Global Hypertonic Drinks Market Size, Share Analysis Report By Nature (Organic, Conventional), By Product (General Energy Drinks, Energy Shots), By End Users (Beverage, Nutraceuticals), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Sales, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152887

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

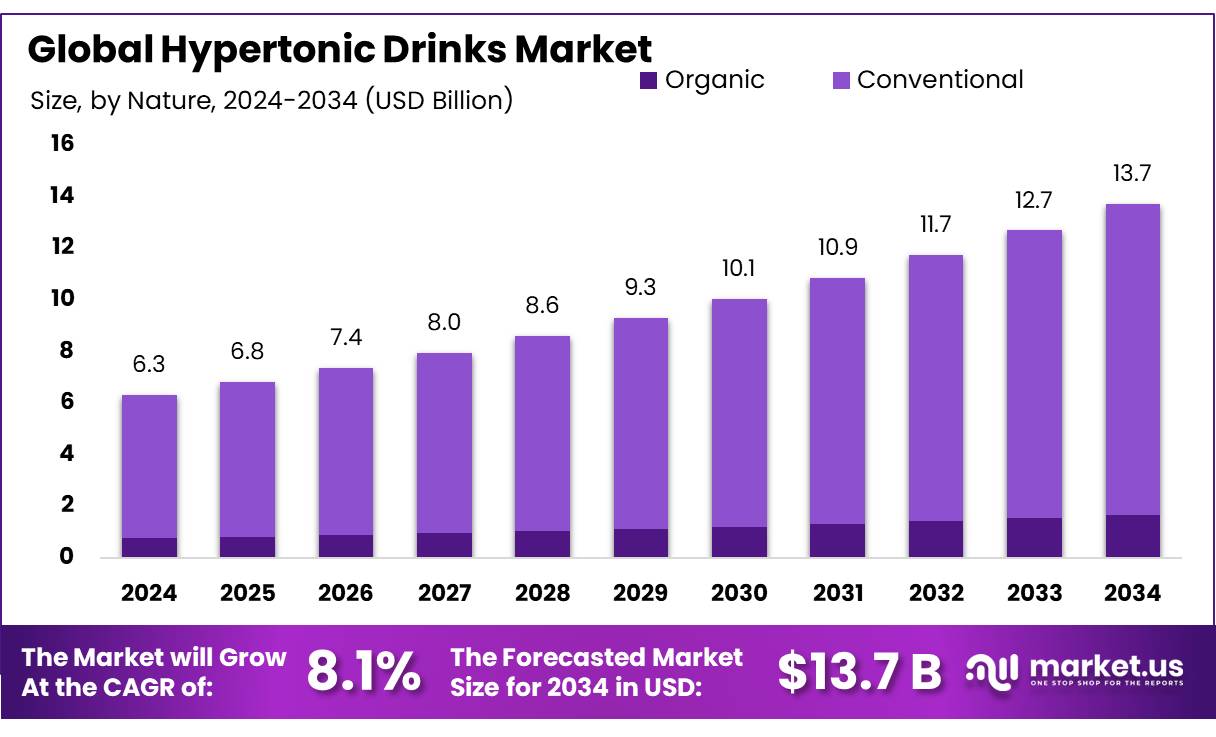

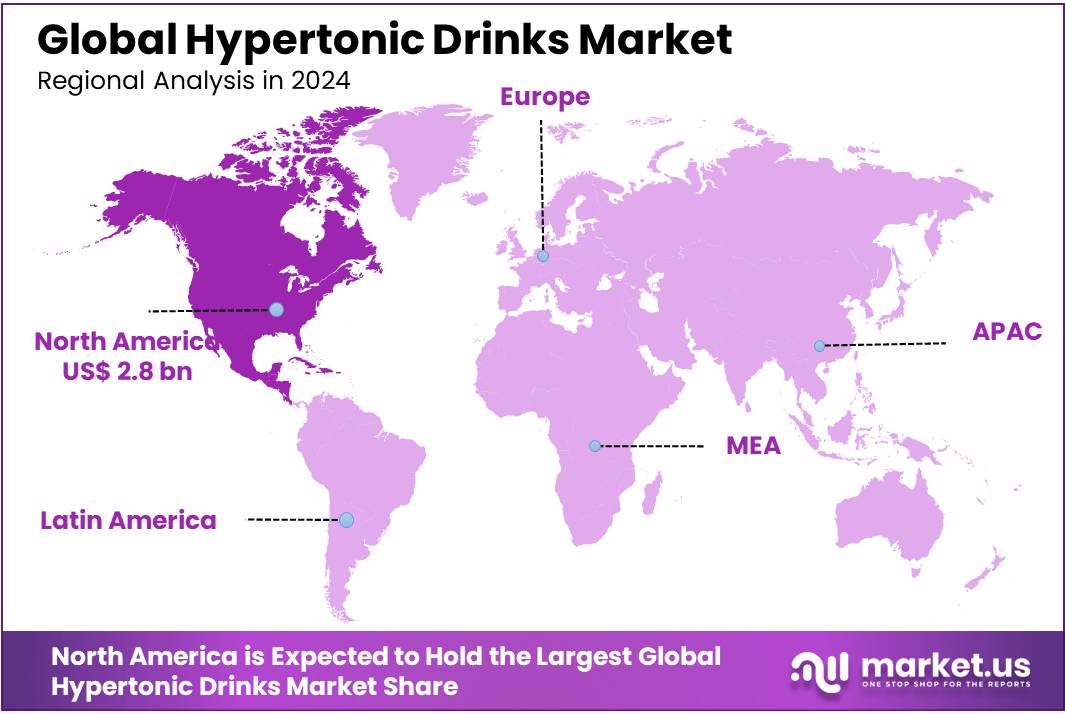

The Global Hypertonic Drinks Market size is expected to be worth around USD 13.7 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 44.6% share, holding USD 2.8 Billion revenue.

Hypertonic drinks concentrates, known for their ability to rapidly rehydrate and replenish electrolytes, have seen significant growth in recent years, driven by increasing consumer demand for health-conscious beverages. These concentrates, which are diluted in water to create energy-boosting drinks, cater to athletes, fitness enthusiasts, and individuals looking for hydration solutions after intense physical activities. The demand for these beverages has been notably rising due to heightened awareness of the importance of electrolyte balance, especially in sports and active lifestyles.

Driving factors behind this growth include a growing focus on fitness and wellness, increased participation in sports, and the rise of health-conscious consumers. According to the International Health, Racquet & Sportsclub Association (IHRSA), the number of gym members in the U.S. increased by 3.1% in 2023, contributing to a growing market for sports nutrition products, including hypertonic drinks. Moreover, the increasing awareness of the adverse effects of sugary sports drinks has pushed consumers towards more natural alternatives, further driving the demand for hypertonic drink concentrates.

