Global Hydraulic Power Unit Market By Operating Pressure (0- 1000 psi, 1000 psi- 2000 psi, 2000 psi -3000 PSI, Above 3000 psi), By Pump Type (External Gear, Fixed, Piston, Variable, Others), By Power Rating (Upto 7.5 kW, 7.5 kW to 75 kW, Above 75 kW), By Flow Rate (Upto 10 gal/min, 10 gal/min to 15 gal/min, Above15 gal/min), By End-use (Manufacturing, Medical, Packaging, Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143772

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

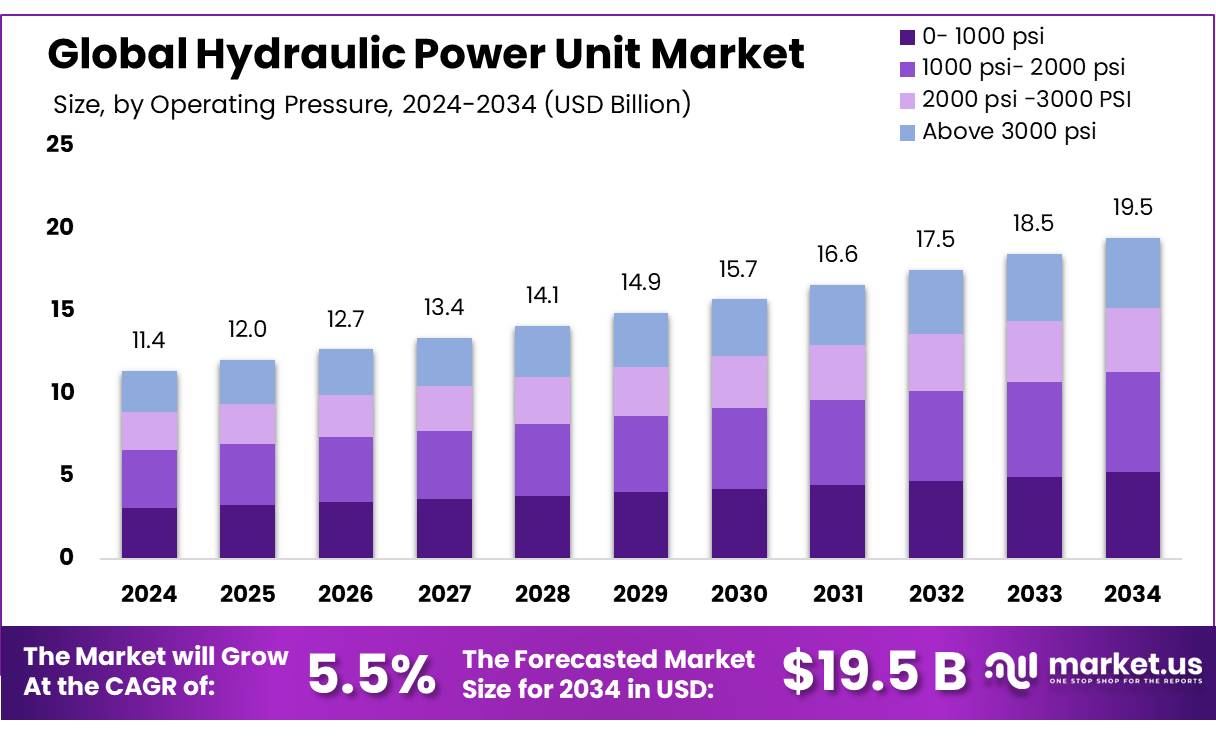

The Global Hydraulic Power Unit Market size is expected to be worth around USD 19.5 Bn by 2034, from USD 11.4 Bn in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The hydraulic power unit (HPU) market serves as a pivotal component within various industrial sectors due to its crucial role in providing hydraulic energy to machinery and equipment. Comprising a motor, a hydraulic pump, and a reservoir, these units are designed to regulate fluid pressure and flow within hydraulic systems, making them indispensable for a wide array of applications including construction, automotive, and heavy machinery.

The hydraulic power unit is robust, buoyed by the expansion of industries that require heavy lifting and precise motion control. As of the latest figures, the construction industry, a major consumer of hydraulic power units, has shown significant growth, with projected expenditures reaching approximately $11 trillion by 2024 globally, according to government infrastructure plans and private sector investments. This growth is mirrored in the manufacturing sector, where precision and efficiency are paramount, thus driving demand for reliable and effective hydraulic systems.

