Global Digital Robots Market By Component (Hardware (Actuators, Sensors, Power Source, Control Systems), Software) By Mobility (Mobile, Stationary) By End User (Personal (Companionship, Education, Others),Professional (Military & Defense, Law Enforcement, Public Relationship, Logistics Management, Industrial, Field/Agriculture, Healthcare Assistance, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144434

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

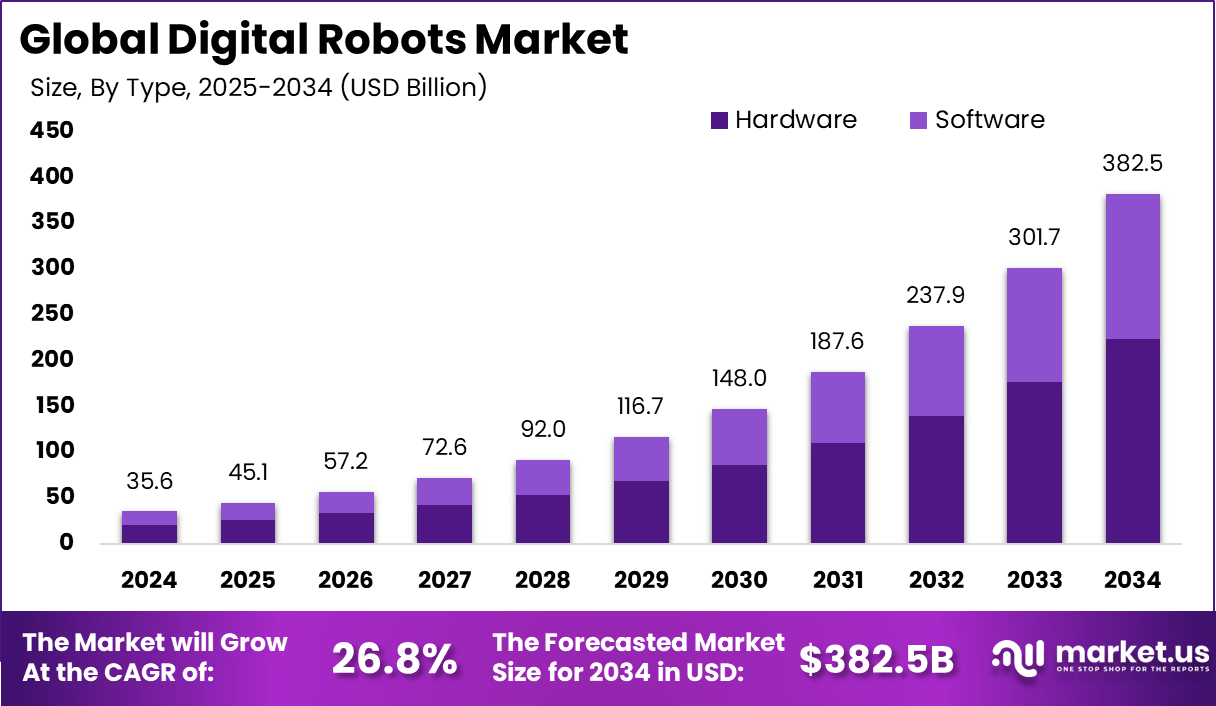

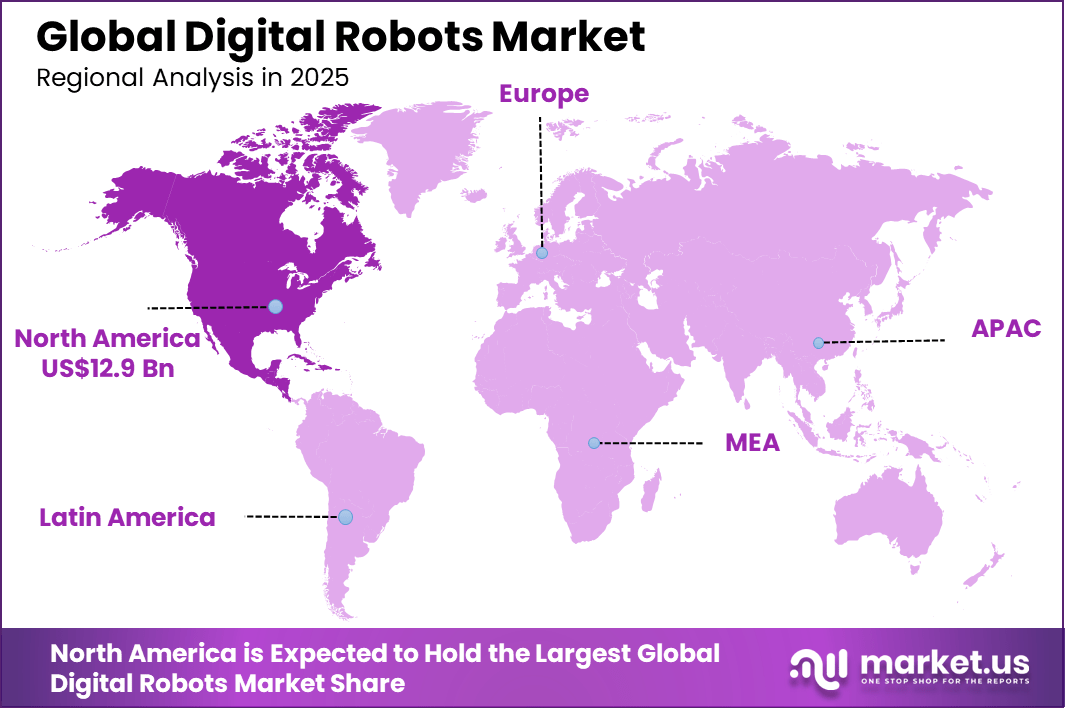

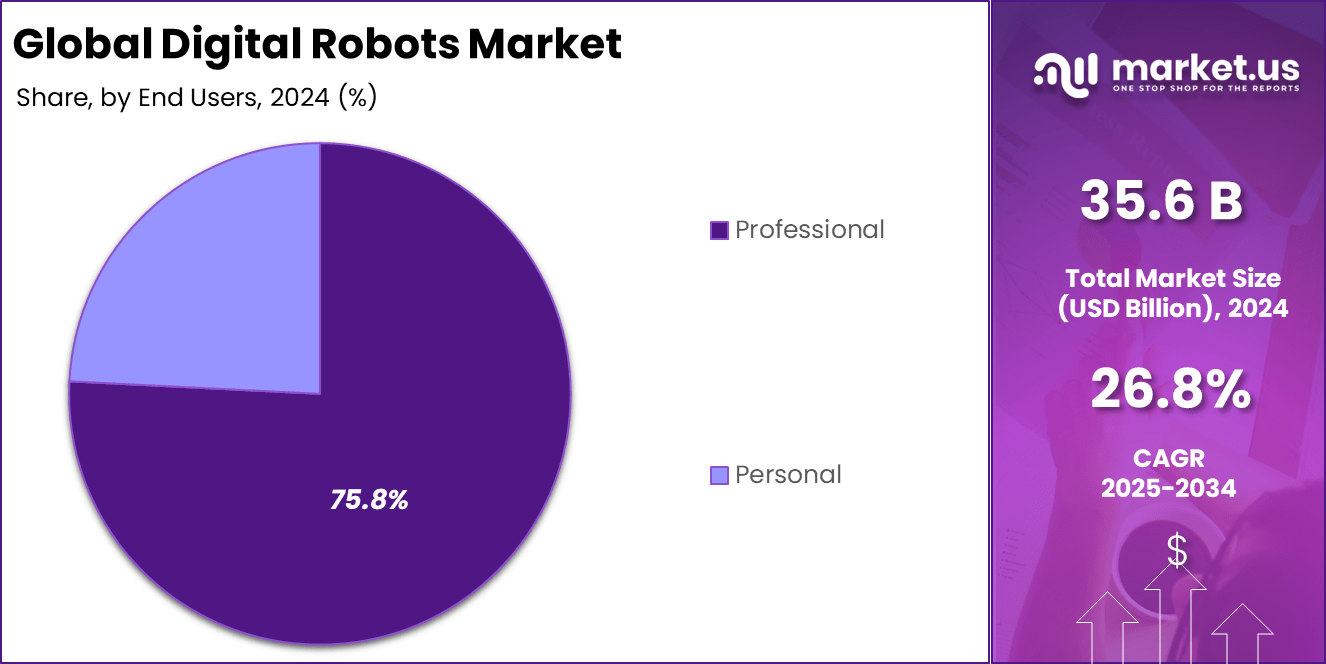

The Global Digital Robots Market size is expected to be worth around USD 382.5 billion by 2034, from USD 35.6 billion in 2024, growing at a CAGR of 26.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.6% share, holding USD 12.9 Billion revenue.