Government initiatives such as the Khelo India program, with an investment of approximately USD 108 million in 2024, aim to promote sports and fitness across the country, thereby indirectly boosting the demand for sports and energy drinks. Additionally, the Ministry of Youth Affairs and Sports allocated USD 5.45 million for the current Olympic cycle, further emphasizing the government’s commitment to enhancing sports infrastructure and participation.

In 2023, the U.S. Food and Drug Administration (FDA) acknowledged the growing significance of electrolyte solutions in hydration, particularly for athletes and individuals in high-temperature environments. The FDA’s stance on these products has paved the way for a broader acceptance of hypertonic drinks, offering safety assurances about their consumption, particularly for the prevention of dehydration and electrolyte imbalances.

Additionally, studies by the National Institutes of Health (NIH) have demonstrated the efficacy of electrolyte replenishment in optimizing physical performance, which has encouraged the expansion of hypertonic drink concentrate offerings. According to the Centers for Disease Control and Prevention (CDC), dehydration is a leading cause of hospitalizations in the U.S., particularly among the elderly and athletes, reinforcing the value of products that can mitigate these risks.

Key Takeaways

- Hypertonic Drinks Market size is expected to be worth around USD 13.7 Billion by 2034, from USD 6.3 Billion in 2024, growing at a CAGR of 8.1%.

