Global Collaborative Robots Market By Payload Capacity (Up to 5kg, Up to 10kg, Above 10kg), By Application (Assembly, Handling, Pick & Place, Quality Testing, Packaging, Gluing & Welding, Other Applications), By End-Use Industry (Food & Beverage, Automotive, Plastic & Polymers, Furniture & Equipment, Electronics, Metal & Machinery, Pharmaceutical, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan. 2024

- Report ID: 17838

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

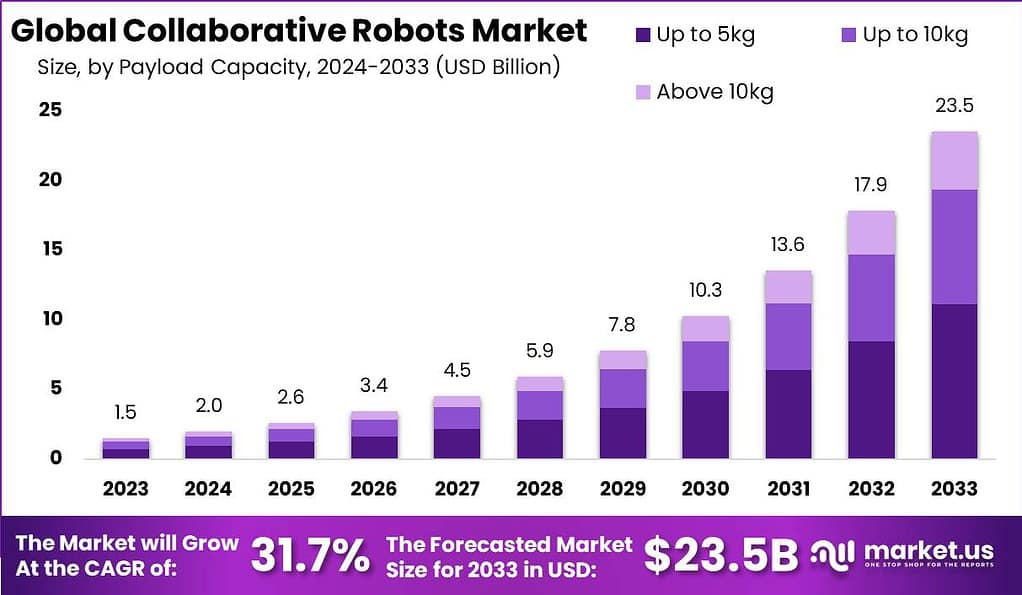

The Global Collaborative Robots Market size is expected to be worth around USD 23.5 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 31.7% during the forecast period from 2024 to 2033.

Collaborative robots, also known as cobots, are advanced robotic systems designed to work alongside humans in a collaborative manner. Unlike traditional industrial robots, which are typically confined to cages or dedicated workspaces, cobots are designed to be safe and interactive, allowing humans and robots to work together in close proximity. These robots are equipped with sensors and advanced safety features that enable them to detect and respond to human presence, minimizing the risk of accidents and injuries.

Collaborative robots offer a flexible and cost-effective alternative to traditional industrial robots, particularly for small and medium-sized enterprises (SMEs) that may have limited resources or space. The ability of cobots to work alongside humans in a collaborative manner enhances productivity and efficiency in industrial settings.

Analyst Viewpoint

The Collaborative Robots (Cobots) market is experiencing significant growth, driven by a confluence of factors. Primary driving forces include the escalating need for automation in manufacturing processes, the imperative to enhance productivity, and the ongoing evolution in artificial intelligence and machine learning technologies. The versatility of cobots, characterized by their ability to safely interact with human workers and adapt to various tasks, renders them an increasingly attractive option across multiple industries.

According to the International Federation of Robotics (IFR), estimates that cobot sales grew by 48% in 2022, reaching a total of 553,052 units sold worldwide. This growth is expected to continue in the coming years, with the RIA predicting that cobot sales will represent 34% of the overall industrial robot market by 2025.

Opportunities in the collaborative robots market are vast and varied. One significant opportunity lies in the realm of customization and flexibility. As cobots become more adaptable, they can be tailored to meet the specific needs of different industries, thus expanding their market reach. Additionally, there is a growing trend towards human-robot collaboration in non-traditional sectors like healthcare, agriculture, and retail, opening new avenues for market expansion.

Furthermore, as industries continue to focus on sustainability and safety, cobots offer an efficient solution. Their precision and consistency can lead to reduced waste and energy consumption, aligning with the global push towards greener manufacturing practices.

