usage.

- Indirect sales and B2C distribution channels dominate with over 76.4% share through stores, supermarkets, and online.

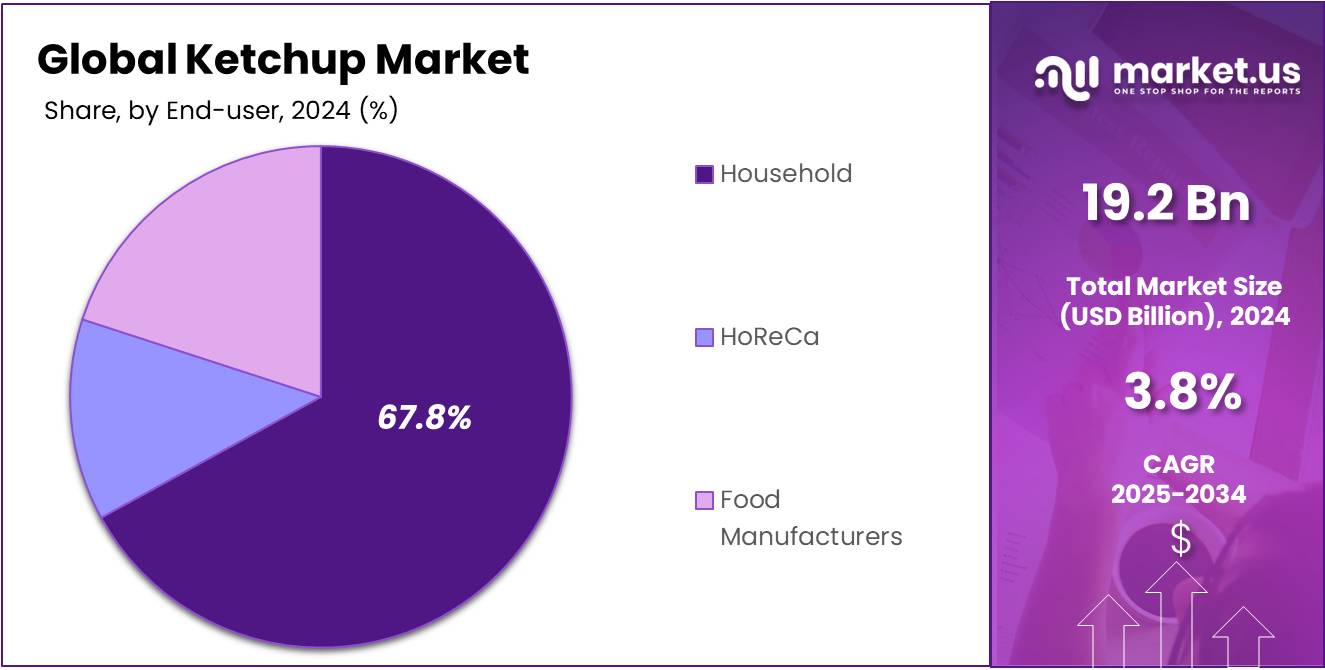

- The household segment leads end-user categories with over a 67.80% share, highlighting ketchup’s staple status in home kitchens.

