Global Industrial PC Market Analysis, Decision-Making Report By Type (Rack Mount IPC, Panel IPC, DIN Rail IPC, Embedded IPC), By Sales Channel (Indirect Sales, Direct Sales), By End-User (Discrete Industries (Automotive, Aerospace & Defense, Semiconductor & Electronics, Medical Device, Others), Process Industries (Chemical, Energy & Power, Oil & Gas, Food & Beverage, Pharmaceutical, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144476

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Analysts’ Viewpoint

- Impact of AI

- China Industrial PC Market

- APAC Industrial PC Market Size

- By Type Analysis

- By Sales Channel Analysis

- By End-user Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

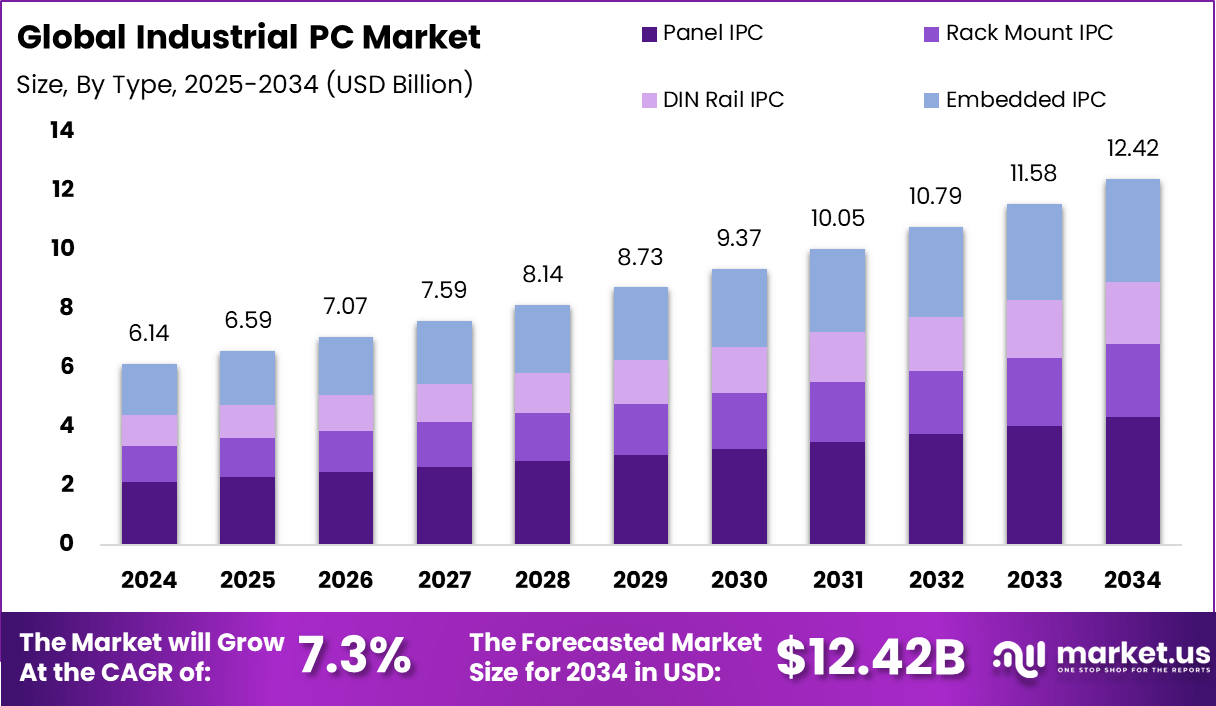

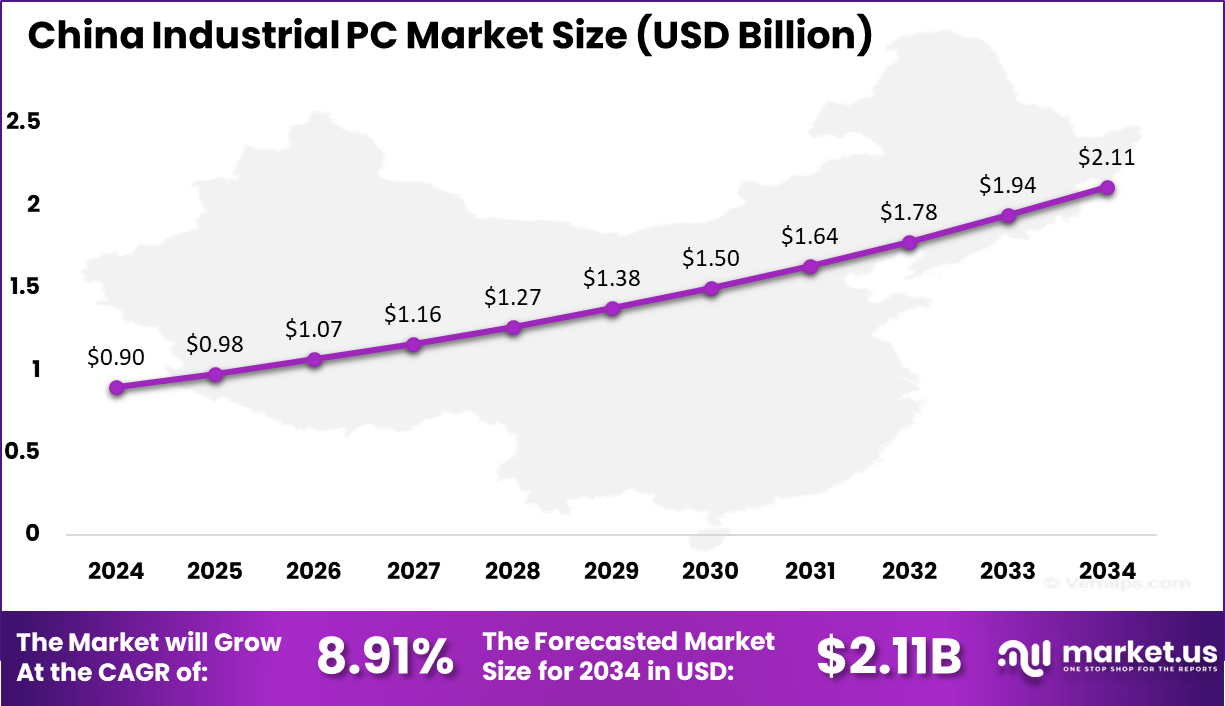

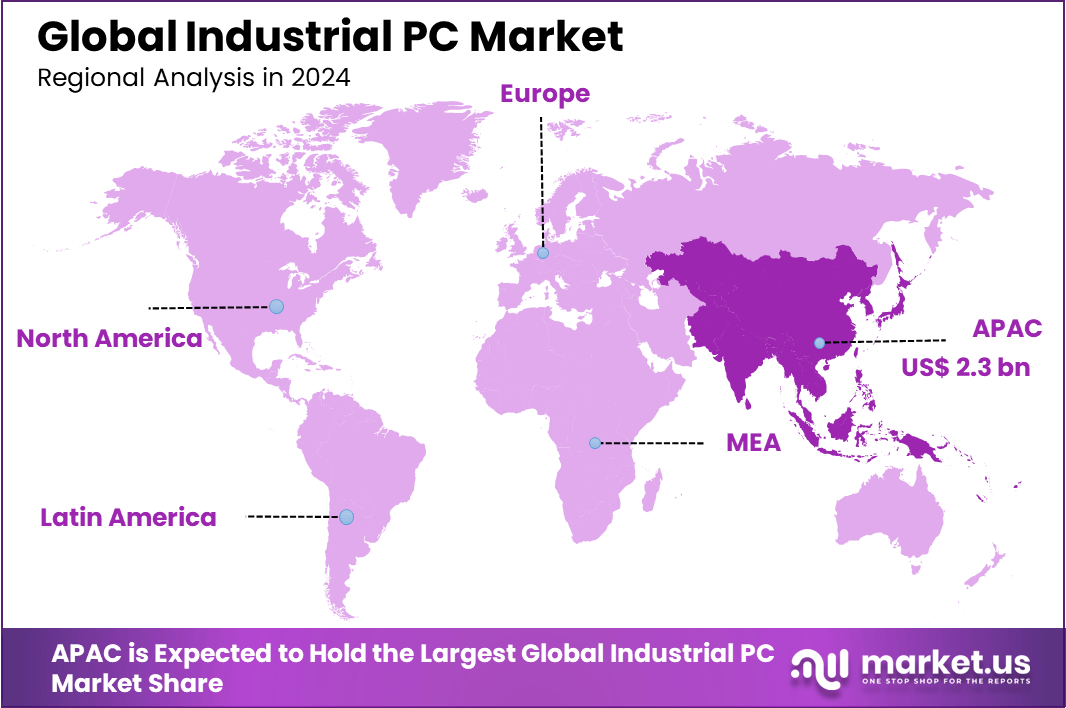

The Industrial PC Market size is expected to be worth around USD 12.42 Billion By 2034, from USD 6.14 billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 38.7% share, holding USD 2.3 Billion revenue. The China Industrial PC Market Size was exhibited at USD 0.90 Billion in 2024 with CAGR of 8.91%.

The Industrial PC market is driven by the increasing need for robust computing solutions that can operate effectively under the tough conditions of industrial environments. As industries push for higher efficiency and automation, the demand for IPCs continues to grow. This growth is facilitated by the evolution of smart manufacturing practices, also known as Industry 4.0, which integrates digital and physical systems.

