Global API Security Testing Tools Market Size, Share, Statistics Analysis Report By Type (Manual API Security Testing, Automated API Security Testing), By Deployment (Cloud Based, On Premises), By Enterprise Size (Small & Medium Enterprise Size, Large Enterprises), By Industry (IT & Telecom, Banking, Financial Services and Insurance (BFSI), Retail & E-commerce, Healthcare, Aerospace & Defence, Others (Manufacturing, Media & Entertainment)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: December 2024

- Report ID: 136582

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

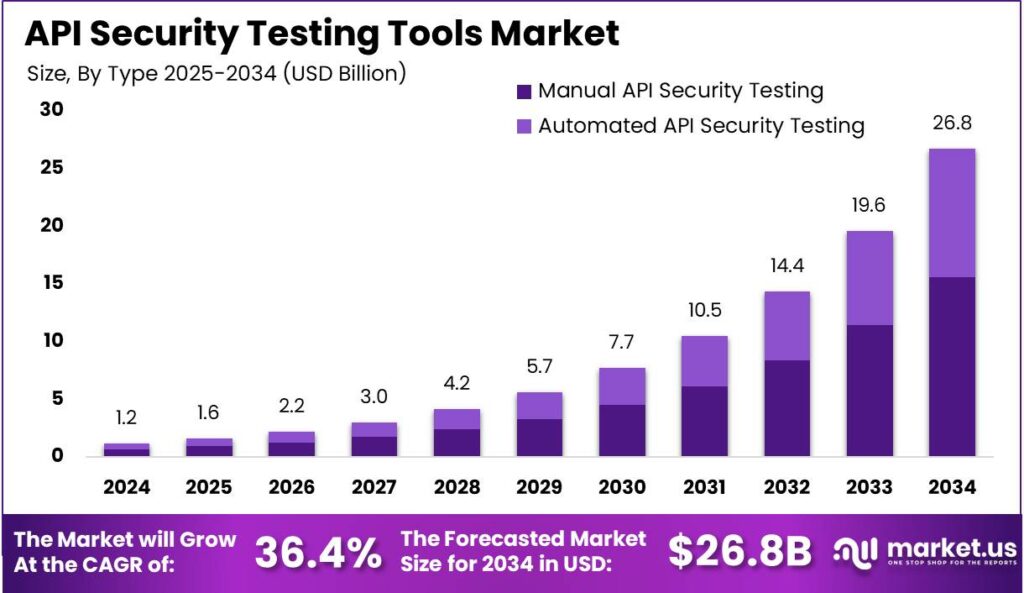

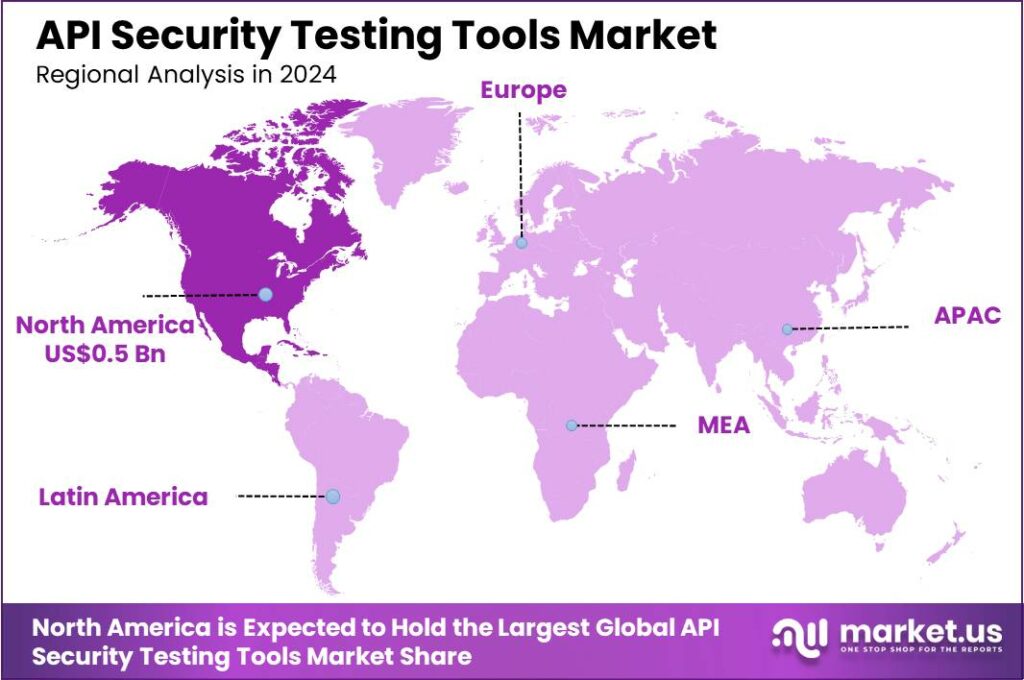

The Global API Security Testing Tools Market size is expected to be worth around USD 26.8 Bn By 2034, from USD 1.2 Bn in 2024, growing at a CAGR of 36.40% during the forecast period from 2025 to 2034. In 2024, the market in North America demonstrated a robust presence, securing a dominant share of over 44.4% and generating revenues amounting to USD 0.5 bn. The U.S. stood out with its market size reaching a significant USD 458.2 Mn.

API Security Testing Tools are essential for safeguarding applications that interact through APIs. These tools come in different types, each addressing various aspects of security. Static Security Testing (SST) scans an API’s source code to detect insecure coding practices, while DST involves simulating attacks to identify runtime vulnerabilities. Another critical type is Software Composition Analysis, which checks for vulnerabilities within an API’s open-source components

The market for API Security Testing Tools is growing, driven by the increasing reliance on APIs for business applications and the consequent rise in security breaches. These tools help organizations protect sensitive data and comply with regulations by identifying and mitigating security threats in API integrations. The market is expanding due to the widespread adoption of cloud technologies and the shift towards microservices architecture, which rely heavily on APIs.

Several factors are propelling the demand for API security testing tools. The foremost among these is the heightened need for robust security measures due to the surge in API-driven applications and the associated risk of data breaches.

Additionally, regulatory pressures to ensure data protection and privacy, such as GDPR and HIPAA, compel organizations to adopt advanced security solutions. Technological advancements in machine learning and artificial intelligence also enhance these tools’ capability to predict, detect, and respond to threats more effectively.

Opportunities in the API Security Testing Tools market are vast. The ongoing shift towards digital transformation in various sectors, including finance, healthcare, and retail, provides a substantial market for these tools. Furthermore, the integration of API security testing into DevOps practices (a strategy known as “shift left”) offers a proactive approach to security, catching vulnerabilities earlier in the software development lifecycle, thereby saving costs and reducing risk.