The digital robots market is witnessing significant growth driven by the increasing need for automation across various industry sectors such as finance, healthcare, manufacturing, and telecommunications. This market expansion is fueled by the continuous advancements in artificial intelligence and machine learning technologies, making digital robots more intelligent and capable of performing complex tasks

The market for digital robots is expanding these days, driven by advancements in automation, robotics, and artificial intelligence. More research and development expenditures are being made in the robotics industry to help businesses further optimize their operations, and the market for digital robots is anticipated to grow into more sophisticated and flexible systems.

Since professional robots are employed in a wide range of sectors, such as customer service, logistics, and surgery, their market share is anticipated to increase. The demand for robotic automation and other efficiency-related applications has increased as a result of this rise, and robots are now being encouraged to perform activities that frequently call for human-like precision or adaptability.

One of the primary drivers of the digital robots market is the enhanced efficiency and productivity these technologies offer. Businesses are leveraging digital robots to streamline operations, reduce labor costs, and improve service delivery, which, in turn, enhances overall business performance. The integration of AI with robotic process automation has particularly been a key factor, as it allows for more complex and adaptive solutions.

Technologies such as AI, machine learning, and advanced analytics are increasingly being adopted in conjunction with digital robots. These technologies enable digital robots to handle not only structured tasks but also unstructured data and unpredictable environments, thus broadening their applicability across different sectors.

Key Takeaway

- In 2024, the Hardware segment held a dominant market position, capturing a 58.6% share of the Digital Robots Market.

- In 2024, the Mobile segment held a dominant market position, capturing a 60.4% share of the Global Digital Robots Market.

- In 2024, the Professional segment held a dominant market position, capturing a 75.8% share of the Global Digital Robots Market.

- The Digital Robots Market was valued at USD 10.39 billion in 2024, with a robust CAGR of 9%.

- In 2024, North America held a dominant market position in the Global Digital Robots Market, capturing more than a 36.5% share.

Analysts’ Viewpoint

The adoption of digital robots is primarily driven by their ability to reduce costs, increase scalability, and enhance accuracy in data handling and processing. Additionally, they offer significant improvements in compliance and risk management by minimizing human errors and maintaining consistent records of all transactions and interactions.

The demand for digital robots is escalating as more organizations recognize their potential to drive business transformation. This is particularly evident in industries that are heavily dependent on data processing and require high accuracy and speed, such as banking and insurance.

Investment in digital robots is seen as a strategic move to future-proof businesses. Investors are particularly interested in solutions that offer seamless integration with existing systems, scalability, and the ability to adapt to new or evolving business processes.

The implementation of digital robots brings numerous business benefits including enhanced operational efficiency, reduced process cycle times, and lower operational costs. Moreover, it frees up human employees to focus on more strategic tasks, thereby increasing workplace productivity and employee satisfaction.