Driving factors for the hydraulic power unit market include technological advancements that improve the efficiency and lifespan of these units. Innovations such as variable frequency drive technology enable hydraulic power unit to operate more efficiently by adjusting the motor speed to match the load requirements, thus reducing energy consumption and operational costs. Additionally, the rising emphasis on sustainable construction practices and the increasing adoption of automation in manufacturing processes further augment the demand for hydraulic power unit.

Government initiatives also play a critical role in the market dynamics of hydraulic power units. For instance, several governments worldwide are introducing regulations aimed at reducing carbon emissions, which encourage industries to adopt energy-efficient technologies including advanced hydraulic systems. In the European Union, the implementation of the EcoDesign Directive underlines the push for energy-efficient industrial machinery, indirectly boosting the market for technologically advanced hydraulic power unit.

Future growth opportunities in the hydraulic power unit market are substantial, particularly in the development and integration of smart and connected technologies. The integration of IoT-enabled devices in hydraulic power units allows for real-time monitoring and data analytics, leading to predictive maintenance capabilities and minimized downtime. This technological integration is anticipated to proliferate extensively, with the IoT in manufacturing market expected to exceed $150 billion by 2024.

Key Takeaways

- Hydraulic Power Unit Market size is expected to be worth around USD 19.5 Bn by 2034, from USD 11.4 Bn in 2024, growing at a CAGR of 5.5%.

- 1000 psi-2000 psi pressure range solidified their market dominance, securing over 31.20% of the total market share.

- Fixed pump hydraulic power units asserted their market leadership by capturing more than a 32.30% share.

- 7.5 kW to 75 kW maintained a dominant market position, seizing more than a 48.20% share.

- 10 gal/min to 15 gal/min established a dominant presence in the market, capturing more than a 46.20% share.

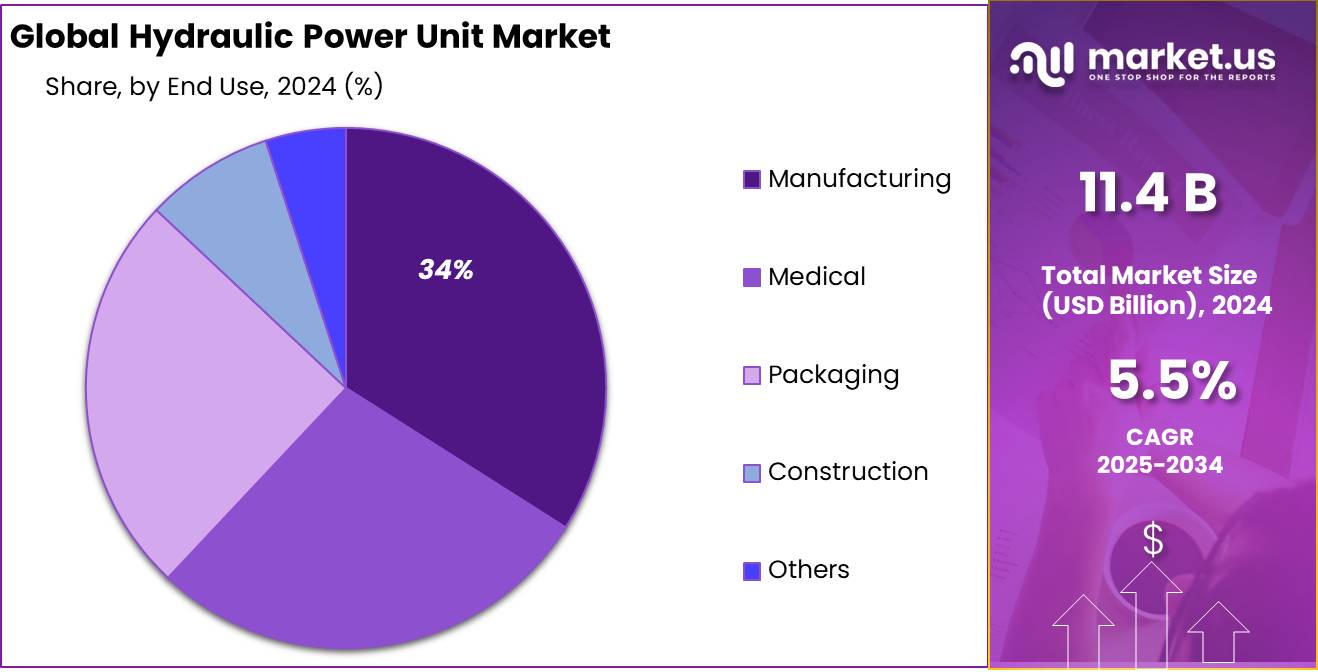

- Manufacturing sector held a dominant market position in the hydraulic power unit market, capturing more than a 34.30% share.