- Conventional held a dominant market position, capturing more than an 88.2% share of the global hypertonic drinks market.

- General Energy Drinks held a dominant market position, capturing more than a 73.9% share of the global hypertonic drinks market.

- Beverage held a dominant market position, capturing more than a 79.1% share of the global hypertonic drinks market.

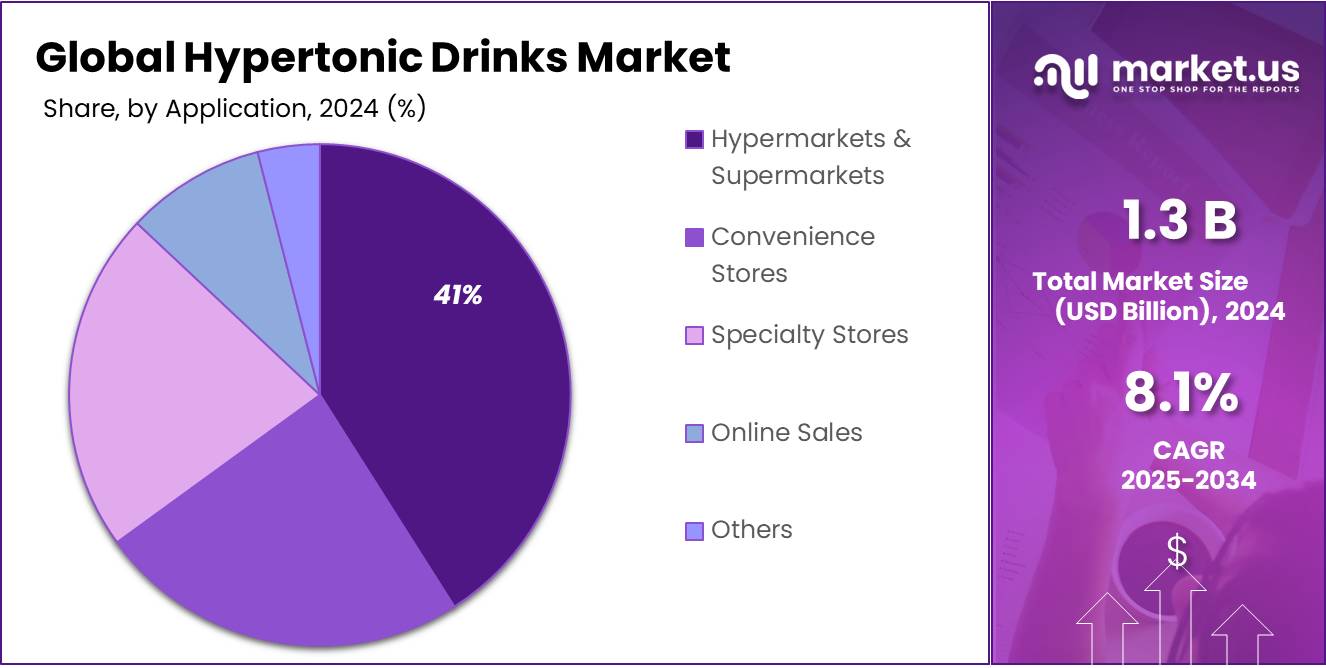

- Hypermarkets & Supermarkets held a dominant market position, capturing more than a 41.6% share of the global hypertonic drinks market.

- North America accounted for a substantial 44.6% of the global hypertonic drinks market, generating approximately USD 2.8 billion.

By Nature Analysis

Conventional Hypertonic Drinks dominate with 88.2% share in 2024, driven by wide availability and consumer familiarity.

In 2024, Conventional held a dominant market position, capturing more than an 88.2% share of the global hypertonic drinks market. This overwhelming preference for conventional variants can be attributed to their easy availability across supermarkets, gyms, and online platforms, along with their affordability and established consumer trust.

Many fitness enthusiasts and casual users still prefer traditional formulations, as they are widely endorsed by athletes and are available in a variety of flavors, formats, and price points. The strong hold of conventional products in both developed and emerging economies highlights their continued relevance in hydration and recovery routines. While clean-label and organic alternatives are gradually gaining ground, conventional hypertonic drinks remain the top choice for most consumers due to their effectiveness, competitive pricing, and brand familiarity.

