Global IoT Insurance Market Analysis, Decision-Making Report By Component (Solution, Services), By Insurance Type (Property and Casualty Insurance, Health and Life Insurance, Others Insurance Types), By Application (Automotive and Transportation, Buildings, Health and Life, Retail, Agriculture, Other Applications), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144192

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Analysts’ Viewpoint

- Key Takeaways

- U.S. IoT Insurance Market Size

- Component Analysis

- Insurance Type Analysis

- Application Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Latest Trends

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

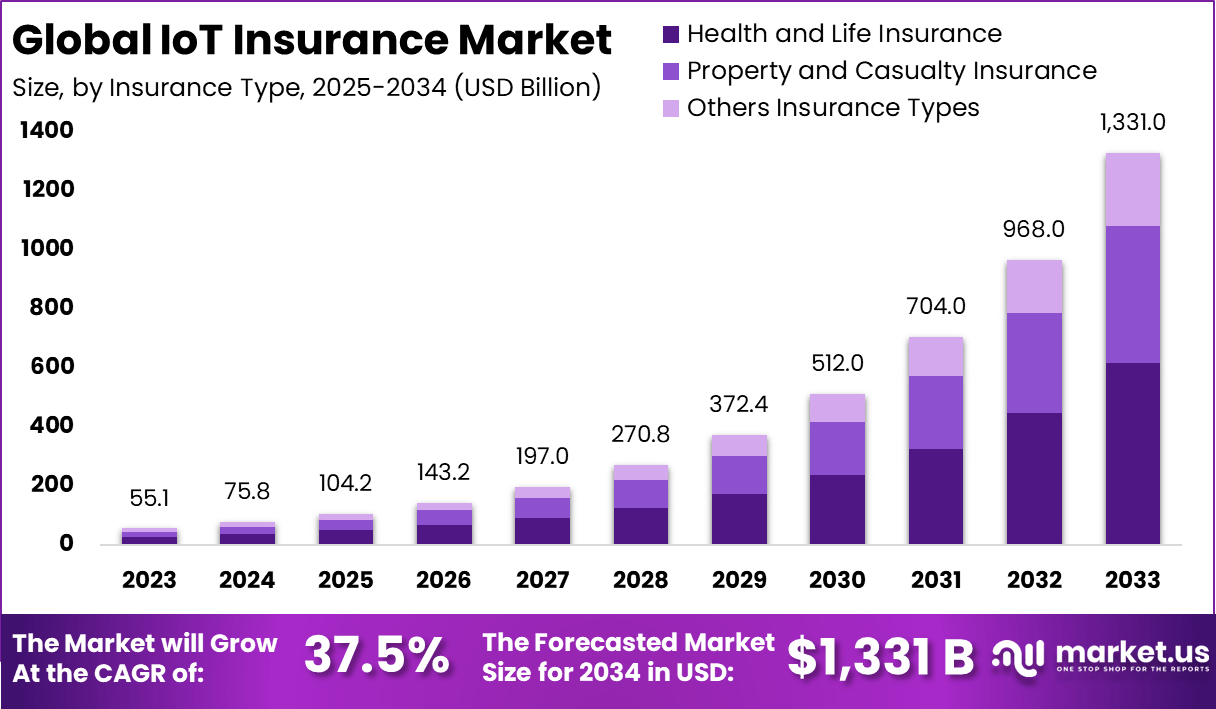

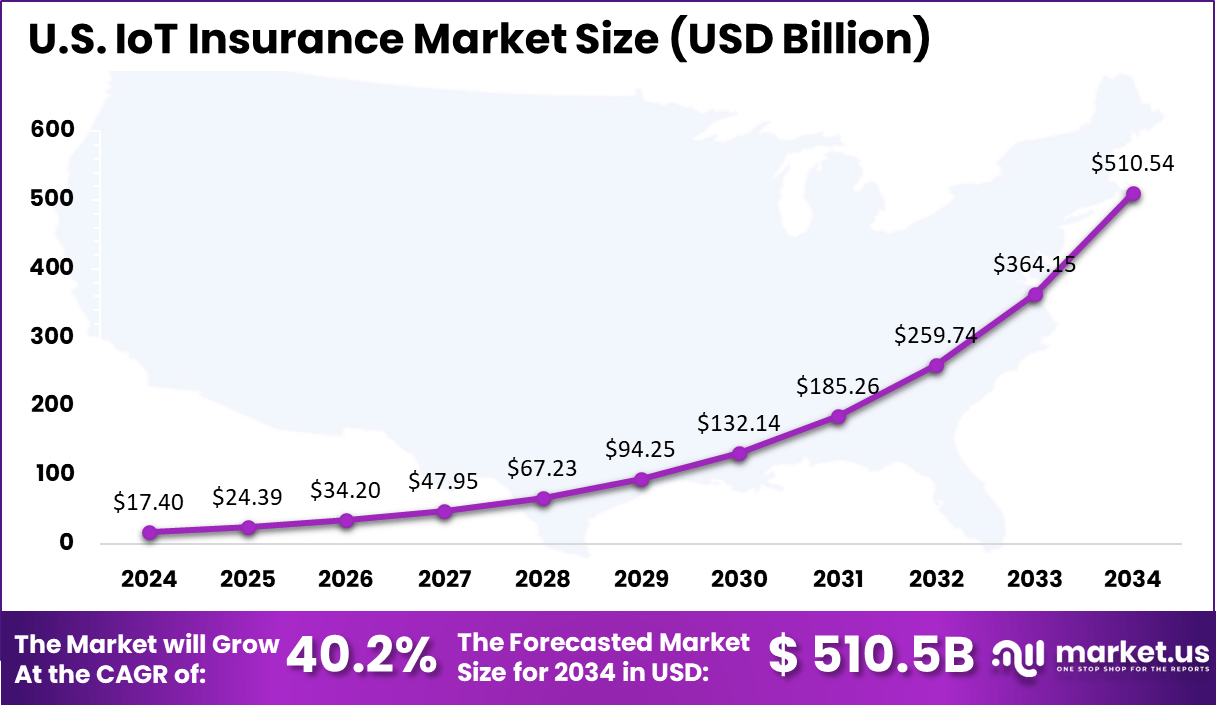

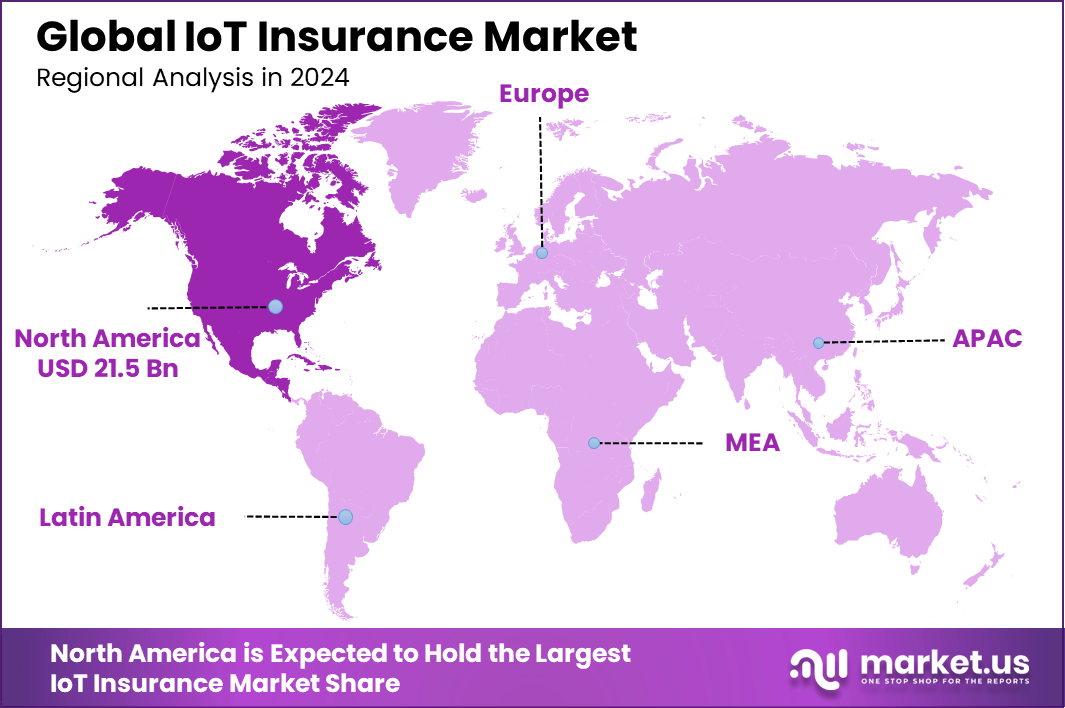

The Global IoT Insurance Market size is expected to be worth around USD 1,331.0 billion by 2034, from USD 55.1 billion in 2024, growing at a CAGR of 37.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.1% share, holding USD 21.5 Billion revenue. The US Market Size was exhibited at USD 17.4 Billion in 2024 with CAGR of 40.2%.

