Global Voice-based Payments Market Size, Share, Statistics Analysis Report By Component (Software, Hardware), By Enterprise (Large Enterprises, SMEs), By End-Use (BFSI, Automotive, Healthcare, Retail, Government, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 134700

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insights

- Impact of AI on Voice based Payments

- Component Analysis

- Enterprise Analysis

- End Use Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

The Global Voice-based Payments Market size is expected to be worth around USD 20.5 Billion by 2033, from USD 7.1 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38% share, holding USD 2.7 Billion revenue.

Voice-based payments refer to a financial transaction method where voice recognition technology is utilized to authenticate and execute monetary transactions. This technology allows consumers to make payments by speaking commands to a device, such as a smartphone, smart speaker, or any other voice-enabled interface. The simplicity and convenience of using voice commands for transactions cater to a broad audience, spanning tech-savvy users to those with physical or visual impairments.

The market for voice-based payments is expanding as businesses and consumers seek more seamless and frictionless transaction methods. This market segment benefits from the growing integration of voice-assisted devices into daily life, such as Amazon Echo and Google Home, which facilitate consumer interactions through voice commands, including shopping and banking.

The growth of the voice-based payments market can be attributed to several factors. Enhanced consumer convenience, improved accessibility for disabled individuals, and the integration of advanced security features like biometric voice recognition that ensures safe transactions, all contribute to this expansion. Additionally, the proliferation of IoT devices and smart home technologies encourages more users to adopt voice-activated payment solutions.

Market demand for voice-based payments is driven by the desire for faster and more convenient payment methods. As lifestyles become increasingly digital and mobile-oriented, consumers are looking for ways to streamline their transactions. Voice-based payments answer this demand by providing a quick, hands-free payment option that can be integrated into various devices and platforms.

Significant market opportunities exist in enhancing the interoperability of voice payment systems across different platforms and regions. As voice recognition technology becomes more sophisticated, there is potential for expansion into new markets and sectors, such as healthcare for patient services billing and in public transportation for contactless fare payments.

According to Nimble AppGenie, Voice payments have been steadily gaining traction over the years, especially in the United States. Back in 2017, 8% of adults in the U.S. used voice payments, but this figure was projected to grow to an impressive 31% by 2022. Globally, voice assistants are also becoming a popular tool for shopping, with 53% of smartphone users expressing interest in using them for making purchases.

One of the key benefits is the efficiency they bring – voice payments can cut checkout times by 50% compared to entering card details manually. For people with disabilities, voice payments offer a much-needed ease of use, with 46% finding them simpler than traditional payment methods. It’s clear that voice technology is becoming a part of daily life, with 31% of the global population now using voice assistants regularly.

Technological advancements are central to the evolution of the voice-based payments market. Developments in AI and machine learning have vastly improved the accuracy and security of voice recognition systems. These technologies help in distinguishing unique voice patterns, reducing the risk of fraud, and increasing user trust in voice-activated payment systems.