By Product Analysis

General Energy Drinks lead with 73.9% share in 2024, supported by strong consumer demand and easy market access.

In 2024, General Energy Drinks held a dominant market position, capturing more than a 73.9% share of the global hypertonic drinks market. This strong foothold is largely due to their broad appeal among both athletes and everyday consumers looking for a quick boost of energy and hydration. These drinks are widely promoted for improving endurance, mental alertness, and post-activity recovery, making them a go-to option in gyms, retail stores, and online platforms.

Their consistent taste, convenient packaging, and trusted brand presence have helped maintain their popularity across different regions. In 2025, the General Energy Drinks segment is expected to retain its top position, as busy lifestyles and rising health awareness continue to drive demand for on-the-go functional beverages that offer both energy and rehydration in one formula.

By End Users Analysis

Beverage segment dominates with 79.1% share in 2024, driven by its mass consumption and rising health-conscious choices.

In 2024, Beverage held a dominant market position, capturing more than a 79.1% share of the global hypertonic drinks market. This strong lead is mainly due to the increasing use of hypertonic formulations in ready-to-drink energy beverages that cater to fitness enthusiasts, athletes, and even casual consumers. The beverage format is favored for its convenience, fast absorption, and widespread availability in gyms, retail outlets, and online stores.

Consumers are leaning toward drinks that provide quick energy boosts along with hydration benefits, making the beverage category the most accessible and preferred choice. In 2025, the beverage segment is expected to continue its dominance, supported by product innovation, flavor variety, and a growing shift towards performance-enhancing functional drinks that easily fit into daily routines.

By Distribution Channel Analysis

Hypermarkets & Supermarkets lead with 41.6% share in 2024, backed by strong shelf presence and consumer convenience.

In 2024, Hypermarkets & Supermarkets held a dominant market position, capturing more than a 41.6% share of the global hypertonic drinks market. This leadership is mainly driven by the broad reach and high visibility these retail formats offer, allowing consumers to explore a wide variety of hypertonic drink options under one roof. Shoppers often prefer these outlets for their easy access, competitive pricing, and frequent promotional offers, which encourage bulk purchases.

Additionally, product placement in health and sports drink aisles in large retail stores has boosted awareness and trial rates. In 2025, this segment is expected to maintain its advantage as retail chains continue to expand into urban and semi-urban markets, while also introducing private label hypertonic drinks to meet rising demand for affordable, functional beverages.

Key Market Segments

By Nature

- Organic

- Conventional

By Product

- General Energy Drinks

- Energy Shots

By End Users

- Beverage

- Nutraceuticals

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Specialty Stores

- Online Sales

- Others

Emerging Trends

Functional Hydration with Clean Labels

A significant trend shaping the hypertonic drinks market is the growing consumer preference for functional hydration beverages that are clean-label and low in sugar. Consumers are increasingly seeking beverages that not only quench thirst but also offer additional health benefits, such as improved energy levels, enhanced focus, and better recovery post-exercise. This shift is driven by a broader wellness movement where individuals are more conscious of the ingredients in their food and drinks.

In response to this trend, beverage companies are reformulating their products to reduce sugar content and eliminate artificial additives, aiming to meet consumer expectations for healthier options. For instance, PepsiCo has committed to limiting products to 100 calories or fewer from added sugars per 12 fluid ounce serving in at least 67% of its beverage portfolio by 2025. Such initiatives are in line with global efforts to promote healthier dietary choices and reduce the intake of added sugars.

Government policies are also influencing this trend. In the United States, the Childhood Diabetes Reduction Act of 2024 was introduced to require warning labels on sugar-sweetened foods and beverages, aiming to inform consumers about the health risks associated with high sugar intake. Similarly, Chandigarh, India, has implemented a citywide initiative to reduce sugar consumption among schoolchildren, including the installation of ‘Sugar Boards’ in schools to educate students about healthy eating habits.

