Global Packaging Printing Market Size, Share, Growth Analysis By Product (Labels, Flexible Packaging, Corrugated Packaging, Folding Cartons, Others), By Application (Food & Beverages, Healthcare, Consumer Goods, Cosmetics & Toiletries, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143647

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

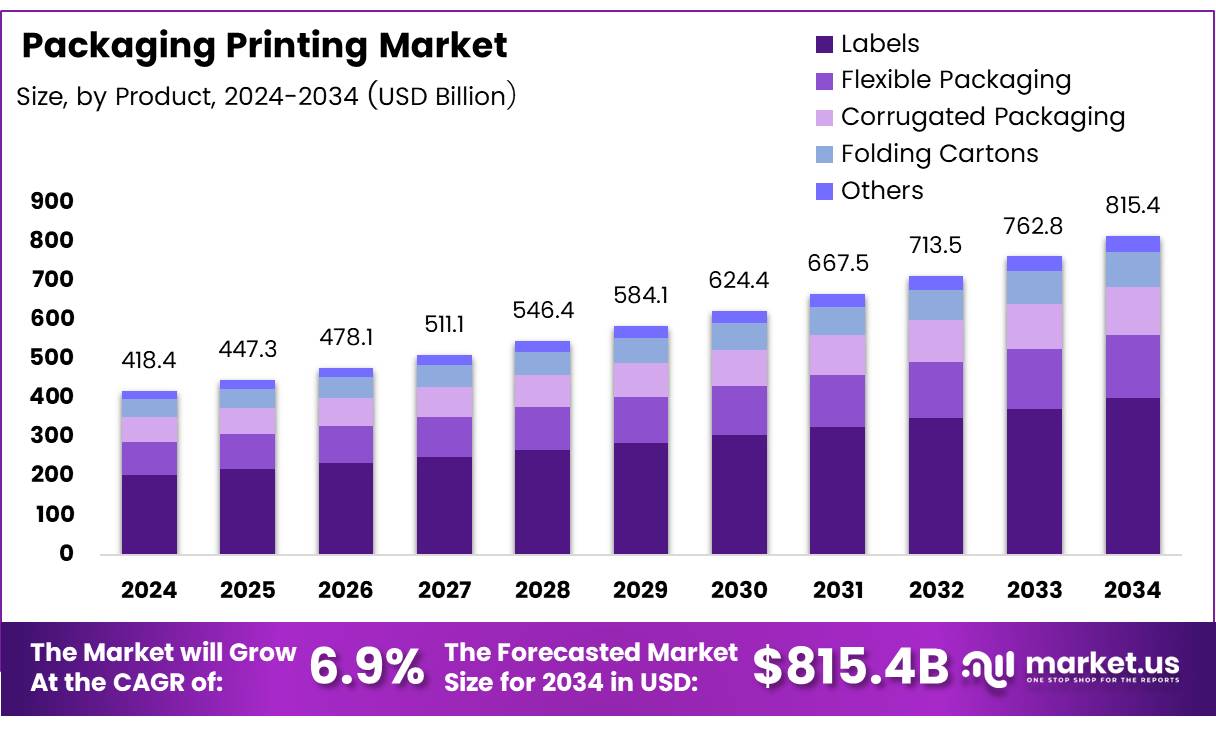

The Global Packaging Printing Market size is expected to be worth around USD 815.4 Billion by 2034, from USD 418.4 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The Packaging Printing Market is a crucial component of the global packaging industry, distinguished by its use of advanced printing technologies to enhance the visual and functional appeal of packaging.

This market employs a variety of printing techniques including digital, flexographic, and gravure, catering to a range of materials such as plastics, metals, and paper. Innovations in printing technology have been instrumental in meeting the evolving standards of aesthetics and functionality required for effective brand differentiation and consumer engagement.

The market is witnessing substantial growth driven by the adoption of innovative technologies such as 3D printing and the Internet of Things (IoT) in traditional printing processes. These advancements are not only enhancing the visual appeal of packaging but also introducing improved tracking and security features, adding significant value for both consumers and manufacturers.

The increasing consumer demand for sustainable and customizable packaging solutions is further encouraging companies to invest in environmentally friendly printing technologies. These technologies comply with stringent environmental regulations and align with the shifting consumer preferences towards sustainability.

Significant growth drivers for the Packaging Printing Market include the booming e-commerce sector, which demands innovative packaging solutions that combine durability with aesthetic appeal to enhance the consumer unboxing experience.