The primary drivers of the industrial PC market include the surge in IoT adoption and the increased use of robotics. IoT devices enhance manufacturing and product quality through advanced monitoring, while robotics advancements lead to more efficient automated processes. These factors are boosting the need for industrial PCs that can handle complex tasks and real-time processing in industrial environments

There is a notable trend towards adopting advanced technologies such as IoT, big data, and machine learning within industrial settings. IPCs are crucial in handling the data-intensive tasks required by these technologies, offering powerful processing capabilities and real-time performance necessary for effective machine control and data analysis.

Organizations opt for Industrial PCs primarily due to their reliability, durability, and adaptability to harsh environments. The ability to customize IPCs to meet specific industrial needs, along with their compatibility with various industrial software applications, makes them invaluable in modern industrial operations.

The demand for Industrial PCs is expected to surge as industries continue to embrace automation and digital technologies. Investment opportunities are particularly promising in sectors that are at the forefront of adopting Industry 4.0 technologies. Moreover, the development of IPCs that can seamlessly integrate with next-generation industrial applications presents a significant growth avenue for manufacturers and investors alike.

Industrial PCs offer numerous business benefits including enhanced process control, improved system reliability, and reduced operational costs through minimized downtime. Their ruggedness and longevity also mean that investments in IPC technology can yield returns over a longer period compared to standard PCs.

Key Takeaway

- The Global Industrial PC Market is projected to reach a value of USD 12.42 billion by 2034, rising from USD 6.14 billion in 2024. The market is expected to grow at a robust CAGR of 7.3% during the forecast period from 2025 to 2034.

- The Asia-Pacific (APAC) region dominated the market landscape in 2024, capturing a substantial 38.7% market share. This equates to a revenue of approximately USD 2.3 billion.

- Notably, China played a pivotal role within the APAC region, exhibiting a market size of USD 0.90 billion in 2024 and demonstrating an impressive CAGR of 8.91%.

- Among various types, Panel IPCs emerged as the most preferred, holding a significant share of 34.8%. The adoption of panel IPCs is driven by their user-friendly interfaces and adaptability in various industrial environments.