IoT Insurance refers to insurance products that incorporate data from interconnected devices within the Internet of Things (IoT) framework to evaluate, manage, and mitigate risks associated with insured assets or individuals. This type of insurance uses real-time data from devices such as wearables, home sensors, and vehicle telematics to offer personalized insurance policies.

The IoT Insurance market has seen rapid growth due to the increasing adoption of IoT technologies across various sectors including automotive, healthcare, and home security. This growth is further propelled by the development of innovative insurance models like usage-based and pay-as-you-go insurance, which align more closely with consumer needs and usage patterns.

For instance, according to the IRDAI, the Indian insurance sector is growing at a speedy rate of 15-20%. Together with banking services, insurance services add about 7% to the country’s GDP. The primary driver of the IoT Insurance market is the enhanced capability to collect and analyze data from a myriad of IoT devices.

This capability allows for more accurate risk assessment and personalized insurance products, which are appealing both to consumers and insurers. The integration of IoT in insurance also facilitates proactive risk management and preventive measures, significantly shifting the traditional insurance model from reactive to proactive.

Market.us reveals that, The Internet of Things (IoT) market is poised for exceptional growth over the next decade. It is projected to expand from USD 492.7 billion in 2023 to an estimated USD 3,454.2 billion by 2033, progressing at a compound annual growth rate (CAGR) of 21.5% during the forecast period from 2024 to 2033.

IoT Insurance offers numerous benefits including reduced risk through continuous monitoring, improved customer engagement by offering personalized experiences, and cost efficiency through automated processes and precise risk assessment. These benefits help insurers to not only enhance their service offerings but also improve operational efficiencies and reduce claims costs.

Analysts’ Viewpoint

The ongoing technological advancements in IoT and the expansion of IoT device capabilities present significant investment opportunities in the IoT Insurance market. Investors are particularly focused on areas where IoT deployment can transform traditional insurance offerings, such as in health monitoring and automotive telematics.

The rise in IoT adoption across developed and developing economies, coupled with the surge in investment by insurance companies in IoT technologies, are among the top factors impacting the growth of the IoT Insurance market. These investments are driven by the need to enhance service delivery and operational efficiency.

Continuous advancements in IoT technology, such as improvements in data analytics and the integration of artificial intelligence, are reshaping the IoT Insurance landscape. These advancements enable insurers to offer more sophisticated and granular risk assessments.

The regulatory landscape for IoT Insurance is evolving, with increasing focus on data security and privacy concerns. Regulations like the General Data Protection Regulation (GDPR) are influencing how insurers collect, store, and process data, adding layers of complexity but also ensuring better consumer protection.

Key Takeaways

- In 2024, the solution segment held a dominant market position, capturing more than a 70.5% share of the Global IoT Insurance Market.

- In 2024, the Health and Life Insurance segment held a dominant market position, capturing more than a 46.3% share of the Global IoT Insurance Market.

