Global AI Enhanced HPC Market Size, Share, Statistics Analysis Report By Component (Hardware (Processors (GPUs, CPUs, TPUs), Memory and Storage, Interconnects), Software (AI Frameworks, HPC Software Solutions, Simulation Software), Services), By Deployment (Cloud, On-premises), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Computing Type (Parallel Computing, Distributed Computing, Exascale Computing), By Industry Vertical (BFSI (Banking, Financial Services, and Insurance), Healthcare & Life Sciences, Automotive & Manufacturing, Telecommunications, Energy & Utilities, Research & Academia, Government and Defense, Other Industries), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142958

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. AI Enhanced HPC Market

- Component Analysis

- Deployment Analysis

- Enterprize Size Analysis

- Computing Type Analysis

- Industry Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Regions and Countries

- Key Player Analysis

- Top Opportunities For Players

- Recent Developments

- Report Scope

Report Overview

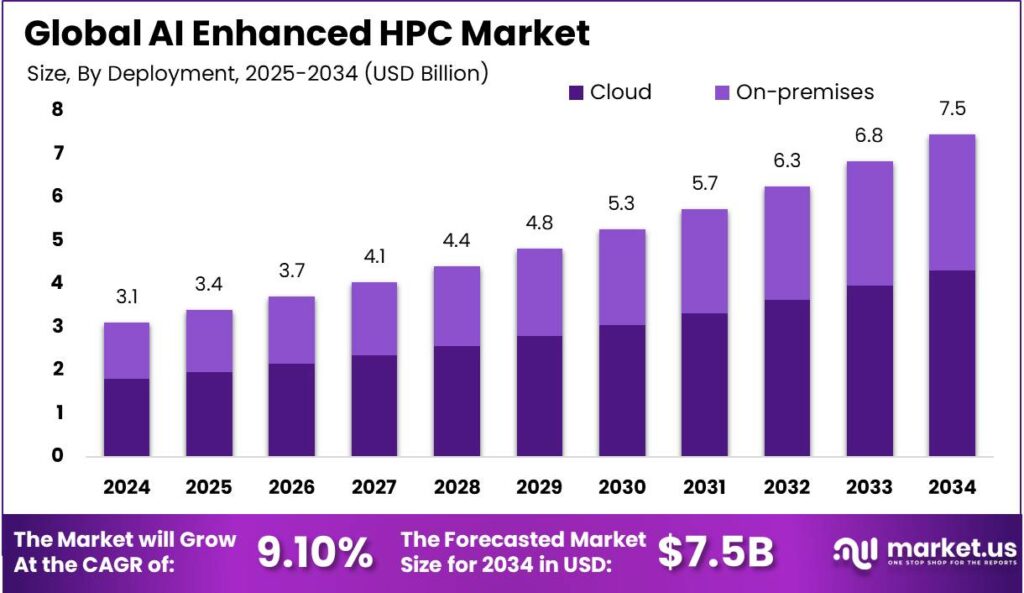