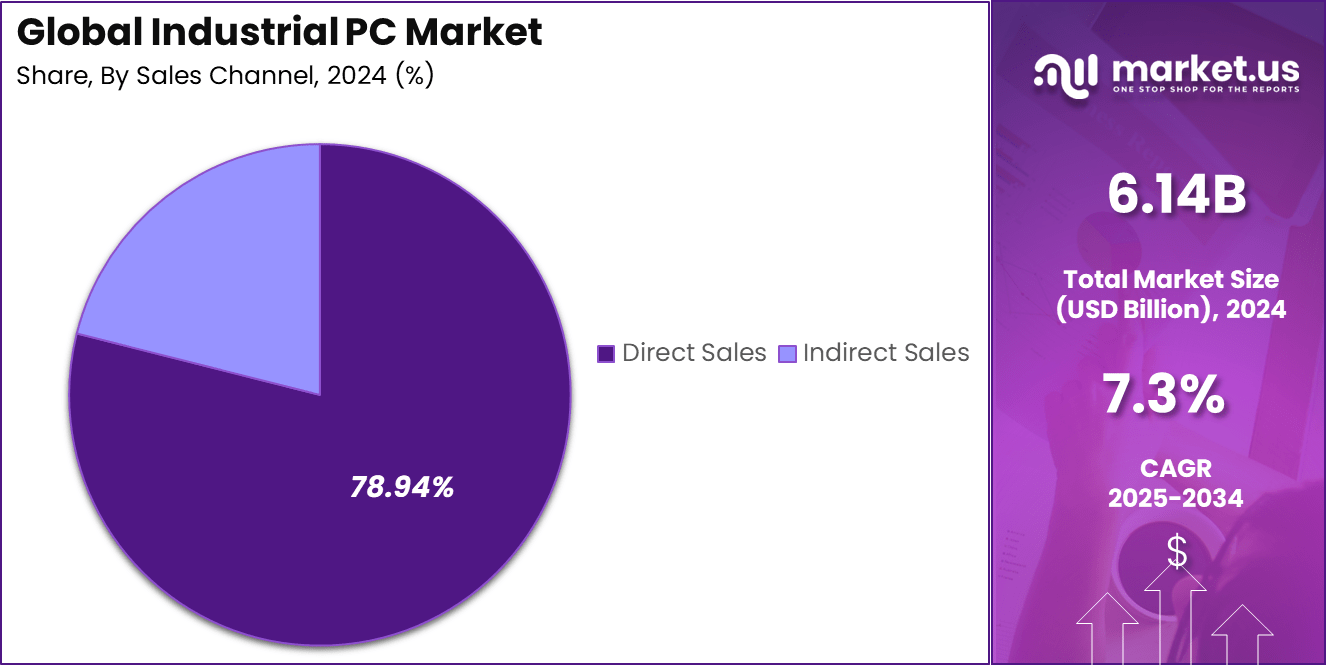

- The direct sales channel accounted for the lion’s share, comprising 78.94% of the total market revenue. Direct sales continue to dominate due to stronger customer relationships and higher profit margins.

- Discrete industries held a commanding position, representing 65.7% of the market share. This segment is driven by increasing automation and the growing demand for high-performance computing in manufacturing processes.

Analysts’ Viewpoint

Current trends in the Industrial PC market include the shift towards fanless designs, which enhance the reliability and longevity of the systems by eliminating one of the common points of failure – cooling fans. Additionally, there is a growing preference for compact and energy-efficient IPCs that can be easily integrated into existing industrial setups without requiring extensive modifications.

Factors such as the increasing complexity of industrial processes, the need for high system uptime, and the stringent requirements for operational safety and regulatory compliance significantly impact the market. These factors drive the development of more sophisticated IPC solutions designed to meet the evolving demands of industrial environments.

The design and operation of Industrial PCs are heavily influenced by various regulatory standards that ensure safety, reliability, and environmental compliance. These standards guide manufacturers in producing IPCs that can operate safely and effectively in regulated environments, thus ensuring that these devices meet the stringent requirements of industrial applications.

Impact of AI

The impact of Artificial Intelligence (AI) on the Industrial PC (IPC) market is profound and multifaceted, demonstrating significant transformations across various dimensions:

- Enhanced Operational Efficiency: AI integration in IPCs significantly boosts operational efficiency. With capabilities for real-time data processing and analysis, IPCs can now offer immediate insights, leading to more informed decision-making and faster responses to operational changes. This enhancement is crucial in sectors like manufacturing, where time and accuracy are paramount.