Key Insights

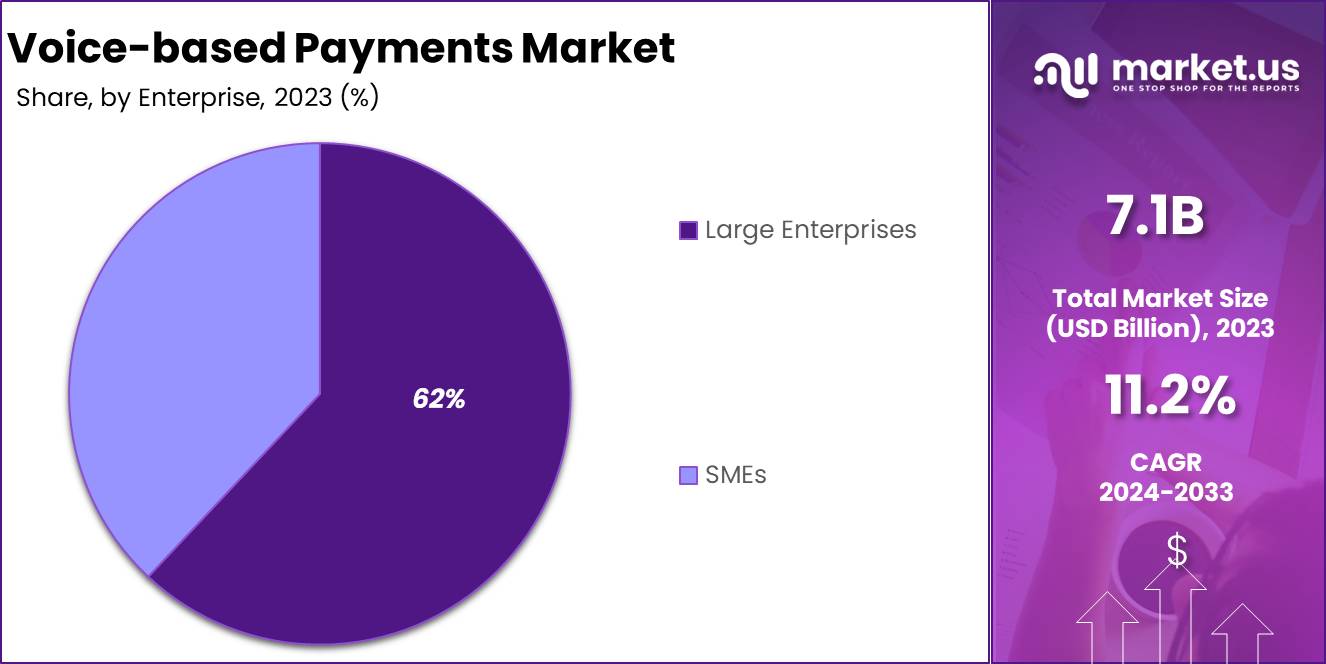

- The market is projected to grow significantly, reaching a value of USD 20.5 billion by 2033, up from USD 7.1 billion in 2023, with an impressive CAGR of 11.2% from 2024 to 2033.

- Software dominates the market, accounting for over 78% share in 2023. This indicates strong demand for advanced solutions to enable voice-driven transactions.

- Large enterprises lead the way, contributing more than 62% of the market share in 2023. These organizations are leveraging voice technology to streamline operations and enhance customer experiences.

- The BFSI sector (Banking, Financial Services, and Insurance) remains a key player, holding over 35% of the market share in 2023. This highlights the sector’s focus on secure and convenient payment options.

- North America continues to dominate, securing a market share of more than 38% in 2023. The region’s advanced infrastructure and early adoption of innovative payment technologies are driving this leadership.

Impact of AI on Voice based Payments

AI tends to impact the voice based payments systems significantly by improving voice recognition accuracy, enabling seamless and error free transactions. Machine learning algorithms adapt to diverse accents and languages, ensuring a broader user base can access the technology.

AI driven biometric authentication strengthens security by identifying unique voice patterns, reducing the fraud risks. It also facilitates personalized payment experiences, such as tailored recommendations or reminders based on user behaviour and preferences.

The integration of AI with natural language processing allows for more intuitive interactions, making voice based payments user friendly. Furthermore, AI’s predictive analytics optimizes transaction processing times and offers proactive support. These advancements positions AI as a critical enabler in expanding the adoption and efficiency of voice based payment systems across industries.

Component Analysis

In 2023, the software component of the voice-based payments market held a dominant position, capturing more than a 78% share. This dominance is primarily driven by the continuous advancements in software technologies that enhance the functionality and security of voice-based payment systems.

Software in this market includes the applications that process and authenticate voice commands, which are integral to the operation of voice-based payment solutions. The increasing integration of artificial intelligence (AI) and machine learning (ML) has significantly improved the accuracy and reliability of voice recognition systems, thereby fostering greater trust and adoption among users.

Moreover, the shift towards digital and contactless payment solutions has accelerated the demand for sophisticated voice payment software. This shift is particularly noticeable in consumer behavior, as more people adopt virtual assistants and smart devices that support voice commands for transactions. This trend is not only about convenience but also about providing a safer, contactless alternative to traditional payment methods, which has become especially relevant in the post-pandemic era.

The software segment’s growth is also supported by significant investments from major tech companies in enhancing their voice payment platforms. These companies are continually developing new features and improvements that make transactions more secure and user-friendly. For instance, advancements in encryption and tokenization enhance the security of transactions, addressing one of the primary concerns users have regarding digital payment methods.

