Global Smart Label Market Analysis, Decision-Making Report By Technology (Radio-Frequency Identification (RFID), Electronic Article Surveillance (EAS), Electronic Shelf Label (ESL), Sensing Labels, Near Field Communication (NFC)), By Component (Batteries, Transceivers, Microprocessors, Memories, Others), By End-User (Retail, Logistics, Healthcare, Food & Beverage, Aerospace, Manufacture), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144228

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

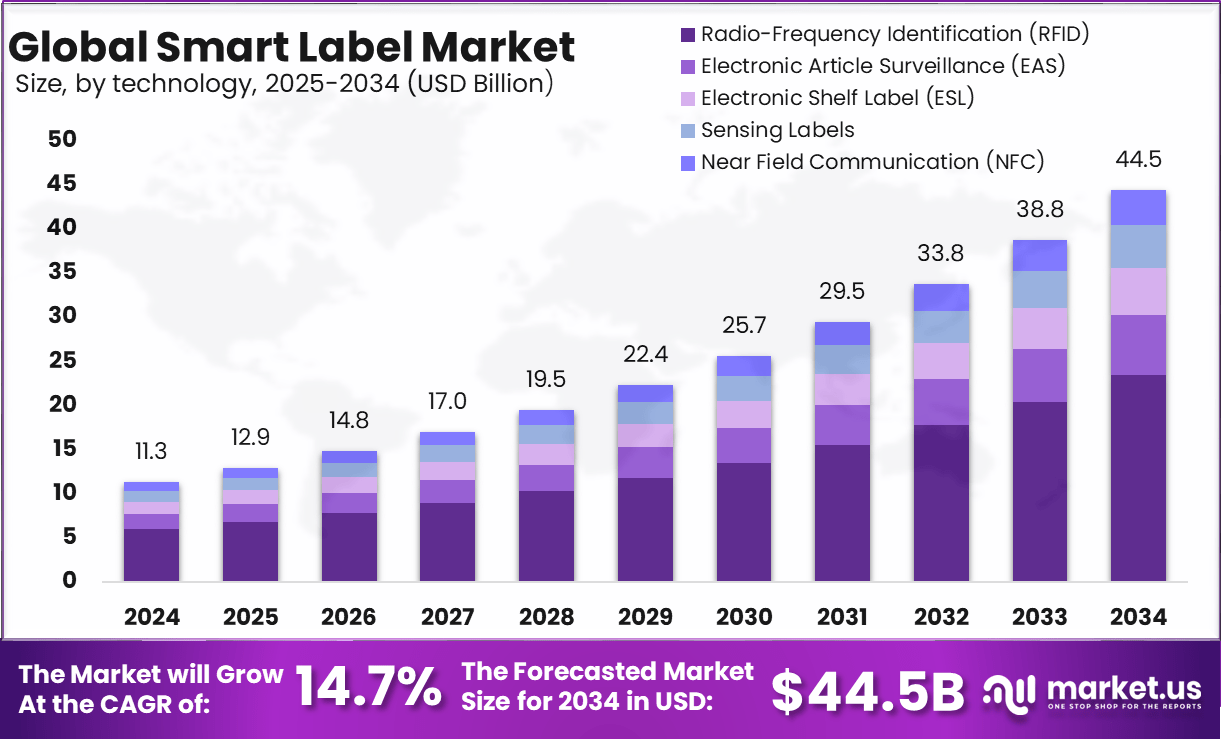

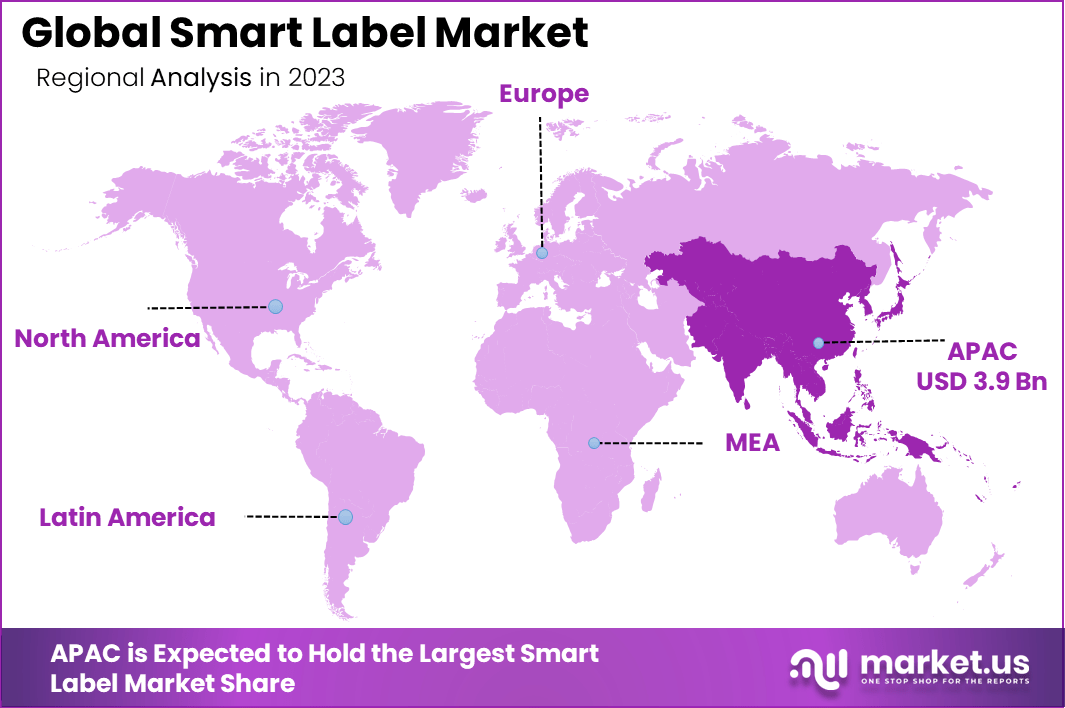

The Global Smart Label Market size is expected to be worth around USD 44.5 Billion by 2034, from USD 11.3 Billion in 2024, growing at a CAGR of 14.7% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 35.2% share, holding USD 3.9 Billion revenue.

The growth of the Smart Label market is primarily fueled by several key factors. A significant driver is the increasing demand for efficient supply chain management in retail and logistics, where smart labels offer real-time tracking and inventory management solutions. Additionally, the healthcare sector’s need for enhanced drug traceability and counterfeit prevention has spurred further adoption of these technologies.

The adoption of advanced technologies in smart labels is on the rise, driven by the need for greater efficiency and accuracy in product tracking. RFID technology, in particular, is being increasingly integrated into smart labels due to its ability to store a vast amount of data that can be accessed remotely. NFC and QR codes are also gaining traction as they facilitate consumer engagement and counterfeit protection.

The primary motivators for the adoption of smart label technologies include the need for greater efficiency in supply chain operations, enhanced product traceability, and the desire to meet increasing regulatory requirements regarding product information transparency. Businesses are increasingly reliant on these technologies to gain a competitive advantage by ensuring product authenticity and combating counterfeit products.

Demand for smart labels is significantly high in the retail sector, where they are used to track products through supply chains and improve customer service by providing detailed product information. The healthcare sector also shows a promising increase in demand, driven by the necessity for precise tracking of medical devices and pharmaceuticals.

Key Takeaways

- The Smart Label Market is poised for significant growth, projected to reach approximately USD 44.5 billion by 2034, up from USD 11.3 billion in 2024. This expansion translates to a compound annual growth rate (CAGR) of 14.7% from 2025 to 2034.

- In 2024, the Radio-Frequency Identification (RFID) segment was a major force in the market, securing a dominant 52.7% share. This dominance underscores the widespread adoption of RFID technology in smart labeling for its tracking capabilities and data accuracy.