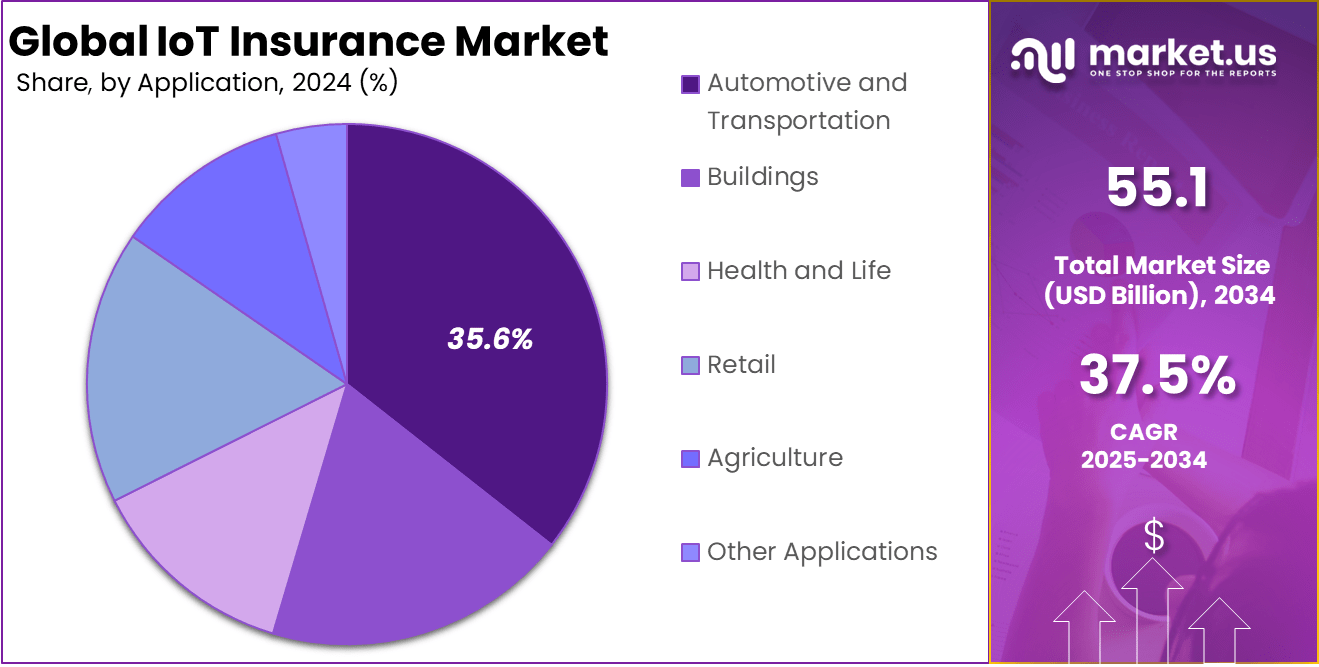

- In 2024, the Automotive and Transportation segment held a dominant market position, capturing more than a 35.6% share of the Market.

- The US IoT Insurance Market was valued at USD 17.4 billion in 2024, with a robust CAGR of 40.2%.

- In 2024, North America held a dominant market position, capturing more than a 39.1% share, holding USD 21.5 Billion revenue.

- According to ITA, India’s insurance market opportunity is as high as $339 billion.

- According to FICCI, IoT spending is expected to register 15.4% y-o-y growth to reach US$1.1 trillion by 2025.

U.S. IoT Insurance Market Size

The US IoT Insurance Market was valued at USD 17.4 billion in 2024, with a robust CAGR of 40.2%. The U.S. insurance market is highly mature and competitive across the globe. This has driven the insurers to adopt new technologies and business models to stay ahead of the competition. Moreover, U.S. insurance companies have also actively collaborated with IoT device manufacturers and other technology giants to develop innovative insurance products and services.

For instance, in April 2023, Arity, a mobility and data analytics company, partnered with Connected Analytic Services, LLC (CAS), a Toyota affiliate, to provide driving data from connected vehicles to auto insurance carriers on behalf of vehicle owners to enable them to access usage-based auto insurance (UBI) products. Such Initiatives have aided the insurers to offer more accurate risk assessment and enhanced customer experiences.

In 2024, North America held a dominant market position in the IoT Insurance landscape, capturing more than a 39.1% share, which translated into a revenue of USD 21.5 billion. This leadership can be attributed to several key factors that uniquely position North America at the forefront of the IoT insurance industry.

Firstly, the region benefits from a highly developed technological infrastructure, which facilitates the widespread adoption and integration of IoT devices across various sectors including automotive, healthcare, and home security.

Secondly, the presence of major IoT and insurance industry players in North America drives innovation and market growth. Companies like Google, IBM, and Cisco are headquartered in this region and actively develop IoT solutions that integrate seamlessly with insurance models.

Component Analysis

In 2024, the solution segment held a dominant market position, capturing more than a 70.5% share of the Global IoT Insurance Market. This is due to the capability of solutions to collect and analyze a vast amount of real-time data from connected devices by the solution component.