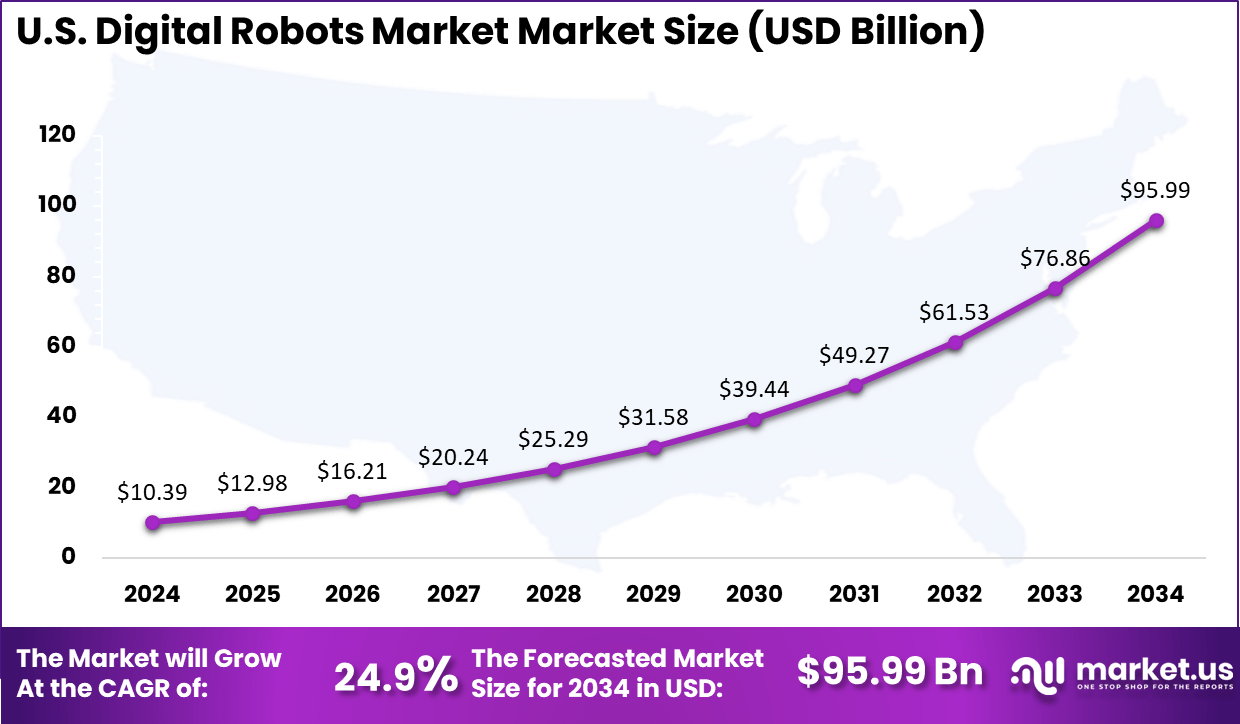

U.S. Digital Robot Market Size

The market for digital robots within the U.S. is growing tremendously and is currently valued at USD 10.39 billion. Increasing adoption of robotics and advancement in technologies related to robotics have propelled this growth. Emerging rapidly, the market has a projected CAGR of 24.9%.

For instance, in January 2025, Robosense, a pioneering AI-driven robotics technology company hosted the world’s first robotics global online launch event in las vegas, “Hello Robot”. This event marked a pivotal moment in the company’s evolution, showcasing its strategic vision as a global robotics technology platform and unveiling groundbreaking achievements.

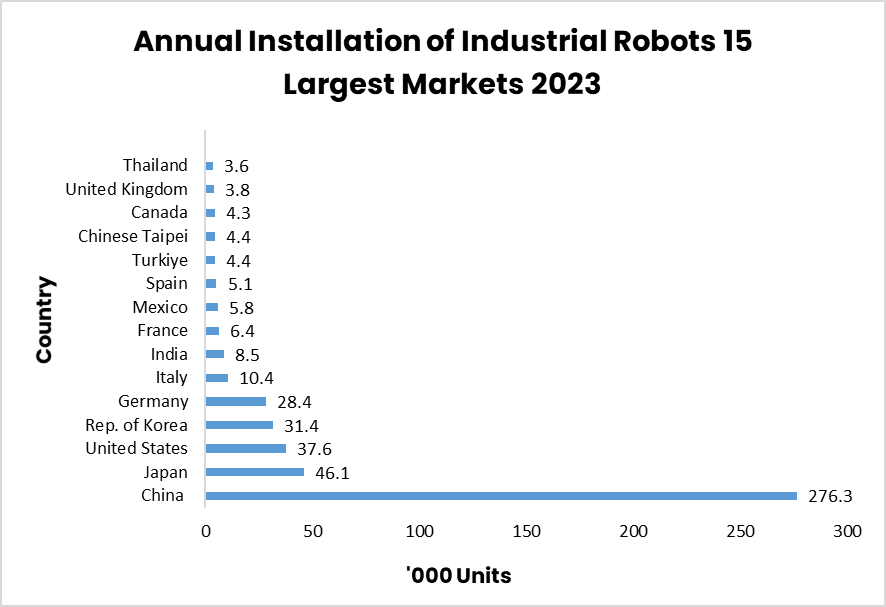

In 2024, North America held a dominant market position in the global Digital Robots Market, capturing more than a 36.5% share. The digital robotics market is largely dominated by North America because of advanced technological infrastructures, high rates of automation adoption within industries, as well as major investments in research and development.