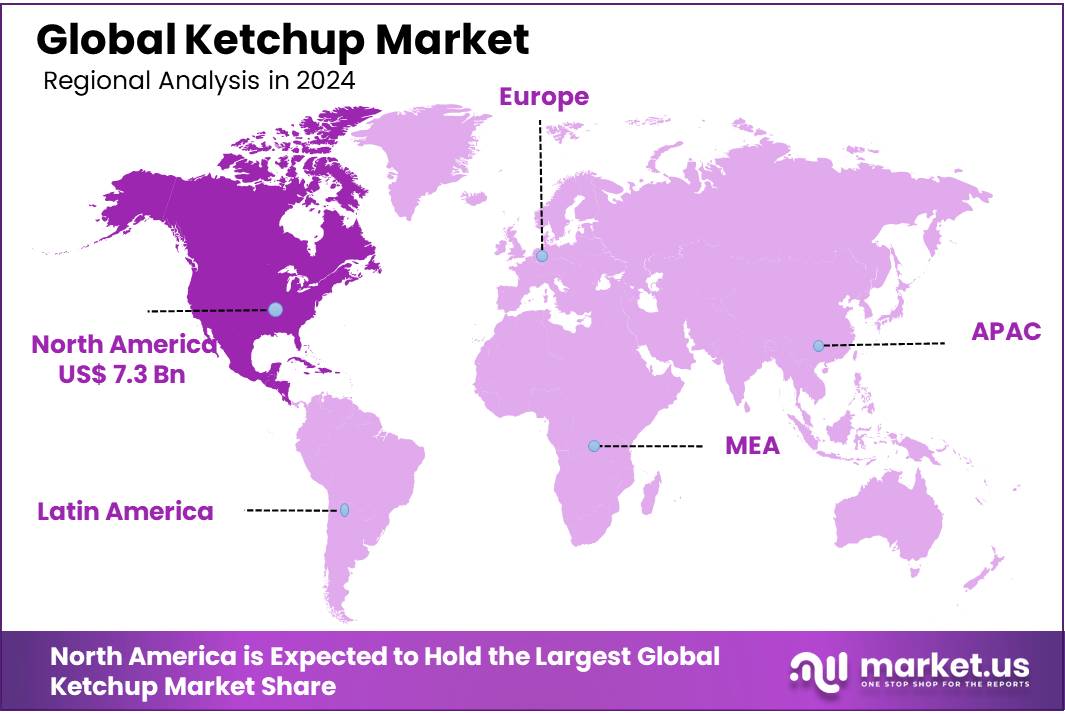

- North America remains the top regional market with a 38.3% share, valued at USD 7.3 billion in 2024, driven by high household consumption.

By Source

Organic Ketchup: Leading the Charge in Health-Conscious Condiments

Organic held a dominant market position, capturing more than an 82.60% share of the ketchup market by source. This segment has taken off as people everywhere look for healthier, cleaner food options. Organic ketchup, made from pesticide-free tomatoes and natural ingredients, has become a go-to choice for families and food lovers who care about what they eat.

Conventional ketchup, while still available, has seen a decline in popularity as shoppers shift toward organic alternatives. The remaining market share belongs to non-organic varieties, which are often priced lower but struggle to compete with the perceived health benefits of organic options.

Looking ahead to 2025, the gap between organic and conventional ketchup is likely to widen further. With more brands launching organic versions and retailers expanding shelf space for these products, organic ketchup is set to strengthen its hold.

By Product Type

Tomato Ketchup: A Market Leader in the Condiment Space

In 2024, Tomato Ketchup held a dominant market position, capturing more than a 63.30% share of the global ketchup market. This segment continues to be the backbone of the industry, loved for its classic taste and wide use in homes, restaurants, and fast-food joints. People everywhere turn to tomato ketchup to add flavor to burgers, fries, and snacks, making it a must-have in kitchens worldwide.

Other varieties like mushroom, spicy, or fruit-based ketchup. While some of these alternatives are gaining niche followings, especially among health-conscious or adventurous eaters, they still can’t compete with tomato ketchup’s mass appeal.

Tomato ketchup is expected to stay on top. Unless major shifts in consumer tastes happen, its dominance isn’t going anywhere. The numbers from 2024 prove that, despite changing trends, people still reach for the classic red bottle more than anything else.

By Category

Regular Ketchup: The Timeless Choice in the Condiment Market

In 2024, Regular held a dominant market position, capturing more than a 73.30% share of the ketchup market by category. This classic ketchup, with its familiar tangy-sweet flavor, remains a favorite in homes, diners, and fast-food spots worldwide.

These alternatives are slowly growing, especially among diabetics and fitness-conscious buyers, but they haven’t come close to overtaking regular ketchup. Some find the taste slightly off, and the higher price doesn’t help either.

Regular ketchup isn’t expected to lose its top spot. Unless sugar taxes or health trends drastically change buying habits, the classic version will keep ruling supermarket shelves and restaurant tables. The numbers from 2024 show that, for now, consumers just aren’t ready to give up their favorite all-purpose condiment.

By Packaging Type

Bottles: The Top Pick in Ketchup Packaging

In 2024, Bottles held a dominant market position, capturing more than a 54.7% share of the ketchup market by packaging type. People love bottles for their convenience easy to squeeze, store, and pour right onto your plate. Whether it’s a big family bottle on the dinner table or a small one at a diner, this packaging rules the roost.

Pouches and other packaging types, like sachets or tubs. While pouches are handy for fast-food joints and on-the-go use, they haven’t taken over at home. Families still want that big bottle sitting on the dinner table.

Bottles aren’t going anywhere. Unless some major packaging revolution hits, they’ll keep dominating simply because people are used to them. The 2024 numbers prove that even with all the new, flashy options out there, when it comes to ketchup, the bottle still wins.

By Distribution Channel

Indirect Sales and B2C: Driving Ketchup to Consumers

In 2024, Indirect Sales and B2C held a dominant market position, capturing more than a 76.4% share of the ketchup market by distribution channel. This segment covers sales through stores, supermarkets, and online shops where folks pick up their ketchup for home use.