Key Takeaways

- The Collaborative Robots Market is projected to reach a valuation of USD 23.5 billion by 2033, growing at an impressive CAGR of 31.7% from USD 1.5 billion in 2023.

- In 2022, cobot sales witnessed a remarkable 48% growth, totaling 553,052 units sold globally, as reported by the International Federation of Robotics (IFR). It is predicted that cobot sales will represent 34% of the overall industrial robot market by 2025, according to the RIA.

- In 2023, cobots with a payload capacity of up to 5kg held a dominant market position, capturing over 47.3% of the market share. These lightweight robots are versatile and cost-effective, making them popular among small and medium-sized enterprises (SMEs).

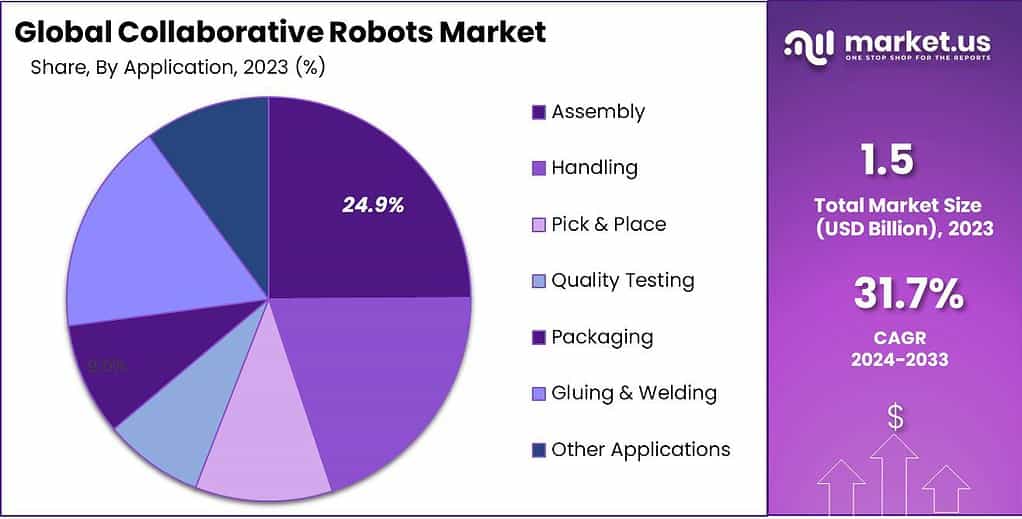

- The assembly segment emerged as a dominant player in the collaborative robots market in 2023, capturing over 24.9% market share. Collaborative robots excel in assembly tasks, improving production efficiency, worker safety, and flexibility.

- In 2023, the automotive sector held the dominant market position in the collaborative robots market, with a share of more than 26.1%. Automotive manufacturers utilize cobots for tasks such as assembly, welding, painting, and inspection to enhance production efficiency and quality.