According to Vanson Bourne’s recent survey, 98% of enterprise leaders believe APIs play a critical role in driving their organization’s digital transformation. An equally impressive 97% agree that having a strong API strategy is essential for ensuring future revenue and business growth. These findings highlight just how integral APIs have become in today’s digital-first landscape.

However, the risks associated with APIs are also significant. The financial impact of API security breaches can be devastating – take, for example, the case of Kronos Research in November 2023, where a cyberattack resulted in $26 million worth of cryptocurrency being stolen. Incidents like these underline the importance of proactive API security.

The 2023 API Security Report by Palo Alto Networks further reveals that 94% of organizations identify the ability to detect APIs handling sensitive data as a must-have security feature. This focus has driven an increase in the adoption of API security testing tools, as businesses aim to prevent breaches and maintain trust. By setting clear standards and investing in robust testing, organizations are not only safeguarding their data but also fostering broader adoption of API best practices.

API security testing tools have gained popularity due to the escalating number of API-related security incidents reported in recent years. As awareness of these risks increases, companies are prioritizing the adoption of advanced security measures. The popularity of these tools is also influenced by the development of more sophisticated and user-friendly solutions that can be seamlessly integrated into existing security systems.

Technological advancements are significantly shaping the API Security Testing Tools market. AI and machine learning are being leveraged to automate complex testing procedures and improve the accuracy of vulnerability detection. Additionally, the evolution of cloud-native technologies promotes the development of more scalable and flexible security testing solutions that can easily integrate with rapidly changing cloud environments

Key Takeaways

- The Global API Security Testing Tools Market size is projected to reach USD 26.8 Billion by 2034, up from USD 1.2 Billion in 2024, growing at a CAGR of 36.40% during the forecast period from 2025 to 2034.

- In 2024, the Manual API Security Testing segment dominated the market, accounting for more than 58.4% of the global API Security Testing Tools market share.

- The On-Premises segment also held a dominant position in 2024, capturing more than 64.0% of the API security testing tools market.

- The Large Enterprises segment led the market in 2024, with a share of more than 67.3% in the API security testing tools market.

- In 2024, the IT & Telecom segment dominated the API security testing tools market, capturing more than 34.5% of the market share.