The luxury market segment significantly benefits from high-quality printing solutions, as evidenced by BRPrinters’ report that 61% of consumers are more likely to repurchase a luxury product if it features premium packaging. Moreover, the daily interaction of individuals with over 50 different packaging items, as noted by RocketIndustrial, underscores the continuous and essential demand for printed packaging.

The regulatory landscape is critically shaping the Packaging Printing Market. Governments are enforcing regulations that mandate the use of safe and sustainable packaging materials, driving the industry towards the adoption of recyclable and biodegradable options.

Additionally, government incentives such as subsidies and tax breaks for sustainable practices are supporting market growth. These initiatives not only ensure compliance with environmental standards but also promote a culture of innovation and sustainability within the industry, ensuring its long-term viability and growth.

Key Takeaways

- The global packaging printing market is expected to reach USD 815.4 billion by 2034, growing at a CAGR of 6.9% from 2025 to 2034.

- Labels held the largest share of 35.2% in the product analysis segment in 2024 due to their role in brand identity and information.

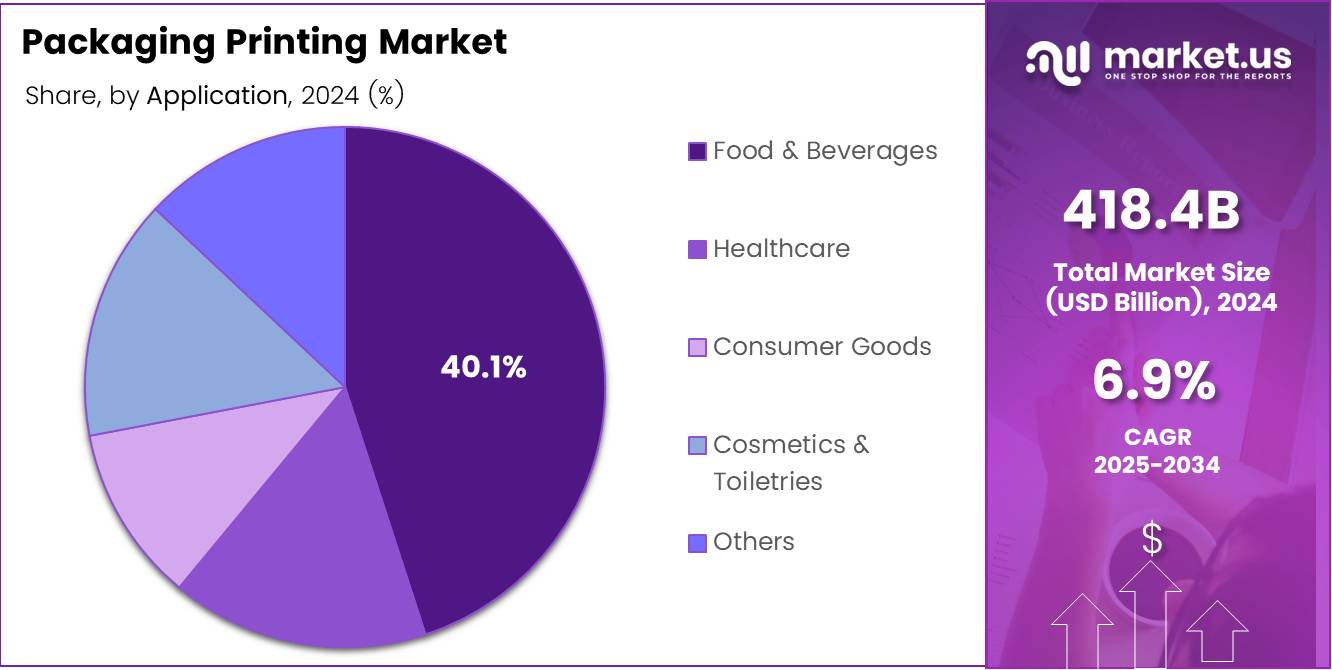

- The food & beverages sector led the application analysis category in 2024 with a 40.1% market share, driven by demand for sustainable packaging.