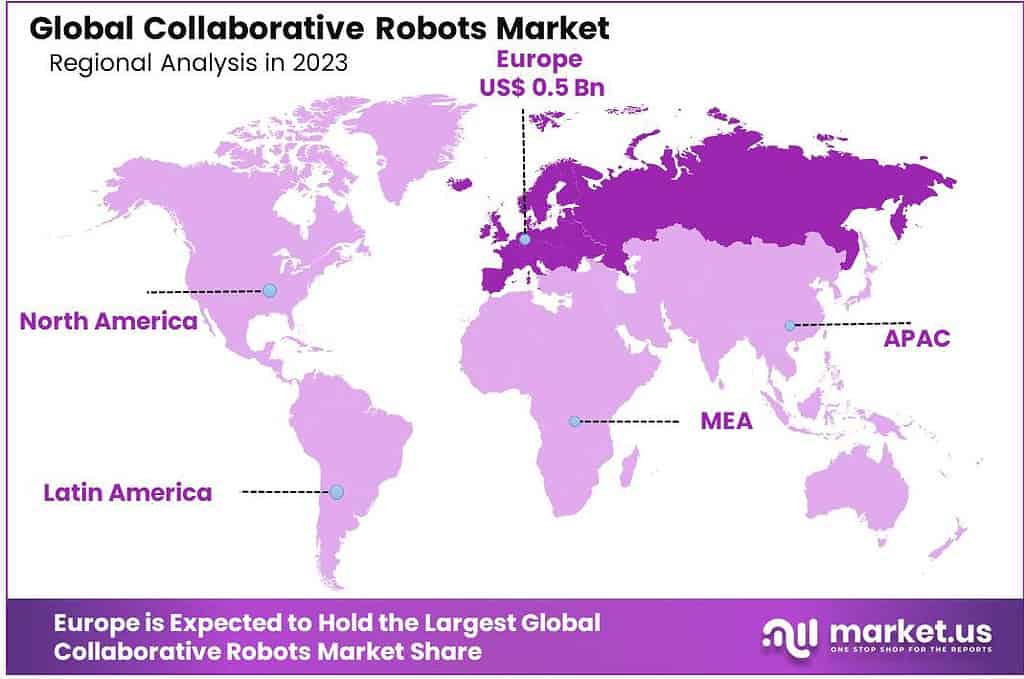

- In 2023, Europe held a dominant market position in the collaborative robots market, accounting for over 33% of the market share. China emerged as the largest market in terms of installations, driven by its strong manufacturing base.

Payload Capacity Analysis

In 2023, the Up to 5kg segment held a dominant market position, capturing more than a 47.3% share of the overall collaborative robots market. This segment’s strong performance can be attributed to several factors. Firstly, robots with a payload capacity of up to 5kg are well-suited for a wide range of applications across various industries, including electronics, automotive, and consumer goods. These lightweight robots are capable of performing tasks such as pick-and-place operations, assembly, and packaging, which are common in manufacturing environments.

The versatility of the Up to 5kg segment makes it a popular choice for small and medium-sized enterprises (SMEs) that require flexible automation solutions. Furthermore, the lower payload capacity of these robots often translates into lower costs compared to higher payload capacity counterparts. The affordability factor makes Up to 5kg collaborative robots more accessible to a broader customer base, particularly for SMEs with budget constraints.

The cost-effectiveness, coupled with the ease of integration and programming, contributes to the segment’s popularity. Moreover, advancements in technology have led to significant improvements in the performance and capabilities of lightweight collaborative robots. Enhanced sensors, better gripping mechanisms, and improved precision enable these robots to handle delicate and intricate tasks with precision and efficiency. Their compact size and agility also allow for easy deployment and adaptability within existing production lines, further driving their demand.

Application Analysis

In 2023, the Assembly segment emerged as the dominant player in the collaborative robots market, capturing a significant market share of over 24.9%.

This can be attributed to several factors that have contributed to the segment’s success. Assembly applications involve the use of collaborative robots in the manufacturing process to assemble various components into a final product. These robots are capable of performing repetitive tasks with precision, speed, and consistency, thereby improving overall production efficiency. With the increasing demand for automation in industries such as automotive, electronics, and aerospace, the assembly segment has witnessed substantial growth.

Moreover, collaborative robots offer several advantages in assembly applications. They can work alongside human workers, ensuring enhanced safety by taking over strenuous or hazardous tasks. This not only minimizes the risk of workplace accidents but also improves worker productivity and reduces fatigue. Additionally, collaborative robots are versatile and can be easily programmed and reprogrammed to adapt to changing assembly line requirements, enabling manufacturers to achieve greater flexibility and agility.

Furthermore, the adoption of collaborative robots in assembly processes helps to streamline operations and reduce costs. These robots are typically more cost-effective compared to traditional industrial robots, requiring minimal installation and maintenance expenses. Their compact size and flexible design allow them to be integrated into existing production lines without major disruptions, leading to a quicker return on investment for manufacturers.

The market for collaborative robots in assembly is expected to continue its growth trajectory in the coming years. As industries increasingly prioritize automation and seek to optimize their production processes, the demand for collaborative robots in assembly applications will persist. Technological advancements, such as improved sensing capabilities and enhanced human-machine interfaces, are also expected to further drive the adoption of collaborative robots in assembly operations.

End-Use Industry

In 2023, the Automotive segment held a dominant market position in the Collaborative Robots (Cobots) Market, capturing more than a 26.1% share. This leading status is primarily due to the extensive adoption of cobots in automotive manufacturing, a sector characterized by its high-volume and high-precision production requirements. Cobots in the automotive industry are primarily utilized for tasks such as assembly, welding, painting, and inspection, contributing significantly to enhancing production efficiency and quality.

The surge in cobot adoption within the automotive sector can be linked to their ability to operate safely alongside human workers, a feature that is particularly beneficial in environments where space is a constraint and human-robot interaction is frequent. This characteristic, coupled with their flexibility and ease of reprogramming, allows for rapid adjustments in production lines, catering to the automotive industry’s need for adaptable manufacturing processes in response to changing market demands and model updates.