- Predictive Maintenance: AI technologies enable IPCs to predict equipment failures before they occur, minimizing downtime and maintenance costs. This predictive capability is achieved through continuous monitoring and data analysis, which can forecast potential system failures and schedule maintenance proactively.

- Increased Automation: AI-driven IPCs facilitate higher levels of automation. They play a critical role in controlling and optimizing automated processes, from simple machine operations to complex production workflows. This not only improves productivity but also enhances the reliability and quality of manufacturing outputs.

- Improved Safety and Monitoring: With AI, IPCs can enhance safety protocols within industrial settings. They can monitor environmental conditions and ensure compliance with safety standards, significantly reducing the risk of accidents and enhancing worker safety.

- Scalability and Future-proofing: The modular nature of modern IPCs, combined with AI capabilities, allows for easy scalability and future upgrades without extensive modifications. This adaptability ensures that industrial systems remain up-to-date with the latest technological advancements, safeguarding investments over the long term.

China Industrial PC Market

The China Industrial PC Market is valued at approximately USD 0.90 Billion in 2024 and is predicted to increase from USD 0.98 Billion in 2025 to approximately USD 2.11 Billion by 2034, projected at a CAGR of 8.91% from 2025 to 2034.

The industrial PC market in China is undergoing significant growth, which can be attributed to several key factors:

- Technological Advancements: The increasing adoption of advanced technologies in discrete industries, which include automotive, aerospace, semiconductor, and electronics, is a major driver. These sectors are leveraging industrial PCs to enhance process flexibility, efficiency, and to reduce operational costs.

- Rising Automation in Manufacturing: There is a noticeable trend towards automation across various manufacturing sectors within China. Industrial PCs are crucial in managing complex manufacturing processes, ensuring real-time operational control, and optimizing production.

- Government Initiatives and FDI: Supportive government policies and foreign direct investments are enhancing the manufacturing capabilities of the region. Initiatives aimed at boosting domestic manufacturing and upgrading industrial technology are pivotal.

- Market Competitiveness: Leading players in the industrial PC market are continually innovating and expanding their product lines to meet the specific demands of this growing market. Companies are focusing on technology, as well as mergers, acquisitions, and partnerships to enhance market presence and meet diverse industrial needs.

APAC Industrial PC Market Size

In 2024, the Asia-Pacific (APAC) region held a dominant position in the industrial PC market, capturing more than a 38.7% share with revenues amounting to USD 2.3 billion.

This leading stance can be attributed to several pivotal factors:

- Rapid Industrialization and Technological Adoption: APAC is characterized by rapid industrial growth and widespread adoption of cutting-edge technologies. Countries like China, Japan, South Korea, and Taiwan are leading in semiconductor, electronics manufacturing, and automotive industries, all of which extensively utilize industrial PCs to enhance manufacturing processes and automation.

- Government Support and Investments: Governments across the region have been instrumental in promoting industrial growth through significant investments and supportive policies. Initiatives aimed at modernizing infrastructure and boosting manufacturing capabilities have led to increased investments in automation and computing technologies.

- Increasing Foreign Direct Investment (FDI): APAC has become an attractive destination for foreign direct investments in the manufacturing sector. Policies favoring economic liberalization and the presence of a skilled workforce have encouraged multinational companies to set up production facilities in the region.

- Demand for High-Performance Computing: The region’s focus on sectors such as high-tech medical equipment, automotive, and consumer electronics has heightened the need for high-performance computing solutions. Industrial PCs, known for their reliability, durability, and advanced computing capabilities, are increasingly employed to meet these demands, ensuring that APAC continues to lead in market adoption.

By Type Analysis

In 2024, the Panel IPC segment demonstrated its market strength by securing a dominant position with over a 34.8% share of the global Industrial PC market. This leadership can be attributed to several compelling advantages that Panel IPCs offer across various industries.

Panel IPCs are renowned for their compact design, integrating the display and computing units into a single housing. This integration not only saves space but also simplifies installation and maintenance, making them particularly attractive in environments where space is at a premium.