- North America held a dominant market position in 2024, with a share of more than 44.4% and revenues reaching USD 0.5 billion in the API Security Testing Tools market.

Type Analysis

In 2024, the Manual API Security Testing segment held a dominant market position, capturing more than a 58.4% share of the global API Security Testing Tools market. This leadership can be attributed to several factors that emphasize the continued preference for manual testing methodologies in specific contexts.

Manual API security testing allows for a more nuanced understanding of complex API behaviors which automated tools might overlook. This type of testing employs skilled security professionals who can think creatively to identify and exploit security vulnerabilities that are not typically predictable or rule-based.

Manual testing is highly valued in scenarios where customized APIs are developed. These APIs often require specific knowledge and a tailored testing approach that automated tools cannot provide. Manual testers adjust their testing strategies based on the unique configurations and business logic of each API, which enhances the effectiveness of the security measures.

Manual testing is crucial for compliance with strict regulatory standards in industries like banking and healthcare, where APIs manage sensitive data. It ensures all security requirements are met, something automated tools may not fully address due to regulatory complexities.

Deployment Analysis

In 2024, the On-Premises segment held a dominant position in the API security testing tools market, capturing more than a 64.0% share. This segment’s leadership can be attributed to several key factors that resonate with the security policies and infrastructure requirements of large enterprises and organizations handling sensitive data.

One of the primary reasons for the preference for on-premises solutions is the enhanced control over security protocols and data management. Companies in industries such as banking, healthcare, and government are particularly cautious about data sovereignty and security, making on-premises tools a preferred choice.

On-premises deployment allows for better customization to meet specific security needs, enabling integration with existing operations. This level of tailoring is harder to achieve with standardized cloud-based tools.

Concerns about cloud security, despite improvements, drive demand for on-premises API security testing tools. While cloud solutions offer scalability and cost-efficiency, risks like third-party access and multi-tenancy deter many organizations from using them.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position in the API security testing tools market, capturing more than a 67.3% share. This significant market share can be attributed to the extensive adoption of API security solutions by large enterprises, which are increasingly prioritizing robust cybersecurity measures to protect their substantial digital infrastructures.

Large organizations typically handle a higher volume of sensitive data and maintain complex API ecosystems, necessitating advanced security testing tools to prevent data breaches and ensure compliance with stringent regulatory standards.

The preference for API security testing tools among large enterprises is further driven by their capacity to invest in comprehensive, cutting-edge technologies. These organizations often have the financial resources to implement state-of-the-art security solutions that provide extensive coverage across multiple API gateways and endpoints.

Additionally, the leadership of large enterprises in the API security testing tools market is supported by their ability to engage with vendors for customized solutions. Unlike smaller businesses, these large entities can leverage their purchasing power to influence the development of tailored security testing frameworks that are specifically designed to meet their unique organizational needs.

Industry Analysis

In 2024, the IT & Telecom segment held a dominant market position in the API security testing tools market, capturing more than a 34.5% share. This prominence is primarily due to the critical need for secure communication channels and data transfer protocols within these highly digital and network-reliant industries.

As IT and telecommunications companies expand their infrastructure to support increasing volumes of data and enhance service delivery, the necessity for stringent API security to prevent data breaches and ensure uninterrupted services becomes paramount.

Moreover, the IT & Telecom industry is at the forefront of technological advancements, including the deployment of 5G, IoT, and cloud technologies, all of which rely heavily on APIs for seamless integration and performance.

This reliance makes APIs a prime target for cyber threats, thereby driving the demand for robust security testing tools in the sector. The segment’s leadership in the market is further reinforced by the ongoing innovation in API technologies, requiring continuous updates to security protocols to protect against emerging vulnerabilities.

Key Market Segments

By Type

- Manual API Security Testing

- Automated API Security Testing

By Deployment

- Cloud Based

- On Premises

By Enterprise Size

- Small & Medium Enterprise Size

- Large Enterprises

By Industry

- IT & Telecom

- Banking, Financial Services and Insurance (BFSI)

- Retail & E-commerce

- Healthcare

- Aerospace & Defence

- Others (Manufacturing, Media & Entertainment)

Driver

Increasing Dependence on APIs in Modern Software Architectures

The proliferation of Application Programming Interfaces (APIs) has become a cornerstone in contemporary software development, facilitating seamless communication between diverse systems and applications.This integration helps businesses improve functionality, streamline operations, and enhance user experiences.

Consequently, the imperative to ensure the security of these APIs has intensified, leading to a heightened demand for robust API security testing tools. These tools are essential in identifying vulnerabilities, preventing potential breaches of interconnected systems.