Overall, the future of the software segment in voice-based payments looks promising, with ongoing technological advancements and a growing emphasis on creating seamless, secure, and efficient user experiences driving the market forward.

Enterprise Analysis

In 2023, the Large Enterprises segment of the voice-based payments market held a dominant position, capturing over 59% of the global revenue, showcasing its significant influence within the industry. This dominance is largely attributed to their robust financial capabilities which allow for the adoption of advanced technologies including voice-based payment systems.

Large corporations are increasingly integrating these systems to streamline operations and enhance customer service, recognizing the efficiency and convenience of voice-activated transactions. Large Enterprises are motivated to implement voice-based payments as part of their broader digital transformation strategies. These firms often operate on a scale where even minor enhancements in transaction processing can result in substantial cost savings and improved customer satisfaction.

Moreover, partnerships between large enterprises and tech giants are commonplace, facilitating the integration of voice technology into their operations. For instance, notable collaborations, such as Walmart with Google, have set precedents in utilizing voice commands to simplify shopping processes, demonstrating the practical benefits of this technology in large-scale operations.

The inclination towards voice-based payment solutions in large enterprises is also driven by the need for better security and fraud prevention measures. As these organizations handle significant volumes of transactions, the adoption of advanced voice recognition technologies that offer enhanced security protocols is a critical factor. This adoption is part of a larger trend towards contactless and frictionless customer interactions, which have been accelerated by the ongoing global shift towards digital services.

On the other hand, the Small & Medium Enterprises (SMEs) segment is expected to register the fastest growth in the voice-based payments market during the forecast period. This growth is spurred by the digital transformation initiatives that SMEs are increasingly undertaking to remain competitive. The lower cost of entry for implementing voice-based technologies and the operational efficiencies they bring are particularly appealing to SMEs striving for growth and enhanced service delivery in a cost-effective manner.

End Use Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment of the voice-based payments market maintained a strong leadership position, capturing over 35% of the market share. This dominance is primarily due to the essential role that digital innovation plays in the BFSI sector, where speed, security, and efficiency are paramount.

Financial institutions are increasingly adopting voice-based technologies to provide better customer service and streamline operations, integrating virtual assistants like Siri, Google Assistant, and Alexa into their systems to facilitate hands-free transactions and enhance user engagement. The trend towards digital banking and the rising consumer preference for quick and secure transaction methods have significantly contributed to the growth of this segment.

Many banks and financial institutions are implementing voice payment solutions to offer more accessibility and convenience to their customers. This not only helps in improving the customer experience but also addresses the growing demand for advanced technological integration in banking services.

Moreover, the BFSI sector’s focus on enhancing security measures and personalizing customer interactions through voice technology is evident from the continuous upgrades and integrations being made in this field. Institutions within this sector are keen on adopting voice-based payment solutions that can perform a range of functions from basic account inquiries to complex transaction commands, all aimed at providing a seamless and secure user experience.

The ongoing advancements in AI and machine learning further bolster the use of voice-based payment solutions in BFSI, making them more reliable and efficient. As these technologies evolve, they improve the accuracy of voice recognition systems, thereby reducing errors and enhancing security, which is crucial for maintaining trust in the financial sector.

Key Market Segments

By Component

- Software

- Hardware

By Enterprise

- Large Enterprises

- SMEs

By End-Use

- BFSI

- Automotive

- Healthcare

- Retail

- Government

- Others

Driver

Increasing Consumer Preference for Convenience

The voice-based payments market is experiencing significant growth, driven by the increasing consumer demand for convenience in financial transactions. This trend is fueled by the broader adoption of voice-assisted technologies across various platforms, including mobile devices and home assistants.

As everyday devices become more integrated with voice recognition capabilities, consumers are finding voice-based payments not only convenient but also time-saving and user-friendly. This shift is particularly noticeable in environments where hands-free operation is preferred, such as during driving or cooking, making voice commands a practical alternative to traditional payment methods.

Restraint

Security and Privacy Concerns

Despite the advantages, security and privacy concerns are significant restraints in the voice-based payments market. The very nature of voice-based transactions, which often rely on transmitting sensitive information via potentially unsecured networks, raises concerns about data privacy and vulnerability to cyber threats. Consumers are wary of the risks associated with voice data interception or misuse, especially given the increasing sophistication of cyber-attacks.