Industries such as automotive, manufacturing, and energy frequently opt for Panel IPCs due to their ergonomic design and modularity, which are essential for efficient operation and adaptability to different industrial applications.

The robust growth in the Panel IPC segment is further propelled by their adaptability and the increasing trend towards smart manufacturing. With the rise of Industry 4.0, there is a growing demand for more integrated and user-friendly interfaces in industrial settings.

Panel IPCs meet these needs effectively by offering touch screen options and customizable interfaces that enhance user interaction and operational control. This capability is vital for industries looking to leverage real-time data and automation to optimize their production processes and improve productivity.

Moreover, innovations in Panel IPC technology have expanded their functionality and durability, making them suitable for harsh industrial environments. These IPCs are designed to withstand extreme conditions, including exposure to dust, moisture, and vibrations, without compromising performance.

By Sales Channel Analysis

In 2024, the Direct Sales segment held a dominant market position in the Industrial PC market, capturing more than a 78.9% share. This prominence is largely due to the direct engagement between manufacturers and end-users, facilitating tailored solutions that meet specific customer needs.

Direct Sales channels are particularly beneficial in the Industrial PC market because they allow manufacturers to offer extensive customization and technical support directly to their clients. This is crucial in industries where specific configurations and software integrations are necessary for the industrial PCs to function optimally within specialized industrial environments.

Direct interaction with customers also enables manufacturers to better understand and respond to the unique challenges and requirements of different industries, leading to improved product development and customer satisfaction.

Furthermore, Direct Sales channels help in building long-term relationships with key industry players, which is vital for sustaining sales growth and gaining strategic insights into market trends. By dealing directly with customers, manufacturers can quickly adapt to changing market demands and technological advancements, ensuring that their products consistently meet the highest standards of performance and reliability.

The dominance of the Direct Sales segment is also reinforced by its role in providing comprehensive after-sales services, including maintenance, updates, and training. These services are essential for ensuring the longevity and effectiveness of industrial PCs in critical applications, thereby enhancing customer loyalty and trust in the brand.

By End-user Analysis

In 2024, the Discrete Industries segment held a dominant market position in the Industrial PC market, capturing more than a 65.7% share. This leadership is attributed to the widespread application of industrial PCs across various sectors within this segment, including automotive, aerospace & defense, semiconductor & electronics, and medical devices, each of which has specific requirements that industrial PCs help to fulfill efficiently.

Discrete Industries rely heavily on automation and precise control systems to manage complex manufacturing and assembly processes. Industrial PCs play a crucial role in these environments by providing the computational power necessary to operate robotics, assembly lines, and process control systems with high reliability and efficiency.

The ability of industrial PCs to withstand harsh industrial environments while maintaining operational integrity makes them indispensable in these sectors. Moreover, the push towards Industry 4.0 and smart manufacturing within Discrete Industries drives the adoption of industrial PCs.

These sectors benefit significantly from the real-time data processing and connectivity capabilities of industrial PCs, which are essential for optimizing production flows and reducing downtime. This technological integration supports quality control, supply chain management, and overall operational efficiency, further solidifying the segment’s dominance in the market.

The robustness of industrial PCs, combined with their ability to integrate with advanced manufacturing technologies, supports the Discrete Industries’ continuous pursuit of innovation and efficiency. As these industries expand their digital infrastructure, the demand for reliable and powerful computing solutions like industrial PCs is expected to grow, maintaining this segment’s leading position in the market.

Key Market Segments

By Type

- Rack Mount IPC

- Panel IPC

- DIN Rail IPC

- Embedded IPC

By Sales Channel

- Indirect Sales

- Direct Sales

By End-user

- Discrete Industries

- Automotive

- Aerospace & Defense

- Semiconductor & Electronics

- Medical Device

- Others

- Process Industries

- Chemical Energy & Power

- Oil & Gas

- Food & Beverage

- Pharmaceutical

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of Industrial IoT in Manufacturing

The growth of the Industrial PC market can be largely attributed to the integration of the Industrial Internet of Things (IIoT) within the manufacturing sector. As industries increasingly adopt digital technologies, the demand for robust computing solutions that can handle real-time data processing and machine-to-machine communication escalates.