Moreover, IoT solutions provide insurers with detailed insights into customer behavior and asset conditions, thus leading to more tailored insurance products and improved customer satisfaction. Additionally, it facilitates the development of innovative insurance models, such as usage-based insurance and pay-as-you-go policies. These models offer more flexibility and affordability to customers.

IoT insurance solutions help insurers to streamline their operations, reduce costs, and improve efficiency. This may include automated claims processing and real-time monitoring, significantly reducing the time and resources that are needed for performing tasks. For instance, according to NAIC, IoT could help insurers cut the cost of the claims process by 30% and also lower premiums for consumers.

Insurance Type Analysis

In 2024, the Health and Life Insurance segment held a dominant market position, capturing more than a 46.3% share of the Global IoT Insurance Market. This is majorly due to the real-time data provided by IoT devices such as wearable health trackers and smart medical devices on the policyholder’s health and lifestyle habits. This data would allow for a more accurate risk assessment, personalized offers, and tailored coverage options.

Moreover, these IoT devices also facilitate faster and more efficient claims of health and life insurance by providing timely and accurate data. This could reduce administrative costs and enhance customer satisfaction. These devices could also enable to development an innovative insurance models, such as usage-based insurance and pay-as-you-go models.

Application Analysis

In 2024, the Automotive and Transportation segment held a dominant market position, capturing more than a 35.6% share of the Market. This could be majorly due to the real-time monitoring provided by IoT devices such as GPS trackers and telematics. This allows insurers to gather accurate data on driving behavior, vehicle usage, and location, leading to more precise risk assessment and personalized insurance premiums.

Additionally, IoT technology supports the development of usage-based insurance models, where the premiums are based on actual usage and driving habits. This tends to offer more flexibility and affordability to customers, making it an attractive option for many drivers.

Key Market Segments

By Component

- Solution

- Services

By Insurance Type

- Property and Casualty Insurance

- Health and Life Insurance

- Others Insurance Types

By Application

- Automotive and Transportation

- Buildings

- Health and Life

- Retail

- Agriculture

- Other Applications

Drivers

Growing need for customized insurance solutions

The growing need for customized insurance solutions is a significant driver for the global IoT insurance market. For instance, according to ITA, The Indian government has allowed foreign companies to invest up to 49% in Indian insurance companies.

This has increased the probability of adopting technologies such as IoT and enabling automation as well as customization of insurance policies. IoT technology allows insurers to offer highly personalized insurance policies based on individual behavior and preferences.

It also enables real-time monitoring and data collection, allowing the insurers to assess risks more accurately. This real-time data collected aids in designing customized policies that reflect the actual risk profile of the insured, thus leading to more competitive pricing and effective risk management.

Restraint

Data privacy concern

IoT devices tend to collect a vast amount of sensitive and personal data that includes health information, driving habits, home security details, and many others. Ensuring the privacy and security of this data is crucial as breaches can have a severe impact on the individuals and the insurer.

Additionally, data privacy concerns can also hamper consumer trust in IoT-enabled insurance products. The consumer also demands transparency concerning the data being used and the entities who have access to it. Insurers must provide a clear and comprehensive explanation of their data usage policies, which can be challenging.

Opportunities

Leveraging IoT data for predictive analytics

IoT devices tend to provide real-time data on different factors such as driving behavior, health metrics, and property conditions. Insurers can use this data to predict potential risks and assess the likelihood of claims more accurately, leading to better pricing strategies and risk management.

Moreover, predictive analytics can identify patterns and trends that indicate the potential issues before they occur. This may include the data from smart home devices which could predict the equipment failures or the security breaches. It allows the insurers to alert policyholders and suggest preventive measures, reducing the frequency and severity of claims.

Challenges

Integration complexity

Integration complexity poses a crucial challenge for the IoT insurance market. There are various IoT devices from different manufacturers and each has its own operational, communication protocols and data format. Ensuring interoperability among these devices can be an issue as it needs significant effort to integrate seamlessly.

The volume of data generated by IoT devices tends to present challenges in terms of storage, processing, and analysis. For instance, according to IACIS, by 2025, the amount of data generated by IoT devices is expected to reach 73.1 zettabytes (ZB). Thus insurers need a robust data management system to handle this influx of information efficiently.