The remaining 23.6% went through direct sales and B2B channels, like restaurants buying in bulk or food service suppliers stocking commercial kitchens. While this segment is steady, it can’t compete with the massive retail side of things. After all, households go through way more ketchup than any single business.

Unless there’s a huge shift in how restaurants or food manufacturers operate, regular consumers will keep driving the ketchup market. The 2024 numbers show that when it comes to getting ketchup, the retail side, both in stores and online, is where the real action is.

By End-user

Household: The Heart of Ketchup Consumption Worldwide

In 2024, Household held a dominant market position, capturing more than a 67.80% share of the ketchup market by end-user. This segment is all about families and folks using ketchup at home—dipping fries, topping burgers, or mixing it into recipes. It’s a kitchen staple that’s hard to beat, loved for its familiar taste and easy grab from the fridge.

The food service sector – restaurants, fast food chains, and cafeterias – took a smaller but still significant chunk of the market. While they go through plenty of ketchup, they can’t compete with the collective buying power of millions of households. Industrial users, like food manufacturers who use ketchup as an ingredient, made up the smallest segment.

This breakdown isn’t likely to change much. Unless eating habits transform overnight, households will keep driving the ketchup market. The 2024 numbers prove that when it comes to ketchup, home use is where the real volume is – and that’s not changing anytime soon.

Key Market Segments

By Source

- Organic

- Conventional

By Product Type

- Tomato Ketchup

- Fruit Ketchup

- Mushroom Ketchup

- Mustard Ketchup

- Others

By Category

- Regular

- Flavored

By Packaging Type

- Bottles

- Pouches

- Containers

- Cans

By Distribution Channel

- Direct Sales and B2B

- Indirect Sales and B2C

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

By End-user

- Household

- HoReCa

- Food Manufacturers

Drivers

Rising Demand for Convenience Foods Fuels Ketchup Growth

One major driving factor pushing the ketchup market forward is the growing love for convenience foods. People today are busier than ever—juggling work, family, and everything in between—so quick, easy meals like burgers, fries, and sandwiches have become a lifeline. Ketchup fits right into this trend, adding a burst of flavor with zero hassle.

It’s no surprise that as fast-food chains and ready-to-eat options explode, ketchup sales keep climbing. Families grab it for weeknight dinners, and teens slather it on snacks, making it a kitchen must-have across the globe. In 2024, the numbers tell the story loud and clear.

The Food and Agriculture Organization (FAO) reports that global food demand, especially for processed and convenient options, has spiked as urban populations grow.

Restraints

Rising Raw Material Costs Squeeze the Ketchup Market

One big hurdle holding back the ketchup market is the climbing cost of raw materials, especially tomatoes. For folks who make ketchup, this is a real headache—tomatoes are the heart of the product, and when prices shoot up, it pinches their wallets and ours, too.

Farmers can’t always keep up, and that means higher costs get passed down to the ketchup bottles we grab at the store. It’s a tough spot for an industry that’s all about keeping things affordable and tasty. In 2024, the Food and Agriculture Organization (FAO) flagged how tricky things have gotten, noting that global tomato production costs rose about 8% from 2023 due to weather woes and supply chain snags.

Opportunity

Growing Love for Fast Food Boosts Ketchup Demand

One huge reason the ketchup market keeps growing is how much people crave fast food these days. Burgers, fries, hot dogs you name it, ketchup’s there to make it taste better. With life moving fast, folks want meals they can grab and go, and fast-food joints are popping up everywhere to meet that need.

That’s a lot of ketchup packets! Government moves help too like the U.S. is pushing its National Strategy on Hunger, Nutrition, and Health, which nudges food industries to keep up with demand while balancing nutrition goals. Ketchup fits in as a crowd-pleaser that’s easy to produce and ship out.

Trends

Healthier Ketchup Options Stir Up New Buzz

One big emerging factor shaking up the ketchup market is the push for healthier versions. People aren’t just dunking fries anymore; they’re asking what’s in their ketchup. With more folks watching their sugar, salt, and calories, companies are rolling out low-sugar, low-sodium, and organic options that still taste good.

The Food and Agriculture Organization (FAO) noted that global organic food demand keeps climbing, and ketchup’s catching that wave. Over in the U.S., the Department of Agriculture (USDA) reported organic food sales with condiments like ketchup playing a part. The U.S. National Strategy on Hunger, Nutrition, and Health is all about nudging folks toward smarter eats, and healthier ketchup fits right in.