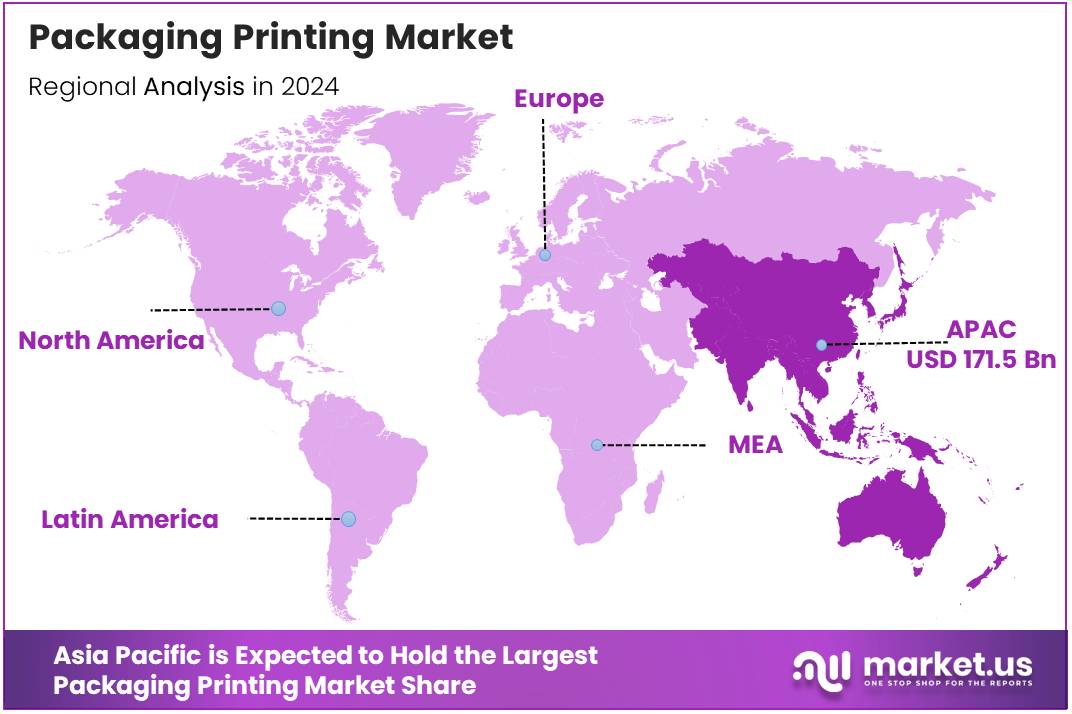

- Asia Pacific dominates the packaging printing market with 41.2% share, valued at USD 171.5 billion in 2024.

Product Analysis

Labels Lead in Packaging Printing with 35.2% Market Share, Driven by Versatility and Branding Necessities

In 2024, labels maintained a dominant position in the By Product Analysis segment of the Packaging Printing Market, commanding a 35.2% share. This prominence can be attributed to the critical role labels play in brand identity and information dissemination. As a result, businesses increasingly invest in high-quality, innovative labeling solutions that offer durability and consumer engagement.

Following labels, flexible packaging emerged as the second most significant category, favored for its adaptability and sustainability. This type of packaging is particularly prevalent in industries where barrier protection and lightweight properties are paramount. Corrugated packaging also captured a substantial market portion, driven by its strength and recyclability, making it ideal for shipping and handling large items.

Folding cartons and other packaging types, although holding smaller shares, are integral to specific market niches. Folding cartons are often chosen for their cost-effectiveness and substantial print area, offering excellent marketing opportunities on retail shelves. The ‘Others’ category, which includes various niche packaging types, continues to evolve with technology, focusing on customization and consumer convenience.

Application Analysis

Food & Beverages Lead Packaging Printing Applications with a 40.1% Market Share

In 2024, the Packaging Printing Market witnessed significant dominance from the Food & Beverages segment, which held a 40.1% market share in the By Application Analysis category. This sector’s commanding presence can be attributed to the escalating demand for sustainable and innovative packaging solutions that ensure food safety and extend shelf life.

The adoption of advanced printing technologies such as digital and flexographic printing has further driven this segment’s growth, catering to the needs for customization and aesthetic enhancement in food packaging.

The Healthcare sector also shows promising growth in packaging printing, driven by stringent regulations for pharmaceutical packaging and the rising demand for patient compliance features in packaging design. Consumer Goods follow closely, utilizing packaging printing to bolster brand visibility and consumer engagement through attractive and informative packaging.

In Cosmetics & Toiletries, packaging printing is crucial for brand differentiation and appeal, leveraging high-quality prints and finishes to attract consumer attention in a competitive market. The Others category, encompassing various industries, continues to explore packaging printing to innovate and add value to their packaging solutions, thereby enhancing overall market growth.

Key Market Segments

By Product

- Labels

- Flexible Packaging

- Corrugated Packaging

- Folding Cartons

- Others

By Application

- Food & Beverages

- Healthcare

- Consumer Goods

- Cosmetics & Toiletries

- Others

Drivers

Rising Demand for Packaged Consumer Goods Boosts Packaging Printing Market

The packaging printing market is experiencing significant growth, primarily driven by the escalating production and consumption of consumer goods. This surge in packaged goods necessitates advanced packaging solutions to ensure product safety, maintain quality, and enhance shelf appeal. Concurrently, technological advancements in printing methods such as digital, flexographic, and 3D printing are revolutionizing the industry.