These security challenges are compounded by the inherent issues of voice recognition technologies, such as their ability to inadvertently capture background conversations or misinterpret commands, leading to unauthorized transactions or data breaches. Addressing these security concerns is crucial for the continued adoption and trust in voice-based payment technologies.

Opportunity

Expansion into Banking and eCommerce

There is a growing opportunity for the expansion of voice-based payment technologies into the banking and eCommerce sectors. As these sectors continuously seek to enhance customer experience and streamline transaction processes, voice-based payments can offer a competitive edge by providing a faster, more engaging way to handle transactions.

Financial institutions and eCommerce platforms are increasingly leveraging voice technology to offer innovative services such as voice-activated banking advice, shopping using voice commands, and personalized customer service. This adoption is driven by the need to meet customer expectations for quick and easy transaction methods and the desire to capitalize on the latest technological advancements to stay ahead in competitive markets.

Challenge

Technological and Linguistic Barriers

One of the major challenges facing the voice-based payments market is overcoming technological and linguistic barriers. The effectiveness of voice recognition technology varies significantly across languages, dialects, and accents, making it difficult to provide a uniformly efficient service on a global scale.

Moreover, the technology’s ability to accurately understand and process user commands is crucial for ensuring transactional reliability and user trust. Continuous advancements in natural language processing and AI are required to enhance the accuracy and adaptability of voice systems to different linguistic nuances. Overcoming these barriers is essential for the widespread adoption of voice-based payment systems, particularly in diverse and multilingual regions.

Growth Factors

The voice-based payments market is set to expand significantly, propelled by several key growth factors. Primarily, advancements in artificial intelligence (AI) and natural language processing (NLP) technologies have greatly enhanced the efficiency and accuracy of voice recognition systems, making them more appealing to users and businesses alike.

These technologies allow for smoother and more intuitive user interactions, which are crucial in facilitating quick and secure transactions via voice commands. Another significant driver is the increasing consumer demand for convenience and faster transaction methods. This demand is particularly strong in scenarios where traditional hands-on interaction is inconvenient, such as during driving or cooking.

Voice-based payment solutions address this need by enabling users to make payments without diverting their attention from their current tasks, thus blending seamlessly into various aspects of daily life. Moreover, the integration of voice-based technologies across a wide range of devices, including smartphones and smart home systems, has broadened the accessibility and utility of voice payment options.

This widespread integration is supported by the growth in the IoT (Internet of Things), which connects an array of devices to the internet, providing multiple touchpoints for consumers to engage with voice payment systems.

Emerging Trends

Emerging trends in the voice-based payments market include the growing integration of these systems within the automotive sector, where hands-free payment options are becoming increasingly necessary. Car manufacturers are incorporating voice-activated systems that allow drivers to pay for services such as fuel, parking, or tolls without the need to use physical payment methods or mobile apps.

Another trend is the personalization of voice payment experiences, where systems recognize individual users’ voices and tailor the interaction based on their transaction history and preferences. This personalization enhances user engagement and can lead to a higher adoption rate.

There is also a noticeable trend towards the use of blockchain and other secure platforms to enhance the security of voice-based transactions. These technologies help in mitigating some of the inherent security risks associated with voice-based payments, such as fraud or unauthorized access, by providing robust encryption and authentication protocols.

Business Benefits

For businesses, the adoption of voice-based payment systems offers numerous benefits. These systems can significantly enhance the customer experience by offering a quick, intuitive, and hands-free method to conduct transactions, which can increase customer satisfaction and loyalty. Additionally, voice payments can reduce the operational costs associated with physical and traditional digital payment methods by minimizing the need for physical infrastructure like POS (Point of Sale) systems and the labor to manage those systems.

Voice-based systems also gather valuable data on consumer preferences and behaviors, which businesses can analyze to improve their services and tailor their offerings to better meet customer needs. This data-driven approach can help businesses stay competitive in a rapidly evolving digital marketplace.

Furthermore, voice payment technologies can help businesses expand their reach to include customers who may have barriers to using traditional payment methods, such as the visually impaired, thereby enhancing inclusivity and opening up new market segments.