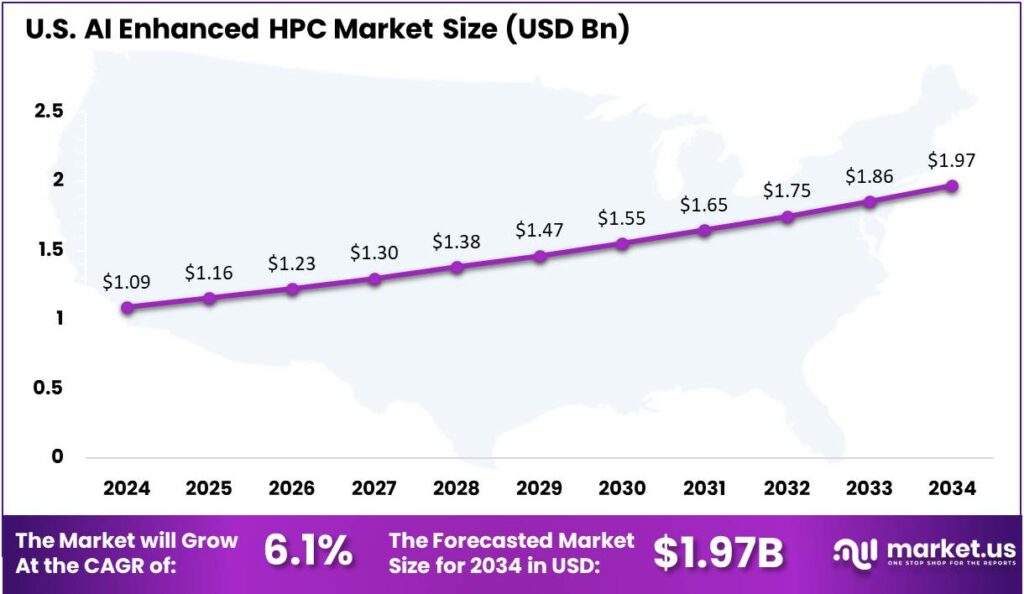

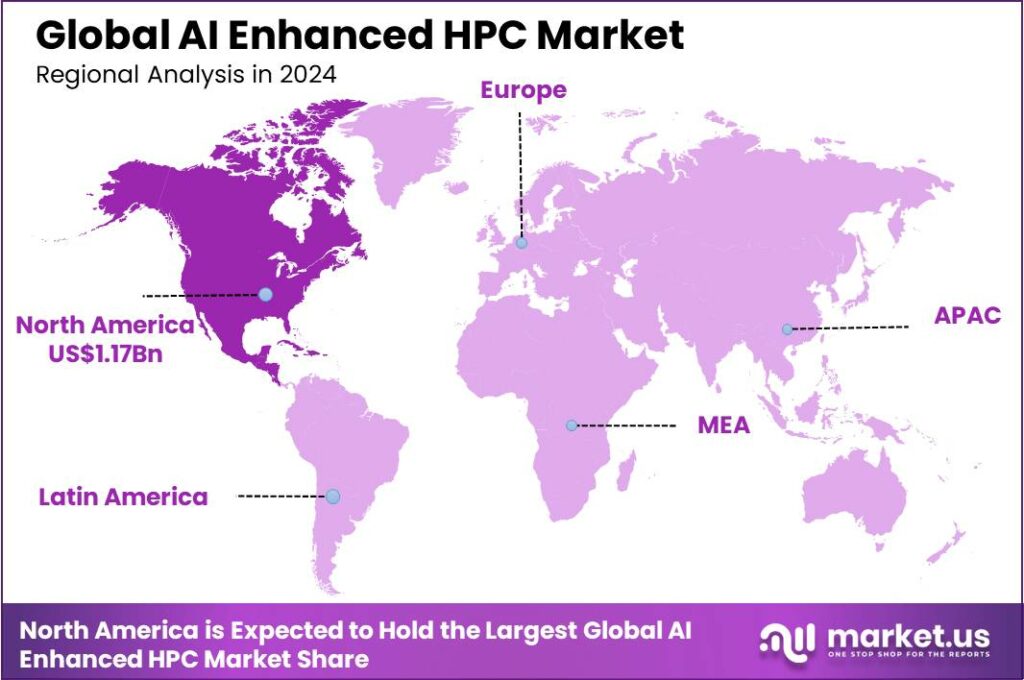

The AI Enhanced HPC Market size is expected to be worth around USD 7.5 Bn By 2034, from USD 3.12 Bn in 2024, growing at a CAGR of 9.10% during the forecast period from 2025 to 2034. In 2024, North America led the market with over 37.5% market share and $1.17 bn in revenue. The U.S. market was valued at $1.09 bn and is projected to grow at a 6.1% CAGR.

AI-enhanced HPC merges advanced AI capabilities with high-performance computing infrastructure. This integration facilitates the handling of complex and data-intensive tasks across various industries by leveraging powerful computing systems. The main appeal of AI-enhanced HPC lies in its ability to process and manage large volumes of data generated by applications.

The market for AI-enhanced HPC is experiencing significant growth, driven primarily by the increasing demand for more powerful computing capabilities that can efficiently process large datasets. This growth is catalyzed by the widespread adoption of cloud computing, which offers scalable and cost-effective access to HPC resources.