Another factor contributing to the dominance of the Automotive segment is the industry’s ongoing push towards automation and digital transformation. Cobots are integral to this transformation, offering a cost-effective and scalable solution compared to traditional industrial robots. They are particularly advantageous for small and medium-sized automotive manufacturers, who are adopting cobots to remain competitive and agile in a rapidly evolving market.

Additionally, technological advancements in cobots, such as enhanced sensor technology, machine vision, and AI integration, have further expanded their application in complex automotive tasks. These advancements not only improve production capabilities but also ensure a higher level of consistency and quality, critical factors in automotive manufacturing.

Driver

Increasing Demand for Automation in Manufacturing

The collaborative robots (cobots) market is significantly driven by the escalating demand for automation in the manufacturing sector. This demand is primarily attributed to the myriad benefits automation offers, such as enhanced productivity, improved quality, and reduced operational costs. Cobots, distinguished by their ability to work alongside human workers safely, are becoming increasingly vital in industries where precision and flexibility are paramount.

The proliferation of Industry 4.0 and the integration of smart factories have further fueled the demand for cobots. These robots are designed to be user-friendly, with capabilities that include easy programming and being equipped with sensors for safe human-robot interaction. This adaptability makes them ideal for small and medium-sized enterprises (SMEs) that require flexible production methods.

Moreover, the growing emphasis on lean manufacturing practices compels industries to adopt automation tools that minimize waste and optimize efficiency. Cobots fit this requirement perfectly, as they can be deployed for various tasks with minimal downtime. Their versatility extends to performing tasks that are hazardous or ergonomically challenging for human workers, thereby enhancing workplace safety and productivity.

Restraint

High Initial Investment Costs

While the adoption of collaborative robots brings numerous benefits, a significant restraint for market growth is the high initial investment costs associated with these robots. Collaborative robots require a substantial upfront investment in terms of the robot hardware, software, training, and integration with existing systems. Small and medium-sized enterprises (SMEs) often face financial constraints in implementing collaborative robot solutions due to their limited budgets.

Moreover, the cost of downtime during the integration and training phases further adds to the overall investment. However, it is worth noting that as the market matures and competition increases, the prices of collaborative robots are expected to gradually decrease, making them more accessible to a wider range of businesses. Additionally, the long-term benefits of increased productivity, improved quality, and reduced labor costs can offset the initial investment over time, making collaborative robots a cost-effective solution in the manufacturing industry.

Opportunity

Advancements in AI and Machine Learning

Advancements in artificial intelligence (AI) and machine learning present significant opportunities for the collaborative robots market. AI-powered collaborative robots can learn and adapt to dynamic environments, making them more versatile and capable of handling complex tasks. These robots can use machine learning algorithms to analyze data, make real-time decisions, and optimize their performance based on changing conditions. For example, AI-enabled vision systems can enhance the perception capabilities of collaborative robots, allowing them to identify and handle objects with greater accuracy and efficiency.

Furthermore, AI algorithms can enable robots to collaborate more intelligently with human workers, leading to improved productivity and reduced errors. As AI and machine learning technologies continue to evolve, the capabilities of collaborative robots are expected to expand, unlocking new possibilities for automation in various industries.

Challenge

Integration with Existing Systems

Key Market Segments

Payload Capacity

- Up to 5kg

- Up to 10kg

- Above 10kg

Application

- Assembly

- Handling

- Pick & Place

- Quality Testing

- Packaging

- Gluing & Welding

- Machine Tending

- Others

End-Use Industry

- Food & Beverage

- Automotive

- Plastic & Polymers

- Furniture & Equipment

- Electronics

- Metal & Machinery

- Pharmaceutical

- Others

Regional Analysis

In 2023, Europe held a dominant market position in the collaborative robots market, capturing more than a 33% share. The demand for Collaborative Robots in Europe was valued at US$ 0.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

Regionally, the distribution of new installations was heavily skewed towards Asia, which accounted for 73% of all new deployments, followed by Europe with 15% and the Americas with 10%. Specifically, China emerged as the largest market, with annual installations reaching 290,258 units, a 5% increase from 2021. This dominance is largely attributed to the region’s strong manufacturing base, particularly in automotive, electronics, and machinery industries.

European countries, notably Germany, Sweden, and Italy, have been early adopters of cobot technology, driven by their focus on innovation and high-quality manufacturing standards. The presence of leading cobot manufacturers in Europe also contributes to the market’s growth, facilitating access to advanced technologies. Furthermore, stringent workplace safety regulations in Europe have encouraged the adoption of cobots, known for their safe interaction with human workers. The region’s emphasis on Industry 4.0 and smart factory initiatives continues to propel the demand for collaborative robots.