As organizations increasingly rely on APIs to drive innovation and operational efficiency, the market for API security testing solutions is poised for significant growth, driven by the necessity to safeguard critical digital assets.

Restraint

Complexity of API Architectures and Testing Challenges

The evolution of intricate API architectures, such as microservices and hybrid models, has redefined the boundaries of efficiency and scalability. These architectures break down applications into smaller, interconnected services, offering unparalleled flexibility and performance improvements. However, this complexity presents a unique set of challenges for API testing.

Microservices, for instance, operate independently yet in tandem, necessitating a testing approach that encompasses individual service functionality and seamless integration. This multi-layered structure demands a meticulous and comprehensive testing strategy, addressing the internal mechanics of each service and its collective orchestration.

Opportunity

Advancements in Automated API Security Testing Solutions

The increasing complexity of API ecosystems has spurred the development of sophisticated automated API security testing tools. These solutions are designed to efficiently identify vulnerabilities, ensure compliance with security standards, and integrate seamlessly into continuous integration and continuous deployment (CI/CD) pipelines.

By automating the testing process, organizations can achieve comprehensive coverage, reduce manual effort, and accelerate the detection and remediation of security issues. This advancement presents a significant opportunity for businesses to enhance their security posture, maintain the integrity of their APIs, and build trust with users by proactively safeguarding sensitive data and functionality.

Challenge

Ensuring Comprehensive Test Coverage Amidst Rapid API Evolution

As systems become more interconnected and feature-rich, APIs grow in complexity, making it harder to ensure that every edge case and user workflow is tested. The key to addressing this challenge is prioritization.

Focus on testing critical features and user journeys that have the greatest impact on your application’s functionality. Automation tools are invaluable here, allowing you to run repetitive tests efficiently and giving testers more time to focus on complex scenarios and edge cases. This approach will guarantee that the most important functionality is always validated.

Emerging Trends

API security testing tools are evolving to address the increasing complexity of modern applications. One notable trend is the integration of artificial intelligence (AI) and machine learning (ML) to enhance testing capabilities. These technologies enable tools to intelligently detect vulnerabilities and adapt to new threats, improving overall security.

Another emerging trend is the adoption of cloud-based API testing platforms. These platforms offer scalability and cost-effectiveness, allowing organizations to efficiently manage and test APIs without significant infrastructure investments.

In February 2024, Invicti Security and Mend.io announced a strategic partnership, bringing together a full suite of tools for application and supply chain security. This collaboration combines Invicti’s expertise in IAST (Interactive Application Security Testing), DAST (Dynamic Application Security Testing), and API security testing, with Mend.io’s capabilities in SCA (Software Composition Analysis), SAST (Static Application Security Testing), and container security.

Additionally, the shift-left approach is gaining traction, emphasizing the importance of incorporating security testing early in the development process. By identifying and addressing vulnerabilities during the initial stages, organizations can reduce risks and enhance the overall quality of their APIs.

Business Benefits

Implementing API security testing tools offers several business benefits. They help protect sensitive data by identifying and mitigating vulnerabilities that could lead to unauthorized access or data breaches. This protection is crucial for maintaining customer trust and complying with data protection regulations.

These tools enhance operational efficiency by automating the detection of security flaws, reducing the need for manual testing. Automation accelerates the development process, allowing teams to focus on other critical tasks and bring products to market faster.

Additionally, these tools facilitate compliance with industry standards and regulations by ensuring that APIs adhere to security best practices. Compliance helps avoid legal penalties and enhances the organization’s reputation.

Regional Analysis

In 2024, North America held a dominant market position in the API Security Testing Tools market, capturing more than a 44.4% share with revenues amounting to USD 0.5 billion. This prominence is driven by several compelling factors that highlight the region’s advanced technological landscape and robust digital infrastructure.

North America, particularly the United States, is home to a large number of technology firms, including major players in the software development and cybersecurity sectors. This concentration of tech companies fosters a strong demand for API security testing tools to safeguard vast amounts of sensitive data transferred across APIs.

The region’s strict data protection laws, like the CCPA and federal regulations, require robust security measures. This legal framework drives organizations to invest in advanced API security testing tools to ensure compliance and avoid penalties, fueling market growth.

Additionally, the high incidence of cyber threats in North America has heightened awareness and proactive measures among enterprises regarding API security. Companies are increasingly recognizing the critical need for comprehensive security testing to protect against sophisticated cyber attacks, leading to increased adoption of both manual and automated testing tools in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The API Security Testing Tools market features several key players that are significantly shaping industry trends with their innovative solutions.