The primary drivers of the AI-enhanced HPC market include the expanding adoption of cloud computing, which provides flexible and scalable computing resources on demand, and the increasing emphasis by governments on integrating AI with HPC to boost national security, scientific research, and economic competitiveness.

Demand for AI-enhanced HPC is robust in sectors that require substantial computational power, such as healthcare, finance, and scientific research. These sectors utilize AI-enhanced HPC for data-intensive tasks like genetic research, financial modeling, and climate simulation, driving the need for continually updated and powerful computing infrastructures.

AI-enhanced HPC is gaining popularity as industries recognize its potential to solve complex problems that were previously unsolvable due to computational limitations. The technology’s ability to rapidly process and analyze vast amounts of data is also appealing to sectors like e-commerce and social media, where real-time data processing is critical.

The expansion of the AI-enhanced HPC market is likely to continue as advancements in AI and machine learning create new use cases and improve existing applications. This expansion is further supported by the ongoing reduction in technology costs and the global increase in computational power, which are making AI-enhanced HPC solutions more viable for a range of applications.

Key Takeaways

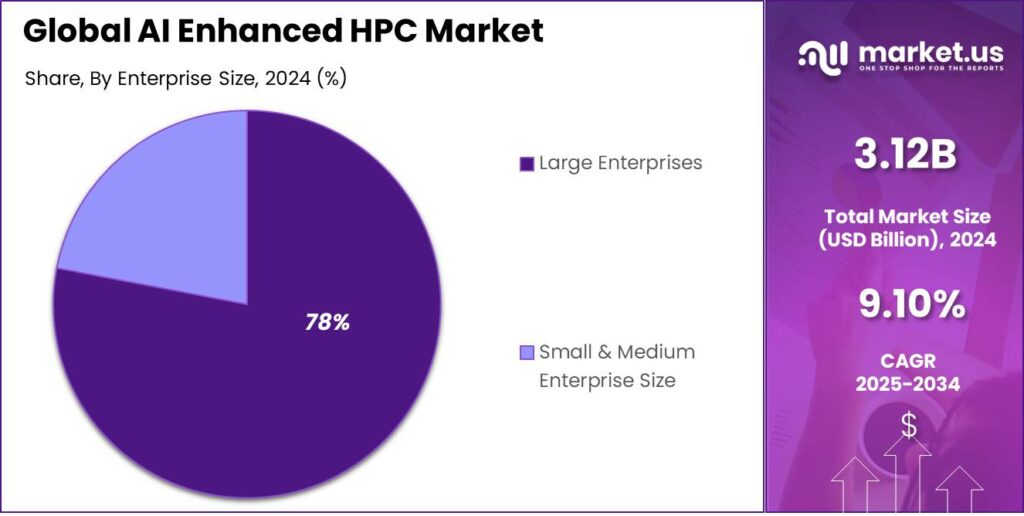

- The Global AI Enhanced HPC Market is projected to grow significantly, reaching around USD 7.5 Billion by 2034, up from USD 3.12 Billion in 2024, representing a CAGR of 9.10% during the forecast period from 2025 to 2034.

- In 2024, the Hardware segment dominated the AI-enhanced HPC market, capturing more than 54% of the overall market share.

- The Cloud segment of the AI-enhanced high-performance computing (HPC) market held a leading position in 2024, securing more than 58% of the market share.

- The Large Enterprises segment held a significant market position in 2024, accounting for more than 78% of the AI-enhanced HPC market.

- In 2024, the Parallel Computing segment maintained dominance in the AI-enhanced high-performance computing (HPC) market, commanding more than 45% of the market share.

- The Healthcare & Life Sciences segment was also a key player in the AI-enhanced HPC market in 2024, holding more than 25% of the market share.

- North America led the AI-enhanced HPC market in 2024, capturing more than 37.5% of the market share, with revenue reaching approximately $1.17 billion.

- The U.S. market for AI-enhanced high-performance computing (HPC) was valued at $1.09 billion in 2024 and is expected to grow at a CAGR of 6.1%.