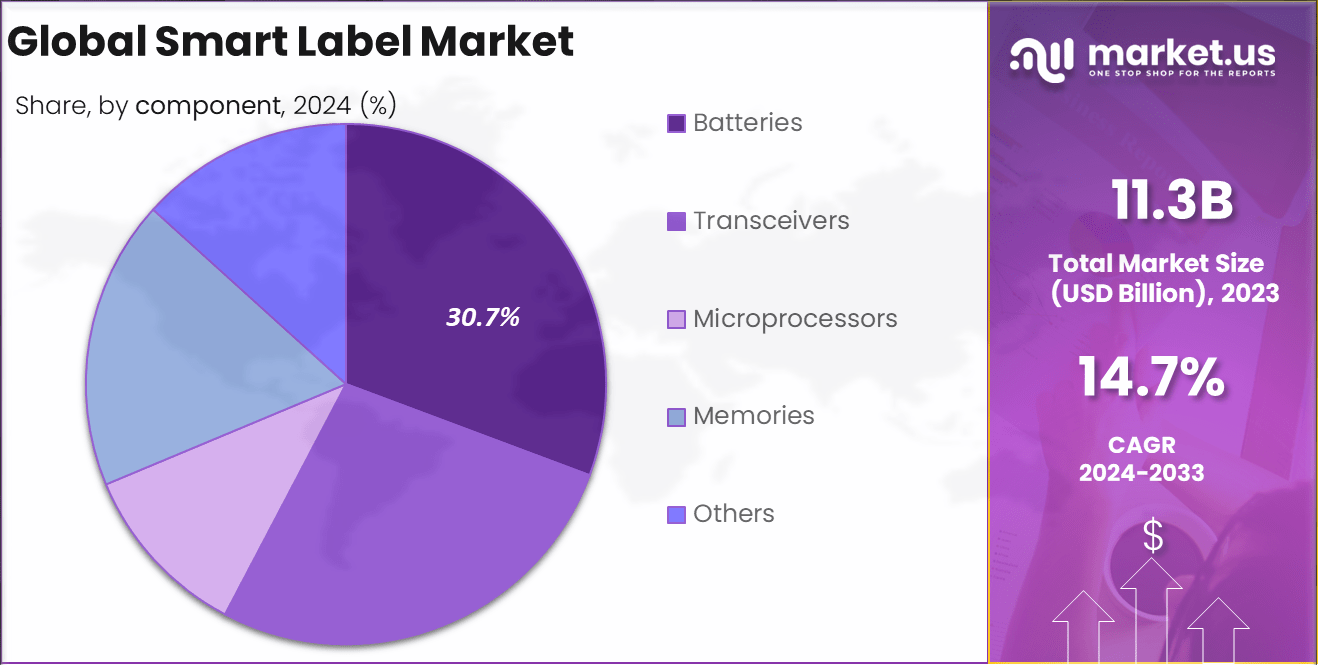

- Additionally, the Batteries segment also played a crucial role, accounting for 30.7% of the market. This highlights the essential role of batteries in powering smart labels, particularly in sectors where long-term operational functionality is critical.

- The Retail sector demonstrated robust use of smart labels, holding over 23.4% of the market. This reflects the retail industry’s increasing reliance on smart technology for inventory management and customer engagement.

- Regionally, the Asia-Pacific (APAC) region led the global market, capturing more than 35.2% of the market share in 2024. The region’s leadership indicates a strong adoption rate and the integration of smart labeling technologies across various industries, driven by a push for greater efficiency and connectivity in supply chain operations.

Analysts’ Viewpoint

The Smart Label market presents numerous investment opportunities, primarily driven by its integration with IoT technologies and the shift towards digital and connected packaging solutions. These technologies are enhancing product traceability and inventory management across diverse industries, notably in retail, healthcare, and logistics.