These innovations not only enhance printing efficiency but also reduce operational costs, making high-quality printing more accessible. Moreover, the need for distinct branding and customization has become crucial for businesses aiming to stand out in a crowded market. Custom packaging printing allows brands to differentiate their products through unique designs and tailored messaging.

Additionally, the exponential growth of e-commerce has amplified the demand for robust and attractive packaging. This trend is driven by the need to protect goods during transit while ensuring they capture consumer attention upon arrival, further fueling the growth of the packaging printing market.

Restraints

Environmental Concerns Over Ink and Packaging Materials May Limit Market Expansion

The packaging printing market faces several challenges, primarily due to rising environmental concerns associated with inks, coatings, and packaging materials. The growing awareness among consumers and regulatory bodies about sustainability has resulted in stricter environmental regulations, creating hurdles for manufacturers using traditional inks and packaging solutions.

Inks containing chemicals that harm the environment or human health are being increasingly scrutinized, pushing companies to seek eco-friendly alternatives. This transition often requires significant investment, impacting smaller businesses that might find adopting sustainable solutions costly.

Additionally, the market is further restrained by the volatility in raw material prices, such as paper, plastic, and inks. These price fluctuations directly affect production costs, making budget planning challenging for companies.

Unpredictable changes in raw material prices can lead to inconsistent profit margins, thus affecting overall market stability. Companies must continuously adapt to these fluctuations, either absorbing costs or passing them onto customers, which can negatively influence demand.

Consequently, both environmental pressures and unstable raw material costs present substantial obstacles that may limit the growth trajectory of the packaging printing market.

Growth Factors

Expansion in Emerging Markets Drives Packaging Printing Growth

The packaging printing market is witnessing significant growth opportunities, particularly due to the expansion in emerging markets. As middle-class populations grow in regions like Asia-Pacific and Latin America, there is a rising demand for consumer goods, which directly influences the need for innovative packaging solutions.

Packaging printing companies can tap into these markets by offering attractive, high-quality, and cost-effective solutions that cater to the growing middle class. Furthermore, the shift toward personalized packaging is opening up new niche markets.

Consumers are increasingly seeking personalized or limited-edition packaging, creating an opportunity for printing companies to create unique designs and packaging formats. Another exciting growth avenue lies in the integration of Internet of Things (IoT) and smart packaging technologies, such as incorporating QR codes, RFID tags, and NFC chips, which offer interactive experiences for consumers and enhance product traceability.

Lastly, sustainable printing solutions are gaining traction as businesses and consumers alike demand eco-friendly options. The use of sustainable materials and eco-friendly inks is not only addressing environmental concerns but also appealing to eco-conscious customers, giving companies an edge in the competitive market. These trends reflect the evolving landscape of the packaging printing industry, offering ample opportunities for growth and innovation.

Emerging Trends

Digital Printing Technologies Revolutionizing Packaging Printing

The packaging printing market is witnessing a shift driven by several emerging trends. One of the most significant is the rise of digital printing technologies, which allow for faster production times and lower setup costs, especially for short-run and customized packaging. This innovation has made it easier for brands to meet consumer demands for personalized and on-demand packaging solutions.

Another trend gaining traction is the demand for smart and interactive packaging, such as the integration of augmented reality (AR) features and QR codes that enhance consumer engagement.

This trend is pushing packaging printing companies to develop new technologies that bring packaging to life. Additionally, there is a growing preference for flexible packaging materials, like pouches and films, which are more versatile and require advanced printing techniques.

As consumers and brands become more conscious of environmental issues, sustainability is also becoming a crucial factor. This has led to the adoption of eco-friendly printing methods, including the use of water-based inks and recyclable materials.

These developments not only align with environmental goals but also meet consumer expectations for sustainable products. The packaging printing market is thus evolving with a focus on innovation, customization, and sustainability, positioning itself to cater to the changing needs of both businesses and consumers.

Regional Analysis

Asia Pacific Leads Packaging Printing Market with 41.2% Share and USD 171.5 Billion

The global packaging printing market is witnessing significant growth, driven by increasing demand for visually appealing, functional, and sustainable packaging solutions. In terms of regional segmentation, Asia Pacific stands as the dominant region, accounting for 41.2% of the global market share, valued at USD 171.5 billion.