Analysts’ Viewpoint

Investment opportunities in the AI-enhanced HPC market are large, particularly in developing cloud-based and AI-optimized HPC solutions. As organizations continue to seek more efficient ways to handle data, investments in technologies that integrate AI capabilities with HPC infrastructures are expected to yield significant returns.

Businesses benefit from AI-enhanced HPC through faster data processing, enhanced accuracy in simulations and predictions, and the ability to handle increasingly complex models and datasets. These capabilities lead to quicker decision-making, reduced time to market for new innovations, and improved competitive advantage in data-driven industries.

The regulatory environment for AI-enhanced HPC is evolving, particularly concerning data security and privacy. Regulations such as GDPR impact how data is handled within AI-enhanced HPC infrastructures, requiring robust security measures to protect sensitive information and comply with legal standards.

U.S. AI Enhanced HPC Market

In 2024, the U.S. market for AI-enhanced high-performance computing (HPC) was valued at $1.09 billion. It is projected to grow at a compound annual growth rate (CAGR) of 6.1%.

The growth of this market can be attributed to several factors, including the increasing demand for complex data processing and enhanced computational power across various industries such as healthcare, automotive, and financial services. High-performance computing, when integrated with artificial intelligence, significantly improves the efficiency and effectiveness of data analysis, simulations, and predictive modeling.

Moreover, advancements in AI algorithms and the development of more sophisticated machine learning models necessitate powerful computing capabilities that only HPC systems can provide. Government initiatives and investments in research and development related to AI and HPC technologies also support this market’s growth.

In 2024, North America held a dominant market position in the AI-enhanced high-performance computing (HPC) market, capturing more than a 37.5% share with revenue amounting to approximately $1.17 billion. This leading stance can be attributed to several strategic factors unique to the region.

North America’s prominence in the market is driven by major tech firms, a strong AI and HPC research ecosystem, and the U.S.’s leadership in tech innovation. The region benefits from continuous investment in R&D by leading companies and startups, along with U.S. government support through funding and policies that promote AI advancements.

Additionally, North America benefits from advanced technological infrastructure and a highly skilled workforce specialized in AI and computer sciences. Universities and research institutions in the region are at the forefront of developing cutting-edge AI applications and HPC solutions, which in turn support the commercial sectors in adopting these technologies.

Additionally, North America’s market growth is fueled by the rising use of AI-enhanced HPC in key industries like healthcare, where it supports precision medicine and genomic research, and the automotive sector, which leverages HPC for designing safer, more efficient vehicles through simulation and testing.

Component Analysis

In 2024, the Hardware segment held a dominant position in the AI-Enhanced HPC market, capturing more than 54% of the overall market share. This prominence is attributable to several factors that underline the critical role hardware plays in AI-enhanced high-performance computing systems.

The dominance of the Hardware segment is driven by the high computational demands of AI applications, which require powerful processors like GPUs, CPUs, and TPUs to accelerate AI algorithms. GPUs, especially, are preferred for their ability to manage parallel tasks and large data volumes, enhancing the performance of AI-driven HPC systems.

AI-enhanced HPC applications generate and process vast amounts of data, necessitating extensive memory and storage capabilities to ensure smooth and efficient operation. The evolution of memory technologies, with faster access times and higher capacities, aligns with the increasing demands of complex AI tasks, reinforcing the hardware’s leading position.

Interconnects are crucial to the Hardware segment’s dominance in the AI-enhanced HPC market. Advanced interconnect systems enable high-speed communication between components, and as AI models grow more complex, the demand for technologies that reduce latency and increase bandwidth becomes essential, highlighting the importance of hardware in AI-driven HPC systems.

Deployment Analysis

In 2024, the Cloud segment of the AI-enhanced high-performance computing (HPC) market held a dominant position, capturing more than a 58% share. This leadership can be attributed to several key factors that make cloud-based solutions particularly attractive for deploying AI-enhanced HPC capabilities.

Cloud services’ scalability allows businesses to adjust computing resources based on demand, making it ideal for AI and machine learning workloads. This flexibility enables companies to scale up during intensive processing and scale down during quieter periods, optimizing both costs and efficiency.