Growth Factors

Various factors are driving the IoT Insurance market. The ongoing developments of IoT devices and advanced data analytics tools are enabling insurers to collect and analyze real-time data more effectively. This is leading to more accurate risk assessments and personalized insurance solutions.

Moreover, the rapid growth in several connected devices including smart home systems, wearables, and telematics, provides insurers with a huge number of data to enhance their product offerings and improve customer experiences. For instance, according to the FTC, consumers and businesses around the world will use more than 20 billion Internet-connected devices by 2025.

Latest Trends

One of the latest trends reshaping the market is the increasing adoption of telematics devices that are becoming more prevalent in vehicle insurance, allowing insurers to offer usage-based insurance (UBI) models. These devices track driving behavior, mileage, and other factors to provide personalized premiums and encourage safer driving habits.

Moreover, the introduction of smart home devices such as sensors and security systems, are being integrated into property insurance. These devices could aid in detecting risks like water leaks, intrusions, and fires, thus enabling insurers to offer discounts and improved risk management.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Internet of Things (IoT) is reshaping the global insurance sector by enabling real-time data collection, risk assessment, and customer engagement. In the IoT Insurance market, a few prominent companies are at the forefront of this transformation. These firms collectively hold a significant share of the market and are driving major trends in product innovation, underwriting efficiency, and claims management.

Allianz SE has been a pioneer in leveraging IoT technologies to enhance property and casualty insurance offerings. The company uses sensor-based solutions to monitor vehicles, industrial equipment, and residential spaces. Through predictive analytics, Allianz can assess risk more accurately and reduce the frequency and severity of claims.

AXA has invested extensively in IoT-driven insurance solutions, especially in health and automotive segments. Wearable technology is used to monitor health metrics, enabling personalized health insurance plans and preventive care. In auto insurance, AXA uses connected car data to tailor pricing models and reward safe driving behavior.

Zurich Insurance focuses on integrating IoT in commercial lines, particularly in risk prevention services. It collaborates with industrial clients to deploy IoT sensors that monitor equipment performance and environmental conditions. This proactive approach helps prevent losses before they occur and reduces downtime, offering added value to business clients.

Top Key Players in the Market

- SAP SE

- Wipro

- SAS Institute Inc.

- Flatirons Development, LLC

- Allerin Tech Pvt Ltd.

- Telit Cinterion

- StreamLabs, Inc.

- Synechron

- Other Key Players

Recent Developments

- In 2025, Wipro emphasized the importance of integrating IoT devices in the insurance sector. The company highlighted that insurers are expected to invest in IoT and device integration to enhance underwriting processes and leverage data for informed risk assessment and pricing decisions.

- February 2025: Water Intelligence PLC announced a partnership with StreamLabs Inc., aiming to integrate smart water monitoring solutions. This collaboration is expected to advance preventive maintenance strategies, directly benefiting insurance companies by mitigating water-related risks.

- July 2024: Divirod, a water data and IoT company, joined the SAS IoT Partner Ecosystem. This collaboration aims to enhance SAS’s IoT analytics capabilities, which could be leveraged to develop advanced solutions for the insurance industry, particularly in risk assessment and management.

- June 2024: SAP SE announced its intention to acquire WalkMe, a leader in digital adoption platforms. This acquisition aims to enhance SAP’s capabilities in facilitating seamless user experiences across applications, potentially impacting their IoT insurance solutions by improving user engagement and adoption rates.

Report Scope

Report Features Description Market Value (2024) USD 55.1 Bn Forecast Revenue (2034) USD 1,331 Bn CAGR (2025-2034) 37.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services), By Insurance Type (Property and Casualty Insurance, Health and Life Insurance, Others Insurance Types), By Application (Automotive and Transportation, Buildings, Health and Life, Retail, Agriculture, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Wipro, SAS Institute Inc., Flatirons Development, LLC, Allerin Tech Pvt Ltd., Telit Cinterion, StreamLabs, Inc., Synechron, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SAP SE

- Wipro

- SAS Institute Inc.

- Flatirons Development, LLC

- Allerin Tech Pvt Ltd.

- Telit Cinterion

- StreamLabs, Inc.

- Synechron

- Other Key Players