The growing emphasis on sustainability also offers a unique investment avenue as companies increasingly adopt eco-friendly and biodegradable smart labels. Several critical factors are influencing the Smart Label market’s trajectory. The adoption of advanced technologies like RFID, NFC, and QR codes is pivotal, enhancing the functionality of smart labels for a range of applications, from anti-theft in retail to real-time tracking in logistics.

For instance, In July 2023, Impinj, Inc., a leading provider of RAIN RFID technology and a recognized pioneer in the Internet of Things (IoT) sector, introduced the Impinj M800 series RAIN RFID tag chips. This launch was strategically positioned to address the growing enterprise demand for seamless item-level connectivity across global IoT deployments.

The M800 series is engineered to deliver unmatched readability in enterprise-scale environments, ensuring faster and more accurate item identification. In addition to performance enhancements, the chips offer improved tag reliability and greater manufacturability, features that are critical for large-scale, cost-effective deployments in logistics, retail, healthcare, and industrial sectors.

The smart label market is experiencing rapid technological evolution. Innovations include the adoption of IoT technologies that enable smart labels to integrate seamlessly within existing digital ecosystems, improving their functionality and application scope. Companies are also focusing on enhancing the sustainability of their products by developing labels that are recyclable and biodegradable, responding to both regulatory pressures and consumer preferences for environmentally friendly products.

Impact of AI

The impact of Artificial Intelligence (AI) on the smart label market is profound and multifaceted, fundamentally transforming how businesses and consumers interact with products.

- Enhanced Data Analytics: AI integrates with smart label technologies like RFID and NFC to analyze vast amounts of data generated from the labels. This capability allows businesses to gain deeper insights into inventory management, supply chain logistics, and consumer behavior.

- Improved Consumer Engagement: AI enhances smart labels by enabling more interactive and personalized experiences. For instance, smart labels can use AI to provide consumers with detailed product information, authenticity verification, and tailored recommendations based on previous buying behaviors.

- Operational Efficiency: AI contributes to operational efficiencies in logistics and retail environments. Smart labels equipped with AI can automate routine tasks such as stock replenishment and price updates. They can also improve the accuracy of asset tracking throughout the supply chain, reducing losses and improving the overall speed of operations.

- Enhanced Security Features: AI technologies are being employed to bolster the security features of smart labels, particularly in combating counterfeiting and theft. AI can analyze patterns to detect anomalies that may indicate fraudulent activities.

- Sustainability Efforts: AI helps in promoting sustainability through smart labels by optimizing routes for logistics to reduce carbon footprints or by managing resources more efficiently in production cycles. Smart labels can also track the lifecycle of a product to ensure proper recycling or disposal, thereby supporting circular economy initiatives.

Technology Analysis

In 2024, the Radio-Frequency Identification (RFID) segment held a dominant market position, capturing more than a 52.7% share of the Global Smart Label Market. The dominance of radio frequency identification (RFID) segment in the smart label market is from its from its superior tracking and identification capabilities.

RFID tags enable real time data collection and wireless communication without line of sight, making them indispensable for inventory management and supply chain operations. RFID’s scalability and versatility across industries such as retail, healthcare and logistics drive its widespread adoption.

It supports bulk scanning, enhances operational efficiency, and minimizes human errors, providing a competitive edge for businesses. additionally, its use in contactless payment and authentication strengthens its market position.

Advancements in RFID technology, such as reduced costs, energy efficient designs, and improved read ranges, further fuel its growth. Its seamless integration with IoT systems positions it’s as a cornerstone of smart labelling solutions.

Component Analysis

In 2024, the Batteries segment held a dominant market position, capturing more than a 30.7% share of the Global Smart Label Market. The dominance of the battery segment in the market is driven by its critical role in powering portable devices, electric vehicles, and renewable energy storage systems. with the surge essential due to their high energy density and efficiency.

Technological advancements have improved battery performance, lifespan, and cost effectiveness, further fuelling their demand. The growing use of batteries in consumer electronics, healthcare devices, and IoT enabled gadgets underscores their market leadership.