Regional Analysis

North America Dominates Global Ketchup Market with 38.3% Share of USD 7.3 Billion

North America remains the undisputed leader in the global ketchup market, holding a commanding 38.3% share valued at USD 7.3 billion in 2024. The region’s dominance stems from deeply ingrained consumption habits, with the average American household purchasing 3 ketchup bottles annually.

The Canadian market is also witnessing stable growth due to evolving consumer tastes and a rising immigrant population, which broadens the acceptance of global flavors, further boosting ketchup consumption. Moreover, product innovations such as organic, sugar-free, and spicy variants are gaining momentum among health-conscious and younger demographics, supporting regional expansion.

Supermarket and hypermarket channels remain the largest sales contributors in North America. Ketchup remains a staple in the food service industry, especially across burger chains, delis, and diners, reinforcing demand consistency. The region also benefits from robust supply chains and efficient cold storage infrastructure, ensuring consistent product availability and shelf life extension.

North America’s leadership in the global ketchup market is underpinned by established consumption patterns, innovative product offerings, and a strong retail ecosystem, with the region projected to maintain its top position over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Nestlé S.A. is a global leader in the ketchup market, leveraging its strong brand portfolio and extensive distribution network. The company focuses on innovation, offering organic and reduced-sugar variants to cater to health-conscious consumers. With a presence in over 180 countries, Nestlé benefits from economies of scale and strategic acquisitions. However, competition from regional players and private labels poses a challenge.

- The Kraft Heinz Company owns the iconic Heinz brand, known for its quality and taste. The company commands a significant market share due to strong brand loyalty and aggressive marketing. It expands through product diversification, including no-sugar and spicy ketchup variants. However, Kraft Heinz faces pressure from private-label brands and shifting consumer preferences. Strategic partnerships and global distribution strengthen its competitive edge.

- Unilever competes in the ketchup segment through brands like Hellmann’s, emphasizing premium and organic options. The company targets health-conscious consumers with clean-label products. Unilever’s strong distribution and marketing capabilities enhance its market position. However, it faces stiff competition from Heinz and private labels.

Top Key Players in the Market

- Nestlé S.A.

- The Kraft Heinz Company

- Conagra Brands, Inc.

- FIFCO

- Unilever

- McCormick & Company, Inc

- General Mills, Inc.

- Del Monte Foods, Inc

- Bolton Group

- Premier Foods Limited

- NutriAsia, Inc.

- Baron Foods Ltd

- Geo Watkins

- Jacky’s Pantry

- Condito

- Roleski Sp.J.

- Aliminter S.A.

- Other Key Players

Recent Developments

- In 2024, Nestlé announced advancements in sustainable packaging across its product lines, including sauces and condiments, aligning with its goal to make 100% of its packaging recyclable or reusable by 2025. This initiative indirectly supports its ketchup-related products under brands like Maggi, which offers tomato-based sauces.

- In 2024, the company celebrated the return of Heinz Beanz Beanz Beanz to Canada, alongside ongoing ketchup production updates. A notable development was the investment of £140 million in its Kitt Green plant in the UK, marking the return of Heinz Ketchup production to Britain after decades.

Report Scope

Report Features Description Market Value (2024) USD 19.2 billion Forecast Revenue (2034) USD 27.9 billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Conventional), By Product Type (Tomato Ketchup, Fruit Ketchup, Mushroom Ketchup, Mustard Ketchup, Others), By Category (Regular, Flavored), By Packaging Type (Bottles, Pouches, Containers, Cans), By Distribution Channel (Direct Sales and B2B, Indirect Sales and B2C, Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retail), By End-user (Household, HoReCa, Food Manufacturers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., The Kraft Heinz Company, Conagra Brands, Inc., FIFCO, Unilever, McCormick & Company, Inc, General Mills, Inc., Del Monte Foods, Inc, Bolton Group, Premier Foods Limited, NutriAsia, Inc., Baron Foods Ltd, Geo Watkins, Jacky’s Pantry, Condito, Roleski Sp.J., Aliminter S.A., Other Key Players Customization Scope Customization for segments, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Nestlé S.A.

- The Kraft Heinz Company

- Conagra Brands, Inc.

- FIFCO

- Unilever

- McCormick & Company, Inc

- General Mills, Inc.

- Del Monte Foods, Inc

- Bolton Group

- Premier Foods Limited

- NutriAsia, Inc.

- Baron Foods Ltd

- Geo Watkins

- Jacky's Pantry

- Condito

- Roleski Sp.J.

- Aliminter S.A.

- Other Key Players