The cloud segment also benefits from lower upfront costs compared to on-premises solutions. With no need for significant investment in physical hardware, cloud services are more accessible, especially for small and medium-sized enterprises, driving the adoption of cloud-based AI-enhanced HPC solutions across various industries.

Cloud providers are constantly upgrading their platforms with the latest AI technologies and advanced analytics tools. These enhancements transform cloud services into more than just a source of computing power, offering a comprehensive environment for developing and deploying AI applications, which has been key to the cloud segment’s market leadership.

Enterprize Size Analysis

In 2024, the Large Enterprises segment held a dominant market position in the AI-enhanced high-performance computing (HPC) market, capturing more than a 78% share. This significant dominance can be attributed to several factors that uniquely position large enterprises to leverage advanced AI and HPC technologies.

Large enterprises typically have the capital to invest in high-end HPC systems necessary for running advanced AI applications. These systems require significant upfront investments in hardware, software, and technical expertise. Large enterprises, with their financial flexibility, can more easily integrate AI-enhanced HPC solutions, enabling them to scale operations and maintain a competitive edge in data-intensive industries.

Furthermore, Large enterprises typically have well-established IT infrastructures that integrate seamlessly with advanced HPC solutions. Large enterprises can hire specialized personnel to manage HPC operations, supporting both deployment and the ongoing development of AI applications, which require continuous tuning and adaptation.

In addition, Large enterprises in high-stakes industries like pharmaceuticals, finance, and automotive benefit from AI-enhanced HPC, which allows them to quickly process large data sets. This accelerates R&D, optimizes operations, and improves decision-making, leading to better product development and market responsiveness.

Computing Type Analysis

In 2024, the Parallel Computing segment held a dominant market position in the AI-enhanced high-performance computing (HPC) market, capturing more than a 45% share. This significant market share can be attributed to the widespread adoption of parallel computing technologies in industries that require intensive data processing and computation.

Parallel computing is crucial for AI and machine learning, particularly in training models like neural networks and deep learning algorithms. Its ability to handle large-scale operations concurrently enables faster insights and more accurate predictions, boosting demand across industries.

Moreover, the development of advanced microprocessor technologies and the increasing availability of scalable parallel computing systems have also supported the growth of this segment. Companies are continually innovating their offerings to provide more powerful and cost-effective solutions that appeal to a broad spectrum of computational needs.

Government and academic institutions are investing heavily in parallel computing to enhance research and boost national competitiveness in science and technology. These investments drive growth in the AI-enhanced HPC market, aligning with the rising complexity and computational demands of global industries.

Industry Vertical Analysis

In 2024, the Healthcare & Life Sciences segment held a dominant market position in the AI-enhanced high-performance computing (HPC) market, capturing more than a 25% share. This leadership is largely driven by the critical need for complex data analysis and simulation in medical research and pharmaceutical development.

The prominence of the Healthcare & Life Sciences segment is also supported by the increasing integration of AI technologies in diagnostic procedures. AI-enhanced HPC systems facilitate the rapid analysis of medical imaging, improving the accuracy and speed of diagnoses for diseases like cancer and neurological disorders.

The COVID-19 pandemic has highlighted the need for rapid, scalable computational resources in healthcare. AI-enhanced HPC has been crucial in modeling virus spread, assessing intervention effectiveness, and accelerating vaccine development, reinforcing its vital role in addressing global health challenges.

The push for digitalization in healthcare and the rise of electronic health records (EHRs) demand robust computing solutions for data privacy, security, and complex analytics. The Healthcare & Life Sciences sector’s reliance on AI-enhanced HPC strengthens its leadership in the market, a trend set to continue as demand for innovative healthcare and personalized treatments grows.

Key Market Segments

By Component

- Hardware

- Processors (GPUs, CPUs, TPUs)

- Memory and Storage

- Interconnects

- Software

- AI Frameworks

- HPC Software Solutions

- Simulation Software

- Services

By Deployment

- Cloud

- On-premises

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Computing Type

- Parallel Computing

- Distributed Computing

- Exascale Computing

By Industry Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare & Life Sciences

- Automotive & Manufacturing

- Telecommunications

- Energy & Utilities

- Research & Academia

- Government and Defense

- Other Industries

Driver

Rising need for advanced data analytics.