The major robot companies like iRobot Corporation, and Kawasaki Heavy Industries, Ltd. Have a presence in the North America region and the relevant government initiatives on automation and AI spur higher growth in this market.

For instance, In February 2025, Tata Consultancy Services announced the collaboration with MassRobotics, which is the largest independent robotics hub in North America. By combining TCS’s technology expertise and reach with MassRobotics’ ecosystem of startups, researchers, and industry leaders, the partnership aims at accelerating innovation within the robotics sector.

Component Type Analysis

In 2025, The Hardware segment held a dominant market position, capturing a 58.6% share of the Global Digital Robots Market. From this segment, there are many major subcomponents whose prerequisites are essential prerequisites in making robots function adequately and perform superior work through Actuators that convert energy into motion, allowing robots to do physical work.

Sensors capture feedback and let robots feel and understand the environment around them so that they can perform more accurately and efficiently. Power provides energy for action. Control coordinates robotic movements. Mostly software benefits robots’ intelligence and flexibility, enabling them to learn, decide, and achieve complex goals.

In such a scenario, its importance underlines the hardware segment in digital robots because its technology is used for developing and operating digital robots in every industry. For Instance, in 2024, ABB showcased the latest generation of AI-powered robotic solutions at LogiMAT- the international trade show for intralogistics solutions and process management in place in Stuttgart, Germany.

Mobility Segment Analysis

In 2025, the mobile segment held a dominant market position, capturing a 60.4% share of the Global Digital Robots Market. Digital Robots are mainly classified into two categories which are mobile robots and stationary robots. Mobile robots are providing flexible and adaptive applications in logistics, delivery, and service robots.

The stationary robots are fixed ones in a certain place; these robots are generally used for industrial automation and assembly lines. Therefore, the major share of the market is populated with mobile robots, primarily because this characterizes the shift towards more versatile, autonomous systems, that and capable of performing various functions outside fixed applications.

For instance, Continental Automotive introduced its autonomous mobile robot (AMR) at the MODEX show in 2024, showcasing its advanced technology in warehouse and material handling solutions. These robots are designed to navigate autonomously in complex environments, facilitating efficient material transport and optimizing workflows.

End User Segment Analysis

In 2025, the Professional segment held a dominant market position, capturing a 75.8% share of the Global Digital Robots Market. The digital robots market is segmented by end-use into two categories one personal type and another is professional type. Models of digital robots have now started finding usage in several professional segments within the healthcare field.

For instance, in surgery, the da Vinci Surgical System provides the surgeon with deftness, accuracy, and visualization for minimally invasive procedures. In nursing care, the robots can manage a few routine processes, such as dispensing medications, monitoring vital signs, or even drawing blood hence making it ready for patient interaction from the nurse’s point of view.

Rehabilitation is another area where patients are guided through exercises, monitored for progress, and assisted to improve mobilization. New, innovative robots are proving to be important in these areas, with some now taking on quite punitive roles in logistics and administration, such as those assessing the collection and cleaning and disinfecting facilities through the use of robots, and patient transfers.

Key Market Segments

By Component

- Hardware

- Actuators

- Sensors

- Power Source

- Control Systems

- Software

By Mobility

- Mobile

- Stationary

By End User

- Personal

- Companionship

- Education

- Others

- Professional

- Military & Defense

- Law Enforcement

- Public Relationship

- Logistics Management

- Industrial

- Field/Agriculture

- Healthcare Assistance

- Others

Drivers

Advancements in Artificial Intelligence (AI) in digital robotics

The advancements in artificial intelligence (AI) have significantly transformed the field of digital robotics, enabling robots to become smarter, more adaptable, and capable of performing increasingly complex tasks. As noted in most articles, like that of Technexion, AI-empowered robots bring up perception from advanced computer vision to sensor fusion in environments where robots must navigate through complex designs.

Better decision-making and more robust adaptability, thanks to machine-learning and deep-learning algorithms, enable robots to act according to cataloged conditions as they change. The Draft National Strategy on Robotics from the Ministry of Electronics and Information Technology (MeitY) in India is a fine instance of government intention to propel AI towards digital robotics. It aims to use AI to achieve automation in multiple sectors of industries.