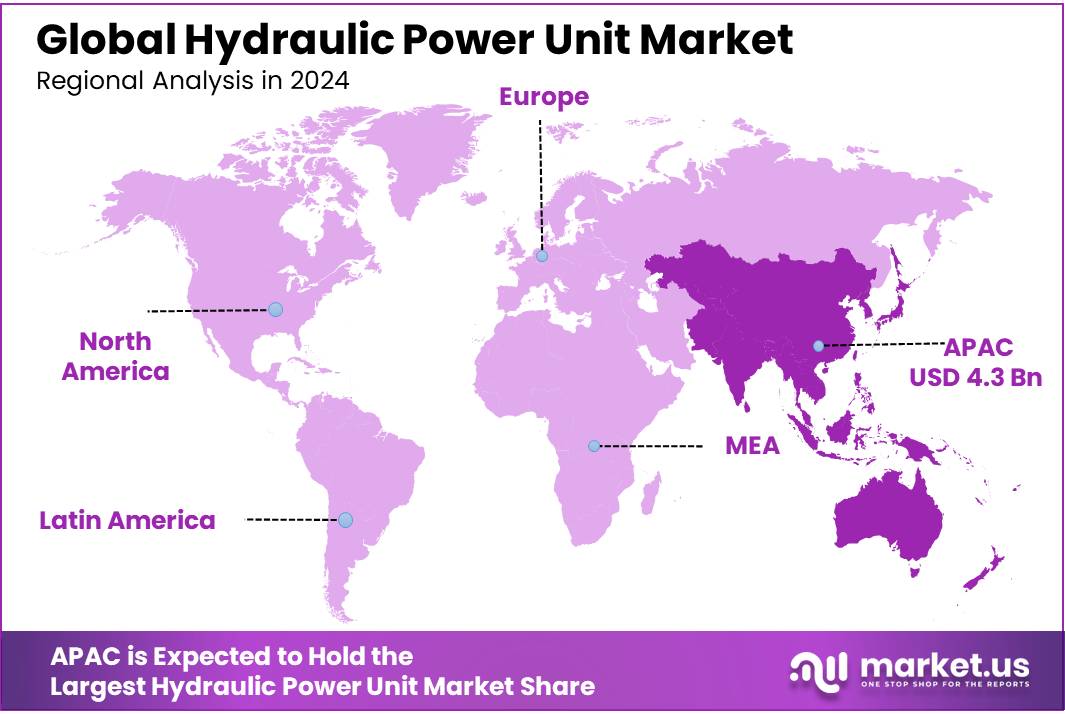

- Asia-Pacific (APAC) region has emerged as a dominant force, capturing a substantial 38.20% market share, which equates to a value of approximately USD 4.3 billion.

By Operating Pressure

Hydraulic Power Units with 1000 psi-2000 psi Pressure Range Lead the Market with a 31.20% Share

In 2024, hydraulic power units operating within the 1000 psi-2000 psi pressure range solidified their market dominance, securing over 31.20% of the total market share. This segment’s robust position reflects its broad applicability across various industries requiring moderate to high-pressure operations without the extremes that characterize higher psi ranges. The versatility of these units makes them particularly appealing for sectors like manufacturing, where they are essential in machinery operation, and in construction, where they power heavy lifting and earth moving equipment.

The efficiency and reliability of hydraulic power units in this pressure bracket allow businesses to maintain operational productivity while managing energy consumption effectively, which is critical in controlling operational costs. As we progress into 2025, the demand for these units is expected to grow, driven by expanding industrial activities and increasing investments in infrastructure development.

By Pump Type

Fixed Pump Hydraulic Power Units Take a Leading 32.30% Market Share

In 2024, fixed pump hydraulic power units asserted their market leadership by capturing more than a 32.30% share of the overall market. These units are favored for their reliability and straightforward design, which offer enhanced durability and easier maintenance compared to variable pump types.

The strong preference for fixed pump units is particularly evident in industries where operational simplicity and cost-efficiency are prioritized. These include sectors like agriculture, where consistent machine performance is crucial, and in many manufacturing environments, where the demand for steady and predictable hydraulic power is a key operational requirement.