Additionally, the global shift toward clean energy solutions have amplified the need for reliable energy storage. Batteries are integral to stabilizing renewable energy systems, ensuring uninterrupted power supply. Their versatility and scalability make them the preferred choice across industries.

End User Analysis

In 2024, the Retail segment held a dominant market position, capturing more than a 23.4% share of the Global Smart Label Market. The retail segment dominates the market due to its high demand for efficient inventory management, enhanced customer experience, and streamlined supply chain operations. Smart labels enable retailers to track the stock in real time, reducing the shrinkage and improving restocking efficiency.

These labels enhance the customer engagement by offering detailed product information, promotions, and interactive experiences via QR codes or NFC technology. This aligns with the growing consumer preference for transparency and convenience in retail shopping.

Additionally, the rise of e-commerce fuels the demand for smart labels, as they ensure accurate order tracking and delivery. Retailers benefit from cost savings, improved brand loyalty, and compliance with sustainability regulations, further cementing the retail segment’s market leadership in adopting smart label solutions.

Key Market Segments

By Technology

- Radio-Frequency Identification (RFID)

- Electronic Article Surveillance (EAS)

- Electronic Shelf Label (ESL)

- Sensing Labels

- Near Field Communication (NFC)

By Component

- Batteries

- Transceivers

- Microprocessors

- Memories

- Others

By End-User

- Retail

- Logistics

- Healthcare

- Food & Beverage

- Aerospace

- Manufacture

Drivers

Growing demand for real time inventory tracking and management

The growing demand for real time inventory tracking and management drives the market growth as businesses prioritize operational efficiency and cost reduction. Smart labels equipped with RFID and IoT technologies provide instant visibility into stock levels, minimizing overstocking and stock outs.

Retailers benefit significantly by streamlining supply chains, ensuring timely replenishment, and enhancing customer satisfaction. Real time tracking reduces errors in order processing and enables precise demand forecasting, aligning inventory with market needs effectively.

Restraint

Higher initial investment and implementation costs

Higher initial investment and implementation costs are a significant restraint for the smart label market, particularly for small and medium sized enterprises. The adoption of advanced technologies like RFID, NFC, and IoT in smart labels requires substantial capital for infrastructure, technology integration, and training.

For different businesses, the upfront costs of smart label systems can outweigh the immediate benefits, leading to hesitance in adopting the technology. Additionally, the complexity of installation and maintenance can result in additional operational expenses.

Opportunities

Integration with AI for predictive analytics and automation

AI integration in smart labels offers significant opportunities for predictive analytics and automation. AI can analyze large datasets from smart labels, providing insights into inventory trends, demand forecasting, and supply chain optimization, thus improving operational efficiency.

Automation powered by AI reduces human intervention, enabling real time decision making, faster product tracking, and reduced errors. This streamlines processes like stock replenishment and logistics management, saving time and cost for businesses.

Challenges

Complexities in maintaining interoperability across technologies

Maintaining interoperability across different technologies poses a significant challenge in the smart label market. as various industries adopt diverse platforms such as RFID, NFC, and QR codes, ensuring seamless communication between these systems becomes complex.

Each technology may operate on distinct protocols, requiring integration solutions that can unify data streams. This complicates the development and implementation process, increasing time and cost for businesses.

Growth Factors

The smart label market is growing due to the increasing demand for efficient supply chain management and inventory tracking. Retailers and manufacturers are adopting smart labels to enhance operational efficiency, reduce losses, and improve product traceability.

Technological advancements in RFID, NFC, and IoT enable real time data collection and better consumer engagement. These innovations provide more accurate tracking, personalized customer experiences, and quick response times, further driving the market growth.

Regional Analysis

In 2024, APAC held a dominant market position in the Smart Label Market, capturing more than a 35.2% share, which translated into USD 3.9 billion in revenue. This leadership can be primarily attributed to the rapid industrialization and expansion of retail sectors in major economies such as China, India, and Japan.