Regional Analysis

In 2023, North America maintained a strong leadership position in the voice-based payments market, capturing more than a 38% share and generating revenue of approximately USD 2.7 billion. This region’s dominance can be attributed to several factors that collectively foster an environment conducive to the growth of voice-based payment technologies.

One significant driver is the high penetration of smartphones and smart home devices across North America, coupled with a tech-savvy population that is quick to adopt new digital solutions. The prevalence of devices enabled with virtual assistants like Amazon Alexa, Google Assistant, and Apple Siri facilitates the integration and acceptance of voice-driven financial transactions.

Moreover, North America benefits from the presence of major technology innovators and market leaders such as Amazon, Google, and PayPal, who are continually advancing the capabilities of voice recognition technologies. These companies not only push the technological envelope but also ensure that there is robust infrastructure support for secure and reliable transactions. Their efforts are complemented by a regulatory environment that generally supports digital innovation, further accelerating the region’s market growth.

The region’s consumers demonstrate a strong preference for convenience and security in transactions, which voice-based payments can provide. This consumer behavior has been critical in driving the adoption of voice-based payment systems in various sectors, including retail and banking. The push towards contactless transactions, especially highlighted during the COVID-19 pandemic, has also played a role in accelerating the adoption of these technologies in North America.

Overall, North America’s advanced technological infrastructure, strong presence of key market players, supportive regulatory environment, and consumer readiness all contribute to its leading position in the global voice-based payments market. The region is expected to maintain this dominance as it continues to innovate and expand the capabilities and applications of voice-based payment technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Key Players Analysis

The analysis of key players in the voice-based payments market reveals a competitive landscape dominated by major technology and financial services companies. Notable players include Google, Apple, Amazon, and Alibaba, each offering proprietary voice-assisted payment solutions such as Google Assistant, Siri, Amazon Alexa, and Alipay, respectively.

Google LLC has been proactive in enhancing its voice payment capabilities, especially through its Google Assistant platform. A notable development was the introduction of new functionalities allowing users to make payments directly via voice commands on Google’s Home smart devices. This feature not only simplifies the transaction process but also integrates voice match biometrics to enhance security during transactions, reflecting Google’s commitment to combining innovation with user safety.

Amazon.com, Inc. has continued to expand its voice payment solutions integrated within its Alexa ecosystem. The company focuses on creating seamless user experiences, such as allowing consumers to conduct transactions hands-free, which is becoming an integral part of the digital homes. Amazon’s consistent drive towards integrating voice-based payments into everyday life showcases its strategy to dominate the household technology space.

PayPal remains a major player in the voice-based payments arena, with strategic moves aimed at expanding its services and reach. The company has been part of significant acquisitions aimed at enhancing its technological stack and broadening its market influence. For instance, PayPal’s acquisition strategy includes purchasing companies that complement its existing services, thereby enhancing its product offerings and competitive edge in the digital payments landscape.

Top Key Players in the Market

- Amazon.com, Inc.

- PayPal

- Paysafe

- PCI Pal

- Vibepay

- Cerence

- Alibaba

- Apple Inc.

- Microsoft Corporation (Cortana)

- Other Key Players

Recent Developments

- In February 2024, Fintech major Razorpay made a series of product announcements, which include an upgraded payment gateway, a point-of-sale (PoS) device, a marketing stack, and an AI (artificial intelligence) assistant for payments and payrolls. The company also said that it recorded a total payment volume of $150 billion in 2023.

- In September 2024, The National Payments Corporation of India (NPCI) on Wednesday launched a slew of new payment options on the popular payments platform UPI, including conversational transactions.

Report Scope

Report Features Description Market Value (2023) USD 7.1 Bn Forecast Revenue (2033) USD 20.5 Bn CAGR (2024-2033) 11.2% Largest Market North America (USD 2.7Bn) Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Hardware), By Enterprise (Large Enterprises, SMEs), By End-Use (BFSI, Automotive, Healthcare, Retail, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc., PayPal, Paysafe, PCI Pal, Vibepay, Cerence, Google, Alibaba, Apple Inc., Microsoft Corporation (Cortana), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Voice-based Payments MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Voice-based Payments MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon.com, Inc.

- PayPal

- Paysafe

- PCI Pal

- Vibepay

- Cerence

- Alibaba

- Apple Inc.

- Microsoft Corporation (Cortana)

- Other Key Players