By Power Rating

Hydraulic Power Units Rated 7.5 kW to 75 kW Dominate with a 48.20% Market Share

In 2024, hydraulic power units with a power rating from 7.5 kW to 75 kW maintained a dominant market position, seizing more than a 48.20% share. This broad range of power ratings meets the needs of a diverse set of applications, making these units extremely versatile across multiple sectors.

Industries such as construction, where equipment requires moderate to substantial power, and manufacturing, where precision and reliability are paramount, particularly benefit from this power range. The dominance of these units in the market can be attributed to their ability to offer a balance of power and energy efficiency, making them ideal for tasks that require sustained operation without excessive energy expenditure.

By Flow Rate

Hydraulic Power Units with 10 to 15 gal/min Flow Rate Lead with a 46.20% Market Share

In 2024, hydraulic power units featuring a flow rate of 10 gal/min to 15 gal/min established a dominant presence in the market, capturing more than a 46.20% share. This flow rate range is particularly favored in settings that require a balance between volume and pressure, making it ideal for a variety of industrial and mobile applications.

Industries such as automotive manufacturing and mobile machinery benefit greatly from this flow rate, as it supports efficient operation without compromising on performance. The continued preference for hydraulic power units within this flow rate segment is anticipated to persist into 2025, driven by their critical role in enhancing operational efficiencies and productivity in diverse industrial environments.

By End-use

Manufacturing Dominates Hydraulic Power Unit Market with a 34.30% Share

In 2024, the manufacturing sector held a dominant market position in the hydraulic power unit market, capturing more than a 34.30% share. This sector relies heavily on hydraulic power units due to their efficiency and the robust power they provide for operating heavy machinery and automated production lines.

The use of these units in manufacturing is integral to ensuring seamless operations, from assembly lines to material handling and packaging. Their ability to deliver consistent performance under rigorous conditions makes them indispensable in the manufacturing industry. As we advance into 2025, the demand within this sector is expected to continue growing, bolstered by technological advancements and increasing automation in manufacturing processes.

Key Market Segments

By Operating Pressure

- 0- 1000 psi

- 1000 psi- 2000 psi

- 2000 psi -3000 PSI

- Above 3000 psi

By Pump Type

- External Gear

- Fixed

- Piston

- Variable

- Others

By Power Rating

- Upto 7.5 kW

- 7.5 kW to 75 kW

- Above 75 kW

By Flow Rate

- Upto 10 gal/min

- 10 gal/min to 15 gal/min

- Above15 gal/min

By End-use

- Manufacturing

- Medical

- Packaging

- Construction

- Others

Drivers

Increased Demand in Food Processing Industry Spurs Growth in Hydraulic Power Unit Market

One of the primary driving factors for the growth of the hydraulic power unit market is the increasing demand from the food processing industry. As global food production standards continue to rise, there is a growing need for more efficient, reliable, and safe machinery. Hydraulic power units play a crucial role in meeting these demands by powering various types of equipment used in food processing, from conveyors and mixers to packaging machines.

According to the Food and Agriculture Organization (FAO), the volume of processed food items has seen a significant uptick, with a projected increase in food manufacturing outputs globally. This surge is a direct reflection of the rising population and the shift towards more processed foods due to urbanization and changing dietary preferences. Hydraulic power units are favored in this sector for their ability to operate smoothly in environments that require high levels of cleanliness and precision.

Furthermore, government initiatives aimed at boosting food safety and production efficiency have led to stricter regulations, which in turn drive the adoption of advanced machinery equipped with hydraulic systems. For instance, in the United States, the Food Safety Modernization Act (FSMA) emphasizes more preventive controls in food processing operations, which necessitates the use of reliable and efficient equipment.

The reliability of hydraulic systems, combined with their capability to operate effectively under varying pressures and temperatures, makes them ideal for the food processing industry. Their robustness ensures that operations are not only efficient but also compliant with stringent health and safety regulations.

As the industry continues to evolve, the demand for hydraulic power units is expected to grow, further propelled by ongoing innovations aimed at enhancing energy efficiency and system capabilities. This trend is underscored by investments from leading food organizations looking to upgrade and expand their production capacities to meet the increasing consumer demand.

Restraints

Environmental Regulations Tightening Around Hydraulic Power Units

A significant restraining factor for the growth of the hydraulic power unit market is the increasing stringency of environmental regulations. These regulations are particularly impactful in sectors like manufacturing and industrial operations, where hydraulic power units are extensively used. Governments worldwide are imposing stricter controls on emissions and environmental impact, which directly affects the types of machinery and power units that industries can use.