Drivers

Growing Demand for Hydration Solutions in Sports and Fitness

The increasing focus on health and fitness is one of the major driving factors for the growth of the hypertonic drinks market. As more individuals engage in sports and physical activities, the demand for beverages that enhance hydration and energy levels is soaring. According to the International Food Information Council (IFIC), 55% of consumers are now more conscious of staying hydrated and are seeking functional drinks that can support physical performance and recovery.

Sports drinks, particularly hypertonic beverages, are favored for their ability to replenish fluids and electrolytes lost during intense physical activity. Hypertonic drinks typically contain higher concentrations of sugars and electrolytes, which help athletes restore energy levels and improve endurance. A 2023 report from the U.S. National Institutes of Health (NIH) highlighted that hydration is crucial for performance and recovery, noting that even mild dehydration can impair athletic performance by up to 20%.

Government initiatives are also playing a key role in encouraging the consumption of beverages that support physical health. For example, the U.S. Department of Health and Human Services (HHS) has promoted hydration as part of its national “Healthy People 2030” initiative, which aims to increase awareness about the importance of water and electrolyte replenishment for all age groups.

Moreover, fitness-focused consumers are driving innovation in the hypertonic drinks category, leading to an increase in the number of product offerings, such as low-sugar, organic, and plant-based options. These new developments are tapping into the health-conscious consumer market, which continues to grow as people prioritize wellness.

Restraints

Health Concerns Related to High Sugar Content

One of the major restraining factors for the hypertonic drinks market is the growing concern over the high sugar content in these beverages. While hypertonic drinks are effective for quick hydration and energy replenishment, their high sugar levels can lead to negative health impacts, such as weight gain, increased risk of diabetes, and poor dental health. The American Heart Association (AHA) recommends that the average American limit their daily intake of added sugars to no more than 36 grams for men and 25 grams for women. However, many hypertonic drinks exceed this limit, with some containing upwards of 50 grams of sugar per serving.

This has raised concerns among health-conscious consumers who are becoming increasingly aware of the risks associated with excessive sugar intake. According to the Centers for Disease Control and Prevention (CDC), nearly 40% of U.S. adults are classified as obese, and high sugar consumption is directly linked to obesity rates. In fact, the CDC highlights that sugary drinks, including sports and energy drinks, are one of the leading contributors to this growing public health issue.

In response to these concerns, various government health initiatives, such as the U.S. Food and Drug Administration’s (FDA) “Sugar-Sweetened Beverages” initiative, have been advocating for better regulation and clearer labeling on beverage products. The aim is to reduce sugar consumption and encourage consumers to choose healthier alternatives. The increasing push from regulatory bodies to reduce sugar consumption and promote healthier eating habits is leading to a decline in the demand for sugary drinks.

Opportunity

Rising Popularity of Low-Sugar and Functional Beverages

One of the major growth opportunities for the hypertonic drinks market lies in the rising demand for low-sugar and functional beverages. As consumers become more health-conscious and aware of the negative effects of excessive sugar consumption, there has been a notable shift towards beverages with reduced sugar content, better nutritional profiles, and additional health benefits. According to the International Food Information Council (IFIC), 43% of U.S. consumers are actively trying to reduce their sugar intake, and this trend is expected to continue as more people seek healthier alternatives to traditional sugary drinks.

In response to this demand, many hypertonic drink manufacturers are reformulating their products to offer lower sugar options while maintaining the same functional benefits such as hydration and electrolyte replenishment. A significant portion of this demand is coming from athletes, fitness enthusiasts, and people with active lifestyles who are looking for drinks that provide more than just hydration. According to the U.S. Department of Health and Human Services (HHS), 60% of consumers aged 18 to 34 are increasingly prioritizing functional beverages with added health benefits such as vitamins, minerals, and electrolytes.

Government initiatives like the “Healthy People 2030” campaign in the U.S. are actively encouraging consumers to make healthier beverage choices. This initiative promotes the consumption of drinks that are lower in sugar and offer additional nutritional benefits. This growing push for healthier drink options is creating significant opportunities for hypertonic drink manufacturers to innovate and cater to a health-conscious market.