The proliferation of big data across various industries has led to an increased need for advanced data analytics. AI-enhanced High-Performance Computing (HPC) systems enable organizations to process and analyze vast datasets efficiently, facilitating real-time insights and informed decision-making.

Industries such as finance, healthcare, and manufacturing are leveraging these capabilities to optimize operations, enhance customer experiences, and drive innovation. For instance, in the financial sector, AI-enhanced HPC systems are utilized for risk assessment and fraud detection, processing complex models and large datasets at unprecedented speeds.

Restraint

Complexity of integrating with Ongoing infrastructure

Integrating AI-enhanced HPC systems into existing IT infrastructures can be challenging and time-consuming. These systems often require specialized hardware and software configurations that may not be compatible with legacy systems.

Ensuring seamless integration and operation across multiple departments and functions can present challenges for organizations. This complexity may hinder the widespread adoption of AI-enhanced HPC solutions, as organizations may be reluctant to undertake the extensive modifications required for successful implementation.

Opportunity

Progress in cloud-powered HPC solutions.

The evolution of cloud computing presents significant opportunities for the AI-enhanced HPC market. Cloud-based HPC solutions offer scalable, flexible, and cost-effective computing power, making advanced computational resources more accessible to organizations of all sizes.

By leveraging cloud platforms, businesses can access powerful computing resources on-demand without substantial upfront investments in hardware. This shift from traditional on-premises infrastructure to cloud-based solutions enables organizations to adapt quickly to changing computational demands, fostering innovation and efficiency.

Challenge

Lack of skilled professionals.

A significant challenge facing the AI-enhanced HPC market is the shortage of professionals skilled in AI, HPC, data science, and machine learning. These fields require highly specialized knowledge to manage large datasets, algorithms, and optimize computational power.

The growing demand for experts in these domains has led to a talent gap, increasing labor costs and limiting organizations’ capacity to implement and maintain AI-enhanced HPC systems. This shortage is exacerbated by the inability of educational institutions to meet the demand for relevant training programs, posing a significant obstacle to the market’s expansion.

Emerging Trends

AI integration with HPC is revolutionizing industries by boosting computational power and enabling groundbreaking innovations. The development of exascale systems, capable of performing a quintillion calculations per second, is becoming a reality. These systems enable complex simulations and analyses, advancing fields like climate modeling and genomics.

Deploying HPC resources at the edge allows for real-time data processing, which is crucial for applications requiring immediate insights, such as autonomous vehicles and IoT devices. Integrating AI within HPC systems enhances resource allocation and workload management, leading to more efficient operations and reduced energy consumption.

The adoption of diverse computing architectures, including GPUs and specialized accelerators, is optimizing performance for specific AI workloads, thereby improving efficiency. Also, combining quantum computing with classical HPC is unlocking new possibilities in optimization and material science, providing unmatched computational power.

Business Benefits

- Accelerated Product Development: By combining AI’s adaptive learning with HPC’s computational power, companies can rapidly simulate and test product designs, leading to shorter development cycles and quicker market entry.

- Enhanced Decision-Making: AI-driven analysis of extensive datasets on HPC systems enables businesses to uncover patterns and insights, facilitating more informed and timely decisions.

- Optimized Resource Allocation: AI algorithms running on HPC infrastructures can efficiently manage computing resources, reducing operational costs and improving system utilization.

- Improved Risk Management: Financial institutions utilize AI-enhanced HPC to perform real-time risk assessments, allowing for proactive responses to market fluctuations and potential threats.

- Innovative Product Design: In sectors like automotive and aerospace, AI-guided HPC facilitates intelligent simulations, optimizing designs for performance and efficiency, thereby maintaining a competitive edge.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Several major players are leading the charge in integrating AI with HPC.

NVIDIA is a global leader in AI and HPC technologies. The company has revolutionized the AI landscape with its graphics processing units (GPUs), which are specially designed to handle the parallel processing needed for AI and machine learning workloads. NVIDIA’s GPUs, are integral to AI-enhanced HPC systems, enabling faster data processing, complex simulations, and more efficient neural network training.