North America is another significant player in the collaborative robots market, driven by its robust automation and manufacturing sectors. The United States, in particular, has shown a keen interest in cobots, especially in industries like automotive, aerospace, and food and beverage. The presence of a tech-savvy workforce and the adoption of advanced manufacturing practices have facilitated the integration of cobots into various industrial processes.

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The collaborative robots market is highly competitive, with several key players leading the industry. These companies are actively involved in developing innovative collaborative robot solutions and expanding their market presence. Some of the prominent players in the market include Universal Robots, ABB Ltd, FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Rethink Robotics.

Universal Robots, a pioneer in the field of collaborative robots, has established itself as a market leader. The company offers a range of flexible and user-friendly collaborative robot arms that can be easily integrated into various applications. Universal Robots’ robots are known for their advanced safety features, intuitive programming, and high payload capacities, making them suitable for diverse industrial settings.

ABB Ltd is another major player in the collaborative robots market. The company offers a comprehensive portfolio of collaborative robot solutions, including robots with various payload capacities and reach capabilities. ABB’s collaborative robots are designed to work alongside humans safely, enabling efficient and flexible automation in industries such as automotive, electronics, and logistics.

Top Key Players

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Universal Robots

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Rethink Robotics GmbH

- Doosan Group

- AUBO Robotics

- F&P Robotics AG

- Brooks Automation

- MABI AG

- Other Key Players

Recent Developments

In 2023, ABB:

- GoFa & Swifti cobot range expansion: Launched GoFa cobots with extended reach and payload, and Swifti cobots for high-speed picking and packing.

- Partnerships with PickNik Robotics and Covariant AI: Developed integrated gripping and AI vision solutions for cobots.

In 2023, FANUC Corporation:

- CRX-10iA and CRX-10iiA cobot launch: Lightweight and user-friendly cobots for various applications.

- Strategic partnerships with Brain Corp and Plus One Robotics: Focused on expanding cobot applications in logistics and healthcare.

In 2023, KUKA:

- LBR iiWA cobot family expansion: Introduced new LBR iiWA 7 R800 model with higher payload and reach.

- Partnerships with OnRobot and Wandelbots: Developed application-specific cobot grippers and accessories.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 Bn Forecast Revenue (2033) US$ 23.5 Bn CAGR (2024-2033) 31.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Payload Capacity (Up to 5kg, Up to 10kg, Above 10kg), By Application (Assembly, Handling, Pick & Place, Quality Testing, Packaging, Gluing & Welding, Other Applications), By End-Use Industry (Food & Beverage, Automotive, Plastic & Polymers, Furniture & Equipment, Electronics, Metal & Machinery, Pharmaceutical, Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape ABB Ltd., FANUC Corporation, KUKA AG, Universal Robots, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Rethink Robotics GmbH, Doosan Group, AUBO Robotics, F&P Robotics AG, Brooks Automation, MABI AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Collaborative Robots (Cobots)?Collaborative Robots, or Cobots, are advanced robotic systems designed to work alongside humans in a shared workspace. They are engineered to collaborate with human operators in a safe and productive manner.

How big is the collaborative robot industry?The Global Collaborative Robots Market size is expected to be worth around USD 23.5 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 31.7% during the forecast period from 2024 to 2033.

Who are the leading companies in the collaborative robot market?Collaborative robot market include ABB Ltd., FANUC Corporation, KUKA AG, Universal Robots, Yaskawa Electric Corporation, Kawasaki Heavy Industries Ltd., Rethink Robotics GmbH, Doosan Group, AUBO Robotics, F&P Robotics AG, Brooks Automation, MABI AG, Other Key Players

Which region has the biggest share in Collaborative Robot Market?In 2023, Europe held a dominant market position in the collaborative robots market, capturing more than a 33% share.

What industries are adopting Collaborative Robots?Collaborative Robots find applications in various industries, including manufacturing, healthcare, logistics, and electronics. They are employed for tasks such as assembly, material handling, quality inspection, and medical assistance.

What challenges does the Collaborative Robots market face?Challenges include the high initial costs of implementing Cobots, the need for standardized safety regulations, and addressing concerns related to job displacement in certain industries.

Collaborative Robots MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample

Collaborative Robots MarketPublished date: Jan. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Universal Robots

- Yaskawa Electric Corporation

- Kawasaki Heavy Industries, Ltd.

- Rethink Robotics GmbH

- Doosan Group

- AUBO Robotics

- F&P Robotics AG

- Brooks Automation

- MABI AG

- Other Key Players