For example, hydraulic power units, which often use oil-based fluids, can pose a risk of leaks and spills, leading to soil and water contamination. The European Union’s Environmental Protection Agency (EPA) has been at the forefront of advocating for more environmentally friendly industrial practices, which include reducing potential pollutants from hydraulic systems. This push has led to a heightened focus on developing alternatives such as electric and pneumatic systems, which are viewed as cleaner and more sustainable.

Moreover, the trend towards sustainability is not just regulatory but also driven by consumer preferences. More consumers and businesses are prioritizing environmental responsibility, influencing industries to adopt greener technologies. This shift is observed globally, with companies in sectors like food processing, which relies heavily on hydraulic systems for packaging and production, seeking equipment that minimizes environmental impact to align with consumer expectations and compliance requirements.

These environmental and regulatory pressures are challenging the market for traditional hydraulic power units, compelling manufacturers to innovate towards more eco-friendly designs and fluid alternatives that are less harmful in case of a leak. Despite these challenges, this also opens up opportunities for advancements in hydraulic technology, such as the development of biodegradable hydraulic fluids and more efficient system designs that reduce potential environmental risks.

Opportunity

Expansion into Renewable Energy Sectors Opens New Avenues for Hydraulic Power Units

A significant growth opportunity for the hydraulic power unit market lies in the renewable energy sector. As the global emphasis on sustainable energy solutions intensifies, industries are exploring how traditional technologies like hydraulic systems can be adapted for use in renewable energy applications. Hydraulic power units are particularly well-suited for this transition due to their reliability and high-power density, which are essential for the rigorous demands of renewable energy production.

For instance, hydraulic power units play a crucial role in wind turbines, where they are used to adjust blade angles for optimal wind capture and to operate braking systems that protect against high wind speeds. With wind energy expected to constitute a significant portion of the global energy mix, the demand for hydraulic systems in this area is anticipated to grow. According to the Global Wind Energy Council, the wind energy sector is projected to expand substantially, with thousands of new turbines being installed each year.

This growth is supported by governmental initiatives like the European Green Deal, which aims to make Europe the first climate-neutral continent by 2050. Such policies are promoting the development and integration of renewable energy technologies, including enhancements in hydraulic systems that can operate more efficiently and with reduced environmental impact.

Moreover, the reliability and adaptability of hydraulic power units make them ideal for emerging renewable sectors such as tidal and wave energy, where harsh operating conditions require robust systems. As these sectors continue to develop and scale, the expertise and technologies from the hydraulic power unit industry will be increasingly sought after, presenting a lucrative opportunity for manufacturers to innovate and expand their market presence.

Trends

Integration of IoT and Smart Technologies in Hydraulic Power Units

One of the latest trends shaping the hydraulic power unit market is the integration of the Internet of Things (IoT) and smart technologies. This advancement is revolutionizing how hydraulic systems are monitored, maintained, and optimized, offering significant improvements in efficiency and reliability. As industries continue to embrace digital transformation, the demand for smarter and more connected hydraulic solutions is rapidly increasing.

IoT-enabled hydraulic power units can provide real-time data on system performance, including pressure levels, temperature, and fluid quality. This allows for predictive maintenance, where potential issues can be addressed before they lead to system failures, thereby reducing downtime and maintenance costs. In sectors like manufacturing and agriculture, where equipment uptime is crucial, the ability to predict and prevent failures can significantly enhance productivity and operational efficiency.

Furthermore, smart hydraulic systems are increasingly being used in precision agriculture, where they help in optimizing the use of resources like water and fertilizers. By adjusting the operation of equipment based on real-time field data, these systems contribute to more sustainable farming practices, aligning with global efforts to increase agricultural output while minimizing environmental impact.

Government initiatives that promote industrial automation and smart manufacturing are also propelling this trend. For example, programs like the U.S. Advanced Manufacturing Partnership encourage the adoption of advanced technologies, including IoT, to maintain the competitiveness of industries. This governmental support, coupled with the push from industries for greater efficiency and sustainability, is driving significant investments in smart hydraulic technologies.