Traceable Inc. stands out in the market for its cutting-edge approach to API security. Traceable Inc. focuses on using machine learning techniques to detect and block sophisticated attacks on APIs. Their platform provides deep visibility into API activity, allowing businesses to trace the root cause of vulnerabilities and breaches.

Wallarm Inc. is a key player in API security, offering an automated platform that protects APIs, applications, and microservices from various threats. Its solutions excel in real-time threat detection and mitigation, ideal for businesses in dynamic, high-risk environments.

Noname Security rounds out the list of top players with its comprehensive API security platform. Noname Security specializes in holistic API protection, offering capabilities that range from security testing and runtime protection to posture management.

Top Key Players in the Market

- Traceable Inc.

- Wallarm Inc.

- Noname Security

- Cequence Security, Inc.

- 42Crunch Ltd

- Salt Security

- APIsec

- Synopsys, Inc.

- Alphabet Inc.

- Akamai Technologies, Inc.

- Appknox, Xysec Labs

- StackHawk Inc.

- Imperva (Thales)

- Others

Top Opportunities Awaiting for Players

The API security testing tools market is burgeoning with opportunities for industry players, propelled by several dynamic factors and market trends.

- Cloud-Based Solutions: The shift towards cloud-based deployment is gaining momentum. This trend not only facilitates scalability and accessibility but also reduces operational costs associated with physical infrastructures. Companies focusing on cloud-based API security testing solutions are positioned to meet the rising demand across various sectors.

- Integration with AI and Machine Learning: The incorporation of artificial intelligence (AI) and machine learning (ML) in API security tools is revolutionizing the way vulnerabilities are detected and mitigated. By leveraging AI and ML, companies can offer more predictive and proactive security solutions, enhancing their market competitiveness.

- Expansion in the Retail and Consumer Goods Sector: The retail and consumer goods sector is witnessing a substantial growth in the adoption of API security testing tools, driven by the need to protect sensitive customer data and ensure transaction security. Companies focusing on this vertical can tap into significant growth opportunities.

- Focus on Small and Medium Enterprises (SMEs): While large enterprises continue to be significant users of API security testing tools, SMEs are emerging as a rapidly growing customer base. Offering tailored solutions that cater to the budget constraints and specific needs of SMEs could open new revenue streams for providers in this space.

- Geographical Expansion in High-Growth Regions: Regions like Asia Pacific are expected to exhibit high growth rates due to increased digitalization and the rising incidence of cyber threats. Companies expanding their operations and distribution networks in these regions could gain substantial market share.

Recent Developments

- In March 2024, F5 has enhanced its Distributed Cloud Services with automated reconnaissance and penetration testing tools, its acquisition of Heyhack. These features help customers secure the rapidly growing number of applications and APIs in today’s expanding multicloud environments.

- In May 2024, Akamai Technologies announced its intent to acquire Noname Security, an API protection startup, for $450 million. The deal was completed on June 25, 2024, strengthening Akamai’s position in the API security market.

- In November 2024, Snyk, a developer security company, acquired Probely, a startup specializing in dynamic application security testing (DAST) for APIs and web applications. This acquisition aims to enhance Snyk’s platform by integrating modern DAST capabilities, thereby improving support for AI-related development.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 26.8 Bn CAGR (2025-2034) 36.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Manual API Security Testing, Automated API Security Testing), By Deployment (Cloud Based, On Premises), By Enterprise Size (Small & Medium Enterprise Size, Large Enterprises), By Industry (IT & Telecom, Banking, Financial Services and Insurance (BFSI), Retail & E-commerce, Healthcare, Aerospace & Defence, Others (Manufacturing, Media & Entertainment)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Traceable Inc., Wallarm Inc., Noname Security, Cequence Security, Inc., 42Crunch Ltd, Salt Security, APIsec, Synopsys, Inc., Alphabet Inc., Akamai Technologies, Inc., Appknox, Xysec Labs, StackHawk Inc., Imperva (Thales), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  API Security Testing Tools MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

API Security Testing Tools MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Traceable Inc.

- Wallarm Inc.

- Noname Security

- Cequence Security, Inc.

- 42Crunch Ltd

- Salt Security

- APIsec

- Synopsys, Inc.

- Alphabet Inc.

- Akamai Technologies, Inc.

- Appknox, Xysec Labs

- StackHawk Inc.

- Imperva (Thales)

- Others