Intel Corporation, known for its microprocessors, is a key player in the AI-enhanced HPC space, providing a broad range of products that power AI applications. Their Xeon processors and Intel Nervana Neural Network Processors are specifically designed for high-performance computing and AI workloads.

IBM Corporation has been a long-time leader in computing, and it is a major player in the AI-enhanced HPC market as well. IBM’s expertise in both hardware and software solutions makes it a unique contender in this field. The company’s Power Systems servers and AI-driven software, are widely used in industries looking to leverage the power of AI for complex simulations, data analytics, and machine learning tasks.

Top Key Players in the Market

- NVIDIA Corporation

- Intel Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- AMD (Advanced Micro Devices)

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google Cloud

- Alibaba Cloud

- Dell Inc.

- HP Enterprise

- Lenevo

- Penguin Computing

- YOTTA

- Other Key Players

Top Opportunities For Players

The AI-enhanced High-Performance Computing (HPC) market is poised for significant growth, presenting various opportunities for industry players.

- Cloud Deployment and Services Growth: The integration of AI capabilities with cloud-based HPC resources is revolutionizing accessibility and scalability in computing power. This shift is making high-performance computing resources more accessible to a broader range of businesses, without the need for substantial upfront investments in infrastructure.

- Expansion in Healthcare and Pharmaceutical Industries: AI-enhanced HPC is increasingly being applied in the healthcare and pharmaceutical sectors. This technology enables more efficient processing and analysis of large datasets, which is crucial for speeding up drug discovery processes and improving patient care through advanced simulations and predictive analytics.

- Government and Defense Applications: There is significant opportunity in government and defense sectors, where AI-enhanced HPC is utilized for national security measures, including simulations and modeling for nuclear safety and other critical applications.

- Financial Services Analytics: The financial sector is leveraging AI-enhanced HPC to manage and analyze vast amounts of data for better decision-making and enhanced operational efficiency. This technology is crucial in areas such as fraud detection, risk management, and regulatory compliance, where quick and accurate data processing is essential.

- Technological Advancements in Computing Power: The ongoing advancements in parallel and exascale computing are pivotal.Exascale computing performs a billion billion calculations per second, crucial for solving complex problems in climate modeling, research, and AI.

Recent Developments

- In July 2024, Nscale, an AI cloud platform, has strengthened its infrastructure by acquiring Kontena, a leader in high-density modular data centers and AI-driven data center solutions. This acquisition will enhance Nscale’s capabilities to support generative AI and AI-powered high-performance computing (HPC).

- In September 2024, Intel unveiled the Xeon 6 with Performance-cores (P-cores) and Gaudi 3 AI accelerators, significantly enhancing performance for AI and HPC workloads. These new solutions aim to provide better performance per watt and lower total cost of ownership.

Report Scope

Report Features Description Market Value (2024) USD 3.12 Bn Forecast Revenue (2034) USD 7.5 Bn CAGR (2025-2034) 9.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware (Processors (GPUs, CPUs, TPUs), Memory and Storage, Interconnects), Software (AI Frameworks, HPC Software Solutions, Simulation Software), Services), By Deployment (Cloud, On-premises), By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Computing Type (Parallel Computing, Distributed Computing, Exascale Computing), By Industry Vertical (BFSI (Banking, Financial Services, and Insurance), Healthcare & Life Sciences, Automotive & Manufacturing, Telecommunications, Energy & Utilities, Research & Academia, Government and Defense, Other Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Intel Corporation, IBM Corporation, Hewlett Packard Enterprise (HPE), AMD (Advanced Micro Devices), Amazon Web Services (AWS), Microsoft Corporation, Google Cloud, Alibaba Cloud, Dell Inc., HP Enterprise, Lenevo, Penguin Computing, YOTTA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NVIDIA Corporation

- Intel Corporation

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- AMD (Advanced Micro Devices)

- Amazon Web Services (AWS)

- Microsoft Corporation

- Google Cloud

- Alibaba Cloud

- Dell Inc.

- HP Enterprise

- Lenevo

- Penguin Computing

- YOTTA

- Other Key Players