Regional Analysis

In the hydraulic power unit market, the Asia-Pacific (APAC) region has emerged as a dominant force, capturing a substantial 38.20% market share, which equates to a value of approximately USD 4.3 billion. This commanding position is largely driven by rapid industrialization across major economies such as China, India, and South Korea, coupled with significant investments in infrastructure development and manufacturing. The region’s focus on enhancing industrial automation and expanding manufacturing capacities has led to increased demand for hydraulic power units, which are crucial for machinery operation in various industries including construction, automotive, and agriculture.

Furthermore, governmental policies aimed at boosting manufacturing capabilities through initiatives like ‘Make in India’ and ‘Made in China 2025’ have provided additional impetus to the market. These programs are not only enhancing domestic production capabilities but are also attracting foreign investment into the manufacturing sector. The push towards infrastructure modernization and urbanization in APAC countries continues to drive the need for hydraulic power systems in construction equipment and machinery.

Additionally, the region’s commitment to technological advancements and the adoption of smart factory solutions are contributing to the sophistication of hydraulic power units offered in the market. Manufacturers in APAC are increasingly incorporating IoT and other digital technologies to improve the efficiency and operational capabilities of hydraulic systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bosch Rexroth AG stands as a leading supplier in the hydraulic power unit sector, offering advanced technological solutions. Known for their innovation in drive and control technologies, Bosch Rexroth provides highly efficient and energy-saving hydraulic units that serve a broad range of industries, from automotive to heavy machinery. Their commitment to quality and sustainability in manufacturing practices makes them a key contributor to the industry’s growth.

Branch Hydraulic Systems Ltd. specializes in the design and manufacture of custom hydraulic power units tailored to client specifications. Their expertise in delivering high-quality, bespoke solutions enables them to serve critical industries such as marine, defense, and industrial automation. The company’s focus on customer-specific needs and flexibility in design distinguishes them in the market.

Eaton Corporation is a powerhouse in the hydraulic market, known for its comprehensive range of hydraulic power units that combine durability with advanced technology. Their units are used globally across various sectors, including aerospace, residential, and commercial, to provide reliable power solutions. Eaton’s commitment to innovation is evident in their continual development of hydraulic systems that offer improved energy efficiency and safety.

Top Key Players in the Market

- Bailey International LLC

- Bosch Rexroth AG

- Branch Hydraulic Systems Ltd.

- Dana Motion

- Eaton Corporation

- Energy Manufacturing Co., Inc.

- HCS Control Systems Ltd.

- Holstein Hydraulik Gmbh

- Hydac International GmbH

- Hydro-Tek Co Ltd.

- Nachi-Fujikoshi Corporation

- Parker Hannifin Corporation

- Related Fluid Power Ltd.

- Weber-Hydraulik GmbH

Recent Developments

Eaton Corporation, reported a sales revenue of $24.9 billion for the year, representing a 7% increase from the previous year, driven by robust demand across its segments, particularly in electrical and aerospace industries.

Dana Motion Systems, a subsidiary of Dana Incorporated, has been significantly enhancing its offerings in the hydraulic power unit market.

Report Scope

Report Features Description Market Value (2024) USD 11.4 Bn Forecast Revenue (2034) USD 19.5 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operating Pressure (0- 1000 psi, 1000 psi- 2000 psi, 2000 psi -3000 PSI, Above 3000 psi), By Pump Type (External Gear, Fixed, Piston, Variable, Others), By Power Rating (Upto 7.5 kW, 7.5 kW to 75 kW, Above 75 kW), By Flow Rate (Upto 10 gal/min, 10 gal/min to 15 gal/min, Above15 gal/min), By End-use (Manufacturing, Medical, Packaging, Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bailey International LLC, Bosch Rexroth AG, Branch Hydraulic Systems Ltd., Dana Motion, Eaton Corporation, Energy Manufacturing Co., Inc., HCS Control Systems Ltd., Holstein Hydraulik Gmbh, Hydac International GmbH, Hydro-Tek Co Ltd., Nachi-Fujikoshi Corporation, Parker Hannifin Corporation, Related Fluid Power Ltd., Weber-Hydraulik GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hydraulic Power Unit MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Hydraulic Power Unit MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bailey International LLC

- Bosch Rexroth AG

- Branch Hydraulic Systems Ltd.

- Dana Motion

- Eaton Corporation

- Energy Manufacturing Co., Inc.

- HCS Control Systems Ltd.

- Holstein Hydraulik Gmbh

- Hydac International GmbH

- Hydro-Tek Co Ltd.

- Nachi-Fujikoshi Corporation

- Parker Hannifin Corporation

- Related Fluid Power Ltd.

- Weber-Hydraulik GmbH