Regional Insights

North America leads with 44.6% share and USD 2.8 billion revenue in 2024, propelled by strong sports culture and functional drink adoption

In 2024, North America accounted for a substantial 44.6% of the global hypertonic drinks market, generating approximately USD 2.8 billion in revenue. This robust performance can be traced to deep-rooted fitness trends, expansive distribution networks, and heightened consumer focus on fast-acting hydration and recovery beverages.

The regional sports drink market—encompassing isotonic, hypotonic, and hypertonic variants—was estimated at USD 10.0 billion in 2024, underscoring the dominance of North American consumption in this segment . Projections for 2025 suggest further growth, with overall sports drink revenues expected to rise, supported by increasing demand for functional formulations tailored to active lifestyles.

Key driving factors North America’s leadership include established sports nutrition culture, with millions of gym memberships; growing consumer awareness about electrolyte replenishment; and continuous innovations in flavor, packaging, and formulation. In 2025, the market expansion is expected to continue, spurred by health-conscious consumers seeking quick recovery solutions and premium hydration options .

While isotonic products remain dominant overall, hypertonic drinks—which deliver concentrated carbohydrates and electrolytes to expedite post-exercise recovery—have gained a significant share within the broader sports drink umbrella in North America. This underscores the region’s sophistication in segmenting beverage preferences according to specific fitness needs.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PepsiCo is a market leader in hypertonic drinks through its flagship brand, Gatorade. Originating in 1965, Gatorade has grown to cover over 80 countries and maintains approximately 67.7% share of the U.S. sports drink market. Its extensive distribution network—spanning supermarkets, fitness centers, and online platforms—ensures wide accessibility. Innovation continues with tailored formulations like “Prime,” “Perform,” and recovery drinks, reinforcing PepsiCo’s leadership in delivering performance-focused hydration and recovery solutions.

Abbott Nutrition offers advanced nutritional hydration products, notably Pedialyte and Ensure variants. Pedialyte serves as an oral rehydration solution enriched with electrolytes, while Ensure Clear offers therapeutic-level hydration and nutrients . Abbott’s focus lies in clinical-grade solutions designed for rapid fluid replenishment in cases of dehydration—from exercise or illness. Distribution via healthcare providers and pharmacies bolsters its standing as a trusted maker of medically endorsed hydration products.

Monster Beverage stands as a major player in the energy drink sector, with its Monster Energy line capturing a substantial 30.1% of the U.S. energy drink market as of 2022. Known for high caffeine content and sponsorships in extreme sports, Monster offers products like HydroSport that align with hypertonic functional benefits. Its strong global branding and distribution across convenience stores, gyms, and online markets support continued market expansion.

Top Key Players Outlook

- Pepsico

- Abbott Nutrition Co.

- Monster Beverage Company

- Nestle S.A.

- Britvic Plc

- Ba Sports Nutrition,Llc

- Lucozade Ribena Suntory

- Red Bull Gmbh

- Fraser And Neave

- Suntory Holdings Limited

Recent Industry Developments

In 2024, Abbott Nutrition Co. achieved USD 42.0 billion in total sales, growing 4.6% reported and 9.6% organically, driven in part by its hydration-oriented nutrition products.

In 2024, Britvic Plc delivered a strong performance with £1,899.0 million in revenue—a 9.5% increase year-on-year—and adjusted EBIT of £250.9 million, marking a 15.2% rise in profitability.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Bn Forecast Revenue (2034) USD 13.7 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product (General Energy Drinks, Energy Shots), By End Users (Beverage, Nutraceuticals), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Pepsico, Abbott Nutrition Co., Monster Beverage Company, Nestle S.A., Britvic Plc, Ba Sports Nutrition,Llc, Lucozade Ribena Suntory, Red Bull Gmbh, Fraser And Neave, Suntory Holdings Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pepsico

- Abbott Nutrition Co.

- Monster Beverage Company

- Nestle S.A.

- Britvic Plc

- Ba Sports Nutrition,Llc

- Lucozade Ribena Suntory

- Red Bull Gmbh

- Fraser And Neave

- Suntory Holdings Limited