Apart from this, it supports funding in the domain of research and development for AI-enabled robotics and standards for deployment of industrial robots, and it encourages public-private partnerships. Through these, it’s showing how countries exploit AI in their operations to make industries more efficient, better in terms of quality, and safer at the same time, positively impacting the economics of development and computing technologies.

Restraint

Regulatory and Ethical Concerns

Concerns of a regulatory and ethical nature weigh heavily in digital robotics, especially when it comes to applications in really sensitive fields like healthcare and military usage. Rather stringent regulations that substantiate ethical development and deployment can hinder growth due to their very nature of burdening developers and manufacturers with compliance with standards and procedural hurdles.

For instance, the introduction of artificial intelligence surgical robots within the domain of healthcare raises safety issues concerning patient treatment data privacy and possible algorithmic bias. The FDA’s current evolving framework concerning AI-based medical devices contributes a lot to the safety of patients but simultaneously requires an extensive amount of testing and validation processes, which may have a paradoxical effect of increasing the time taken to bring such technology to the commercial arena.

Opportunities

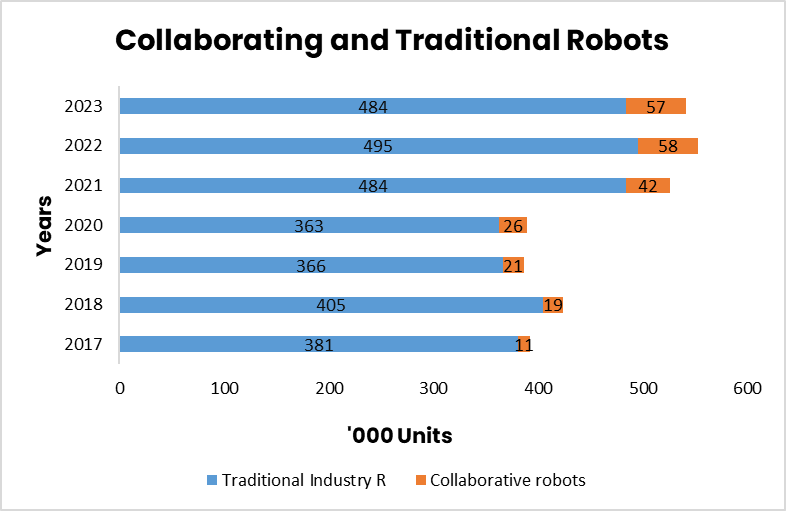

Collaborative Robots

The rise of collaborative robots (cobots) has become a great game-changer in digital robotics, offering massive opportunities for industries to enhance efficiency and safety by working together with humans. It is now possible for these extraordinary robots to work in tandem with humans in different manners-complementing rather than competing-along the assembly lines, material handling, and quality control in manufacturing, it’s all possible due to advanced sensors and safety devices.

This proposition benefits not only productivity but also frees human workers for more complex and creative tasks. In the healthcare sector, cobots assist with patient care, rehabilitation, and surgery, while in logistics, they are used for warehouse automation and order fulfillment. Likewise, now, the service industry is employing cobots for hospitality and customer services.

For instance, The healthcare organization has instituted ingenious advances or developments through the introduction of KUKA medical robots in contemporary practice, which will go as far as a preoperative treatment aid. This technology has examples such as the LBR Med, which has been approved by KUKA for use in procedures such as surgery, rehabilitation, diagnosis, imaging, and caregiving in that field.

KUKA Robots assist during laparoscopy, orthopedic surgery, and also in radiation therapy, producing a higher potency or potency and thereby seem to make medical intervention even easier and safer. They can be integrated with different medical devices, and specially dedicated software makes them almost mandatory in today’s health environments.

Challenges

Technical Complexity and Integration

The intrinsic challenge one faces in the market is that of integrating numerous robotics and high-end industrial robotic hardware as well as software, especially the current industrial infrastructure. It has been declared that specialists were required when it came to harmonizing various hardware and software with the already available industrial infrastructure, which usually ends up making very expensive adjustments and customizations.

Integration of these different robotic components tied to control systems and data platforms becomes further difficult because of incompatibility among them. Developing highly competent engineers and technicians might require an overhaul of the whole system to meet the newly established requirements and act as a great barrier to entry, especially for those businesses that do not have in-house technical resources.