This digital transformation in manufacturing not only enhances operational efficiency but also boosts productivity by enabling the automation of complex industrial processes. Furthermore, industrial PCs play a crucial role in implementing IIoT by providing the necessary hardware to support advanced applications, including predictive maintenance and quality control, thereby driving market growth.

Restraint

High Initial Investment and Cybersecurity Concerns

Despite the advantages, the deployment of industrial PCs is often hindered by the high initial costs associated with upgrading from traditional automation systems to more sophisticated, interconnected solutions. The integration of these advanced systems frequently necessitates substantial upfront investments in both hardware and software.

Additionally, as industrial systems become more connected, they become more vulnerable to cybersecurity threats. Data privacy and security concerns, particularly in critical industries such as pharmaceuticals and energy, pose significant challenges, as any breach can lead to severe disruptions and financial losses.

Opportunity

Smart Manufacturing and IT Infrastructure Improvements

The shift towards smart manufacturing presents significant opportunities for the expansion of the industrial PC market. Smart factories rely on seamless data integration across various operations, where industrial PCs are vital for data collection and analytics, control systems, and operational technology.

The growing awareness of the benefits of effective IT infrastructure in improving resource efficiency, reducing downtime, and maintaining competitive advantage in the market encourages industries to invest in advanced computing solutions. This trend is expected to create lucrative opportunities for market players, especially in developing and implementing scalable and flexible industrial PC solutions.

Challenge

Integration Complexities

One of the main challenges in the widespread adoption of industrial PCs is the complexity associated with integrating these systems into existing industrial environments. Industrial PCs must be compatible with a variety of legacy systems and software applications, making the integration process technically demanding.

Additionally, the need to ensure that these PCs can operate reliably under harsh industrial conditions – such as extreme temperatures, vibrations, and electromagnetic disturbances – further complicates their deployment. Managing these integration challenges while ensuring system reliability and efficiency remains a critical obstacle for industry stakeholders.

Growth Factors

The industrial PC market is poised for substantial growth, driven by several key factors and characterized by emerging trends that are reshaping its landscape.

- Increased Automation and IoT Integration: The integration of Industrial Internet of Things (IIoT) technology is a significant driver. As manufacturing sectors push towards digitalization, the demand for industrial PCs that can facilitate real-time process control and data acquisition is escalating.

- Advancements in Robotic Technologies: Another critical growth factor is the rising adoption of robotics across various industries. Industrial PCs play a crucial role in robotic systems, providing the necessary computing power for precise control and monitoring, which is essential for enhancing manufacturing processes and automation levels.

- Focus on Customization and Regulatory Compliance: The market is also seeing a demand spike driven by the need for customized solutions that meet specific industry regulations. This is particularly relevant in sectors like healthcare, where industrial PCs must comply with stringent standards for data handling and equipment safety.

Emerging Trends

- Edge Computing and Industry 4.0: A major trend is the integration of edge computing capabilities and Industry 4.0 technologies, which facilitate decentralized processing and closer data analysis at the site of data generation. This shift is crucial for industries that require immediate insights from vast data streams, such as manufacturing and logistics.

- Fanless and Touchscreen Innovations: The development of fanless industrial PCs and those with advanced touchscreen interfaces is rapidly becoming a trend. These features not only enhance the operational reliability of industrial PCs in harsh environments but also improve user interaction through intuitive interfaces and robust design.

- Smart Manufacturing Solutions: There is an increasing deployment of smart manufacturing solutions that leverage industrial PCs for better integration with other automated systems. This enhances the overall efficiency of production processes and supports more sophisticated monitoring and control mechanisms.

- Renewable Energy and Smart City Initiatives: In regions like the Middle East and Africa, the focus on renewable energy projects and smart city initiatives is driving the adoption of advanced industrial computing solutions. These projects require robust and efficient computing platforms to manage complex operations and ensure high levels of system integrity and security.