The region’s dominance is primarily driven by the rapid industrialization and urbanization in countries like China, India, and Japan. These countries have become global manufacturing hubs, with a substantial rise in consumer goods production. Furthermore, the growing e-commerce sector, coupled with a shift towards eco-friendly packaging, bolsters demand for packaging printing in the region.

Regional Mentions:

In North America, the packaging printing market is also robust, primarily due to technological advancements and the high demand for custom and flexible packaging solutions. The region is expected to see steady growth, driven by innovations in digital printing technologies and an increasing consumer preference for personalized packaging. The market in North America is further supported by a strong consumer base, regulatory support for sustainable packaging, and a growing focus on reducing plastic waste.

In Europe, sustainability trends dominate, with stringent regulations on packaging waste management and recycling. The European packaging printing market is witnessing growth, especially in countries such as Germany, the UK, and France, where there is a notable emphasis on eco-friendly packaging solutions. The shift towards more sustainable packaging materials, along with the growing demand for high-quality printed labels, has led to positive growth trends in the region.

The Middle East & Africa market is experiencing gradual expansion, with increasing investments in packaging printing technologies. Countries like the UAE and Saudi Arabia are becoming key players in the packaging sector, driven by demand from the food and beverage industry, coupled with growing retail markets.

In Latin America, the packaging printing market is poised for growth, driven by increasing urbanization and a rising middle class. While the region is still developing compared to other regions, there is substantial potential due to the growing demand for packaged goods. The market in Latin America is expanding due to technological adoption and the evolving trend of sustainable packaging practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global packaging printing market is set to experience significant growth, with key players continuously shaping the industry’s evolution through technological advancements and sustainability initiatives. Companies like Sun Print Solutions and Virtual Packaging are rising as important regional players, focusing on innovative, eco-friendly printing solutions tailored to the unique demands of diverse industries.

WestRock Company and ITC LIMITED are prominent leaders in the market, offering a broad range of packaging solutions and focusing on incorporating digital printing technologies. This allows them to meet the rising demand for customized, high-quality packaging, particularly in sectors such as food and beverages, personal care, and pharmaceuticals. Their extensive global reach and technological investments position them as critical players in the packaging printing market.

Tetra Pak, recognized for its leadership in the food packaging sector, continues to innovate with sustainable packaging materials and advanced printing technologies, helping companies deliver environmentally responsible products.

Likewise, Rainbow Packaging and Transcontinental Inc. focus on providing integrated packaging solutions with an emphasis on digital printing, which enables enhanced brand recognition and improved supply chain efficiency.

DuPont and Sealed Air bring cutting-edge technologies in materials and printing processes, making strides in packaging performance while also addressing environmental concerns. Regional players like Parksons Packaging LTD, Shree Arun Packaging Company, and Arihant Packaging play crucial roles in catering to local market needs and contribute to the industry’s diverse growth.

Top Key Players in the Market

- Sun Print Solutions

- Virtual Packaging

- WestRock Company

- ITC LIMITED

- Tetra Pak

- Rainbow Packaging

- Transcontinental Inc.

- DuPont

- Sealed Air

- Oliver, Inc.

- Parksons Packaging LTD

- Shree Arun Packaging Company Private Limited

- Arihant Packaging

- International Paper

- Belmont Packaging Ltd.

- Uniflex

Recent Developments

- In April 2024, Velox secured $38 million in funding, led by Fortissimo Capital, to accelerate the development of its cutting-edge semiconductor technologies. This investment aims to expand Velox’s capabilities and support its innovative solutions in the tech industry.

- In October 2024, the White House announced a $1.6 billion competition focused on advancing the U.S. semiconductor industry’s packaging technologies under the CHIPS Act. This initiative seeks to strengthen domestic production and innovation in semiconductor manufacturing.

- In September 2024, Notpla, a leader in sustainable packaging, secured $26.8 million in Series A+ funding to scale its seaweed-based packaging solutions. The funding will be used to accelerate production and expaand its environmental impact in the packaging sector.

Report Scope

Report Features Description Market Value (2024) USD 418.4 Billion Forecast Revenue (2034) USD 815.4 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Labels, Flexible Packaging, Corrugated Packaging, Folding Cartons, Others), By Application (Food & Beverages, Healthcare, Consumer Goods, Cosmetics & Toiletries, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sun Print Solutions, Virtual Packaging, WestRock Company, ITC LIMITED, Tetra Pak, Rainbow Packaging, Transcontinental Inc., DuPont, Sealed Air, Oliver, Inc., Parksons Packaging LTD, Shree Arun Packaging Company Private Limited, Arihant Packaging, International Paper, Belmont Packaging Ltd., Uniflex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Packaging Printing MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Packaging Printing MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-