Further, the difficulty of having seamless integration leads to longer deployment times and increases the overall costs incurred to put into function the advanced robotics solutions and makes the adoption relatively longer.

Latest Trends

The rise of digital robotics is significantly driving demand across numerous sectors. AI is developing rapidly, notably machine learning and computer vision, allowing robots to cope with increasingly sophisticated tasks, thus providing a further thrust to automation in manufacturing, logistics, and healthcare. Besides, industries are forced to deploy robotic solutions owing to an increased demand for efficiency and concurrent labor shortages.

E-commerce growth, on the other hand, requires automation for warehousing and delivery systems, generating demand for mobile robots and automated guided vehicles. Finally, Industry 4.0 and smart factories are creating an increased impetus for integrating robotic systems and demand for advanced automation technologies.

Human-robot collaboration is being taken to new heights in safety and efficiency through the cobots in the spirit of collaboration. Another trend observed in the market is the increasing digitalization and software solutions, where digital twins and simulation tooling optimize the deployment of robots.

For Instance, In 2025, At CES- the most powerful tech event in the world, Nvidia introduced its Mega Omniverse blueprint, aimed at transforming industrial robot fleet management and operations through digital twins. This facility includes building AI, Nvidia Isaac, and Omniverse technologies for making digital mirror factories and warehouses for simulation testing of robotic systems before any possibility of their actual installation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in the market, iRobot, has been acquired by Amazon, marking a significant strategic move toward merging sophisticated home robotics, particularly Roomba, into Amazon’s existing smart home ecosystem. The purchase aims to harness iRobot’s cutting-edge mapping and automation technology to build better-integrated smart home experiences for Amazon customers.

With that integration, Amazon will expand its smart home product lines enormously, showing its determination to become a meaningful player in the rapidly developing home automation space. The partnership that Kawasaki and Hurco Robotics have newly struck is aimed at offering a complete robotic machine-tending industrial quality solution.

Bringing Kawasaki’s robotic innovation into the mix is intended to marry Hurco’s proficiency in CNC machines with computerized control systems, producing automated solutions and enriching industrial processes. Central to this collaboration is advancing intuitive robotic solutions that blend seamlessly into current workflows, especially in high-mix, low-volume production environments.

Top Key Players in the Market

- iRobot Corporation

- Kawasaki Heavy Industries, Ltd.

- Fanuc Corporation

- Omron Corporation

- Intuitive Surgical Operations, Inc.

- OTC Daihen Inc.

- Panasonic Industry Europe GmbH

- Yaskawa Electric Corporation

- Kuka AG (Midea Group)

- Boston Dynamics

- Others

Recent Developments

- In August 2024, Kawasaki Robotics launched a new educational robot specifically designed for North American educators and students, aiming to make hands-on robotics experiences more accessible. This initiative underscores the company’s commitment to fostering STEM education by providing a user-friendly and versatile platform for learning and experimentation in robotics.

- In November 2024, AGILOX launched a complete Digital Twin for every Autonomous Mobile Robot (AMR) model. This inventive tool permits virtual testing of almost any function and aspect of an AMILOX robot to match real-world capabilities with high fidelity. The Digital Twin encapsulates the important elements of the robot’s operation, including mapping, localization, navigation, safety, and collision avoidance.

Report Scope

Report Features Description Market Value (2024) USD 35.6 Bn Forecast Revenue (2034) USD 382.5 Bn CAGR (2025-2034) 26.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software) By Mobility (Mobile, Stationary) By End User (Personal- Professional) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape iRobot Corporation, Kawasaki Heavy Industries, Ltd., Fanuc Corporation, Omron Corporation, Intuitive Surgical Operations, Inc., OTC Daihen Inc., Panasonic Industry Europe GmbH, Yaskawa Electric Corporation, Kuka AG (Midea Group), Boston Dynamics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- iRobot Corporation

- Kawasaki Heavy Industries, Ltd.

- Fanuc Corporation

- Omron Corporation

- Intuitive Surgical Operations, Inc.

- OTC Daihen Inc.

- Panasonic Industry Europe GmbH

- Yaskawa Electric Corporation

- Kuka AG (Midea Group)

- Boston Dynamics

- Others