Business Benefits

Investing in industrial PCs offers numerous business benefits:

- Enhanced Operational Efficiency: By automating and optimizing processes, companies can achieve higher productivity and reduced operational costs.

- Increased System Reliability: Industrial PCs are designed to withstand harsh industrial environments, which reduces downtime and maintenance costs.

- Scalability and Flexibility: The modular nature of many industrial PC systems allows for easy upgrades and scalability, adapting to changing business needs.

- Improved Data Management: With advanced data analytics capabilities, businesses can harness critical insights to make informed decisions and improve overall operational effectiveness.

Key Players Analysis

The Industrial PC market is supported by several key players who play crucial roles in shaping the industry’s landscape. These companies specialize in the design, manufacture, and distribution of industrial PCs that are used across various sectors including manufacturing, energy, and transportation.

Siemens AG stands out as a prominent figure in the market. With a strong focus on innovation and quality, Siemens offers a wide range of rugged and durable industrial PCs that meet the diverse needs of industrial applications. Their products are known for their reliability and cutting-edge technology, making them a preferred choice for many businesses.

Advantech Co., Ltd. is another leader in this field. Advantech excels in providing embedded and automation products that offer versatility and scalability. Their industrial PCs are designed to withstand harsh environments, ensuring continuous operation and longevity. The company’s commitment to developing advanced solutions has earned them a solid reputation among customers.

Rockwell Automation, Inc. also plays a significant role in the market. Known for their Allen-Bradley line of industrial computers, Rockwell Automation focuses on delivering systems that enhance operational efficiency. Their products are integral to complex industrial processes, where precision and control are paramount.

Top Key Players in the Market

- Schneider Electric

- NEXCOM International Co., Ltd.

- OMRON Corporation

- American Portwell Technology Inc.

- VarTech Systems

- Crystal Group Inc.

- Cervoz Technology Co., Ltd.

- Diamond Flower Inc.

- OnLogic Inc.

- Advantech Co., Ltd.

- Panasonic Corporation

- ADLINK Technology Inc.

- DFI

- Kontron

- Siemens

- Emerson Electric Co.

- B&R Automation

- Beckhoff Automation

- Other Major Players

Recent Developments

- In October 2024, Siemens announced its agreement to acquire Altair Engineering Inc., a leading provider of simulation and artificial intelligence software, for $10.6 billion. This strategic move aims to strengthen Siemens’ position in industrial software by integrating Altair’s advanced computational tools into its portfolio.

- In November 2024, Emerson Electric proposed a $15.1 billion deal to acquire the remaining shares of AspenTech, a company specializing in industrial software solutions. This acquisition is intended to enhance Emerson’s focus on industrial automation and software capabilities.

Report Scope

Report Features Description Market Value (2024) USD 6.14 Bn Forecast Revenue (2034) USD 12.42 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Rack Mount IPC, Panel IPC, DIN Rail IPC, Embedded IPC), By Sales Channel (Indirect Sales, Direct Sales), By End-User (Discrete Industries (Automotive, Aerospace & Defense, Semiconductor & Electronics, Medical Device, Others), Process Industries (Chemical, Energy & Power, Oil & Gas, Food & Beverage, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schneider Electric, NEXCOM International Co., Ltd., OMRON Corporation, American Portwell Technology Inc., VarTech Systems, Crystal Group Inc., Cervoz Technology Co., Ltd., Diamond Flower Inc., OnLogic Inc., Advantech Co., Ltd., Panasonic Corporation, ADLINK Technology Inc., DFI, Kontron, Siemens, Emerson Electric Co., B&R Automation, Beckhoff Automation, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schneider Electric

- NEXCOM International Co., Ltd.

- OMRON Corporation

- American Portwell Technology Inc.

- VarTech Systems

- Crystal Group Inc.

- Cervoz Technology Co., Ltd.

- Diamond Flower Inc.

- OnLogic Inc.

- Advantech Co., Ltd.

- Panasonic Corporation

- ADLINK Technology Inc.

- DFI

- Kontron

- Siemens

- Emerson Electric Co.

- B&R Automation

- Beckhoff Automation

- Other Major Players