Furthermore, the adoption of smart labels has been significantly boosted by the increasing emphasis on consumer safety and the traceability of products in these regions. The proliferation of advanced technologies within APAC, including RFID, NFC, and IoT, which are integral to smart labels, has also played a crucial role.

According to a U.S. Census, nearly 95% of the United States population – equivalent to approximately 322,563,519 individuals – had access to the Internet as of 2024. This widespread digital connectivity has created significant opportunities for consumer goods companies to engage with shoppers through online platforms and digital product experiences.

In alignment with this trend, the U.S. Grocery Manufacturers Association (GMA) has projected that approximately 80% of products within key consumer verticals – namely food and beverages, pet and personal care, and household goods – are expected to feature a smart label within the next five years. These smart labels, often equipped with QR codes or digital links, provide detailed product information, including ingredients, sourcing, allergens, and sustainability practices.

These technologies enhance the functionality of smart labels, facilitating real-time tracking, temperature indicators, and security features, which are highly valued in the food and beverage, pharmaceutical, and consumer goods industries. This technological integration has been supported by governmental initiatives aimed at promoting digital infrastructure, which in turn has accelerated market growth.

Moreover, the cost-effectiveness of producing smart labels in APAC, due to lower labor costs and the availability of raw materials, has attracted numerous global companies to set up their manufacturing bases in the region. This has not only driven local market growth but also fostered export opportunities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

A leading player in the market is Zebra Technologies that offer a wide range of RFID based smart labelling solutions. they are focused on supply chain efficiency, enhancing inventory management, and improving customer experience.

Another leading player in the market is Avery Dennison that provides innovation, RFID, NFC, and QR code solutions, particularly for the retail and logistics industries. They emphasize sustainability and aim to reduce the environmental impact of their labels.

Top Key Players in the Market

- Avery Dennison Corporation

- CCL Industries Inc.

- William Frick & Company

- Honeywell International Inc.

- Invengo Information Technology Co. Ltd

- Scanbuy Inc.

- Sato Holdings Corp.

- Alien Technology

- Zebra Technologies Corp.

- Roambee Corporation

- Other Key Players

Recent Developments

- In September 2024, Trackonomy, the leader in advanced enterprise resource optimization for logistics, healthcare, utilities, industrial, cold chain, airlines, government, and defense markets, has announced the launch of SmartTape.

- In May 2024, At Labelexpo 2024, CCL Label, in collaboration with Checkpoint Systems, presented an extensive selection of RFID labeling options designed to enhance tracking, improve inventory management, and boost security across various industries.

- In May 2024, Roambee introduced the world’s first true 5G GPS ‘peel-and-ship’ smart label. This innovative label utilizes advanced 5G, GPS, and sensors to monitor temperature, humidity, shock, and light for single-journey shipments, offering a ‘barcode-like’ user experience.

Report Scope

Report Features Description Market Value (2024) USD 11.3 Bn Forecast Revenue (2034) USD 44.5 Bn CAGR (2025-2034) 14.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Radio-Frequency Identification (RFID), Electronic Article Surveillance (EAS), Electronic Shelf Label (ESL), Sensing Labels, Near Field Communication (NFC)), By Component (Batteries, Transceivers, Microprocessors, Memories, Others), By End-User (Retail, Logistics, Healthcare, Food & Beverage, Aerospace, Manufacture) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Avery Dennison Corporation, CCL Industries Inc., William Frick & Company, Honeywell International Inc., Invengo Information Technology Co. Ltd, Scanbuy Inc., Sato Holdings Corp., Alien Technology, Zebra Technologies Corp., Roambee Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avery Dennison Corporation

- CCL Industries Inc.

- William Frick & Company

- Honeywell International Inc.

- Invengo Information Technology Co. Ltd

- Scanbuy Inc.

- Sato Holdings Corp.

- Alien Technology

- Zebra Technologies Corp.

- Roambee Corporation

- Other Key Players